HydrogenOne Capital Growth

Investment companies | Update | 17 October 2023

Sky is the limit for HGEN

The disconnect between HydrogenOne Capital Growth (HGEN)’s NAV, current and prospective track record and its share price is hard to rationalise.

The recent bond rout has added insult to injury for renewable energy investors as higher rates have increased concerns around the availability and cost of financing, in addition to the added competition from money market funds, which are now providing steady returns without the associated credit and duration risks. Even so, discounts now appear to be out of step with reality, driven by sentiment rather than any fundamental justification.

This is certainly the case for HGEN, which saw revenue growth of 170% year-on-year across its portfolio of green hydrogen investments, further vindicating the investment case. Whilst the last six months have been particularly harrowing for many investors, there appear to be few trusts with as high a potential ceiling as HGEN, and for the long-term investor, the current discount should provide an excellent entry point.

Diversified green hydrogen exposure

HGEN aims to deliver an attractive level of capital growth by investing, directly or indirectly, in a diversified portfolio of hydrogen and complementary hydrogen-focused assets while integrating core ESG principles into its decision-making and ownership process.

Green Hydrogen Backdrop

Our initiation note – funding a green revolution – describes HGEN’s investment approach and the fundamentals of the green hydrogen sector.

Whilst it is understandable that the broader renewables sector has derated as capital has flown towards money markets and debt (now that both offer higher returns), the scale of the move is hard to fathom. This is particularly true for HGEN, given the underlying quality and potential of its assets.

The discount for HGEN is now 44%, despite steady NAV growth and ongoing portfolio execution. Unfortunately, this distinction does not count for a huge amount in the current climate as the multitude of investment trusts trading on wide discounts can attest. What sets HGEN apart, in our view (outside of its ongoing fundamental performance, which we believe justifies a much tighter discount in its own right), is the potential upside of the fund due to the weight of the tailwinds driving green hydrogen, particularly the scale of fiscal spending flowing into the sector.

$16bn of new investment in green hydrogen has been announced YTD.

The sector is developing at an impressive rate. HGEN’s managers report that $16bn of new investment in green hydrogen has been announced so far in 2023, including $8.4bn to fund a 4GW plant as part of the wider Saudi NEOM project. This increased interest is reflected in the growing backlogs and rapidly expanding production capacity of HGEN’s portfolio companies, and we believe this to be an underappreciated element of the investment thesis.

The opportunity is vast, particularly in hard to decarbonise sectors.

It remains early days, however. As we covered in more detail in our initiation note, the opportunity for industrial-scale green hydrogen production is vast, particularly in hard to decarbonise sectors of the market such as power generation and transport. Whilst estimates vary, some 20bn tonnes per annum of GHG emissions could be addressed with clean hydrogen over time, which is over one third of all GHG emissions today.

Hydrogen technology is proven.

It is true that ‘world changing’ technological innovations have been a dime-a-dozen over the last few decades. However, the attraction of green hydrogen, and the HGEN portfolio, is that the technology is proven, growing in profitability and can scale rapidly – which is why we are beginning to see significant investment interest from both the public and private sector.

170% Y-o-Y revenue growth for H1 2023.

This growth was highlighted in HGEN’s interim results (covering the six months ended 30 June 2023), which showed aggregate revenue across the portfolio increasing by 170% year-on-year. The bulk of this is attributable to just three of HGEN’s 10 portfolio companies – Bramble, NanoSUN, and Sunfire (which we discuss from page 5 onwards) – highlighting the potential upside of these assets as they reach commercial scale.

HGEN’s significant discount is on top of conservative valuations.

Despite these bullish tailwinds, there is no guarantee that the pain is over for investors as interest rate volatility increases, and even if rates do settle, it is entirely possible that flows don’t immediately revert back to the sector. However, over the long term, fundamentals drive prices and, given the size of the thematic tailwinds behind green hydrogen, and the execution of the HGEN team, the potential upside for the fund appears to be significant. This is especially true given the current discount on what are already conservative valuations.

