Reforms at a tipping point

As we show in this note, AVI Japan Opportunity (AJOT) has delivered impressive returns to its shareholders in recent years. The work that the manager Asset Value Investors (AVI) has done to encourage investee companies to improve operations, capital structures, shareholder communications, and corporate governance has borne fruit.

However, even as it exits a number of successful investments, AVI stresses that AJOT has no shortage of opportunities to pursue and has an attractive pipeline of new investments. AVI suggests that the pace of corporate governance reform in Japan has reached a tipping point. Management teams are more open to AJOT’s constructivist approach, and the pool of potential wins has expanded. In an uncertain world, an investment strategy such as this, that does not rely on favourable macroeconomics, holds considerable appeal.

Unlocking value in Japanese smaller companies

AJOT aims to achieve capital growth in excess of the MSCI Japan Small Cap Index by investing in a concentrated portfolio of over-capitalised small-cap Japanese equities. Asset Value Investors (AVI) leverages its four decades of experience investing in asset-backed companies to engage with company management and help to unlock value in this under-researched area of the market.

| Year ended | Share price total return (%) | NAV total return (%) | MSCI Japan Small Cap TR (%) | MSCI AC World TR (%) |

|---|---|---|---|---|

| 28/02/2021 | 11.6 | 9.9 | 13.9 | 19.0 |

| 28/02/2022 | 9.8 | 10.7 | (1.8) | 12.3 |

| 28/02/2023 | 5.8 | 4.8 | 2.2 | 1.7 |

| 29/02/2024 | 5.3 | 10.6 | 9.0 | 17.9 |

| 28/02/2025 | 31.7 | 33.4 | 4.9 | 15.6 |

A significant pick-up in activity

AJOT benefited from four takeovers last year and two more corporate actions so far in 2025

AVI reports that there was a significant pick up in the pace of corporate activity in Japan over the course of 2024 and into 2025. That has been reflected in AJOT’s performance numbers as it benefited from four takeovers last year and two further corporate actions so far in 2025, in addition to several buyback announcements.

As we show on page 11, AJOT has built an impressive track record of outperformance of both its performance benchmark (the MSCI Japan Small Cap Index) and its peer group, delivering an NAV return of 85.7% from launch to the end of February 2025.

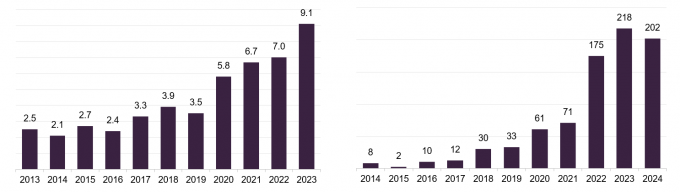

The number of activist funds targeting Japan had risen from eight in 2014 to 73 in 2024. For many years, private equity funds have been running a slide rule over Japanese companies and large sums have been allocated to investments in the country. The rise of activists on shareholder registers and directives from regulators have encouraged private equity to begin deploying this capital.

Figure 1: Amount of dry powder held by PE funds with interest in Japan (US$trn)

Figure 2: Number of shareholder proposals made by activists

Source: PwC paper based on Preqin database

Source: IR Japan

The impetus for reform is being supported by measures such as the TSE’s decision in November 2024 to identify companies that are tackling an inadequate return on capital employed, effectively naming and shaming those that are not. It is also publishing on companies’ willingness to engage with investors.

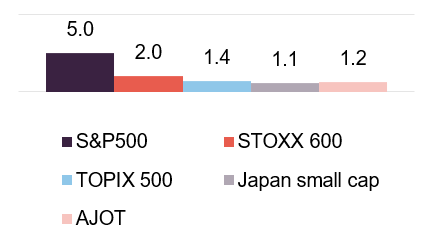

Figure 3: Price/book ratios

Source: AVI as at 31 January 2025

Japan’s Ministry of Economy Trade and Industry (METI) has been encouraging takeover approaches (it revised its guidelines for takeovers in 2023). All directors who are aware of an approach by a third party must now bring that to the attention of the full board (surprisingly, this was not a requirement in the past). These measures are being supported by activist pressure, which in turn is resulting in a change of corporate attitudes amongst management and boards.

AVI’s constructivist approach, which is as equally focused on how companies can improve margins, hone efficiency, and drive up profitability as it is on balance sheet reform, is being welcomed by most boards.

Figure 4: Analysts per stock in Japan

Source: AVI as at 31 January 2025

AVI says that, despite the pace of change, there is no shortage of opportunity. There are around 4,000 listed companies in Japan. Many of these have fallen under the radar of investors. AVI notes that around 70% of its target investment universe has no analyst coverage.

As at 28 February 2025, AVI had identified over 800 companies in its investible universe that meet initial screening criteria. Although valuations have risen from the extreme lows of when AJOT was launched, the environment has become more constructive and supportive of generating returns through active engagement.

Fund profile

More information is available at the fund’s website www.ajot.co.uk

AJOT is an investor in Japanese companies. Its focus is on good-quality small- and mid-cap listed companies that have a large portion of their market capitalisation in cash, listed securities or other realisable assets. AJOT’s manager seeks to engage proactively with these companies to unlock their value potential.

