Economic and Political Roundup

Investment companies | Monthly | November 2023

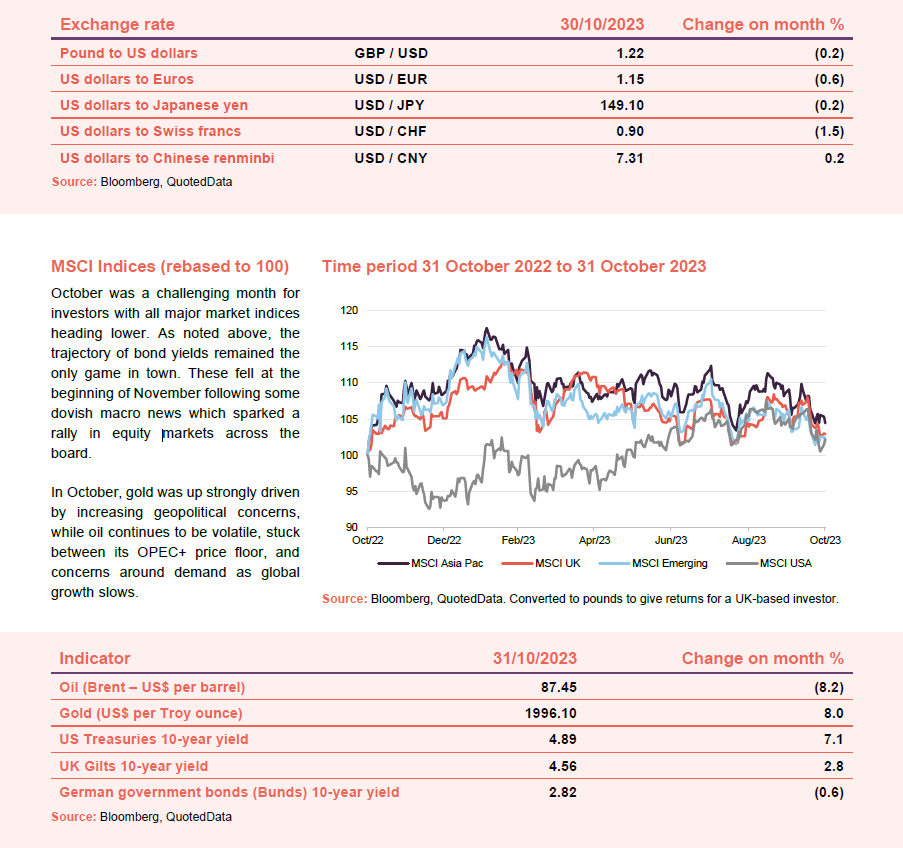

Despite further geopolitical upheaval over the course of October, the US bond sell-off continued to dominate the market narrative with 10-year treasury yields briefly breaching 5% for the first time since the collapse of Lehman Brothers in 2007, which, for many marked the beginning of the global financial crisis. Part of the ‘problem’ was seen as the ongoing resilience of the US economy, with strong jobs, retail sales, and GDP data culminating in a hotter than expected inflation read. In addition to broader concerns around the long-term stability of government finances, these conditions led to a further entrenchment of the ‘higher for longer narrative’. US equites fell 1.9% for the month, although remained well ahead of developed market peers, who have continued to battle with slowing growth and stubborn inflation.

“Extreme fear can be just as costly as greed.” – Savita Subramanian, BofA

The UK led the way down, falling 3.7%, as gilt yields jumped higher, and economic indicators continued to deteriorate. With inflation stuck over 6%, the outlook in the short term looked relatively bleak. EMs also struggled with rising yields and increasing geopolitical concerns, while China continues to grapple with its broader economic slowdown.

All in all, October was a tough month for investors as both equities and bonds fell, with commodities offering the only real buffer.

However, looking ahead indications are that November may offer some respite. Bond yields in the US fell significantly following a slew of positive data releases and a technical change to the treasury refunding programme, while the Bank of England decided against hiking further as the economy stutters, although inflation risks remain skewed to the upside. Global markets bounced almost 5% as financial conditions eased, although it remains to be seen whether this rally is sustainable.

At a glance

Global

compare global investment funds here, here, and here

Katy Thorneycroft & Gareth Witcomb, JPMorgan Multi-Asset Growth & Income – 12 October 2023

Market sentiment remains cautious as recession risks continue to be modestly elevated. Our base case sees further moderation of inflation and economic growth, but also acknowledges the underlying resilience of the U.S. economy. This leads us to favour investments in bond markets with an attractive yield and relative value trades within markets rather than bold directional calls, although we believe that rates will move lower once it becomes clear that central banks will no longer need to continue increasing interest rates. Therefore, current yields support holding moderate levels of interest sensitivity in our fixed income allocation and we see diversification potential in the UK and Europe, where growth is slower, and in Australia where interest rates are lower. In equity markets, we have a bias towards the better earnings and cash flow outlook in the U.S. and Japan compared with Europe and the emerging markets.

. . . . . . . . . . .

Managers, Ruffer Investment Company – 3 October 2023

The recession, when it comes, will arrive with a sudden thud. Sentiment, valuation and market narratives are akin to an echo-bubble of 2021. The pessimism of 2022 has been forgotten and the markets are pricing a soft landing fuelled by AI-driven productivity improvements. The key dynamic is that monetary policy and liquidity withdrawal work with Milton Friedman’s infamous long and variable lags, but their inevitable bite on economic activity and asset prices is coming. Perhaps, in our caution, we underestimated the willingness of the US consumer to keep spending in a strong labour market. The evolution of the UK mortgage market from predominantly variable, to predominantly fixed rate deals, has increased the time between a rate rise and the impact on consumer finances. Further, accumulated lockdown savings have offset the cash flow squeeze from inflation and interest rates. This buffer could either attenuate the pain or delay the reckoning; having been mostly spent it now seems likely it will be the latter.

. . . . . . . . . . .

UK

(compare UK funds here, here, here and here)

Sue Noffke, manager, Schroder Income Growth Fund – 26 October 2023

Investing in the UK equity market is not the same as investing in the UK economy. Listed UK equities include a wide array of international firms, many of which are global leaders in their fields and derive the majority of their revenues from overseas. In fact, 77% of FTSE All Share revenues come from outside the UK. However, the negative narrative surrounding the UK economy has heavily impacted investor sentiment in the UK equity market, leading to an acceleration of outflows from the market into mainly global equities and other asset classes.

Since the Brexit vote in 2016, the UK has gained a reputation as a problematic economy among major economies, with political instability generating uncertainty about the nation’s future and a lack of confidence from both domestic and overseas investors. However, the economic performance of the UK has been better than feared. While Brexit has weakened supply potential, the UK economy has broadly kept pace with the trends seen across advanced economies over the past seven years. Recent revisions to UK economic data challenge the prevailing view that the UK lags behind all other major industrial economies (the G7) in its economic performance since the Covid pandemic. UK business investment has also been picking up more recently, having initially stalled after the UK’s vote to leave the EU and the aftermath of the pandemic. Recent data continues to exceed expectations, and UK corporates have strong balance sheets and liquidity to increase investment spending.

Sentiment towards UK equities has remained very negative, with persistent outflows weighing on market valuations. This has heavily impacted the absolute and relative valuations of listed UK companies, particularly those in the small and medium-sized (SMID) sectors. There has been a significant de-rating of medium and smaller-sized companies over the past two years, both in absolute terms and relative to the largest FTSE 100 companies, due to selling pressures from outflows. However, SMID companies have traditionally outgrown larger companies in the UK and have delivered attractive total returns that have kept pace with the best returns from global equity markets over the long term. The convergence of valuations between SMID and large-cap areas presents a mispriced opportunity.

