NextEnergy Solar Fund

Investment companies | Update | 12 July 2023

Recycling champion

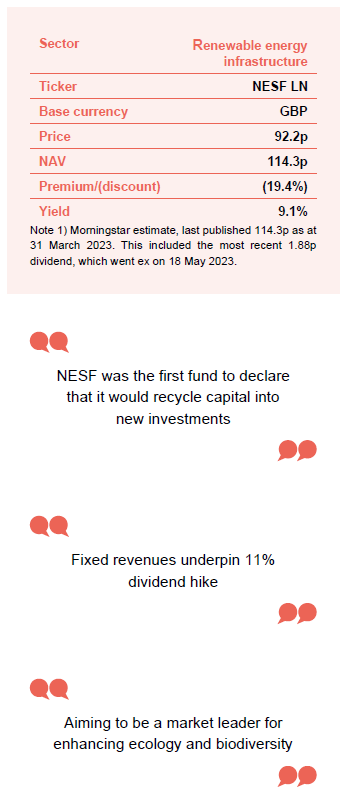

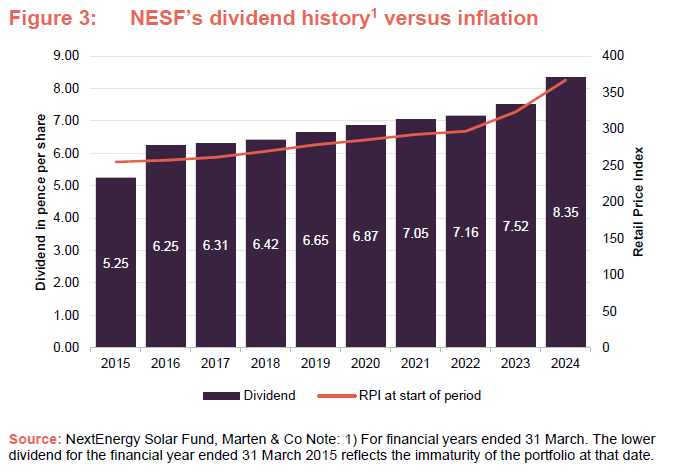

From an operational standpoint, NextEnergy Solar Fund (NESF) is doing well. As we discuss on page 5 of this note, the board, encouraged by a high proportion of predictable revenue, has felt comfortable in declaring an inflation-matching 11% increase in NESF’s dividend per share, and is confident that this will be well-covered by earnings.

In the face of a difficult market for fundraising (expanding the fund by issuing new shares), NESF’s managers propose recycling capital from its portfolio of subsidy-free solar assets. In the short term, the proceeds would be used to reduce borrowings (gearing) and fund a potential share buyback. Longer-term, the proceeds would be used to secure new solar and energy storage opportunities that present a suitable return profile.

After a good 2022/23 financial year, new investments could boost the NAV and cashflows further. Share buybacks could turn the tide on NESF’s share price discount to net asset value (NAV) and lower debt levels could calm investors’ nerves. Combine this with a prospective dividend yield of 9.1% and NESF’s future looks bright.

Income from solar-focused portfolio

NESF aims to provide its shareholders with attractive risk-adjusted returns, principally in the form of regular dividends, by investing in a diversified portfolio of primarily UK-based solar energy infrastructure and complementary energy storage assets.

Navigating a difficult environment

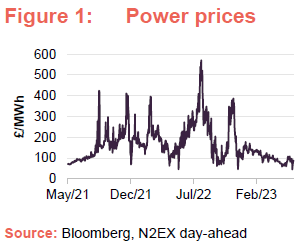

As Figure 1 shows, power prices have subsided from the extreme highs that we saw in 2022, and are almost back to 2021 levels. However, the manager has a specialist energy sales desk that is tasked with mitigating market price volatility and so NESF has been less exposed to this as a result. To illustrate this point, prices for 88% of NESF’s budgeted generation for its financial year ending in March 2024 (FY24) have been fixed at an average price of £79.0/MWh, 44% of budgeted generation has been fixed at an average of price of £91.4/MWh for FY25 and 13% of budgeted generation has been fixed at a price of £147.2/MWh for FY26.

