Real Estate Roundup

Kindly sponsored by abrdn

Performance data

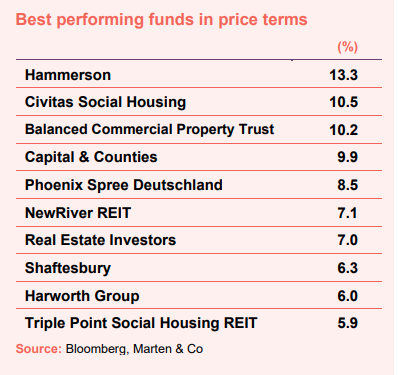

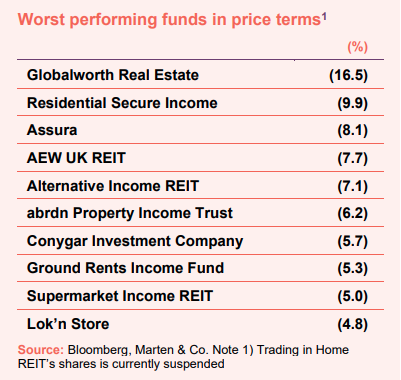

February’s biggest movers in price terms are shown in the charts below.

It was a mixed month in terms of share price performance for property companies, with a mean average share price fall of 0.3% across the sector. On the positive side, shopping centre behemoth Hammerson topped the charts as it continued its recent share price rally. So far this year the company is up 27.1%, while it is up 63.7% since shareholders approved the cancellation of its £198m share capital reserve (which will be applied to its distributable reserves) on 25 October. Civitas Social Housing also saw a double-digit uplift in its share price in February, with a NAV announcement indicating that the impact of valuation falls has largely been offset by an uplift in its inflation-linked income. Fellow social housing specialist Triple Point Social Housing REIT also saw its share price rise during the month. The £3.5bn merger between Capital & Counties and Shaftesbury was ratified by the Competition and Markets Authority in February, paving the way for a West End of London property giant – to be renamed Shaftesbury Capital. Retail park landlord NewRiver REIT continued its share price resurgence and is up 20.3% in 2023.