Negative sentiment has resulted in aggregate valuations of UK equities at multi-year lows. Total shareholder yields are high in absolute terms, relative to other equity markets and other assets, including bonds and cash. Companies across the market, including those in your portfolio, are particularly active in buying back their own shares, as they see compelling returns from investing in their businesses at current prices. Small and medium-sized stocks are subject to ongoing bid activity from overseas and private equity-backed entities. These low valuations are unlikely to persist indefinitely, and there is currently a broad set of investment opportunities within the UK equity market that may well be considered bargains in the future.

Fading political uncertainty, combined with a reassessment of economic performance on growth and inflation, could support a revision of the negative narrative on UK risk assets and be one of the catalysts to address the market’s persistent undervaluation. Investing in a market that remains significantly out of favour with investors provides a plethora of opportunities across the market spectrum, which should provide patient investors with highly attractive returns in the medium term.

. . . . . . . . . . .

Roland Arnold, manager, BlackRock Smaller Companies Trust – 25 October 2023

The UK has been highlighted by many as a particularly weak economy, with inflation more persistent than other developed nations, a poor recent record of growth, a succession of Prime Ministers, a weakening consumer environment, and a collapsing housing market. All of these factors have been compounded by the on-going disruption caused by Brexit. However, we would question this negative narrative. Starting with inflation (where recent published data has shown a moderation from the high levels previously experienced) we note that higher wage settlements are starting to feed through into the economy. The result is a potential increase in real wages towards the end of the year which (all else being equal) will be supportive for consumer spending. How about mortgage costs? No doubt mortgage costs at the population level are increasing, and will continue to do so, but the transmission mechanism is not as immediate as in previous interest rate cycles, with a higher proportion of mortgages on five-year fixed rate deals, giving time for wage growth to moderate the impact (or indeed for the rate cycle to start to turn). There is no doubt the housing market will continue to face headwinds as potential homeowners either struggle to find willing lenders or hold off purchases in the expectation of a better deal next year, but we believe that the housing market will eventually bounce back perhaps as a reaction to government policy. Finally, we note that unemployment, which tends to have a high correlation to consumer confidence, has remained low.

However, the negative narrative has gained traction, bolstered by a political backdrop which gives a perception of a country in turmoil. It is interesting to note the recent changes to GDP statistics show that rather than lagging behind pre-COVID-19 GDP, the UK has in fact recovered all lost ground. But perception matters, and in the case of equity markets, perception manifests in flows, with the UK Small-cap market recording negative flows every month since September 2021. We note the recent statements from the Chancellor with regards to encouraging equity ownership in the UK, and from the London Stock Exchange with regards to reviewing and amending the Listing Rules in an attempt to encourage more companies to list in the UK. We also have to acknowledge the potential for the Labour party to win the next election, a party who are currently projecting a more market friendly set of policies, not least with regards to housing.

If equity investors are unwilling to take advantage of the valuation opportunities that currently exist, there are other forms of capital more than capable of doing so. After a lull around the time of the Truss budget, M&A activity has started to step up again in the UK. There have been a number of bids in the market from cash rich Private Equity firms. Given the huge sums these parties have to invest, and the attractive valuations of UK assets, we would expect this to continue.

Whilst the narrative so far has focused on the UK, we should not forget that the UK market is not the UK economy. UK listed growth companies have significant international exposure and global trends matter. From a global perspective we see a number of opportunities. The significant disruption to supply chains brought about by COVID-19 will see a prolonged period of capital investment. Investment will be made to near shore or “friend shore” essential components, supported by government initiatives such as the Inflation Reduction Act. The increasing cost of labour will lead to a long overdue investment in productivity as firms look to reduce labour content and automate where possible. This brings us on to those two magic letters, “AI” (Artificial Intelligence). AI has hit the headlines at a furious pace this year. Never have we seen a technology so widely adopted so quickly. AI will change business models and industries for years to come, there will be use cases that haven’t been thought of yet. But as with all new waves of technology, the reality is often more nuanced than the rhetoric would suggest, leading to opportunities to invest in businesses where the valuation suggests their business models will be obliterated.

. . . . . . . . . . .

Guy Anderson & Anthony Lynch, managers, Mercantile Investment Trust – 16 October 2023

In the near-term, we expect that financial markets will continue to be heavily influenced by the inter-connected forces of inflation, monetary policy, and the impact of these upon economic growth expectations. These projections have all oscillated even more than usual in recent months, as economic forecasters have swung from expecting a UK recession this year, towards predicting a soft landing. Their assessment has shifted again more recently in light of the recent deterioration in leading economic indicators. Consensus forecasts now suggest that the UK will avoid slipping into recession in 2023, but most foresee a marked slowdown in economic activity over coming months, and only a shallow recovery in 2024.

While this may sound gloomy, there are some reasons for cautious optimism. Through a period of painful inflation and a genuine squeeze on consumer finances, consumption has remained more resilient than anticipated. The housing market is certainly a concern as higher mortgage rates gradually feed through to borrowers once their fixed rate deals expire, but aggregate debt levels are not excessively high, and the BoE has scope to reduce rates if it becomes clear that monetary tightening has been excessive. Furthermore, with inflation moderating, the average UK consumer is now experiencing real wage growth for the first time in nearly two years. If employment levels can be sustained, this should provide some support to the domestic economy. Furthermore, the uncertain outlook is evidently reflected in valuations, as the UK market is trading at a steep discount to both its own history and relative to other developed markets.

The market’s historically low valuations, combined with the solid fundamentals of many UK companies, leave us excited by the investment opportunities in our market.

. . . . . . . . . . .

Georgina Brittain & Katen Patel, managers, JPMorgan UK Smaller Companies – 12 October 2023

The trajectory of inflation and interest rates are clearly key for the outlook. While we had expected a mild recession in the UK in the second half of 2023, the economy looks likely to avoid this – but UK growth prospects are pedestrian at best. Following the encouraging inflation figures over the summer we believe inflation has peaked

in the UK, and we foresee a significant further decline from the current levels over the course of 2023, which will hopefully bring the UK more in line with other developed markets. Interest rates at 5.25% have risen significantly and we believe are close to peak levels. Consumer confidence has staged a significant recovery from its abject lows – largely we believe due to continuing very low unemployment rates and the wage increases that have been seen this year – although the recent spike in mortgage rates caused a setback in what had been an upward trend.

Clearly the stockmarket is currently extremely focused on the macro economic outlook. In this regard, the very recent historic revisions to GDP by the ONS are a notable positive, demonstrating that the growth of the UK economy post the pandemic has not been out of line with that of Europe. However, as always our focus is on the companies themselves. Overall the message we are hearing from them is a positive one. The majority of smaller companies are successfully navigating their way through the headwinds of cost inflation, labour inflation, labour shortages and higher interest costs.

History tells us that stockmarkets rally when investors believe that interest rates are close to peak levels – and this has especially been the case for the UK smaller companies sector. When this occurs, we believe the upside from current lowly valuation levels could be substantial. In addition, investors will be aware there is a significant focus by the Government on the future of the UK equity market, and a strong desire to improve its allure. Although not an instant fix, the change to pension investing proposed by the Mansion House reforms this summer, with DC pension providers being strongly encouraged to invest at least 5% of their funds in unlisted assets, should also be beneficial for small cap companies. This is because stocks on the AIM market are included in the definition of ‘unlisted’.

