Edinburgh Worldwide

Investment companies | Annual Overview | 13 February 2024

“The opportunity is as exciting as ever”

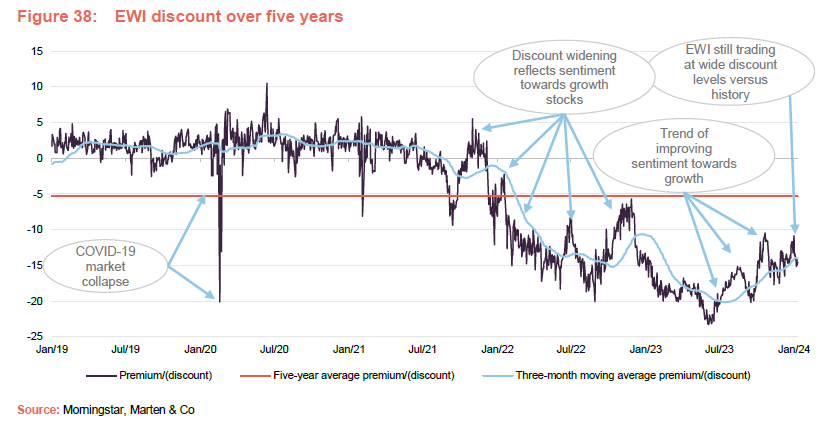

As the rate of inflation continues to fall (barring a small bounce in the UK in December 2023) interest rates look likely to fall. Growth stocks, which tend to suffer disproportionately when interest rates rise, have been recovering and Edinburgh Worldwide (EWI), the most growth-focused of the global smaller companies trusts (see pages 23 and 24) has seen a pickup in its relative performance.

Within the portfolio, valuations are relatively low, and history suggests that we are only at the beginning of what could be a significant period of outperformance.

EWI shareholders could benefit further as this should trigger a narrowing of EWI’s own wider than average discount to net asset value (NAV) (see page 28). At the same time, EWI’s managers say that the portfolio remains operationally resilient, technological transformation is continuing, and “the opportunity is as exciting as ever”. Reflecting this, team members have been adding to their EWI shareholdings.

Capital growth from entrepreneurial companies

EWI aims to achieve capital growth from a global portfolio of initially immature entrepreneurial companies, typically with a market capitalisation of less than $5bn at time of initial investment, which are believed to offer long-term (over at least five years) growth potential.

At a glance

Fund profile

EWI is an investment trust which invests globally in a portfolio of listed and private companies. It aims to profit from a global portfolio of initially immature entrepreneurial companies, typically with a market capitalisation of less than US$5bn at the time of initial investment, which are believed to offer long-term growth potential.

Long-term growth potential

The board chooses to compare the trust’s performance to the S&P Global Small Cap Index (total return in sterling). However, the composition of the index has no bearing on the manager’s choice of stocks or position sizes. As evidence of this, the active share at the end of December 2023 was about 99% (relative to the S&P Global Small Cap Index).

Further information is available at the Baillie Gifford’s website

To achieve a spread of risk, the portfolio should have between 75 and 125 holdings and have exposure to at least six countries and 15 industries. No more than 5% of the portfolio will be invested in a single security (at the time of acquisition).

The trust was launched in 1998 but did not adopt its current strategy until 31 January 2014.

EWI’s AIFM is Baillie Gifford & Co Limited, a wholly-owned subsidiary of Baillie Gifford & Co.

Douglas Brodie is the lead manager on the trust and its open-ended equivalent Global Discovery. He is supported by two deputy managers – Svetlana Viteva and Luke Ward – along with two analysts and two product specialists. Collectively, they make up the global discovery team within Baillie Gifford. Some more biographical details are provided on page 31.

The wider firm had £225.7bn of assets under management at 31 December 2023 and the global discovery team was managing £2.3bn of that.

Exposure to unlisted securities

Up to 25% of the portfolio (at the time of investment) may be invested in unlisted securities (shareholders approved the increase from 15% to the current limit at the annual general meeting (AGM) in February 2022).

Up to 25% of the portfolio may be invested in unlisted securities.

At the end of December 2023, 23.9% of EWI’s portfolio was in unlisted securities, some of which are discussed from page 15 onwards. The board and the managers believe that for EWI to gain access to the most exciting immature entrepreneurial companies, increasingly it must have the flexibility to invest across private and listed companies. The reason being that technological advances have lowered the initial capital requirement needed to establish and scale many companies.

The amount of funding available to promising private companies is considerable. Entrepreneurs may never need to turn to public markets for growth capital, instead choosing to use an initial public offering (IPO) as a means to provide liquidity for backers once the business is large and mature.

The small company effect

As we have discussed in our previous notes, a key reason for making an allocation to smaller companies is that, while often perceived as being riskier and therefore more volatile, smaller companies tend to outperform larger companies over the longer term (this is sometimes referred to as the small company effect). This can be due to a variety of factors, but experience tells us that it is intrinsically easier for a smaller company to grow, perhaps doubling or quadrupling in size in a relatively small space of time, than it would be for a comparable much larger company.

It is intrinsically easier for a smaller company to double or quadruple in size.

Many reasons for the small company effect are often cited, including a tendency towards greater nimbleness (smaller companies tend to have less-complex structures that might otherwise prove a barrier to innovation) and a greater range of opportunities due to their size (larger companies are more likely to have to exclude a range of opportunities that are not sufficiently large to meaningfully impact their performance). It is also true that smaller companies are more likely to be in less mature industries where new products are naturally creating new demand and these companies are able to benefit from lower competitive pressures in a market that is naturally expanding. Although there are exceptions, larger companies tend to be in more mature industries where growth can be harder to come by, particularly if a significant element of this has to come from taking market share from competitors.

It is easier to grow in a new industry that is creating its own demand.

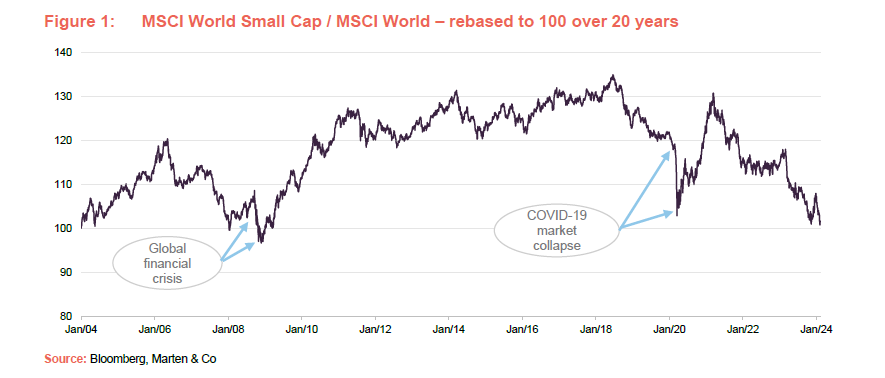

Figure 1 illustrates the performance of global small caps versus global large caps over the last 20 years. It shows that, while there have been distinct periods where global small caps have been out of favour and have underperformed global large caps, these tend to give way to periods of recovery with small caps providing strong outperformance.

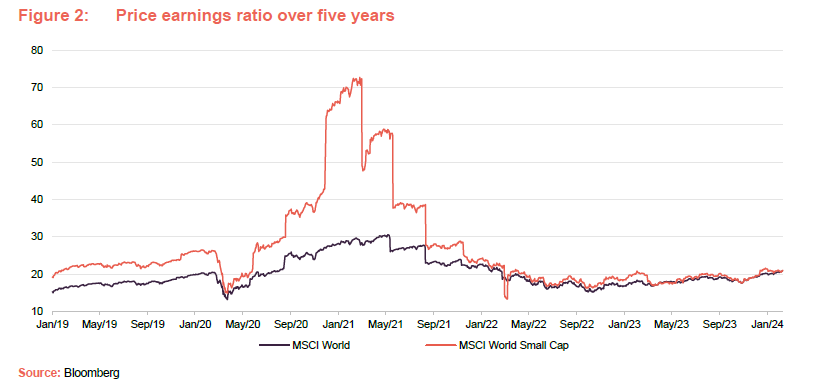

As inflation in developed markets peaked some time ago and interest rates now appear to be coming down, growth stocks whose valuations were disproportionately affected by rising interest rates look set to benefit from a strong re-rating from the relatively low valuations that these stocks are trading at versus their own history.

Small cap equities look very cheap versus their history.

Small cap equities look very cheap versus their history.

As Figure 2 illustrates, global small caps have tended to trade at a marked premium to global equities as a whole (arguably reflecting their superior growth prospects) but, despite valuations edging up over the last 18 months, small caps still look attractive (a current price-earnings ratio (P/E ratio) of 21.1x versus a five-year average of 26.9x), while large caps are close to their longer-term average (a current P/E ratio of 20.7x versus a five-year average 20.3x). We reiterate our view that, when coupled with EWI’s own wider than average discount to NAV (see Figure 38 on page 28), this still represents an attractive entry point for the long-term investor.

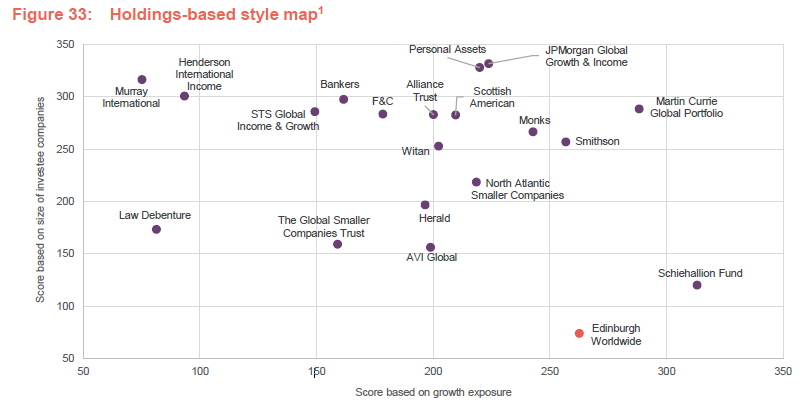

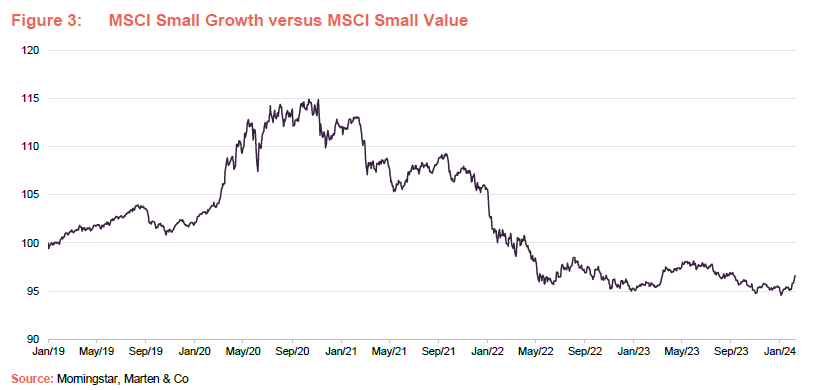

As Figure 33 on page 24 illustrates, EWI’s focus is on small-cap growth stocks and, while the performance of small cap growth versus small-cap value appears to have stabilised recently (see Figure 3), it is clear that small-cap growth suffered heavily from the rotation out of growth into value that began in late 2020. As explained above, we think that small cap growth is well positioned for a recovery from this nadir.

