Targeting full dividend cover

Targeting full dividend cover

Civitas Social Housing (CSH) has secured a new £60m debt facility that it will use to buy new properties. This will increase its rental income and move CSH very close to full dividend cover. CSH has the option to extend the loan by another £40m and is also in advanced negotiations to secure a separate £70m loan.

We estimate that, if CSH moves to a fully invested position, which it expects to by the end of March 2020, it would comfortably fully cover its dividend from operations.

The company has identified an acquisition pipeline, worth more than £200m, that includes new government-backed social housing and new geographies, as it looks to broaden its exposure. It has identified homelessness and NHS stepping down accommodation as two growth areas and in both cases, the cost saving to the local authority and NHS in placing people in supported living accommodation is large. CSH has also received AGM approval to open up its investment criteria to include Scotland and Northern Ireland, where it believes it can capture attractive returns.

Income and capital growth from social housing

Income and capital growth from social housing

CSH aims to provide its shareholders with an attractive level of income, together with the potential for capital growth from investing in a portfolio of social homes. The company expects that these will benefit from inflation-adjusted long-term leases and that they will deliver a targeted dividend yield of 5.3% per annum on the issue price, with further growth expected. CSH intends to increase the dividend broadly in line with inflation.

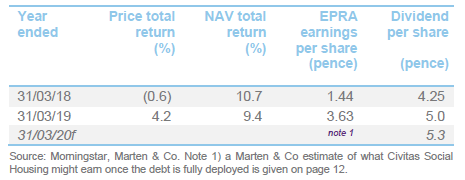

Note 1) a Marten & Co estimate of what Civitas Social Housing might earn once the debt is fully deployed is given on page 12 of the attached pdf file.

Fund profile

Fund profile

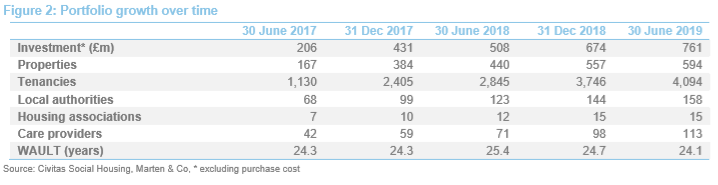

CSH has invested £761m to amass a portfolio of diversified supported social housing assets since it launched on 18 November 2016. It raised £350m at IPO and expanded in November 2017, raising an additional £302m through a C share issue (whereby C share investors own a separate class of shares which has its own portfolio). These two pools were merged together in December 2018.

CSH aims to provide an attractive yield, with stable income growing in line with inflation and the potential for capital growth. Its diversified portfolio is let to housing associations and local authorities (referred to as registered providers) on long-term lease agreements, typically 25 years. It buys only completed homes, which includes acquiring new developments on completion, but it does not get involved with forward funding deals (putting up money to finance the construction of new social homes), or the management of social homes directly.

CSH’s portfolio has a low correlation to the general residential and commercial real estate sectors, as the supply and demand demographics driving the social home sector do not move in line with that of the wider real estate market. It is a real estate investment trust (REIT), giving it certain tax advantages. As a REIT, it must distribute at least 90% of its income profits for each accounting period.

The adviser: Civitas Housing Advisors

The adviser: Civitas Housing Advisors

CSH is advised by Civitas Housing Advisors (CHA), a business established in 2016. Many of the 16-strong team have long experience of working in the sector and in specialist healthcare, and collectively, they have been involved in the acquisition, sale and management of more than 80,000 social homes in the UK.

Supported living – market update

Supported living – market update

Supported social housing, in which CSH is the leading UK investor, is an integral part of the healthcare sector in the UK and a key component in facilitating the delivery of care for individuals with significant long-term care needs. It enables such people to live fulfilling lives within the community and close to their families, rather than in a hospital or institution. More than 170,000 people are housed in supported living facilities, according to the government, and growing at an average of around 5% a year, reflecting ongoing demographic shifts in the UK.

The bulk of CSH’s portfolio is comprised of specialised supported housing properties. These are homes for people requiring some form of care, mainly people with learning disabilities, autism, mental health issues and physical disabilities. CSH, whose portfolio covers half of the local authority jurisdiction in England and Wales, has indicated that demand for supported housing is growing and expanding to cover a wide range of underlying needs faced by people who are battling homelessness, addiction or who are stepping down from the NHS into a more appropriate supportive care environment.

The 2014 Care Act consolidated the way in which care is provided and paid for, and put local authorities at the heart of it. The pressure on local authority budgets has never been as onerous, and this has resulted in high demand from them for high quality solutions that deliver from a social perspective and that also save them money. Supported living meets both of these criteria. State funding for a person in a specialised supported housing facility is £1,569 a week on average (rent and service charge being £235 a week on average). This compares with £1,760 for a residential care placement and £3,500 for an inpatient facility.