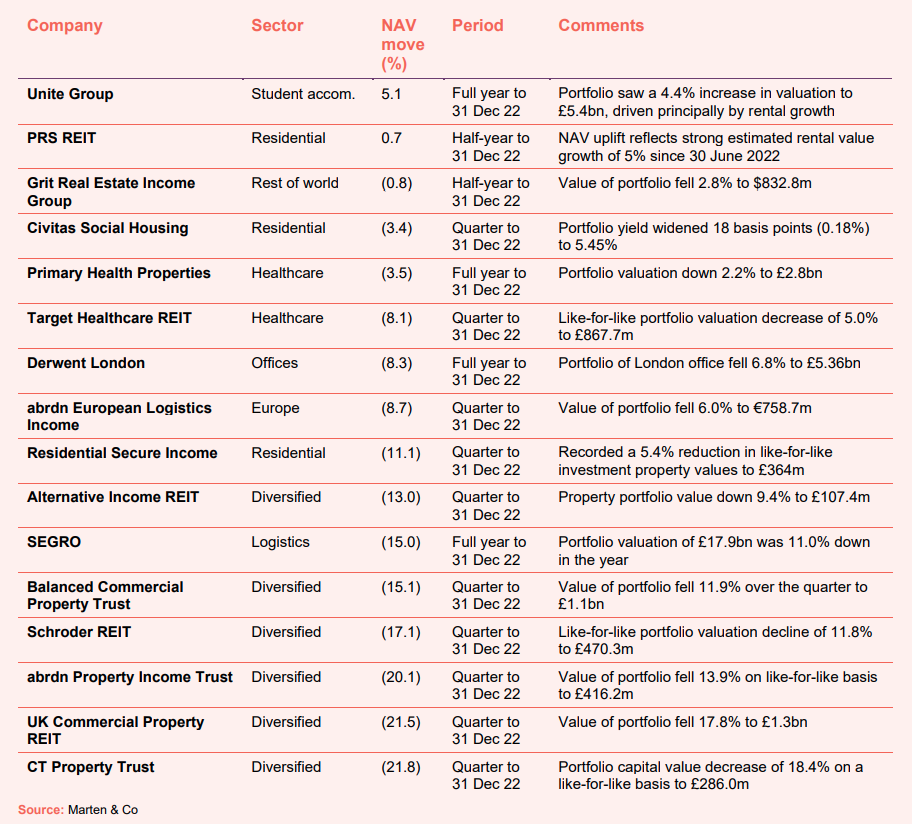

Topping the list of fallers over the month was central and eastern European property investor Globalworth Real Estate. Meanwhile, Residential Secure Income, which owns a portfolio of retirement living and shared ownership homes, saw its share price drop 9.9% after announcing that its NAV fell 11.1% over the final quarter of 2022 (see page 2). The ‘generalist’ REITs, whose portfolios are generally diversified by property sector, had a tough month on the whole, with several reporting significant valuation declines for the final quarter of 2022 (see page 2). AEW UK REIT, whose share price has been less volatile than its peers during the past few months of rising interest rates, saw a 7.7% drop after reporting a 13.9% decrease in NAV in the final quarter of 2022. It was a similar story at Alternative Income REIT, which owns long-income assets, reporting a 13.0% fall in NAV, and abrdn Property Income Trust. Ground Rents Income Fund continues to suffer from several legacy issues and headwinds relating to building safety and leasehold reform. While Supermarket Income REIT announced that its portfolio had fallen 13.3% in value in the second half of 2022.

Valuation moves

Corporate activity

The merger between Capital & Counties and Shaftesbury was cleared by the Competitions and Markets Authority (CMA) and completed on 6 March 2023, creating a £3.5bn company – named Shaftesbury Capital (SHC) – with a substantial portfolio in the West End of London.

Embattled Home REIT received unsolicited interest from Bluestar Group Limited – regarding a possible offer for the company – and RM Funds which indicated an interest in taking on the management contract. The board said that it was considering all strategic options for the company including the possible sale after its rent collection rate tanked at the end of 2022. Bluestar was founded by Ben Gotlieb a former employee of Alvarium Investments, Home REIT’s former manager.

Circle Property is seeking shareholders’ approval to cancel the admission of its shares trading on AIM following the sale of its largest assets. It sold Concorde Business Park for £12.3m in February and following completion will be regarded as a ‘cash shell’ (having ceased to own all or substantially all of its assets). The disposal is therefore conditional on the consent of shareholders at an Extraordinary General Meeting (set for 22 March). A resolution approving the future disposal of the company’s final remaining asset, 300 Pavilion Drive, will also be put to shareholders. The proceeds from all sales will be returned to shareholders through B shares issues, the first of which is expected to occur in March.

Civitas Social Housing closed a new five-year term debt facility of £70.875m with a leading major European bank lender. The facility was deployed in full to redeem an existing facility with Lloyds Bank of £60m as well as providing additional liquidity. The drawdown of the facility increased the company’s LTV to 35.3% (based on 31 December 2022 gross portfolio valuation).

Workspace Group announced its chairman Stephen Hubbard will step down on 6 July 2023 after serving nine years on the board. Duncan Owen will succeed him as chairman and chair of the company’s nominations committee from that date. Owen, formerly global head of real estate at Schroders plc, joined the board as a non-executive director on 22 July 2021, with his appointment forming part of the company’s long term succession planning.

Supermarket Income REIT had its investment grade credit rating of ‘BBB+’ with a stable outlook reaffirmed by Fitch Ratings.

Major news stories

- Great Portland Estates sells City office at sub-4% yield

Great Portland Estates completed the sale of 50 Finsbury Square, EC2 (its first net zero carbon development) for £190m, reflecting a net initial yield of 3.85%. The company recently completed development of the building and fully let it to Inmarsat Global Limited.

- Helical selected to develop offices at three London tube stations

Helical was selected as the preferred investment partner by Transport for London for the development of its commercial office portfolio above three central London tube stations – Bank, Paddington and Southwark.

- Derwent London secures huge pre-let to PIMCO

Derwent London pre-let 106,100 sq ft of office space at 25 Baker Street to PIMCO worth £11.0m a year on a 15-year lease with no breaks. It also let 31,100 sq ft at The Featherstone Building to Buro Happold at a rent of £2.3m a year, also on a 15-year lease with a break a year 10.

