Time, well invested

Caledonia Investments (CLDN) is a self-managed trust that, at its heart, is about backing companies, with strong market positions and fundamentals, for the long term. CLDN buys to hold, targeting long-term compounding real returns from its portfolio. Its investment strategy means that it can ignore the gyrations of fickle markets, exploiting secular growth rather than short term cyclical opportunities.

CLDN’s £3bn of net assets is invested across a focused portfolio of: good-quality public companies; carefully-chosen and (as its history of realisations might suggest) conservatively-valued direct, predominantly UK headquartered mid-market private companies; and private equity funds, investing in North American and Asian private companies.

With its culture underpinned by the long-term support of the Cayzer family, CLDN is essentially a listed family office. It invests time in nurturing its team, and in building its relationships and understanding of the companies that it invests in.

The interests of the management team and shareholders are wholly aligned. Few listed funds have an explicit objective of growing shareholders’ capital and income in real terms, but CLDN does, and has a long track record of success in this regard, having grown the value of net assets by 160% over the 10 years to end June 2024.

Inflation-beating returns

CLDN’s aim is to generate long-term compounding real returns that outperform inflation by 3%-6% over the medium to long term, and the FTSE All-Share index over 10 years.

Generating real, absolute returns, over the long term

Objective

Growing the real value of net assets and dividends

In line with its strategic objectives of growing the real value of its net assets and dividends, while managing investment risk for long term wealth creation, CLDN has set itself the target of generating long-term compounding real returns that outperform inflation by 3%-6% over the medium to long term, and the FTSE All-Share index over 10 years.

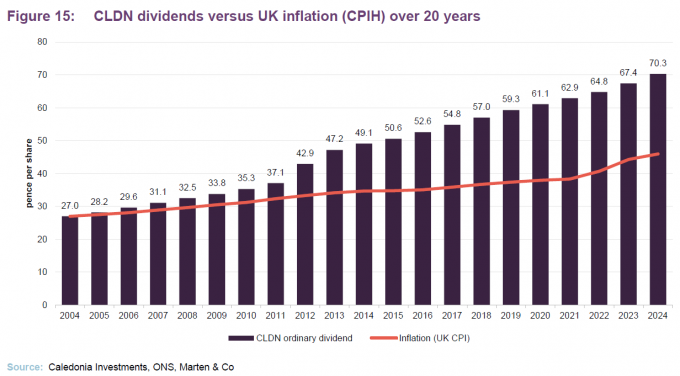

Meeting its objectives

As we show in Figure 10 on page 16, the performance objectives have been achieved comfortably, and on the dividend front, as we show in Figure 15 on page 20, CLDN has grown its dividend well ahead of inflation. It is a leading AIC dividend hero, having grown its dividend each year for 57 consecutive years.

However, it is important to stress that none of the portfolio is managed to beat a benchmark – that is simply not how the CLDN approach works. For example, the equity managers buy companies they believe will generate long term compounding returns, not companies that everyone else is buying just because they dominate an index.

Founding family’s significant stake nurtures a culture of long-term thinking

CLDN has a rich history, having evolved from a family-run shipping business established in the late 1800s to a broadly diversified global investment trust today, that offers something akin to a family-office service but makes it available to shareholders of all sizes. The founding Cayzer family still owns about 49% of the company and a number of their representatives sit on the board (see pages 23 and 24). This has nurtured a culture of long-term thinking and an entrepreneurial environment, but with a measured approach to risk.

Letting the companies drive the returns

Experience has shown the CLDN team that investing in companies and allowing them to drive value, rather than short-term trading delivers very good returns.

Investment approach

Investing in high quality companies

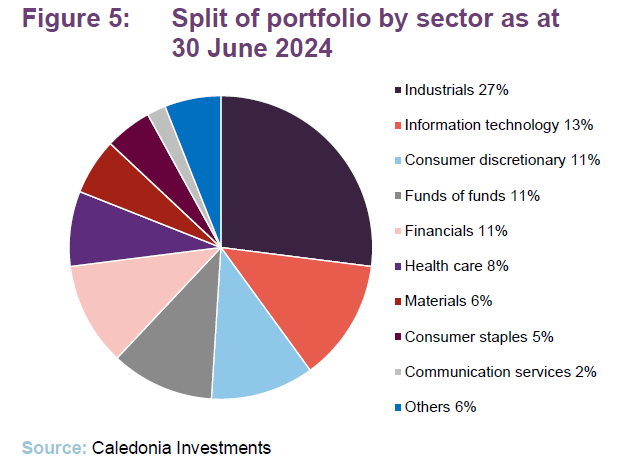

CLDN’s approach incorporates three investment strategies, each of which is fundamentally doing the same thing – identifying and backing high quality and growing companies, while seeking to manage company specific risks through diversification, both by company, market and geography and investing time in understanding the companies and what drives returns through extensive due diligence – but in different areas of the market.

‘Time is our friend’

CLDN believes in the power of compounding returns over long periods of time. Taking a long-term view and being patient have been key to its success. As a self-managed trust, CLDN is not constrained by a need to meet short-term performance objectives or comply with fixed-life fund cycles. The team is focused solely on CLDN’s success, incentivised in such a way as to be aligned with shareholders, and is not distracted by running outside money or the need to fundraise.

CLDN has access to revolving credit facilities for working capital purposes but no permanent debt. Investments are funded off its balance sheet.

Accomplishing CLDN’s objectives requires a great team of people and a willingness to tap into outside expertise when appropriate.

Strategy is set by the CEO and the board has an oversight function

Everything is managed from one office. Strategy is set by the CEO with support from the executive team. The board provides oversight, but it is not involved in day-to-day decisions. However, it will sign off material investment decisions, such as a new investment or realisation in the private capital portfolio.

Day-to-day investment decisions are signed off by an investment committee

All investment decisions are signed off by an investment committee made up of CEO Mat Masters, CFO Rob Memmott, company secretary Richard Webster, and the team heads – Jamie Cayzer Colvin (head of funds), Tom Leader (head of private capital), Ben Archer (co-head of public companies), and Alan Murran (co-head of public companies).

