Momentum Building

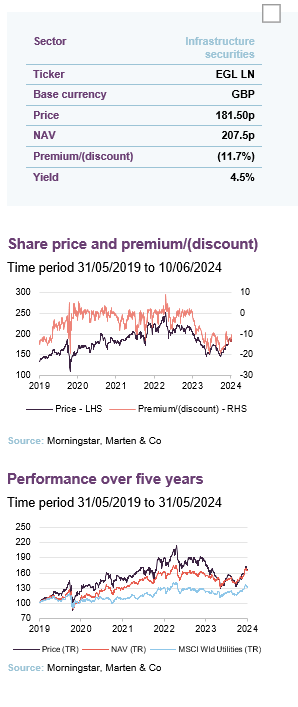

After a challenging 18-month period, things are beginning to look a lot brighter for the Ecofin Global Utilities and Infrastructure Trust (EGL). Since the middle of February, strong earnings, AI momentum behind electricity demand, and a shifting macroeconomic outlook have contributed to a 23% bounce in the company’s shares.

The recent rally reflects the company’s NAV performance and the considerable opportunity which exists across the utilities and infrastructure sectors as the energy transition gathers steam. In our view, the structural upside of the EGL portfolio remains dramatically underappreciated by the market, and with shares still trading at a double-digit discount, investors have an opportunity to invest in a long-term market leader at a very attractive price.

Developed markets utilities and other economic infrastructure exposure

EGL seeks to provide a high, secure dividend yield and to realise long‐term growth, while taking care to preserve shareholders’ capital. It invests principally in the equity of utility and infrastructure companies which are listed on recognised stock exchanges in Europe, North America, and other developed OECD countries.

Fund into – Interim report

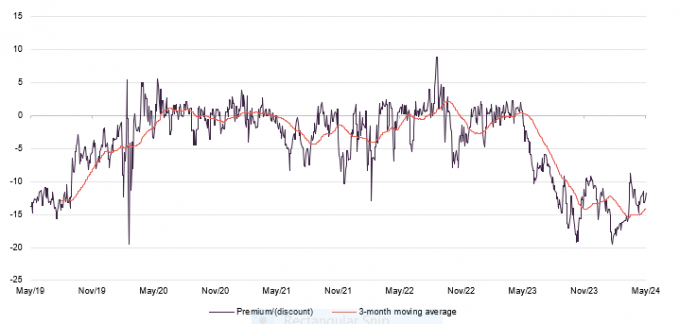

The company’s interim report for the six-months to 31 March 2024 highlights the ongoing disconnect between EGL’s portfolio and the current share price. The NAV total return for the period was 9.0% and despite rallying almost 10% in March, the shares rose by only 3.2% over the period. This caused the discount to widen to 15.9%, which has since narrowed slightly to 11.7% at the time of publishing.

EGL’s NAV continued to outperform comparative market benchmarks, the S&P Global Infrastructure Index and the MSCI World Utilities Index, which both increased by 8.2% (total return in sterling).

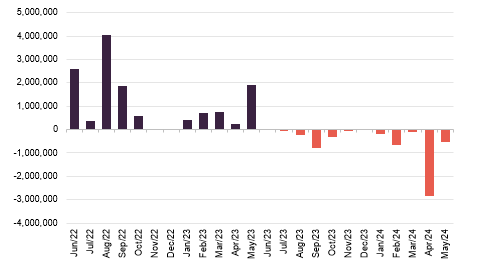

Acknowledging that the shares in no way reflect the underlying value of the portfolio, the company has continued to fund buybacks, repurchasing 1.3m shares during the half-year period (£2.1m), with an additional 3.3m shares repurchased since 31 March.

EGL also noted ongoing income growth with income from investments increasing by 10.8% and the revenue return per share increasing by 11.4%, helping fund its attractive dividend (current yield of 4.5%). There was also a considerable amount of activity within the portfolio over the six-month period, which we discuss in the asset allocation section on page 7.

Post period end, the trust has maintained its recent momentum with the NAV increasing by an impressive 8.6% over the two months to 31 May. Utility performance led the way, driven by US positions, while stock selection continues to add value.

