On firm footing

The leading UK social housing investor, Civitas Social Housing (CSH), is on a firm footing as it steps up its growth plans. It has secured new debt facilities that will allow it to grow the portfolio in the near-term. Significantly, it has also attained an investment grade credit rating that not only gives it access to the bond market and cheaper debt, but provides a big vote of confidence for the lease-based model in the social housing sector.

Strong operational performance, including a rent collection rate that was unaffected by the pandemic, coupled with the planned growth of the portfolio, has given the board the confidence to raise its dividend target for the year to March 2022 above inflation forecasts.

Income and capital growth from social housing

CSH aims to provide its shareholders with an attractive level of income, together with the potential for capital growth from investing in a portfolio of social homes. The company expects that these will benefit from inflation-adjusted long-term leases and that they will deliver a targeted dividend yield of 5% per annum on the issue price, with further growth expected. CSH intends to increase the dividend broadly in line with inflation.

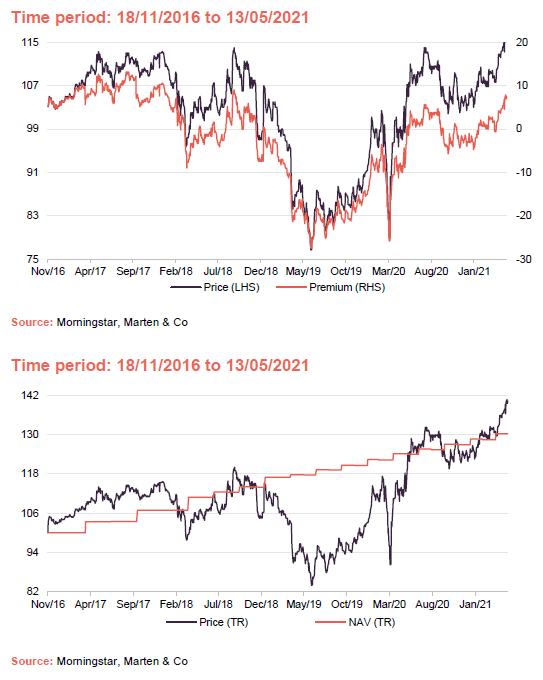

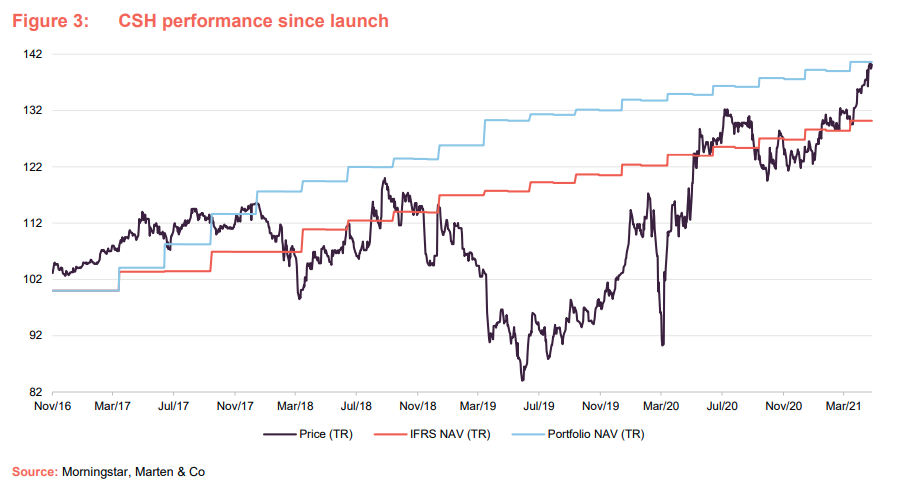

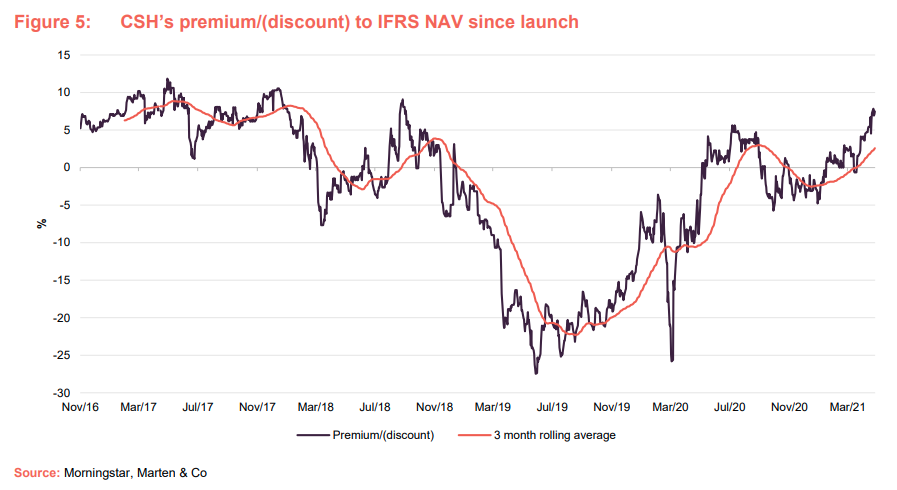

CSH’s share price recovered from an all-time low in June 2019 and bounced back strongly following the COVID-19 related market sell-off. Its discount has been on a narrowing trend since July 2019 and returned to a premium rating in the second half of 2020. As of 13 May 2021, CSH was trading at a premium of 7.5%.

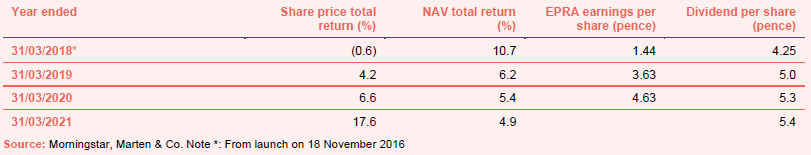

This chart shows CSH’s share price and NAV total return (TR), which assumes that any income is reinvested. CSH’s performance has been strong, especially since March 2020 when markets dived on fears about the economic effects of the coronavirus.

Market update