They find that debating the merits of each investment decision promotes a culture of long term ownership, in line with CLDN’s overall ethos.

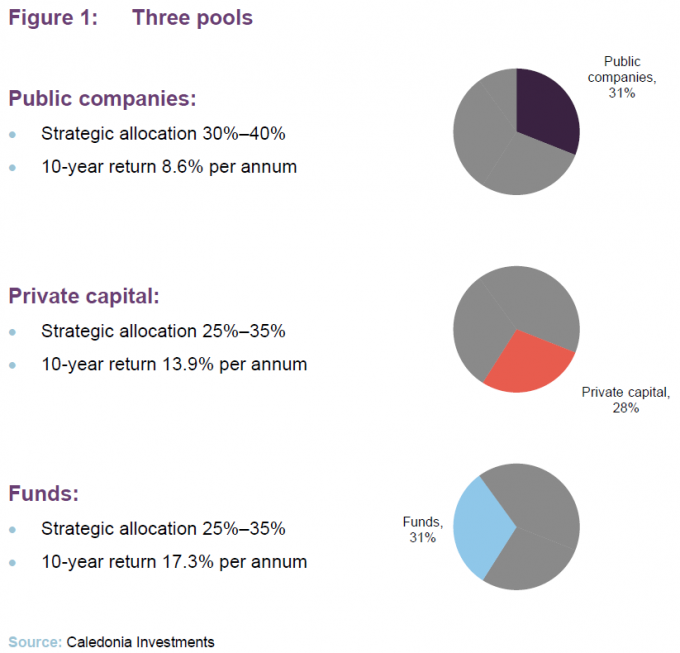

Three pools

CLDN’s capital is invested across three pools – each has a strategic allocation and target return. The three investment strategies deliberately address large markets. which CLDN expect will offer attractive long-term opportunities.

Public companies

Capital and income pools of public companies

The public companies allocation is run by a single team and is not managed to any benchmark. The strategic allocation to this part of the portfolio has been set at 30%–40%, but this pool of assets is further subdivided into a capital portfolio – headed up by Alan Murran – and an income portfolio – headed up by Ben Archer. Altogether, they hold about 30 stocks.

High quality, well-understood businesses

In both cases, these are global portfolios of high-quality businesses that the team feels that it has a good understanding of. These companies should have underlying growth and pricing power. Companies with little trading history, unprofitable companies, and recent IPOs are discounted. There is also a general aversion to banks and companies sensitive to commodity price fluctuations.

Targeting 10% a year on the capital portfolio and 7% a year on the income portfolio

The portfolios are invested to achieve a total return target of 10% a year on the capital portfolio and 7% a year on the income portfolio.

The capital portfolio is unconstrained. Given the importance ascribed to the quality of these businesses, many will pay a dividend, and this part of the portfolio makes a meaningful contribution to the trust’s revenue account.

The income portfolio, valued at £251m (currently 26.5% of the public companies portfolio) provides a reliable income stream to cover a portion of CLDN’s cost base and dividend.

Think about what might go wrong

The team does a great deal of due diligence on potential investments. The outlook for these companies is considered over the long term and emphasis is placed on determining what might go wrong with their thesis. Companies that appear to be good at optimising returns on capital are favoured. They should have robust balance sheets.

Do your research and be nimble when the chance arises

The team will form a view of an appropriate valuation for a stock through extensive due diligence and financial modelling. Nevertheless, periods of stock market volatility – such as the March 2020 COVID panic – can provide an opportunity to invest at attractive prices (as we show when discussing Oracle on page 14 and Watsco on page 15). It is important that they have done the work ahead of time and then can be nimble when the chance arises.

When stocks get more expensive, they are reassessed against the 10% per annum long-term target. The team may trim or add to positions on market volatility, but turnover is generally low.

3.5% yield target on cost to support CLDN’s progressive dividend policy

Recognising that higher yields are often associated with riskier businesses, the yield threshold for a stock to be considered for inclusion within the income portfolio is now 3.5% on cost (down from 4.5%). The team wants to hang onto good quality businesses, and so any income stock that re-rates so that its running yield falls below this level may be retained within the portfolio. Given the target of growing investors’ income in real terms, it is important that these stocks offer good dividend growth prospects. However, the team takes a portfolio approach, including a mix of higher-yielding lower growth stocks as well as lower-yielding but faster-growth companies.

(Commentary on the recent performance of this pool is provided on pages 18 and 19).

Private capital

Focused portfolio of private companies

This part of the portfolio is invested in a target portfolio of six to eight companies with the aim of generating a total return target of 14% a year and a 2.5% yield on cost. The strategic allocation to this area is 25%–35%. However, it is currently towards the lower end of that range following the sale of 7IM (see page 7).

The 10-strong private capital team is led by Tom Leader. It is focused on origination, valuation and working to support value creation within investee companies. Unlike traditional private equity investors, the long-term focus of CLDN means that the team have a buy-to-own philosophy rather than buy-to-sell.

The private capital allocation is composed of direct investments focused on high-quality, mainly-UK headquartered, mid-market companies.

CLDN partners with management to drive improvements; leverage used conservatively

Typically, CLDN will invest £50m–£150m in these businesses for a controlling stake (although there are some minority positions within the portfolio). CLDN sees itself as partnering with these companies. Value is created by improving the underlying business rather than financial engineering.

Leverage is used conservatively, typically in a range of 2x–2.5x. That makes this part of the portfolio much less sensitive to interest rates and helps facilitate the payment of dividends.

Good quality businesses with a path to improving profitability

Given the income requirement and CLDN’s conservative approach, target companies must be good-quality, EBITDA-positive (they are unlikely to buy a loss-making company), and have a clear path to increasing profitability. When assessing potential investments, maintenance capex is factored into their deliberations. CLDN tends to avoid capital-hungry businesses and is happy to support sensible accretive bolt on acquisitions, but is unlikely to seek out a buy-and-build strategy (7IM is a good example of this – see page 7).

