Compelling yield

Whilst falling power price forecasts (the product of a range of factors, including lower gas prices and reduced demand) have weighed on GCP’s NAV in recent quarters, the good news on vaccines should provide some relief.

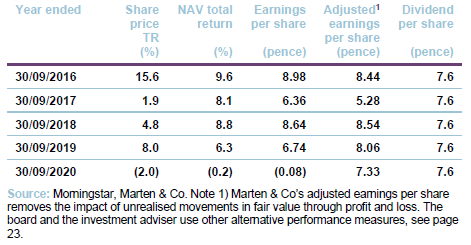

We explained the rationale for GCP’s rebased 7p annual dividend in our last note. We would note that, even after the cut, GCP trades on the highest yield in its sector (by some distance) and the investment adviser has a pipeline of opportunities lined up that it thinks will allow GCP to maintain and possibly grow the dividend in the future.

Public-sector-backed, long-term cashflows from loans used to fund UK infrastructure

GCP aims to provide shareholders with regular, sustained, long-term distributions and to preserve capital over the long term by generating exposure primarily to UK infrastructure debt and related and/or similar assets which provide regular and predictable long-term cashflows.

GCP primarily targets investments in infrastructure projects with long-term, public-sector-backed, availability-based revenues. Where possible, investments are structured to benefit from partial inflation-protection.

Fund profile

GCP Infrastructure Investments Limited (GCP) is a Jersey-incorporated, closed-ended investment company whose shares are traded on the main market of the London Stock Exchange. GCP aims to generate a regular, sustainable, long-term income while preserving investors’ capital. The fund’s income is derived from loaning money at fixed rates to entities which derive their revenue, or a substantial portion of it, from UK public-sector-backed cashflows. Wherever it can, it tries to secure an element of inflation-protection.

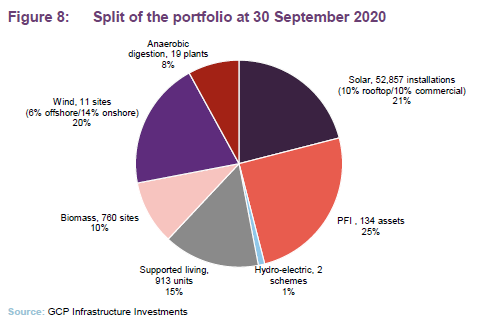

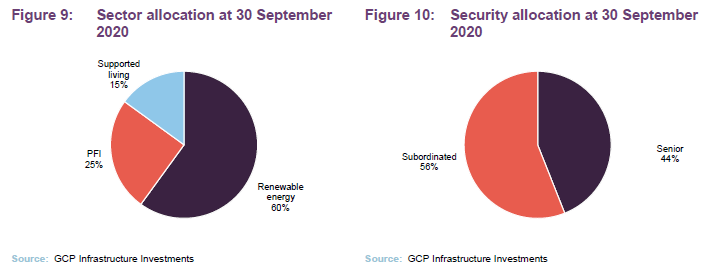

In practice, GCP has exposure to renewable energy projects (where revenue is part subsidy and part linked to sales of power), PFI/PPP-type assets (whose revenue is predominantly based on the availability of the asset) and specialist supported social housing (where local authorities are renting specially-adapted, residential accommodation for tenants with special needs).

The investment adviser

Gravis Capital Management Limited (Gravis) is the fund’s AIFM and investment adviser. It is also investment manager of GCP Student Living and GCP Asset Backed Income, and advises VT Gravis Clean Energy Income Fund, VT Gravis UK Listed Property Fund and VT Gravis UK Infrastructure Income Fund. Assets under management are about £3bn.

Gravis announced on 4 December that it has entered into a strategic partnership with ORIX Corporation whereby ORIX will acquire a 70% equity stake in the Gravis business. ORIX is a diversified financial services group. GCP’s board said that it has been reassured that there will be no changes to the team currently providing services to the company, and that service levels will be uninterrupted by the transaction. It sees it as a positive that Gravis will remain independently-managed and will operate under its current brand while ORIX’s global presence will, over the longer term, provide Gravis’s management team with additional experience, expertise and access in areas such as asset sourcing, financing and potential new investors.

Philip (Phil) Kent is the lead fund adviser, and is supported by an extensive team which includes Rollo Wright (Gravis Capital’s CEO, who was co-lead manager until May 2018).

Phil joined Gravis from Foresight Group, where he had responsibility for waste and renewable projects. He has also worked for Gazprom Marketing and Trading (latterly in its Clean Energy team) and PA Consulting’s Energy practice.

At 7 December 2020, directors of the investment adviser held – together with their family members – 984,073 shares in GCP.

10 years of a changing landscape

It is now more than 10 years since GCP’s IPO. In recent quarters, falling power prices have impacted on the NAV. Nevertheless, the NAV remains above the initial issue price, and since launch GCP has delivered returns to initial investors of 109%, equivalent to 8.2% a year.

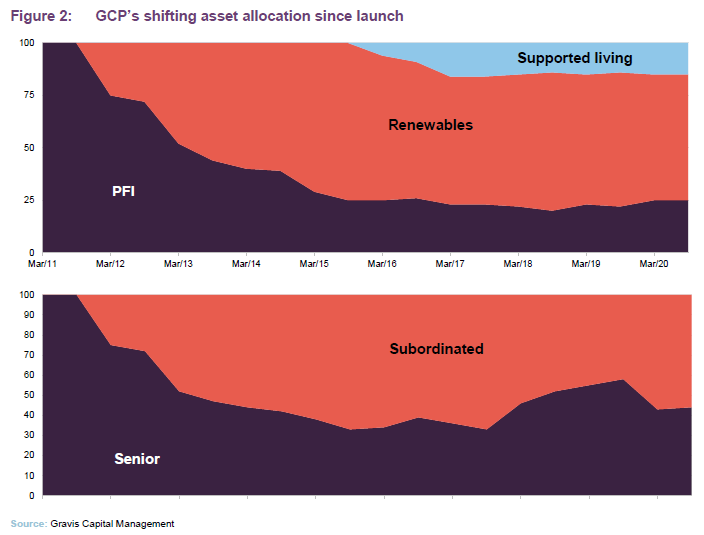

Once the portfolio was fully invested, GCP began paying annual dividends of 7.6p and kept that up for eight years. However, market rates of return have been in a steep decline over the past decade. GCP’s board resolved to rebase GCP’s dividend for the current financial year to 7.0p, rather than taking on additional risk to maintain the dividend at its previous level. GCP will still offer a yield well in excess of most other forms of investment and, as we discuss on page 22, the highest yield in its sector by some distance.