CSH has put in place the building blocks that should see net asset value (NAV) and earnings growth take off this year. In February 2021, the group finally secured new debt facilities with M&G Investment Management (which were delayed due to the COVID-19 pandemic) that brought it up to its loan to value (LTV – the ratio of debt (minus cash) to the portfolio valuation) target of 35% and gave it around £75m to invest in new acquisitions. Significantly, the company also secured an investment grade credit rating from Fitch Ratings that will open up access to cheaper finance through new lenders and the bond market.

This, on top of a strong operational performance, has helped cement its place as the leading UK investor in supported social housing. We explained the structure of the specialist supported housing market in the UK in our October 2020 annual overview note. To recap, substantial savings are available to local authorities if they can rehome a person in need of supported living (for example, people with learning disabilities, autism, mental health issues or physical disabilities) from a hospital into a property adapted to their needs. Research has also shown that these tenants then have an improved quality of life and better medical outcomes. Local authorities turn to care providers to manage the day-to-day welfare of the tenant and to housing associations to provide the accommodation. The housing associations lease property on a long-term basis from the likes of CSH.

The fundamentals that underpin the supported living sector – namely, the chronic shortage in supply of appropriate accommodation for the delivery of mid- to higher-acuity care (the scale in which nursing assignments are made, with higher acuity patients needing more care), and growing demand; the better health outcomes that specialist supported housing brings to occupants; and the substantial cost saving to government – are only intensifying. Demand for this specialist accommodation is growing at a rate of around 2% to 5% a year, with between 170,000 and 250,000 people already housed in supported living facilities like those provided by CSH.