Average rents at a supported living scheme are generally higher than general purpose housing, but for good reason. The specialist nature of the accommodation means that it may need some or all of the following additional facilities: 24-hour staffing; installation and monitoring of CCTV; enhanced fire and safety equipment; care-driven bespoke adaptations to the building; and office facilities for staff. Supported living schemes also have higher levels of wear and tear and the environment around the properties is adapted to meet the needs of its residents.

The government has considered the existing framework of funding, seeking to ensure it is sustainable, ensures quality, provides value for money and encourages supply of supported housing, and in August 2018 it concluded that supported housing is a vital service for some of the most vulnerable people in the community and that housing benefit should remain in place to provide typically 100% of the funding of rent and service charge for all supported housing.

Demand for supported housing is expected to increase, driven by government policy to offer supported living to more people in need and general growth in that demographic. An April 2018 report, based on research carried out by the Housing Learning and Improvement Network and published by Mencap, found that there were between 22,000 and 35,000 supported living homes (each with several dwellings), while it was estimated that between 29,000 and 37,000 supported living homes would be needed to meet demand by 2027/28. There is substantial unmet demand for suitable properties with the demand/supply gap forecast to grow.

Social impact

Social impact

Investment in supported living makes a positive impact on society. Investments are designed with the intention of enhancing the lives of people who, as a result of the homes CSH acquires, are able to benefit from the availability of secure, long term, high-quality housing, whether of a general nature or as a base for the provision of more specialist housing and care.

In June 2019, social advisory firm The Good Economy published its latest report examining the social impact of CSH’s investments. The report sets out CSH’s performance against its social objectives and found CSH to be an “authentic impact investor” in accordance with the International Finance Corporation Principles for Impact Management. As part of the report, the Social Profit Calculator (SPC) – a social value consultancy that specialises in calculating the additional value of social, economic, and environmental impact – calculated the social value of CSH’s portfolio in monetary terms and found the portfolio to have produced £114m of social value per year. This equates to £3.50 of social value being created for every £1 of annualised investment.

How it works

How it works

Local authorities enter into care contracts with care providers, who are responsible for the personal care of each individual tenant, and pay them from funding provided by the Department of Housing, Communities and Local Government.

The care provider in turn enters into a service level agreement with a registered provider, usually a housing association, which has ultimate responsibility for housing provision. Housing benefit is paid by the local authority to the registered provider to cover each individual tenant’s rent and service charge. The local authority receives funding from the Department of Work and Pensions to cover this.

CSH owns the property and rents it under a long-term lease, or an occupancy agreement, to the registered provider. The registered provider uses the housing benefit that it receives to cover the rent due and the costs of managing and maintaining the property, as well as seeking to generate a modest surplus.

Admittedly, it is fairly complex structure, but from CSH’s point of view it is only the last paragraph that has any direct impact on it. CSH undertakes due diligence on the registered provider and the care provider, assesses the care needs of the tenant, ensures the property is suitable and the rent is appropriate, and has regular dialogue with the key bodies involved at all stages of the process.

In the sector generally, the care providers’ service level agreement with the registered provider is typically around five years, while the typical lease length is around 25 years. The disparity has led to some concern that a change of care provider could see registered providers lose tenants and rents and be unable to meet the longer-term lease obligation. However, over many years historically, agreements have rolled over and CSH, and the sector generally, believes this will continue to be the norm.

CHA has, in addition, made significant progress in extending these care agreements, with one third of the portfolio now supported by 25-year back-to-back agreements between care providers and registered providers.

Deals in the pipeline

Deals in the pipeline

CSH has secured a new £60m debt facility and is close to securing another £70m facility that will help it push borrowings towards its target 35% loan to value ratio. The new £60m facility is to be used to buy additional properties as well as to top up reserves (£20m is to be allocated). This will increase CSH’s rental income, helping it approach full dividend cover (CSH say a run rate of 96% as at 30 June 2019).

CSH also has an option to extend the £60m NatWest facility by another £40m. This is on similar terms to CSH’s existing facilities and is secured against existing assets with a diverse range of registered providers and geographies.

CSH has identified a pipeline of property that it wants to buy, worth more than £200m. The majority will be similar to the properties it has in its portfolio at the moment. The company is seeing continued opportunities to buy from local authorities and care providers, looking to release capital in order to invest back into quality care. However, going forward, the company is also evaluating plans to broaden its portfolio exposure in the supported living sector to include other areas of government-backed housing, such as facilities for homeless people and accommodation for people stepping down from the NHS. Much like the properties in its current portfolio, which predominantly caters for individuals with learning difficulties and mental health issues, the cost savings for local authorities in placing people in supported living accommodation is large. CHA believes that the move will help CSH achieve greater diversification and make the company ever more relevant to the needs of local authorities.

The move comes after the passing of the Homelessness Reduction Act 2017, which states that local authorities have an increased responsibility for ensuring that those at risk of homelessness are helped. Homeless charity Shelter estimates that there are 35,000 people regularly sleeping rough and over 100,000 families in temporary accommodation, which is often expensive and of poor quality. CSH (in some cases in partnership with Crisis) is in discussion with a number of local authorities to provide social housing for the homeless where the properties will be let directly to the local authority.