- Letting success for UK Commercial Property REIT in Hertfordshire

UK Commercial Property REIT secured new leases on 116,200 sq ft of space at its Ventura Park industrial estate in Radlett, Hertfordshire. Location Collective, the UK’s third largest film studio operator, took the 86,000 sq ft Unit B on a 15-year lease and Aerospace Reliance Ltd, a global supplier of aircraft maintenance materials, took occupation of the 32,000 sq ft Unit 7 on a 10-year lease.

- Triple Point Social Housing REIT to cap rental uplifts

Triple Point Social Housing REIT will voluntarily implement a 7% cap on its inflation-linked rental uplifts this year. The temporary one-year cap will allow for material rental growth whilst ensuring that the group’s rent increases remain sustainable and in line with wider social housing sector policy, it said.

- Grit Real Estate sells stake in Mauritius hotel venture

Grit Real Estate Income Group has sold a 17.32% stake in BHI, a hospitality company that owns three hotels in Mauritius, for €14.5m. It also announced the potential further exit by Grit of its remaining 27.1% interests in the company.

- ASLI increases rent at French asset

abrdn European Logistics Income agreed a 3,939 sqm lease renewal with Dachser France, an international provider of transport and logistics solutions, at its urban logistics property in Niort, France. Dachser signed a 9.5-year lease 3% ahead of the previous passing rent.

- Life Science REIT makes letting progress at Oxford Technology Park

Life Science REIT let 5,509 sq ft of the ground floor of Building One at Oxford Technology Park to Arcturis Data Limited, a healthcare technology company, at a rent of £28.66 per sq ft, for 10 years with a break clause and rent review at the end of the fifth year.

- Palace Capital sells Plymouth industrial asset

Palace Capital sold an industrial property in Plymouth for £3.2m, marginally ahead of the 30 September 2022 book value, and is now looking to selectively market other assets where it has completed asset management initiatives.

- Impact Healthcare REIT sells non-core asset

Impact Healthcare REIT sold a non-core care home for £1.25m, in-line with the latest valuation as at 31 December 2022. Mulberry Manor, a 49-bed care home in Mexborough, was acquired as part of the company’s seed portfolio in May 2017. Completion is expected by the end of March.

Managers’ views

A collation of recent insights on real estate sectors taken from the comments made by chairmen and investment managers of real estate companies – have a read and make your own minds up. Please remember that nothing in this note is designed to encourage you to buy or sell any of the companies mentioned.

Diversified

Will Fulton, manager:

The positive performance that UK real estate recorded at the start of the year was unwound with a notable acceleration in the final quarter, as capital value declines weighed on performance. UK real estate recorded a total return of -10.1% in 2022, according to the MSCI monthly index data, having returned 9.6% in the first half of 2022 and -17.9% in the second half of the year. Regardless of the continued strength of many operational markets, there was a broad repricing of UK real estate, driven by a weaker macroeconomic environment and, primarily, rising debt costs. Value declines for All Property were 13.3% over the year and -15.6% in the fourth quarter alone.

Yields moved out across all real estate sectors, with lower yielding areas of the market, such as the industrial sector and long income which have experienced the biggest value gains in recent years, experiencing greater outward yield movements than the wider market. Indeed, given the magnitude and speed of correction we have seen in the supermarket, industrial and logistics, and areas of the long-income market, we think that market pricing for these areas of UK real estate will find a floor much quicker than we have seen in previous cycles. As such, our outlook and forecasts for these areas of the market have improved materially, given the level of correction these sectors experienced in the latter part of the year.

The UK economy has faced a period of significant volatility over the second half of 2022, as the macroeconomic environment weakened and political turmoil rocked financial markets. While greater political stability has returned to the UK, the economy is facing headwinds as we enter 2023. Although UK GDP edged up in November the ONS attributed this to a World Cup-related services boost and it seems likely to be an upwards blip rather than evidence of a stronger underlying rate. We currently forecast UK GDP to decline by 1.3% in 2023, before recovering in 2024 with modest growth of 0.6%.