In addition, around 50% of NESF’s revenues are derived from inflation-linked (RPI) government-backed subsidies, which gives greater visibility over NESF’s predicted revenues.

The UK inflation assumptions used in NESF’s end-March 2023 NAV calculation are based on HM Treasury Forecasts and long-term implied rates from the Bank of England. At 4.9% for March 2024 and 3.4% for March 2025, these look perhaps overly conservative to us. Inflation figures have been coming in ahead of forecasts and core inflation is rising. Fortunately, reflecting the significant degree of inflation-linkage in NESF’s revenues, higher inflation has a positive effect on NESF’s NAV; at the end of March 2023, NESF said that a 1% increase in inflation above the rate assumed in its valuation would be expected to add about 8.7p (7.3%) to the NAV.

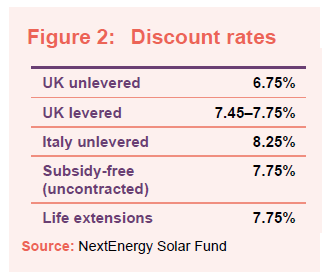

Unsurprisingly, given this backdrop, interest rates are still climbing, up 2% since 13 December 2022, when we last published a note on NESF. Investors’ concern is that this will feed through into higher discount rates used to work out the present value of NESF’s cash flows to calculate the NAV. A higher discount rate means a lower NAV and vice versa. Figure 2 shows the discount rates that NESF is using in its NAV currently. These compare to 20-year gilt yields of about 4.5% at the end of June 2023, which were about 0.75% higher than they were when we last published. At the end of March 2023, NESF said that a 0.5% increase in its discount rate would be expected to take off about 3.2p (2.7%) from its NAV.

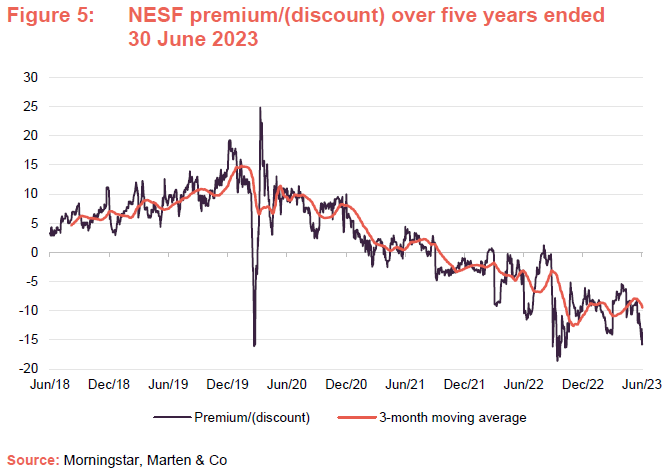

As interest rates climb and fears grow of a slowing economy, which could perhaps even tip into recession, funds that can offer high levels of predictable, reliable and growing income ought to be in demand. However, like all other renewable energy funds, NESF has experienced a widening of its share price discount to its NAV over the past couple of years, and almost all renewable energy funds now trade on double digit discounts to NAV.

Almost all renewable energy funds now trade on double digit discounts.

From an environmental standpoint, NESF is classified as an Article 9 fund under EU SFDR and Taxonomy. You can read the company’s latest Taskforce on Climate-related Financial Disclosures (TCFD) report here. The actions that it is taking are making a real difference to the problems of climate change and the UK’s energy security. It produces enough power for 242,000 UK homes and since launch its activities have enabled the avoidance of the production of 2.2 megatonnes of greenhouse gases. However, as we know, in order to achieve net zero much more needs to be done and, unsurprisingly, the manager has a significant pipeline of investment opportunities.

NESF is classified as an Article 9 fund.

With new equity fundraising off the table until the share price discounts close decisively, NESF was the first fund to declare that it would instead seek to recycle capital from operational projects to fund new investments in solar and in energy storage, creating opportunities to add to its NAV and its cash flows as well as benefitting the planet.

NESF was the first fund to declare that it would recycle capital into new investments.

We think that a prospective dividend yield of 9.1%, a record of dividend increases matching inflation, the possibility of NAV growth, and a board that is prepared to undertake NAV-accretive repurchases add up to an attractive opportunity.

