Henderson High Income

Investment companies | Update | 14 December 2023

Improving outlook on a double discount

Henderson High Income (HHI) has recently announced that Henderson Diversified Income will be merged into it, subject to shareholder approval, which will add advantages of scale to HHI in the coming months. For the new HHI shareholders, the timing of this merger may be fortuitous, as HHI’s manager David Smith believes that a number of key risks facing the UK equity market are reducing: it is likely to avoid a material recession, inflationary pressures have diminished, and political risk should fall away as the next government seems likely to be more centrist.

David’s bullishness has led him to rotate HHI into unloved UK mid cap companies, while also increasing HHI’s bond exposure to take advantage of higher yields on offer. The combination of the discount on UK stocks with HHI’s current share price discount of 8.4% (which is below its three-year average) offers an attractive entry point.

High income from a diverse UK equity income portfolio

HHI invests in a prudently diversified selection of both well-known and smaller companies to provide investors with a high income stream while also maintaining the prospect of capital growth. Gearing is used to enhance income returns, and also to achieve capital growth over time. A portion of gearing is usually invested in fixed-interest securities, which helps dampen the overall volatility of the trust.

New year, new look

Since our annual overview note (published in September), HHI has revealed plans to merge with Henderson Diversified Income (HDIV), a bond strategy run by the same team that helps manage HHI’s fixed income sleeve.

HHI may soon merge with Henderson Diversified Income Trust

It was announced on 4 October that HDIV would, subject to shareholder approval, wind down its strategy and give its shareholders the option to either receive new HHI shares and/or realise part, or all, of their holding for cash. The background to the decision was the board’s belief that the current market environment is no longer conducive for HDIV’s fund managers to take advantage of their ability to invest in loans and so the board was concerned about the ability of HDIV to maintain income levels and the capital value of the trust in real terms in the future.

HHI is a natural choice for HDIV to be merged into. It provides some management continuity, given both trusts are run by Janus Henderson and the HDIV team will remain involved with the management of HHI. HHI, with its more flexible mandate, and its ability to purchase the inflation/interest rate ‘winners’ like energy and banking stocks, allows its shareholders to benefit from the upside of the market environment that has negatively impacted HDIV. HHI is better able to protect investors’ capital, offers a comparable yield with better prospects of dividend growth, and should be a bigger, more appealing, more liquid, and more efficient trust.

We covered the mechanics of the merger in more detail in a previous note.

A recent prospectus has been published by the board of HHI detailing the exact terms of the merger, which can be read here.

Market outlook – key questions answered

Some of the major questions around the UK economy may have finally been answered

The UK market is plagued by uncertainty: have interest rates peaked? Is the economy about to enter a recession? When will the next general election be and what will the new government’s policies be? Though, in fairness, these have been the same questions that pundits have been asking for virtually the entirety of 2023. What has changed over the year is that forecasts are being formed with greater certainty than before, thanks to more positive economic data and the shorter time frame until the next UK election. HHI’s manager, David Smith, believes that the risks around these three key issues may finally be subsiding.

It helps a great deal that end-October inflation came in below expectations in the US, EU and the UK. This raised hopes that we have seen the peak in interest rates. Nevertheless, the feeling is that rates will settle a lot higher than they were a couple of years ago, as a ‘higher for longer’ mantra is adopted by central banks. The general consensus amongst these policy makers is that the long-term impacts of heightened inflation are more dangerous than the shorter-term pain of high interest rates.

UK real wage growth makes a recession increasingly unlikely

David is optimistic that real wage growth of about 2% next year will cushion the UK economy from the lagged effect of higher rates. He notes that the UK has never entered a recession at a time of real wage growth. This can be attributed to a very robust labour market, with UK employees continuing to command wage growth of a nominal 7.8% year-on-year (YoY) as of August. It appears that this may be surviving the fall in inflation, which has led to the growth in real wages that fuels David’s optimism, as can be seen in Figure 1, especially against low expectations. He also notes that the average UK consumer has also been paying down debt, meaning their finances are relatively healthy.

The UK economy may be heading for a soft landing

David in fact believes that the UK is likely to see a ‘soft landing’, whereby policy makers will be able to tame inflation without triggering a material decline in UK economic output. The same also appears to be happening in the US, albeit with much more positive growth figures and lower inflation. HHI is overwhelmingly invested in UK assets, however the international nature of many of its portfolio companies’ operations means HHI will benefit from this. While the nominal growth prospects of the UK may seem low, it is important to contextualise how hard it is to achieve a soft landing, as the majority of rate hiking cycles have historically led to recessions.

As for next year’s elections, David points to studies that suggest that long term (since 1955) GDP growth averages are much the same under Labour and Tory governments. He also observes that the Labour Party is more centrist than it has been in some years, and it appears to be reasonably business friendly in its engagement with companies. Even the Conservative Party may be taking a step back towards the centre, with the reinstatement of David Cameron in British politics being one example. Once the current bout of infighting subsides, for the first time in a decade, the British public may end up being able to choose between two more optically centrist parties.