Market backdrop – tide turning

Promisingly, since EGL released its interim results, its shares have continued to move higher, capping off a roller coaster 18 months which included a peak to trough sell-off of more than 40%. For comparison, this was 10% worse than the depths of the COVID-19 pandemic, highlighting the absurdity of the situation where a few percentage points of monetary tightening were deemed significantly worse than a global catastrophe. Of course, it is not quite that simple, however the point remains that the scale of the recent selling for both EGL, which invests in listed infrastructure securities, and the renewable energy infrastructure sector went well past the fundamental realities of the macroeconomic situation. This is especially true given the structural resilience of many of the companies in these sectors, which we have highlighted repeatedly in our recent commentary.

Having reached their nadir in November 2023, shares in EGL proceeded to rally, collapse, and rally once more, all in the space of about four months. Nominally, these moves were tied to the path of real interest rates which fell steadily towards the end of last year. More recently however, EGL has maintained its momentum despite real rates climbing back towards cycle highs, suggesting that the market may be starting to acknowledge the exceptional value provided by the portfolio.

AI utilities?

Somewhat ironically given the general defensive perception of utilities, one of the key catalysts for the current re-rating appears to lie with the growth of AI. It may be a surprise to some that three of the best performing stocks in the S&P 500 this year are utilities, the best of which, Vistra Energy, is up 132%, trailing just AI giant NVIDIA and Super Micro Computer in the index rankings. Constellation Energy (up 86%) and NRG Energy (56%) occupy spots 4, and 10 respectively. Both Vistra and Constellation are top 10 holdings for EGL, and all three are beneficiaries of the downstream effects of the AI boom as they are capable of providing decarbonised baseload energy to fuel the increasing power demands of energy-hungry data centres (discussed in more detail in the asset allocation section of this note on page 7).

Part of a bigger picture

Southern California Edison currently estimates around an 80% increase in load growth by 2045 in regions with high electric vehicle (EV) adoption.

The scale of these moves has helped drive EGL’s NAV higher over the last few months, and while the opportunity provided by data centre growth and AI is certainly significant, in reality, it is just one component of the broader energy transition and the long term, structural upside provided by the EGL portfolio.

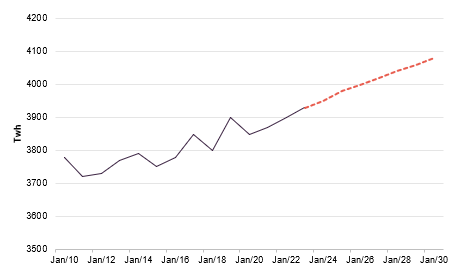

As we have discussed in previous notes, the scope of this transition is immense as highlighted in Figure 1, with transport systems, infrastructure, and manufacturing all forced to rapidly decarbonise. As an example, Southern California Edison currently estimates around an 80% increase in load growth by 2045 in regions with high electric vehicle (EV) adoption.

Figure 1: US Electricity demand growth to accelerate

Source: Morgan Stanley

While the production side of the equation tends to capture much of the attention due to its consumer facing components like EVs and solar installations, it is widely considered that the infrastructure development required to supply this electricity remains an even larger challenge.

New transmission and distribution grid projects will need to be added at around four times and 10 times their historical rates, respectively.

To meet expected demand growth and to accommodate the accelerated rate of renewable electricity capacity additions each year, grids need to expand and modernise significantly. This means new transmission and distribution grid projects will need to be added at around four times and 10 times their historical rates, respectively.

So, while the AI bonanza has provided the catalyst for the recent rally in a handful of targeted companies, it remains unclear whether the market yet fully appreciates the scale and complexity of the wider energy transition, or the role that the utilities and infrastructure sectors will play in making it a success.