The impact of generative AI

The release of Chat GPT-4 (or Generative Pre-trained Transformer 4, which is a multimodal large language model created by OpenAI, and the fourth in its series of GPT foundation models) in March 2023 jumpstarted a period of mania in markets for anything related to artificial intelligence (AI), which led to a remarkable run of outperformance for the ‘magnificent seven’ mega-cap tech stocks with exposure to the theme: Apple, Microsoft, Amazon, Alphabet, Meta, Nvidia and Tesla. These stocks were collectively up 80% over the year, while the remaining 493 stocks that make up the S&P 500 index were relatively flat at around 5%.

The release of Chat GPT-4 started a period of AI-related mania in markets.

Generative AI (AI that is capable of generating text, images, or other media, using generative models that learn the patterns and structure of their input training data and then generate new data that has similar characteristics) has been an incredibly hot topic and, as markets have settled after this initial sprint, EWI’s managers have been doing a lot of work reflecting on its impact – looking not just at primary effects but also second order impacts. For example, within the portfolio, Upwork is becoming more profitable as it is getting paid to find AI talent, while CyberArk has been doing well as cybersecurity has moved up most businesses’ agendas. As a result, EWI’s managers have evolved their thinking, and this has given rise to some portfolio changes.

Hardware 2.0

Traditionally, hardware and software have been seen as very different businesses that require different skill sets and have significantly different drivers and revenue streams. For decades, software – aided by higher IP and greater defensive moats – is where the bulk of value-adding innovations have arisen.

The lines between hardware and software are becoming blurred.

Hardware, in comparison, has been a much more commoditised business. The industry innovated, but with competition limiting the ability of the industry to expand margins, it has tended to be the case that software businesses have built on hardware’s development successes and captured a disproportionate amount of the value added. Microsoft was always touted as a better investment than IBM, for example. However, because of the impact of AI on the development of software, all of this is changing and the lines between software and hardware development are increasingly being blurred.

Increasingly, value-creating innovation has been coming through on the hardware side.

EWI’s managers observe that we are now seeing much more value-creating innovation coming through on the hardware side and they expect this trend to continue. They cite the example of 3D printers, where they say that the applications of this potentially game changing technology are being driven by the technological limits of both the hardware and software but, with software development evolving, the opportunities increasingly hinge on the capabilities of the hardware. However, whereas previously hardware and software tended to be separate businesses, to maintain a competitive advantage the two need to progress in tandem.

To capitalise on Hardware 2.0, EWI’s managers are allocating towards earlier stage companies that the market is struggling to value.

EWI’s managers say that the big question is, how do they capitalise on opportunities in the evolving hardware landscape in the market? They say that they are allocating away from more mature businesses (for example, Axon Enterprise and CyberArk) and reallocating to earlier stage growth companies (for example, Oxford Nanopore and Transmedics). They argue that the market is not yet extending its horizon far enough to value these earlier-stage hardware-orientated companies properly, which is creating an opportunity for longer-term investors such as EWI.

In the private company space – the managers have also been moving more towards holdings that are hardware-focused for the same reason, as well as those that are a key part of the AI toolset. For example, they see satellite connectivity (think SpaceX) as a game changer for AI as systems such as SpaceX’s Starlink network will allow AI to be used anywhere, with the myriad of benefits this could bring.

EWI’s managers point out that this is where the trust’s closed-end structure comes into its own as many of these investments are not suitable for inclusion in an open-ended fund but EWI’s structure allows it to arbitrage this market inefficiency.

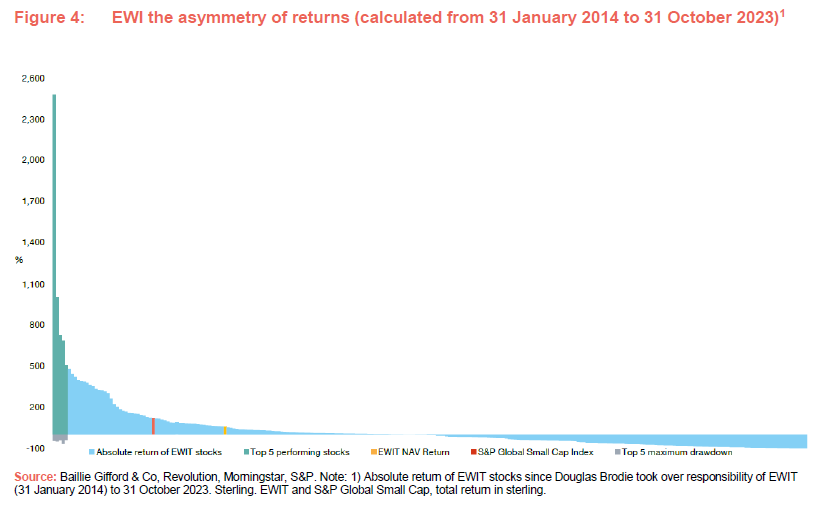

Philosophy and process

The philosophy that drives the construction of EWI’s portfolio is common to other Baillie Gifford trusts and is based on the manager’s observation of the asymmetry of returns. Only a few stocks have the ability to become global leaders in their fields and sustain that position. The rewards that accrue to them are considerable. By contrast, most companies will struggle to outperform and, as is especially the case with the younger, more immature companies that EWI focuses on, quite a few will fail. It is important that investors in EWI understand this.

Tools and technology have levelled the playing field. Advances such as the internet, cloud computing and online payments are enabling even relatively small businesses to scale fast and address a global market. If the market is global, differences in country and regional macroeconomic and political environments are much less relevant.

A true stock-picking portfolio

EWI, therefore, represents a true stock-picking portfolio, constructed without reference to index weights or to reflect the views of an asset allocation committee. The portfolio has a bias to technology, but as the managers point out, technology is everywhere.

The managers are not compelled to sell good companies on market cap grounds

Potential investments should typically have a market cap of no more than $5bn at the time of initial investment. Nevertheless, the emphasis is on identifying the winners and running with them and EWI may end up with holdings in far larger companies. EWI can act as an incubator of companies that grow to become large enough to be included in Baillie Gifford’s larger-cap strategies and identify up and coming disrupters. However, they can retain exposure to these; the managers are not compelled to sell good companies on market cap grounds.

Only a few stocks have the ability to become global leaders in their fields and sustain that position

This is not a venture capital portfolio – the managers tend not to consider companies less than $300m–$400m in size – but these are relatively immature companies on the frontiers of change. The uncertain outlook for these businesses makes it hard for the market to value them properly. This is especially true for those companies that are expected to become significantly profitable some years in the future. The managers believe that most of these stocks are poorly understood and that creates the space for bottom-up research to add value. The universe is vast – perhaps 30,000 companies – but most of these will not have the characteristic traits that they are looking for and some entire sectors are not a fit.

The sector is full of companies that are small and will stay that way

The managers seek to assess the potential of the business model and the risk that it does not succeed. Companies need to have a scalable business model and a clear competitive advantage. Credibility of management is very important as is an alignment between the interest of management and investors. Only a very small number of stocks fit their criteria. The sector is full of companies that are small and will stay that way.

EWI’s evergreen structure is an advantage

To deliver transformational growth, a business needs to have a culture of innovation which allows it to identify and solve problems for their customers. It often helps if they are starting with a clean sheet of paper rather than simultaneously managing the decline of an incumbent business. EWI is often a provider of growth capital and, in some instances, this could be before a company is revenue generating (as is the case with many of the trust’s healthcare investments, for example). For the companies, EWI’s evergreen structure is an advantage. It means that they can think long-term without having to be bound to the normal 10-year cycle of private equity limited partner (LP) funds.

Generally, the managers are not keen on situations where a number of companies are competing in the same niche, unless they can demonstrate differentiated propositions, each with their own edge. This is true of the trust’s oncology-focused stocks, for example.

EWI’s board and managers take their stewardship role seriously. However, the company will not seek to influence the strategic direction of the companies that it invests in.

EWI may end up holding a significant stake in a business (Baillie Gifford has informal caps on the size of the stakes held across all funds), especially early in a business’s life. However, the managers are mindful of the daily liquidity in listed stocks and factors that into position sizes. A typical new position will start life in the portfolio as a 0.5%–1.5% position. Where the risks associated with the business model are binary, the position size will be smaller.

Flawed investment cases trigger a sale

Sales are triggered once it is clear that the investment case is flawed. Mergers and acquisitions (M&A) activity is also a source of involuntary sales – often companies end up being taken over for less than the managers think they could be worth. In addition, positions will be re-evaluated and may be sold if the managers feel that the upside is limited.

Environmental, social and governance (ESG) and stewardship principles

Baillie Gifford & Co is a signatory to the United Nations Principles for Responsible Investment and the Carbon Disclosure Project and is also a member of the Asian Corporate Governance Association and International Corporate Governance Network.

EWI’s natural bias towards capital-light businesses contributes towards the portfolio’s lower-than-market-average carbon intensity (97.8% lower than the S&P Global Small Cap Index, based on the 68.4% by value of the company’s portfolio that reports on carbon emissions and other carbon related characteristics). We have reproduced the company’s stewardship principles below.

Baillie Gifford’s overarching ethos is that we are ‘Actual’ investors. That means we seek to invest for the long term. Our role as an engaged owner is core to our mission to be effective stewards for our clients. As an active manager, we invest in companies at different stages of their evolution across many industries and geographies, and focus on their unique circumstances and opportunities. Our approach favours a small number of simple principles rather than overly prescriptive policies. This helps shape our interactions with holdings and ensures our investment teams have the freedom and retain the responsibility to act in clients’ best interests.

Long-term value creation

We believe that companies that are run for the long term are more likely to be better investments over our clients’ time horizons. We encourage our holdings to be ambitious, focusing on long-term value creation and capital deployment for growth. We know events will not always run according to plan. In these instances we expect management to act deliberately and to provide appropriate transparency. We think helping management to resist short-term demands from shareholders often protects returns. We regard it as our responsibility to encourage holdings away from destructive financial engineering towards activities that create genuine value over the long run. Our value will often be in supporting management when others don’t.

Governance fit for purpose

Corporate governance is a combination of structures and behaviours; a careful balance between systems, processes and people. Good governance is the essential foundation for long-term company success. We firmly believe that there is no single governance model that delivers the best long-term outcomes. We therefore strive to push back against one-dimensional global governance principles in favour of a deep understanding of each company we invest in. We look, very simply, for structures, people and processes which we think can maximise the likelihood of long-term success. We expect to trust the boards and management teams of the companies we select, but demand accountability if that trust is broken.