Now cheaper than chips

Inflation, growth, and politics have not been the only issues clouding the UK equity market, as global investors place a perennial discount on UK equites, which David thinks may soon dissipate.

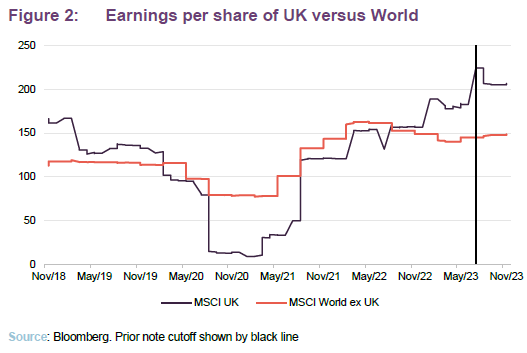

UK earnings remain strong, especially when compared to its international peers

In our September note we commented on the relative strength of UK earnings to their peers, having surpassed them earlier in 2023. As can be seen in Figure 2, this trend has continued (with the data cutoff shown by the black line), with UK earnings comfortably above their global peers.

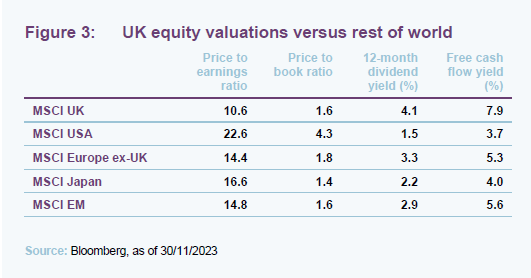

UK mid and small caps are becoming increasingly attractive when compared to large cap valuations

This rise in earnings has not been met with a rise in valuations however, as the UK continues to remain cheaper than its peers. We draw readers’ attention to the much higher free cashflow yield of the UK in particular, as this is a key metric for income investors. The ability to convert earnings into cash is important in ensuring there is available capital to fund dividend increases. It also provides support for share buybacks which together with cheap valuations in the UK market has seen UK corporates introduce significant share buybacks, so much so that the FTSE 100 in aggregate is now buying back more shares as a percentage of market cap than the S&P 500.

Most of the UK market is undervalued to a greater extent, given that recent rises in the UK index have been driven by the largest companies. David says there is a greater than 40 percentage point gap in the performance of the 20-largest stocks (a sub-section dominated by the giant, internationally exposed, energy and resource stocks as well as the UK’s banking giants) relative to the FTSE 250 index. David says that the valuation gap between UK large and small has become so great that the FTSE 250 index trades on a lower valuation than the FTSE 100, at a P/E ratio of 10.4x and 10.9x respectively, something that has only happened twice in the last 30 years.

Generally speaking, David has a quiet confidence in the opportunity presented by the UK’s current valuation discount, believing that HHI’s ‘double discount’ (the combination of the low valuation of its holdings and the trust’s own discount) makes it an opportune time to buy. Especially when one considers the fact that, in his mind, the UK may have avoided realising the major risks that dogged it.

Asset allocation

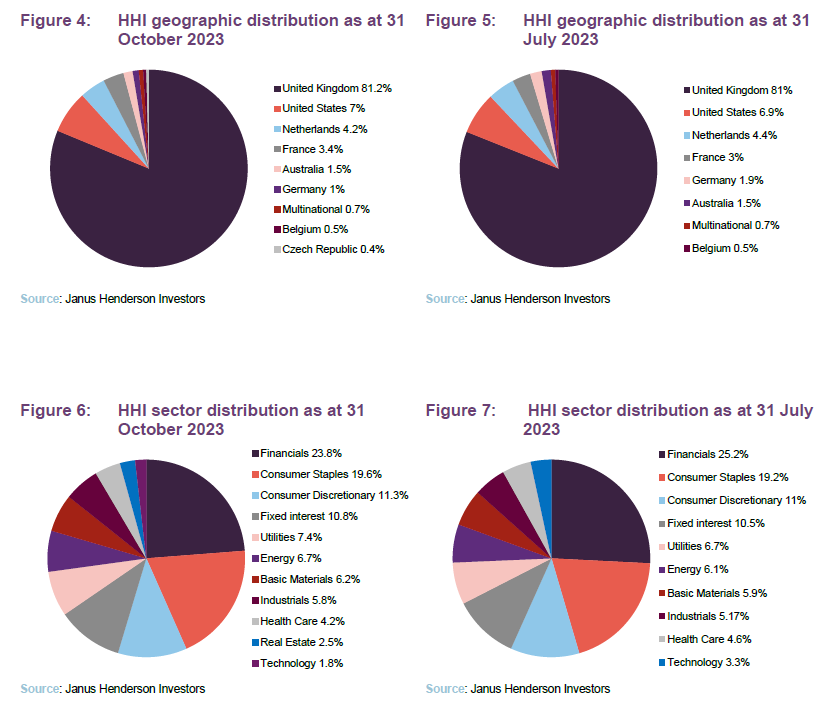

While only a few months have passed since the September note, the headline change in HHI has been a shift from UK large caps to UK mid caps, to capitalise on the relative valuation opportunity we alluded to on page 5. While not immediately apparent from Figures 4 to 7, HHI now has a higher allocation to mid cap stocks and lower allocation to large caps.