CSH has had a number of conversations with NHS trusts and other providers to develop a pipeline of NHS step-down facilities. These are long-term step-down homes and facilities for those with care needs who are currently housed in hospitals.

Shareholder approval has also been received to open up its investment criteria to include the rest of the UK. Up until now, the company has been restricted to acquiring social homes located in England and Wales. It believes it can capture good returns in Scotland and Northern Ireland and has been actively looking at investment opportunities.

CHA has met with Scottish and Northern Ireland governments and housing associations based in these areas, and believes that the rationale for investing there is strong. House prices are cheaper than in many parts of England and Wales and demand for this kind of accommodation is high.

Investment process

Investment process

The CSH portfolio has grown steadily since IPO, with £761m (before acquisition costs) committed as at 30 June 2019. The bulk of the properties have been acquired from housing associations, care providers, developers and private owners, at yields of between 5.5% and 6.5%; the majority of the time on an off-market basis. As the first and largest fund in the sector, CSH has established extensive relationships with developers, care providers and registered providers, which it uses to put in place acquisition agreements. All of the properties that it acquires already have a lease agreement with a registered provider in place, and so are income-producing from day one. It may, from time to time, require the seller to review and upgrade the contracts that it has with various parties before acquisition.

CSH makes a detailed assessment of each property to ensure it is fit for purpose before acquisition. It only invests in completed buildings and does not engage in development or forward funding risk.

Investment restrictions

Investment restrictions

CSH operates within the following investment restrictions:

• It may only invest in social homes where the counterparty to the lease is a housing association or a local authority;

• The minimum unexpired term for a lease or occupancy agreement at the time of acquisition will be 10 years (although leases with shorter lengths can be included in an acquisition of a portfolio that has a weighted average unexpired lease term (WAULT) of more than 15 years);

• The maximum exposure to a local authority or housing association is 25% of gross asset value (once the capital of the group is fully invested);

• The maximum exposure to a group of houses/apartment blocks in a single geographic location is 20% of gross asset value (once the capital of the group is fully invested);

• Only completed social homes will be acquired – forward finance of social homes under construction is not permitted;

• No investment in other investment companies or alternate finance funds; and

• No short selling.

Asset allocation

Asset allocation

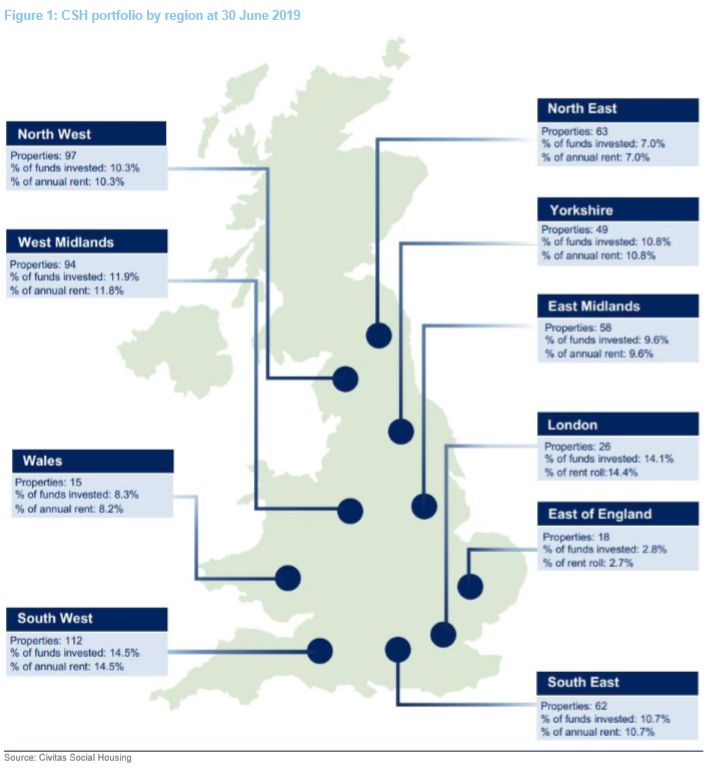

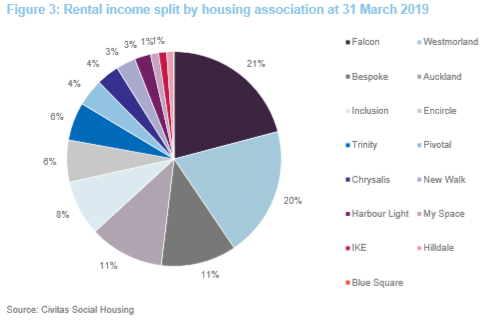

CSH’s portfolio is spread throughout England and Wales with properties in almost half of local authority jurisdictions.

