Bluefield Solar Income Fund – Walking on sunshine

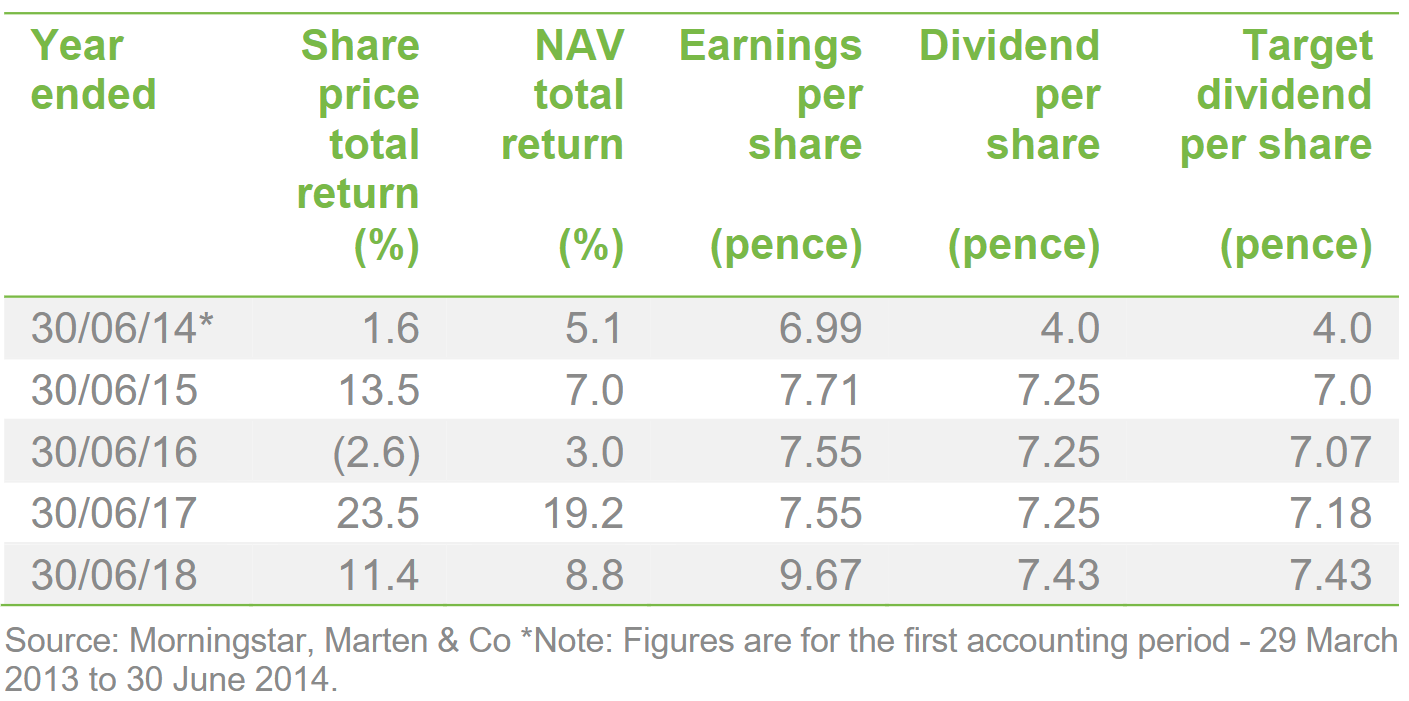

Faced with rising prices for secondary solar PV assets, Bluefield Solar Income Fund (BSIF) has taken a strategic decision not to emphasise portfolio expansion during the last couple of years. A focus on increasing operational efficiency, coupled with a 32.5% increase in the power price, has helped deliver a 16.2% year-on-year uplift in BSIF’s underlying earnings for the year ended 30 June 2018 (from 8.32 pps to 9.67pps).

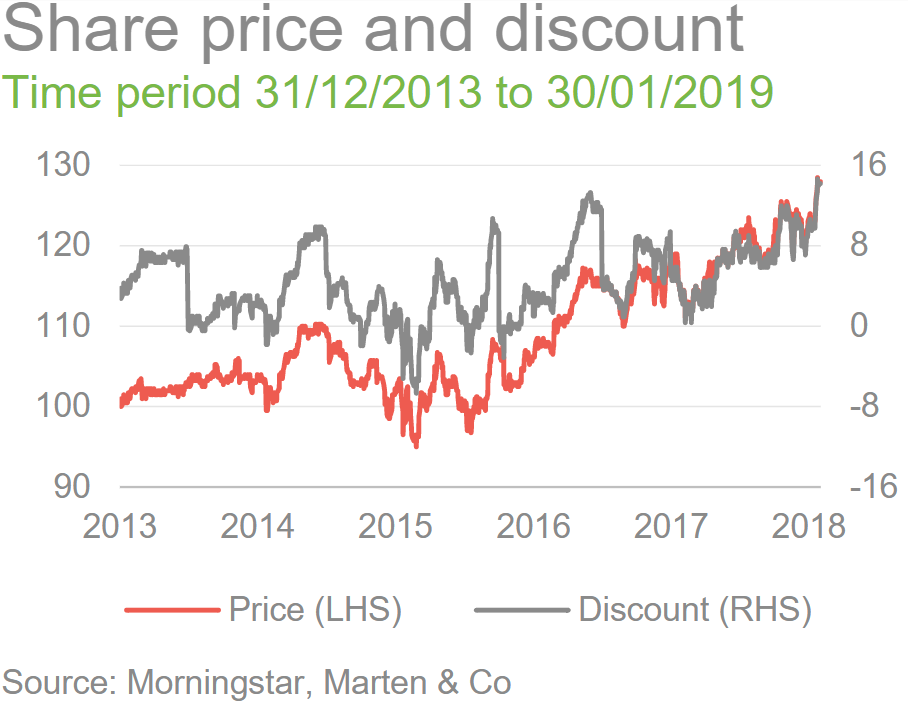

BSIF has an annual dividend target that, after the repayment of debt, is RPI linked (7.68p for the current year – a 6.0% yield on the current share price), which it is well-positioned to meet, and offers one of the highest yields in its sector.

Pure play large-scale UK solar photovoltaic assets

BSIF’s aims to pay shareholders an attractive return, principally in the form of regular income distributions, by investing in a portfolio of large-scale, UK-based solar-energy infrastructure assets. BSIF is targeting long-life assets that are expected to generate stable renewable energy output over at least a 25-year life. Individual assets, or portfolios of assets, are held in SPVs (BSIF can invest in these using both equity and debt).

Dividends are paid quarterly and, should the total dividend fall short of its RPI-linked target, the manager’s fee is subject to a clawback (a performance fee is also earned if the dividend beats the target).

BSIF : Bluefield Solar Income Fund – Walking on sunshine