. . . . . . . . . . .

Jonathan Brown & Robin West, Invesco Perpetual UK Smaller Companies – 11 October 2023

The current level of economic growth in the UK is lacklustre, and we are just beginning to feel the lagged effects of the steep increase in the Bank of England base rate, so the prognosis for the coming year appears gloomy. However, we are not currently in recession and the most recent data suggests that wages are growing again in real terms for the first time in a couple of years. We are also in the fortunate position of having full employment and healthy consumer balance sheets (in aggregate) which should feed through to confidence over time.

We are hopeful that inflation should continue to decline over coming months. The supply chain tightness that drove the initial wave of inflation following the pandemic has largely normalised, and energy prices have now significantly fallen year on year. Conversations with companies suggest that it is now much easier to find staff than it was a year ago and this is beginning to feed through to wage settlements. So hopefully the worst of the cost of living crisis is now behind us, and we are near the peak of the current interest rate cycle.

The value within the UK smaller companies market is very apparent to us. Whether we compare current valuations to history, or to other international markets, the sector looks anomalously cheap. Over time this should attract increased interest from the investment community, but in the meantime we have seen a surge in takeover activity from both corporate and private equity buyers looking to exploit the “knock-down” prices of UK equities. Whilst the economic backdrop is underwhelming we continue to see opportunities to buy undervalued shares in companies with excellent long term growth potential. So, after a difficult couple of years, we are optimistic of better returns over the coming year.

. . . . . . . . . . .

David Barron, Dunedin Income Growth Trust – 6 October 2023

The economic challenges to global growth continue to build, following rapid and sustained interest rate increases from central banks across the world, coupled with a Chinese economy facing significant headwinds. Despite some signs of easing, inflationary pressures remain significant in most economies and supply constraints are placing upward pressure on many commodity prices. In the UK, inflation remains too high and growth too low, albeit there are indications that a trough has been reached and perhaps somewhat ahead of other major economies. For equity markets, there remain reasons to be cautious and the next 18 months are likely to be a tough period for corporate earnings development.

. . . . . . . . . . .

Charles Luke and Iain Pyle, Murray Income Trust – 5 October 2023

Recent data points provide a less than clear picture around current conditions and future direction. However, in most developed economies growth appears to be more robust than might be expected in light of the meaningful monetary policy tightening over the past 12 months. On the other hand, the momentum of China’s reopening has faded and more stimulus is likely to feature. Underlying price pressures have been sticky reflecting excess demand across various sectors and economies prompting central banks to remain hawkish. We believe that the current tightening cycle will ultimately restrict economic growth with the resulting downturn in demand helping to engineer a relatively rapid fall in inflationary pressures allowing significant interest rate cuts over the next 18 months. The valuations of UK-listed companies remain attractive on a relative and absolute basis. Apart from the global financial crisis, the UK’s market multiple is nearing its lowest point for 30 years. It is cheap in absolute terms, relative to history and also relative to global equities. Investors are benefiting from global income at a knockdown price. Moreover, the dividend yield of the UK market remains at an appealing premium to other regional equity markets.

. . . . . . . . . . .

Asia

(compare Asian funds here)

Gabriel Sacks & Flavia Cheong, managers, abrdn Asia Focus – 20 October 2023

We expect global market sentiment to remain volatile in the short term, given concerns regarding global growth, monetary policies in the US and other developed markets, as well as developments in China, where macroeconomic data remainssoft. Having said that, at the time of writing the Chinese government has begun another round of easing measures which should increase support to the economy at the margin. While we are yet to see more impactful policy action, there are still good opportunities to invest in small cap stocks that trade at attractive valuations and that provide exposure to pockets of growth within China’s domestic market.

Elsewhere, other Asian economies are benefiting from diversification in global supply chains. Companies are adding alternative sourcing locations, increasingly adopting “China plus one” or “plus two” strategies.India is in the early stages of a cyclical upswing, and enjoys a demographic dividend, meaning it is well-placed for sustainable long-term growth. The region will also gain from growing demand for AI-related apps and chips, especially in the semiconductor and consumer electronics segments.

Resource-rich Indonesia has a sizeable and dynamic domestic market with rising post-pandemic consumer demand.Vietnam, meanwhile, has become a key player in manufacturing – benefiting from diversification in the global supply chain and numerous free-trade agreements. The country is on a growth track, and we continue to like the long-term macro story. On the other hand, we do see some near-term political risk in some parts of the region, with political uncertainty in Thailand and general elections for both India and Indonesia in 2024. Outside of Thailand though, we generally expect political stability with a continuity in policymaking which provides a positive backdrop for the corporate sector.

In summary, we continue to believe Asian small caps offer significant value. There are attractive opportunities around the structural themes of aspiration, building Asia, digital future, going green, health & wellness and tech enablers.

. . . . . . . . . . .

Angus Macpherson, chairman, Pacific Horizon Investment – 6 October 2023

The invasion of Ukraine ended the geopolitical consensus that prevailed since the fall of the Berlin Wall. This consensus was an impetus for globalisation and a key component of growth in Asia. Today, we live in a much less certain time. It was perhaps inevitable that, as economic power shifted to the East, tensions with the hitherto economically dominant West were likely to grow.

US and Western sanctions on a seemingly increasing number of Chinese companies have made some of them uninvestible. There is little doubt that foreign disinvestment from China is impacting asset prices, at least in the short term. Should these sanctions be materially extended, in response for example to military action, there is a risk this could even render the market as a whole uninvestible.

Domestic considerations in China are also of concern. The Chinese Government is developing its own economic system, the success of which remains to be seen. Coupled with escalating tensions with the US, we recognise that in the future there is likely to be greater complexity and risk in securing investment exposure to the ‘Asian economic miracle’.

Excess investment return is generated by judging and managing risks. On the basis of the information currently available, the Manager and your Board believe that the risks of investment in China and the broader Asian region are justified by the potential rewards. China is a critical trading partner of the West and only the most extreme geopolitical confrontation would justify the economic disruption of severing economic ties entirely.

More broadly, the economies of Asia including the Indian Sub-continent are, as outlined in the Managers’ review, unencumbered by some of the issues affecting more developed markets, such as high levels of debt and elevated levels of inflation. The region is fostering competitive companies that are well placed to benefit from key drivers of long- term growth such as the rising wealth of the Asian consumer, the transition to renewable energy and an AI led digital age of innovation. However, it remains incumbent on our portfolio managers to unearth the right investments. This requires patience and fortitude, an approach that has served investors well in the past.

The region remains one of the fastest growing globally and company valuations, particularly when set against western peers, are undemanding; the Board is of the view that investing in the fastest growing companies in the fastest growing region still offers attractive long-term investment opportunities for patient growth investors. The portfolio managers call this ‘growth squared’.

. . . . . . . . . . .

Europe

(compare European funds here and here)

Ollie Beckett, manager, European Smaller Companies – 10 October 2023

Last year we warned that central banks could overreact to inflation by pushing rates too high and into an energy shock. Today, we think that may still be the case. Concerns of too-high-too-soon rates and the resulting recession has created a fear factor that has dissuaded many from investing in European smaller companies.

Our fundamental belief is that there is considerable value to be found in European smaller companies currently, with valuation multiples looking extremely attractive. Much of our investment universe is already priced for a recession. The resilience of labour markets suggest that there is a reasonable chance that the global economy has a ‘soft landing’. In such an environment, European smaller companies should be a good area to invest: it is the area of the market that could deliver greater growth and is currently trading at a discount to its more pedestrian larger European counterparts.

