Pacific Horizon

Investment companies | Annual overview | 8 December 2022

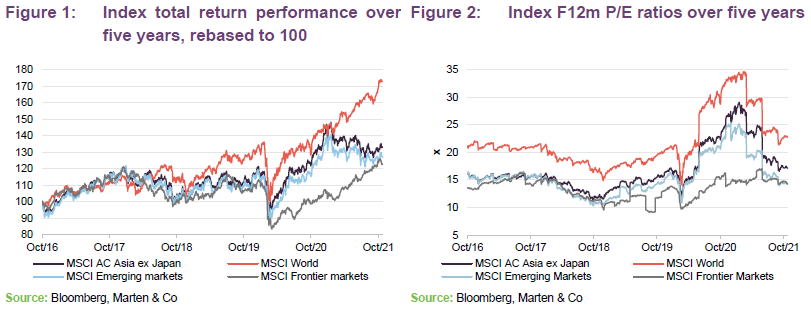

Convergence opportunity

Pacific Horizon (PHI) appears to have, in 2022, found itself at a convergence of both negative sentiment towards Asia and growth stocks more generally (seemingly a function of lockdowns in China, a slowing global economy and rising interest rates). While there has been a dent in its performance in the short term and it has been pushed it down its peer group rankings, the manager remains confident in the portfolio, commenting that, in its view, many of its companies are cheap (Asia Pacific ex Japan equities are trading at close to their five-year lows on a P/E basis, and look cheap versus global equities more generally), are cash generative and retain their strong growth prospects. Perhaps reflecting the current poor sentiment, PHI’s discount is approaching its five-year high (excluding a brief spell during COVID), which might offer investors an additional layer of comfort as there is the possibility that it could tighten if sentiment improves.

Focused on Asia ex Japan growth stocks

PHI invests in the Asia-Pacific region (excluding Japan) and in the Indian subcontinent in order to achieve capital growth. The company is prepared to move freely between the markets of the region as opportunities for growth vary. The portfolio will normally consist mostly of quoted securities, although it may hold up to 15% of total assets in unlisted investment opportunities, measured at the time of initial investment.

Fund profile

Additional information is available at the managers’ website: www.bailliegifford.com.

Pacific Horizon (PHI) is an Asia ex Japan investment trust that specialises in investing in growth companies. Baillie Gifford & Co (Baillie Gifford) has been appointed to manage PHI’s portfolio on behalf of Baillie Gifford & Co Limited, the trust’s alternative investment fund manager. Baillie Gifford has managed PHI since 1992. Baillie Gifford is a long-term growth investor and it believes that there is a significant opportunity to outperform markets over the long term using this approach.

Roderick Snell, who is the lead fund manager for Baillie Gifford’s Asia ex Japan strategies, has day-to-day responsibility for the management of PHI’s portfolio. Roderick was deputy manager of the trust’s portfolio between March 2014 and June 2021 before then being named lead manager. Roderick has managed the Baillie Gifford Pacific Fund OEIC since 2010.

PHI is managed by Roderick Snell, who is the lead fund manager for Baillie Gifford’s Asia ex Japan strategies.

Roderick has a degree in Medical Biology from Edinburgh University. He has been at Baillie Gifford since 2006 and in addition to managing the Baillie Gifford Pacific Fund since 2010, he is a co-manager on the Baillie Gifford China Growth Trust and co-manager of the emerging markets leading companies strategy.

About the manager

Baillie Gifford has 141 investors/analysts based in its Edinburgh office, with a further three in the US and five in China. It is structured as a partnership and encourages a collegiate approach to managing money, although it allows its portfolio managers the freedom to have the final say about their portfolios. It managed or advised on about £227.5bn as at the end of September 2022, of which £68.5bn was invested in Asia Pacific equities (including the Indian subcontinent). PHI and the Baillie Gifford Pacific Fund (its open-ended equivalent) had combined total assets of roughly £3.19bn as at 30 September 2022.

PHI is a stock-picking fund that bears little resemblance to the MSCI All Country Asia ex Japan Index comparative index.

The process and philosophy that is used to manage PHI has been the same for the last 30 years.

Roderick says that his natural inclination is to take be cognisant of political and macro influences in Asia and that thematic considerations are always in the back of his mind. However, he thinks that you only really get to see the big picture by being a bottom-up stock picker. This is very much a stock-picking fund and the portfolio bears very little resemblance to the fund’s MSCI All Country Asia ex Japan Index comparative Index (the active share of PHI’s portfolio at the end of October 2022 was 83%).

Roderick spends most of his time in meeting companies and undertaking stock-specific research. He emphasises that the process and philosophy that is used to manage PHI has been the same for the last 30 years.

