HydrogenOne Capital Growth

Investment companies | Update | 23 April 2024

Momentum building despite discount

The advisor notes that while shares of HydrogenOne Capital Growth (HGEN) have continued to fall, it believes that investors should be buoyed by the ongoing growth of the portfolio and the accelerating development of the green hydrogen sector.

The advisor points out that despite challenging macro-economic conditions, HGEN’s NAV grew 5.8% over 2023, while the portfolio generated aggregate revenue growth of 125%. It says that this momentum reflects the rapidly accelerating demand for green hydrogen products and services, highlighting that many of HGEN’s companies are investing heavily to increase productive capacity to cope with growing backlogs. It says that Industry dynamics also remain supportive as investment flows into the sector while government funding programmes provide further support.

The advisor adds that given the growing confidence of those within the sector and the ongoing fundamental performance of its companies, it is difficult to see how such a wide discount has opened up. It believes this is more a symptom of negative market sentiment, and if economic conditions steadily improve, it thinks a significant re-rating of HGEN’s shares is possible.

Diversified green hydrogen exposure

HGEN aims to deliver an attractive level of capital growth by investing, directly or indirectly, in a diversified portfolio of hydrogen and complementary hydrogen-focused assets.

Annual results and market backdrop

Our initiation note – funding a green revolution – describes HGEN’s investment approach and the fundamentals of the green hydrogen sector

On 18 April 2024, HGEN published its annual results for the year ended

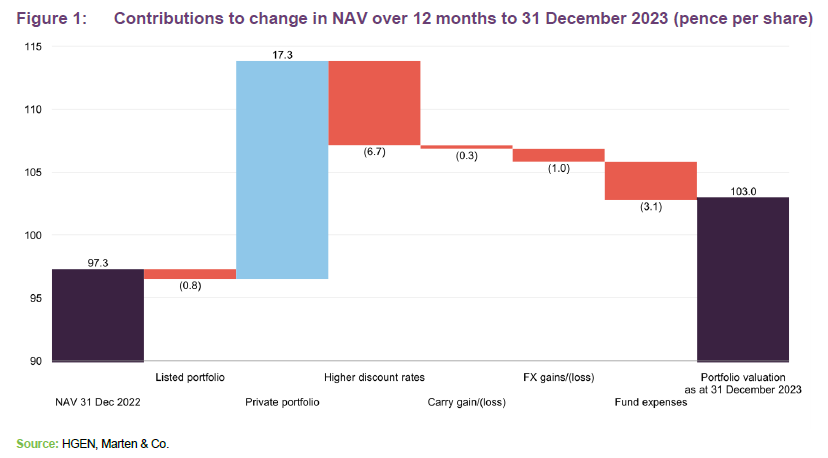

31 December 2023. Over the 12-month period, the company’s NAV increased by 5.8% to £132.7m which the advisor attributes to the strong performance of its portfolio companies. Despite the positive returns the share price fell 37%, widening the discount to 52%.

The advisor says that while not reflected in the share price, the outlook for the company continues to improve as the adoption of green hydrogen accelerates, commenting that this is supported by investment from some of the world’s largest companies. In 2023, some $17bn flowed into green hydrogen projects, a 400% year on year increase, which, according to the advisor, highlights the nascent value of the sector. It says that several of HGEN’s investments also saw significant developments over the course of the year, which are discussed in detail on page 5. This included progress on HH2E’s Lubmin project which, if approved, the advisor says, will mark a significant milestone for green hydrogen production in Europe.

The advisor comments that the opportunity for industrial-scale green hydrogen is vast with estimates suggesting a third of all greenhouse gas (GHG) emissions today could be addressed by the technology.

It says that accelerating industry dynamics are reflected in the performance of HGEN’s portfolio, with aggregate revenue up 125% from the year prior. In many cases, it says, this is a result of these companies converting developing technologies into orders from customers, with investment flowing into productive capacity to match growing order books.