AJOT’s AIFM and investment manager is Asset Value Investors Limited (AVI). The lead manager working on AJOT’s portfolio is Joe Bauernfreund, one of a seven-strong team focused on Japan, one of whom is based permanently in Japan, and the majority of whom are Japanese-speakers. Within the team, Daniel Lee decided to leave the industry last autumn. AVI hired Nicola Takada Wood from Redwheel as its new managing director Japan. She is a fluent Japanese speaker and has worked in Tokyo. See page 17 for more information on the team.

AVI and its employees are aligned with shareholders

AVI was established in 1985 to manage what is now AVI Global Trust (AGT) and has total AUM of about £1.8bn. AVI began investing in Japan over four decades ago and AJOT was launched in October 2018 to focus on the opportunities presented by that market. At the end of February 2025, AVI owned 2,000,000 shares in AJOT.

AJOT compares its performance to the MSCI Japan Small Cap Total Return Index, expressed in sterling terms. The index does not inform AJOT’s portfolio construction. AJOT has a very high active share (about 98%) relative to the performance benchmark.

Is Japan’s economy normalising?

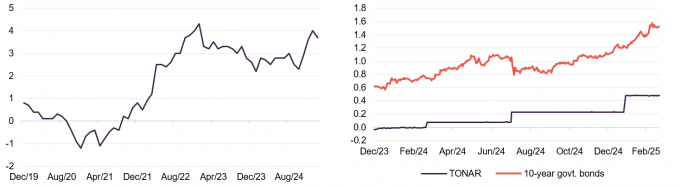

After many decades of a stagnant economy, deflation, and easy-money policies, there has been a shift over the last ten years, which has accelerated more recently. Inflation imported into the Japanese economy through soaring energy prices is now taking root as wage inflation picks up, wage increases in 2025 are forecast to be the highest in 34 years. Rising prices are depressing consumer spending, which is bad news in the short term. However, some analysts believe that the latest round of wage increases will reverse this. Once consumers’ mindsets have adjusted to the new reality, negative real interest rates could spur consumers to run down their excessive cash deposits, perhaps in favour of equity investments.

Figure 5: Japan inflation (CPI)

Figure 6: Japan interest rates

Source: Bloomberg

Source: Morningstar. TONAR is an acronym for Tokyo Overnight Average Rate, the Japanese equivalent of SONIA

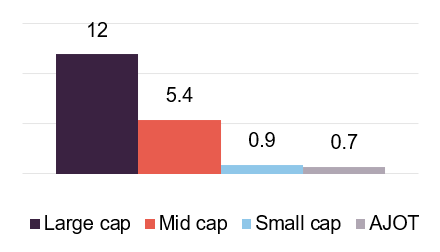

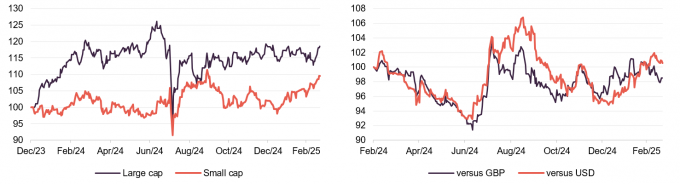

Japanese equities did well in the early part of 2024. Investors were encouraged by evidence that corporate governance reforms were working, endorsements by high-profile investors such as Warren Buffett, and a sense that the logjam in the Japanese economy was finally shifting. However, for the most part, that excitement was confined to large-cap stocks, which were often beneficiaries of the weak yen. Small caps, which derive most of their revenue domestically, remained out of favour.

The Bank of Japan’s decision to raise rates to 0.25% in July 2024 was widely anticipated, yet somehow still seemed to cause an upset in markets. Most commentators feel that the unwinding of yen carry trades (investments backed by borrowing in yen) caused the problem, but it also coincided with some weak data in the US. Markets recovered fairly swiftly, but remained fairly flat over the rest of the year. External factors, such as China’s weak economy, Trump’s election, and the associated possibility of a disruption to world trade, weighed on the market. In January 2025, rates were increased again to 0.5%.

Figure 7: Comparing Japan large cap and small cap

Figure 8: JPY exchange rates

Source: Bloomberg,

large cap is MSCI Japan, small cap is MSCI Japan Smaller Companies, both in JPY

Source: Bloomberg (rebased to 100 on 29 February 2024)

Since AJOT was launched, yen weakness has had a considerable impact on its returns and has masked the true level of its outperformance. Some commentators believe that the currency is overdue a rebound. Over the past 12 months, the yen has been volatile relative to sterling and the dollar, as Figure 8 shows.

Investment process – how the portfolio is selected

Start with a simple quantitative screen

As mentioned earlier, there are about 4,000 listed companies in Japan. AVI’s focus is on small- and mid-cap companies – those with market caps in a typical range of £50m to £4bn – where it can take meaningful stakes and leverage these to achieve results.

AVI begins by screening, on at least a monthly basis, the market for companies with excess cash/listed securities. The data is not always accessible – it takes a lot of work for the analysts to find the true figures – for example, sometimes the cash has been lent to the parent company.

Not all of these are great businesses – many are effectively zombie companies existing just to provide employment or to service pension payments. Given that it can take time for activism to bear fruit, a poor-quality investee company could destroy value faster than AVI can unlock it.

Exclude loss-making and highly cyclical businesses

The next step, therefore, is to exclude loss-making and highly cyclical businesses. AVI wants to invest in companies of reasonably good quality, with resilient business models and the prospect of healthy profit growth. The targets are solid and sometimes high-margin businesses. AVI quantifies the fundamental value of these companies using measures such as EV/EBIT.