CLDN is wholly aligned with the underlying management teams

CLDN likes to back good management teams, but is happy to make changes where necessary, for succession reasons for example, and can tap into its network to help source talent. CLDN seeks to align with management by investing in the same ordinary equity as them. In addition, as an evergreen fund, CLDN can be a genuine long-term backer of these businesses, and that helps build trust.

CLDN works with the management team, not looking to interfere with the day-to-day running of the company, but rather to provide a strategic partner and, when needed, capital for investment and acquisitions.

Realisations

Unlike a typical private equity investor, there is no fixed timeframe for realising these assets and CLDN will happily continue to hold them as long as it sees long-term growth potential. However, all of these investments are for sale at the right price.

As one example, Deep Sea Electronics – a business that CLDN bought in 2018 for equity of £117.2m and short-term debt of £50m that was subsequently repaid – was one that the team was happy to hold for the long term. However, Genarac Holdings – a US strategic buyer – was keen to acquire the company and CLDN sold its stake for net proceeds of £242.2m in 2021, making a return of 2.0x in three years.

There is no proscribed upper limit for the size of a successful investment within the portfolio, but CLDN are conscious of single asset risk.

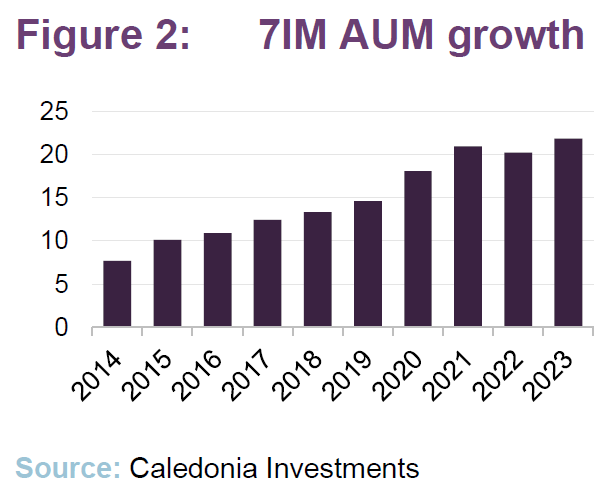

Seven Investment Management

Seven Investment Management was a recent success. In 2023, CLDN’s stake in that business was sold to Ontario Teachers’ Penson Plan Board for £255m, crystallising a return of 2.3x on cost and a 15% IRR.

CLDN acquired a 94% stake in the business for £74m in September 2015 and topped this up with £54m of follow-on capital, although this was offset by £42m of dividends.

CLDN’s investment thesis for long term ownership was to expand direct to consumer distribution, invest in people and operations and management succession. A new CEO was appointed in 2019 and a new chair in 2020.

7IM implemented a strategic shift under CLDN’s ownership, expanding its reach to retail customers, with a shift to a ‘platform led’ wealth manager model.

7IM’s AUM grew from £7.7bn in 2014 to £21.8bn at the end of Q3 2023. Much of this was organic, however 7IM also acquired Tcam in 2018, Partners Wealth Management and Find a Wealth Manager in 2020, and Amicus Wealth in 2023.

(Commentary on the recent performance of this pool is provided on page 19).

Private equity funds

Funds provide exposure to things that the team could not do on its own

The strategic allocation to this area is 25%–35% and the total return target is 12.5% per annum. The funds allocation provides diversified long term returns in geographic markets that counterbalance CLDN’s quoted equity and UK-centric private capital investments. This part of CLDN’s portfolio covers about 74 funds (including some funds of funds), managed by 42 managers, with over 600 underlying companies.

The allocation is split currently between North America (59%) and Asia (41%). Globally, market activity has slowed over the last 18 months, although there was a pick-up in North America in Q1 of 2024. The team is expecting relatively depressed levels of activity in Asia to continue for a while yet.

CLDN wants to see evidence that the underlying General Partner’s (GP) approach is working before making an investment with them. Usually, therefore, CLDN will typically not invest until the GP is launching its second or third fund. The team does not tend to invest in first time funds, unless they are backing a team that has spun out from a manager they know well.

Valuations are conservative – there is no benefit to write them up ahead of realisation

There is no benefit to the GPs to writing up valuations (because fees are based on committed capital and crystallised capital gains) and so there is often a big jump in the value of a position on realisation.

At end March 2024, CLDN had outstanding commitments of £377m that it expected to be drawn over three to four years. That was balanced against cash of £227m and CLDN’s £250m undrawn credit facility. CLDN observes that it expects a number of its US managers to be fundraising over the next 12-18 months, as broader market conditions for exits in this market improve.

North America

US lower mid-market buyouts, a hard to access part of the market for UK-based investors

The North American exposure is to lower-mid-market buyouts, a part of the market that is hard to access for UK-based investors. Often, they are the only European investor in these funds, and have an advisory board seat for 80% of the funds. There is less competition for deals in this part of the market and typically this represents the first institutional money being invested in these companies. The GPs provide knowledge, resources, and capital. They may also add some leverage. Exits tend to be to strategic buyers alongside mid-market private equity players.

Typically, CLDN is making primary investments into four or five new LPs each year and can also participate in the secondary market. Three of these deals will be with GPs that they have backed before, and the balance will be with new GPs.

The team considered whether it should get exposure through co-investments, but decided that this did not make sense from a risk perspective in its chosen area of lower mid-market.

The weighted average life (time elapsed since first investment) of CLDN’s North American primary fund investments is about 4.0 years. Most private equity LP structures are established with 10-year lives and will typically look to hold investments for between four and seven years. Hence a weighted average life of 4.0 years might suggest that these funds contain a number of relatively mature investments.

New Heritage Capital

To illustrate the approach, CLDN recently provided investors with more information on its investments with New Heritage Capital, a mid-market (enterprise value of $50m–$200m) buyout firm based in Boston with a focus on business services, healthcare services and specialised manufacturing.