Alignment in vision and practice

Alignment is at the heart of our stewardship approach. We seek the fair and equitable treatment of all shareholders alongside the interests of management. While assessing alignment with management often comes down to intangible factors and an understanding built over time, we look for clear evidence of alignment in everything from capital allocation decisions in moments of stress to the details of executive remuneration plans and committed share ownership. We expect companies to deepen alignment with us, rather than weaken it, where the opportunity presents itself.

Sustainable business practices

A company’s ability to grow and generate value for our clients relies on a network of interdependencies between the company and the economy, society and environment in which it operates. We expect holdings to consider how their actions impact and rely on these relationships. We believe long-term success depends on maintaining a social licence to operate and look for holdings to work within the spirit and not just the letter of the laws and regulations that govern them. Material factors should be addressed at the board level as appropriate.

Asset allocation

Global small cap portfolio with high active share (99%) with biases to the US and UK.

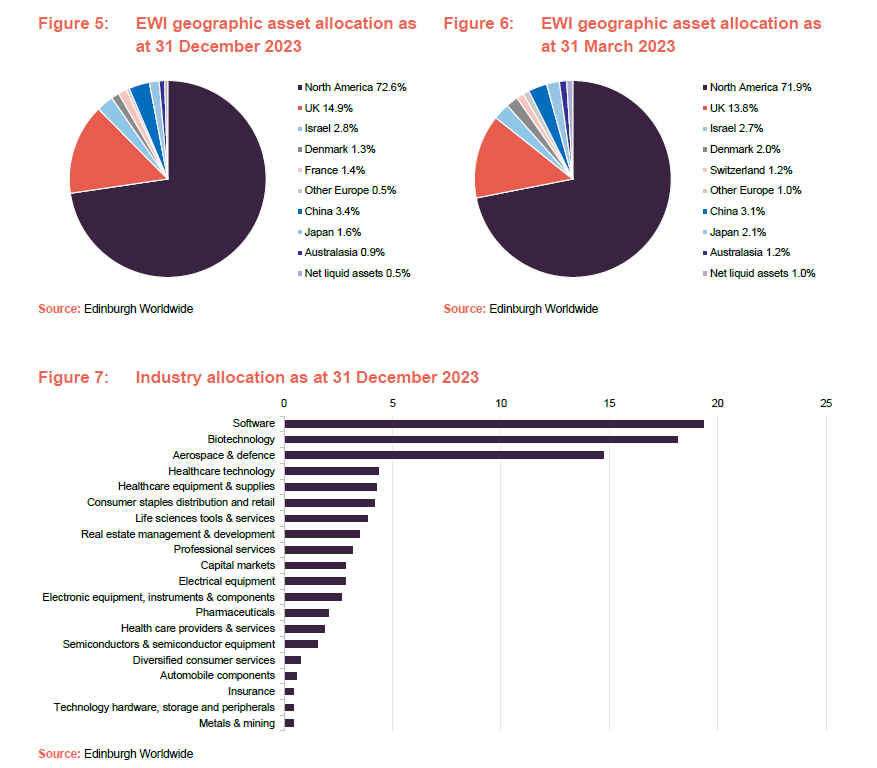

As we have discussed previously, EWI’s asset allocation is driven by the manager’s stock selection decisions, and reflecting this, it has a high active share. As is illustrated in Figure 5, the portfolio is global, but has a heavy bias towards North America, which tends to account for about two-thirds of the fund’s assets. Relative to its comparative index, EWI’s portfolio is overweight both North America and the UK and tends to be underweight other geographical regions. Comparing Figures 5 and 6, it can be seen that there have been no major changes in allocation since we last published.

Software and biotechnology account for around 45% of the portfolio.

On an industry basis, the portfolio has a significant exposure to sectors such as software and biotechnology and an underweight exposure to sectors such as financials, materials and consumer goods and services. To try and mitigate risk, the portfolio holds between 75 and 125 companies and is required to have exposure to a minimum of six countries and at least 15 industries. As at 31 December 2023, 23.9% of EWI’s total assets were invested in private companies (see further discussion below), up from 20.7% as at 31 March 2023. The managers have been tidying up the tail of the portfolio recently, selling small positions where the investment case has not played out and shifting out of holdings less suited to the current environment. This has seen the number of holdings fall. At the end of October 2023, EWI held 84 listed and 14 unlisted companies, making 98 in total, down from 105 when we last published.

In terms of industry allocation (once again driven by stock selection decisions), the allocation to software has increased by around 5 percentage points since we last published, replacing biotechnology as the largest sectoral allocation, which is down by about two percentage points. Otherwise, the allocations are reasonably comparable.

Top 10 holdings

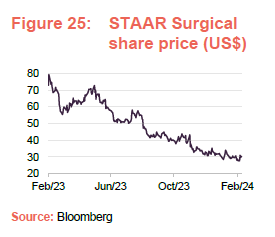

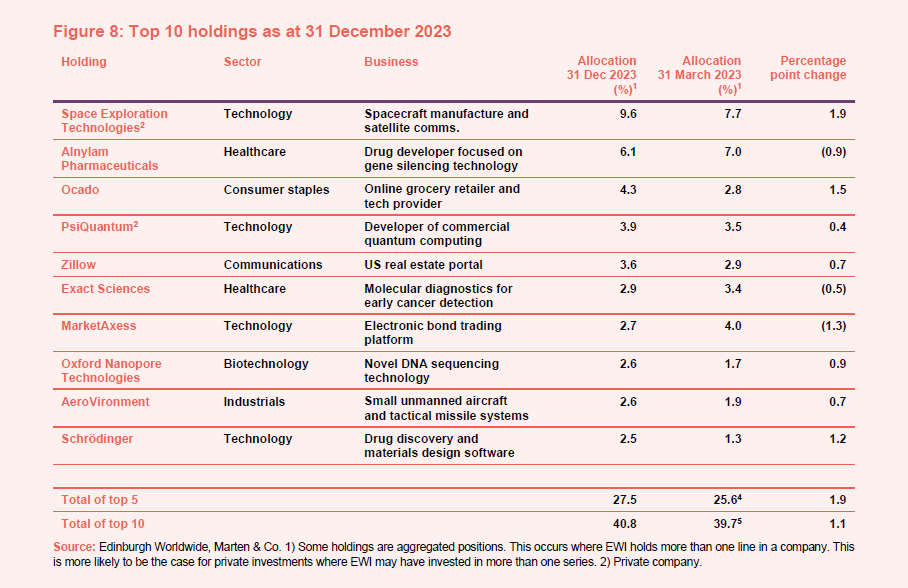

Figure 8 shows EWI’s top 10 holdings as at 31 December 2023, and how these have changed since 31 March 2023 (the most recently-available data when we last published). Reflecting its long-term low turnover approach, seven of these were also constituents of its top 10 at the end of March 2023, although some of the relative positions have changed. The three holdings that have moved into the top 10 are AeroVironment, Oxford Nanopore Technologies and Schrödinger, while STAAR Surgical, Axon Enterprise and Novocure have moved out.

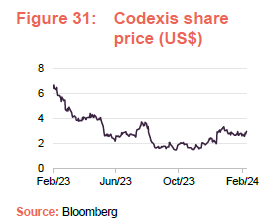

We discuss some of the more interesting developments in the next few pages. However, readers interested in more detail on these top 10 holdings, or other names in EWI’s portfolio, should see our previous notes (see page 34 of this note). Otherwise, Codexis, Space Exploration Technologies, Alnylam Pharmaceuticals and Zillow are discussed in the performance section on pages 17 to 23, along with the three positions noted above that have moved out of the top 10.

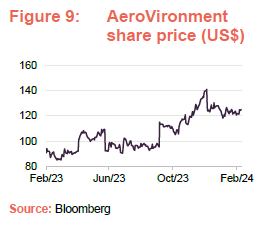

AeroVironment (2.6%) – benefitting from ramp up in drone spend

AeroVironment (www.avinc.com) company produces small, unmanned aircraft and tactical missile systems. As we discussed in our last note, (see page 34 of this note), it has benefitted from a trend of increasing interest and demand for defence-related products in the aftermath of Russia’s invasion of Ukraine. EWI’s managers say that previously, spending on drones has been relatively low but AeroVironment has benefitted from crisis-led adoption of drone technology, which will be key to defence going forwards. NATO is increasing its spend on drones and there is also a need to restock inventories where these have been supplied to Ukraine.

EWI’s managers say that, despite the increased interest in the aftermath of the invasion of Ukraine, their interest in this long-standing position (they have held it since 2012) stems from their view that it is much more than military hardware. They say that AeroVironment is effectively a drone platform that provides an interface that allows other hardware to be integrated into drones’ technology. They think it is a company that will increasingly benefit from the fusion of hardware and software.

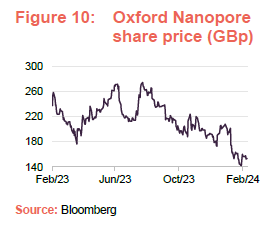

Oxford Nanopore Technologies (2.6%) – long-held position bolstered while significantly undervalued

Oxford Nanopore (nanoporetech.com/) offers real-time and mobile DNA and RNA sequencing, which is used in applications such as genetics, food safety and identifying/monitoring pathogens. It is a company that EWI’s managers have known for a long time (EWI has owned it since 2015) and was a significant constituent of EWI’s portfolio of unlisted investments prior to its IPO in September 2021.

EWI’s managers say that, while EWI saw a good valuation uplift from the IPO process, Oxford Nanopore’s share price has fallen dramatically since its IPO and is now undervalued. The managers have taken the opportunity to add significantly to the position. The managers comment that the disruptive potential in gene sequencing is improving and Oxford Nanopore is differentiated by its long-read DNA technology that offers richer data and insights than traditional alternatives. The company also benefits from being able to deploy its technology in a compact hand-held device that makes its application much more accessible and flexible when compared to some of the alternatives. EWI’s managers acknowledge that it has taken Oxford Nanopore longer to commercialise its technology than it had expected, but comment that the company offers a great opportunity.

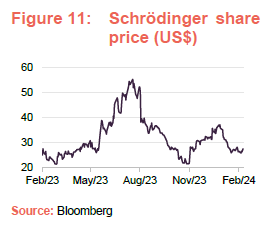

Schrödinger (2.5%) – targets from BMS collaboration programme showing promise

Schrödinger (newsite.schrodinger.com) is a scientific software company that develops computational tools and simulation software for drug discovery and materials science. EWI’s managers describe it as providing a software platform that codifies the laws of physics and allows the company to model molecule interaction in small-molecule drug design. Schrödinger uses its proprietary technology to run a high number of in silico (experiments performed by a computer) simulations of molecules, which allows scientists to gain an understanding of the compounds they are designing, prior to manually/physically checking them.

EWI’s managers comment, reflecting the strength of its technology, that the top 20 pharmaceutical businesses globally are using Schrödinger’s platform and it is growing sales at around 15% per annum. It also has a multi-year collaboration programme with Bristol Myers Squibb (BMS) to advance small molecule therapeutics for targets in oncology, immunology, and neurological disorders. Playing to their individual strengths, Schrödinger is responsible for the discovery of development candidates for each of the targets under the collaboration and Bristol Myers Squibb is then responsible for the development, manufacturing, and commercialisation of these candidates. EWI’s managers say that treatments from this collaboration are showing promise and that Schrödinger has a very healthy balance sheet with around $500m of cash that will help it to progress its pipeline.