New age utilities – fundamentals support secular tailwinds

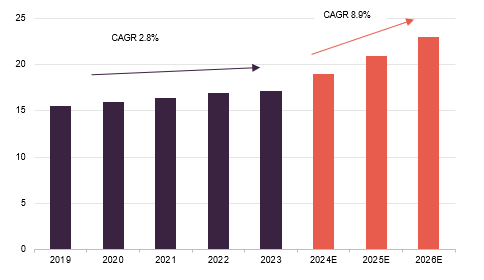

If you watched our recent interview with Jean-Hugues de Lamaze, manager of EGL (click here to view), he observed that today’s utilities can no longer be considered simple defensive plays. Thanks to evolving business mixes (i.e. much less conventional generation and commodity price exposure) and modern revenue contracts derived from renewable energy production and distribution, many utility companies are now capable of providing earnings and dividend growth comfortably ahead of broader market averages. Reflecting these changes, companies in the sector are now targeting annualised returns in the high single digits. The shift in focus was on display throughout the first quarter of 2024 in the US, with the sector delivering the second highest (year-over-year) earnings growth rate of all eleven sectors at 23.9% (trailing just communication services which is dominated by Alphabet and Meta). As Figure 2 highlights, this momentum is expected to continue over the next few years, at a rate well above historic averages.

Many utility companies are now capable of providing earnings and dividend growth comfortably ahead of broader market averages.

Figure 2: S&P 500 Utilities EPS growth

Source: Bloomberg

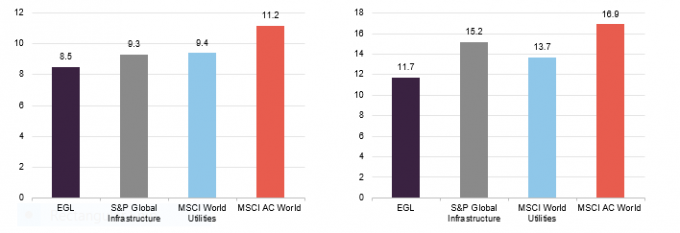

What Figure 2 also shows is that whilst at a lower rate, utility earnings have been steadily growing over the last few years. Despite this, there remained a steady flow of capital away from the sector, particularly over the last year as economic resilience in the US drove investment towards growth, technology, and more cyclical sectors of the market. For EGL, this has meant that valuation metrics have become increasingly attractive, as highlighted in Figures 3 and 4. These become even more compelling when accounting for the growth prospects noted above.

Figure 3: 1-year forward EV/EBITA Figure 4: 1-year forward P/E multiple

Source: Bloomberg

This flow of capital away from traditionally more defensive areas of the market has occurred at a time when the structural tailwinds driving EGL’s sectors have arguably never been stronger, providing an attractive entry point for investors looking for reliable, long-term exposure to the energy transition and the broader infrastructure sector.

The valuation gap between utilities and the broader market reached historically extreme levels.

The opportunity is highlighted in Figure 5 which shows the valuation gap between utilities and the broader market has now reached historically extreme levels.

Figure 5: US utilities P/E ratio relative to US equity P/E ratio

Source: Morningstar, Marten & Co

Looking ahead

The ability to drive long term earnings growth provides the perfect foil for current economic conditions

With the focus of the recent share price moves on AI, it may be easy to forget the defensive characteristics of EGL which maintains a portfolio of assets with high barriers to entry, effective pricing power (as operators of essential infrastructure), structural growth, and predictable cash flows. These attributes came to the fore during 2022, when markets had almost universally priced in a recession. This led to a period of significant outperformance over global benchmarks. With data beginning to soften again in the US, we have seen renewed interest in companies able to provide reliable returns. It is yet to be seen if this economic weakness is just a soft patch, or the beginning of something more nefarious, but as 2022 showed, the upside for EGL is considerable if the economic environment deteriorates or risk appetite slips.

In our view, this ability to drive long term earnings growth makes these new age utilities the perfect foil for current economic conditions, adding the opportunity for capital appreciation to their fundamental defensive characteristics. We expect that over time, this will begin to shift the view that the performance of these companies is dependent on the economic cycle.

EGL maintains a portfolio of assets with high barriers to entry, effective pricing power, sustainable growth and predictable cash flows.

Portfolio – Asset allocation

Since we last published, there have only been minor changes to the portfolio’s geographic and sector allocations. However, as is often the case with EGL, this masks considerable activity behind the scenes. As touched on above, the US utilities sector has rebounded as the market recognises the potential increase in energy demand from AI. In addition, broader electricity demand growth in the US, which has been absent for many years, is beginning to show up across the sector’s revenue and capital expenditure outlooks. A strong earnings period and ongoing nuclear energy momentum has added further support. EGL’s allocation to US utilities was also raised last summer so the portfolio was well positioned for the current strong rebound in US names where valuations had become so depressed in 2023.