Identify route to unlocking value

The next question is how might AVI go about unlocking value; for example, are there like-minded shareholders? This step includes dialogue with other key stakeholders.

About 80–120 companies make it through AVI’s screening criteria. The team carries out in depth research on about five to 10 companies per month. Roughly, AJOT ends up making one to three new investments each quarter.

Portfolio construction

From the target list, the manager maintains a single-digit number of “ready to go” opportunities on which it has performed detailed due diligence.

Each stock in the portfolio should have the potential to outperform the market on its quality and growth merits. Additional alpha then comes from the events that unlock the underlying value.

15–25 positions

AJOT is managed with about 15–25 positions and AVI is happy for AJOT to be at the low end of this. The manager applies a risk overlay to ensure that the portfolio is not over-exposed to any one sector or group of companies.

Starting with a hypothetical blank canvas, the manager would deem it appropriate to allocate roughly equally to each opportunity given the uncertainty around how engagement will evolve. However, in reality, portfolio sizes vary based on liquidity and the manager’s conviction in the likelihood of successful engagement and the possibility of a corporate event. If some positions are relatively low in weight, this is due to availability of capital rather than a desire to have small tail positions. At the end of February 2025, around 70% of the portfolio was invested in the 10 largest positions.

Ahead of a purchase, the analysts will prepare a detailed internal note on the suitability of a stock and an allocation decision will be made based on business quality, scope for upside through engagement, and liquidity.

AVI is prepared to be patient – it can take time to get alignment amongst stakeholders. The manager would exit a position if it became clear that the desired result was not achievable or if it felt that the quality of the stock had deteriorated markedly. The expected holding period is three to five years. However, turnover has recently been higher than this due to several privatisations and corporate events.

Given the approach, AJOT’s portfolio differs markedly from benchmark indices. For example, as at end February 2025, AJOT’s active share was about 98%.

AVI’s approach to engagement

No companies are truly alike, and thus AVI’s approach to engagement must be tailored to the idiosyncrasies of each company’s business model, and the governance issues that AVI is trying to remedy. However, AVI does not generally aim to take a hostile or overly aggressive approach to activism; rather, it aims to work with their management in private to find co-operative solutions to these companies’ problems. On average, AVI is meeting each investee company around seven times per annum.

Improving aspects of ESG is a core focus, as would be expected; as is improving balance sheet efficiency. However, AVI also aims to persuade company management to define and focus on core business segments, and to develop long-term strategies for achieving revenue growth and margin expansion.

AVI is prepared to go public with its concerns if they cannot resolve them in private

The team will seek to escalate the intensity of its campaigns if it is not seeing sufficient progress. For the majority of AJOT’s holdings, AVI’s campaigns will not be made public until after the outcomes have been announced, if at all. In rare cases, AVI may choose to initiate public engagement to apply additional pressure on management teams. AVI may submit shareholder proposals to drive changes in the board’s behaviour.

Investment restrictions

There are no limits on sector weightings within the portfolio. It is not expected that, at the time of investment, any single holding (including exposure by way of any derivative instrument) will represent more than 10% of AJOT’s gross assets. However, AJOT has discretion to invest up to 15% of its gross assets in a single stock if a suitable opportunity arises.

There are no restrictions on AJOT’s exposure to stocks with any given market capitalisation, but the portfolio will normally be weighted towards small- and medium-sized companies.

Derivatives can be used for efficient portfolio management purposes and to provide gearing.

Asset allocation

At the end of February 2025, AJOT’s gearing was 5.4%. This is more than offset by cash that the trust should receive once a couple of takeovers of stocks in the portfolio (Beenos and Tecnos Japan – see later) conclude.

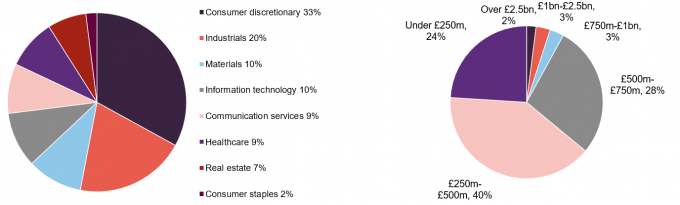

On 28 February 2025, AJOT had 25 holdings. As usual, the split by sector is a consequence of AVI’s stock selection decisions. The split by market cap indicates a shift towards smaller companies, as flagged in previous notes; although, as we discuss later, the managers are seeing opportunities amongst some companies towards the top end of AJOT’s target range.

Figure 9: AJOT sector breakdown as at 28 February 2025

Figure 10: AJOT portfolio split by market cap as at 28 February 2025

Source: AVI Japan Opportunity Trust

Source: AVI Japan Opportunity Trust

10 largest holdings

Since we last published, using data as at end June 2024, three positions – Nihon Kohden, NC Holding, and Jade Group – have exited the top 10, replaced by Atsugi, SharingTechnology, and Raito Kogyo.

Atsugi (atsugi.co.jp) manufactures stockings, lingerie, and elderly care products. SharingTechnology (sharing-tech.co.jp) is a portal that enables thousands of providers of professional services to communicate with customers, with services ranging from pest control to iPhone repairs. Raito Kogyo (raito.co.jp) is a landscape management business with operations in slope stabilisation, slope greening, ground improvement, and soil-cement walls.

The largest position, TSI Holdings, has demonstrated positive progress recently by selling off its former headquarters for a price equating to about 30% of its then market cap. Kurabo Industries and Aoyama Zaisan Networks have performed well and are discussed on page 12.