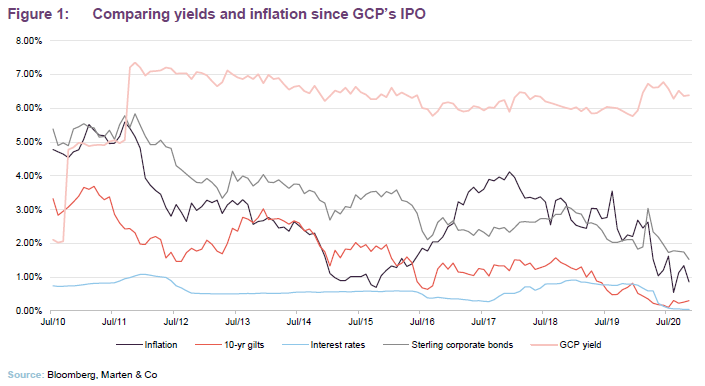

In the face of a shifting backdrop, GCP’s managers have sought out new opportunities that would offer similar risk-adjusted returns. When the trust was launched, the principal focus of the portfolio was on PFI/PPP projects. As available yields on these fell, attention switched to subsidy-backed renewable energy projects. In 2015, GCP began to lend against specialist supported housing projects, where the rent is effectively funded by national and local government.

The evolution has been gradual and cautious. The advisers have seen no reason to look beyond the UK for investments (but should they feel that opportunities in the UK are no longer attractive, this will be considered). Where the fund has lent to new sectors, Gravis has first undertaken substantial due diligence and has focused on the safer end of the capital structure. The loans that the fund makes are backed by physical assets, offering a degree of capital protection.

Recent investment activity

In our last note, we highlighted some of the problems facing GCP’s managers as projects take advantage of falling rates to refinance. Whilst GCP may benefit from prepayment penalties in such scenarios, the money freed up must be reinvested.

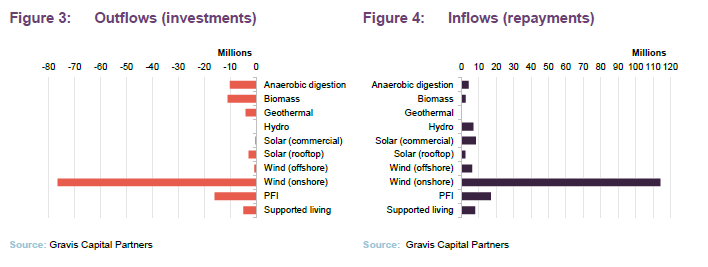

Between 30 September 2019 and the middle of December 2020, unscheduled repayments totalled £139m against scheduled repayments of £30m. £77m was lent against new investments and £49m was advanced to existing borrowers. This translates into a net £43m influx of cash. The company repaid a net £27m of its revolving credit facility.

Figures 3 and 4 show the parts of the portfolio where this activity was concentrated. The figures are dominated by the refinancing of a portfolio of onshore wind assets.

Results for the year ended 30 September 2020

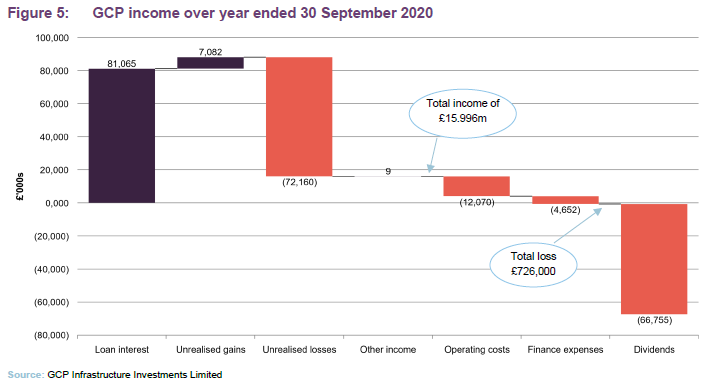

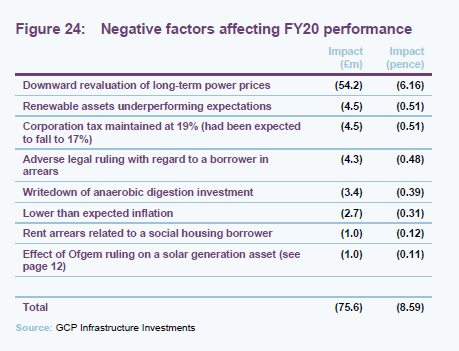

GCP announced a total comprehensive loss of £0.7m for the year ended 30 September 2020, following the recognition of £72.2m of unrealised losses, most of which relate to reductions in electricity price forecasts. Operating costs of £12.1m were £0.6m higher than the previous year, but all of this and more related to one-off costs, and the ongoing charges ratio was unchanged at 1.1%.

Backdrop – the UK’s infrastructure strategy

The outlook for infrastructure funding in the UK has been unclear for some time. With the exception of some projects in the devolved administrations, very few projects are being developed on an availability model using PFI/PPP-type financing structures.

On 25 November 2020, the UK Government published a policy paper, The National Infrastructure Strategy – subtitled “fairer, faster, greener”. The ambition is to refresh and upgrade large swathes of the UK’s existing infrastructure while levelling up the UK regions, laying the groundwork for the target of net zero emissions by 2050 and creating jobs. The Government also says that it wants to provide investors with clarity over its plans to reduce their uncertainty about policy.

The policy paper rules out a return to the PFI model, but instead favours regulated asset base (RAB) models and contracts for difference (CfDs). It also envisages the establishment of a new UK infrastructure bank, which it says will invest alongside private sector investors.

The paper says that, in the renewables sector, the government wants the 2021 CfD Auction to support up to double the renewable capacity procured in the 2019 round, subject to maintaining competitive tension in the auction. It also confirms that onshore wind and solar projects will be included. These auctions will continue to be held every two years. Future CfD rounds will seek to factor in the cost of ensuring stable supply while stimulating development of renewable projects that generate power intermittently. How they will square this circle has not yet been disclosed.

The paper acknowledges the importance to investors of the direction of future power prices, as more renewable generation with near-zero marginal cost is added to the mix. This is an issue that we discussed in our last note. The paper seems to imply that the government will use the support mechanisms available to it to ensure that investors are still incentivised to back new renewable energy projects. This suggests to us a continuing role for GCP.

Subject to thorough due diligence, GCP has demonstrated a willingness to embrace new investment areas, as is evidenced by its recent investment in a geothermal project. There may be opportunity, too, in areas that the government is seeking to prioritise, such as low-carbon hydrogen production, carbon capture and storage and power distribution. Some of GCP’s peers are backing projects in vehicle charging, energy efficiency and localised heat distribution. To the extent that such projects suit the fund’s risk/reward requirements, GCP may follow suit.

Powering our net zero future

An energy white paper, published on 14 December 2020 and subtitled: Powering our net zero future, underscored the opportunity to create jobs and boost economic growth through investment in measures designed to combat climate change.