EWI’s managers comment that the company is at a very early stage and is a great fit with the portfolio. They think that the market does not understand its potential properly and the stock is mispriced, allowing them to add to the position at very attractive valuations.

Unlisted positions

At the end of October 2023, EWI held 14 unlisted investments, which was unchanged in terms of both number and the names from the 14 unlisted investments held at 28 February 2023 (the most recently available information when we last published). As at 31 October 2023, EWI’s private holdings accounted for 26.2% of the portfolio, up from 20.1% of the portfolio as at the end of February 2023. Since the end of October 2023, rising valuations of EWI’s listed positions have reduced the portfolio’s overall exposure to unlisted companies to 23.9%. EWI only invests in private companies where these offer an exposure that is distinctly different from what can be found in public markets.

EWI’s managers comment that they are happy with the companies in the private portfolio and the way they are progressing.

Updates on SpaceX, Relativity Space and PsiQuantum are provided in the performance section on pages 17 to 19.

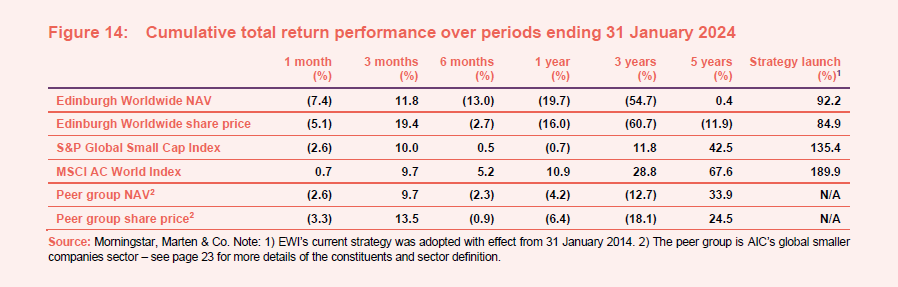

Performance

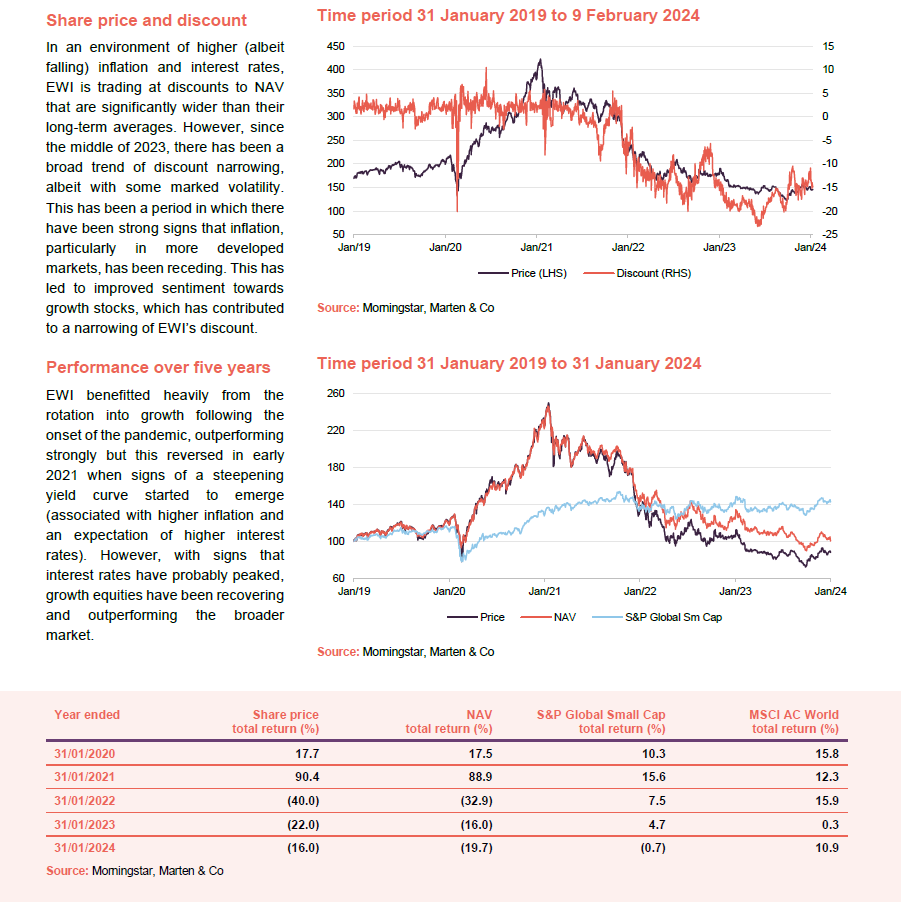

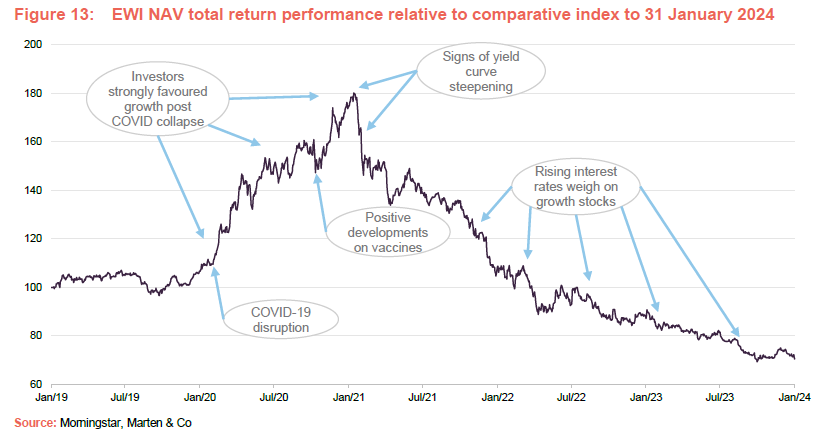

As we have discussed in our previous notes, EWI benefitted heavily from the rotation into growth following the onset of the pandemic (see Figure 13 below), and the marked trend of outperformance continued until early 2021 when signs of a steepening yield curve started to emerge (a steepening yield curve is where interest rates for longer-dated debt increase relative to shorter dated debt – this is associated with higher inflation and an expectation of higher interest rates). This was particularly tough for growth equities that have a larger proportion of the value discounted from the future (see our previous notes for more discussion). These trends of outperformance and underperformance have been very marked and illustrate the extent to which macroeconomic considerations have outweighed the microeconomic factors.

Another consideration has been the impact of higher interest rates on loss-making companies that may need to raise finance. This was an issue for a number of EWI’s largest detractors for the last financial year (see below). EWI also has a sizeable allocation to healthcare stocks, which have also had a particularly difficult period for similar reasons.

However, with signs that interest rates have probably peaked, growth equities have been recovering and outperforming the broader market. Assuming that inflation remains sufficiently subdued to allow interest rates to continue to gradually retreat, there could be significant upside in growth equities, particularly the types of higher-growth equities in which EWI invests. EWI shareholders would likely benefit further as such outperformance should lead to a narrowing of the discount to NAV over time.

Key performance contributors for the last financial year

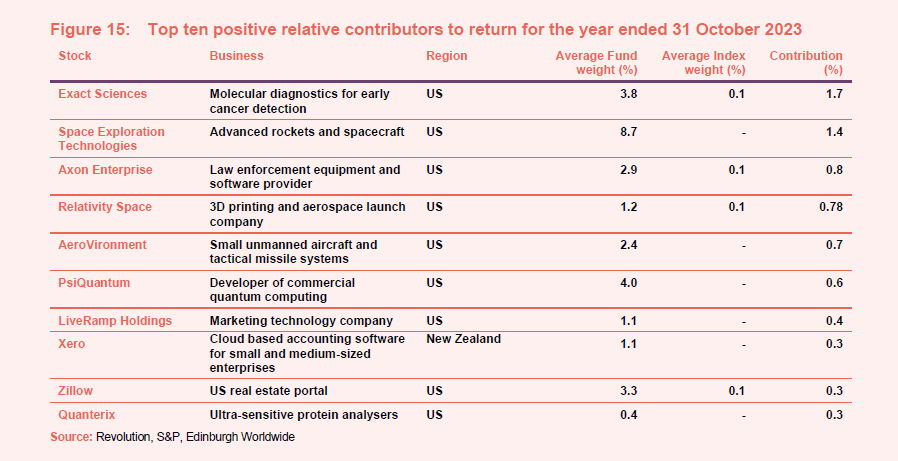

The strongest positive relative contributions came from:

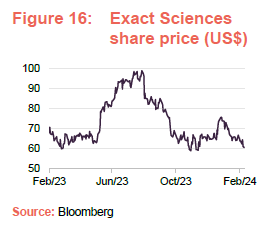

- Exact Sciences – this molecular diagnostics company specialises in the detection of early-stage cancers. Its initial focus was on the early detection and prevention of colorectal cancer, and in 2014 it launched Cologuard, the first stool DNA test for colorectal cancer. In our May 2023 note, we commented that Guardant Health has been trying to break into this market with a new test and that the prospect of greater competition in its key market was weighing on Exact Sciences’s share price. However, clinical trial data showed that Guardant’s test actually had lower efficacy, the announcement of which caused a c.40% uplift in Exact Sciences share price. EWI’s managers also comment that Exact Sciences has also made really good operational steps, delivering around c.30% growth in revenues from its main cancer product. Reflecting its strong performance, EWI’s managers reduced the position size as they felt it was quite fully valued, but continue to like the company.

- Space Exploration Technologies – this private company has been EWI’s largest position for some time – it accounted for close to 10% of the portfolio at the end of November 2023 – and is a position that we have spoken about it in both of our previous notes (see page 34 of this note). EWI’s managers say that it is a great example of the sort of company they like; they have held it for five years now and it gets better as it gets bigger, in their view. SpaceX has continued to improve its launch capability, which has enabled it to accelerate the pace of its Starlink roll out (Starlink is a satellite internet constellation that providing coverage to over 70 countries). EWI’s managers believe that Starlink will be the first global utility as it starts to roll out its mobile internet network. The company continues to invest and its new rocket, which is cheaper to launch, will not only help it build a better Starlink network, but will advance the opportunities for manufacturing in space; removing the barriers of gravity and a wet, heavy atmosphere opens up the possibilities to manufacture new things.

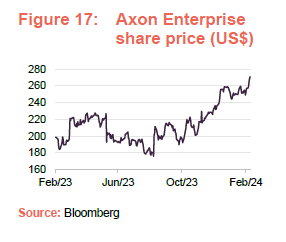

- Axon Enterprise – this US company develops technology and weapons products for military, law enforcement, and civilians (it invented the taser) has provided seven quarters of +30% top line growth, aided by its margins expanding as software sales are becoming a greater part of the business. Axon’s share price has performed strongly and EWI’s managers have reduced the holding as they consider it a more mature business that is delivering and is more fully valued, in favour of less-mature businesses that the managers think are being mispriced by the market and offer a better opportunity.