The advisor observes that investors have remained wary of more growth orientated companies due to the challenges created by stubbornly high inflation and interest rates, in addition to what it says is the wider negative sentiment surrounding the UK economy. However, it says this is reflected in the increase in the discount rate used to value HGEN’s portfolio and it believes there have been signs of improvement, commenting that inflation in particular has fallen well below the average levels seen over 2023.

It says that while uncertain macro-economic conditions continue to be a challenge, the potential upside for the sector could be one of the highest in the investment trust universe. Thanks to its diverse portfolio invested across the green hydrogen supply chain, the advisor believes HGEN provides an excellent platform to invest in this fast-growing sector, with the opportunity, it says, made even more attractive given current discounts.

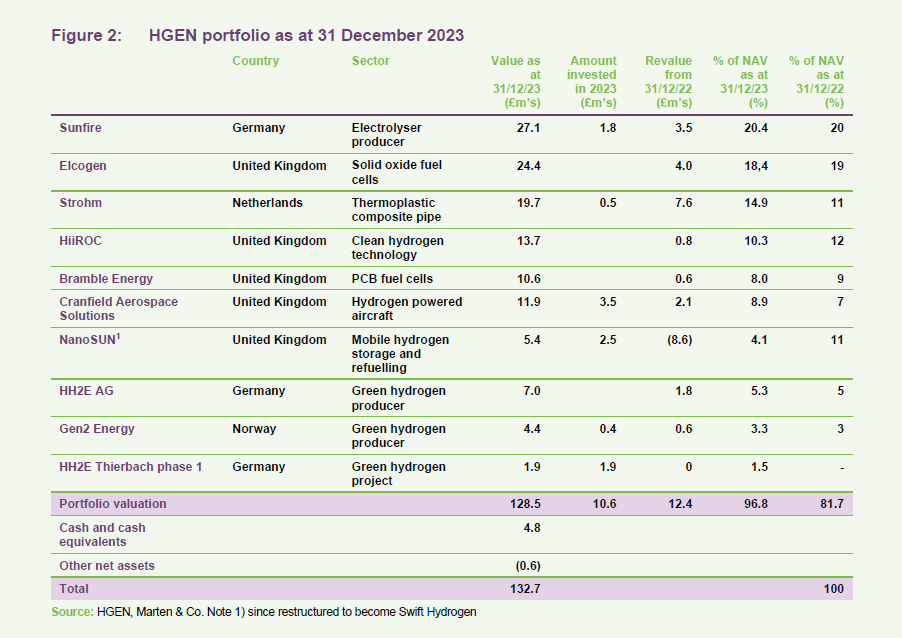

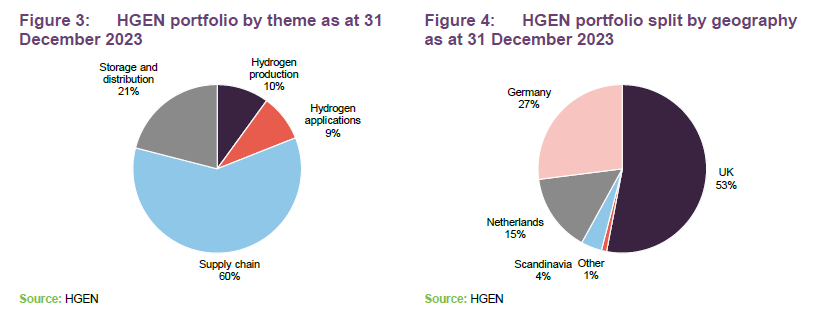

Asset allocation

As of 31 December 2023, HGEN had deployed the majority of its available capital, with 95% of the portfolio invested in private assets, 2% in listed assets and 3% in cash. The advisor notes that this is a significant shift in its position from 12 months ago where almost 15% of the portfolio was still held in cash.

It says that the investment activity over the year focused predominantly on strategic follow-on investments alongside both existing and new investors such as Cemex, HD Hyundai, and Baker Hughes. There was one new investment made earlier the year, the Thierbach project in Germany.

In total, £10.6m of investments were made, which is discussed in the portfolio developments section on page 6.