It also commits to “leverage private capital” as much as possible to achieve ambitions such as a wholesale shift to electric vehicles and electrically heated homes, with increased renewable generation. Much has been achieved already – an expansion of renewable generation capacity from 8GW in 2009 to 48GW in June 2020, for example. The white paper puts some numbers on the ambitions outlined in the National Infrastructure Plan, including 40GW of offshore wind (including 1 GW of floating offshore wind) by 2030, 5GW of low carbon hydrogen by 2030, 600,000 electric heat pumps installed per year by 2028, and up to £1bn invested in carbon capture and storage by 2025. It also envisages the creation of a new UK Emissions Trading System to replace our membership of the EU ETS.

This year’s CfD auction is intended to support the deployment of 12GW of low-cost renewable generation. Energy storage assets will need to be developed as well. In addition to battery storage plants, a 250MWh cryogenic energy storage plant (which stores energy by liquefying air) is under construction in Manchester. Other innovative solutions to the energy storage problem will no doubt be trialled in coming years.

Increased biomethane production is another target for the government. A Green Gas Support Scheme will launch in autumn 2021 and run for four years. It will support the deployment of additional anaerobic digestion plants, the suggestion is that the amount of biomethane in the gas grid could treble between 2018 and 2030. (As an aside, the government proposes to extend the existing RHI support for domestic heat projects to March 2022. The non-domestic scheme will close to new applications from April 2021. Post April 2022, households and small businesses may be able to benefit from a Clean Heat Grant of up to £4,000.)

Further publications are planned, including “The Net Zero Review” – a look at how to address areas such as the stability of the national power grid. However, the advisers highlight Ofgem’s proposed reduction in baseline returns from electricity transmission projects from 7–8% to 4.3% as evidence of the significant pressure on returns available to investors.

Ian Reeves CBE, GCP’s chairman, summarises the position in his statement published on 16 December 2020: “The company has maintained an attractive pipeline of investment opportunities and continues to review investments in existing and new sectors to reinvest capital and to support modest growth. Significant future growth, however, remains dependent on the emergence of new policy support for infrastructure.”

The outlook for electricity prices

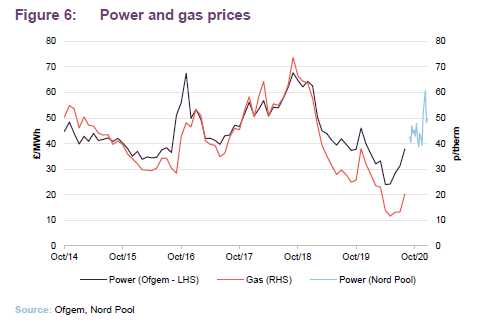

Over the year to the end of September 2020, the most significant factor influencing GCP’s returns was a reduction in forecast power prices. One important driver of this was falling gas prices – in the UK, gas is the dominant fuel for peaking plants. Measures to control the spread of COVID-19 have reduced power demand by about 15% and forecasters are factoring in lower-than-expected demand for power for three to five years hence.

The reduced consumption of power associated with the COVID-19 lockdowns, coupled with warm weather, put considerable downward pressure on power and gas prices in the spring. However, as the economy has begun to recover, prices are starting to firm again. The Ofgem data runs to the start of August but Figure 6 also shows weekly averages for power prices on Nord Pool are back to long run average levels. The price of the February 2021 UK natural gas daily future was 57.19 pence per therm on 30 December 2020, according to ICE Futures Europe.

Investment process

Restrictions

GCP invests at least 75% of total assets, directly or indirectly, in investments with exposure to infrastructure projects with the following characteristics (core projects):

- pre-determined, long-term, public-sector-backed revenues;

- no construction or property risks; and

- benefit from contracts where revenues are availability-based.

In respect of core projects, the company focuses predominantly on taking debt exposure (on a senior or subordinated basis) and may also obtain limited exposure to shareholder interests (equity).

The company may also invest up to 25% of total assets (at the time the relevant investment is made) in non-core projects. These might include:

- taking exposure to projects that have not yet completed construction;

- projects in the regulated utilities sector; and

- projects with revenues that are entirely demand-based or private-sector-backed (to the extent that the investment adviser considers that there is a reasonable level of certainty in relation to the likely level of demand and/or the stability of the resulting revenue).

There is no – and it is not anticipated that there will be any – outright property exposure (except potentially as additional security).

No more than 10% in value of its total assets (at the time the relevant investment is made) will consist of securities or loans relating to any one individual infrastructure asset (having regard to risks relating to any cross‑default or cross‑collateralisation provisions).

The portfolio should be diversified by asset type and revenue source.

Structural gearing of investments is permitted up to a maximum of 20% of NAV at the time that the debt is drawn down.

The investment adviser is well-resourced

Phil leads the team that works on GCP, but the investment adviser has a significant resource working on the fund.

Ben Perkins, Beth Watkins, Max Gilbert and Ben Rider are analysts dedicated to GCP. GCP and GCP Asset Backed Income (GABI) share an origination team of five, including Phil and David Conlon (the lead adviser to GABI). Members of staff monitor loans, keeping in regular contact with borrowers and monitoring covenants and an administration team helps process payments. Matteo Quatraro is commercial director at Gravis, looking after GCP’s renewable energy investments.

GCP lends money to a relatively narrow group of sectors. The investment adviser may consider other infrastructure sectors or renewable technologies, but considerable due diligence is required before investing in new areas. As stated above, to be eligible as a core investment, a loan must have some backing from public-sector cashflows. This rules out unsubsidised solar and wind farms (which derive their revenue largely from PPAs), for example.

GCP is operating in relatively small markets. Some new business comes from direct approaches. Much of it is the result of introductions from lawyers and advisers whom the investment adviser has worked with before. Not much proactive marketing is necessary and the investment adviser steers clear of competitive auctions.

Ideally, returns on loans will have some inflation-linkage, but this is not always available. Even where it does exist in the portfolio, the relationship between returns and inflation may not be linear. Some loans have clauses that trigger higher rates if inflation spikes above a certain threshold, for example.

Exposures informed by rigorous risk analysis

A thorough understanding of risk is essential. This varies by asset type and by where GCP sits in the capital structure. The approach is a cautious one – senior debt is favoured over subordinated debt when first making a foray into a sector, for example.