HHI is increasing its allocation to UK small and mid-caps, and bonds

On an aggregate sector and regional level there has been no material shift in the regional or sectoral allocations. Shifts in sectoral or region allocations are instead a reflection of stock specific factors, such as share price appreciation or new purchases. At a geographical level HHI retains its c.80% allocation to the UK, with its 20% overseas exposure present to ensure good portfolio diversification, as well as opening up HHI to investing in sectors that are underrepresented in the UK: with one example being HHI’s investment in Texas Instruments, the US semiconductor manufacturer. HHI’s international exposure is also attributable to its fixed income exposure, which has an allocation to overseas corporate bonds predominantly in the US.

On a sector level HHI’s largest allocations remain in financial and consumer stocks.

David has increased HHI’s bond exposure in recent months, with its current allocation now around 16% of net assets (as of October 2023). This increased allocation comes on the back of the higher yields available.

Portfolio breakdown

Top 10 holdings

Turnover within the portfolio is low, reflecting the manager’s long-term approach. There are two new entrants to HHI’s top 10 holdings when compared to September’s note: Imperial Brands and Shell. These replaced Tesco and NatWest Group. There are currently 95 holdings in total.

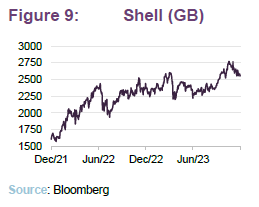

Shell

Shell is the global leader in the energy sector and the largest company within the UK market with a market cap of £167bn. There has been little trading activity by David in Shell, instead its inclusion in HHI’s top 10 is a result of its strong performance over the past six months, up 16% between May and November.

The major factor behind Shell’s impressive performance has been the rise in oil prices since July, though its shares have fallen off somewhat given the recent reversal in oil prices on the back of surging US oil production and at fears over slowing demand. Shell’s improving share price can be attributed to the company’s positive Q3 results, which announced $6.2bn in profits, up $0.9bn from the previous quarter and largely in line with estimates, and included a 17% increase in its quarterly share buyback.

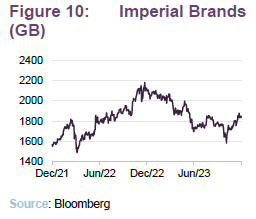

Imperial Brands

Imperial Brands is a global tobacco giant, and world’s fourth largest tobacco company. Imperial Brands released its financial year results in November (for the year ending 30 September). The company reported higher profits, which showed momentum building in its operational turnaround strategy. The company’s cash flow was also strong, with the dividend increased by 4% and share buyback by 10%.

Portfolio changes

David has made several new additions and sales in the portfolio over the last six months which do not yet appear in HHI’s top 10 holdings.

Purchases

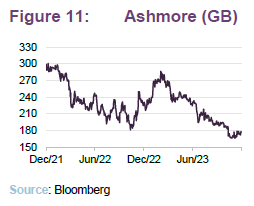

Ashmore

Ashmore is a UK asset manager that focuses on emerging market debt investing, having developed a well-known brand within the professional investment community. Ashmore is also a member of the FTSE 250 index and is part of the cohort of mid and small cap investments David has recently made.

Given its strong investment biases, Ashmore’s fortunes are directly linked to the performance of the wider emerging market debt universe. While this has historically weighed on Ashmore’s share price, given the underperformance of the asset class, it is also the reason why David has recently decided to initiate a position. He believes that the general prospect for global bonds is improving, given the likelihood that we have now passed peak global inflation and interest rates, which should be a tailwind for Ashmore. He also notes that emerging market debt remains a component of most professionally-managed portfolios, given its diversification benefits, which should see continued long term support when the asset class comes back into favour.

Ashmore is also a disciplined dividend payer, with its management team committed to maintaining its 16.9p per share dividend, even during the underperformance of the asset class, with Ashmore currently yielding 8.9%.

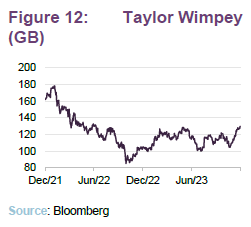

Taylor Wimpey

Taylor Wimpey is a large UK housebuilder and member of the FTSE 100. While the rise in interest rates and previous worries of economic stagnation had led the market to spur UK housebuilders, fearing a structural decline in housing demand, David believes that these expectations are overly bearish and views the market selloff as an attractive entry point. Not only have house prices begun to show signs of stabilising, rising by 0.2% in November, but David also highlights the “rock solid” balance sheets of house builders, and general good financial health of the sector. In the case of Taylor Wimpey, its management team have tested its cashflow for multiple bearish scenarios to ensure that it can sustain its dividend.