The advisor notes that, while HGEN’s discount has limited the ability for the company to raise new capital, it remains happy with the state of the existing portfolio. In addition, it says the team has identified exit opportunities for a number of private portfolio companies, some of which have already engaged with the market. The adviser remains confident that these companies can achieve targeted exit multiples. It expects that this would further validate HGEN’s NAV, while also believing it could provide a catalyst for the re-rating of the company’s shares. It says that any exits will also provide additional capital for the ongoing development of the portfolio.

Major portfolio developments

Sunfire

Sunfire has seen 10x revenue growth since HGEN’s initial investment

Electrolyser manufacturer, Sunfire, remains HGEN’s largest investment and the advisor says that the company continues to go from strength to strength, delivering what it says were a number of key milestones over the past year. It adds that Sunfire has seen impressive revenue growth from a growing global customer base, with this increasing over 10x since HGEN’s initial investment back in October 2021.

The advisor continues that the company received a significant boost in August following a purchase order for a 100 MW pressurised alkaline electrolyser. It says that this supply agreement marks a key milestone, supplying one of the world’s largest electrolyser systems.

This announcement followed the launch of the company’s new production facility in Solingen, Germany earlier in the year with the advisor noting that Sunfire is seeking to keep up with the growing demand for its products. The expansion of this facility has increased the company’s total capacity to 500MW of alkaline electrolysis.

The advisor comments that both the increasing scale and demand for electrolysers reflects the fast-moving dynamics of the green-hydrogen industry, which are discussed in our initiation note which you can find here. HGEN invested a further £1.8m early in 2023, which, the advisor notes, highlights the company’s level of confidence.

Sunfire has secured a €500m funding package

Sunfire continues to receive additional funding which the advisors says will help drive forward development, receiving €169m under the EU IPCEI scheme, to establish the first industrial series production of its solid oxide and pressurised alkaline electrolysis technologies. The company’s capital position was supported further by an announcement in March 2024 of an equity funding round which was part of a wider funding package totalling more than Є500m. The advisor says that the success of this round underscores both HGEN’s strategy of backing the leading innovators in the hydrogen industry, and its current valuation of Sunfire. As part of the funding round, HGEN exercised its rights to make a follow-on investment of £0.3m which it says will mitigate the potential impact of dilution, leaving the company’s stake in Sunfire unchanged.

Elcogen

Elcogen has external funding for its new plant in Estonia

Elcogen is another of HGEN’s major electrolyser investments. The advisor says that the company continues to benefit from its track record and established position with over 60 industrial customers worldwide. It says that the company’s existing footprint and potential for scalability has helped attract ongoing strategic investment. This includes Korea Shipbuilding & Offshore Engineering, a member of HD Hyundai Group, which invested €45m in Q4 2023, and Baker Hughes who in April 2024 announced a strategic investment as part of an overall funding package totalling €140m. The advisor says that the money will help fund a new factory facility in Tallinn, Estonia, where preparations for construction have now commenced. Initially, the facility will have capacity of 100MW, but the plan envisages capacity of 360MW in time.

In addition to these investments, the advisor notes that Elcogen intends to collaborate on green hydrogen production solutions with the two companies going forward. For HD Hyundai, it says the focus will be on marine propulsion systems and stationary power generation, with the intent to manufacture products in South Korea.

Other significant developments noted by the advisor included a supply and R&D collaboration agreement with the French company Genvia. It was also awarded funding from IPCEI for a €25.4m project to accelerate the deployment of its solid oxide technology.

Strohm

Tripling of capacity at Strohm’s Dutch plant

HGEN’s third largest holding, Dutch-based pipeline company Strohm, was one of the main drivers of HGEN’s NAV improvement over 2023. The advisor notes that the company continues to execute its growth strategy in response to what it says is rapidly accelerating demand by tripling the capacity of its Dutch plant to 140km/year.

Strohm’s clients feature multi nationals ExxonMobil, TotalEnergies, and PRIO with projects including natural gas pipeline installations off the coast of Brazil and Congo and a more recently announced development in Guyana which was the largest contract ever secured by Strohm. The advisor notes that the Guyana project was also a technological success with Strohm installing its first deep-water / high pressure TCP jumper at water depths of 1,700m, which the advisor says opens up the possibility of a range of potential markets.