It aims to take control of and then add value to the companies that it invests in but likes the family/founder owners of these businesses to retain an investment. Typically, New Heritage Capital is the first institutional investor in these companies.

The first New Heritage Capital fund was launched in 2006. CLDN identified it as a potential partner in 2015 but made its first commitment of $20m to New Heritage Capital’s $260m Fund III in 2019 and then a further $30m to its $438m Fund IV in 2024. Each of these funds tends to make 10–12 investments at a rate of about 1–3 investments per year.

As at 31 March 2024, the Fund III investment was valued at 2.0x CLDN’s investment. Exits achieved by 31 March 2024 included Revela Foods and Carnegie at a premium to NAV.

Asia

In Asia, CLDN holds funds that give it exposure to buyout (through funds-of-funds), growth, and venture capital in non-cyclical, new economy sectors. These sectors, such as healthcare and technology, tend to benefit from underlying demographic trends. The end markets for some of these products and services may be outside Asia, in the US, for example.

While these are investments in relatively young, growing companies, CLDN’s focus is on companies with proven business models.

Breaking down the 41% of the fund’s pool that was invested in Asia at end March 2024, 23% was in directly-owned funds and18% is invested through fund of funds providers such as Asia Alternatives, Axiom, and Unicorn.

The team observes that, as the private equity market is less mature in Asia, exit opportunities are provided mainly by IPOs and trade sales. Exits have been impacted by market volatility and geopolitical uncertainty. Consequently, the CLDN team feels that the pace of distributions could take longer to improve in Asia.

The weighted average life of CLDN’s Asian investments is about 5.1 years.

(Commentary on the recent performance of this pool is provided on page 19).

ESG

CLDN is a responsible investor and does not seek to profit from things that do damage to the environment or society without a strategy for change. It does not operate a list of banned sectors or companies; rather, investments are considered individually and an assessment of ESG factors is built into all stages of the investment process. A responsible investment/responsible corporate working group chaired by the CEO oversees CLDN’s efforts in this area.

Within public companies, the CLDN team exercises its voting rights at shareholder meetings of portfolio companies. Every voting decision is considered by the team rather than being outsourced to a third party.

The approach naturally excludes many polluting industries and consequently the scope 1 and 2 carbon emissions of CLDN’s public companies allocation are well below those of the MSCI World Index.

Within the private capital allocation, where CLDN is represented on the boards of these companies, CLDN monitors a range of KPIs and requires the companies to document progress against these. The team finds that this discipline adds value on exit.

Within the funds allocation, CLDN maps and monitors ESG matters into due diligence, portfolio monitoring and General Partner engagement.

CLDN is seeking to reduce its own net greenhouse gas emissions and wants companies that are significant emitters to reduce their emissions. It expects the businesses in which it invests to target net zero emissions by 2050.

Asset allocation

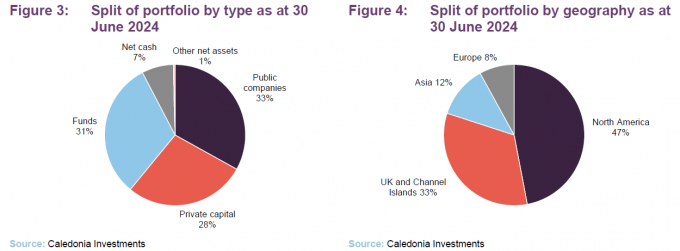

CLDN’s asset allocation at end June 2024 reflects the relatively recent disposal of 7IM (see page 7), which reduced the exposure to private capital. Other net assets include the freehold on the trust’s headquarters in Buckingham Gate.

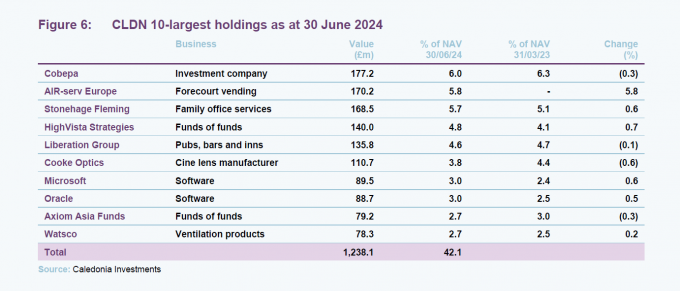

Top 10 holdings

Cobepa

Cobepa (cobepa.com) is a Belgian investment company that was established in 1957 and has a lot of similarities with CLDN. Cobepa manages around €4.7bn on behalf of a growing number of families, including initially some of those behind InBev. CLDN first invested by acquiring a stake from BNP Paribas around 20 years ago. CLDN director Will Wyatt sits on its board.

Cobepa makes €50m–€300m investments in European and US companies with established and proven business models. The portfolio is diversified across around 20 companies.

The CLDN team says that Cobepa has provided about a 12% return pretty consistently, including a growing dividend. It has also been a source of investment ideas. CLDN can choose to co-invest alongside Cobepa if it finds a deal attractive. For example, BioAgilytix was a Cobepa deal. CLDN invested £23m in the company in 2019 for an 8.8% stake and eventually sold the majority of its holding in 2021 for $183m. Similarly, if the CLDN private capital team came across a deal that it wanted to do but would ordinarily be too large for the trust, Cobepa could co-invest.

CLDN says that the majority of the businesses within the Cobepa portfolio continue to trade well, with many delivering good performance and valuation progression.

AIR-serv Europe

AIR-serv (air-serv.co.uk) was CLDN’s most recent private capital investment. It is a UK-headquartered forecourt vending machine business with around 22,000 machines installed across its Air, Vac and Jet Wash ranges. CLDN put up £142.5m for a 99.7% stake, management invested £0.5m, and bank debt facilities contributed £60m, to finance the acquisition. The deal was a corporate carve-out from CSC ServiceWorks, a US firm focused on laundry services, which retained the AIR-serv operations in the US.

The business was founded in 1948 and now has operations in the UK and Ireland, the Benelux, France, Germany, and Spain.