- Relativity Space – this US aerospace manufacturing company is developing manufacturing technologies to build launch vehicles and rocket engines for commercial orbital launch services. However, EWI’s managers say that this private company can be described as both a 3D metal printing company and a space technology company. It has 3D printed a large orbital class rocket, with just the electronics added afterwards. The managers say that 3D printing rockets could make them more affordable and easier to customise for clients. 3D printing also allows the company to quickly iterate to improve the rocket’s design. However, the company has struggled to get the rocket into mass production, but EWI’s managers think that the company’s approach (starting with a high margin ‘hero product’, as Tesla did) will give it the cash flow to expand its process to other areas (think submarines, aircraft, and cars) once it has commercialised its rocket. EWI’s managers say that there is a lot of demand for rockets and users want to diversify supply beyond SpaceX. They hope to see the company make digital printing relevant to mass production and use the lessons learned with the rocket to disrupt the industrials space.

- AeroVironment – see discussion on page 13 in the asset allocation section.

- PsiQuantum – this is one of EWI’s private holdings (see page 15) and one that we last discussed in detail in our January 2022 initiation note – see page 14 of that note). To recap, quantum computing uses entangled particles in place of electrical circuits and could theoretically be far more powerful than conventional computers, but entangling electrons (the typical approach to building quantum computers) is complex and advances have been slow. In contrast, PsiQuantum is using an approach based on entangling photons and this can use technology and components that is more readily available and understood. EWI’s managers say that quantum computing is quickly becoming the new space race and that they expect to see lots of news flow coming through. They think that PsiQuantum is well positioned, with its differentiated approach, to scale the technology.

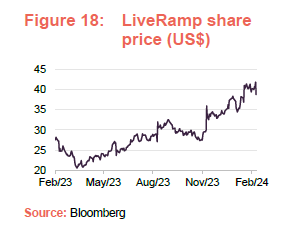

- LiveRamp – EWI’s managers describe LiveRamp as a marketing technology company. Businesses often have a wide variety of data on their customers but can struggle to bring it together in one place. LiveRamp’s data platform helps to solve this by allowing its clients to integrate disparate customer datasets and bring these together with online customer data so as to allow them to optimise their marketing decisions. With online marketing being an ever-increasingly important channel, and data being key to making these decisions, EWI’s managers see a long growth runway ahead for LiveRamp’s offering, but its share price had become very depressed (it still trades below pre-pandemic levels despite a strong uplift during the last 16 months). The managers added to the position significantly during the last financial year and EWI has benefitted as the share price has recovered.

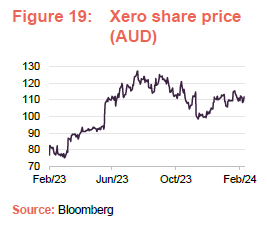

- Xero – this company, which provides cloud-based accounting software for SMEs, saw its share price come under pressure during 2022 as investors worried about the impact on Xero’s customer base from higher interest rates and inflation. The first nine months of 2023 saw a sharp reversal of the previous share price falls. This was driven first by signs of inflation slowing, which raised the prospect that interest rises could be pause or even be reversed, and second that its new CEO was going to improve profitability (through a combination of revenue growth from growing the core accounting business and restructuring the business to trim costs).

However, since September, Xero’s share price has been under pressure again as progress has not been as strong as the market had expected. Some costs have been taken out of the business and prices have moved up, but the market was expecting to see more in the way of an improved product range and sales strategy. Most of this has occurred since EWI’s financial year end.

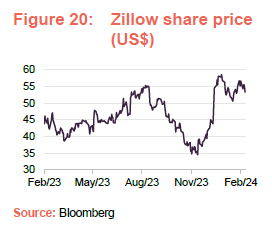

- Zillow – in our last note we explained how this US property portal had suffered heavily during 2021 (see page 23 of that note), despite record high prices, as its home buying division, Offers, got into significant difficulties (its aim was to use algorithms to buy attractive properties, make minor renovations and then quickly flip them on for a profit, but it appears that it overpaid and also got hampered by shortages of labour to make the renovations). This division was shut down and whilst the effects dragged into 2022 (around 2,000 people were laid off with losses estimated to be in the region of US$300m), Zillow was able to refocus on its core business and its share price recovered during the financial year as the company proved more resilient than the market was expecting.

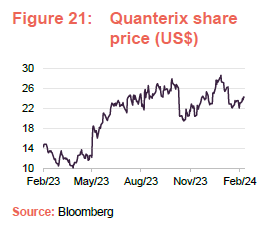

- Quanterix – this company, which makes ultra-sensitive protein analysers, suffered during 2022 both because of a difficult market environment for growth companies and because this loss-making company experienced a reduction in the revenues that it derives from the consumables it makes for its analysers, due to problems with assay-quality and initiatives to improve its processes. However, 2023 saw a reversal as the company got back on track, with revenue improving and its net losses falling. Quanterix said in its results for the third quarter of 2023 that it was on track to achieve its six-quarter transformation plan by the end of 2023, and that this would yield highly-scaled production lines and serve as a foundation for an accelerated innovation rate in 2024.

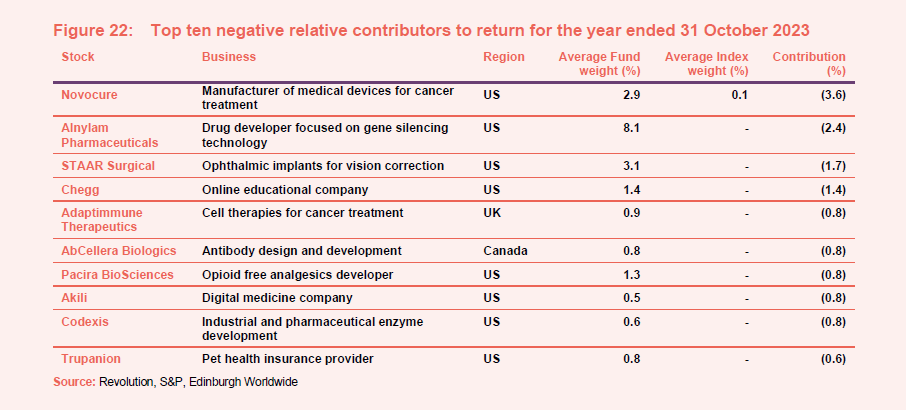

Key performance detractors for the last financial year

A key theme within EWI’s largest detractors is that many of them are healthcare companies.

The strongest negative relative contributions came from the following companies:

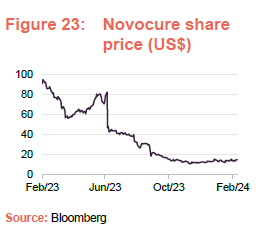

- Novocure has developed a medical device for arresting cancer cell division (mitosis), which ultimately leads to cell death. As we discussed in our May 2023 note – see page 14 of that note, EWI’s managers say that Novocure’s technology should synthesise well with modern drugs that work with enhancing the body’s immune system; for example, checkpoint blockers/inhibitors (these block immune checkpoint proteins from binding with partner proteins and a number of which are coming off patent from 2028 onwards). However, the company’s shares suffered in June 2023 when the results of its LUNAR trial (which aimed to prove the benefits of the technology in late-stage ovarian cancer) were unsuccessful. More recently, it has suffered from a setback in commercialising its therapy for lung cancer. EWI’s managers remain enthused about the long-term prospects for the technology and think that the market does not yet fully appreciate its importance.

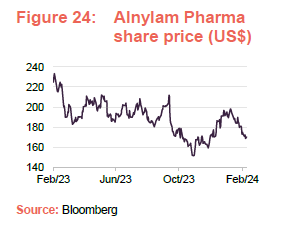

- Alnylam Pharmaceuticals, which is a long-standing EWI holding, focuses on gene-silencing (RNA interference) technology that blocks certain genes that cause a range of diseases. It has three approved products tackling rare diseases and an extensive pipeline of over 20 clinical programmes which includes therapies for haemophilia, liver disease, hypertension, gout, Alzheimer’s, and Hepatitis B. EWI’s managers comment that the company is moving along nicely at an operational level but that it suffered from poor sentiment towards healthcare during the last financial year and a surprise refusal by the US Food and Drug Administration (FDA) to approve a label expansion for its drug Onpattro to treat Amyloidosis. An FDA committee had recommended the label expansion be approved, but the incremental improvement in patient outcomes was not considered to justify the additional cost.

The managers say that the impact is limited as this approval was a stepping-stone drug and its next generation treatment, Vetruvisan, which is in Phase III, has data that looks stronger than Onpattro. It also has the benefit of requiring six-monthly injections, versus the monthly injections that Onpattro requires. They say that Anylam also has five other approvals that are progressing well.

- STAAR Surgical produces ophthalmic implants (implantable lenses for the eye) for vision correction with companion delivery systems. All of its lenses are foldable, which allows a surgeon to insert them through a small incision. The company has had a difficult couple of years. 2022 sales were hit by COVID lockdowns in China, its largest market, while 2023 sales saw progress but were below market expectations.

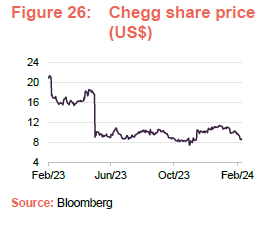

- Chegg – this online education business saw its share price take a sharp hit in May 2023 when, despite reporting solid results for the first quarter of 2023, it warned that generative AI was disrupting its business model. EWI’s managers have decided to hold the position for now. It recognises the challenges that Chegg faces but says that Chegg’s offering is still superior to ChatGPT, and it observes that enrolment numbers have been picking again up over the last three months. The managers are also intrigued about Chegg’s plans to integrate generative AI into its own products (to develop a more sophisticated personalised proposition for students), having spoken to Chegg at length about integrating AI into its tech stack.

- Chegg – this online education business saw its share price take a sharp hit in May 2023 when, despite reporting solid results for the first quarter of 2023, it warned that generative AI was disrupting its business model. EWI’s managers have decided to hold the position for now. It recognises the challenges that Chegg faces but says that Chegg’s offering is still superior to ChatGPT, and it observes that enrolment numbers have been picking again up over the last three months. The managers are also intrigued about Chegg’s plans to integrate generative AI into its own products (to develop a more sophisticated personalised proposition for students), having spoken to Chegg at length about integrating AI into its tech stack.

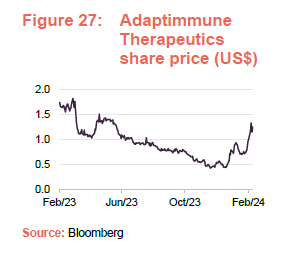

- Adaptimmune Therapeutics – this clinical-stage biopharmaceutical company is focused developing immunotherapy oncology products (cell therapies for treating cancer as opposed to an antibody-based approach). Its proprietary cell therapy platform targets the most challenging solid tumours, using a patient’s cells to combat their cancer. The company, which is loss-making, suffered during 2023 in a market environment where healthcare companies were out of favour. It saw a leg down in its share price when it announced its plans to acquire its rival, TCR2, in March 2023, despite the combined company having enough cash to fund operations until 2026. However, post-EWI’s financial year end in December, Adaptimmune’s share price rallied strongly as market’s surged as rate cuts came into view. Having shored up its balance sheet, EWI’s managers say that they are comfortable with the progress the company is making.