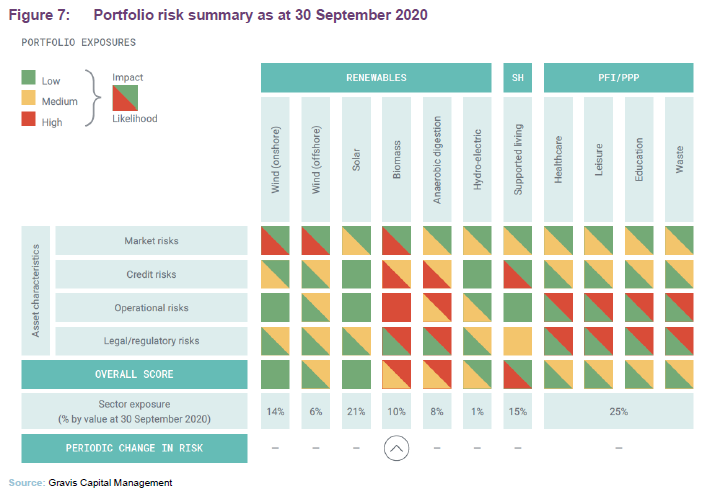

Gravis has compiled a matrix of their perception of risks across the various asset classes that GCP invests in.

The only area where the adviser believes that risk has increased materially since last year is in the operational risks associated with biomass projects. The initial COVID-19 lockdowns shut building sites and recycling centres, which affected the supply of waste wood. Three waste wood biomass plants saw reduced output as a result.

The advisers also draw attention to increased risks to returns from renewable energy projects associated with lower power prices (which was already a factor last year) and reminds us that some of its commercial solar projects are still the subject of ongoing audits by Ofgem (these relate to their initial accreditation and compliance with renewables obligations). Ofgem has revoked ROCs on one project and a judicial review of that decision is expected to be heard early in 2021. Should the judicial review fail, GCP has the option of seeking to recover its losses from third parties in relation to a breach of investment documentation. A further judicial review has been granted in respect of decisions made by Ofgem relating to a portfolio of 757 domestic wood pellet boilers.

The portfolio’s exposure to PFI is mainly through subordinated loans or loans secured against equity positions within the capital structure. Wind farms are an area with which the investment adviser feels comfortable enough to gain all the exposure through subordinated debt. By contrast, the initial investments in social housing have been made via senior debt. Corporate and social responsibility analysis may disqualify some potential investments. The investment adviser takes into account the alignment of incentive structures with GCP’s interests, for example.

External advisers help with an assessment of legal, tax and insurance factors and the investment adviser may also use some external technical expertise when evaluating projects.

Proprietary cash flow models are built for each potential investment, and these incorporate an element of sensitivity analysis.

Independent board sign-off for every investment decision

Once the investment case has been established, potential investments are first submitted to an internal credit committee consisting of Nick Parker, Stephen Ellis and Rollo Wright (all founders of Gravis Capital Management and members of its board of directors).

However, the final decision on each investment is the responsibility of the GCP board’s investment committee, made up of non-executive directors, independent of Gravis (see page 26). They will have been made aware of potential investments well before the formal business of the investment committee. The investment adviser says that the questions that they raise and the opinions that they put forward are invaluable to the investment process.

Every investment is through a loan to an intermediate company.

GCP’s loans carry fixed interest rate coupons, albeit with some inflation protection. The company is permitted to use interest rate hedging. Where GCP holds subordinated debt, the investment adviser ensures that the senior debt ranking above it has been, where appropriate, hedged against movement in interest rates, through the use of interest rate swaps.

ESG

Gravis believes that integrating environmental, social and governance (ESG) considerations into investment management processes and ownership practices can help to create more successful and sustainable businesses over the long-term, which in turn should generate enhanced value for its clients and society at large. It screens positively for investments that promote sustainability or benefit society.

Gravis is a signatory to the UN Principles for Responsible Investment and, as such, incorporates a consideration of ESG issues into its decision-making. Potential investments should promote sustainability or benefit society, including, but not limited to, the areas of climate change mitigation and adaptation, energy transition, critical infrastructure, affordable living, social housing, education and healthcare. It excludes investments which focus on animal testing; armaments; alcohol production; pornography; tobacco; coal production and power; and nuclear fuel production.

Prior to a new investment being approved, Gravis’s investment teams will assess how the investment fares against key relevant ESG criteria, laid down in an ESG checklist tailored for GCP. Gravis’s checklists typically cover the counterparty’s commitment and capability to effectively identify, monitor and manage potential ESG-related risks and opportunities (counterparties can include management teams, borrowers, asset developers and operators and the equity owners of the projects in which its funds invest). Furthermore, to the extent that it is applicable,

Gravis will assess the availability of relevant policies and procedures; alignment with industry or investment specific standards and ratings; and compliance to relevant ESG-related regulation and legislation.

A positive outcome from Gravis’s ESG due diligence assessment may increase the adviser’s enthusiasm for an investment. Conversely, where it identifies issues, this may weigh against a potential investment, and although it would not necessarily prevent an investment, it may cause Gravis to seek a greater risk premium or hold a smaller position.

Following an investment, relevant ESG indicators will be monitored on an annual basis. Gravis may engage with counterparties on ESG issues. It also reports on its progress on responsible investment on an annual basis. An external consultant, MJ Hudson Spring will perform a periodic review of Gravis’s responsible investment processes and ensure the policy remains relevant and appropriate.

In October 2020, the London Stock Exchange awarded GCP its Green Economy Mark. The company’s renewable energy investments have supported renewable energy facilities providing enough power to cover the needs of almost a million average UK homes, while displacing the production of the equivalent of around 900,000 tonnes of CO2 each year. The company’s investments also support the provision of homes for tenants needing support with physical or mental challenges.

Asset allocation

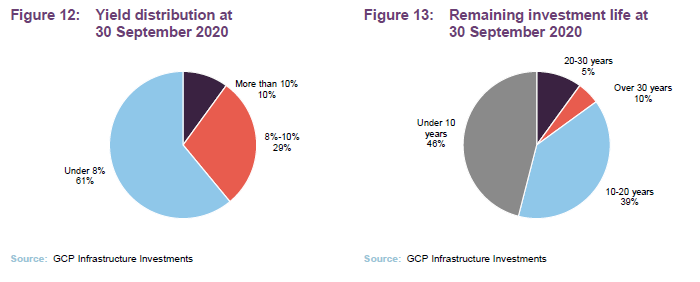

At the end of September 2020, there were 47 investments in GCP’s portfolio, producing an annualised yield of 8.1% and with an average life of 15 years. 39% of the portfolio was partially inflation-protected. These figures are not much changed from when we last published, using data at the end of March 2020. Loans against three energy efficiency schemes that were in the portfolio at the end of March have been repaid since and a number of small PFI projects are now no longer in the portfolio. Two more anaerobic digestion projects have been added. As we discuss on page 17, GCP has recently advanced a loan to a geothermal heat project.