Regulatory update

Regulatory update

The registered providers of supported social housing, which are regulated by the Regulator for Social Housing (RSH), are generally specialist housing associations that have been established in the past 10 years or so. Being relatively new associations, they have moderate capital bases and, in some instances, less-sophisticated management and governance structures.

In February 2018, one of CSH’s lessees, First Priority Housing Association, became financially distressed. The RSH published a regulatory notice on the company that said it did not believe First Priority had sufficient working capital or the financial capacity to meet its debts as they fell due. It also highlighted governance concerns. CSH took the decision to reassign the First Priority leases in its portfolio – of which there were 45 – to other providers on similar terms and without any material loss; around £300,000 or 0.05% of net asset value (NAV).

Since First Priority, the Regulator has investigated similar housing associations and raised a number of concerns, primarily in relation to corporate governance and financial viability. It has published regulatory judgments and notices in some specific cases and has issued judgments or notices on five housing associations that feature in CSH’s portfolio – Westmorland Supported Housing, Inclusion Housing CIC, Trinity Housing Association, Encircle Housing Association and Bespoke Supportive Tenancies.

In most cases, the judgments and notices have not related to any financial matters or properties owned by CSH and often reflect historic concerns, which have been addressed. The judgment on Westmorland Supported Housing, published by RSH in May 2019, concerned the quality of accommodation related to a small property portfolio owned by other landlords. It has continued to meet its obligations to CSH and provides high-quality homes for tenants while producing rental income. An earlier judgment, in November 2018, related to governance and viability issues. Since then, Westmorland has made significant steps to address the shortcomings, including the appointment of a chairman with experience of the sector, board members and chief executive. CSH believes it is well on the way to being able to demonstrate that it is a strong, well-governed and successful organisation.

Again, the judgment published in August 2019 on Bespoke Supportive Tenancies, concerning health and safety breaches, did not relate to financial matters or properties owned by CSH. Bespoke Supportive Tenancies has advised CSH that the statutory checks to which the notice relates have now been undertaken or instructed.

Since it was established, CSH has worked to enhance its property monitoring activities and engaged with its registered providers. This includes the appointment of a dedicated head of asset management and the establishment of an ongoing rolling programme of on-site property inspections. It has a detailed due diligence process, which encompasses:

• Completion of diligence forms for key performance indicators, health and safety and finances;

• Discussions with the chief executive and finance director of the registered provider;

• Site visits to meet management and property inspection;

• Standard investigation reports on key individuals for standards of conduct;

• Regulatory checks;

• Review of management accounts and business plans;

• Independent third-party benchmarking of rent;

• References from all significant care providers; and

• Requests for ring-fencing, with segregated accounts or charges for protection of rent and deposits due to CSH.

CSH shares the Regulator’s ambition to raise standards in the sector. It frequently engages with the Regulator and, as mentioned above, works closely with registered providers to support them and help recruit experienced and knowledgeable non-executive directors onto boards in order to strengthen corporate governance and improve standards of disclosure and asset management. CSH also seeks to structure its deals in a way that enhances the stability of the registered providers, recognising the fact they are signing long leases. The Regulator is due to publish a risk review in October 2019 and is expected to report on improvements across the sector in board makeups, health and safety and scenario testing.

Property consultancy firm JLL, which values CSH’s property portfolio on a quarterly basis using the standard RICS Red Book method based on discounted cashflows, has not thought it necessary to reduce valuations in respect of any of the judgments or notices, and consequently there has been no downward pressure on CSH’s NAV. The rationale is that the tenants remain in place and the underlying cashflows are unchanged despite the notice being issued.

Best practice protocol

Best practice protocol

CSH has developed a best practice protocol which it is encouraging other investors and interested parties to adopt. The objective is to ensure that when a registered provider enters into a property transaction, it is structured for long-term stability to the benefit of all parties, including the tenant, the registered provider and the investor.

The protocol contains eight core principles relating to matters such as financial prudence, resolving any possible conflicts of interest, management and control interaction with regulators. In addition, it contains detailed objectives for the on-boarding of new properties. These include:

• Independent verification of rent to confirm this is appropriate within the local authority area and represents value for money;

• A minimum ‘on-boarding fee’ paid to the registered provider from the proceeds of the sale of the property to CSH, to cover the setup costs of getting the property ready for occupation by a tenant;

• The registered provider maintaining segregated accounts/charges for rent and service charges for properties leased from CSH (where possible);

• The establishment of a rental protection fund for each tenant, to cover three to six months’ rent on every property;

• A sinking fund for each property to cover certain capital and maintenance costs and overruns; and

• An indexation reserve fund (to cover extra costs related to inflation) to be set up at the outset of a lease and topped up over its life, with indexation being set with reference to the consumer prices index.

CSH implements this protocol on each new transaction and much of it was applied from launch. Where sellers and registered providers are reluctant to abide by the overall direction of the protocol, CSH will walk away from deals.