New dividend target

NESF declared quarterly dividends totalling 7.52p for its financial year that ended on 31 March 2023. These were covered 1.4x. For the current financial year, NESF is targeting a dividend of 8.35p, an 11.0% increase. The board believes that this dividend is likely to be covered 1.3–1.5x and it can be reasonably confident in that because 1–1.1x cover is coming from fixed revenues.

Fixed revenues underpin 11% dividend hike.

The net effect of this is that NESF is one of very few investment companies that offers investors both a high starting yield and dividend increases that have matched inflation.

Capital recycling programme

On 27 April 2023, NESF announced plans to divest a 236MW portfolio of subsidy-free UK solar assets (Hatherden, Whitecross, Staughton, The Grange, and South Lowfield). It said that the proceeds would be used to:

- reduce gearing: materially reducing the amount drawn down on its revolving credit facilities;

- invest in future long-term growth opportunities: providing it with flexibility to capture higher returning investment opportunities in the future, such as energy storage; and

- buyback shares if the share price continues to trade at a material discount to NAV.

Two operational subsidy-free assets will remain within the portfolio and the company remains committed to its remaining subsidy-free solar pipeline. At 31 March 2023, NESF had total gearing (on a gross asset value basis) of 44.6%, which compares to a 50% cap on gearing. The gearing figure includes its £200m of preference shares, excluding these the gearing figure is 28%. NESF had £38.7m of headroom within its £135m revolving credit facility at the end of March 2023.

The effect of the proposed capital recycling should be threefold: validating the assumptions used in calculating the NAV, narrowing the discount, and – perhaps, most importantly – freeing up cash for new NAV-enhancing projects that will further the fight against climate change.

Portfolio progress

NESF is asking shareholders for permission to invest up to 25% of its gross assets in energy storage assets (up from the current 10% limit). We discussed NESF’s energy storage strategy in our last note. In February 2023, NESF announced more detail on this in a document that you can read here. NESF’s £500m pipeline includes the 250MW battery storage project that we discussed in our last note.

NESF has fleshed out its energy storage strategy.

NextPower III ESG, to which NESF has a $50m commitment, continues to make progress. NESF has also made direct co-investments into two construction-phase assets – a 25% stake in a 50MW Spanish solar project and a 13% stake in a 210MW Portuguese solar asset. Both projects have secured PPAs with Statkraft. These projects may provide an NAV uplift on completion. The manager has indicated that instead of a new commitment to the next NextPower fund, we are more likely to see co-investments such as these, which come on a no-fee, no-carry basis.