He also notes that because of the recent selloff, Taylor Wimpey now trades on a discount to its listed NAV (which is a function of the total properties and assets it has on its balance sheet, and its future pipeline, making its NAV calculations less subjective). Taylor Wimpey thus not only offers a source of reliable, and high income (Taylor Wimpey currently yields 7.1%), but it also brings with it the upside of a potential rebound as UK housing expectations stabilise.

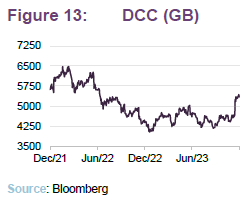

DCC

DCC is an industrial holding company and member of the FTSE 100, though it is one of the smallest constituents of the index. DCC is split into three divisions: DCC Energy, DCC Healthcare and DCC Technology. David highlights DCC’s Energy segment as one of the key motivations in his purchase of the company. He notes that DCC is a leader in off grid energy, e.g. gas container distribution. The whole of the grid energy sector has been slow to move towards sustainable alternatives, however DCC is one of the few distributors of low carbon alternatives, such as biofuel. Beyond its off-grid energy segment, DCC can also offer its customers solar installation services, further capturing the demand for low-carbon energy.

DCC’s share price has been in general decline over the last five years, despite its earnings growth, with its revenues and profits both up c.70% over five years. David’s recent purchase reflects his belief that the current valuation of DCC is not sufficient given its growth prospects, having bought into the stock at a c.10x P/E (he notes that it was trading on a P/E of 19x two years ago). He also notes that DCC’s non energy businesses have been discounted from its share price, with its healthcare arm being of particular attraction given its high cash generation. DCC’s earnings have finally begun to be appreciated, its share price rallied on the back of its recent earnings call held in November. DCC announced 12% profit growth over the first half of its financial year as well as outlining a £310m commitment to acquisitions within its energy division.

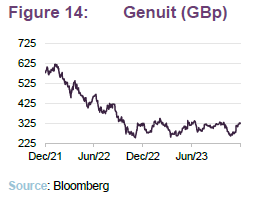

Genuit

Genuit is a UK based company that designs and manufactures plastic piping systems. This is another reflection of David’s desire to have greater exposure to the UK small and mid cap space. Over the past year Genuit’s share price has been volatile, but ultimately bounded, trading between 250 and 350 pence per share. The inability to gain ground reflects what David believes is an overly pessimistic view on the demand for Genuit’s products. In fact, he thinks that Genuit’s orders are more resilient than the market believes, with its revenues remaining robust over its last two financial years, though it has seen a marginal decline in its recent half year results.

More than simply being oversold by the market, David also believes that there are structural tailwinds supporting Genuit’s outlook. Its plastic PVC products have a strong sustainability angle, as they offer a durable, efficient, long-term solution to the world’s ailing metal piping infrastructure. Genuit also has a direct correlation to GDP, as piping is a key part of infrastructure spending, so an improving outlook for the UK and global economy should be supportive for Genuit’s order book. David is also encouraged by the appointment of a new CEO who he believes will be focused on cost cutting and margin expansion.

Sales

These recent purchases have been funded in part by several sales. These include Sage, the accounting software firm. He sold out of his 2.1% position in Sage due to fears that the market’s expectations had become too high for the company, with it hitting a P/E of c.30x and its yield falling to 2%. He saw better valuation opportunities elsewhere.

Well ahead of the recent Panorama programme, David also sold out of United Utilities, (a 1.2% position). David feared the political risk associated with the wider utility sector, as the industry enters a ‘review period’. He had justified concerns around the treatment of wastewater by utility companies, compounding the regulatory risk. David questions to what extent the regulator will allow water utility companies to generate suitable returns on the investment needed in wastewater infrastructure. He has opted to keep HHI’s exposure in higher quality utility companies, like Scottish Southern Energy.

David also sold HHI’s 1.5% position in Vistry, a UK housebuilder. The catalyst for this was a change in Vistry’s business model, moving away from conventional housebuilding towards a public/private partnership model for building social houses. Although the strategy change wasn’t the reason to sell, the company also elected to drop its dividend programme in favour of share buybacks, which sealed its fate in being incompatible with HHI’s income requirements.

The final noteworthy sale was a reduction in HHI’s exposure to AstraZenca, the pharmaceutical giant, which David made on the back of strong performance and heightened valuations.