Asset allocation

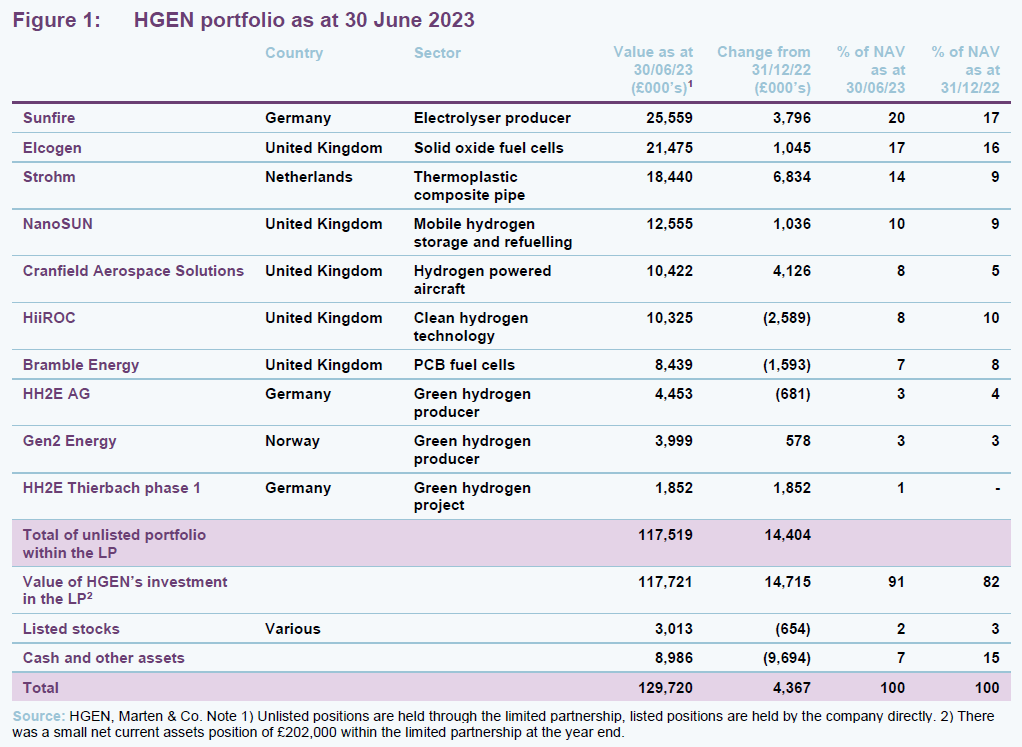

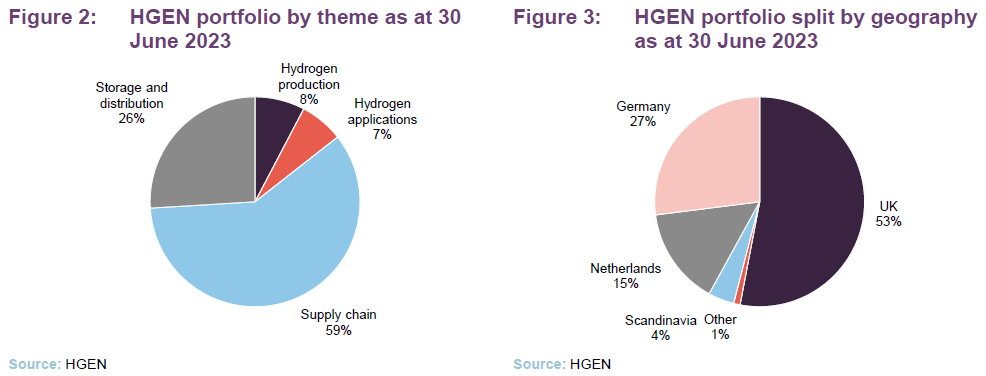

At 30 June 2023, HGEN had £117m invested or committed to 10 private hydrogen assets, had £3.0m in listed assets and a further £9.0m of cash.

Over the first six months of 2023, HGEN made £8m of investments, including the Thierbach hydrogen plant that we discussed in our initiation note and follow-on investments into three other portfolio companies: £1.5m for NanoSUN, £1.8m for Sunfire, and £2.9m for Cranfield Aerospace.

The distribution of the portfolio is not much changed from that of our initiation note. Changes reflect the £8m of investments that HGEN made in H1 2023 and valuation movements.

Portfolio developments

Sunfire

Sunfire says that the Bad Lauchstädt Energy Park green hydrogen project in Saxony, Germany has been given the go-ahead. Over the course of two years, Sunfire is building a 30MW electrolyser as part of the project. The electrolyser will be powered by a nearby wind farm.