. . . . . . . . . . .

North America

(compare North American funds here and here)

Dame Susan Rice, North American Income Trust – 5 October 2023

Macroeconomic uncertainty persists given elevated inflation, tight monetary policies and geopolitical tensions. At the same time, the US is starting the extended run-in to the next presidential election in November 2024 and we are alert to the prospects of vote-garnering announcements by prospective candidates from both sides over the coming months.

While investor sentiment now favours an end to the Fed’s interest-rate hiking cycle, some further rate increases cannot be ruled out due to still-high core inflation and the Fed’s commitment to achieving its 2% target. Meanwhile, inflation could increase further due to the recent rise in oil prices. In addition to price increases, more restrictive lending policies as a result of the banking sector collapses in March and the restarting of student loan repayments could hinder consumer spending. However, the US economy has remained resilient during the review period, with a notably strong labour market which is an improvement on forecasts at the start of the year.

Against this backdrop, the Board believes a mild recession is still likely to begin at some point by the end of the year or in early 2024.

. . . . . . . . . . .

North America

(compare North American funds here and here)

Dame Susan Rice, North American Income Trust – 5 October 2023

Macroeconomic uncertainty persists given elevated inflation, tight monetary policies and geopolitical tensions. At the same time, the US is starting the extended run-in to the next presidential election in November 2024 and we are alert to the prospects of vote-garnering announcements by prospective candidates from both sides over the coming months.

While investor sentiment now favours an end to the Fed’s interest-rate hiking cycle, some further rate increases cannot be ruled out due to still-high core inflation and the Fed’s commitment to achieving its 2% target. Meanwhile, inflation could increase further due to the recent rise in oil prices. In addition to price increases, more restrictive lending policies as a result of the banking sector collapses in March and the restarting of student loan repayments could hinder consumer spending. However, the US economy has remained resilient during the review period, with a notably strong labour market which is an improvement on forecasts at the start of the year.

Against this backdrop, the Board believes a mild recession is still likely to begin at some point by the end of the year or in early 2024.

. . . . . . . . . . .

China

(compare emerging market funds here)

Mark Huntley, chairman, Macau Property Opportunities Fund – 6 October 2023

H1 2023 saw a 180-degree turnaround in Macau’s economic performance, with the lifting of all zero-COVID restrictions by January. Fuelled by tourism and gaming activity, in H1 2023, GDP grew 71.5% YoY to reach approximately 71% of H1 2019 levels. The economic recovery had also reduced unemployment among local residents to 3.5% in Q2 2023, compared to 4.8% in the same period in 2022.

The Economist Intelligence Unit (EIU) expects Macau’s economy to return to its pre-pandemic size only in late 2024 due to the extent of the shocks it suffered during 2020-22. That projection is ahead of previous forecasts, which were for a full recovery only by early 2025, although the EIU also expects Macau’s growth to moderate amid China’s recent slowing economic activity.

Macau’s economy appears to be on a path to recovery, but economic growth has been concentrated in the tourism and gaming industries, with the property market continuing to face a unique set of challenges; a deteriorating Chinese economy, high interest rates, and Macau’s outdated anti-speculation property measures. Collectively, these have adversely impacted market sentiment, limiting the progress of the Company’s divestment programme

Managers, Baillie Gifford China Growth Trust – 3 October 2023

The bright lights of a consumption-led post-Covid recovery, fuelled by low interest rates and excess savings, have so far failed to shine. Investors have been left to ponder China’s weaker-than-expected domestic economy, while distrust between the two largest superpowers continues to act as a headwind.

Towards the end of the reporting period, the property market deteriorated further, leading to concerns around financial stability. Property company Country Garden and trust company Zhongzhi Enterprise Group made headlines for missing coupon payments on their debt. This led to predictions of the collapse of China’s financial system – the same kind of dire prognostications made in 2001, 2008 and the Covid lockdowns.

While weakness in property hurts growth within the economy, we think the risk of financial instability is low. Property sales are down almost 50 per cent from their 2021 peak but prices have barely budged. Why? Because China never experienced the asset price bubble that has precipitated almost every property market collapse in developed markets. Property prices have grown at around 7 per cent per annum over the last decade, but income growth has surpassed this at around 10 per cent per annum. Property should have become more affordable. And while developers such as Country Garden have become over-indebted, the Chinese consumer remains in very good health.

So why is activity so depressed?

- Firstly, Covid lockdowns undoubtedly hurt consumer confidence. It’s important to remember that lockdowns only ended in China in January this year, versus almost 18 months ago in the west. In addition, the size of the Chinese government’s stimulus package equated to around only 10 per cent of GDP versus an average of 70 per cent in the West, and Chinese stimulus did not take the form of direct handouts. Instead, consumers saved up an estimated $7tn of excess savings from their own earnings. Consumers, therefore, have money to spend and, as the trauma of Covid fades and income growth continues, we expect confidence to return and activity to improve.

- Secondly, the government’s regulatory crackdown damaged private sector confidence. Indeed, the private sector’s contribution to the Chinese economy is frequently underestimated. It accounts for nearly 50 per cent of tax revenue, 60 per cent of GDP, 70 per cent of technological innovation and most importantly, 80 per cent of jobs. It’s been weak, partly because of Covid, and partly because of concerns that Xi Jinping no longer supports entrepreneurs. Over the past 12 months, the government has attempted to address these concerns by clarifying the rationale behind the regulatory crackdown. Some of our third party research providers argue that we’re now witnessing the most concerted effort to support the private sector in the history of the People’s Republic. This culminated in a 31-step support package aimed at promoting ‘a bigger, better and stronger private sector’. The package seeks to improve market access, level the playing field with state-owned enterprises, strengthen access to finance and incorporate more private sector input into policymaking. Importantly, the latter may reduce the risk of future policy errors. As with the Chinese consumer, the private sector remains, on average, in very good health, with strong balance sheets and the ability to invest once confidence improves.

- Finally, what about debt and the risk of contagion? Aggregate debt levels are a challenge, but we think the risk of financial instability is low. The majority of debt in the Chinese system circulates within a closed loop, ie it is issued by state-owned banks to state-owned enterprises within the context of a closed capital account. This gives the government the ability to decide how quickly bad debts are recognised and to stagger recognition in line with economic activity. In addition, the risk of contagion from hidden debt within the system has been drastically reduced after the government’s 2016-2017 campaign to clean up balance sheets and reduce shadow banking.

Debt levels do limit the government’s ability to offer a very large stimulus package. However, gradual easing remains viable. Indeed, the government’s prudent approach to Covid stimulus and to the property market over the last decade means that it has many levers to pull. China is one of the very few countries that can lower interest rates in response to economic weakness without raising fears of stagflation. It has also begun to relax the restrictions it put on property in the early 2010s. For example, in July it gave local and city governments the go-ahead to relax restrictions on home purchases. In August we saw Guangzhou, a major tier-one city, become the first to act. We expect others to follow suit and for the government’s gradual easing approach to bear fruit.

So, while economic growth is weaker than expected, the current consensus seems excessively pessimistic. The regulatory crackdown seems to be over, the government is moving to support the domestic economy, and the consumer is in rude health. We just need to be patient.

Indeed, for all the gloomy reporting, the data suggests that we’re starting to see the fruits of this measured approach. There are signs that household

consumption is gaining momentum. Air passenger numbers and visits to the casino-rich island of Macau are rapidly returning to pre-pandemic levels.