The manager’s increased weighting in US utilities last year – when valuations were depressed – has paid off very well over the last few months.

Nuclear energy’s positive momentum is thanks to its ability to deliver carbon-free baseload power and a number of positive developments including a commitment from nearly two dozen countries including the US, UK, and United Arab Emirates to triple nuclear energy capacity by 2050. The US also provided considerable tax incentives for the sector through the Inflation Reduction Act which effectively put a floor under nuclear power prices, necessary to ensure incentives line up for companies and developers to commit capital to new projects.

The company’s Chinese exposure also provided a positive contribution after a period of weakness. Positions in China Suntien and China Water Affairs have been among the best NAV contributors over the last couple of months.

The manager has also been proactive with portfolio gearing, which increased to 13.5% at the end of December. This was used mostly to fund buybacks. With the company’s share price and NAV rebounding strongly so far this year, the gearing has been reduced, sitting at 7.9% as of 31 May 2024.

Earlier in the year, the company looked to reduce its exposure to power prices, trimming several positions including Drax, SSE, AES, EDP and Iberdrola with proceeds reallocated to transmission and distribution/grids (reflected in the higher weighting in regulated utilities) and a timely increase in Vistra Energy whose position was doubled. In January, the holding in environmental services specialist Veolia was increased, as were positions in NextEra, RWE, Engie and Terna.

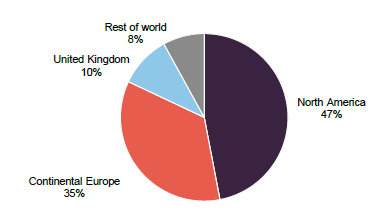

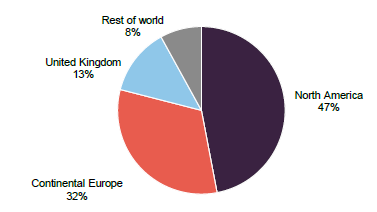

Figure 6: Geographic allocation as at

31 May 2024

Figure 7: Geographic allocation as at

31 December 2023

Source: Ecofin Global Utilities and Infrastructure Trust

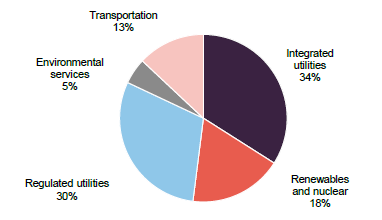

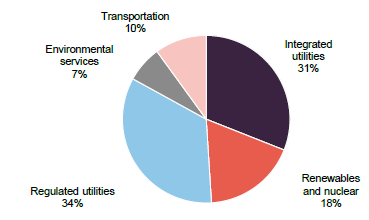

Figure 9: Sectoral allocation as at

31 December 2023

Figure 8: Sectoral allocation as at

31 May 2024

Source: Ecofin Global Utilities and Infrastructure Trust

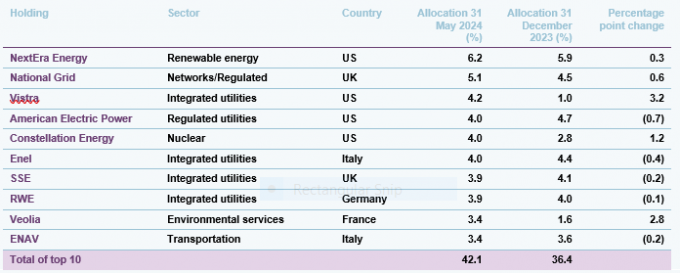

Top 10 holdings

Since we last published, Constellation Energy, Vistra, and Veolia have moved into the list of EGL’s top 10 largest holdings, with Xcel Energy, AES and Edison International dropping out. Whilst no longer in the top 10, each remains in the portfolio. Xcel has suffered from exposure to the Texas Smokehouse Creek fire while AES saw its position reduced following the manager’s aforementioned reduction to power price exposure.