In August, Sunfire announced an order for a 100MW pressurised alkaline electrolyser (10, 10MW modules and associated power supply units) for an unnamed European refinery.

Later that month, it got €169m of IPCEI grant funding, which we believe formed part of the €5.2bn of public funding announced in September 2022 that EU states and regions are putting towards research and innovation – first industrial deployment, and construction of relevant infrastructure in the hydrogen value chain, including large-scale electrolysers. Sunfire is putting the bulk of the money towards its plant in Saxony. This is intended to have capacity of 500MW in 2023, expanding to 1GW in due course.

Finally, in September 2023, Sunfire announced that one of its solid oxide electrolysers is in use at a 250kW test facility at Lingen in Lower Saxony.

Elcogen

Elcogen was also a beneficiary of IPCEI grant funding, this time for €24.5m, which will be used to accelerate the deployment of solid oxide (SOEC) technology.

In addition, Korea Shipbuilding & Offshore Engineering (part of the HD Hyundai Group) is making a €45m investment in Elcogen, having collaborated with it on R&D. This will help fund Elcogen’s new 360MW facility in Tallinn, Estonia.

Elcogen’s SOEC technology is being used in a test facility (ARENHA – Advanced Materials and Reactors for Energy Storage Through Ammonia) that will produce ammonia as a means of energy storage and as a fuel. This is the technology that is often touted as a solution to decarbonisation of the shipping industry. This is also part of the attraction for HD Hyundai.

Strohm

Strohm was the main driver of HGEN’s NAV improvement over H1 2023. It is involved in a test floating hydrogen and/or ammonia production and storage facility (the OFFSET project) and a test 10MW hydrogen production project (HOPE) powered by an offshore wind farm in the North Sea off the coast of Belgium. In its fossil fuel business, it has also won new business for natural gas pipelines being installed in deep water of the coast of Brazil and Congo.

HGEN says that Strohm has a €60m order book, which will be easier to tackle having tripled its production capacity to 140km of pipe per annum, and it is forecast to be EBITDA- and cashflow-positive in 2024.

NanoSUN

NanoSUN has worked with Westfalen to provide a mobile hydrogen refuelling station to a small fleet of six fuel-cell-powered buses in Brühl, North Rhine Westphalia, Germany. In addition, in Italy NanoSUN and IIT Hydrogen Bolzano have agreed a pathfinder initiative to promote Pioneer mobile hydrogen refuelling in that country.

Italy is making a €3.64bn national investment towards the green hydrogen transition, €230m of this will be dedicated to establishing a national network of hydrogen refuelling stations, 36 of which will be operative in 2026.

Cranfield Aerospace

The merger with aircraft manufacturer Britten Norman that we discussed in our last note is yet to be concluded. However, Cranfield has announced a deal with MONTE Aircraft Leasing and Torres Strait Air to convert up to 10 Britten-Norman Islander aircraft to hydrogen-electric power.

Cranfield Aerospace has also signed a Memorandum of Understanding with Dronamics, the world’s first cargo drone airline, with the intention of using hydrogen fuel cell propulsion in Dronamics’ Black Swan cargo drone aircraft. This includes a letter of intent for the supply of a substantial number of propulsion systems from 2026.

The two companies have been working together since November 2022 on a joint feasibility study for the Black Swan cargo drone aircraft, which is capable of carrying 350kg of freight for up to 2,500km. These studies have concluded that the Cranfield Aerospace hydrogen fuel cell system is well suited to meet the required payload, cargo volume and range for the Black Swan aircraft. With the letter of intent that was included in the deal, Cranfield Aerospace now has a total order pipeline of over 1,300 drivetrains.

In addition, upgrade work at company’s UK hangar and R&D facility was completed in the summer.

HH2E

HH2E announced that it had secured development funding for its second 100MW green hydrogen plant at Lubmin, Mecklenburg-Western Pomerania, Germany from Foresight Group. HGEN opted not to participate in this project. As with Thierbach, the intention is that the plant will scale to 1GW in time. Orders for the electrolysers for this and other HH2E projects have been placed, with an order for 120MW from Norwegian manufacturer Nel.