Income growth averaged 8 per cent in the most recent quarter, up from 4 per cent in the first. And our consumer-related holdings in China have also posted impressive recent quarterly numbers. As the trauma of Covid and the regulatory crackdown fade, we expect a private sector and consumer-led recovery to take root.

. . . . . . . . . . .

Emerging Markets

(compare emerging market funds here)

Elisabeth Scott, chair, JPMorgan Global Emerging Markets Income – 26 October 2023

Wariness is spreading across markets as the Middle East crisis looks increasingly complex. Oil prices are climbing amid concerns about global supplies and crude is expected to remain susceptible to more spikes on signs of further disruptions in the Middle East. Global gas supply is set to remain tight and subject to a wide range of uncertainties. These latest developments increase concerns on higher inflation and lower growth.

Despite some near-term uncertainties, there are good reasons to be optimistic about the long-term prospects for Emerging Markets. The uncertainties relate mostly to how the US and Chinese economies perform in coming months. In the US, the Federal Reserve’s restrictive monetary stance is likely to dampen activity over the remainder of this year and next, which may reduce demand for Emerging Market exports. It is not yet clear whether the US economy will dip into recession as the impact of higher interest rates and tighter financing conditions are seemingly taking longer to take effect on consumer demand and inflation than previously expected. With respect to China, we believe that the market does not fully appreciate that, although China’s near-term growth is less vigorous than before the pandemic, its GDP is forecast to grow much more rapidly than in most developed economies. Longer-term growth is likely to be supported by the Chinese authorities’ pro-growth stance. When investors form a more realistic and more upbeat view of the country’s prospects, China is likely to resume its role as an important positive driver of activity and markets within Asia and further afield, especially if the recent apparent warming in relations between China and the US results in an easing of trade and political tensions between the world’s two largest economies.

It is important to note that, while China has been absorbing investors’ attention in recent months, many other Emerging Markets, notably equity markets in Taiwan, Mexico and Peru have been performing well and are forecast to continue growing strongly over the medium term. Expansion will be underpinned by positive structural trends such as digitalisation, urbanisation and favourable demographics, which result in growing working-age populations and rising incomes.

In summary, the Board believes that Emerging Markets continue to offer many attractive opportunities capable of delivering capital growth and above market yields, especially after the declines in valuations seen over the past couple of years.

. . . . . . . . . . .

Heather Manners, chairman, Fidelity Emerging Markets – 12 October 2023

On a historical basis, emerging markets themselves offer attractive relative valuations as well as compelling fundamentals. While the Western world struggles with the challenges of over a decade of ultra-loose monetary policy and the fallout from Covid stimulus packages, leading to the highest levels of inflation and interest rates in nearly a generation, in most emerging markets the picture is completely different.

The structural case for investing in developing economies remains extremely strong: attractive demographics, a burgeoning middle class providing new markets for goods and services, and economies that can grow more rapidly than those in the West. Many emerging economies have already experienced the pain of higher interest rates and prices that are facing the developed world, and now have greater monetary policy flexibility as well as declining inflation.

In recent years the US stock market has dominated an enormous amount of the rest of the world’s liquidity, but outflows from emerging markets funds have begun to slow and even reverse as investors once more get on board with the long-term growth story, buoyed by relatively attractive valuations and in many cases decent dividend yields. In our view, the year ahead may infuse emerging markets with more momentum in terms of performance versus the rest of the world.

. . . . . . . . . . .

India

Andrew Watkins, chairman, Ashoka India Equity Investment Trust – 9 October

India has come a long way since Narendra Modi took over as Prime Minister in 2014, initiating a plan for India to become a developed nation within 25 years. It is certain that, come next year’s election, he will make much of the progress over that 10-year period and he would be right to do so. India’s population, at 1.4 billion, overtook China’s this year and the differences between the world’s largest autocracy and the world’s largest democracy in the race for economic growth remain stark; China’s leader favours a retention of power over a well-functioning economy thus reducing the potential for entrepreneurial flair that is so evident in India. It seems very likely that growth will expand for the foreseeable future with material investments in renewable energy, high-speed railways and new roads in a generational boost to India’s economy. Of this expanding population, a significant number will grow up as well-educated, tech-savvy individuals who speak fluent English and, therefore, be well equipped to converse in the business markets of the world. Hosting the G20 conference in September added further to both India’s and Modi’s personal status.

The “global south”, as this part of the world is now being referred to, is growing in importance, both geographically, politically and economically. It is not at all unreasonable to assume that India is the unelected leader of such a bloc and its relevance and importance is only likely to grow in direct proportion to its economic growth and continuing status as a democracy, perhaps eventually leading to a permanent seat on the UN Security Council, further burnishing Modi’s personal credentials and India’s world status.

Global inflation is easing and, war to one side, India is coping well with supply lines both in and out of the country. Growth is forecast to reach 6% this year, materially in excess of any other major economy, and is likely to continue apace into 2024-5

. . . . . . . . . . .

Managers, Ashoka India Equity Investment Trust – 9 October

India’s economy delivered solid, above expectation GDP growth of 7.2% for the fiscal year to March 2023. Its healthy macro-fundamentals, resilient corporate earnings as well as promising growth prospects – garnered strong foreign and domestic investment against a global back drop of geopolitical tensions, higher commodity prices and credit costs, as well as fears of a recession in the US and Europe.

To take inflation, India recorded an average CPI of 6.7% for the year to 30 June 2023 compared to 7.4% and 8.8% in the US and EU, respectively. The government’s focus on a capital expenditure push as opposed to a loose consumption stimulus (which was relatively lower during the pandemic, leading to increased availability of labour as the pandemic subsided) has kept India’s inflation at manageable levels. For the current fiscal year, India’s inflation is likely to be around 5.5% as global growth slows, keeping commodity prices benign. Moderating inflation will help contain the government’s fiscal deficit through lower subsidies, providing room for the Reserve Bank of India to avoid raising policy rates, and help support the margins of Indian based corporations. India’s external sector position is also likely to improve in FY24. The Current Account Deficit (“CAD”) as a percentage of GDP is likely to be recorded at 1.5% in FY24 (compared to 2% in FY23). This coupled with healthy capital flows should ensure that India’s Balance of Payments remains positive. Additionally, India’s healthy foreign exchange reserve, which stands at US$607 billion results in one of the lowest debt-to-GDP (19%) positions globally, and provides comfort against any potential global macro volatility.

India’s economy is experiencing the start of a growth phase as ingredients for a revival in the investment cycle seem to be in place. The twin balance sheet problem (overleveraged corporate balance sheets and high non-performing assets (“NPAs”) of banks) which held back private investments in the last decade seem to be behind us. Corporate debt is at its lowest in many years and banks are enjoying one of the lowest bad-loans ratios in the last decade (gross and net bank NPA ratios stand at 3.9% and 1% respectively). This provides a conducive environment for private sector capex to pick up from here.

Government capex has also grown at a brisk pace recently, reflecting policy commitment to building infrastructure and facilitating private investment. The FY24 budget signalled continuity on public capex (roads, railways and housing), enhancing the ease of doing business and boosting exports and manufacturing. Given this is a pre-election year, public sector capex growth is likely to remain robust. As estimated by various global agencies, such as the IMF and the World Bank, India is likely to emerge as the fastest growing major economy over this decade.

The pandemic and geopolitical tensions over the last few years have accelerated supply chain diversification across various industries. India’s favourable demographics, with 900 million people of working age, makes it an attractive destination for companies to set up their production base. The production linked incentives issued by the government since 2020, for setting up new manufacturing units producing and exporting from India, have started to show results. A number of global giants are in the process of starting production in India. Despite the strong growth in the export of electronics, India’s global share in many other sectors such as chemicals and engineering goods is still small (approximately 2% to 4%). Even a 1% to 2% incremental market share gain from China, could result in high-teens growth rates for these sectors.