The advisor notes that these deals reflect the value of Stohm’s unique, Thermoplastic composite pipe technology (see our initiation note for more details) which it says can be used across conventional energy, as well as renewable applications.

Strohm achieved profitability ahead of schedule

Notably, it continues, the company has achieved profitability ahead of schedule, converting year on year revenue growth of 200% into positive EBITDA in Q4 2023. The advisor says the company also continues to benefit from strong regulatory tailwinds, having been selected as a partner for the Hydrogen Offshore Production for Europe project and OFFSET project.

It notes that the company’s ongoing execution saw HGEN invest a further £0.5m in November 2023.

Cranfield Aerospace

The £3.5m follow-on investment in UK-based passenger airline, Cranfield Aerospace, was the largest made by HGEN in 2023. This was done alongside Safran Corporate Ventures and the Strategic Development Fund. The advisor notes that the fresh capital injection reflects the de-risking of its hydrogen-electric turbo-prop technology and the introduction of the Dronamics platform, the world’s first cargo drone airline using hydrogen fuel cell propulsion.

De-risking hydrogen-powered turboprop passenger flight and introduction of cargo drones

During the year, the company also unveiled its newly refurbished hangar and R&D facility while announcing what the advisor describes as a change in its strategic direction. It says that this related to a previously announced plan for a merger with Britten-Norman (discussed in our last note, which you can read here). It says that this has been updated, with the intention now to further strengthen the strategic co-operation between these two separate parties.

Swift Hydrogen

Post period end, in Feburary 2024, NanoSUN was relaunched as Swift Hydrogen. The advisor notes that this was to support a lower cost base and simplified capital structure. It received £2.5m of follow-on funding from HGEN in 2023, which the advisors says reflects the ongoing development of its hydrogen distribution and mobile refuelling equipment. Swift Hydrogen continues to generate the fastest top-line growth of HGEN’s investments, expanding revenue by over 90x since December 2021.

HH2E & Thierbach investments

HGEN invested in HH2E (the German developer of hydrogen production plants) in May 2022 and provided £1.9m of finance to the HH2E Thierbach project in 2023.

Post period end, the advisor notes that HGEN agreed to a restructuring of HH2E in order to streamline its business ahead of its planned third-party fundraising efforts. As a result, it says that HGEN has essentially swapped stakes in project SPVs for topco equity. While its equity share stays at 11%, HGEN now has direct exposure to the Lubmin project which is designed for an initial input capacity of 100 MW, producing 7,000 tonnes per annum of REDII-compliant green hydrogen from 2026. The advisors says that this project is expected to be the first FID out of the block for HH2E with the value impact for HGEN expect to come following the financial close of the project within the next 12 months.

HGEN now has exposure to HH2E’s Lubmin project

It adds that on completion, this would mark a significant milestone for HGEN while also increasing green hydrogen’s technological footprint in Europe.

The advisor says that the development of these projects, which are supported by institutional investors such as DHL Group and Sasol, continues to provide validation to HGEN’s investment thesis. It adds that there remains significant growth potential for these assets and HH2E continues to secure contracts covering power procurement, hydrogen distribution, and offtake arrangements, alongside forming strategic alliances with notable entities such as 50hertz, Gascade, DHL, and H2 Mobility.