Performance

Performance

IFRS NAV versus portfolio NAV

IFRS NAV versus portfolio NAV

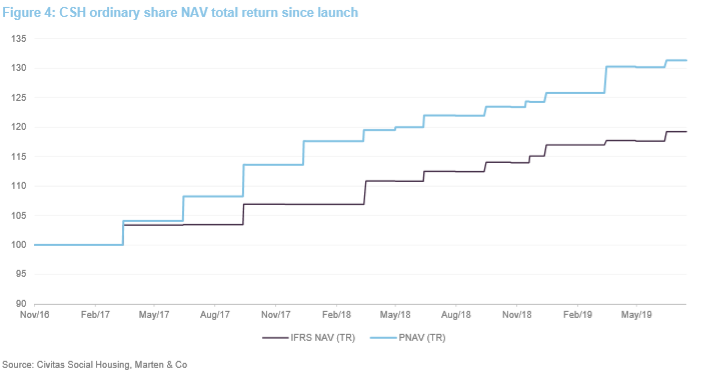

CSH’s property portfolio is valued by JLL on a quarterly basis, using a standard Royal Institute of Chartered Surveyors (RICS) method which is based on discounted cashflows. It published an International Financial Reporting Standards (IFRS) NAV, which adds up the valuations of individual assets and reflects the value of the portfolio if it was sold off on a piecemeal basis. CSH also publishes a portfolio NAV based on value if it were to be sold as a single portfolio. This reflects the fact that the properties are held in special purpose vehicles and attract a lower tax charge when they are sold on than selling properties individually.

At 30 June 2019 the IFRS NAV was £667.5m or 107.24p per share. On a portfolio basis, the NAV was £739.4m or 118.79p per share.

Share price

Share price

Peer group comparison

Peer group comparison

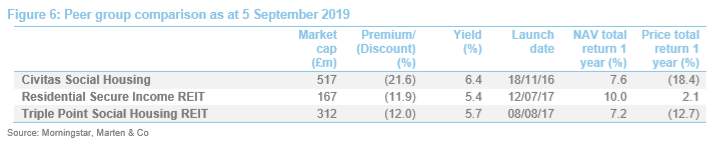

CSH sits within a small group of listed peers comprised of Triple Point Social Housing REIT (SOHO) and Residential Secure Income REIT (RESI). CSH is by far the largest fund in this peer group. RESI’s focus is more on retirement properties and shared ownership housing (without leases), and therefore SOHO may provide a better comparison. CSH’s higher yield, larger size, better dividend cover, longer track record and similar NAV performance over one year should mean that it attracts a higher rating than SOHO. Its wider discount seems perverse, therefore.

Earnings

Earnings

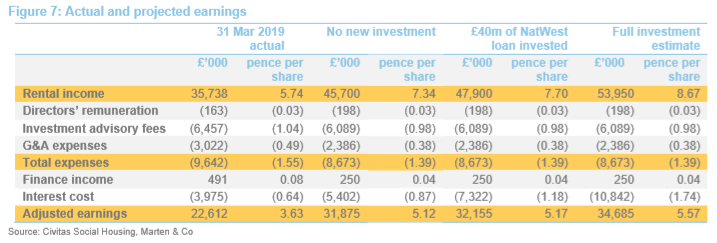

The first three columns in Figure 7 show the makeup of CSH’s income for full year 2019 and a base case if no new investments were made this year. In the next column, Marten & Co has built a model that shows how earnings might change if £40m of the new £60m NatWest facility was invested (CHS has indicated that £20m of the loan will be allocated to cash reserves to provide flexibility over future acquisitions). The final column shows the potential impact of moving to a fully invested position (in other words having invested the £40m NatWest loan, the £40m accordion and a separate £70m facility that CSH is in advanced negotiations to secure) on its adjusted earnings, in cash terms. The assumptions used in the model are listed below.

The model shows that CSH will have almost covered its target dividend of 5.3p with the investment of the first tranche of debt from NatWest (minus the £20m that will go into reserves), and will comfortably cover the dividend at full investment with projected earnings coming out at 5.57 pence per share.

Assumptions

Assumptions

At the end of March 2019, CSH’s portfolio was valued at £826.9m and its annualised rent roll stood at £45.7m, equivalent to an implied net initial yield of 5.53%. The final column of the model assumes CSH will invest £150m of the £170m of new borrowings. It assumes a net initial yield of 5.5% on new purchases.

CSH has indicated it will appoint a fifth board member, at an annual fee of £32,000 plus associated National Insurance contributions.

CHA’s fee going forward will be based on IFRS NAV. At June 2019, this was £667.5m, which implies an annual fee of £6.1m.

General and Administrative (G&A) expenses were inflated last year as the company changed its administrators, resulting in a doubling up of charges.

CSH has indicated that the additional gearing will be long-term in nature and consequently this will come at a higher interest rate than its existing facilities. The model uses an assumed rate of 3.2%.