India’s well diversified corporate sector continues to generate stable earnings growth. Earnings growth for the Nifty is projected to grow by mid-teens over the near term, marking the best phase of corporate profitability since the period 2003 to 2007. Despite periodically rising concerns over the impact of higher credit or raw material costs on the broader market, we believe several of our portfolio companies are market leaders and have managed inflationary scenarios fairly well. The underlying trend of market share consolidation in favour of stronger, well-run businesses continues. The unbranded (or unorganised) segment of the market has found it challenging to deal with higher input costs and frequent supply chain disruptions. Also, in the context of potentially slowing global growth, it is worth re- iterating that India’s earnings have generally been more resilient than its emerging market peers during previous downcycles.

In view of these positives, the broader Indian equity market has seen a recovery rally since April 2023 and valuations are back to 23x (FY24 P/E multiple), as compared to the 10 year average of 19x for BSE Sensex. Although the market seems expensive, in the last 10 years, bar a few instances during market corrections between 2016 and 2020, India has consistently traded at a premium relative to other emerging markets.

India offers a diversified sector exposure relative to its international peers, with a good mix of cyclical and counter cyclical businesses.

Separately, from a potential risk perspective, general elections in India are likely to be held in April or May 2024. Although the current Prime Minister’s popularity remains intact, and the risk of regime change appears low, such an event or a weak coalition government could be a negative surprise for the market. The markets would like to see policy continuity. Furthermore, any sustained weakness in global growth could weigh on market performance. On the other hand, a sharp reversal in anticipated global risk factors such as inflation, recession, or geopolitical tensions could boost investor sentiment.

In conclusion, we remain optimistic and continue to believe the structural growth drivers of the Indian economy are deep rooted which, notwithstanding the near-term challenges, presents India as an attractive long-term investment opportunity.

. . . . . . . . . . .

Vietnam

(Compare country specialist funds here)

Managers, Ashoka India Equity Investment Trust – 9 October

The world is going through a difficult period as governments and central banks strive to control inflation. In setting interest rates, central banks continue to wrestle with the dilemma that higher rates may help to control inflation but at the same time reduce growth. Having increased interest rates significantly to protect the currency, the Vietnamese central bank has now reduced rates decisively to reduce the pressures in the real estate sector and help stimulate growth in domestic consumption.

The real estate sector in Vietnam has liquidity problems and these continue to be of concern. However, we do expect the situation to improve over time as there is a shortage of supply and pent-up demand, particularly for apartments in the major cities. Elsewhere, there is evidence that manufacturers are beginning to receive increased orders and Foreign Direct Investment remains strong. After slower growth in 2023, there are reasons to be optimistic that GDP growth in Vietnam will return to historic levels next year.

While during 2023 the equity market has recovered some of the ground lost in 2022, listed Vietnamese equities are still trading at a low valuation compared with regional peers and their own past levels. With the usual caveat that returns are likely to be volatile and buffeted by extraneous events, combining the low valuation with continued economic growth gives cause for optimism for Vietnamese equities. It is hoped that the recent elevation of the relationship between Vietnam and the United States to a Comprehensive Strategic Partnership will yield significant economic benefits over time.

. . . . . . . . . . .

Biotech and Healthcare

(compare Biotech and Healthcare funds here)

Investment managers, RTW Biotech Opportunities – 13 October 2023

The longest biotech bear market (as measured by the small-cap heavy Russell 2000 Biotech) stretched exactly three years from peak to trough (March 2000 to March 2003). Almost twenty years later, we find ourselves in a similarly protracted bear market, five months shy of three years. The most recent high for the current cycle was set in February 2021 and the low in June 2022. The sector rallied strongly in the second half of last year until the end of January this year, but sector indices are now retesting the June 2022 low, which is a level first achieved in February 2015: an eight-plus year roundtrip. Price-to-Sales has dropped over 40% over this period, putting valuations only 20% above financial crisis lows. The amount of substantive innovation that has taken place during this period, including the emergence and validation of new modalities and blockbuster commercial products, makes it all the more striking. We believe that the prolonged underperformance of the sector, low valuations, high innovation, and growing M&A all increase the odds of a strong recovery.

We have begun to see small signs of improvement. Individual securities are behaving more rationally around events this year than they did the previous two, and dispersion has improved. Higher dispersion and rational price action is the optimal backdrop for a strategy like ours. That said, capital flows for biotech mutual funds and ETFs have been significantly negative this year as retail investors are showing their fatigue. This inevitably dampens some of the upside we normally see in a more balanced market.

Only eight traditional biotech IPOs have made it out this year. They include two metabolic, two immunology, and one radiotherapy company, all areas that have shown recent commercial success, indicating the market will pay for companies with commercially viable products.

New financing trends often emerge in challenging markets in response to company needs. Post-2009, it was convertibles and PIPEs that were popular. This time, it is non-dilutive financing solutions like royalties that are gaining popularity. Royaltybacked financing helps companies approaching commercialisation raise significant sums of capital without taking large amounts of balance sheet risk. We think royalty financing represents a good solution for companies and opportunities for investors.. . . . . . . . . . .

. . . . . . . . . . .

Commodities and Natural Resources

(Compare commodities and natural resources funds here)

Managers, CQS Natural Resources – 20 October 2023

Macro uncertainty remains high. Against the backdrop of already soft demand growth the synchronised tightening of central bank interest rates, to try to quell inflation, has introduced more pressure on economies. Notwithstanding lag effects, the broader demand outlook and particularly investor sentiment remains sensitive to the success of interest rate policies in taming inflation. Inflation is now showing signs of easing, most notably in those regions which experienced higher prior year rates. Though implied rates indicate a peak in the next year, central banks remain highly cautious on easing too soon. Unless there is a correction in general economic activity, interest rates may plateau at an elevated level.

We believe market consensus of a sharp retracement may not come to fruition. The ongoing property crisis in China, with large developers such as Evergrande and more recently Country Garden in effective bankruptcy, represents another pocket of risk which is dampening a major source of commodity demand. It is likely China will continue to seek stimulus to support its general economy, but we still believe the effects will be felt selectively in demand for certain commodities. This is especially so for iron ore in which the fund has no investments and also contributed to the material reduction in our copper exposure, which stood at 6.4% as at the end of June 2023. Over the medium to longer term we do expect a structural shortage of copper for deployment in the energy transition given the lack of investment into large new supply projects. However, we believe some measure of this view is already implied in the premium valuations of many copper producers which contrast starkly with the discounted valuations ascribed to out of favour energy peers.

In response to elevated risks arising from tightening OECD interest rate policy and risks around China’s financing of expected economic stimulus, we increased the fund’s precious metals exposure, which stood at 19.5% at 30 June 2023, as a direct hedge against this general uncertainty. Additionally, we believe precious metal producers have fallen further out of favour and thus trade at a discount versus historic multiples and also versus other mining peers. Though cost inflation has been a major headwind for precious metal producers, which have less ability to pass costs through to consumers, cost pressures are now easing, notably for energy and steel, while importantly labour tightness is now also showing signs of abating. It is never easy to reduce wages, so this aspect remains stickier than other inputs. We believe this can support both earnings growth and multiple expansion, while providing a useful macroeconomic hedge to the overall portfolio.