Portfolio development

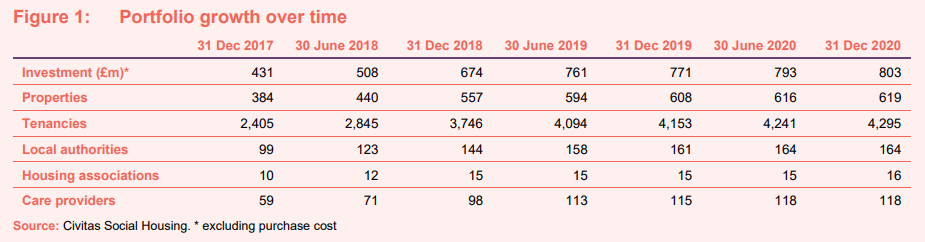

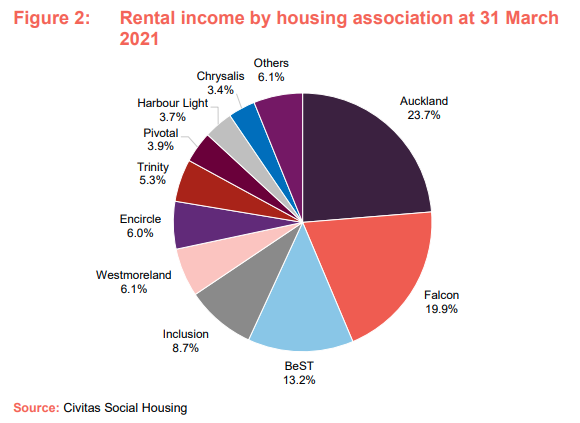

In April 2021, CSH made the first acquisition financed with the proceeds from the M&G debt facility. It bought 15 supported living and care facilities (providing a total of 51 beds) in South Wales for £10.9m. The properties are subject to 25-year leases with existing tenant Auckland Home Solutions C.I.C., with rents adjusted annually in line with inflation measured by the consumer price index (CPI) over the full term, subject to a lower limit of inflation of 0% per annum and a maximum indexation of 4% per annum.

CSH now provides homes for 4,346 working age adults with long-term care needs, in 634 bespoke properties that are supported by 119 specialist care providers, 16 approved providers and working with over 172 individual local authorities.

CSH has an ongoing pipeline of investment opportunities worth in excess of £200m, primarily coming from extensive relationships with housing associations, care providers and local authorities.

Demand for supported housing is growing and expanding to also cover a wide range of underlying needs faced by people who are battling homelessness, addiction or who are stepping down from the NHS into a more appropriate supportive care environment. To this end, CSH is making significant steps in the homeless accommodation sector. It has partnered with Barnet Council in North London to repurpose three of CSH’s properties into specialist accommodation for the homeless. In all, the three projects will provide 80 to 100 beds and cost CSH between £400,000 and £500,000. Barnet Council will be paying CSH income during the refurbishment period and will provide the accommodation to local homelessness charities, which will lease the properties from CSH. The manager said that this local authority tie-up would be replicated across the country and it was already receiving enquiries.

Debt facilities

An equity raise had been mooted by the manager last year, and this remains an option for the company this financial year. It is likely that this will be done through smaller equity raises, to avoid cash drag.

In the short term, the company will use the new debt facilities secured with M&G Investment Management to acquire new assets. In February 2021, it announced it had secured a new seven-year-term, interest-only loan facility of £84.55m from M&G Investment Management (£75m net to invest). The facility is priced at 2.75% above a fixed rate set by reference to the LIBOR swap rate of the loan term, and is repayable seven years from the date of utilisation. It is secured by an existing portfolio of specialist supported living assets. CSH had been in negotiations with M&G more than 18 months ago, but securing the loan was delayed due to M&G’s decision to pause lending to new clients as they assessed the impact of COVID-19. The manager says that the M&G debt facility will be the last piece of conventional debt it uses for the foreseeable future, following the investment grade credit rating it received in March 2021 and the favourable finance options open to it as a result.

Impact of investment grade credit rating

Receiving an investment grade credit rating was a big milestone for CSH and a vote of confidence for the lease-based model in the social housing sector, with acknowledgement that the ultimate security of income comes from government and not the housing association counterparties.

The manager says it will look to replace some of its existing debt facilities with the issue of a bond. It has two revolving credit facilities – a £60m facility with Lloyds that expires in November 2021 and a £100m facility with HSBC that expires in 2022 – that can be replaced. It expects to benefit from a material reduction in the cost of debt finance and an increase in the term length. One option that it is investigating is issuing a green bond, based on the company’s strong Environmental, Social and Governance (ESG) credentials – especially the positive social impact of its portfolio (more detail below). The manager says that the level of demand from institutional investors for ethical bonds is strong, while interest rates are lower.

Boosting ESG credentials

Investment in supported living has an obvious positive social impact. The lives of people who live in the homes owned by CSH are enhanced due to the secure, long-term, high-quality nature of the housing, whether of a general nature or as a base for the provision of more specialist housing and care.