Market roundup – attractive valuations following Asia weakness

As we discussed in our November 2021 note, while the Chinese market had suffered as the authorities had clamped down on sectors such as technology, education and housing, Asia as a whole appeared to be a relative bright spot within the global economy. Most countries had managed the virus relatively well (Vietnam, for example, was a standout performer in this regard) while China, which initially struggled with its vaccination programme, appeared to get a better grip on its handling of the virus, allowing its economy to remain more open.

However, as we moved into the closing stages of 2021, there were signs that, at least in the developed world, the unprecedented monetary and fiscal stimulus injected into economies to hold off the worst effects of the pandemic was starting to rear its head in the form of inflation. Moving into 2022, this has been exacerbated by the invasion of Ukraine and the resultant sanctions and supply curtailments that have pushed energy costs to extreme levels and created a cost-of-living crisis in the developed world.

Central banks have responded, raising rates at a faster pace than has been seen for 40 years in an attempt to choke off inflation. Inflation hasn’t been particularly high in Asia, but Asian markets have suffered as interest rates have risen overseas, especially in the US, leading to capital flows away from the region.

Compounding this, China’s rigid zero-COVID policy does not appear to be sustainable and appears to be damaging both China and the wider region. The combination of these effects appears to have led to Asian market weakness.

Manager’s view

The manager’s long-term arguments for investing in growth companies in emerging Asia remain broadly unchanged, and readers may wish to see our previous notes for more discussion. It should be noted that, whilst the manager is cognisant of macro issues and takes long-term structural themes into consideration, the portfolio is very much managed bottom-up. A key summary of the manager’s thinking is as follows:

- China and the broader Asia Pacific ex Japan region offer very strong growth prospects. PHI’s mandate provides it with access to more than 3bn consumers across Asia, and pre-pandemic data from the IMF forecast that the per-capita spending power of Chinese consumers would nearly double in US dollar terms over the five-year period to 2024. China is now at the bottom of the regulatory cycle and there is an opportunity to add to tech at depressed valuations, in the manager’s view.

- The manager still has very little appetite for domestic Hong Kong stocks commenting that the fundamental issues that led to the protests remain unresolved. Hong Kong has been a hugely profitable gateway into the mainland, helped by tax-free price differentials, but the outlook for retail spending and tourism (which both suffered during the crisis) still appear to be challenged.

- The manager remains positive on the long-term outlook for new economy companies in India, although he observes that Indian valuations currently look full and has been reducing exposure, particularly for old economy stocks which he believes have lower growth prospects.

- The manager continues to like Vietnam (see further discussion below), which he thinks is the best growth story in Asia at present.

- The manager is much more constructive on domestic stocks in Indonesia (see further discussion below), which he thinks is one of the better-positioned economies in the Asia Pacific region.

- The manager has continued to emphasise cyclical recovery over duration and pace. Digitalisation, technological change and the rise of the Asian middle class continue to be key themes within PHI’s portfolio. These are discussed in greater detail below.

- The manager thinks that markets will likely be volatile for the next 6–12 months, but comments that, unlike most developed markets, emerging Asia hasn’t destroyed government balance sheets in providing COVID support and there are increasing signs that Asia’s economy is starting to converge with that of developed markets (he says that it is notable that we haven’t had a market crisis in Asia for over 20 years).

Interest rates are at sensible levels in Asia, in his view, and real rates have been positive for several years in an environment that has seen positive inflation. In recent years, Asia has been less dependent on hot money and he thinks that it offers the best growth over the next five years globally.

The three key growths

The manager looks to embrace growth in all of its forms and lists three market inefficiencies from which it can add value because growth has been under-appreciated:

- duration;

- pace; and

- surprise.

For the duration theme, the manager is looking for world-class companies, using a long-term time horizon, where it believes these companies have the ability to compound the benefits of high growth for much longer than the market expects. In the manager’s view, analysts’ models are biased towards assuming that growth reverts to a normalised level too quickly, which is why they frequently fail to value this class of high-growth company properly. The approach to profiting from such companies is to hold them and leave them to compound over the long term.

For the pace theme, the manager seeks to identify high-quality companies that are growing rapidly and, crucially, faster than the market expects. In the manager’s view, analysts tend to play safe, and huddle in the 5-15% per annum growth range when building their models. PHI says that there are plenty of instances where 30-50% or more is achievable, but analysts tend to under-appreciate this.

For the surprise theme, the manager is looking for sudden changes as companies or industries hit inflexion points in their growth trajectories. To profit from these, you need to get in early and wait for the inflexion point to occur. Some of PHI’s plays on copper and nickel are examples of this (see discussion below).