The new positions are discussed below. Readers interested in other names in the top 10 should see our previous notes (see page 17 for a list of these).

Figure 10: Top 10 holdings as at May 2024

Source: Ecofin Global Utilities and Infrastructure Trust, Marten & Co

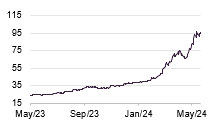

Vistra Energy

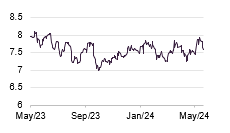

Figure 11: Vistra Energy (USD)

Source: Bloomberg

Vistra Energy (Vistra.com) is a relatively new name in the portfolio, with EGL initiating a position in November 2023. Originally, the manager identified Vistra as a targeted play on the undervaluation of US utilities and the growing opportunity in the Texas energy market where reserve margins are tighter than average.

The investment focused on the company’s integrated portfolio, 90% of which is fully dispatchable generation (i.e., power supplied to the grid which can be turned on or off as required). This allows Vistra to provide baseload power which is crucial for the successful development of broader renewable use given the intermittent supply provided by solar and wind. In March, the company completed the purchase of retail energy supplier, Energy Harbor Corp, adding a 4000 MW nuclear fleet to its generating capacity making Vistra one of the largest nuclear power providers in the US. Almost half of its generation capacity is located in Texas, an increasingly attractive destination for baseload generation as traditional thermal sources continue to be replaced by renewables.

The manager was certainly aware of the potential upside given this baseload capability; however, it would be fair to say that the speed at which this view was vindicated may have come as something of a surprise. Since 1 December 2023, its shares have returned 143%, as the market has latched onto the excitement generated by AI energy demand. The opportunity is a significant one with one estimate suggesting data centre energy consumption will increase by more than 500% over current levels in the next three to four years.

The scale of the recent rally means Vistra’s valuation is no longer as attractive as when EGL first invested. However, thanks to an annualised earnings growth forecast of around 20% through to 2025, the company’s earnings multiple remains more or less in line with sector averages, further highlighting the value originally identified by EGL’s manager.

Fundamentally, the company remains on reasonable footing, boasting one of the strongest free cash flow yields in the sector, providing the foundation for its strong balance sheet and buyback programme, which amounts to around 10% of its market cap. Relatively low gearing helps insulate the company from rising rates, as does its earnings outlook, which continues to improve.

While there could become a point where exposure may need to be managed, the fundamental case of the investment remains given the secular tailwinds.

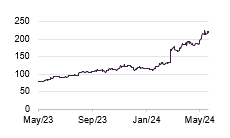

Constellation Energy

Figure 12: Constellation (USD)

Source: Bloomberg

Constellation (constellation.com) was one of EGL’s best performers over the course of 2023 and has maintained its momentum so far this year. The company is able to leverage its position as one of the largest and most reliable clean energy suppliers in the US with a portfolio including nuclear, solar, wind, and hydro, producing about 10% of the country’s carbon-free generation. Notably, it also boasts the largest nuclear portfolio in the US, which provided the catalyst for the rally in 2023 as the technology experienced a renewed shift in momentum.

Constellation’s nuclear expertise continues to provide the foundation for the company’s growth thanks to its ability to supply clean baseload power for data centres. As it operates in wholesale markets, it can also sell its power at competitive prices, without needing government permission to raise rates. This momentum was reflected in its Q1 earnings results where the company trounced consensus 2024 earnings guidance and longer-term growth targets.

Like Vistra, significant increases in the earnings outlook have meant that valuations have remained reasonable despite shares more than doubling over the past year, although Constellation does now trade on a reasonable premium to its peers. Positively, the company maintains a strong balance sheet and impressive free cash flow growth, and given the potential upside associated with increased energy and carbon free electricity demand, it remains possible that ongoing earnings momentum can offset the current multiple expansion.