The forecourt machines are operated either on a rental or revenue share basis. A programme of shifting the machines to work with contactless rather than coins has made them easier to manage and monitor remotely. CLDN says that the business is trading well; it has been able to pay down some of the debt from cashflow, and the equity has been written up in value. CLDN feels that the ROI from the machines is good, and there is the opportunity to expand the business and improve efficiencies and cash generation.

CLDN says that the business has reported year-on-year growth, trading ahead of expectations. Having been held at equity purchase cost since acquisition in April 2023, the business is now valued on an earnings basis, leading to an increase in value of £28m in CLDN’s NAV. Growth has been further supported by the addition of over 1,000 machines to the portfolio, supported by £12m of capex.

Stonehage Fleming

Stonehage Fleming (stonehagefleming.com) is a family office business serving high-net-worth clients, offering them wealth planning advice, accounting, tax advice, and other services.

The CLDN team says that Stonehage Fleming’s business has the attractive long-term growth dynamics of the ultra-high net worth market. The business also benefits from a geographic and product-based acquisition strategy, with significant investment made in its technology platform and people.

The firm has expanded through M&A. Stonehage has its roots in South Africa; the management team bought the firm out of ABSA in 2005. 2015 saw the merger with Fleming Family & Partners, and CLDN took a 35% stake (now 37.2%) in 2019. The most recent deals were the acquisition of Maitland’s private client services division in 2022 (which added a presence in Monaco, Malta, the Isle of Man, Guernsey and Mauritius), and 2023’s purchase of Stellenbosch-based investment management firm, Rootstock Investment Management.

CLDN says Stonehage Fleming continues to deliver good revenue and margin growth across each of its family office, investment management and financial services businesses, driven by client wins and increased activity levels.

HighVista Strategies

HighVista (highvistastrategies.com) is a Boston-based alternative asset manager with about $10bn of AUM and a 20-year track record. It acquired abrdn’s $4bn US private equity business and the 30-strong team managing that in July 2023. It just closed its $675m Fund X. HighVista’s private equity funds focus on the lower mid-market (small, privately held companies, typically with enterprise values less than $150m). It partners with sub-$500m specialist private equity sponsors, co-investing directly into founder-owned and founder-led businesses in the US, and opportunistically acquiring lower-middle-market secondary interests.

Liberation Group

Liberation (liberationgroup.com) is a Jersey-based business operating over 130 pubs across the Channel Islands and Southwestern UK, offering 400 rooms, with additional income from cigarettes and alcohol importation and distribution in the Channel Islands. The group owns two breweries (Liberation, brewed in the Channel Islands, and Butcombe Brewing Company, based in Bristol and with distribution and bottling facilities in Bridgwater, Somerset).

The pubs are a mix of managed and tenanted sites. The offering is food-led but pitched at a more affordable level than its closest rival.

Since CLDN backed the business in a £118m deal in 2016, it has expanded with acquisition of a portfolio of 21 pubs from Wadworth during lockdown and a merger with Cirrus Inns in December 2022. CLDN now has an 83.6% stake in the business.

In 2019, CLDN brought in Jonathan Lawson (ex-Greene King) to run the business. The CLDN team says that this is a defensive, asset-backed business generating robust cash flow from its Channel Islands operations. There is scope for capital growth generated through targeted capex within the UK estate, both enhancing current assets and the acquisition of additional pubs. Value can also be added through market share gains and synergies from acquisitions.

CLDN says that Liberation has been adversely impacted by the cost-of-living crisis, reducing consumer discretionary incomes and sustained cost inflation, particularly UK energy costs. Profitability and revenue growth continues to improve, and the optimisation of the Cirrus Inns business is ongoing.

Cooke Optics

Cooke Optics (cookeoptics.com) has a 120-year track record of producing high-quality lenses, various iterations of which accompanied the development of cinema, and it continues to innovate. In 2013, the company was honoured with its own Oscar for services to filmmaking.

The CLDN team says that Cooke’s heritage is an important part of the value of the business. Generations of filmmakers have trained on Cooke lenses and the signature look that they produce helps underpin demand. Third-party distributors rent Cooke products to production companies as part of a bigger package of production equipment. CLDN’s team says that this arrangement removes the need for production companies to finance purchases of kit and so makes it more affordable.

New product development is a key part of the story. For example, Cooke recently created a new business unit to develop software-enabled products for post-production, VFX, virtual production, animation, and gaming.

Disruptions to film and TV production associated with the pandemic, and then the Hollywood writers’ and actors’ strikes, have held back short-term performance, but CLDN is pleased to see improvement in demand for Cooke Optics’ core products and the success of the new SP3 ‘prosumer’ range, which gives access to Cooke’s expertise but at a lower price point than its traditional merchandise. Encouragingly, the strikes were resolved in November 2023.

Oracle

Within the public companies portfolio, Microsoft and Oracle give CLDN exposure to the AI theme that has been driving markets, and consequently each have returned double digit annualised returns since initial investment. CLDN invested in Microsoft when it was out of favour and has ridden the recovery since.

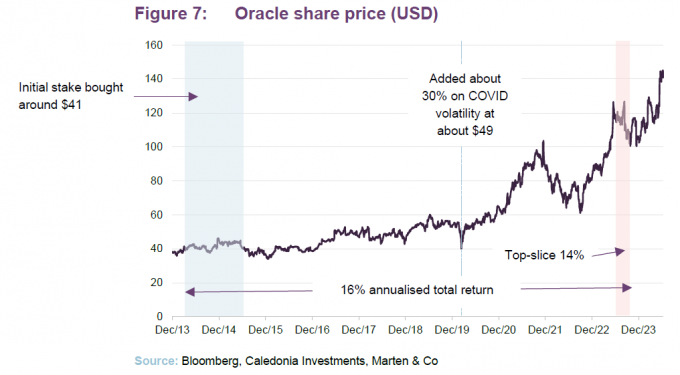

CLDN made its initial investment in Oracle in 2014 and this was one of the stocks that was topped up in the market panic of March 2020. The team was attracted by the growth opportunity and improvement in earnings quality that Oracle’s transition to a subscription-based, cloud model was bringing. Substantial share buybacks have helped enhance returns (Oracle bought back around half its stock over a decade).