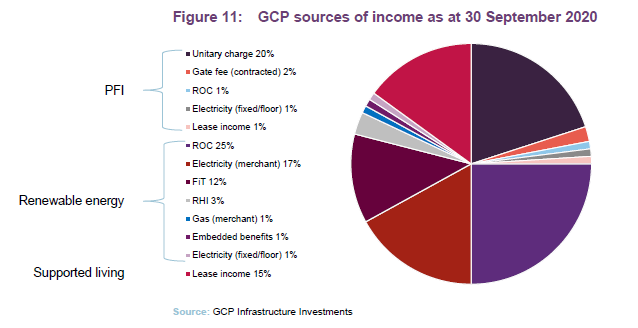

Figure 11 breaks down Figure 9 further, providing more information on GCP’s sources of income.

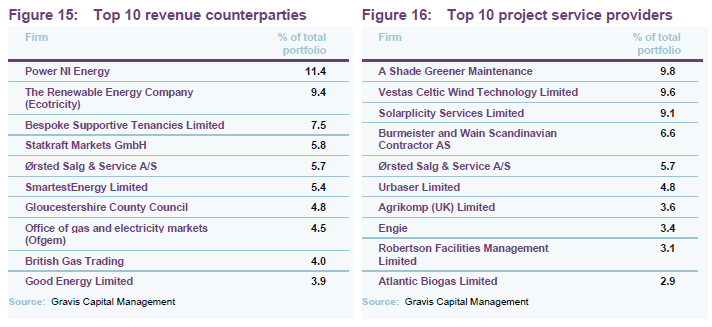

The vast majority of GCP’s sources of revenue are predictable and stable. Exposure to merchant electricity and gas accounted for just 18% of GCP’s revenue at end September 2020.

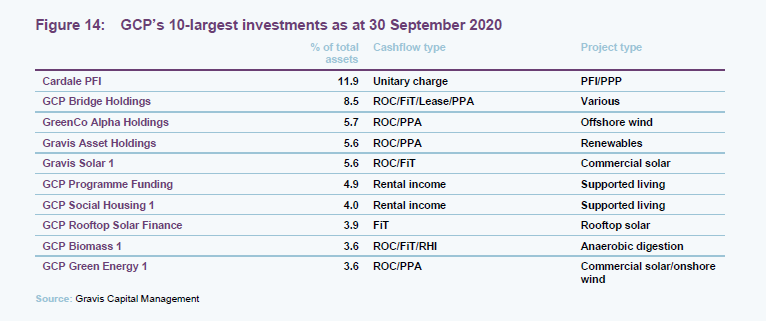

Top 10 investments

Update on social housing

GCP’s adviser has said previously that it would not invest in new projects in this sector. However, the storm of negative publicity that surrounded the Regulator for Social Housing’s non-compliance gradings for a number of registered providers (RPs) of social housing has eased over the past year. The adviser notes that these RPs have been working to improve processes, people and systems to allay the regulator’s concerns. The REITs that focus on this part of the market are back trading at asset value. The adviser believes that “the fundamentals of the sector, underpinned by a well‑protected housing benefit budget and a care model that has demonstrated healthcare and financial benefits for the recipients, remain attractive”. However, the adviser also notes that there is increased competition in this sector.

Subject to attractive returns being available, we would support further investment in this area. The adviser and the board note the regulator’s desire to see more private investment in the sector and are keeping the position under review.

Recent investment – geothermal energy

GCP has committed to provide £8m of finance in support of a project to supply heat to the Eden Project in Cornwall. The heat will be supplied by geothermal energy. £4m of this financing had been drawn down by 16 December 2020.

Pipeline of potential new investments

At 30 September 2020, GCP’s adviser had an active pipeline of around £150m of investment opportunities under consideration. These included follow-on investments in existing assets, operational projects in the anaerobic digestion and biomass sectors, portfolios of rooftop solar projects (benefiting from the feed-in tariff), large investments in offshore wind transactions, and areas such as geothermal, hydrogen and forestry infrastructure, that benefit from support mechanisms such as the RHI.

Valuation

Each quarter, the investment adviser and a third-party valuation agent (Mazars LLP) reassess the fair value of GCP’s financial assets. Values are based on discounted cash flows, where asset-specific market discount rates are applied to the contractual cash flows of each asset.

The valuation agent decides what the discount rates should be, taking into account:

- UK interest rates;

- changes in spreads for similar credits;

- observable yields on other comparable instruments;

- investor sentiment, activity and pricing in the primary and secondary markets for infrastructure investments; and

- changes to the economic, legal, taxation or regulatory environment.

The expected operational performance of the asset is factored into the valuation. Other factors, such as power prices and inflation rates are factored in where appropriate. The valuations are reviewed by the investment adviser and the board. The directors review and approve the quarterly NAV before publication.

Sensitivities

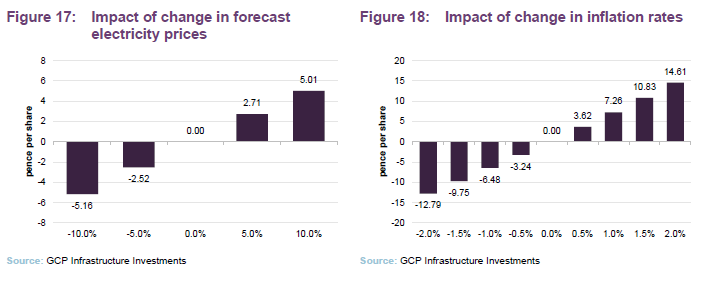

The investment adviser provides sensitivity analysis to a range of factors. Figures 17 and 18 show the impact of changes in power prices and the inflation rate. The portfolio’s sensitivity to power prices has risen as a result of the impairment of biomass loans for the reasons outlined on page 12.

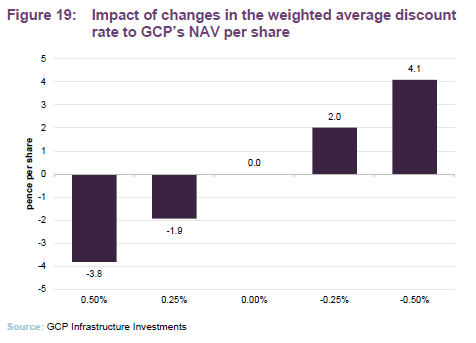

Figure 19 shows the sensitivity of GCP’s NAV per share to changes in the weighted average discount rate. In practice, at 30 September 2020, the discount rates used in the valuation of financial assets ranged from 5.00% to 10.38%.