Every year, social advisory firm The Good Economy publishes a report examining the social impact of CSH’s investments. Due to COVID-19, it has not been able to publish one since 2019, but is due to publish one this year. The 2019 report found CSH to be an “authentic impact investor” in accordance with the International Finance Corporation Principles for Impact Management. As part of the report, the Social Profit Calculator (SPC) – a social value consultancy that specialises in calculating the additional value of social, economic, and environmental impact – calculated the social value of CSH’s portfolio in monetary terms and found the portfolio to have produced £114m of social value per year. This equates to £3.50 of social value being created for every £1 of annualised investment.

CSH is also pressing ahead with plans to increase the environmental credentials of its portfolio. It intends to roll out initiatives such as the installation of PV solar panels on the roofs and the introduction of heat pumps at some of its properties. It will look to take advantage of government grants that are available and is in early discussions with national contractors to carry out works across its portfolio. The manager says that the works should provide a small incremental improvement to the value of the portfolio, as well as the obvious environmental improvements.

Dividend target increased

CSH’s board is targeting a dividend of 5.55p per share for the financial year ending 31 March 2022, 2.8% above the 5.4p per share it has paid for the year to 31 March 2021.

The board said that the increase (above current CPI inflation estimates of 2.0%) reflects its confidence in the future performance of the company due to strong operational and financial performance, stability of rental collection and target gearing (35% debt to gross assets) now in place.

Going forward, the board said that the dividend would grow in line with inflation as measured by CPI.

Performance

CSH publishes two NAVs – an International Financial Reporting Standards (IFRS) NAV, which reflects the value of the portfolio if it was sold off on a piecemeal basis, and a portfolio NAV, which is based on the value if it were to be sold as a single portfolio. This is generally higher than the IFRS NAV, reflecting the fact that the properties are held in special purpose vehicles and attract a lower tax charge than selling properties individually.

At 31 March 2021, the IFRS NAV was £673.5m or 108.3p per share. On a portfolio basis, the NAV was £736.8m or 118.47p per share.

CSH’s share price has been on an upward trajectory since June 2019, apart from the COVID-19 induced blip in March 2020 when its share price crashed as part of a wider sell-off due to fears over the pandemic. The share price quickly regained all its losses as investors recognised the strength of its government-backed income. Unlike most other real estate investment trusts (REITs), CSH has not seen a drop-off in its rent collection rates throughout the COVID-19 pandemic.

Peer group comparison

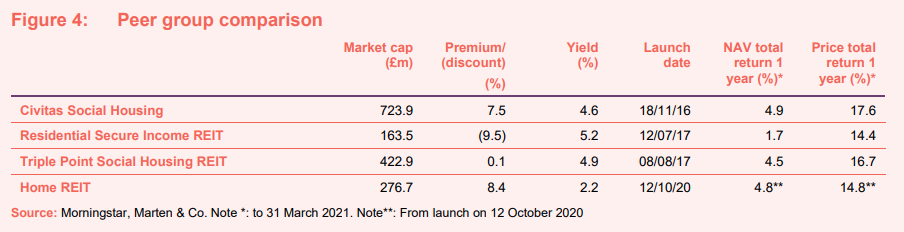

CSH sits within a small group of listed peers comprised of Triple Point Social Housing REIT (SOHO), Home REIT (HOME) and Residential Secure Income REIT (RESI). CSH is by far the largest fund in this peer group.

RESI’s focus is more on retirement properties and shared ownership housing (without leases), whilst HOME launched in October 2020 and is solely focused on providing homeless accommodation. Therefore, SOHO may provide a better direct comparison. CSH is larger and has a longer track record than SOHO, a comparable yield and a better performance over one year in both price and NAV terms.

Premium/(discount)

CSH’s shares initially traded at a premium to its IFRS NAV, but moved to trade at a discount due to the concerns that the regulator highlighted regarding some of the housing associations in its portfolio. As the company demonstrated the underlying fundamentals supporting growth in the supported living sector and its leading position in it, the discount narrowed from July 2019. As the company and the sector proved resilient during the pandemic, helped by secure government-backed income, it returned to a premium rating in the second half of 2020 and as of 13 May 2021 was at a premium of 7.5%.

CSH is authorised to repurchase up to 14.99% of the issued share capital (renewal of this authority is sought annually at the company’s AGM). Any shares repurchased may be cancelled or held in treasury and later resold. Shares will not be resold from treasury at a discount to NAV unless as part of an offer that is being made to all shareholders on a pro-rata basis.