HH2E, DHL Group, and Sasol have signed an agreement for the setup of a joint initiative aimed at building potential production capacities for sustainable aviation fuels based on green hydrogen (eSAF) at a suitable location in East Germany. The intention is that the initial plant has the capacity to produce 200,000 tonnes per annum (avoiding the emission of 632,000 tonnes of CO2) and the potential to scale that to 500,000 tonnes. HH2E is participating in its role as a producer of green hydrogen. Sasol is using its technology to turn that into eSAF and DHL will be a major consumer of that eSAF (it has an air cargo hub at Leipzig/Halle airport). Airbus intends to join the consortium with the expected aim of being another potential offtaker.

Gen2 Energy

Gen2Energy has signed a transaction term sheet with SEFE Securing Energy for Europe GmbH, an integrated midstream energy company, to supply green hydrogen from its plant in Mosjøen Norway to customers in Germany. The agreement is conditional on (and a big boost towards) the final investment decision to construct the Mosjøen plant, which is expected in 2024. Assuming that construction work commences in 2024, the construction time is expected to be 30 to 36 months.

ESG

HGEN is an Article 9 fund with 87.6% of its portfolio aligned with EU taxonomy under SFDR. HGEN has just adopted a six-monthly reporting cycle on ESG metrics. As part of this, it disclosed that 83,497 tonnes of CO2e of greenhouse gas emissions were avoided in the six months ended 30 June 2023 as a result of its activities, and 134,076 tCO2e since IPO.

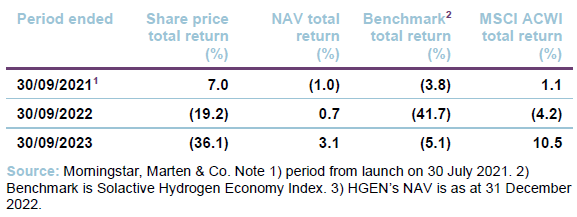

Performance

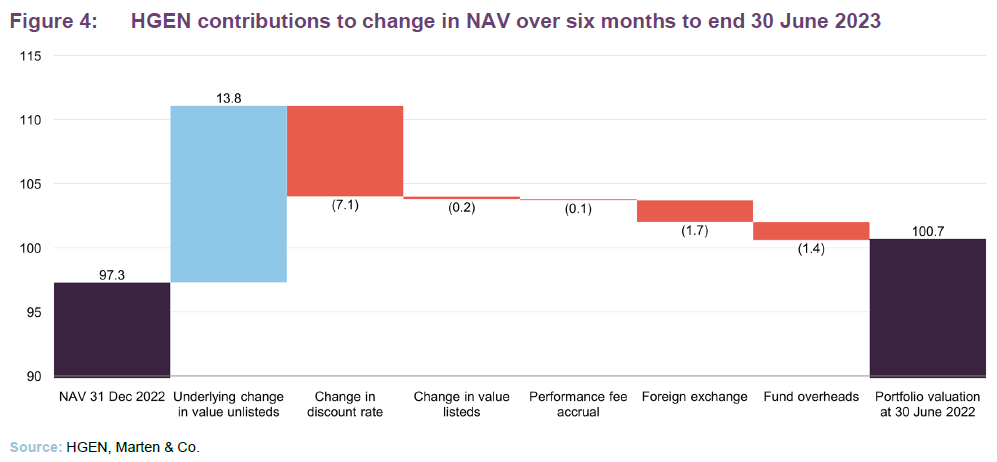

Over the six months ended 30 June 2023, HGEN’s NAV rose by 3.5% despite an adverse movement in the discount rates used to value the portfolio. The weighted average discount rate rose to 13.7% from 13.0% over H1 2023. DCF valuations were used for 81% of the portfolio (by value). The balance of the unlisted portfolio was valued based on a blend of DCF and the price of recent investment. Listed stocks are, as you might expect, valued on listed share prices.

To add further reassurance as to the quality of HGEN’s valuations, all of the positions in the private portfolio have downside protections such as anti-dilution and liquidation preferences.

Valuation of HGEN’s portfolio is around 30% lower than the average listed hydrogen company.

HGEN’s portfolio was valued on about 4x 2024’s forecast revenues at the end of June 2023. That is said to be about 30% lower than the average listed hydrogen company.