The outlook for the sector is positive, as commodity supply remains constrained by disciplined management teams, ESG constraints and tough global government policies and whilst the energy transition provides incremental sources of demand, is perhaps more impactful in its restriction of supply of the old economy fossil fuels. The producers themselves are generally attractively valued, especially in energy, where many funds remain cautious on ownership due to ESG restrictions, whilst constrained supply supports pricing, underpinning dividends and buybacks. Some near-term concerns are evident, as a higher rate environment and Chinese economic slowdown weigh on demand expectations. We believe energy is less discretionary, so less affected by these aspects, whilst any investment in new supply is muted. Longer term base metals such as copper look attractive given the long lead time in bringing on new mines, as well as being required in enabling the energy transition.

. . . . . . . . . . .

Debt

(compare debt funds here, here, here, here)

Pieter Staelens, portfolio manager, CVC Income & Growth – 6 October 2023

After a strong recovery in the first half of 2023, the Investment Vehicle Manager remains positive on the outlook for the remainder of 2023. Corporate earnings have so far held up reasonably well and default rates have – in line with what we anticipated in our full year 2022 report – increased slowly. Overall, these defaults remain manageable for the loan market. There have been some high profile defaults such as Orpea (nursing homes), Casino (food retail) and Genesis Care (healthcare) in Europe to name only a few.

Even though these are more idiosyncratic events, rising base rates and more difficult access to capital markets have accelerated some of these defaults. The Investment Vehicle Manager anticipates defaults in the market to continue to pick up over the next 6-12 months. M&A activity remained very subdued in H1 2023, but we are starting to see some green shoots, with, for example, the announced public-to-private of Software AG for €2.6bn by Silver Lakec . There are further signs that M&A activity is picking up however we don’t anticipate a major resurrection in volumes before the start of 2024, at the earliest. With limited new deal flow coming to the European leveraged loan and high yield markets, most primary activity will continue to be dominated by refinancing activities.

. . . . . . . . . . .

Jack Perry, chairman, ICG-Longbow – 2 October 2023:

Current UK economic and property market conditions are not conducive to quick or easy asset sales. The sustained rise in UK interest rates, up four percentage points in a little over a year, has dramatically reduced liquidity in property and finance markets as well as affecting asset prices in many property sectors. The value of property transactions in the first half of 2023 was over 50% lower than the same period in the prior year, and 37% below the 10-year average. Hotel sales in the first half were at their lowest levels for over a decade. More recently, the data has trended weaker again: Colliers International reports that property investment transactions in July were less than £1bn, the lowest monthly level since 2008.

An illiquid and distressed market with few buyers is clearly not helpful for any seller. Compounding the problem are finance markets, where lenders are struggling with reduced interest coverage on new or maturing loans, and borrowers are facing all-in rates that often cannot be accretive to returns.

It is not clear how long it may take for liquidity to improve but it seems unlikely to be soon. The few buyers that exist are opportunistic, under no pressure to acquire assets and demand steep discounts.

. . . . . . . . . . .

(compare private equity funds here)

Private Equity

Richard Hickman, managing director, HarbourVest Global Private Equity – 26 October 2023

Private markets activity has slowed in the first half of 2023 from the records set in 2021 and 2022. As noted by Pitchbook, US deal volumes have declined in four of the last six quarters, down 24% by deal count and 49% by deal value since peaking in Q4 2021. It is a similar story in Europe, where if the deal numbers seen in the first half of 2023 are maintained for the rest of the year, 2023 totals will be around 24% below the levels set in 2022.

Fundraising has also been challenging, with the numbers for the first half of 2023 in the US coming in at 15-25% below last year’s pace based on the number of funds closed and the final sizes of these closed funds. The picture is mixed when viewed through different lenses – infrastructure in particular has seen a steep drop-off in funds raised compared with 20225, but a silver lining is that the European fundraising environment remains strong and is in fact on track to exceed 2022’s total.

Exits (or lack thereof) are a symptom, rather than cause, of the negative investor sentiment. Quarterly exit value in Q2 2023 was flat or down for the seventh consecutive quarter in the US, as the continued uncertainty of the macroeconomic outlook led sponsors to wait for improved sentiment among prospective buyers. Perspective is important here; the US PE industry overall delivered the equivalent of approximately 2.6 years of exit value in a single year in 20216, and so the consistent quarterly decline noted points both to a weak 2023 environment as well as an unusually positive 2021 environment.

One growing exit route is GP-led secondaries, allowing sponsors to roll portfolio companies out of their original fund and into a new vehicle which, in turn, provides the option of a partial or full cash exit to existing LPs. This allows GPs to continue to add value to well-calibrated assets without being forced by the constraints of a single fund lifecycle to sell assets at an inopportune time. The growth of this portion of the secondaries market in recent years is evidenced by the fact it now represents approximately half of annual secondaries transaction volume, having outnumbered LP secondaries for the first time in 20207. Despite this development, Pitchbook notes that the exit-to-investment ratio overall in the US has fallen compared to previous years.

Property

(compare UK property funds here, here, here, here, here, here and here)

Richard Shepherd-Cross, investment manager of Custodian Property Income REIT:

The disconnect between the occupational and investment markets in UK real estate continues to persist. While the impacts of high inflation and interest rates appear to weigh heavily on investor sentiment, perhaps the greater influence has been the marked re-rating of valuations in the final quarter of 2022, which still seems to colour investors’ attitude to real estate investment. However, since the start of 2023 valuations have been reasonably stable across the market, with some sub-sectors showing signs of recovery while others continue to drift. The outcome for the NAV of Custodian Property Income REIT has been a marginal decrease of 3.9% over the past three quarters.

By contrast, occupational demand has been consistently strong which has led to a reduced vacancy rate and increase in the portfolio rent roll. It is the strength of the occupational market driving rental growth and low vacancy that will ultimately support fully covered dividends and earnings growth. Income/earnings remain a central focus for Custodian Property Income REIT, and it is income that will deliver positive total returns for shareholders. On this basis we remain cautiously optimistic.

. . . . . . . . . . .

Richard Kirby, fund manager of Balanced Commercial Property Trust:

Real estate continues to be impacted by the macro-economic challenges of elevated rates of inflation and high interest rates which continue to weigh on investor sentiment. However, the Bank of England broke its cycle of 14 consecutive increases to the base rate, holding the benchmark interest rate at 5.25 per cent in September. While the rate of inflation has proven stubborn since, it may be that the worst of the inflation-driven market uncertainty and interest rate hikes are now behind us.

At the market level, total returns as measured by the MSCI Monthly UK Property Index turned negative in the third quarter. This was largely driven by yields continuing to drift out in the retail and office sectors, reflecting perceived risk and an absence of capital as quarterly investment volumes remain subdued. The headline figures are nuanced both between prime and secondary stock and, at the sector level, as investors increasingly favour the resilience offered by the sectors with the strongest occupational markets.

Occupational markets continue to show resilience, with all sectors seeing annualised rental value growth at the headline level. This is an encouraging sign in the prevailing environment of limited capital growth and where income will drive real estate returns.

. . . . . . . . . . .

M7 Real Estate, investment adviser of Alternative Income REIT:

After rising substantially over the last two quarters of 2022, commercial property yields effectively plateaued in early 2023. At that time, core inflation data, on the upside of expectations, caused the market to think again. Some were expecting that the previous ‘yield peak’ may be an inflection point with some yield softening in the latter half of 2023, others suspected an extended period of relative stability.