In March 2021, CSH sold 250,000 shares from treasury at a price of 109.8p and at a premium to the prevailing NAV.

Fund profile

CSH has invested £803m to amass a portfolio of diversified supported social housing assets since it launched on 18 November 2016. It raised £350m at IPO and expanded in November 2017, raising an additional £302m through a C share issue (whereby C share investors own a separate class of shares which has its own portfolio). These two pools were merged together in December 2018.

CSH aims to provide an attractive yield, with stable income growing in line with inflation and the potential for capital growth. Its diversified portfolio is let to housing associations and local authorities (referred to as registered providers) on long-term lease agreements, typically 25 years. It buys only completed homes, which includes acquiring new developments on completion, but it does not get involved with forward funding deals (putting up money to finance the construction of new social homes), or the management of social homes directly.

CSH’s portfolio has a low correlation to the general residential and commercial real estate sectors, as the supply and demand demographics driving the social home sector do not move in line with that of the wider real estate market. It is a real estate investment trust (REIT), giving it certain tax advantages. As a REIT, it must distribute at least 90% of its income profits for each accounting period.

The adviser – Civitas Investment Management

CSH is advised by Civitas Investment Management (CIM), previously named Civitas Housing Advisors, a business established in 2016. Many of the 25-strong team have long experience of working in the sector and in specialist healthcare, and collectively, they have been involved in the acquisition, sale and management of more than 80,000 social homes in the UK.

Previous publications

QuotedData has published five previous notes on CSH. You can read them by clicking the links.

Socially beneficial investing, initiation note, published June 2018

Regulatory action is positive, update note, published February 2019

Targeting full dividend cover, annual overview, published September 2019

Proved its mettle, update note, published April 2020

Solid foundations for future growth, annual overview, published October 2020

The legal bit

Marten & Co (which is authorised and regulated by the Financial Conduct Authority) was paid to produce this note on Civitas Social Housing.

This note is for information purposes only and is not intended to encourage the reader to deal in the security or securities mentioned within it.

Marten & Co is not authorised to give advice to retail clients. The research does not have regard to the specific investment objectives financial situation and needs of any specific person who may receive it.

The analysts who prepared this note are not constrained from dealing ahead of it but, in practice, and in accordance with our internal code of good conduct, will refrain from doing so for the period from which they first obtained the information necessary to prepare the note until one month after the note’s publication. Nevertheless, they may have an interest in any of the securities mentioned within this note.

This note has been compiled from publicly available information. This note is not directed at any person in any jurisdiction where (by reason of that person’s nationality, residence or otherwise) the publication or availability of this note is prohibited.

Accuracy of Content: Whilst Marten & Co uses reasonable efforts to obtain information from sources which we believe to be reliable and to ensure that the information in this note is up to date and accurate, we make no representation or warranty that the information contained in this note is accurate, reliable or complete. The information contained in this note is provided by Marten & Co for personal use and information purposes generally. You are solely liable for any use you may make of this information. The information is inherently subject to change without notice and may become outdated. You, therefore, should verify any information obtained from this note before you use it.

No Advice: Nothing contained in this note constitutes or should be construed to constitute investment, legal, tax or other advice.

No Representation or Warranty: No representation, warranty or guarantee of any kind, express or implied is given by Marten & Co in respect of any information contained on this note.

Exclusion of Liability: To the fullest extent allowed by law, Marten & Co shall not be liable for any direct or indirect losses, damages, costs or expenses incurred or suffered by you arising out or in connection with the access to, use of or reliance on any information contained on this note. In no circumstance shall Marten & Co and its employees have any liability for consequential or special damages.

Governing Law and Jurisdiction: These terms and conditions and all matters connected with them, are governed by the laws of England and Wales and shall be subject to the exclusive jurisdiction of the English courts. If you access this note from outside the UK, you are responsible for ensuring compliance with any local laws relating to access.

No information contained in this note shall form the basis of, or be relied upon in connection with, any offer or commitment whatsoever in any jurisdiction.

Investment Performance Information: Please remember that past performance is not necessarily a guide to the future and that the value of shares and the income from them can go down as well as up. Exchange rates may also cause the value of underlying overseas investments to go down as well as up. Marten & Co may write on companies that use gearing in a number of forms that can increase volatility and, in some cases, to a complete loss of an investment.