Dividend

Dividend

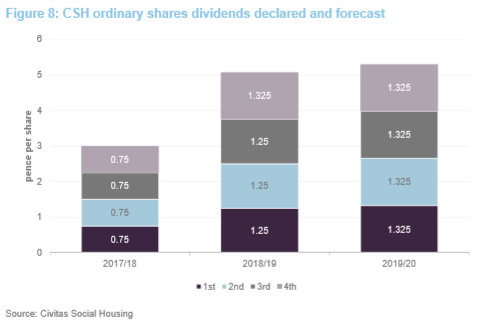

CSH paid 3p per share in its first year, and 5.075p per share in its second accounting year. Since year end, 31 March 2019, the company has declared its first dividend on the ordinary shares of 1.325p per share. The company has a target dividend of 5.3p per share for the financial year ending 31 March 2020.

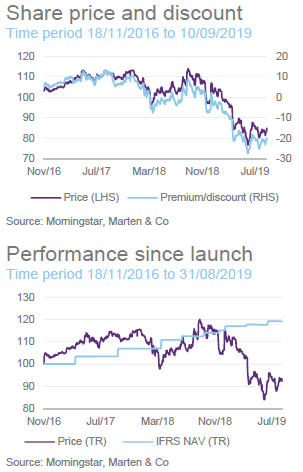

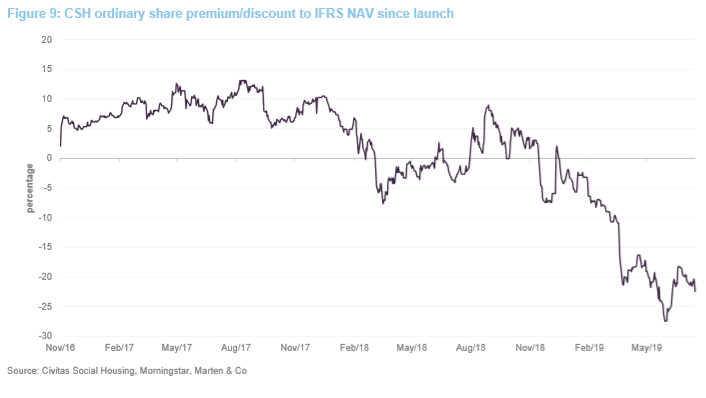

Discount/premium

Discount/premium

CSH’s ordinary shares initially traded at a premium to its IFRS NAV but moved to trade at a discount due to the concerns that the Regulator has highlighted regarding some of the registered providers in its portfolio.

The directors have powers to repurchase up to 93,306,960 ordinary shares, 14.99% of the issued share capital as at 5 September 2019. Any shares repurchased may be cancelled or held in treasury and later resold. Shares will not be resold from treasury at a discount to NAV unless as part of an offer that is being made to all shareholders on a pro-rata basis.

Fees and costs

Fees and costs

In April 2019, the board and the investment adviser agreed to revise the advisory fee. CHA is entitled to an annual advisory fee based on a percentage of CSH’s IFRS NAV. This is calculated as 1% on the first £250m, 0.9% on the next £250m, 0.8% on the next £500m and 0.7% on amounts above £1bn. The fee is calculated and paid quarterly in advance.

CHA’s contract cannot be terminated before 30 May 2024 (prior to April 2019 this was 30 November 2021) and thereafter 12 months’ written notice is required. If CSH is taken over at a premium to NAV and at a price higher than 100p per share (the initial offer price), CHA is entitled to another 1% of the NAV in addition to its entitlement under the existing contract. There is no performance fee.

Other service providers

Other service providers

G10 Capital Limited is CSH’s AIFM and is entitled to an annual management fee of 0.03% of NAV, subject to a minimum of £96,000 (this contract is terminable with three months’ notice).

The administrator is Link Alternative Fund Administration Limited. The secretary, which has been in place since 28 March 2018, is Link Company Matters Limited. It receives a fixed fee.

Indos Financial Limited has been appointed as CSH’s depositary and receives an annual fee of £59,000, plus 0.006% of the first £350m of any new equity capital raised and 0.003% of further equity thereafter, subject to a maximum of £150,000. The agreement is terminable on six months’ notice.

The company’s auditor is PricewaterhouseCoopers LLC. It received £211,000 for its auditing services relating to the period ended 31 March 2019.

Capital structure

Capital structure

At the date of the publication of this note, CSH had 622.5m ordinary shares. Gearing may be used up to an absolute maximum of 40% of gross asset value (i.e. net gearing of 66.7%). Debt has to be secured at an asset level (a property or collection of properties held within a special purpose vehicle) without recourse to CSH. The board has stated that it intends that CSH should have an average leverage of 35% on a gross asset basis. At the end of June 2019, CSH had deployed £208m of borrowings against facilities of £212.5m.

Existing debt facilities

Existing debt facilities

The existing facilities comprise a £52.5m loan note from Scottish Widows with a 10-year maturity and an all-in fixed cost of 2.99% and two revolving credit facilities – a £40m, three-year floating rate facility (plus a one-year extension) with Lloyds that was extended by £20m and a £100m, three-year floating rate facility (plus two one-year extensions) with HSBC.