Forecasters’ predictions for a peak in base rates went through a volatile period in the first half of 2023, ranging from 6.0% to 6.5% This rate shift from 5.0% is relatively small compared with the near doubling of the cost of debt last year. Investors in a position to take a medium to long-term view, with long-term drawn down facilities at below current debt pricing, may well start taking key assets from leveraged investors. There is still a weight of global capital seeking a home in UK real estate.

The gap between stronger and weaker assets with more vulnerable occupiers is widening. Investment volumes are down, sellers are reluctant to dispose of assets, and new development supply is slowing. Another summer of low activity was expected.

It is income returns, rather than capital growth, which are expected to continue to drive performance in 2023. Business insolvencies, property defaults and consequently void rates are marginally increasing. However, where businesses have requirements there is a focus on quality and sustainability, reducing their occupational overheads and retaining staff. Moreover, the ongoing lack of suitable development supply continues to underpin prime markets particularly in comparison with secondary space.

The MSCI Capital Value Growth Index (June 2023) demonstrates the historical movement in the investment market, showing the rerating in the second half of 2022 and the recent stability. The industrial sector, being the lowest yielding, fell back more dramatically than the other main sectors, when rising inflation and interest rates hit. This sector sits relatively favourably at present, with a significant global weight of capital targeting the sector, despite headwinds for occupiers. Void rates may rise somewhat over the short term, but rental growth is expected to remain positive.

Both investors and occupiers have a renewed focus on the physical climate risk after record temperatures which may be the new norm. Each are developing a better understanding of the value of sustainability features, accurate measurement of ‘green’ features and the impact of improved energy efficiency on the corporate bottom line. More mandatory disclosure requirements are expected, including net zero transition plans.

. . . . . . . . . . .

Alison Fyfe, chair of Target Healthcare REIT:

Our share price has declined alongside the UK REIT sector, reflecting the expected impact of higher interest rates and concerns for the UK economy on earnings and valuation outlooks. We believe our own outlook is more positive, given the high levels of investment demand for our assets, the underlying demographics of an ageing population, and the dearth of quality care home real estate across the UK. Our portfolio is performing strongly, benefitting from our initiatives to dispose of non-

core assets, from further capex to refresh or enhance our real estate, from our active engagement with tenants, and from the more favourable trading environment.

The downward pressure on real estate valuations was muted in our portfolio, underpinned by the strength of investment demand for our type of modern, purpose-built assets and from the improved trading conditions our tenants are encountering. The net result has been a valuation move of c.40 basis points on yield, significantly lower than UK real estate has experienced more widely.

Despite the more challenging macroeconomic environment, strong sector tailwinds continue to support investment in modern care home real estate. Underlying demand for residential care places is supported by demographic change, evidenced by projected growth in the number of those aged over 85, and investment demand for modern, ESG-compliant care home real estate remains strong.

On inflation and recessionary concerns, our portfolio bias towards private pay provides comfort that our tenants are more likely to be able to pass on their cost increases through higher resident fees, supporting sustainable tenant trading. We have seen evidence over the year that the quality of our real estate allows tenants to secure commercially appropriate fee levels.

. . . . . . . . . . .

Steve Smith, chairman of PRS REIT:

The total number of rental properties in the UK has not increased significantly since 2016 although demand for rental accommodation continues to rise. According to Zoopla, a leading UK aggregator of property listings, the ongoing chronic imbalance between supply and demand has pushed rents higher across all parts of the UK. It forecasts continued demand and rental inflation into the second half of 2023.

Private landlords have faced greater pressures since 2016, when an extra 3% was added on stamp duty for additional home purchases. This was followed by reform on mortgage interest rate relief. Proposed rental reform measures in the government’s Renters (Reform) Bill have further added to pressures on private landlords. These include the proposed abolition of fixed-term tenancies and reform of the grounds for repossession. Higher interest rates gave further cause for concern for private landlords.

According to the National Landlords Association, even though rental demand is high, the proportion of landlords looking to reduce their portfolio over the next 12 months continues to rise and landlords “planning to sell” are now at record highs, with 30% planning to cut the size of their portfolios. Hamptons, the property consultancy, reports that 140,000 landlords left the sector last year and expects the run-rate of landlords leaving the sector to be 100,000 per year for the next five years.

Challenges to home ownership have not eased, further fuelling rental demand. Increased interest rates have created new pressures for prospective homeowners wishing to purchase their first home and for homeowners with mortgages due for renewal. The median house price to income ratio, according to the Office for National Statistics is currently 8.16, and in August 2023, the average interest rate on a two-year fixed mortgage was 6.85% according to financial data provider, Moneyfacts, with the average rate on a five-year fixed mortgage at 6.35%. By comparison, the PRS REIT’s homes remain very affordable. At 30 September 2023, the average household income of a PRS REIT tenant was £51,000 and the average rent was £934 per calendar month, meaning that rent as a proportion of household income was 22%. We believe that it is reasonable to assume this improvement reflects a combination of wage inflation and the emergence of a wealthier cohort of disenfranchised would-be home buyers.

In summary, it is clear that the market opportunity in the build-to-rent (BTR) sector remains significant and that the sector remains an important means of fulfilling a social need and meeting demand for high-quality, well-managed rental housing in the UK.

. . . . . . . . . . .

IMPORTANT INFORMATION

This note was prepared by Marten & Co (which is authorised and regulated by the Financial Conduct Authority).

This note is for information purposes only and is not intended to encourage the reader to deal in the security or securities mentioned within it.

Marten & Co is not authorised to give advice to retail clients. The note does not have regard to the specific investment objectives, financial situation and needs of any specific person who may receive it.

Marten & Co may have or may be seeking a contractual relationship with any of the securities mentioned within the note for activities including the provision of sponsored research, investor access or fundraising services.

This note has been compiled from publicly available information. This note is not directed at any person in any jurisdiction where (by reason of that person’s nationality, residence or otherwise) the publication or availability of this note is prohibited.

Accuracy of Content: Whilst Marten & Co uses reasonable efforts to obtain information from sources which we believe to be reliable and to ensure that the information in this note is up to date and accurate, we make no representation or warranty that the information contained in this note is accurate, reliable or complete. The information contained in this note is provided by Marten & Co for personal use and information purposes generally. You are solely liable for any use you may make of this information. The information is inherently subject to change without notice and may become outdated. You, therefore, should verify any information obtained from this note before you use it.

No Advice: Nothing contained in this note constitutes or should be construed to constitute investment, legal, tax or other advice.

No Representation or Warranty: No representation, warranty or guarantee of any kind, express or implied is given by Marten & Co in respect of any information contained on this note.

Exclusion of Liability: To the fullest extent allowed by law, Marten & Co shall not be liable for any direct or indirect losses, damages, costs or expenses incurred or suffered by you arising out or in connection with the access to, use of or reliance on any information contained on this note. In no circumstance shall Marten & Co and its employees have any liability for consequential or special damages.

Governing Law and Jurisdiction: These terms and conditions and all matters connected with them, are governed by the laws of England and Wales and shall be subject to the exclusive jurisdiction of the English courts. If you access this note from outside the UK, you are responsible for ensuring compliance with any local laws relating to access.

No information contained in this note shall form the basis of, or be relied upon in connection with, any offer or commitment whatsoever in any jurisdiction.

Investment Performance Information: Please remember that past performance is not necessarily a guide to the future and that the value of shares and the income from them can go down as well as up. Exchange rates may also cause the value of underlying overseas investments to go down as well as up. Marten & Co may write on companies that use gearing in a number of forms that can increase volatility and, in some cases, to a complete loss of an investment.