Premium/(discount)

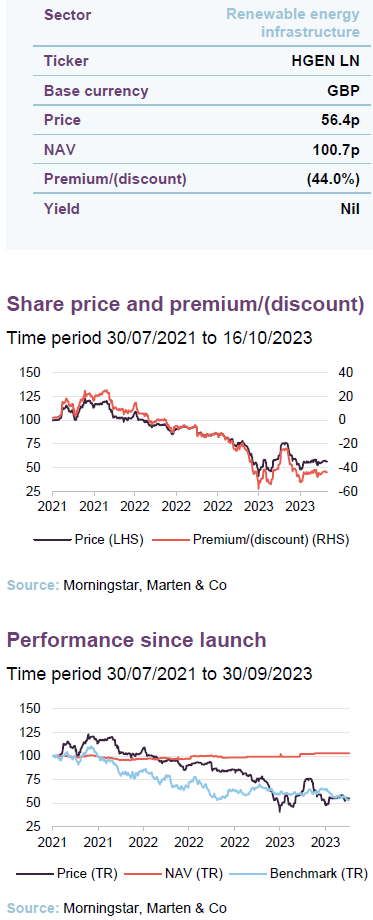

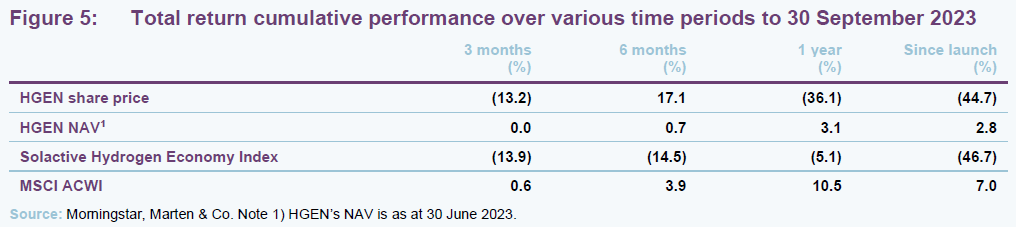

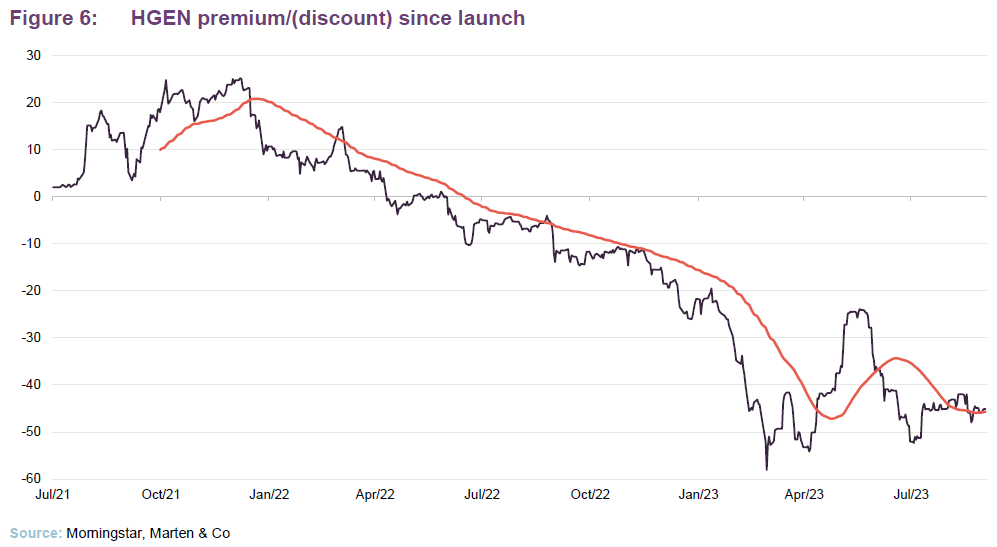

Over the 12 months ended 30 September 2023, HGEN’s shares have moved within a range of a 10.7% to a 58.1% discount to NAV and averaged a discount of 33.5%. At 16 October 2023, HGEN was trading on a 44% discount.

HGEN’s shares moved from trading at a premium to trading at a discount in May 2022 and the discount hit its widest level in March 2023. Since the publication of our initiation note, the discount narrowed, but has widened again subsequently. The swings in discount suggest that the shares are fairly illiquid, which seems sensible given the long-term nature of HGEN’s investment proposition and the fund’s short history. This might suggest that a small improvement in sentiment could have a meaningful positive impact on the share price.

A significant driver of HGEN’s discount has been the ‘risk off’ attitude that investors have adopted since interest rates began to rise. This has contributed towards falls in the share prices of listed stocks.