Headline inflation looks to have peaked with the Consumer Price Index falling in December from 10.7% to 10.5%. Powerful base effects combining with global goods disinflation are expected to pull inflation down in 2023. However costs remain high and underlying inflation pressures are still apparent, leading us to expect headline inflation to only moderate through 2023, not fall to pre-2022 levels. We expect 6.2% by the end of the year, before falling to 2.4% in 2024.

The real estate investment market reacted quickly to expanding interest rates and, as expected, the Bank of England continued its monetary policy tightening cycle in December 2022, with a further 50bps rise in response to the rate of UK inflation, taking the base rate to 3.5%. Further hikes are expected in early 2023, with the base rate expected to peak between 4.25% and 4.5% before a sharp rate-cutting cycle begins towards the end of 2023 as the Bank of England attempts to stimulate the UK economy out of recession.

Due to the recessionary pressures, we expect our view is more bullish than some for an earlier rate-cutting, which we expect being towards the end of 2023. While there is considerable uncertainty around the speed and trajectory of monetary policy easing, we expect the base rate to be cut to 2.5% by the end of 2023, before stabilising between 1-2% during 2024. The risk of the base rate returning to even lower bounds is skewed to the upside.

This has significant, and potentially very positive, implications for real estate. During the second half of 2022 the combination of an uncertain economic environment and rising cost of debt financing hit markets hard with significant negative repricing. The prospect of an earlier than anticipated rate cutting cycle, combined with a repriced market, offers the prospect of a far more positive real estate yield margin over a 10-year Gilt risk free rate, providing the potential for renewed interest and appetite for the real estate sector.

Higher costs in this inflationary environment are naturally having a significant impact on UK consumers who are experiencing a deepening cost-of-living crisis and are expected to face further pressure from a weakening employment market in the face of recession. The most obvious implication for real estate is likely to be further depressed retail sales as household discretionary spend drops but this weaker economic environment is likely to weigh on occupational sentiment across the entire real estate sector as we move through 2023. The relative strength of income and occupier covenant therefore will grow in importance as will asset quality and location, in addition to simple sector selection.

On a brighter note, and unlike previous market cycles, we enter this period of market turbulence with supply levels remaining tight across many sectors. This is particularly the case for those sectors benefitting from longer-term structural growth drivers, such as residential asset classes and industrial and logistics. In the latter sectors, tenant demand has remained robust and the UK vacancy rate remains near an all-time low of 3.4%, on top of which supply is expected to remain limited by the fact that development pipelines have been constrained by higher construction costs. We expect this to contain availability rates, albeit partly offset by rising occupational costs including an expected 2023 rise in business rates. It is hard to imagine that business sentiment will not be weakened which will temper occupational demand but rental growth in the industrial sector is still anticipated to remain positive, at more normalised levels rather than the high-growth levels experienced over the last few years. As with the wider real estate market, asset location and specification will be important to secure this.

The question around the future occupation of offices and how this sector reacts is perhaps the hardest to decipher. There is a historic correlation between office take-up and GDP growth, with poorer business sentiment and a weakening economic environment expected to add further pressure to a sector already facing structural headwinds as businesses and employees re-evaluate working practices. And so, as we enter a recessionary environment in 2023, we anticipate demand for good-quality accommodation will prove more resilient but secondary accommodation will progressively face tougher conditions. ESG adds another layer of complexity to the office equation as owners face mounting costs to repurpose offices to a ‘B’ energy rating, the expected legal occupational and trading requirement by 2030 and that increasingly demanded by many tenants. It is fair to assume not all will succeed and a reduced national office demand, a response to agile working practices, is likely to lead to a concentration of that demand, and so rental growth, in only the very best offices.

Retail will continue to feel the impact of the cost-of-living crisis and the subsequent squeeze on household disposable incomes. Retail sales volumes have continued to decline and occupier sentiment, particularly in the discretionary end of the market, has weakened. The sector remains structurally oversupplied and further retailer failures are likely in this environment, adding further space to an already saturated market. Discount-led retailers and budget supermarkets have enjoyed more robust trading conditions, particularly in the run up to Christmas, but the prospect of rental value growth in the sector is more limited in the near term.