Nihon Kohden

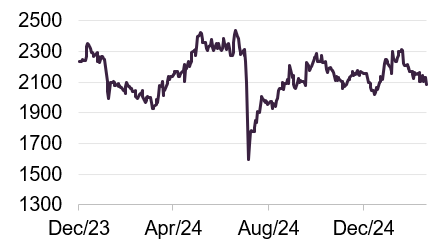

Figure 11: Nihon Kohden (JPY)

Source: Bloomberg

Nihon Kohden (nihonkohden.com) was discussed in our last note. The company had listened to AVI’s suggestions and acted upon them to the benefit of the share price. However, disappointing quarterly results (on the back of a decline in margins and an inventory write-down) weighed on returns.

As the share price recovered in the wake of the stock market wobble last summer, AJOT sold down its stake in the company. As we show on page 12, the pull-back in the share price in August weighed on AJOT’s returns for H2 2024. Nevertheless, over the life of this investment, it made a meaningful positive contribution to AJOT’s NAV progression.

NC Holdings

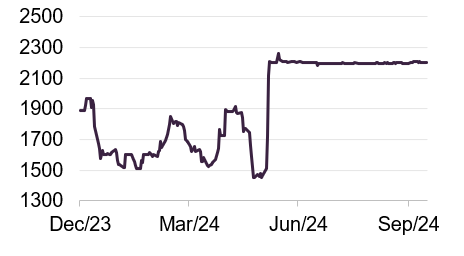

Figure 12: NC Holdings

Source: Bloomberg

NC Holdings is a conglomerate with a mix of businesses – conveyor belts, management of multistorey car parks (3D parking equipment and mechanical parking equipment), renewable energy (solar power), and charging equipment for the electric vehicles. It had been in AJOT’s portfolio since June 2021 and was a stock that we have discussed in a number of earlier notes.

Towards the end of June 2024, Miri Capital, which was another large shareholder in NC Holdings, decided to launch a bid for the shares that it did not already own. The bid price was at a 47% premium to the undisturbed price.

AVI was a significant investor in the company, owning around 22% of its shares, and its support was instrumental in the success of Miri’s bid.

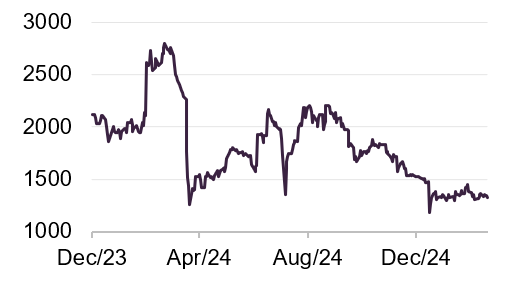

Jade Group

Figure 13: Jade Group (JPY)

Source: Bloomberg

AJOT’s position in Jade Group was sold in February 2025. It was a company that had been in AJOT’s portfolio for around three years. It had surplus cash on its balance sheet and was growing its revenue at a decent pace. AVI also noted that the management team was keen to grow the company, through M&A as well as organically.

However, AVI reassessed the position last year. The cash pile had been deployed on acquisitions and the valuation multiple had risen. AVI lost conviction in management’s efforts to improve communication with shareholders, particularly around the acquisition of Magaseek in 2024. It decided that there were better opportunities elsewhere. Over the life of the investment, AJOT made a return of 26% (and IRR of about 12%).

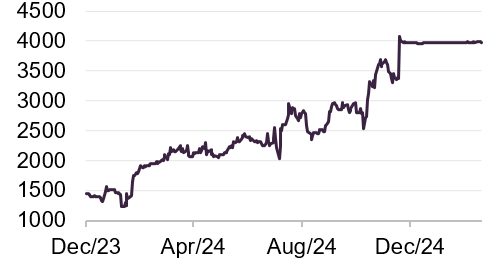

Beenos

Figure 14: Beenos (JPY)

Source: Bloomberg

Beenos (beenos.com) is an ecommerce operator that AJOT has held since January 2024 and built up a 9.5% stake in. We discussed it on page 9 of our last note, but to recap, it allows non-Japanese customers to purchase Japanese products from popular sites in Japan. The AVI team held 11 meetings with the company and submitted a shareholder proposal over the course of 2024.

After AVI declared its stake in the company, a number of other activists purchased shares in the company, driving up the share price and creating a situation where it was easier for a strategic or financial buyer to bid for the entire company.

LY Corporation is tendering for Beenos stock with the aim of acquiring the whole company. AJOT agreed to sell its stake into the tender offer. As Figure 15 shows, as at end January 2025, AJOT had made a 125% return on its investment.

The JPY4,000 tender offer price was at a 19% premium to the undisturbed closing price. That jump added 1.74% to AJOT’s NAV.

Tecnos Japan

Figure 15: Tecnos Japan (JPY)

Source: Bloomberg

Just outside the top 10 is IT services business Tecnos Japan (tecnos.co.jp). AVI recently signed a tender agreement with Ant Capital Partners Co., Ltd. for AVI’s 10% stake. Ahead of the announcement, the investment in Tecnos Japan accounted for 3.8% of AJOT’s NAV. The tender offer price of Y1,155 per share was at a 39% premium to the undisturbed closing price on 4 February 2025 and the deal added around 1.45% to AJOT’s NAV.

