QuotedData’s economic roundup – December 2018 is a collation of recent insights on markets and economies taken from the comments made by chairmen and investment managers of investment companies – have a read and make your own minds up. Please remember that nothing in this note is designed to encourage you to buy or sell any of the companies mentioned. Kindly sponsored by Polar Capital.

Roundup

Brexit rumbled on and the Democrats won control of the House of Representatives in November. The big move though was the collapse in the oil price. The Federal Reserve’s chairman, Jerome Powell, made a speech at the end of the month in which he hinted that US interest rates would not need to rise much further. US Treasury yields fell as a result.

Global

Increased market volatility was, perhaps, inevitable and seems likely to persist into 2019. This may create opportunities for those able to take advantage.

In the UK it is Brexit, Brexit, Brexit as our commentators highlight the opportunities thrown up by the de-rating of the UK market and the uncertainty facing the UK.

There are notable challenges to European markets include Italy, Brexit and US trade wars but there is some optimism.

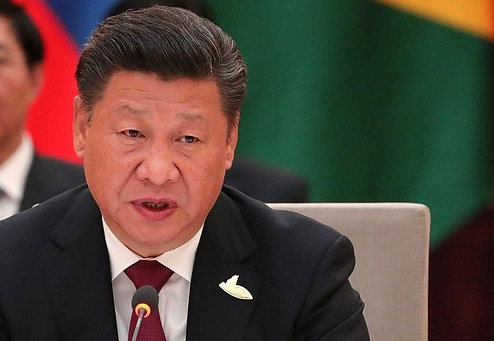

Asian markets look cheap. Headwinds, notably the trade war, exist but may be priced into markets.

Japan is vulnerable to a global economic slowdown but its companies are innovating and recent market falls may provide opportunities.

While Brexit overshadows mainstream UK property funds, alternatives property plays, such as social housing and medical centres, have different drivers.

We also have comments on global emerging markets from Templeton Emerging; China, from Dale Nicholls, manager of Fidelity China Special Situations; India, from Aberdeen New India; a detailed look at Eastern Europe from Baring Emerging Europe; Debt, from TwentyFour Income and Alcentra European Floating Rate Income; a comprehensive look at the healthcare market from the team managing Worldwide Healthcare; HICL’s chairman discusses the Infrastructure market. NextEnergy Solar and John Laing Environmental Assets outline the prospects for electricity prices. Lastly, Andre Liebenberg, chief executive officer of Yellowcake, explains the likely drivers of the uranium price.