New debt facilities

New debt facilities

As noted on pages 5 and 12, CSH announced on 10 September 2019 that it had secured a new £60m debt facility with NatWest. This is on similar terms to its current facilities and is secured against existing assets with a diverse range of registered providers and geographies. CSH also has an option to extend this facility by another £40m.

Separately, CSH says that it is close to securing another £70m facility that will help it push borrowings towards its target 35% loan to value ratio.

Life

Life

CSH’s year end is 31 March. CSH will hold a continuation vote at the AGM following the fifth anniversary of its admission (2022) and every five years thereafter.

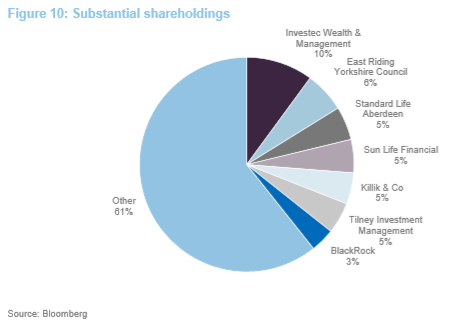

Major shareholders

Major shareholders

Team

Team

CSH’s investment advisor, Civitas Housing Advisors (CHA), has a proven track record in the social housing sector, combined with many years of experience in the investment industry and financial sector. CHA has a new group chief financial officer, Subbash Thammanna, following the departure of Graham Peck. The individuals that investors are most likely to meet are as follows:

Paul Bridge is CHA’s chief executive and co-founder. He has over 20 years’ experience of working at a senior level in the social housing sector. He was chief executive of Homes for Haringey, a registered provider, where he was responsible for 800 staff and 21,000 homes. He has also held a variety of non-executive roles including the chairman of Thames Valley Charitable Housing Association.

Andrew Dawber is a director and co-founder of CHA. He has been active in the social housing sector since 2012 and was part of the team that founded the private investment company Funding Affordable Homes. He also founded PFI Infrastructure, the first publicly traded social infrastructure fund.

Tom Pridmore is a director and co-founder of CHA. He has been involved in real estate investment for over 18 years, having originated, underwritten, financed, and asset managed a wide range of properties within the UK and abroad, through both equity and mezzanine investment including being part of the team that established the housing investment company, Funding Affordable Homes.

Nick Abbey is a director of CHA and has almost 40 years’ experience in the social housing, charity and care sectors. He was previously chief executive of ExtraCare Charitable Trust, a leading UK developer and operator of affordable retirement villages. He is currently the chairman of Tower Hamlets Community Housing.

Phil Ellis is a director at CHA. He has more than 33 years’ experience in institutional investment management, specialising in real estate. He enjoyed a long career at Aviva Investors and as client portfolio director was responsible for the development of the Aviva Investors institutional real estate fund management business.

Subbash Thammanna, is the chief financial officer at CHA. He has 20 years of experience in finance roles in the real estate sector, having worked across a variety of private and public structures covering all aspects of financial reporting, control and operations. Subbash joins Civitas having held senior finance positions at AEW Europe, Harbert Management Corporation, and most recently as finance director at Henderson Park, with responsibility over all financial and operational matters for their European real estate strategies.

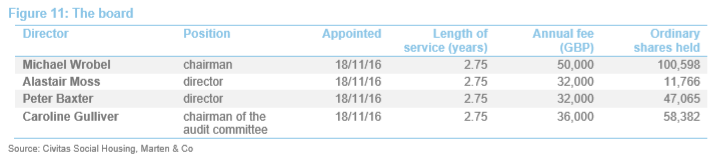

Board

Board

The board comprises four non-executive directors, all of whom were appointed on the company’s incorporation in November 2016. All members are non-executive and independent of the investment adviser.

The company’s articles of association require that all directors automatically stand for election at the first AGM following their appointment. Thereafter, all directors are required to stand for re-election at three-yearly intervals, unless they have served for nine or more years, after which they stand for re-election annually. Excluding newly appointed directors that are required to stand for election at their first AGM, and excluding directors who have served more than nine years and therefore must stand for re-election annually, one-third of the remaining directors must retire and stand for re-election by rotation at each AGM.

Other than CSH’s board, its directors do not have any other shared directorships, and all have made significant personal investments in CSH’s ordinary shares. The annual limit on directors’ fees in CSH’s articles of association is £200,000.

Michael Wrobel has over 30 years’ experience in the investment industry. He is the non-executive chairman of Diverse Income Trust. He serves as a trustee director of the BAT UK Pension Fund and chair of its Investment and Funding Committee. He is also the chairman of trustees of the Thorntons Pensions Scheme, a trustee of the Cooper Gay (Holdings) Ltd Retirement Benefits Scheme and acts as an investment adviser to a number of Rio Tinto pension schemes. Formerly, he was a non-executive director of JPMorgan European Smaller Companies Trust and NatWest Smaller Companies. He has served as a director of the Association of Investment Companies and Investment Management Association. He previously worked at Morgan Grenfell, Fidelity International, Gartmore Investment Management and F&C Management. Michael has an MA in Economics from the University of Cambridge.