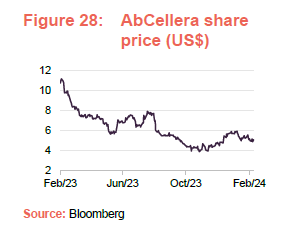

- AbCellera Biologics – this company researches and develops antibodies for human beings. It has developed antibody discovery and development technologies that it says can unlock high-value drug classes and targets. These include T-cell engagers for cancer and transmembrane proteins for indications such as metabolic and endocrine conditions, pain and autoimmunity.

The company’s share price has been under pressure during the last year as royalties from the sales of its research and development partner Eli Lilly’s COVID-19 antibody therapeutics have dried up. However, EWI’s managers note that AbCellera has a number of molecules in its clinical pipeline and that, longer-term, the prospects for these and new partnerships look promising.

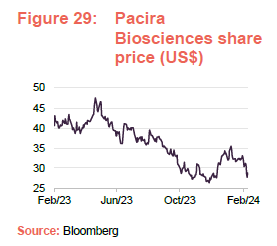

- Pacira Biosciences – this company is focused on the development and production of opioid free analgesics. Its aim is to reduce overreliance on opioids for post-surgical pain management, through innovative alternatives that achieve better outcomes.

The company has seen its earnings per share deteriorate during the last three years, which, in combination with healthcare stocks struggling more recently has weighed heavily on its share price (it is currently trading below pre-pandemic levels). However, EWI’s managers point out that whilst Pacira suffered during the pandemic from the postponement or suspension of scheduling for elective surgical procedures, the company has continued to grow both its revenue and EBITDA for the last three years.

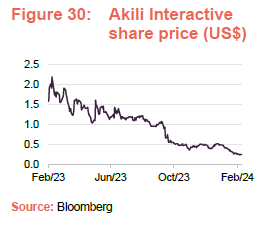

- Akili Interactive Labs is a digital medicine company that uses specially-designed computer games to treat various cognitive impairments such as ADHD. Its products deliver sensory and motor stimuli to selectively target and activate specific cognitive neural systems in the brain to improve cognitive function. Its EndeavorRx therapy has been approved by the FDA for the treatment of ADHD. While the company has been growing its revenues, sales have been outpaced by expenses, which led it to the company to announce plans to cut 30% of its workforce and to put a number of programmes on hold to rein in costs, in January 2023. The company has continued to post quarterly losses, but the cost cutting is taking effect as these losses have reduced and Akili returned a positive gross margin of 60% for the third quarter of Q3 2023 (as opposed to a gross margin of -50% for the third quarter of 2022).

- Codexis – this protein engineering company is a market leader in the production of high-performance enzymes for bioprocesses, life science tools and biopharma applications. The company is loss-making, and an ongoing concern has been its cash burn and what its fundraising needs might be (it suffered heavily when interest rose rates because of this). Reflecting this, the company has been focused on reducing its cash burn and in its most recent quarterly results (for the third quarter of 2023) it said that it believes that it has sufficient cash to get itself to cashflow positive, which it expects to be towards the end of 2026.

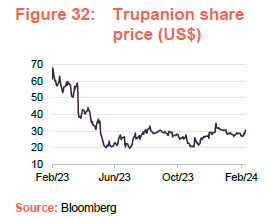

- Trupanion – this company is a pet health insurance provider that offers cat and dog insurance in the US, Canada, Australia and Puerto Rico. It offers comprehensive plans that have unlimited pay-outs and cover hereditary and congenital conditions. The company has a long track record of growing its annual revenues, but is yet to turn a profit and this has weighed on its share price during a period where loss-making growth companies have been out of favour. It has also suffered as, despite benefitting from a growing market in recent years (pet ownership boomed during the pandemic, with dogs being the most popular, followed by cats), veterinary costs increased faster in the inflationary environment than Trupanion was able to increase its premiums, which saw its net losses increase substantially for 2021 and 2022.

Peer group

Please click here for an up-to-date peer group comparison of EWI versus its global smaller companies peers.

EWI is a constituent of the AIC’s global smaller companies sector, which comprises five members, all of which are illustrated in Figures 33 to 36. All of these were members of the peer group when we last wrote about EWI. Members of the global smaller companies sector will typically have:

- over 80% invested in quoted global smaller company shares;

- less than 80% in any single geographic area;

- an investment objective/policy to invest in medium to smaller cap stocks;

- a majority of investments in medium to micro-cap companies; and

- a global smaller companies benchmark.

It should be noted that the peer group as a whole does not provide an ideal comparison for EWI. Herald is arguably its closest comparator, as it too has a strong bias to growth and technology and operates with a long-term time horizon. However, Herald is predominantly focused on the technology, media and telecommunications (TMT) space and, while EWI is predominantly focused on the US, with a smaller amount in the UK, Herald’s portfolio is the reverse. Herald also invests in much smaller and earlier stage companies. Reflecting this, it has a much longer tail of investments (about 3x as many as EWI).

A distinctly different investment proposition

Figure 33 provides a representation of EWI’s investment style versus both its global smaller companies peers (Herald, North Atlantic Smaller Companies, Smithson and The Global Smaller Companies Trust) as well as other popular global trusts.

The Y-axis (or vertical axis) is a size score – the larger the score, the larger the underlying investments in the portfolio, while the X-axis (or horizontal axis) is a measure of the growth and value factors (the larger the score, the more growth-orientated the trust’s portfolio).

EWI distinguished by having the most-growth orientated portfolio of its global smaller company peers.

Looking at Figure 33, it is clear that EWI has a portfolio that is tilted distinctly towards smaller companies when compared to the other trusts included. It is also apparent that the global smaller companies’ peers offer different propositions, in terms of their value-growth tilt although, overall, EWI continues to be distinguished by having the most-growth orientated portfolio (the growth score for EWI is still higher than those of Herald and Smithson, which are also known for their growth biases).

It is not surprising that The Schiehallion Fund – another Baillie Gifford Fund – sits to the right of EWI in terms of the growth factor. Schiehallion sits in the growth capital sector and traditionally backs earlier-stage and higher-growth companies that are unlisted. EWI could be a natural choice for investors looking to capture long-term growth but who favour a tilt towards listed market investments.

Performance

As its name suggests, The Global Smaller Companies Trust (GSCT) invests more broadly in global smaller companies. It does not have the specific growth/technology bias of either EWI or Herald and so its sectoral exposure is much broader. GSCT operates with close to 40% in the US and around 25% in the UK.

North Atlantic Smaller Companies targets companies that the manager believes are trading at a discount to their intrinsic value and may then engage with management with the aim of unlocking that value. Consequently, its portfolio is an eclectic mix of investments, which can be hard to categorise. It has a bias to smaller UK companies, but invests in the US periodically. It also makes investments in some unquoted companies, including investments in limited partnership funds advised by the management company, and has stakes in two investment companies: Oryx International Growth and Odyssean Investment Trust.

Smithson operates with a bias towards quality growth stocks (typically companies with high returns on capital, defensible business models, attractive free cash flow yields and low levels of debt funding), which tends to help it in periods where investors are nervous about economic growth.

As a consequence, while all of EWI’s peers invest globally in smaller companies, all the portfolios are markedly different to EWI’s.

Growth sell-off has eaten into EWI’s longer-term performance record.

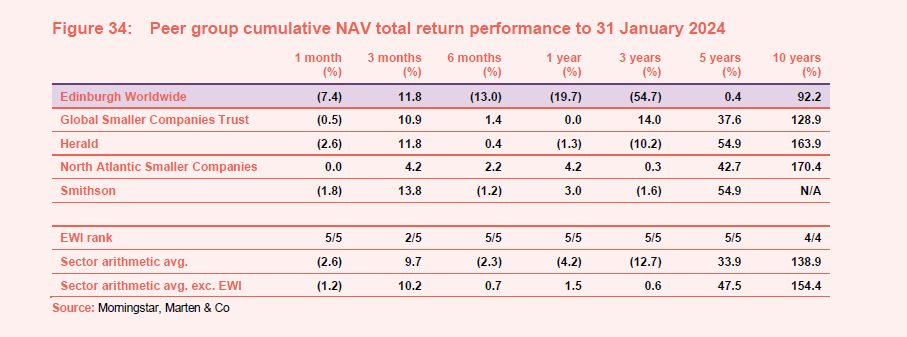

Looking at Figure 34, it is clear that EWI found itself at the sharper end of the sell-off in growth stocks during the last 12 months and this has eaten into its longer-term performance record that shows up in the periods of one year and above (something which has also affected its peers, but to a much lesser extent). It has benefitted recently from improved sentiment towards growth as inflation expectations have reduced. This is something we have previously predicted, and think this has much further to go.

Herald, despite its more specialist focus, has held up relatively well, which helped its longer-term numbers – it ranks in third place over three years, and first over five and 10 years in NAV total return terms. The Global Smaller Companies Trust, while still growth-focused, has less of a growth bias than either EWI or Herald. It ranks first over three years but otherwise places between third and fifth for all of the other periods. North Atlantic Smaller Companies is arguably the most value-focused but has been held back by its strong allocation to the UK recently but has been a better performer over the longer term. Smithson’s performance has been quite variable. Its focus on quality did not appear to translated into higher relative returns when growth was struggling but has benefited from a decent allocation to the US, a better performing market.