AJOT had been a shareholder in Tecnos Japan since April 2024, and in yen terms had already made a return of about 17% on its position before the tender was announced. AVI was the largest shareholder in Tecnos Japan, owning 10%. It had engaged extensively with the board of Tecnos Japan on ways to enhance corporate value and returns to shareholders.

Figure 16: 10 largest holdings at 28 February 2025

| Holding | Industry | AVI ownership (%)1 | EV/EBIT(x)1 | NFV as % of market cap1 | ROI in JPY(%)1 | Percentage of NAV 28/02/25 | Percentage of NAV 30/06/24 | Change(%) |

|---|---|---|---|---|---|---|---|---|

| Beenos | Ecommerce | 9.5 | 12.5 | 44 | 125.4 | 10.1 | 6.4 | 3.7 |

| TSI Holdings | Holds several clothing brands | 8.5 | 17.4 | 53 | 144.1 | 10.0 | 10.1 | (0.1) |

| Kurabo Industries | Conglomerate | 4.0 | 1.2 | 89 | 41.9 | 9.5 | 5.1 | 4.4 |

| Eiken Chemical | Diagnostics | 4.9 | 24.5 | 13 | 32.3 | 8.1 | 8.8 | (0.7) |

| Aoyama Zaisan Networks | Wealth management | 6.4 | 8.3 | 30 | 29.0 | 7.3 | 4.8 | 2.5 |

| SharingTechnology | Service matching platform | 13.0 | 9.5 | 18 | 9.5 | 6.2 | – | 6.2 |

| Atsugi | Apparel, stockings | 16.5 | n/a | 122 | 25.9 | 5.9 | – | 5.9 |

| Raito Kogyo | Construction groundworks | n/a | n/a | n/a | n/a | 4.9 | 4.5 | 0.4 |

| Tecnos Japan | IT services | n/a | n/a | n/a | n/a | 5.2 | 1.4 | 3.8 |

| Konishi | Synthetic adhesives and sealants | 4.7 | 5.6 | 32 | 75.1 | 4.4 | 5.8 | (1.4) |

| Total | 71.6 |

Performance

AJOT’s NAV and share price returns have continued to accelerate away from those of its benchmark, the MSCI Japan Small Cap index.

Figure 17: Total return cumulative performance over various time periods to 28 February 2025

| 3 months(%) | 6 months(%) | 1 year (%) | 3 years(%) | 5 years(%) | Since launch(%) | |

|---|---|---|---|---|---|---|

| AVI Japan Opportunity share price | 7.0 | 16.4 | 31.7 | 46.6 | 79.6 | 72.4 |

| AVI Japan Opportunity NAV | 9.8 | 17.2 | 33.4 | 54.7 | 88.2 | 85.7 |

| Benchmark | 0.9 | 2.1 | 4.9 | 16.9 | 30.7 | 22.2 |

Up-to-date information on AJOT and its peers is available on our website

AJOT’s returns are driven by the manager’s stock selection and the success of its campaigns to unlock value. We believe that its performance is best considered over the long term. From launch to the end of February 2025, AJOT’s NAV was over 60 percentage points ahead of its benchmark.

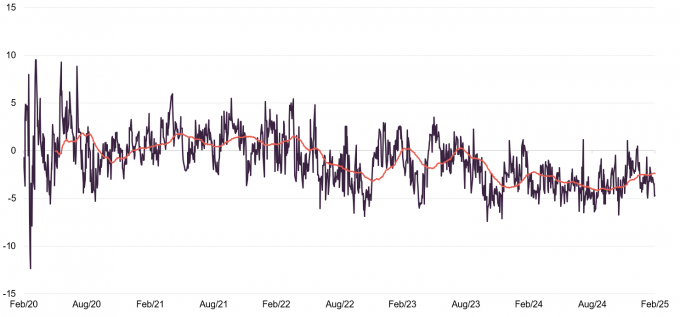

Figure 18: AJOT NAV total return performance relative to MSCI Japan Small Cap index for the five years to 28 February 2025

Source: Morningstar, Marten & Co

Performance attribution

AVI provided us with data on the leading contributors and detractors from AJOT’s returns over the second half of 2024.This complements the data that we provided in our last note, which covered the first six months of 2024.

Figure 19: Leading contributors and detractors from AJOT returns over H2 2024

| Contribution (GBP %) | Share price return (%) | Contribution (GBP %) | Share price return (%) | ||

|---|---|---|---|---|---|

| Beenos | 5.2 | 67.6 | Hachijuni Bank | (0.1) | (2.0) |

| Kurabo Industries | 1.7 | 16.6 | Kyoto Financial Group | (0.2) | (17.6) |

| Aoyama Zaisan Networks | 1.6 | 25.9 | Shiga Bank | (0.2) | (5.5) |

| Atsugi | 1.0 | 57.9 | Rohto Pharmaceutical | (0.5) | (14.3) |

| TSI Holdings | 1.0 | 9.3 | Nihon Kohden | (0.5) | (6.6) |

Positive contributors

We discussed Beenos and TSI Holdings earlier.

Kurabo Industries

Figure 20: Kurabo Industries (JPY)

Source: Bloomberg

Kurabo Industries (kurabo.co.jp) was mentioned in our last note, but to recap, it is a conglomerate that started life as a textile company and now has a presence in chemical products, advanced technology, food and services, and real estate. AVI was attracted by a strong core business and overcapitalised balance sheet.