Additional developments

EGL’s exposure to AI and nuclear energy is not limited to Vistra and Constellation with several other holdings also seeing positive updates. Southern Company has significantly expanded its nuclear capacity as its Vogtle-4 unit was recently placed into service, making it one of the largest clean energy generators in the US; while NextEra energy picked up on the momentum given its relatively large nuclear footprint. NextEra Energy also announced an impressive earnings beat for Q1, citing both the improving nuclear outlook and accelerating power demand dynamics. Earlier in the year, it received further positive news relating to a complaint filed in 2022 against its Florida utility with the Federal Election Commission finding no violations, removing a key overhang for its shares.

Growing power demand in the US has been a common theme so far this year with several portfolio companies including American Electric Power and Public Service Enterprise Group highlighting that this is starting to show up in commercial sales and capital plans across the sector. Notably, several of EGL’s power network operators, E.ON, Terna, and National Grid have also announced significant increases to their grid investments plans over the next few years.

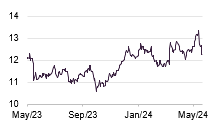

E.ON

While the fast-growing energy suppliers in the EGL portfolio have captured investors’ attention, Jean-Hugues and his team continue to manage exposure to strike a balance between growth and income. E.ON is an example of one of EGL’s more defensive positions with the German utility providing highly stable, predictable income thanks to its large, regulated asset base.

Figure 13: E.ON (EUR)

Source: Bloomberg

The company has undergone significant restructuring over the last few years, selling off much of its generation assets to focus on becoming a pure play network operator. It continues to make considerable investments in grid infrastructure development, recently announcing a 27% increase to its five-year investment target which now sits at €42bn. As noted, the opportunity here is significant, with E.ON highlighting the IEA’s most recent World Energy Outlook which predicts that global network infrastructure will need to be doubled. Early indications are that this transition will likely be a lucrative one for operators such as E.ON with the scale to capitalise on the level of development required. The company’s latest profit outlook came in significantly above estimates and management expects to deliver EBITDA growth of around 7% p.a through to 2028 as its regulated asset base expands to match the growing demand.

While fundamentally a defensive play, E.ON offers solid upside given it trades on one of the most attractive valuations in the sector, with the manager noting that it appears to have slipped off other investors’ radar since the sale of its generation assets. In addition, the company offers an attractive dividend yield of 4.3%.

Since the beginning of the year, its weighting within the portfolio has grown steadily, as the manager looked to reduce direct power price exposure, with E.ON now sitting just outside the top 10 holdings.

Terna

Terna is another regulated network provider capitalising on the growing demand for grid infrastructure development. The Italian energy utility is responding to government targets to generate 65% of its electricity from renewable energy sources by 2030 (almost double the existing output), phasing out coal by 2028 and reducing gas-fired power stations.

Figure 14: Terna (EUR)

Source: Bloomberg

During its recent Q1 earnings update, the company announced a 65% increase in capex compared to the previous plan, up to €16.5bn and mostly in the regulated business. This is expected to drive around an 8% p.a increase in the company’s mostly regulated earnings over this period.

The company is able to deliver a reliable dividend which currently sits at 4.1% and this is expected to grow comfortably ahead of inflation at an annual minimum rate of 4% over the next four years. It does trade at a slight premium to its peer group, reflecting the quality of its operations, with the EGL manager happy to gain exposure to the structural upside which exists across European transmission and distribution energy markets through the reliable energy giant.