Performance

NAV progression

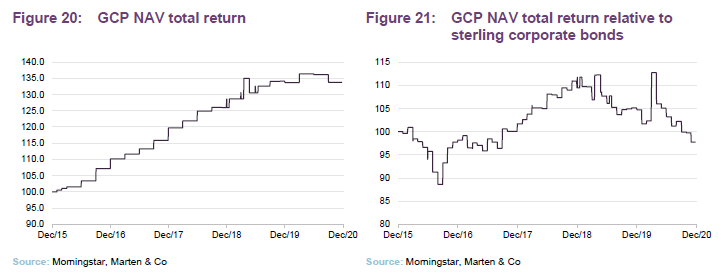

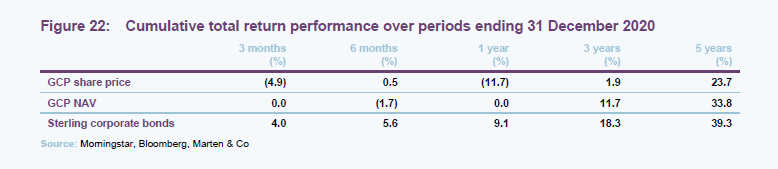

GCP does not have a formal benchmark, but the board chooses to compare its returns to those of a sterling corporate bond index, and we have done so here.

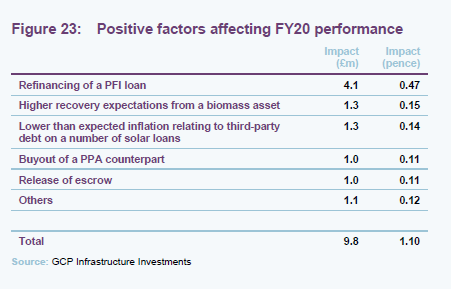

Factors affecting performance over the year to the end of September 2020

Over the 12 months ended 30 September 2020, the weighted average discount rate used to value GCP’s investments fell from 7.58% to 7.44%.

As stated on page 9, recently, the overwhelming influence on GCP’s NAV has been falling projections for power prices. Last year’s problems with some anaerobic digestion plants have also affected this year’s result. Lower-than-expected inflation has both positive and negative implications.

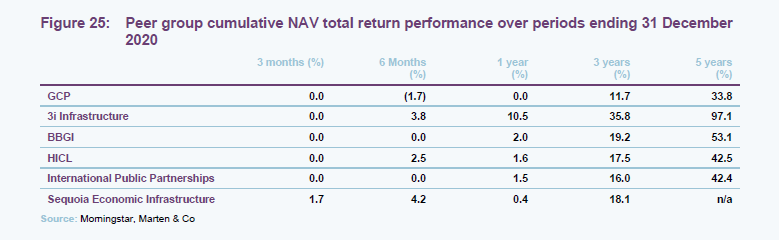

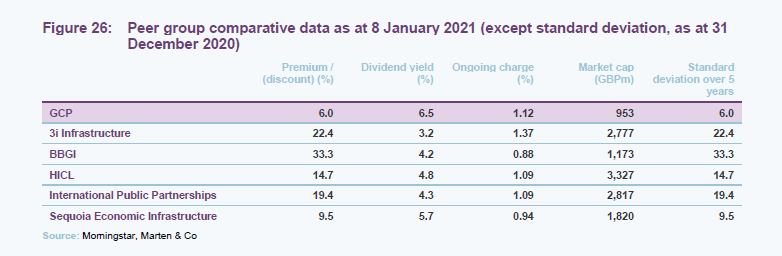

Peer group

GCP sits in the infrastructure sector alongside four funds (3I Infrastructure, BBGI, HICL and International Public Partnerships) which invest primarily in project equity, and one fund (Sequoia Economic Infrastructure) which, like GCP, invests primarily in infrastructure debt, but using a much broader definition of what constitutes infrastructure. We have excluded Infrastructure India (which has a very different risk/reward profile to the rest of the peer group) for the purposes of this note. The equity-focused funds generate higher returns, but as is evidenced in the higher standard deviation of their returns, at the cost of higher risk. GCP’s long-term returns are closer to this group than to its closest peer.

Each of these funds trades on a premium to NAV but GCP’s premium is lower than those of its peers. GCP’s yield is well above those of competing funds. Its ongoing charges ratio is competitive, especially given that it is one of the smaller funds in this group. GCP has the lowest standard deviation of returns in this group, reflecting its bias toward debt investments.

Quarterly dividend

GCP has paid dividends totalling 7.6p a year for the past eight years. For the current financial year ending 30 September 2021, the target dividend has been reduced to 7.0p, reflecting the decline in acceptable rates of risk-adjusted returns available in an environment of ultra-low interest rates (as discussed at length in our last update note). The board and the adviser believe that, at the new lower level of dividend, the current pipeline of investment opportunities is likely to enable GCP to reinvest capital and to support modest potential growth in the dividend.

Dividends are declared and paid quarterly. Shareholders are able to elect to take their dividend as scrip (in shares rather than cash).

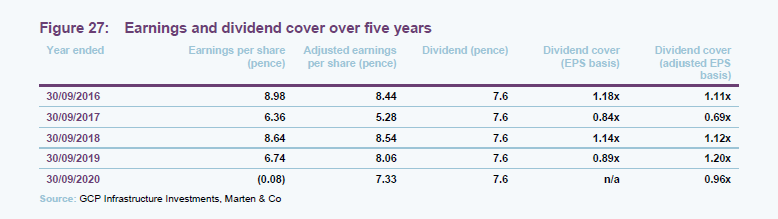

Dividend cover

As discussed on page 18, loans made by the company are valued on a discounted cash flow basis. When a loan is first made, it is typically valued using the interest rate charged to the borrower. However, loans are often revalued by the valuation agent to reflect changes in the market rate of interest or for project specific reasons, for example. As market rates of interest have fallen since GCP was launched, higher values have been attributed to many of the loans that it has made, uplifting the NAV. That has the effect of pulling forward the recognition of income from these loans and, on an IFRS accounting basis, reduces GCP’s earnings per share and dividend cover in subsequent years (a pull-to-par effect). For this reason, we, the board and the investment adviser have calculated a range of alternative performance measures.

Figure 22 shows GCP’s dividend cover ratios on two bases – normal (IFRS) earnings cover, and an adjusted figure which strips out the impact of unrealised fair value adjustments on the company’s earnings and better contrasts GCP’s revenue and dividend payout.

The board and advisers use two other alternative performance measures, including two other measures of dividend cover. The first is based on loan interest accrued for the financial year (less total expenses and finance costs) and the second is a cash earnings cover calculated as the ratio of total cash received per share to the dividend per share. For the year ended 30 September 20202, the dividend cover based on loan interest accrued was 1.01x (FY 2019: 1.16x) and cash earnings cover was 2.98x (FY 2019: 2.29x). This measure does not assume any reinvestment of loans that have been repaid in the period.

We discussed the factors affecting the recent results on page 20. In the 2017 financial year, GCP made a significant investment into a portfolio of loans issued by the Green Investment Bank. The loans took longer to arrange than had been anticipated, and earnings were depressed in that period by GCP holding substantial cash balances.