Turning to residential, fundamentals in the private rented sector (PRS) remain supportive reflected in very strong levels of rental value growth. We expect the limited availability of good-quality rental accommodation across much of the UK, and increasing demand, to offset consumer cost pressures and allow rents to moderate to more normalised levels of growth for PRS and the Build to Rent sector.

All in all a weaker economic environment is expected to weigh on occupational sentiment across real estate as a whole, as we move through 2023, with the relative strength of income, occupier covenant, location and asset quality growing in importance to tenants and so investors.

Quality will prevail across all sectors, with prime assets remaining far more resilient. The 2022 repricing of real estate and the likelihood of a positive recalibration of its historic attractive margin over a risk-free investment yield later in 2023 and into 2024 as interest rates fall is likely to enhance general investment appetite.

Investors continue to narrow their focus on prime and best-in-class assets, and particularly within those sectors that benefit from structural and demographic growth drivers. Secondary assets, and those that do not meet current environmental and occupier criteria, are expected to see much weaker demand from investors. Pricing is likely to recalibrate, as a result. While prime and secondary pricing moved out in tandem during 2022, prime pricing is expected to stabilise in 2023 while secondary pricing sees greater capital value declines. While this trend has occurred in previous market cycles, we expect the divergence in pricing in some sectors to be more pronounced during this cycle as occupier and investor demand narrows.

The pace of repricing for UK real estate will mean opportunities will arise over the course of 2023, particularly as the path of monetary policy turns more accommodative. Those sectors that benefit from longer-term growth drivers, such as the industrial and living sectors, will see greater demand return and at more attractive pricing levels. The repricing of long-income real estate investments will also provide an attractive opportunity to investors, particularly as yields for gilts and inflation linked bonds are expected to move lower in line with the expected policy rate cuts from the Bank of England. Despite seeing significant capital value declines during 2022, the industrial sector will grow in favour once again. Investors are attracted by re-based yields and rental value growth prospects, driven by a very positive supply/ demand dynamic in the sector. Investors will focus on assets with good fundamental attributes, location and specification.

Offices

Paul Williams, chief executive:

2022 was characterised by a spike in global inflation, a rapid increase in borrowing costs and a cost-of-living crisis in the UK. Towards the end of the year, inflationary pressures began to ease, partly driven by a reduction in both energy and food costs, which has led to expectations of a lower peak in interest rates than was expected at the height of the political and economic instability.

Following a strong post-pandemic bounce in 2021, UK GDP was 4.0% in 2022 albeit weighted to Q1. The latest forecasts from Oxford Economics and others are for both the UK and London to experience a short-lived and mild recession in 2023 as households and businesses respond to the increase in input costs from higher costs of materials and utilities, and interest rates. The economy is then expected to return to growth from 2024, with London to maintain its outperformance.

Job creation is an important indicator for London offices. Forecasts from Oxford Economics show a small contraction in the number of office-based jobs in 2023, before a return to growth from 2024. These forecasts should be viewed, however, in the context of the last two years during which a combined c.280,000 net new office-based jobs were created.

The opening of the Elizabeth line, which has added c.10% capacity to London’s rail transport network, has driven a surge in footfall around the central stations along the route. According to TfL data, more than 100m journeys have already been made since opening and daily usage is above the expected level of c.600,000. Tottenham Court Road is now in the top five most-used stations in the TfL network, with its usage increasing by more than 80% since launch. Approximately 41% of our portfolio is located in nearby Fitzrovia (including Soho Place).

Office occupancy rose through 2022 according to data from Remit Consulting, following an initial period of adjustment when work from home guidance was lifted in mid-January. West End office occupation has increased from c.10% to in excess of 45%. By contrast, occupation levels in the City continue to lag, reaching c.30% through Q4.

London remains an attractive location for domestic and international investors and CBRE estimates there is c.£33bn of potential investment demand targeting London offices. The story of ‘the best versus the rest’ continues and investor appetite is polarised. Well-located and high-quality buildings with strong ESG credentials, let on long leases to strong covenants remain in demand as do those with potential for regeneration into prime. Investor appetite for secondary assets, however, is very limited and these are likely to underperform.