The position was trimmed when the price spiked on the initial excitement around AI. Over the period shown in Figure 7, CLDN generated a 16% per annum annualised return on this investment.

Axiom Asia Funds

Axiom Asia Private Capital (axiomasia.com) is headquartered in Singapore and has branches in Taiwan and China. It invests across Asia including investments in Japan, Australia, and South Korea. Underlying holdings are in growth sectors such as TMT, retail, consumer, and healthcare.

Axiom Asia manages nine private equity funds of funds, with total commitments of over $7bn. Its funds are diversified across mid-market buyout, growth, and venture capital. Many of these underlying funds are hard to access.

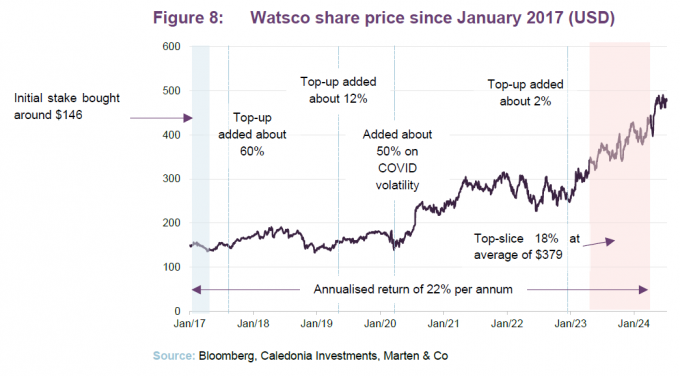

Watsco

Watsco (watsco.com) is a heating, ventilation, air conditioning, and refrigeration distribution business. It is a $22.1bn market cap listed company operating a buy-and-build business strategy that has allowed it to become a market leader in a highly fragmented market. Watsco has also often collaborated with OEM Carrier Global when making acquisitions, investing in these through a number of joint ventures that Watsco controls.

Watsco aims to be the leading player in the geographies that it operates in, leveraging this to provide better customer service.

The CLDN team has a good relationship with Watsco management. For CLDN, part of the attraction is that it is still 30% owned by the Nahmad family who have led the company since 1973 and repositioned it towards distribution in 1988. CLDN’s public companies team believe that Watsco’s increasing investments in technology supports market share growth and margin improvements, and also increases its attractiveness as a buyer of smaller distributors. The team feels that Watsco can deliver strong compounding of earnings.

CLDN’s initial investment was made in 2017 and since that time Watsco has grown its revenue by 68% and expanded its margins from 8.2% to 10.9%. That has helped drive a tripling of its share price.

Over the past year, CLDN has begun to take some profits from the position. Over the period shown in Figure 8, Watsco delivered a 22% annualised return.

Performance

CLDN’s performance is not benchmarked against any peer group, and we have not sought to do so in this note.

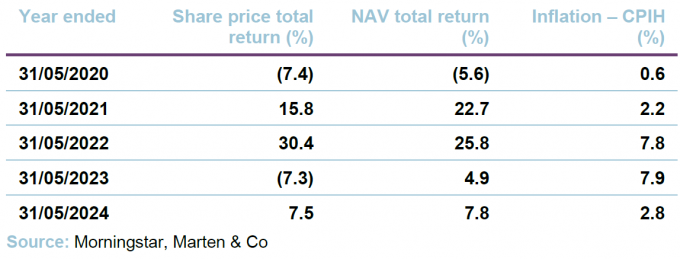

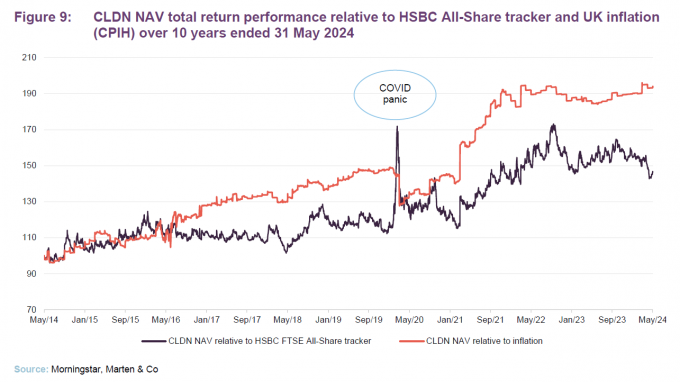

As a reminder, CLDN has set itself the target of generating long-term compounding real returns that outperform inflation by 3%-6% over the medium to long term, and the FTSE All-Share index over 10 years. For the purposes of this report, we have substituted the HSBC FTSE All-Share Index Fund class C accumulation units, which seeks to track the returns of the FTSE All-Share Index, for that index. As a measure of inflation, we have used UK CPIH, which is the consumer prices index including owner occupiers’ housing costs.

As Figures 9 and 10 show, over the past 10 years CLDN has produced good returns relative to both the UK equity market and UK inflation.

In NAV terms, CLDN has comfortably met its objective of beating the return on the UK market over 10 years, and over the medium-to-long term it is also ahead of its inflation plus 3%–6% per annum target.

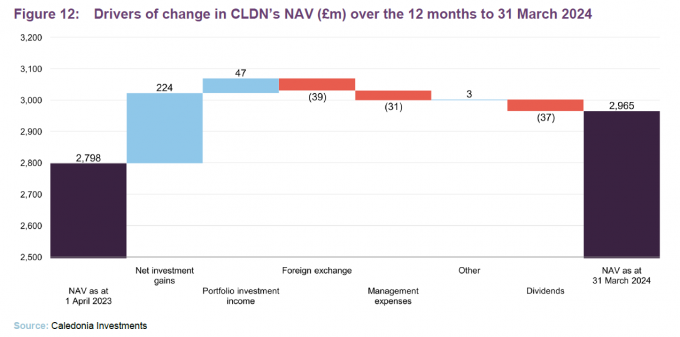

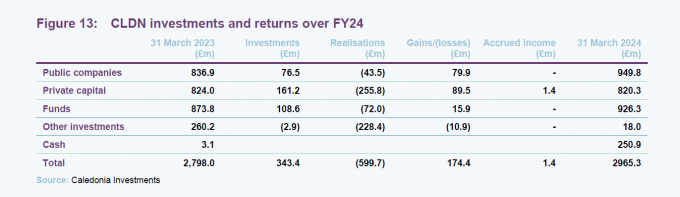

Results for the 12 months ended 31 March 2024

For the 12-month period ended 31 March 2024, CLDN generated a NAV total return of 7.4%. The dividend was increased by 4.5% to 70.3p, marking 57 years of consecutive dividend growth.