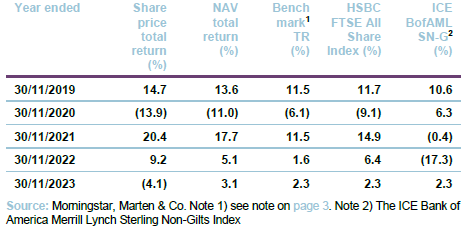

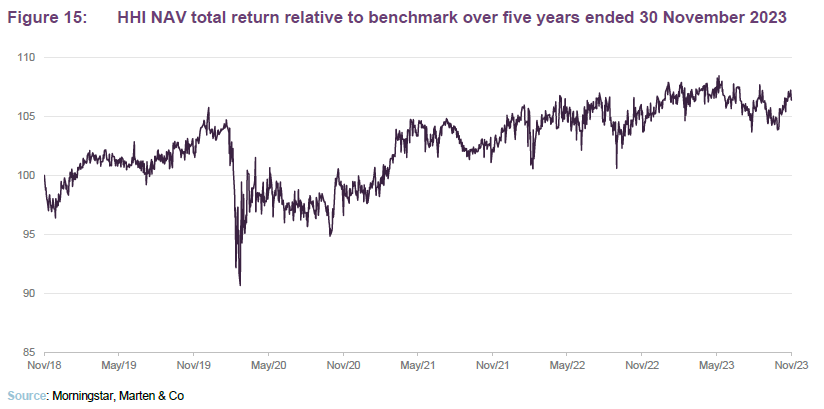

Performance

Given HHI’s bias to value stocks it is no surprise that it saw its relative performance improve in the aftermath of the COVID-19 growth rally, with its outperformance accelerating in the latter months of 2020 and into 2021. Since 2022 HHI’s outperformance has crept up more slowly, largely fluctuating around a c.5% outperformance.

HHI has been able to outperform its benchmark, and the wider UK equity market, over the long term

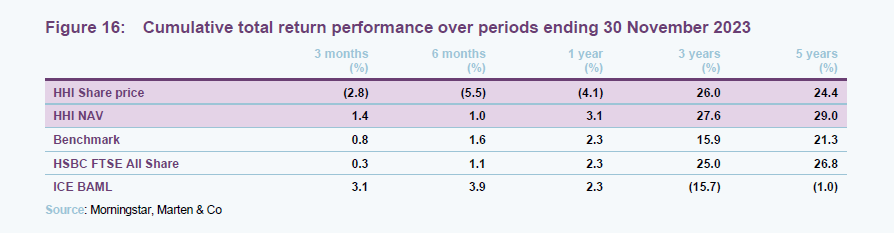

HHI’s performance over the last two years reflects the realities of the UK equity market, which is one that has been driven by a narrow band of stocks, typically energy, banks and resources (the staples of value investing). These have historically had a presence within HHI’s portfolio, meaning that while it has shown positive nominal performance, as shown by Figure 16, its NAV returns have largely kept up with its benchmark as they both share the common tailwinds behind UK value investing.

While David has not fully capitalised on these tailwinds in the same way the All Share has, given his comparative underweight, he has benefited from his ability to adjust his bond weighting over the past few years, bringing it down to half that of its benchmark at the end of 2021 (allowing HHI to be less affected by the bond selloff) and only rebuilding exposure as higher yields became available.

HHI has been able to outperform not only its benchmark but also the wider UK equity market over one, three, and five years. We note that HHI’s outperformance of the All Share (its choice of equity benchmark, represented here by the returns on an All-Share tracker ETF) over the longer term is particularly impressive given the substantial underperformance of bonds over both three and five years. HHI’s long-term outperformance does act as evidence to the successful sector and stock selection of David, which contributed 1.3% and 2.2% respectively over the last five years.

Performance contributors

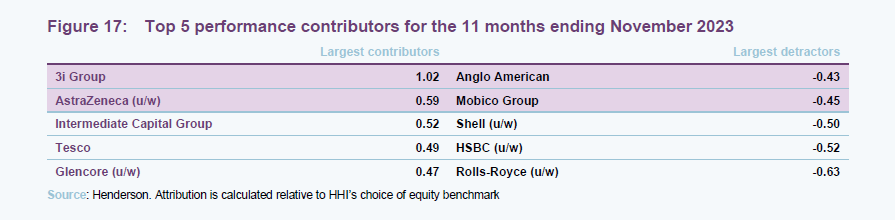

David has kindly provided us with the major contributors to HHI’s year-to-date performance, as can be seen in Figure 17.

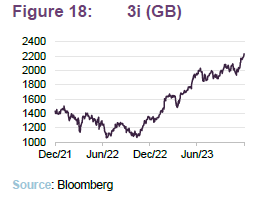

The largest contributor to HHI returns was 3i Group, the UK based private equity firm. The majority of 3i’s strong performance has been helped by its largest holding, Action, the European discount retailer. Action’s strong performance can be attributed to the ‘cost of living’ crisis that gripped Europe, which has driven consumers towards lower-cost retailers, but also good management decisions by Action, whereby they have focused on reducing costs within the company and being competitive on consumer prices. 3i’s share price continues to hit all-time highs, with the company up 71% year-to-date.