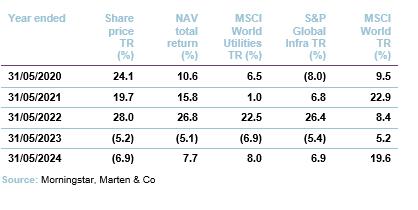

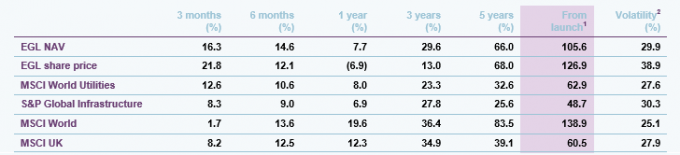

Performance

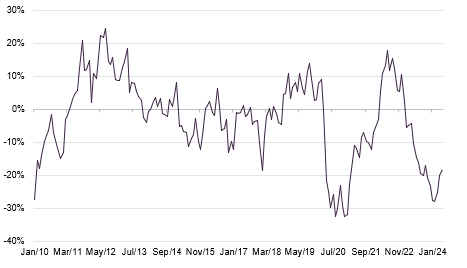

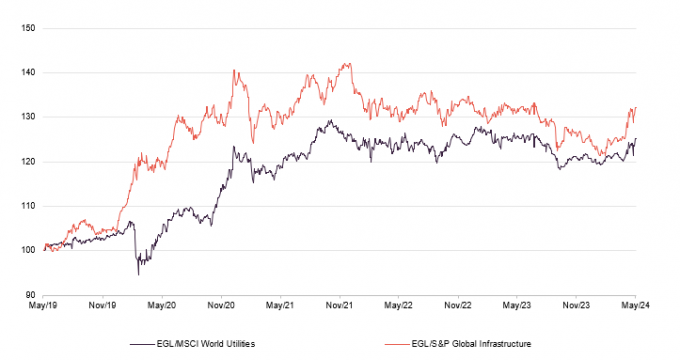

Figure 15: EGL’s NAV total return relative to benchmark indices, over five years to 31 May 2024

Source: Morningstar, Marten & Co

Figure 16: Cumulative total return performance over periods ending 31 May 2024

Source: Morningstar, Marten & Co. Note 1) EGL was launched on 26 September 2016. Note 2) Volatility is the annualised standard deviation of daily returns over five years.

Despite recent challenges, EGL’s long-term performance remains well ahead of both the wider utilities and infrastructure sectors, highlighting the benefits of its diversified portfolio and the manager’s ongoing execution. Notably, both lines have begun to head higher in recent times, particularly the infrastructure comparison, highlighting again the recent momentum of the utilities sector.

Up-to-date information on EGL is available on the QuotedData website.

The first point to make regarding Figure 13 is how well EGL has performed over the long term. This is particularly notable given shares are still down 7% over the past year. The chart also highlights the extent of the divergence that has opened up across global markets over the last year, with the returns of the MSCI World index in stark contrast to the other sectors thanks to the AI bonanza which dragged global indices forward in 2023. Promisingly, the outlook for EGL continues to improve as strong fundamentals and slowly changing market sentiment drive returns.

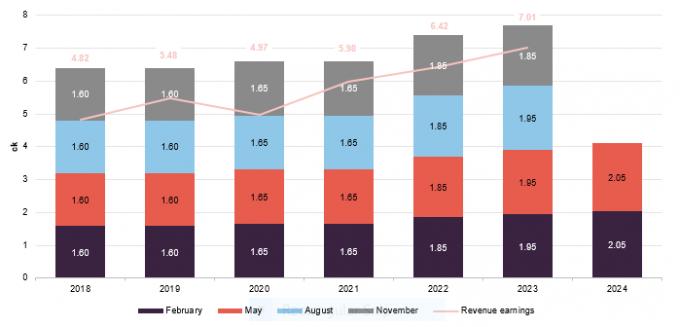

Dividend

EGL is managed to strike a balance between structural capital growth and income, and while much of this note has focused on the portfolio’s growth potential, it remains a reliable source of income for investors. As Figure 20 shows, EGL has tended to pay an uncovered dividend in recent years, supplementing its net revenue with modest amounts from its distributable reserves. These reserves remain substantial, amounting to £114m at the end of September 2023. Therefore, in our view, there is minimal likelihood that the board would feel it was unable to pay its target dividend, as is evidenced by its actions in 2020 when COVID knocked companies’ distributions.

Supporting this is the ongoing growth of EGL’s investment income, with revenue return per share increasing by 11.4% year on year, for the six period to March 31 2024. Due to confidence in its growth prospects, the company announced an increase in its quarterly dividend to 2.05p per share (8.20p per annum) effective from February 2024. At the current share price and increased dividend rate, the company’s shares yield around 4.52%.