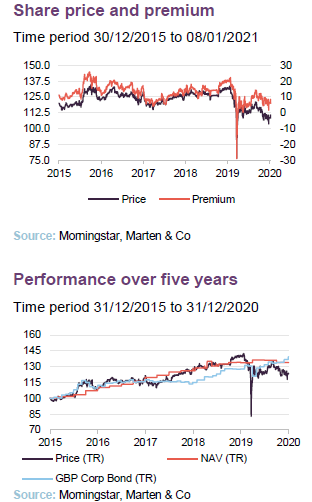

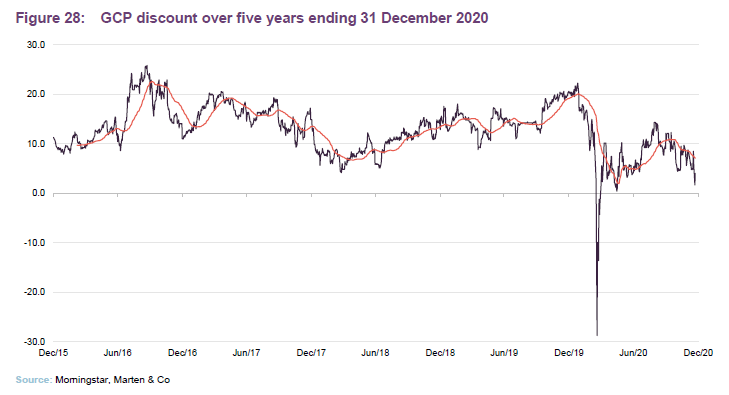

Premium rating

Barring a brief spike at the height of the market panic in March 2020 (when the discount hit 28.8%), GCP has traded at a premium for all of its life.

Over the year ended 31 December 2020, GCP’s premium has averaged 8.7% and hit a high of 22.3%. At 8 January 2021, the premium was 6.5%.

In February 2020, shareholders approved the issuance of up to 20% of GCP’s then-issued share capital without pre-emption. They also approved the repurchase of up to 14.99% of the then-issued share capital. Repurchased shares could be held in treasury and reissued at the board’s discretion. The board does not issue shares in an attempt to moderate the premium. However, it would consider buying back shares if the shares were trading at a discount to NAV.

Over the course of its financial year ending 30 September 2020, GCP issued 1,898,910 shares to satisfy demand for scrip dividends and a further 791,944 shares were issued in December for the same reason. No shares were repurchased.

Fees and costs

The investment adviser receives an investment advisory fee of 0.9% a year of the NAV net of cash. This fee is calculated and payable quarterly in arrears. There is no performance fee. The investment adviser is also entitled to an arrangement fee of up to 1% (at its discretion) of the cost of each asset acquired by GCP. Gravis will generally seek to charge the arrangement fee to borrowers rather than to the company where possible. To the extent that any arrangement fee negotiated by the investment adviser with a borrower exceeds 1%, the benefit of any such excess shall be paid to the company. The investment adviser also receives a fee of £70,000 (subject to RPI adjustments) a year for acting as AIFM.

The investment advisory agreement may be terminated by either party on 24 months’ written notice.

Apex Financial Services (Alternative Funds) Limited is GCP’s administrator and company secretary. The fee for the provision of administration and company secretarial services during the year was £726,000 (30 September 2019: £739,000).

Depositary services are provided by Apex Financial Services (Corporate) Limited. The fee for the provision of these services during the year was £298,000 unchanged from the prior year.

Valuation agent fees totalled £220,000 for the year ended 30 September 2020 (30 September 2019: £258,000).

The ongoing charges ratio for the year ended 30 September 2020 was 1.1%, unchanged from the prior year.

Capital structure and life

GCP has 880,457,993 ordinary shares outstanding and no other classes of share capital. The company’s financial year end is 30 September and AGMs are held in February.

GCP is an evergreen fund with no fixed life and no regular continuation vote.

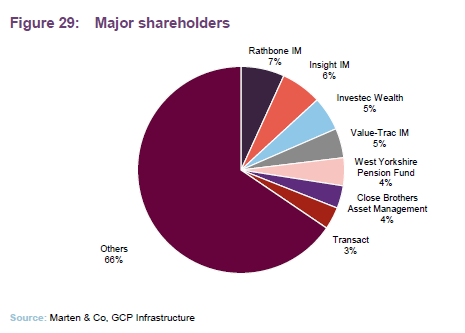

Major shareholders

Gearing

Structural gearing of investments is permitted up to a maximum of 20% of NAV immediately following drawdown of the relevant debt. At 30 September 2020, GCP’s net gearing was 12.7%.

GCP has revolving credit facilities totalling £165m available to it, of which £138m was drawn down at 30 September 2020. GCP has a three-year £115m revolving facility arrangement with RBSI, ING and NIBC (‘Facility A’), of which £88m was drawn down at 30 September 2020, and a three-year £50m fixed‑term facility with RBSI and ING (‘Facility B’).

Interest on amounts drawn under Facility A and Facility B is charged at LIBOR plus 1.9% per annum. A commitment fee is payable on undrawn amounts of 0.67% on Facility A. No commitment fee is payable on Facility B as this is fixed to be fully drawn for the life of the loan. The revolving credit facilities include loan-to-value and interest cover covenants that are measured at company level.

These facilities mature in March 2021. The board says that the process of refinancing these is well-progressed and on track to complete ahead of the expiry of the current facilities. The intention is to secure similar three-year flexible arrangements.

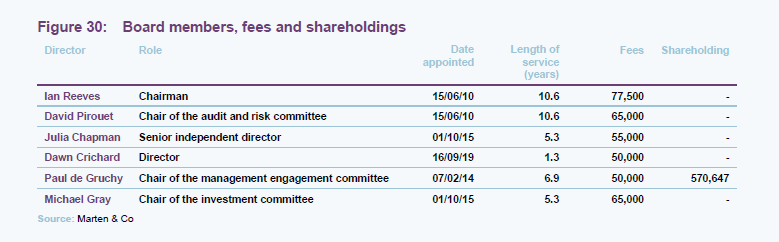

Board

Currently, the board has six directors, all of whom are non-executive and independent of the investment adviser.

David Pirouet will retire following the conclusion of GCP’s AGM in February 2021. A new director, Steven Wilderspin, has been recruited to replace him. He will assume the chairmanship of the audit and risk committee.

Dawn Crichard has been allocated specific responsibility for consideration of broader ESG themes and ensuring that GCP continues its strong commitment to sustainability.

The board believes that the chairman should continue to lead the company until the AGM in February 2022. It is the intention of the board to present further details of the succession plan in the half-yearly report for the period ended 31 March 2021.

It is very unusual, in our experience, that only one director has a personal investment in the company.