Results for year ended 31 March 2023

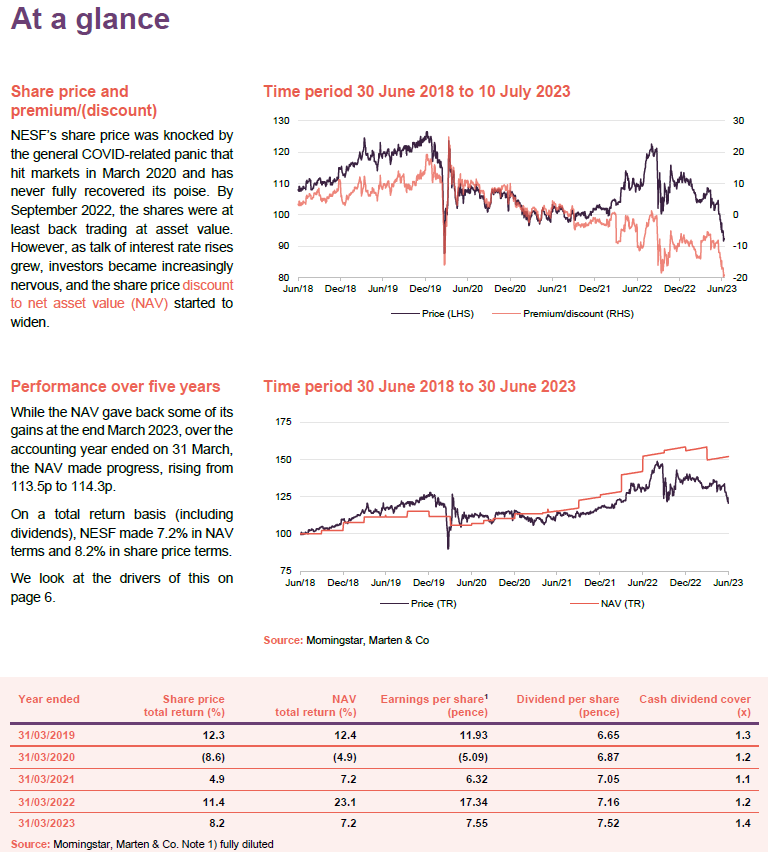

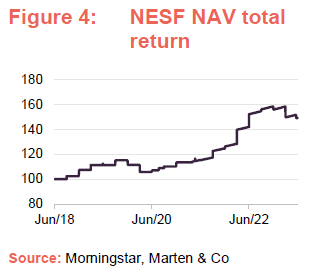

NESF published results for the 12 months ended 31 March 2023 on 19 June 2023. The NAV made progress over the year under review, rising from 113.5p to 114.3p. On a total return basis, NESF made 7.2% over the period in NAV terms and 8.2% in share price terms. It generated 870GWh of power, 12.5% more than over the previous year.

There are a lot of moving parts within that modest NAV uplift. Higher power price forecasts added 14.6p, higher inflation added 5.7p, and 13.4p was added from existing operations (within that solar irradiation came in above budget but power prices achieved were below expectations). Offsetting that was a 1% hike in the weighted average discount rate applied to NESF’s forecast cash flows to calculate its NAV.

NESF also released a corrected NAV recently after an internal review identified that an issue with automated reports had led to overstatements of the NAV by up to 2.7p. The board has stated this was not an issue within the accounting system and had no impact on the cash flow generated by the business or on its dividend cover. It was satisfied that this was an isolated incident and has agreed a number of additional steps to further strengthen controls.

Premium/(discount)

NESF’s share price was knocked by the general COVID-related panic that hit markets in March 2020 and has never fully recovered its poise. By September 2022, the shares were at least back trading at asset value. However, as talk of interest rate rises grew, investors became increasingly nervous, and the discount started to widen.

We think that the capital recycling programme offers one route to stabilising the discount. An end to interest rate rises would likely be a catalyst for a re-rating as well. We are encouraged by the additions that the chairman and the chair-elect have made to their personal holdings, which shows confidence in the strategy, as well as NESF’s willingness to repurchase its own shares, which is a differentiator versus many of its peers. We note also the considerable increase in the shareholding of NextEnergy Group employees disclosed on 5 April 2023; to 1,538,657 shares from 317,961 at 15 June 2022, which emphasises the alignment between management and shareholders.

Fund profile

NESF is a UK-focused solar fund which was established in April 2014 with the aim of generating attractive risk-adjusted returns. The intention was that most of the return would come as dividends. Following shareholder approval for a revised investment policy in September 2020, the company has the freedom to invest up to 30% of gross assets in other OECD countries outside the UK. It can also invest up to 15% in solar-focused private equity structures, and 10% in energy storage.

NESF’s investment manager is NextEnergy Capital IM Limited and it is advised by NextEnergy Capital Limited. Both companies are part of the NextEnergy Capital Group (NEC), which has around $3.7bn of assets under management. To date, NEC has invested in over 378 individual solar plants for an installed capacity in excess of 1.4GW, putting it amongst the most experienced solar investors globally. WiseEnergy is NEC’s operating asset manager. It has provided solar asset management, monitoring and technical due diligence services to over 1,350 utility-scale solar power plants with an installed capacity over 2.2GW. Starlight is NEC’s development company. It has developed over 100 utility-scale projects and continues to progress a global pipeline of c.2.5GW of both green and brownfield project developments.

There are over 270 members of the NextEnergy team, around 159 of whom are employed on the asset management side of the business. The adviser has offices in Chile, India, Italy, Portugal, Spain, the UK, and the USA. NESF now has some exposure to most of these markets.