Figure 19: EGL revenue income and dividend by financial year

Source: Ecofin Global Utilities and Infrastructure Trust

Fund Profile

Further information regarding EGL can be found on the manager’s website:

uk.ecofininvest.com/funds/ecofin-global-utilities-and-infrastructure-trust-plc

Ecofin Global Utilities and Infrastructure Trust Plc is a UK investment trust listed on the main market of the London Stock Exchange (LSE). The trust invests globally in the equity and equity-related securities of companies operating in the utility and other economic infrastructure sectors. EGL is designed for investors who are looking for a high level of income, would like to see that income grow, and wish to preserve their capital and have the prospect of some capital growth as well.

Reflecting its capital preservation objective, EGL does not invest in start-ups, small businesses or illiquid securities, as these may involve significant technological or business risk. Instead, it invests primarily in businesses in developed markets, which have ‘defensive growth’ characteristics: a beta less than the market average; dividend yield greater than the market average; forward-looking EPS growth; and strong cash-flow generation.

It also operates with a strict definition of utilities and infrastructure as follows:

electric and gas utilities and renewable operators and developers – companies engaged in the generation, transmission and distribution of electricity, gas, liquid fuels and renewable energy;

transportation – companies that own and/or operate roads, railways, and airports; and

water and environment – companies operating in the water supply, wastewater, water treatment and environmental services industries.

EGL does not invest in telecommunications companies or companies that own or operate social infrastructure assets funded by the public sector (for example, schools, hospitals or prisons).

No formal benchmark

EGL does not have a formal benchmark and is not constructed with reference to any index.

EGL does not have a formal benchmark and its portfolio is not constructed with reference to an index. However, for the purposes of comparison, the MSCI World Utilities Index, and the S&P Global Infrastructure Index are the global indices deemed the most appropriate by the manager. The company also supplies data for the MSCI World Index and the All-Share Index in its own literature for general interest. We consider the MSCI World Utilities to be the most relevant – although it should be noted that this index has a strong bias towards US companies and excludes transportation services and some environmental services which EGL may be invested in.

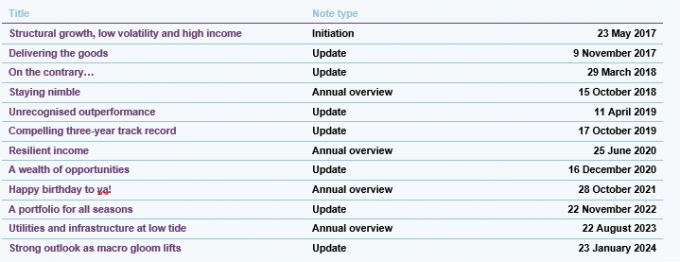

Previous publications

Accuracy of Content: Whilst Marten & Co uses reasonable efforts to obtain information from sources which we believe to be reliable and to ensure that the information in this note is up to date and accurate, we make no representation or warranty that the information contained in this note is accurate, reliable or complete. The information contained in this note is provided by Marten & Co for personal use and information purposes generally. You are solely liable for any use you may make of this information. The information is inherently subject to change without notice and may become outdated. You, therefore, should verify any information obtained from this note before you use it.

No Advice: Nothing contained in this note constitutes or should be construed to constitute investment, legal, tax or other advice.

No Representation or Warranty: No representation, warranty or guarantee of any kind, express or implied is given by Marten & Co in respect of any information contained on this note.

Exclusion of Liability: To the fullest extent allowed by law, Marten & Co shall not be liable for any direct or indirect losses, damages, costs or expenses incurred or suffered by you arising out or in connection with the access to, use of or reliance on any information contained on this note. In no circumstance shall Marten & Co and its employees have any liability for consequential or special damages.

Governing Law and Jurisdiction: These terms and conditions and all matters connected with them, are governed by the laws of England and Wales and shall be subject to the exclusive jurisdiction of the English courts. If you access this note from outside the UK, you are responsible for ensuring compliance with any local laws relating to access.

No information contained in this note shall form the basis of, or be relied upon in connection with, any offer or commitment whatsoever in any jurisdiction.

Investment Performance Information: Please remember that past performance is not necessarily a guide to the future and that the value of shares and the income from them can go down as well as up. Exchange rates may also cause the value of underlying overseas investments to go down as well as up. Marten & Co may write on companies that use gearing in a number of forms that can increase volatility and, in some cases, to a complete loss of an investment.