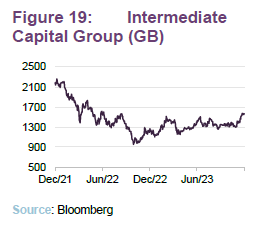

Intermediate Capital Group (ICG) is another private equity firm, though its assets are invested across a range of security types, including both private debt and equity. ICG’s strong YTD performance can be attributed to its strong half year results, with the company delivering a better-than-expected deployment of its private debt strategies, and an overall positive investment return from across its balance sheet. ICG’s profits beat analyst expectations for the period, with its fund management profits having grown by 13% before tax.

The final noteworthy contributor has been Tesco, the UK supermarket giant. Tesco’s gains have come on the back of rising profits and increasing market share, as well as a falling cost of goods now that inflation is easing, with Tesco’s recent half year results reporting an 9% increase in UK sales. Its management has improved its guidance on the back of this stronger performance, expecting to deliver an operating profit of between £2.6bn and £2.7bn, up from the £2.5bn it previously forecasted.

The other positive contributors, AstraZeneca and Glencore, are a result of David being underweight and not holding these stocks respectively during a period of poor performance. We note that three of the largest detractors are for similar reasons, as HHI owns both Shall and HSBC but is underweight given the large index weights of the companies. HHI does not own Rolls Royce given the current lack of dividend.

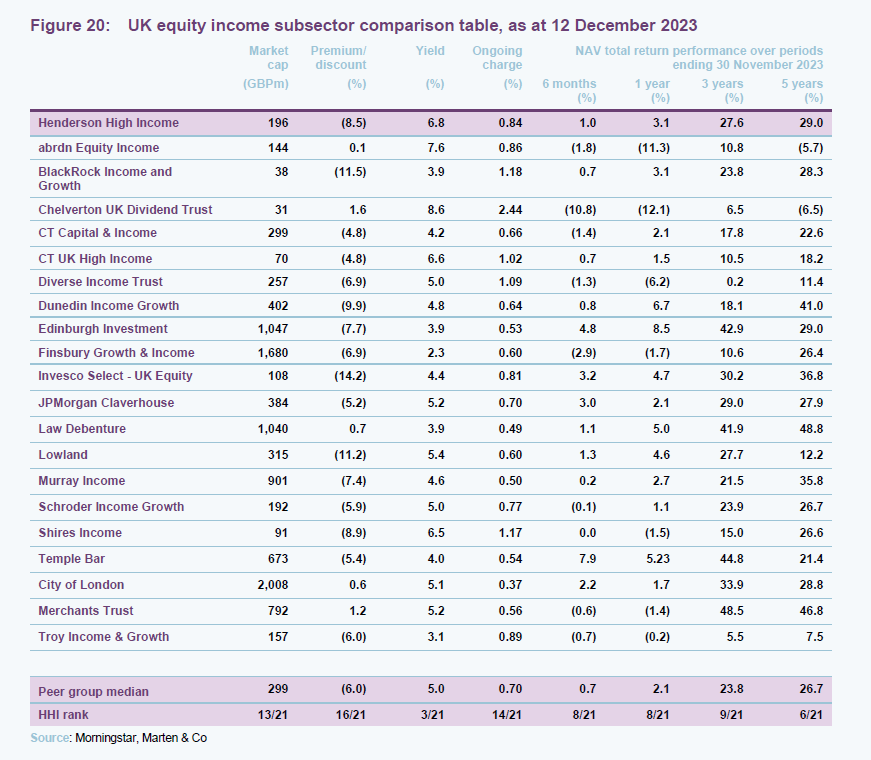

Peer group

Up-to-date information on HHI is available here

HHI sits within the AIC’s UK Equity & Bond Income sector. However, given its investment objective, and the nature of its holdings, we believe it is fair to compare HHI to the UK Equity Income sector, which has similar equity exposures and yield profiles.

HHI ranks amongst the top performing UK income trusts over the last three years

As was the case in our last note, HHI’s NAV total return ranks in the top half of the table over one, three and five years; and ranking in the top third over five years. We note that over the past couple of years HHI’s blend of fixed income and equity could be viewed as a hinderance relative to a purely listed equity strategy, given the underperformance of that asset class versus equites (see Figure 16). A fact which makes HHI’s outperformance of a predominantly listed equity peer group more impressive than it may have seemed at first glance.

HHI offers one the of highest yields amongst its peers

Outside of its performance, HHI offers one of the highest yields in the peer group and is available on a discount that is wider than the peer group’s average. Whilst its 0.84% OCF may be competitive by other sectors’ standards, it ranks in the bottom half of its peers. The OCF will improve post-merger, however. Its market cap sits dead centre of the peer group and will rise should its combination with HDIV be approved.