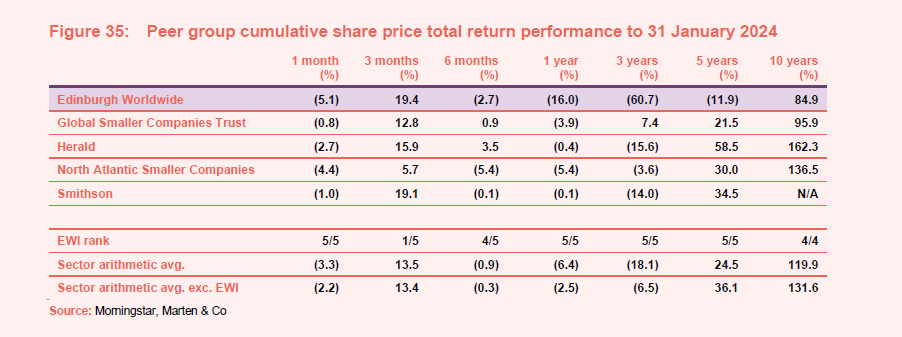

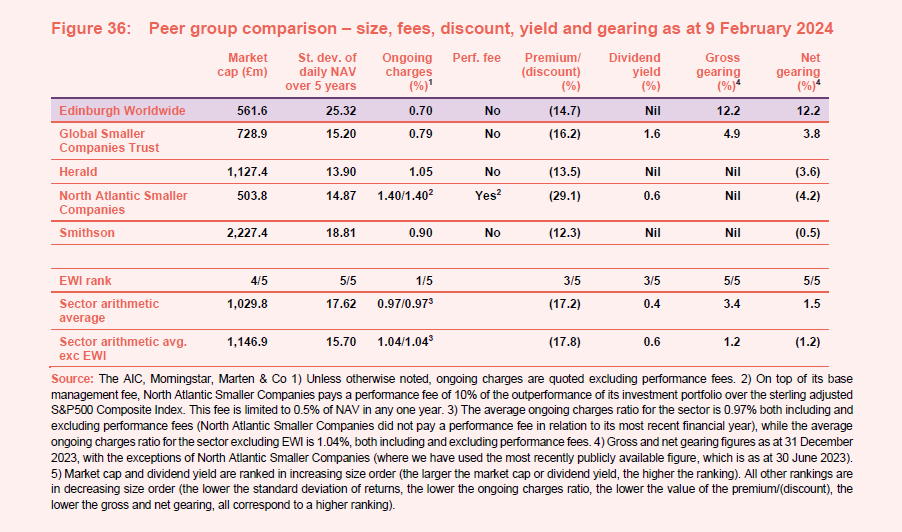

Looking at Figure 35, it can be seen that, while all of the funds are a very respectable size, there are significant differences between them and, to a certain extent, the peer group is distorted by the behemoth that is Smithson. The distortion is such that the next-largest fund, Herald, is comparable in size to the peer group average. If Smithson is excluded, the average market cap is £730m and whilst EWI is still around £170m below this, it is reasonably close to the average.

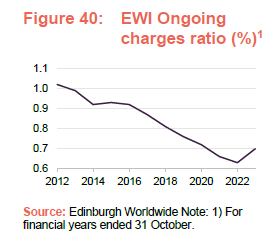

EWI is the most efficient with the lowest ongoing charges ratio in the peer group.

As we have previously observed, Smithson does not have a similarly distorting effect on the average ongoing charges ratio for the peer group as, despite its colossal size, its ongoing charges ratio is close to the sector average. In this regard, EWI is the most efficient, with the lowest ongoing charges ratio in the peer group, despite only being the fourth-largest fund. The Global Smaller Companies comes in a reasonably close second, although its ongoing charges ratio is still 9 basis points (bps – effectively 0.09%) higher than EWI’s, despite having net asset that are c. 26% higher than EWI’s.

It is perhaps unsurprising that Herald has an ongoing charges ratio a bit over the sector average, as its more specialist approach – combined with a very high number of portfolio companies – is likely to be more expensive to manage. It is worth noting that North Atlantic Smaller Companies is the only fund with a performance fee and, while it did not incur a performance fee in relation to its last reported financial year (for the year ended 31 January 2023), its ongoing charges ratio inclusive of performance fees could, in a good year, cost up to an additional 50bps in round figures.

The volatility of EWI’s NAV returns remains the highest in the peer group by a significant margin.

Reflecting their focus on smaller companies, which are more likely to be in a growth phase and reinvesting their earnings in their businesses, EWI and its peers are all managed with a focus on capital growth and not income. It is not surprising that three of the peer group, including EWI, have not paid a dividend during the last 12 months.

EWI’s discount to NAV is fractionally above the sector average, although this is distorted by the very high discount to NAV of North Atlantic Smaller Companies (its manager, Christopher Mills, who is also a director, owns around 28% of the trust, making it difficult for an external shareholder to put pressure on the trust to close its abnormally wide discount). If North Atlantic Smaller Companies is excluded, the average discount to NAV is 14.2%, making EWI look even cheaper versus its peers.

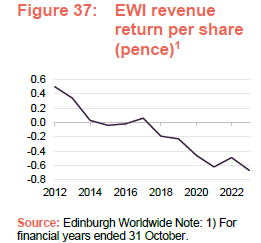

Dividend

EWI’s focus on capital growth tends to mean that there is insufficient net revenue to fund dividends. Reflecting this, the company has not declared a dividend since 2014, the year that the new strategy was adopted.

For the accounting year ended 31 October 2023, EWI’s net revenue per share was -0.65p, down from -0.49p for the prior year. The revenue reserve is negative (a net revenue loss of £8.6m) and this would have to be eliminated before EWI declared a dividend. If circumstances change, board policy is that the trust would pay the minimum permissible dividend to allow it to retain its investment trust status.

Premium/(discount)

As is illustrated in Figure 38, in an environment of higher (albeit falling) inflation and interest rates, where growth continues to be out of favour, EWI is trading at discounts to NAV that are significantly wider than their long-term averages. However, since the middle of 2023, there has been a broad trend of discount narrowing, albeit with some marked volatility. This has been a period in which there have been strong signs that inflation, particularly in more developed markets, has been receding. This has led to improved sentiment towards growth stocks, which has contributed to a narrowing of EWI’s discount to NAV.

Discount opportunity

We think that if sentiment continues to improve towards growth stocks more generally and if EWI’s managers are correct in their stock selection decisions, the superior growth achieved by the winners within the portfolio will drive long-term outperformance of EWI’s NAV and ultimately a narrowing of its discount to NAV.

EWI is trading at discounts to NAV that are significantly wider than their long-term averages.

As we have discussed previously, higher interest rates and increased risk of recession have been weighing heavily on both growth and small-cap stocks and this has eaten heavily into EWI’s long-term performance, which contributed to a significant widening of the discount to NAV. We think that the current discount still offers a good opportunity to gain access to this strategy, which could see a significant reversal of its recent fortunes if the market shifts back to a more risk-on focus. Readers interested in further discussion of the trends within EWI’s discounts should see our previous notes (see page 34 of this note).

Over the last 12 months, EWI has traded at discounts between 10.5% and 23.3%, with an average of 17.4%. As at 9 February 2024, EWI was trading at a discount to NAV of 14.7%, which is still significantly wider than its longer-term three- and five-year discount averages of 10.1% and 5.3% respectively, despite the broad trend of narrowing seen during the last six months.

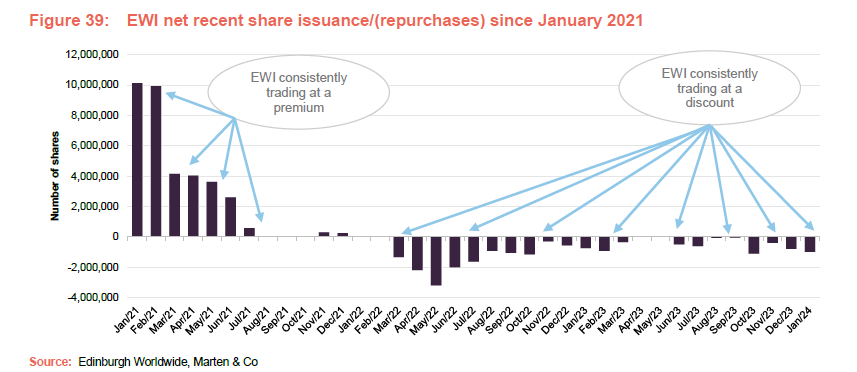

Board continues to taking action on the discount with NAV accretive purchases

Each year, the board asks shareholders for permission to buy back up to 14.99% and issue up to 10% of EWI’s issued capital. Repurchased shares may be held in treasury and reissued when demand returns. Shares will only be issued or reissued at a premium to asset value, thereby enhancing the NAV for existing shareholders.

Figure 39 shows the pattern of net share issuance since the beginning of 2021. It illustrates how the board has provided liquidity – initially through issuance when EWI was trading at a premium to NAV when growth and small caps were much more in favour – to repurchasing shares as sentiment towards growth stocks deteriorated and EWI moved to trading at a discount to NAV.

Fees and costs

The annual management fee is 0.75% on the first £50m of net assets, 0.65% on the next £200m and 0.55% on any remaining net assets. The management fee is calculated and payable quarterly. The management agreement can be terminated on three months’ notice.

The ongoing charges ratio for the accounting year ended 31 October 2023 was 0.70%, up from 0.63% for the prior year and 0.66% for the year ended 31 October 2021. As is illustrated in Figure 40, there has been a marked reduction in EWI’s ongoing charges during the last decade reflecting asset growth, both as a result of strong performance and the share issuance that has taken place in response to the demand that has followed. The year ended 31 October 2023 has seen a reversal of this trend, reflecting the reduction in EWI’s net assets over the period.

Capital structure

EWI has a simple capital structure with one class of ordinary share in issue. EWI’s ordinary shares have a premium main market listing on the London Stock Exchange and, as at 9 February 2024, there were 384,648,708 of these with voting rights in issue with 21,104,987 held in treasury.

Simple capital structure.

Major shareholders

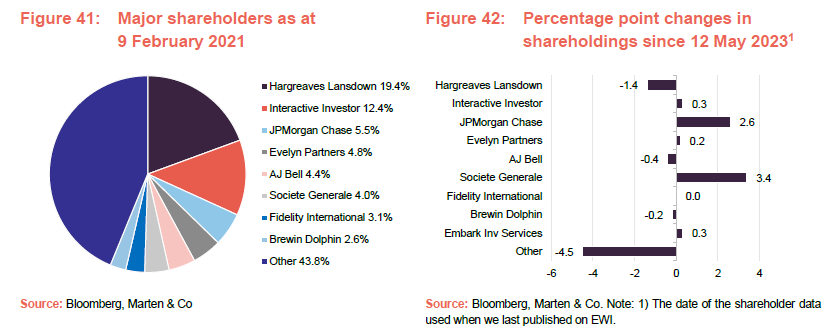

EWI has a significant retail presence on its share register.

Figure 41 illustrates that EWI has a significant retail presence within its share register, reflected by the prominence of the major platforms, which account for around 40% of the share register. Wealth managers are also a significant element, accounting for around 40%. Since we last published, the trend has been one of retail investors and wealth managers reducing their holdings at the margin with institutional investors building their positions. We are also aware that Saba Capital, the activist investor, has been buying through accounts with both JPMorgan Chase and Société Générale, and think it is likely that most, if not all, of the shareholdings attributed to these two in Figure 41 are in fact Saba Capital.

Gearing and derivatives

The company recognises the advantages of long-term gearing (borrowing), and the investment policy allows gearing up to 30% of net assets. In practice, however, gearing has tended to be in single digits in recent years. Gearing levels are discussed at each board meeting.

EWI tends to use single digit levels of gearing.

EWI has a £100m five-year multicurrency revolving credit facility (effectively a bank overdraft) which is provided by The Royal Bank of Scotland International Limited and expires on 9 June 2026. EWI also has a £36m multicurrency revolving facility provided by National Australia Bank Limited with expiry on 30 September 2024. EWI previously had a £26m multicurrency revolving credit facility provided by National Australia Bank Limited that expired of 29 June 2023. This was not renewed at expiry.

The main covenants (restrictions placed on the borrower) relating to both existing loan facilities are that total borrowings shall not exceed 35% of EWI’s adjusted gross assets and the minimum adjusted gross assets shall be £260m.