CLDN’s return for the year is almost double the rate of inflation (as measured by CPIH) which was running at 3.8%, but – as discussed above – slightly behind the return on the UK market.

A sharp recovery in CLDN’s income meant that the dividend was well covered by net revenue earnings of 73.3p per share.

Stronger sterling proved a headwind to returns over the financial year. At the period end, about 52% of CLDN’s portfolio was in US dollars, 7% in euros, 2% in other currencies and 39% in sterling.

Public companies – return 12.0% (13.7% in local currency)

With a total return of 14.0%, the £698.2m capital portion of the public companies pool was the main contributor to returns over the financial year. This was held back by adverse foreign exchange movements, which took off about 2.0% from the return.

The strongest performers were:

- Hill & Smith 49.2%

- Microsoft 44.2%, took some profits

- Fastenal 43.0%

- Oracle 38.1%, took some profits

- Watsco 37.2%, took some profits

Notable detractors were:

- Alibaba (27.9%)

- Charter Communications (21.3%)

- Croda International (19.1%), added to the position

The £251.6m income portfolio returned 6.8% (after a 1.1% hit from adverse foreign exchange movements)

The strongest performers were:

- Fastenal 43.5%, also held within the capital portfolio, the different return reflects trading activity within the stock over the period

- Watsco 37.7%

- RELX 43.0%, this was a new position during the period

- DS Smith 34.6%, received two takeover approaches during March 2024. CLDN has sold its position since the period end

- Sabre Insurance 61.4%, on a recovery in the UK motor insurance market

Notable detractors were:

- Reckitt Benckiser (24.5%), on litigation relating to its baby formula brand Enfamil

- Diageo (15.2%)

Private capital – return 12.3% (12.9% in local currency)

Realisation activity (the sale of 7IM) and good operating progress within the ongoing portfolio were the principal drivers of returns within the private capital portfolio.

We have discussed these already, but over the 12 months ended 31 March 2024:

- Cobepa returned 4.3%

- AIR-serv returned 19.4%

- Stonehage Fleming returned 18.8%

- Liberation Group returned 2.6%

- Cooke Optics returned (14.9%), the end-March 2024 valuation includes a 10% equity discount to reflect continued uncertainty around the timing and nature of the post-strike recovery (see page 13).

Funds – return 2.2% (4.3% in local currency)

CLDN’s North American mid-market buyout fund exposure delivered good performance of 9.8% in local currency terms, but this was offset by weaker performance, -3.1% in local currency terms, from its Asia growth and venture capital funds.

$59m of new commitments were made during the period. Of the money invested over the year, 63% went into North American funds and the balance was invested in Asia, and distributions from underlying funds were split 75/25 North America/Asia.

CLDN says that its North American managers are cautiously optimistic about an improvement in exit markets, with evidence of that in a growing pace of realisations over the course of 2024.

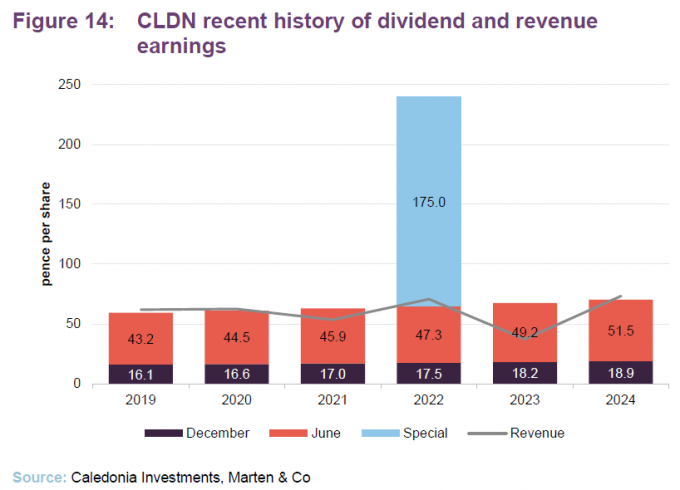

Dividend

57 years of dividend growth

CLDN has built up an impressive track record of growing its dividend every year for 57 consecutive years, making it a leading AIC dividend hero.

CLDN’s revenue earnings per share reflect the mix of investments in its portfolio. The board do not want the ‘tail to wag the dog’ though, and the portfolio is not managed to produce any target level of income. There are some years where revenues dip, as happened during the pandemic, and again in FY23. In these circumstances, the board is happy to dip into reserves to maintain its dividend growth objective.

There are also some financial years where CLDN finds itself with excess cash or there has been a significant disposal. In these circumstances, the board may opt to pay a one-off special dividend. This was the case in 2017 (when CLDN sold Park Holidays) and again in 2022 (when CLDN realised its stake in Deep Sea Electronics and BioAgilytix).

Growing shareholders’ dividend income in real terms is a key part of CLDN’s strategic objective. Figure 15 looks at the trust’s dividend history over the past 20 years. Had the dividend merely kept pace with inflation over that period, the dividend for 2024 would have been 46p rather than 70.4p, 34.7% less.

The public companies allocation contributes sufficient income to cover about half the dividend.

The income pool is biased to UK companies, reflecting the higher yields available in that market. However, the whole portfolio is generally biased to North American and UK stocks in any case.

Capital structure

CLDN had 54,252,577 ordinary shares in issue and with voting rights as at 10 July 2024.