Ian Reeves CBE (Chairman)

Ian Reeves CBE, a Jersey resident, is the CEO and co-founder of Synaps International Limited, the senior independent director of Triple Point Social Housing REIT Plc and a director of several other private companies. He is also visiting professor of Infrastructure Investment and Construction at The Alliance Manchester Business School. Ian was founder and chairman of High‑Point Rendel Group Plc, president and CEO of Cleveland Bridge, chairman of McGee Group, and chairman of the London regional council of the CBI. He was made a CBE in 2003 for his services to business and charity.

David Pirouet (chair of the audit and risk committee)

David Pirouet, a Jersey resident, is a qualified Chartered Accountant. He was an audit and assurance partner for over 20 years with PwC CI LLP until he retired in June 2009. He specialised in the financial services sector, in particular in the alternative investment management area. Subsequent to this, he has served on the boards of a number of private and listed investment funds. David also sits on the board of AIM-listed EPE Special Opportunities Limited.

Julia Chapman (senior independent director)

Julia Chapman, a Jersey resident, is a solicitor qualified in England & Wales and Jersey with over 30 years’ experience in the investment fund and capital markets sector. Having trained with Simmons & Simmons in London, Julia moved to Jersey to work for Mourant du Feu (now known as Mourant) and became a partner in 1999.

She was then appointed general counsel to Mourant International Finance Administration (which provided services to alternative investment funds). Julia serves on the boards of three other Main Market listed companies: Henderson Far East Income Limited, BH Global Limited and Sanne Group Plc.

Dawn Crichard

Dawn Crichard, a Jersey resident, is a Fellow of the Institute of Chartered Accountants of England and Wales with over 20 years’ experience in senior chief financial officer and financial director positions. Having qualified with Deloitte, Dawn moved into the commercial sector and was chief financial officer of a large private construction group for 12 years. Following this, she was appointed as chief financial officer for Bathroom Brands Plc. Her broad accounting and commercial experience includes establishing new group head offices, mergers, acquisitions, refinancing and restructuring.

Paul de Gruchy (chair of the management engagement committee)

Paul De Gruchy, a UK resident, is a qualified Jersey Advocate with 20 years’ experience in financial services law. Paul was previously the head of Legal for BNP Paribas Jersey within the UK offshore area. He has extensive experience in the financial services sector, in particular in the area of offshore funds. He has held senior positions at the Jersey Economic Development Department, where he was the director responsible for finance industry development, and the Jersey Financial Services Commission.

Michael Gray (chair of the investment committee)

Michael Gray, a Jersey resident, is a qualified corporate banker and corporate treasurer. Michael was most recently the regional managing director, Corporate Banking for RBS International, based in Jersey, but with responsibility for The Royal Bank of Scotland’s Corporate Banking Business in the Crown Dependencies and British Overseas Territories.

In a career spanning 31 years with The Royal Bank of Scotland Group Plc, Michael has undertaken a variety of roles, including that of an auditor, and has extensive general management and lending experience across a number of industries. He is also a non-executive director of Jersey Finance Limited, the promotional body for the finance sector in Jersey, and a Main Market listed company, JTC Plc.

Steven Wilderspin (incoming director)

Steven Wilderspin is a chartered accountant and has extensive governance experience on public and private company boards, with more than 10 years’ experience as a non-executive director on the boards of private equity partnerships and listed investment companies. He was chair of the audit and risk committee of 3i Infrastructure Plc for the majority of the period from 2007 until he retired from its board on 31 December 2017.

Steven is currently the chair of the audit and risk committee of HarbourVest Global Private Equity Limited, and chair of the risk committee of Blackstone/GSO Loan Financing Limited.

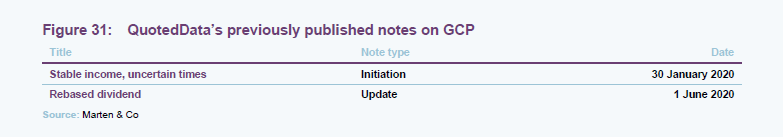

Previous publications

Readers interested in further information about GCP may wish to read our previous notes (details are provided in Figure 31 below). You can read the notes by clicking on them in Figure 31 or by visiting our website.

The legal bit

This marketing communication has been prepared for GCP Infrastructure Investments Limited by Marten & Co (which is authorised and regulated by the Financial Conduct Authority) and is non-independent research as defined under Article 36 of the Commission Delegated Regulation (EU) 2017/565 of 25 April 2016 supplementing the Markets in Financial Instruments Directive (MIFID). It is intended for use by investment professionals as defined in article 19 (5) of the Financial Services Act 2000 (Financial Promotion) Order 2005. Marten & Co is not authorised to give advice to retail clients and, if you are not a professional investor, or in any other way are prohibited or restricted from receiving this information, you should disregard it. The note does not have regard to the specific investment objectives, financial situation and needs of any specific person who may receive it.

The note has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. The analysts who prepared this note are not constrained from dealing ahead of it but, in practice, and in accordance with our internal code of good conduct, will refrain from doing so for the period from which they first obtained the information necessary to prepare the note until one month after the note’s publication. Nevertheless, they may have an interest in any of the securities mentioned within this note.

This note has been compiled from publicly available information. This note is not directed at any person in any jurisdiction where (by reason of that person’s nationality, residence or otherwise) the publication or availability of this note is prohibited.

Accuracy of Content: Whilst Marten & Co uses reasonable efforts to obtain information from sources which we believe to be reliable and to ensure that the information in this note is up to date and accurate, we make no representation or warranty that the information contained in this note is accurate, reliable or complete. The information contained in this note is provided by Marten & Co for personal use and information purposes generally. You are solely liable for any use you may make of this information. The information is inherently subject to change without notice and may become outdated. You, therefore, should verify any information obtained from this note before you use it.

No Advice: Nothing contained in this note constitutes or should be construed to constitute investment, legal, tax or other advice.

No Representation or Warranty: No representation, warranty or guarantee of any kind, express or implied is given by Marten & Co in respect of any information contained on this note.

Exclusion of Liability: To the fullest extent allowed by law, Marten & Co shall not be liable for any direct or indirect losses, damages, costs or expenses incurred or suffered by you arising out or in connection with the access to, use of or reliance on any information contained on this note. In no circumstance shall Marten & Co and its employees have any liability for consequential or special damages.

Governing Law and Jurisdiction: These terms and conditions and all matters connected with them, are governed by the laws of England and Wales and shall be subject to the exclusive jurisdiction of the English courts. If you access this note from outside the UK, you are responsible for ensuring compliance with any local laws relating to access.

No information contained in this note shall form the basis of, or be relied upon in connection with, any offer or commitment whatsoever in any jurisdiction.

Investment Performance Information: Please remember that past performance is not necessarily a guide to the future and that the value of shares and the income from them can go down as well as up. Exchange rates may also cause the value of underlying overseas investments to go down as well as up. Marten & Co may write on companies that use gearing in a number of forms that can increase volatility and, in some cases, to a complete loss of an investment.