An investment committee comprising Michael Bonte-Friedheim (founding partner and group chief executive officer), Giulia Guidi (head of ESG), Ross Grier (UK managing director), and Aldo Beolchini (managing partner and chief investment officer) oversees NESF’s portfolio.

More information is available at the trust’s website www.nextenergysolarfund.com.

Videos – introducing NESF

Fund brief

Fund manager brief

Environmental and social benefits

NESF aims to be a market leader in the solar sector for enhancing ecology and biodiversity, with a particular emphasis on supporting pollinators such as bees. Ground-mounted solar is underplanted with wildflower meadows (with a bias to white flowers such as chamomile that reflect light back onto the panels, enhancing generation). Sheep graze sites, and a portion of each site is left uncut over the winter. NEC has a Biodiversity Management Plan which is being deployed over a select number of sites and involves, for example, the planting of wildflower meadows, and installation of bird and bat boxes etc. NEC has recently hired an environmental impact manager with over 20 years’ experience in the environment sector to drive this work forward across the NESF portfolio.

Aiming to be a market leader for enhancing ecology and biodiversity.

NESF provides funding to local communities and supports educational projects. The NextEnergy Foundation (to which the manager contributes at least 5% of its profits) is a global organisation tasked with alleviating poverty, providing access to clean power and reducing emissions. The adviser has been working with suppliers to ensure that equipment is sourced ethically. ESG clauses are incorporated into contracts with suppliers of equipment and operations and maintenance firms.

Previous publications

Readers may wish to refer to our previous notes Climbing inflation and power prices driving NAV uplift , which was published on 9 February 2022, and Earnings visibility underpins divided target, which was published on 13 December 2022. These can also be accessed through the QuotedData website.

Legal

Marten & Co (which is authorised and regulated by the Financial Conduct Authority) was paid to produce this note on NextEnergy Solar Fund Limited.

This note is for information purposes only and is not intended to encourage the reader to deal in the security or securities mentioned within it.

Marten & Co is not authorised to give advice to retail clients. The research does not have regard to the specific investment objectives financial situation and needs of any specific person who may receive it.

The analysts who prepared this note are not constrained from dealing ahead of it, but in practice, and in accordance with our internal code of good conduct, will refrain from doing so for the period from which they first obtained the information necessary to prepare the note until one month after the note’s publication. Nevertheless, they may have an interest in any of the securities mentioned within this note.

This note has been compiled from publicly available information. This note is not directed at any person in any jurisdiction where (by reason of that person’s nationality, residence or otherwise) the publication or availability of this note is prohibited.

Accuracy of Content: Whilst Marten & Co uses reasonable efforts to obtain information from sources which we believe to be reliable and to ensure that the information in this note is up to date and accurate, we make no representation or warranty that the information contained in this note is accurate, reliable or complete. The information contained in this note is provided by Marten & Co for personal use and information purposes generally. You are solely liable for any use you may make of this information. The information is inherently subject to change without notice and may become outdated. You, therefore, should verify any information obtained from this note before you use it.

No Advice: Nothing contained in this note constitutes or should be construed to constitute investment, legal, tax or other advice.

No Representation or Warranty: No representation, warranty or guarantee of any kind, express or implied is given by Marten & Co in respect of any information contained on this note.

Exclusion of Liability: To the fullest extent allowed by law, Marten & Co shall not be liable for any direct or indirect losses, damages, costs or expenses incurred or suffered by you arising out or in connection with the access to, use of or reliance on any information contained on this note. In no circumstance shall Marten & Co and its employees have any liability for consequential or special damages.

Governing Law and Jurisdiction: These terms and conditions and all matters connected with them, are governed by the laws of England and Wales and shall be subject to the exclusive jurisdiction of the English courts. If you access this note from outside the UK, you are responsible for ensuring compliance with any local laws relating to access.

No information contained in this note shall form the basis of, or be relied upon in connection with, any offer or commitment whatsoever in any jurisdiction.

Investment Performance Information: Please remember that past performance is not necessarily a guide to the future and that the value of shares and the income from them can go down as well as up. Exchange rates may also cause the value of underlying overseas investments to go down as well as up. Marten & Co may write on companies that use gearing in a number of forms that can increase volatility and, in some cases, to a complete loss of an investment.