We feel that HGEN’s discount is entirely unjustified and is not supported by the fundamentals. As we have explained in this and our previous note, the prospects for the hydrogen industry are bright.

Fund profile

More information is available on the trust’s website: hydrogenonecapitalgrowthplc.com.

HGEN is the first London-listed fund investing in clean hydrogen for a positive environmental impact. It aims to deliver an attractive level of capital growth by investing, directly or indirectly, in a diversified portfolio of hydrogen and complementary hydrogen-focused assets whilst integrating core ESG principles into its decision-making and ownership process.

HGEN compares its NAV performance to the Solactive Hydrogen Economy Index.

HGEN’s AIFM is FundRock Management Company (Guernsey) Limited (formerly Sanne Fund Management (Guernsey) Limited). It is advised by HydrogenOne Capital LLP, whose lead managers are JJ Traynor and Richard Hulf.

HGEN can hold both listed and unlisted (private) investments: however the majority of the portfolio is invested in unlisted hydrogen assets. In both cases, HGEN aims to be a long-term investor. The early portfolio was established with a liquidity reserve of cash and listed hydrogen assets, with the intention of giving investors exposure to the sector from day one.

HGEN holds its unlisted investments through a 100% stake in a limited partnership, HydrogenOne Capital Growth Investments (1) LP.

Previous publications

We published our initiation note – Funding a green revolution – on 3 May 2023. Click the link to read it.

Legal

This marketing communication has been prepared for HydrogenOne Capital Growth Plc by Marten & Co (which is authorised and regulated by the Financial Conduct Authority) and is non-independent research as defined under Article 36 of the Commission Delegated Regulation (EU) 2017/565 of 25 April 2016 supplementing the Markets in Financial Instruments Directive (MIFID). It is intended for use by investment professionals as defined in article 19 (5) of the Financial Services Act 2000 (Financial Promotion) Order 2005. Marten & Co is not authorised to give advice to retail clients and, if you are not a professional investor, or in any other way are prohibited or restricted from receiving this information, you should disregard it. The note does not have regard to the specific investment objectives, financial situation and needs of any specific person who may receive it.

The note has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. The analysts who prepared this note are not constrained from dealing ahead of it, but in practice, and in accordance with our internal code of good conduct, will refrain from doing so for the period from which they first obtained the information necessary to prepare the note until one month after the note’s publication. Nevertheless, they may have an interest in any of the securities mentioned within this not.

This note has been compiled from publicly available information. This note is not directed at any person in any jurisdiction where (by reason of that person’s nationality, residence or otherwise) the publication or availability of this note is prohibited.

Accuracy of Content: Whilst Marten & Co uses reasonable efforts to obtain information from sources which we believe to be reliable and to ensure that the information in this note is up to date and accurate, we make no representation or warranty that the information contained in this note is accurate, reliable or complete. The information contained in this note is provided by Marten & Co for personal use and information purposes generally. You are solely liable for any use you may make of this information. The information is inherently subject to change without notice and may become outdated. You, therefore, should verify any information obtained from this note before you use it.

No Advice: Nothing contained in this note constitutes or should be construed to constitute investment, legal, tax or other advice.

No Representation or Warranty: No representation, warranty or guarantee of any kind, express or implied is given by Marten & Co in respect of any information contained on this note.

Exclusion of Liability: To the fullest extent allowed by law, Marten & Co shall not be liable for any direct or indirect losses, damages, costs or expenses incurred or suffered by you arising out or in connection with the access to, use of or reliance on any information contained on this note. In no circumstance shall Marten & Co and its employees have any liability for consequential or special damages.

Governing Law and Jurisdiction: These terms and conditions and all matters connected with them, are governed by the laws of England and Wales and shall be subject to the exclusive jurisdiction of the English courts. If you access this note from outside the UK, you are responsible for ensuring compliance with any local laws relating to access.

No information contained in this note shall form the basis of, or be relied upon in connection with, any offer or commitment whatsoever in any jurisdiction.

Investment Performance Information: Please remember that past performance is not necessarily a guide to the future and that the value of shares and the income from them can go down as well as up. Exchange rates may also cause the value of underlying overseas investments to go down as well as up. Marten & Co may write on companies that use gearing in a number of forms that can increase volatility and, in some cases, to a complete loss of an investment.