Alastair Moss is a property development lawyer with over 20 years’ experience and is a partner at Memery Crystal. He has been a non-executive director of Notting Hill Housing Group (now Notting Hill Genesis) and a member of the Audit and Treasury Committees. He is the deputy chairman of the Investment Committee of the City of London Corporation and its Property Investment Board. He is also the deputy chairman of the City’s Planning and Transportation Committee. He is a trustee of Marshall’s Charity and a mentor to commercial directors in government departments. He has also been a board member of Soho Housing Association and was a member of the Area Board of CityWest Homes. He was a councillor at Westminster City Council for 12 years, including his tenure as chairman of the Planning & City Development Committee.

Peter Baxter has 30 years’ experience in the investment management industry. He is a managing director of Project Snowball, a social impact investment organisation, and a trustee of Trust for London, a charitable foundation. He is also a non-executive director of BlackRock Greater European Investment Trust. Previously he served as chief executive of Old Mutual Asset Managers (UK), and has worked for Schroders and Hill Samuel in a variety of investment roles. He holds an MBA from London Business School and is an associate of the Society of Investment Professionals.

Caroline Gulliver is a chartered accountant with over 25 years’ experience at Ernst & Young, latterly as an executive director. During that time, before leaving in 2012, she specialised in the asset management sector and developed extensive experience of investment trusts. She was a member of various technical committees of the Association of Investment Companies’ and a member of the AIC SORP working party for the revision to the 2009 investment trust SORP (which set out how investment companies should lay out their accounts). Caroline is a non-executive director and audit committee chair for JP Morgan Global Emerging Markets Income Trust, International Biotechnology Trust and Aberdeen Standard European Logistics Income.

Previous publications

Previous publications

Marten & Co published its initiation note on CSH, Socially beneficial investing, in June 2018 and an update note, Regulatory action is positive, in February 2019. You can read these notes by clicking on the links or by visiting our website.

The legal bit

The legal bit

This marketing communication has been prepared for Civitas Social Housing PLC by Marten & Co (which is authorised and regulated by the Financial Conduct Authority) and is non-independent research as defined under Article 36 of the Commission Delegated Regulation (EU) 2017/565 of 25 April 2016 supplementing the Markets in Financial Instruments Directive (MIFID). It is intended for use by investment professionals as defined in article 19 (5) of the Financial Services Act 2000 (Financial Promotion) Order 2005. Marten & Co is not authorised to give advice to retail clients and if you are not a professional investor, or in any other way are prohibited or restricted from receiving this information you should disregard it. The note does not have regard to the specific investment objectives, financial situation and needs of any specific person who may receive it.

The note has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. The analysts who prepared this note are not constrained from dealing ahead of it but, in practice and in accordance with our internal code of good conduct, will refrain from doing so. Nevertheless, they may have an interest in any of the securities mentioned in this note.

This note has been compiled from publicly available information. This note is not directed at any person in any jurisdiction where (by reason of that person’s nationality, residence or otherwise) the publication or availability of this note is prohibited.

Accuracy of Content: Whilst Marten & Co uses reasonable efforts to obtain information from sources which we believe to be reliable and to ensure that the information in this note is up to date and accurate, we make no representation or warranty that the information contained in this note is accurate, reliable or complete. The information contained in this note is provided by Marten & Co for personal use and information purposes generally. You are solely liable for any use you may make of this information. The information is inherently subject to change without notice and may become outdated. You, therefore, should verify any information obtained from this note before you use it.

No Advice: Nothing contained in this note constitutes or should be construed to constitute investment, legal, tax or other advice.

No Representation or Warranty: No representation, warranty or guarantee of any kind, express or implied is given by Marten & Co in respect of any information contained on this note.

Exclusion of Liability: To the fullest extent allowed by law, Marten & Co shall not be liable for any direct or indirect losses, damages, costs or expenses incurred or suffered by you arising out or in connection with the access to, use of or reliance on any information contained on this note. In no circumstance shall Marten & Co and its employees have any liability for consequential or special damages.

Governing Law and Jurisdiction: These terms and conditions and all matters connected with them, are governed by the laws of England and Wales and shall be subject to the exclusive jurisdiction of the English courts. If you access this note from outside the UK, you are responsible for ensuring compliance with any local laws relating to access.

No information contained in this note shall form the basis of, or be relied upon in connection with, any offer or commitment whatsoever in any jurisdiction.

Investment Performance Information: Please remember that past performance is not necessarily a guide to the future and that the value of shares and the income from them can go down as well as up. Exchange rates may also cause the value of underlying overseas investments to go down as well as up. Marten & Co may write on companies that use gearing in a number of forms that can increase volatility and, in some cases, to a complete loss of an investment.