Investment activity for 2022 was £11.2bn, 12% above 2021 and in line with the long-term average of £11.4bn. Unsurprisingly, given the uncertain economic backdrop, investment volumes were low in the last quarter of the year, totalling just £0.7bn. Overseas capital dominated investment activity, accounting for 80% of all transactions, with investors from Asia the most active at 43%.

Underlying rates and credit spreads both increased significantly in the year with prospective investors appraising return requirements against the higher borrowing costs. Consequently, investment yields came under upward pressure through the second half of the year. The West End was more resilient than the City, with prime yields rising c.50bp to 3.75% compared to City yields up c.75bp to 4.5%.

The rise in yields combined with heightened risk awareness from credit providers is expected to present potential acquisition opportunities. Owners who are currently actively marketing assets for sale are primarily driven by a combination of upcoming refinancing events, future vacancy risk and EPC/upgrade capex requirements.

Vendor pricing expectations are being reset as transactional evidence starts to emerge and financial markets show signs of stabilising. In contrast to previous market corrections, both the development pipeline and the volume of debt maturing in the short term are relatively low, which is expected to limit the magnitude of any market correction.

Logistics

David Sleath, chief executive:

Our long-standing disciplined approach to portfolio management means that SEGRO has one of the best and most modern pan-European industrial warehouse portfolios, through which we can serve our customers’ entire regional and local distribution needs. Two-thirds of this portfolio is located in Europe’s most attractive urban markets, often in substantial clusters in key sub-markets, where the lack of available land means that supply-demand dynamics are tightest and where long-term growth and returns are therefore likely to be the highest. This is complemented by the remaining one-third of our portfolio, comprising clusters of high-quality logistics warehouses situated at key hubs along major transportation corridors.

Occupier demand for warehouse space across Europe continues to be positive and is derived from a wide variety of customer types. Our space is flexible and can be adapted to suit businesses from many different industries which, when coupled with our relentless focus on customer service through our market-leading operating platform, is reflected in high customer satisfaction and retention rates, as well as our asset management and leasing performance. Our business is therefore both resilient and positioned to support growth sectors and adapt to trends, including e-commerce, the digital sector (data centres), urbanisation and the consequential need for industrial and distribution space close to the end customer from a very broad range of businesses.

Supply and availability of modern, sustainable warehouse space in the locations most desired by occupiers remains extremely limited across Europe. Vacancy levels are at historic lows and supply is likely to remain constrained given recent increases in financing and construction costs. We expect this contrast between positive demand and limited supply to drive further growth in rental levels. We already have £130 million of reversionary potential embedded in the portfolio (most of which will be captured through the five-yearly rent review process), as well as indexation provisions in almost half of our leases, both of which underpin future like-for-like rental income growth even before any further growth in market rental levels.

Our sizeable, mostly pre-let current development programme and well-located land bank, provide us with further potential to grow our rent roll profitably and allows us significant optionality due to the short construction periods of our assets. We will continue to be led by customer demand and our Disciplined approach to capital allocation as we make decisions regarding the execution of future projects.

With modest leverage, a long-average debt maturity of 8.6 years, no near-term refinancing requirements and virtually all of our debt at fixed or capped rates, we have significant financial flexibility to continue to invest capital in the development and acquisition opportunities that offer the most attractive risk-adjusted returns.

Macroeconomic factors caused a sharp correction in interest rates in the second half of 2022, with a consequential impact on real estate volumes, property yields and asset values. As we enter 2023, there are early signs of liquidity returning to the investment markets as investors see value at current levels of pricing. As the path of future interest rates becomes more evident, we believe there is a significant volume of capital ready to be deployed into the industrial and logistics sector due to its attractive fundamentals. We will continue to respond tactically to changes in market conditions, but our long-term strategic focus is to ensure that our properties are of the highest quality and the most sought after, able to generate superior long-term growth, and therefore command a valuation premium.

Student accommodation

Richard Smith, chief executive:

The outlook for student accommodation remains positive, with structural factors continuing to drive a demand/supply imbalance for our product. Demographic growth will see the population of UK 18-year-olds increase by 140,000 (19%) by 2030. Application rates to university have also grown steadily over recent years, reflecting the value young adults place on a higher level of education and the life experience and opportunities it offers.