At the end of October 2023, EWI’s gearing was in the form of drawings in euros, dollars and sterling. As at 31 December 2023, EWI had gross gearing (borrowings as a proportion of net assets) and net gearing (borrowings less cash and equivalents as a proportion of net assets) of 12.2% and 12.2% respectively.

Derivatives can be used either as a hedge or to exploit an investment opportunity. In practice, they are not normally used.

Financial calendar

EWI’s year-end is 31 October. The annual results are now usually released in January (interims in June) and its AGMs are now usually held in March of each year.

EWI does not have a fixed life and does not hold regular continuation votes.

Management team

Douglas Brodie (portfolio manager)

Douglas joined Baillie Gifford in 2001 and is head of the Global Discovery Team. He became a partner in 2015 and is a CFA Charterholder. Douglas graduated with a BSc in Molecular Biology & Biochemistry from the University of Durham in 1997 and attained a DPhil in Molecular Immunology from the University of Oxford in 2001.

Svetlana Viteva (deputy portfolio manager)

Svetlana joined Baillie Gifford in 2012 and is an investment manager in the Global Discovery Team. She is a CFA Charterholder. Svetlana graduated with a BA in Economics and a BA in Business Administration from the American University in Bulgaria in 2008, an MSc in Investment Analysis in 2009 and a PhD in Accounting and Finance in 2012, both from the University of Stirling.

Luke Ward (deputy portfolio manager)

Luke joined Baillie Gifford in 2012 and is an investment manager in the Global Discovery Team. He graduated with an MEng (Hons) in Mechanical Engineering from the University of Edinburgh in 2012.

Board

EWI’s board is composed of seven directors (soon to be six), all of whom are non-executive and considered to be independent of the investment manager. It is board policy that all directors will retire and offer themselves for re-election each year. Other than EWI’s board, its directors do not have any other shared directorships.

Board succession planning

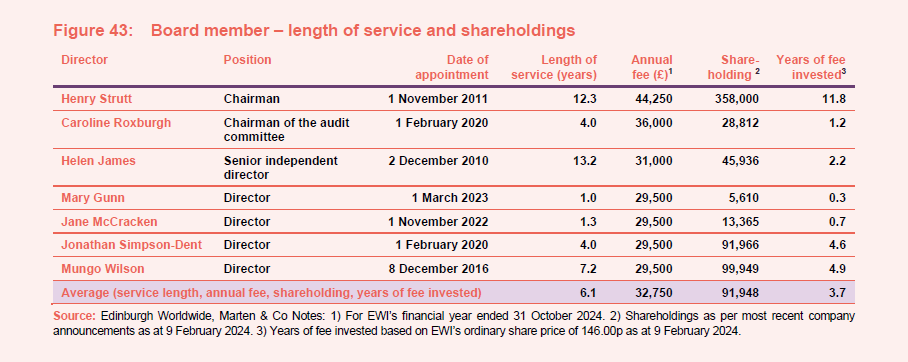

As is illustrated in Figure 43, Henry Strutt and Helen James have both served for more than 10 years. Henry has advised that he will retire from the board at the upcoming AGM on 5 March 2024. Helen has said that she will stand down as EWI’s senior independent director at the same AGM and will not be standing for re-election to EWI’s board at the 2025 AGM. It is the intention that Jonathan Simpson-Dent will become EWI’s chairman upon Henry’s retirement from the board and that Jane McCracken will become the senior independent director when Helen relinquishes the position of senior independent director.

Directors’ fees

Total directors’ fees are capped at £250,000 per year (shareholders approved an increase in the cap from £200,000 at the 2022 AGM) and any further change to the cap will require shareholder approval. The average increase in directors fee for the 2024 financial year is 5.7%

Recent share purchase and disposal activity by directors

Four directors have purchased EWI shares during the last 12 months: Caroline Roxburgh purchased 8,324 shares at 179.18p on 24 January 2023; Jonathan Simpson-Dent purchased 5,000 shares at 157.9 on 10 March 2023 and then 14,000 shares at 139.8p per share on 3 July 2023; Jane McCracken purchased 13,365 shares at 150.6p per share on 12 September 2023; and Mary Gunn purchased 5,610 shares at 141.0p per share on 23 November 2023. For McCraken and Gunn, the most recent additions to EWI’s board, these were their inaugural share purchases. None of the directors have disposed of any shares during the last year.

Board well-aligned with external shareholders

Now that Mary Gunn and Jane McCracken have acquired shares, all of EWI’s directors have personal investments in the trust, which we consider to be favourable as it helps align directors’ interests with those of shareholders. As we have previously noted, Henry Strutt has a particularly high shareholding, which should mean that he is well aligned with external investors. It does, however, distort the average level of years of fee invested for the board as a whole, but even excluding the chairman, who is due to retire at the conclusion of the AGM in March, the average level of fees invested is still a respectable 2.3 years.

Henry Strutt (outgoing chairman)

Henry was appointed chairman on 24 January 2017. He qualified as a chartered accountant in 1979, following which he spent over 20 years with the Robert Fleming Group, 17 of which were in the Far East. Henry is chairman of Taylor Maritime Investments Limited and a non-executive director of New Waves Solutions Limited. As noted above, Henry is not standing for re-election at the forthcoming AGM and is standing down from the board.

Caroline Roxburgh (chairman of the audit committee)

Caroline is a qualified Chartered Accountant and was a partner at PricewaterhouseCoopers LLP until 2016. She is the senior independent director and chair of the audit committee of Montanaro European Smaller Companies Trust Plc, a non-executive director and chair of the audit and risk committee of Edinburgh International Festival Society, a non-executive director of the Royal Conservatoire of Scotland and a non-executive director and chair of the audit and risk committee of VisitScotland. Caroline was appointed as chairman of EWI’s audit and management engagement committee at the AGM on 2 February 2022.

Helen James (senior independent director)

Helen is the former CEO of Investis Digital, a leading digital corporate communications company. She was also previously head of pan-European equity sales at Paribas, having started her career at HSBC James Capel as an investment analyst, and is currently the group chief operating officer of Brunswick Group. Helen is retiring from the role of senior independent director at the forthcoming AGM and intends to retire from the board altogether at the conclusion of EWI’s AGM in 2025.

Dr Mary Gunn (director)

Mary is a scientist, lawyer and C-level executive in life science companies, including previously at Pfizer, Crucell, ICON Plc, and Health Decisions. She also served on the boards and advisories of Brown University, Modelis, Lumiio, and SpotArt Foundation. Mary is currently an Independent Director of Burst Diagnostics and the President of RemRem LLC, a value creation advisory for investors, banks, and entrepreneurs in clinical research and life science.

Jane McCracken (senior independent director designate)

Jane has spent her career working with high-growth technology businesses based in the USA and UK as an entrepreneur, equity investor, board member and advisor. Her experience covers a variety of areas including enterprise software, e-commerce, fintech, digital health and clinical research. Most recently, she served as a Research Faculty member and Entrepreneur-in-Residence at the Georgia Institute of Technology in Atlanta, Georgia, USA, and is currently the Chief Growth Officer for Corps Team LLC. Jane is also a non-executive director of Radyus Research LLC.

Jonathan Simpson-Dent (chairman designate)

Jonathan has spent the majority of his career running entrepreneurial private equity and listed mid-cap international growth businesses across multiple sectors, being a former CEO of Evander Group, Cardpoint and WLT (EMEA), CCO of Cardtronics Inc and CFO of HomeServe Plc and General Healthcare Group. He has also previously worked at PricewaterhouseCoopers LLP, McKinsey & Company and PepsiCo. Jonathan is the chair of three private equity companies: Danx Carousel Group, Andwis Group and Easby Group. He has also previously worked at PricewaterhouseCoopers LLP, McKinsey & Company and PepsiCo. He is a Fellow of the Institute of Chartered Accountants.

Mungo Wilson (director)

Mungo is a former solicitor and is Associate Professor of Finance at Saïd Business School, University of Oxford. He is also an associate member of the Oxford Man Institute of Quantitative Finance. He is a non-executive director of Neo Risk Reap Asia Equity Fund Limited, Embedded Insurance Inc., and Carbon Insurance Inc.

Previous publications

Readers interested in further information about EWI may wish to read our previous notes (details are provided in Figure 44 below). You can read the notes by clicking on them in Figure 44 or by visiting our website.

Figure 44: QuotedData’s previously published notes on EWI

| Title | Note type | Publication date |

| Tomorrow’s winners | Initiation | 25 January 2022 |

| The output of innovation is alive and well | Annual overview | 16 May 2023 |

Source: Marten & Co

IMPORTANT INFORMATION

Marten & Co (which is authorised and regulated by the Financial Conduct Authority) was paid to produce this note on Edinburgh Worldwide Investment Trust Plc.

This note is for information purposes only and is not intended to encourage the reader to deal in the security or securities mentioned within it.

Marten & Co is not authorised to give advice to retail clients. The research does not have regard to the specific investment objectives financial situation and needs of any specific person who may receive it.

The analysts who prepared this note are not constrained from dealing ahead of it but, in practice, and in accordance with our internal code of good conduct, will refrain from doing so for the period from which they first obtained the information necessary to prepare the note until one month after the note’s publication. Nevertheless, they may have an interest in any of the securities mentioned within this note.

This note has been compiled from publicly available information. This note is not directed at any person in any jurisdiction where (by reason of that person’s nationality, residence or otherwise) the publication or availability of this note is prohibited.

Accuracy of Content: Whilst Marten & Co uses reasonable efforts to obtain information from sources which we believe to be reliable and to ensure that the information in this note is up to date and accurate, we make no representation or warranty that the information contained in this note is accurate, reliable or complete. The information contained in this note is provided by Marten & Co for personal use and information purposes generally. You are solely liable for any use you may make of this information. The information is inherently subject to change without notice and may become outdated. You, therefore, should verify any information obtained from this note before you use it.

No Advice: Nothing contained in this note constitutes or should be construed to constitute investment, legal, tax or other advice.

No Representation or Warranty: No representation, warranty or guarantee of any kind, express or implied is given by Marten & Co in respect of any information contained on this note.

Exclusion of Liability: To the fullest extent allowed by law, Marten & Co shall not be liable for any direct or indirect losses, damages, costs or expenses incurred or suffered by you arising out or in connection with the access to, use of or reliance on any information contained on this note. In no circumstance shall Marten & Co and its employees have any liability for consequential or special damages.

Governing Law and Jurisdiction: These terms and conditions and all matters connected with them, are governed by the laws of England and Wales and shall be subject to the exclusive jurisdiction of the English courts. If you access this note from outside the UK, you are responsible for ensuring compliance with any local laws relating to access.

No information contained in this note shall form the basis of, or be relied upon in connection with, any offer or commitment whatsoever in any jurisdiction.

Investment Performance Information: Please remember that past performance is not necessarily a guide to the future and that the value of shares and the income from them can go down as well as up. Exchange rates may also cause the value of underlying overseas investments to go down as well as up. Marten & Co may write on companies that use gearing in a number of forms that can increase volatility and, in some cases, to a complete loss of an investment.