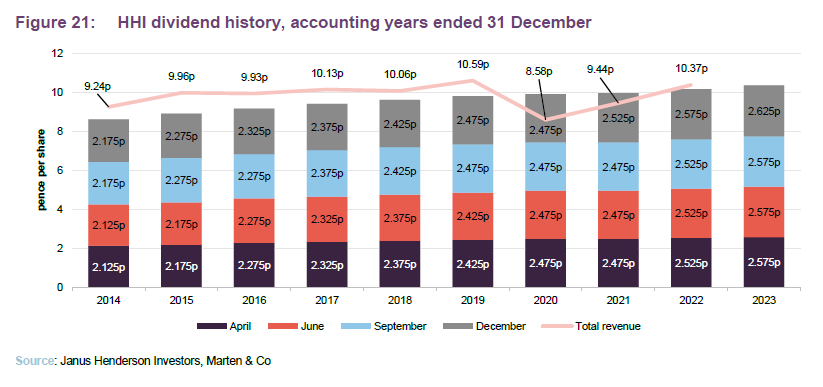

Dividend

HHI has recently made its 11th consecutive dividend increase, further embedding it amongst the AIC’s next generation of dividend heroes. Over these 11 years HHI has achieved a compounding annual dividend growth rate of 2%. The recent surge in inflation means that it trailed CPI of 2.4% per annum over the same period.

HHI’s most recent dividend, 10.35p per share, was also 2% higher than that of its prior year. HHI’s dividend yield of 6.8% is not only comfortably above the current levels offered by cash deposits, but it is also one of the highest yielding UK equity trusts.

HHI has 11 years of consecutive dividend increases

While HHI is yet to release its revenue figures for its current financial year, David remains confident that HHI’s revenue will cover the dividend for this year.

David runs frequent stress tests of HHI’s revenue account under different scenarios, looking several years ahead. Despite the recovery in HHI’s revenues, David has been cautious when stress-testing the revenue account, given the more uncertain economic backdrop. He remains confident, however, that the underlying revenues of HHI under the different scenarios, coupled with the robust level of revenue reserves, can continue to support dividend growth into the future. Beyond David’s own revenue generation, the board of HHI can utilise its robust revenue reserves to shore up its dividend. Currently HHI has revenue reserves of £9.8m, as per its semi-annual report, which is equal to a cover of 0.7 times its current full-year dividend.

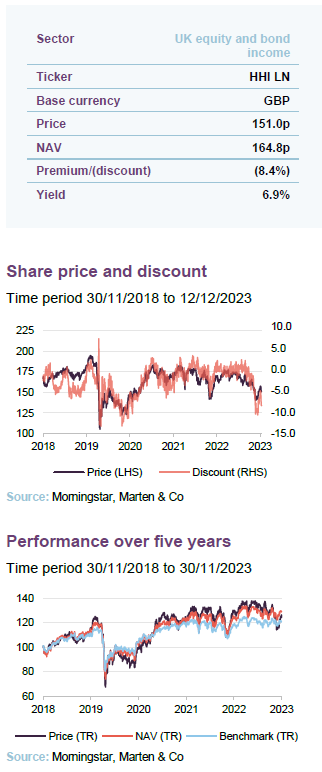

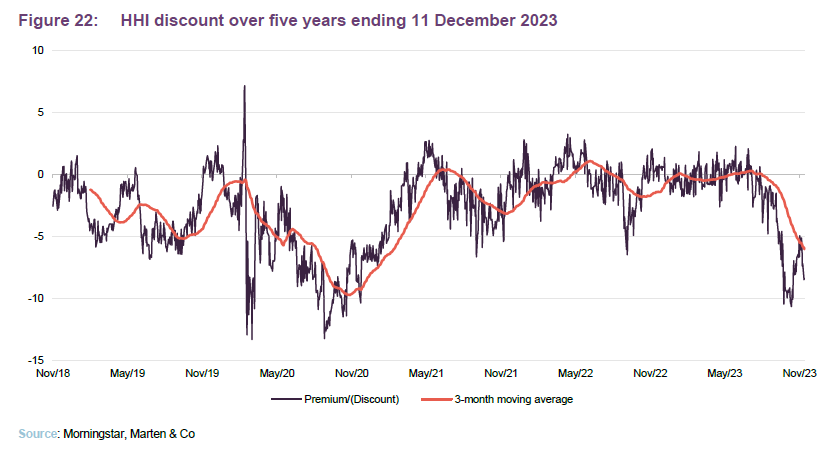

Premium/discount

Over the past 12 months, HHI has traded between a discount of 10.7% and a premium of 2.3%. The median discount for the period is 1.5% while the average discount is 0.5%. As at 12 December HHI was trading on a 8.4% discount.

HHI’s current discount is a recent development, as the trust had largely traded around its NAV since 2021, helped by the broader rotation into value-style investing across the globe in light of rising inflation expectations.