This backdrop creates significant opportunities to grow the business in the UK student accommodation sector through development and targeted acquisitions in our strongest markets and partnerships with universities.

The HMO sector, which provides homes to over one million students, is increasingly expensive due to rising mortgage costs for landlords and utility costs for tenants. We expect these cost pressures to only grow for private landlords given increasing regulation around the quality of homes and environmental performance standards through EPC certification. We expect this to further reduce the availability of private rented homes over time, increasing demand for the purpose-built, sustainable accommodation we provide.

Healthcare

Steven Owen, chairman:

The modernisation of the primary care estate been is becoming increasingly important as the NHS seeks to work through the backlog of treatments created by the COVID-19 pandemic, address staff shortages and recruitment issues and deal with the inadequate provision of both primary and social care in the UK, which is directing patients, who could be treated in the community, to hospitals where many then remain longer than clinically necessary because appropriate provision does not exist in the community or care sector where it is needed.

In the longer term, the ageing and growing demographic of western populations means that health services will be called upon to address more long-term, complex and chronic co-morbidities. Consequently, the Government needs to respond and invest in new structures to deliver more healthcare in primary care and community settings and away from over-burdened hospitals. PHP stands ready to play its part in delivering and modernising the real estate infrastructure required to meet this need in the community.

In July 2021, the UK Government published a draft Health and Social Care Bill setting out several reforms in order to implement the commitments of the NHS England Long Term Plan. This included the introduction of regional Integrated Care Boards and Partnerships tasked with co-ordination between NHS partners and local government services and their budgets such as those for social care and mental health, in a geographic area, for the first time – the idea being that services are then pushed to the most efficient, cost-effective part of the system (whether primary care, hospital or care home) for the best patient outcomes. We welcome these reforms and are hopeful they will lead to better outcomes for patients and to further development opportunities in primary care in the medium to long term.

Real estate research notes

Civitas Social Housing – Time to buy?

abrdn European Logistics Income – Negotiating choppy waters

Grit Real Estate Income Group – Going for growth

abrdn Property Income Trust – Laser focus on the basics

Legal

This report has been prepared by Marten & Co and is for information purposes only. It is not intended to encourage the reader to deal in any of the securities mentioned in this report. Please read the important information at the back of this note. QuotedData is a trading name of Marten & Co Limited which is authorised and regulated by the Financial Conduct Authority. Marten & Co is not permitted to provide investment advice to individual investors categorised as Retail Clients under the rules of the Financial Conduct Authority.

Accuracy of Content: Whilst Marten & Co uses reasonable efforts to obtain information from sources which we believe to be reliable and to ensure that the information in this note is up to date and accurate, we make no representation or warranty that the information contained in this note is accurate, reliable or complete. The information contained in this note is provided by Marten & Co for personal use and information purposes generally. You are solely liable for any use you may make of this information. The information is inherently subject to change without notice and may become outdated. You, therefore, should verify any information obtained from this note before you use it.

No Advice: Nothing contained in this note constitutes or should be construed to constitute investment, legal, tax or other advice.

No Representation or Warranty: No representation, warranty or guarantee of any kind, express or implied is given by Marten & Co in respect of any information contained on this note.

Exclusion of Liability: To the fullest extent allowed by law, Marten & Co shall not be liable for any direct or indirect losses, damages, costs or expenses incurred or suffered by you arising out or in connection with the access to, use of or reliance on any information contained on this note. In no circumstance shall Marten & Co and its employees have any liability for consequential or special damages.

Governing Law and Jurisdiction: These terms and conditions and all matters connected with them, are governed by the laws of England and Wales and shall be subject to the exclusive jurisdiction of the English courts. If you access this note from outside the UK, you are responsible for ensuring compliance with any local laws relating to access. No information contained in this note shall form the basis of, or be relied upon in connection with, any offer or commitment whatsoever in any jurisdiction.

Investment Performance Information: Please remember that past performance is not necessarily a guide to the future and that the value of shares and the income from them can go down as well as up. Exchange rates may also cause the value of underlying overseas investments to go down as well as up. Marten & Co may write on companies that use gearing in a number of forms that can increase volatility and, in some cases, to a complete loss of an investment.