Figures for the nine-month period ended 31 December 2024 show flat sales but a decent 12% improvement in its operating profit and a much greater 46% improvement in earnings per share. The full-year dividend target has been hiked by 50% and the company has been buying back shares.

Figure 21: Aoyama Zaisan Networks (JPY)

Source: Bloomberg

Aoyama Zaisan Networks

We discussed Aoyama Zaisan Networks in our last note (see page 9 of that note). Japan’s ageing population supports support the growth of its inheritance tax planning service. The company recently released results for 2024 that showed a 26% increase in net sales year-on-year, and a 17.8% uplift in profit attributable to shareholders. Aoyama Zaisan Networks is targeting a 10% increase in customer numbers for 2025. The plan is to raise the dividend by 5 yen to 51 yen, and it will also establish a new shareholder benefit programme. AVI still believes there is further upside to be had.

Negative contributors

None of the negative contributors are particularly significant and most of these are relatively new positions that would ordinarily take time to show improvement. We discussed Nihon Kohden on page 9.

Rohto Pharmaceuticals

Figure 22: Rohto Pharmaceuticals (JPY)

Source: Bloomberg

Rohto Pharmaceuticals is a relatively new investment for AJOT. Its share price fell sharply on the back of its interim results in November and has continued to slide since. Higher sales, especially in overseas markets, did not translate into higher profits, as the company reported higher cost of sales and increased R&D expenditure. However, more recently in February 2025, the company raised its full-year dividend forecast from 33 yen to 36 yen, implying an improved outlook for profitability.

Dividend

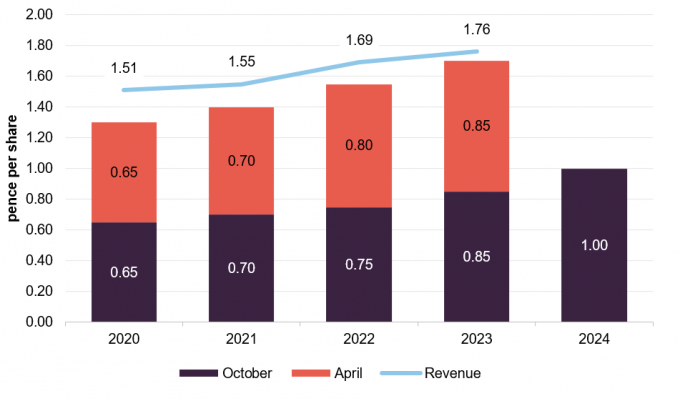

AJOT is not managed to produce any target level of income. The board distributes substantially all of AJOT’s net revenue, taking the form of semi-annual dividends declared in April and October.

At 30 June 2024, AJOT had accumulated revenue reserves of £2,629,000 (1.92p per share), which have been building since launch, as revenue has been consistently ahead of the level of distribution.

Figure 23: AJOT dividend history – accounting years ended 31 December

Source: AVI Japan Opportunity Trust

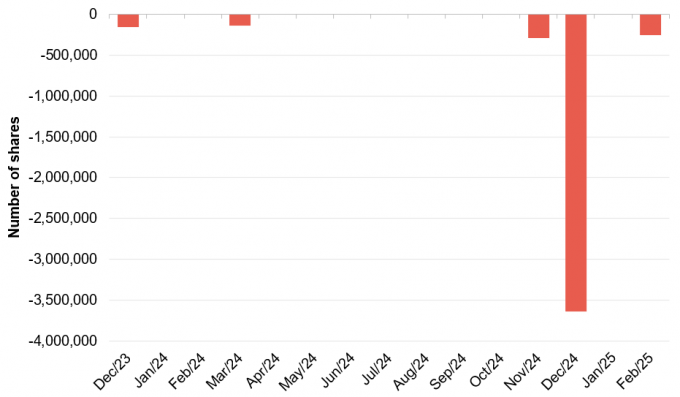

Capital structure

At 21 March 2025, AJOT had 137,198,943 ordinary shares in issue, 1,075,716 of which were held in treasury. Therefore, the number of shares admitted to trading and with voting rights was 136,123,227. There are no other classes of share capital. No ordinary shares were held in treasury at that date.

The company’s accounting year end is 31 December, and its AGMs are usually held in April/May.

AJOT has an unlimited life; however, shareholders have a regular opportunity to exit the company at a price close to NAV. The most recent opportunity was announced in October 2024 and took the form of a tender offer at NAV after costs associated with providing the tender less a 2% discount. 3,637,759 shares were tendered at 152.37p per share. These shares were repurchased and cancelled.

In 2024, the board amended the exit opportunity schedule, increasing the frequency from biennially to annually. Details of the next opportunity will be announced in October 2025.

We do not agree with the board’s decision. We feel that it is incompatible with the long-term nature of AJOT’s investment approach and what may – from time to time – be a relatively illiquid portfolio.

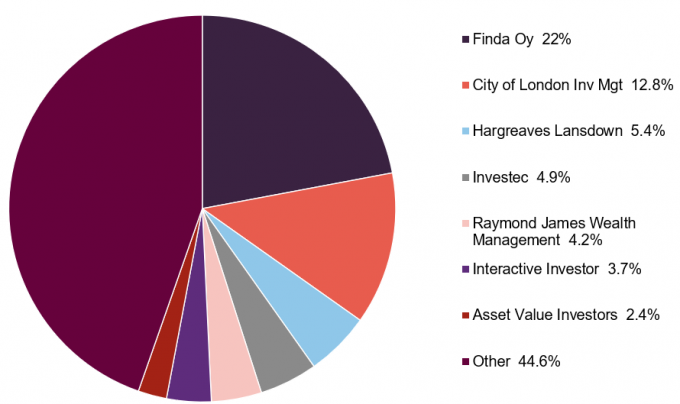

Major shareholders

Figure 26: Major shareholders as at 21 March 2025

Source: Bloomberg

Gearing and hedging

AJOT has a JPY2.93bn (roughly £15.3m) revolving credit facility that matures on 2 April 2026. Interest is charged at TONAR plus 1.55%.