We believe that the recent discount widening resulted from a selloff during October. This selloff coincided with the announcement of its merger with HDIV – and it may be that there is some merger arbitrage activity at work – although it also coincided with a sharp upward move in US treasury yields.

As we enter the New Year, recognition that the merger is a net positive for HHI shareholders, the recovery in HHI’s performance in November, as well as the potential tailwinds for the trust (given the increasingly bullish outlook David has) should work to close the discount once again.

HHI’s current anomalous discount could be an attractive entry point.

The board considers the issuance and buyback of the company’s shares where prudent, subject always to the overall impact on the portfolio, the pricing of other comparable investment companies and overall market conditions. The board believes that flexibility is important in this regard and that it is not in shareholders’ interests to set specific levels of premium and discount for its issuance and buy-back policies. At the time of writing, no additional shares had been issued in the past 12 months. The last time HHI issued shares was on 21 June 2022.

Fund profile

Diversification, high income and the prospect of capital growth

Henderson High Income Trust (HHI) invests in a prudently diversified selection of both well-known and smaller companies, to provide investors with a high income stream while also maintaining the prospect of capital growth.

The majority of HHI’s assets are invested in the ordinary shares of listed companies, with the balance in listed fixed interest stocks (no unquoted investments). Investee companies should have strong balance sheets that are capable of paying dividends. There is a focus on well-managed companies whose qualities may have been temporarily overlooked by investors and which offer the potential for capital appreciation over the medium term. A maximum of 30% of gross assets may be invested outside of the UK.

A portion of gearing is invested in fixed interest securities

Gearing is used to enhance income returns, and to help achieve capital growth over time. A portion of gearing is usually invested in fixed-interest securities.

Janus Henderson Fund Management Limited is the company’s AIFM and it delegates investment management services to Henderson Global Investors (both are subsidiaries of Janus Henderson Group Plc). The lead fund manager assigned to the trust is David Smith. He was made co-manager of the trust in 2014 and has been sole manager since 2015.

Blended benchmark

HHI benchmarks itself, for performance measurement purposes, against a blend of 80% of the FTSE All-Share Index return and 20% of the ICE Bank of America Merrill Lynch Sterling Non-Gilts Index. For the purpose of this note, we have used the performance of the HSBC FTSE All Share Index Fund as a proxy for the FTSE All-Share Index. The HSBC fund closely tracks the performance of the FTSE All-Share index, although the two can differ over certain time periods.

Previous publications

Readers interested in further information about HHI can read our previous annual overviews and update notes by clicking on the links in Figure 23 below. You can also read the notes by visiting our website.

| Title | Note type | Publication date |

| The trust that delivers | Initiation | 26 November 2019 |

| Able to commit to the dividend | Update | 20 May 2020 |

| Robust high yield | Annual overview | 4 December 2020 |

| A taste of more to come | Update | 25 August 2021 |

| Last man standing | Annual overview | 26 April 2022 |

| Does what it says on the tin | Update | 21 December 2022 |

| There’s value in value | Annual overview | 6 September 2023 |

| Merger terms agreed | Flash | 4 October 2023 |

Accuracy of Content: Whilst Marten & Co uses reasonable efforts to obtain information from sources which we believe to be reliable and to ensure that the information in this note is up to date and accurate, we make no representation or warranty that the information contained in this note is accurate, reliable or complete. The information contained in this note is provided by Marten & Co for personal use and information purposes generally. You are solely liable for any use you may make of this information. The information is inherently subject to change without notice and may become outdated. You, therefore, should verify any information obtained from this note before you use it.

No Advice: Nothing contained in this note constitutes or should be construed to constitute investment, legal, tax or other advice.

No Representation or Warranty: No representation, warranty or guarantee of any kind, express or implied is given by Marten & Co in respect of any information contained on this note.

Exclusion of Liability: To the fullest extent allowed by law, Marten & Co shall not be liable for any direct or indirect losses, damages, costs or expenses incurred or suffered by you arising out or in connection with the access to, use of or reliance on any information contained on this note. In no circumstance shall Marten & Co and its employees have any liability for consequential or special damages.

Governing Law and Jurisdiction: These terms and conditions and all matters connected with them, are governed by the laws of England and Wales and shall be subject to the exclusive jurisdiction of the English courts. If you access this note from outside the UK, you are responsible for ensuring compliance with any local laws relating to access.

No information contained in this note shall form the basis of, or be relied upon in connection with, any offer or commitment whatsoever in any jurisdiction.

Investment Performance Information: Please remember that past performance is not necessarily a guide to the future and that the value of shares and the income from them can go down as well as up. Exchange rates may also cause the value of underlying overseas investments to go down as well as up. Marten & Co may write on companies that use gearing in a number of forms that can increase volatility and, in some cases, to a complete loss of an investment.