Gearing

CLDN has no permanent debt, but as at 31 March 2024, CLDN had access to £250m of revolving credit facilities for working capital purposes, which were undrawn. £112.5m provided by ING Group matures in July 2025 and £137.5m provided by RBSI matures in November 2027.

At 30 June 2024, CLDN had net cash on its balance sheet of £213.6m.

Major shareholders

The Cayzer Trust and associated individuals own about 49% of the ordinary shares between them. They are consulted on voting their shares at CLDN meetings and so form a concert party. However, the majority of the board are independent of the Cayzer Family (of the 11 board members, 3 are members of the Cayzer family),and strategy is set by the independent CEO.

AGM

CLDN’s next AGM is scheduled for 17 July 2024.

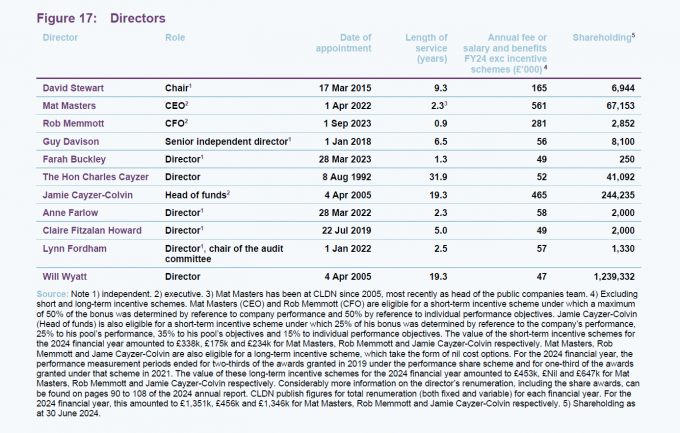

Management team

As a large, self-managed trust, CLDN has an extensive team of around 20 investment specialists working on the portfolio. At its head is Mat Masters (CEO), who has been at Caledonia since 2005, most recently as head of the public companies team, and who has been in the CEO role since Will Wyatt retired in July 2022. As discussed below, Will stayed on as a non-executive director.

The rest of the executive team comprises Rob Memmott (CFO), Richard Webster (company secretary), Jamie Cayzer-Colvin (head of funds), Tom Leader (head of private capital), and Alan Murran and Ben Archer (co-heads of public companies). There is more information about the team on CLDN’s website.

Board

CLDN has an 11-strong board composed of three executive and eight non-executive directors. Six of the directors are independent. Biographies of each of the directors are available on CLDN’s website.

In September 2023, Rob Memmott (CFO) was the most recent addition to the board, replacing Tim Livett on his retirement.

David Stewart has been chair of the company since 2017 and a director since March 2015. The board has agreed that, given there has been some notable change within the make-up of the board in recent years, as long as shareholders approve, he will stay on as chair until the AGM in 2025.

The Hon. Charles Cayzer and Will Wyatt are both former members of the executive and now sit on the board as two of the three representatives of the Cayzer family (the third being Jamie Cayzer-Colvin). Charles is chairman of The Cayzer Trust Company. Will is a non-executive director of Cobepa (see page 11).

IMPORTANT INFORMATION

This marketing communication has been prepared for Caledonia Investments Plc by Marten & Co (which is authorised and regulated by the Financial Conduct Authority) and is non-independent research as defined under Article 36 of the Commission Delegated Regulation (EU) 2017/565 of 25 April 2016 supplementing the Markets in Financial Instruments Directive (MIFID). It is intended for use by investment professionals as defined in article 19 (5) of the Financial Services Act 2000 (Financial Promotion) Order 2005. Marten & Co is not authorised to give advice to retail clients and, if you are not a professional investor, or in any other way are prohibited or restricted from receiving this information, you should disregard it. The note does not have regard to the specific investment objectives, financial situation and needs of any specific person who may receive it.

The note has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. The analysts who prepared this note are not constrained from dealing ahead of it, but in practice, and in accordance with our internal code of good conduct, will refrain from doing so for the period from which they first obtained the information necessary to prepare the note until one month after the note’s publication. Nevertheless, they may have an interest in any of the securities mentioned within this note.

This note has been compiled from publicly available information. This note is not directed at any person in any jurisdiction where (by reason of that person’s nationality, residence or otherwise) the publication or availability of this note is prohibited.

Accuracy of Content: Whilst Marten & Co uses reasonable efforts to obtain information from sources which we believe to be reliable and to ensure that the information in this note is up to date and accurate, we make no representation or warranty that the information contained in this note is accurate, reliable or complete. The information contained in this note is provided by Marten & Co for personal use and information purposes generally. You are solely liable for any use you may make of this information. The information is inherently subject to change without notice and may become outdated. You, therefore, should verify any information obtained from this note before you use it.

No Advice: Nothing contained in this note constitutes or should be construed to constitute investment, legal, tax or other advice.

No Representation or Warranty: No representation, warranty or guarantee of any kind, express or implied is given by Marten & Co in respect of any information contained on this note.

Exclusion of Liability: To the fullest extent allowed by law, Marten & Co shall not be liable for any direct or indirect losses, damages, costs or expenses incurred or suffered by you arising out or in connection with the access to, use of or reliance on any information contained on this note. In no circumstance shall Marten & Co and its employees have any liability for consequential or special damages.

Governing Law and Jurisdiction: These terms and conditions and all matters connected with them, are governed by the laws of England and Wales and shall be subject to the exclusive jurisdiction of the English courts. If you access this note from outside the UK, you are responsible for ensuring compliance with any local laws relating to access.

No information contained in this note shall form the basis of, or be relied upon in connection with, any offer or commitment whatsoever in any jurisdiction.

Investment Performance Information: Please remember that past performance is not necessarily a guide to the future and that the value of shares and the income from them can go down as well as up. Exchange rates may also cause the value of underlying overseas investments to go down as well as up. Marten & Co may write on companies that use gearing in a number of forms that can increase volatility and, in some cases, to a complete loss of an investment.