AJOT does not currently intend to hedge its underlying currency exposure, but the board and manager keep this under review.

Management team

AVI is fielding quite a large team on AJOT (currently seven in total, five of whom are Japanese nationals). In addition, AVI is recruiting an ESG analyst to work with the team.

Joe Bauernfreund (CEO and CIO)

Joe is chief executive officer and chief investment officer of AVI. He is the sole manager of AVI Global Trust and AVI Japan Opportunity Trust and responsible for all investment decisions across AVI’s global and Japan strategies. Before joining AVI in 2002, Joe worked for six years at a real estate investment organisation in London. He has a Masters in Finance from the London Business School.

Nicola Takada Wood (managing director Japan)

Nicola joined AVI in January 2025 from Redwheel, where she was portfolio manager and portfolio advisor of the Japan strategy. Prior to that she was responsible for Japanese equity sales at Mizuho International and Japanese sales trading at Goldman Sachs (Japan). Nicola has a BSc from University of London, SOAS.

Kaz Sakai (head of Japan research)

Kaz started working with AVI in May 2020, researching Japanese companies while completing his MBA at Harvard Business School. He formally joined AVI’s investment team in June 2021. Prior to Harvard, he was engagement manager at McKinsey & Company’s Strategy and Corporate Finance Practice in Tokyo.

Kaz had previously been with McKinsey & Company from 2011–2016 as a general consultant in Tokyo and an RTS Practice Associate in Melbourne, and also gained valuable private equity experience from 2016-2018. He holds a BSc in Geochemistry from the University of Tokyo and an MBA from Harvard Business School.

Shuntaro Shimizu (senior investment analyst)

Shuntaro joined AVI in August 2023 from Bain & Company, where he worked within its management consultancy division. Prior to that, he worked within the Bank of Japan. He has a Bachelor of Law degree from the University of Tokyo and an MBA from Stanford.

Jason Bellamy (senior engagement consultant)

Jason joined AVI in March 2020. He works closely with the analyst team and leads on the engagement efforts in Japan. Jason brings more than 30 years’ experience in the financial services industry, working for and engaging with global companies, government bodies, regulators and international investors including Sumitomo Mitsui Trust Bank, First Trust Advisors and Aberdeen Standard Investments. He is based in Tokyo.

Jason has a BSc in Economics from The London School of Economics & Political Science (University of London).

Luke Hutcherson (investment analyst)

Luke joined AVI in February 2023. He researches Japanese companies and provides support to the investment team. Before joining AVI, he completed internships at Tico Capital Management and Ernst & Young. Luke has a BCom in Finance & Accounting from the University of Sydney and an MSc in Financial Analysis from London Business School.

Yuki Nicholas (Japan team assistant)

Yuki joined AVI in February 2020 as a Japan team assistant to provide translating support, desk research and other secretarial support to the members of the Japan team.

Yuki previously worked for BZW Tokyo as an assistant to the investment strategist and the economist.

Board

AJOT has four directors, all of whom are non-executive and independent of the manager. No director sits on another board together with another member of AJOT’s board. The directors stand for re-election at each AGM.

The composition of the board has been refreshed in recent months, with Yoshi Nishio resigning with effect from 30 September 2024, Katya Thomson stepping down on 21 January 2025, and Andrew Rose and Tom Yoritaka appointed in February 2025. Margaret Stephens took on the role of chair of the audit committee following Katya’s departure.

Figure 27: Directors’ length of service, fees, and shareholding

| Role | Appointed | Length of service (years) | Fees(£) | Shareholding | |

|---|---|---|---|---|---|

| Norman Crighton | Chairman | 27/07/2018 | 6.7 | 45,000 | 26,575 |

| Andrew Rose | Director | 12/02/2025 | 0.1 | 38,000 | – |

| Margaret Stephens | Chair of the audit committee | 05/09/2018 | 6.6 | 41,000 | 10,000 |

| Tom Yoritaka | Director | 12/02/2025 | 0.1 | 38,000 | – |

Norman Crighton

Norman is an experienced public company director, having served on the boards of eight closed-end funds and one operating company. He has 32 years of experience in investment companies, having previously been head of closed-end funds at Jefferies International and investment manager at Metage Capital Limited. Norman’s career in investment banking covered research, sales, market making and proprietary trading, servicing major international institutional clients over 15 years. His work in many countries included restructuring closed-end funds as well as several IPOs. As a fund manager, Norman managed portfolios of closed-end funds on a hedged and unhedged basis covering developed and emerging markets.

Following on from his long-term promotion of best corporate governance practice, Norman has more recently been focusing on expanding his work into environmental and social issues. He holds a Master’s degree from the University of Exeter in Finance and Investment.

Norman is currently non-executive chair of RM Secured Direct Lending Plc and Harmony Energy income Trust Plc.