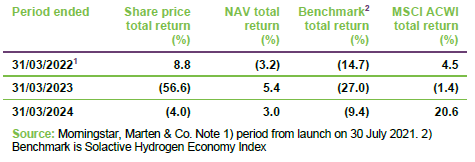

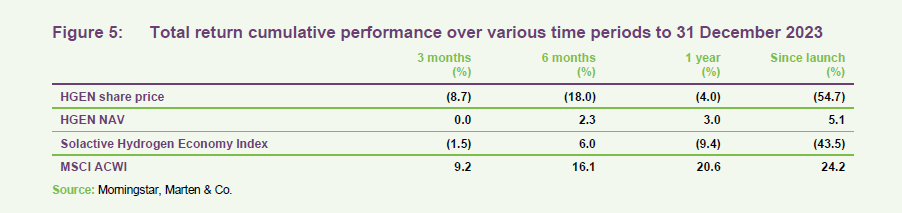

Performance

The advisor says that despite generating solid NAV growth over the course of the year, HGEN’s share price has continued to struggle. It says that this reflects the challenges faced by both the renewable energy sector and its immediate listed green hydrogen peers and while this remains frustrating, solid NAV growth and the fundamental momentum of the sector should be reassuring.

It believes that these factors should eventually support a significant re-rating of the company’s shares, particularly, it says, if we see ongoing improvements in economic conditions. It adds that the portfolio’s current revenue multiple of 9.8x supports this view when taken together with accelerating revenue growth of over 100%.

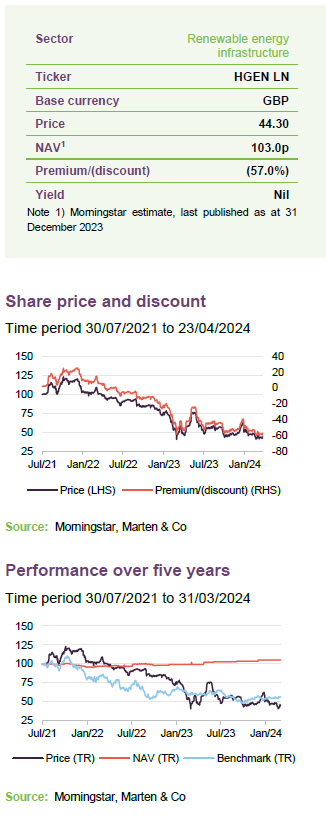

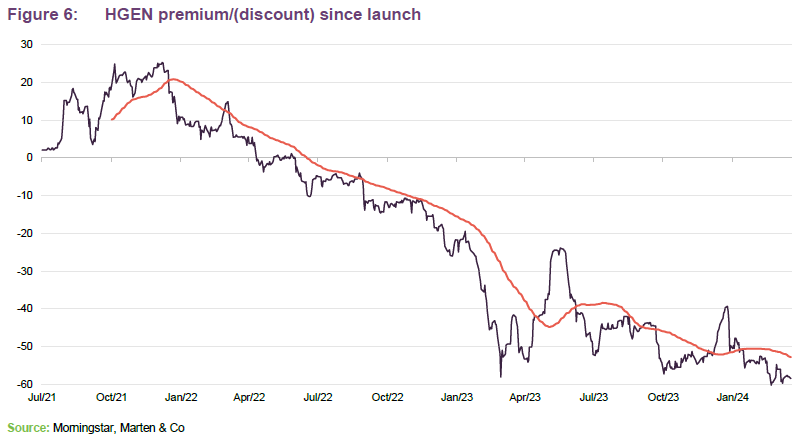

Premium/(discount)

Over the 12 months ended 31 December 2023, HGEN’s shares traded on an average discount of -41.5%, moving within a range of -17.6% to -58.1%. As of publishing, this stood at 57%.

The advisor does not believe this is a fair reflection of the underlying quality of the company’s assets, or the overall health of the green hydrogen sector. Promisingly, it says, the share price can respond rapidly to changes in sentiment, as was the case in May last year, shown in Figure 6.

ESG

HGEN is an Article 9 fund, the most sustainable classification under EU SFDR, with 92% of its portfolio aligned with EU taxonomy. In 2023, the company produced its first standalone sustainability report aligned with the IFRS International Sustainability Standards Board as an early adopter. This showed that as a result of its activities, 91,116 tonnes of CO2e greenhouse gas emissions were avoided over FY 2023, and 141,695tCO2e have been avoided since IPO.

Fund profile

More information is available on the trust’s website:

hydrogenonecapitalgrowthplc.com

HGEN is the first London-listed fund investing in clean hydrogen for a positive environmental impact. It aims to deliver an attractive level of capital growth by investing, directly or indirectly, in a diversified portfolio of hydrogen and complementary hydrogen-focused assets whilst integrating core ESG principles into its decision-making and ownership process.

HGEN compares its NAV performance to the Solactive Hydrogen Economy Index.

HGEN’s AIFM is FundRock Management Company (Guernsey) Limited (formerly Sanne Fund Management (Guernsey) Limited). It is advised by HydrogenOne Capital LLP, whose lead managers are JJ Traynor and Richard Hulf.

HGEN can hold both listed and unlisted (private) investments, however the majority of the portfolio is invested in unlisted hydrogen assets. In both cases, HGEN aims to be a long-term investor. The early portfolio was established with a liquidity reserve of cash and listed hydrogen assets, with the intention of giving investors exposure to the sector from day one.

HGEN holds its unlisted investments through a 100% stake in a limited partnership, HydrogenOne Capital Growth Investments (1) LP.

Previous publications

Readers interested in further information about HGEN may wish to read our previous note – Sky is the limit for HGEN – published on 3 May 2023, and our initiation note provided in Figure 7 below.

Richard Hulf, from Hydrogen One Capital, also appeared on our weekly news show on 16 February 2024. Click here to see the interview.

Figure 7: QuotedData’s previously published notes on HGEN

| Title | Note type | Date |

| Funding a green revolution | Initiation | 3 May 2023 |

| Sky is the limit for HGEN | Update | 17 October 2023 |

Source: Marten & Co

IMPORTANT INFORMATION

Marten & Co (which is authorised and regulated by the Financial Conduct Authority) was paid to produce this note on HydrogenOne Capital growth Plc.

This note is for information purposes only and is not intended to encourage the reader to deal in the security or securities mentioned within it.

Marten & Co is not authorised to give advice to retail clients. The research does not have regard to the specific investment objectives financial situation and needs of any specific person who may receive it.

The analysts who prepared this note are not constrained from dealing ahead of it but, in practice, and in accordance with our internal code of good conduct, will refrain from doing so for the period from which they first obtained the information necessary to prepare the note until one month after the note’s publication. Nevertheless, they may have an interest in any of the securities mentioned within this note.

This note has been compiled from publicly available information. This note is not directed at any person in any jurisdiction where (by reason of that person’s nationality, residence or otherwise) the publication or availability of this note is prohibited.

Accuracy of Content: Whilst Marten & Co uses reasonable efforts to obtain information from sources which we believe to be reliable and to ensure that the information in this note is up to date and accurate, we make no representation or warranty that the information contained in this note is accurate, reliable or complete. The information contained in this note is provided by Marten & Co for personal use and information purposes generally. You are solely liable for any use you may make of this information. The information is inherently subject to change without notice and may become outdated. You, therefore, should verify any information obtained from this note before you use it.

No Advice: Nothing contained in this note constitutes or should be construed to constitute investment, legal, tax or other advice.

No Representation or Warranty: No representation, warranty or guarantee of any kind, express or implied is given by Marten & Co in respect of any information contained on this note.

Exclusion of Liability: To the fullest extent allowed by law, Marten & Co shall not be liable for any direct or indirect losses, damages, costs or expenses incurred or suffered by you arising out or in connection with the access to, use of or reliance on any information contained on this note. In no circumstance shall Marten & Co and its employees have any liability for consequential or special damages.

Governing Law and Jurisdiction: These terms and conditions and all matters connected with them, are governed by the laws of England and Wales and shall be subject to the exclusive jurisdiction of the English courts. If you access this note from outside the UK, you are responsible for ensuring compliance with any local laws relating to access.

No information contained in this note shall form the basis of, or be relied upon in connection with, any offer or commitment whatsoever in any jurisdiction.

Investment Performance Information: Please remember that past performance is not necessarily a guide to the future and that the value of shares and the income from them can go down as well as up. Exchange rates may also cause the value of underlying overseas investments to go down as well as up. Marten & Co may write on companies that use gearing in a number of forms that can increase volatility and, in some cases, to a complete loss of an investment.