Andrew Rose

Andrew is a respected conference speaker and media commentator in both English and Japanese, with over 38 years of expertise in Japanese equities. He held senior roles at Schroder Investment Management in both Tokyo and London. For 13 years, he managed the Schroder Tokyo Fund and the Schroder Japan Growth Fund Plc in London. In Japan, he served as head of Japanese equities at Schroder Investment Management for five years, where he built a robust team and significantly grew assets.

From 1984 to 2001, Andrew worked in various research and fund management positions across Japan and the UK, covering the full market capitalisation spectrum. His deep knowledge of Japanese listed companies earned him recognition as a successful equity manager. Additionally, Andrew served as a non-executive director and member of the Audit and Supervisory Committee at Uhuru Corporation in Tokyo for three years.

Margaret Stephens

Margaret was a partner at KPMG until 2016, having qualified as a Chartered Accountant in 1988. From 2007, she played a key role in building KPMG’s Global Infrastructure Practice, also leading UK and international due diligence and structuring services on major merger and acquisition transactions and public private partnerships. Margaret was also a board trustee of the London School of Architecture until April 2020 and a non-executive board member and chair of the audit and risk committee at the Department for Exiting the European Union until its closure in January 2020.

Currently, Margaret is a non-executive director of VH Global Energy Infrastructure Plc and Sequoia Economic Infrastructure Income Fund Limited.

Tom Yoritaka

Tom is a venture capital investor, software executive and board member with over 30 years of experience in the technology industry in the UK, North America, and Japan. He invests in early-stage technology/science-backed start-ups and works closely with founders and co-investors, many of whom are leading venture capital funds or C-suite executives of multinational companies. He also sits on the Board of Trustees of SOAS University of London, as well as on boards of various technology industry organisations in the UK.

Previously, Tom served in software product and corporate development executive roles at Cisco Systems, Yahoo!, and Microsoft in the US. Early in his career, he worked as a strategy consultant at The Boston Consulting Group in the US and Japan.

Previous publications

Readers interested in further information about AJOT may wish to read our previous notes listed below. You can read them by clicking on the links in Figure 28 or by visiting our website.

Figure 28: QuotedData’s previously published notes on AJOT

| Title | Note type | Date |

|---|---|---|

| Progress on a number of fronts | Initiation | 20 July 2021 |

| The tortoise triumphs | Update | 15 February 2022 |

| Maintaining its firepower | Annual overview | 21 October 2022 |

| Good governance, better returns | Update | 19 July 2023 |

| The sun has risen | Annual overview | 20 February 2024 |

| Pushing on an opening door | Update | 6 August 2024 |

IMPORTANT INFORMATION

This marketing communication has been prepared for AVI Japan Opportunity Trust Plc by Marten & Co (which is authorised and regulated by the Financial Conduct Authority) and is non-independent research as defined under Article 36 of the Commission Delegated Regulation (EU) 2017/565 of 25 April 2016 supplementing the Markets in Financial Instruments Directive (MIFID). It is intended for use by investment professionals as defined in article 19 (5) of the Financial Services Act 2000 (Financial Promotion) Order 2005. Marten & Co is not authorised to give advice to retail clients and, if you are not a professional investor, or in any other way are prohibited or restricted from receiving this information, you should disregard it. The note does not have regard to the specific investment objectives, financial situation and needs of any specific person who may receive it.

The note has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. The analysts who prepared this note are not constrained from dealing ahead of it, but in practice, and in accordance with our internal code of good conduct, will refrain from doing so for the period from which they first obtained the information necessary to prepare the note until one month after the note’s publication. Nevertheless, they may have an interest in any of the securities mentioned within this note.

This note has been compiled from publicly available information. This note is not directed at any person in any jurisdiction where (by reason of that person’s nationality, residence or otherwise) the publication or availability of this note is prohibited.

Accuracy of Content: Whilst Marten & Co uses reasonable efforts to obtain information from sources which we believe to be reliable and to ensure that the information in this note is up to date and accurate, we make no representation or warranty that the information contained in this note is accurate, reliable or complete. The information contained in this note is provided by Marten & Co for personal use and information purposes generally. You are solely liable for any use you may make of this information. The information is inherently subject to change without notice and may become outdated. You, therefore, should verify any information obtained from this note before you use it.

No Advice: Nothing contained in this note constitutes or should be construed to constitute investment, legal, tax or other advice.

No Representation or Warranty: No representation, warranty or guarantee of any kind, express or implied is given by Marten & Co in respect of any information contained on this note.

Exclusion of Liability: To the fullest extent allowed by law, Marten & Co shall not be liable for any direct or indirect losses, damages, costs or expenses incurred or suffered by you arising out or in connection with the access to, use of or reliance on any information contained on this note. In no circumstance shall Marten & Co and its employees have any liability for consequential or special damages.

Governing Law and Jurisdiction: These terms and conditions and all matters connected with them, are governed by the laws of England and Wales and shall be subject to the exclusive jurisdiction of the English courts. If you access this note from outside the UK, you are responsible for ensuring compliance with any local laws relating to access.

No information contained in this note shall form the basis of, or be relied upon in connection with, any offer or commitment whatsoever in any jurisdiction.

Investment Performance Information: Please remember that past performance is not necessarily a guide to the future and that the value of shares and the income from them can go down as well as up. Exchange rates may also cause the value of underlying overseas investments to go down as well as up. Marten & Co may write on companies that use gearing in a number of forms that can increase volatility and, in some cases, to a complete loss of an investment.