India looks fully valued; rotating back to China

When we last published, we discussed how the manager has been reallocating some of the proceeds of its sales of Chinese holdings into both old and new India, with India becoming the biggest overweight. This proved to be a good move, as the Indian market has boomed as lockdown restrictions have eased, while China has been weighed down both by strict regulations applied to sectors such as e-commerce and education (see page 7 of our November 2021 note for a discussion of the Chinese clampdown), and by its strict zero-COVID policy. Reflecting these developments, the Indian market now looks to be much more expensive than it was, while the Chinese market appears markedly cheaper. The manager expects to keep adding to China at the margin.

PHI’s manager still likes India and the long-term structural growth opportunities that it offers, but has reduced the trust’s exposure to the country significantly on valuation grounds. He notes that within the Asia Pacific region, India is one of the most exposed to rising energy prices (it has kept its energy costs down by purchasing lots of Russian oil but has faced criticism for doing so and has been bringing these down). However, he comments that it helps that the government no longer provides fuel subsidies.

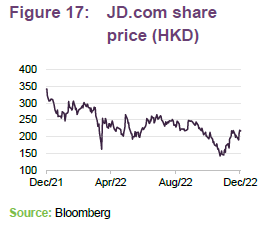

The manager has rotated most of the sale proceeds into China and Indonesia (see below), where he sees much better opportunities. PHI had been underweight China for quite some time, particularly Chinese tech, but has added around 500bp of exposure in the last eight months. The manager says that sentiment has been hugely against China, which has impacted valuations. For example, he cites the example of Alibaba, which was trading on a P/E of around 4x, if you strip out its cash, which the manager thinks is incredibly cheap. Similarly, Baidu has been trading at around 7x P/E for its core search business, but this ignores what the manager describes as the huge potential upside from its investments in AI and autonomous vehicles.

By way of illustration, Roderick highlights that the entire Hang Seng Tech Index (which includes the likes of Tencent, Alibaba and JD.com) is worth less than the market cap of Amazon. Roderick thinks that this is largely due to the regulatory environment, but he believes that we are past the worst. He notes that technology accounts for 90% of the new job creation in the private sector and so the government has a vested interest in it succeeding, in his view. He has therefore been adding the big tech platforms back into the portfolio.

While avoiding SOEs, the manager has also been adding to what he describes as ‘policy-aligned companies’. During the party congress, China laid out its favoured areas for the next decade. These include services, advanced manufacturing, and the environment.

With the party congress out of the way and President Xi having strengthened his grip on power, Roderick thinks that there is greater prospect of an easing of lockdown restrictions. President Xi has been tied very closely to these and the administration appears to have been very cautious on easing them; the current wave has led to some backtracking. However, PHI’s manager thinks that we could start to see a programme of rolling re-openings from the second quarter of 2023. This might give the president a few more months to solidify his position and control the narrative around the relaxing of restrictions.

There are concerns over the Chinese property market, but the manager observes that China has been deleveraging since 2016, and unlike some western nations, has kept its balance sheet in check during COVID. The manager thinks that China could likely loosen interest rates if it wanted to, rather than being forced to raise them as is being seen in the west. The manager comments that, while the property market is a concern and volumes are down year-on-year, last year’s volumes were inflated as the economy re-opened and, when compared against 2019 volumes, property transactions have not collapsed. LTVs are typically around the 25% level and so this he thinks that this is not a systemic risk as might be expected elsewhere.

Increasing exposure to Indonesia

When we last published, PHI had around 4-5% in Indonesian mining companies (primarily copper and nickel) but did not have any exposure to the domestic market. However, PHI’s manager thinks that Indonesia is one of the better-placed economies in ASEAN today – it has significant palm oil, coal and nickel resources, all of which are in demand. The manager believes that we are at the beginning of a new cycle for commodities such as copper and nickel, which should be supportive of commodity prices and broader economic activity in the country. Reflecting this, the manager has increased the portfolio’s exposure to the country. The largest of these are Bank Rakyat (see page 17), which is a microlending institution with, the manager believes, a highly defensible moat, and Astra International, Southeast Asia’s largest independent automotive group that is backed by Jardine Matheson.

Thematic focus – digitalisation and technology transforming industry

Looking for top- and bottom-line growth of around 15%-20%.

The manager believes that the market’s focus on geopolitics and capital flows can result in it missing the bigger picture of a global rise in digitalisation, technological change and the rise of the Asian middle class. The manager seeks to ignore the noise, focusing instead on long-term growth opportunities. He looks for companies that have the potential to increase revenue and earnings at around 15%-20% per annum over a five-year period or longer, and for opportunities where this potential has not been fully recognised by the market.

PHI’s starting premise is how it thinks the world and individual countries may change over the next three, five and 10 years plus, in every area of life – economically, socially and politically – and the impact that technology might have on these trends. When looking at a company and thinking about what the market size of its industry might be, the manager assesses what the current rate of growth is, how this industry could change, and whether there are additional opportunities for growth in adjacent markets that the company could enter.

The manager’s feeling is that the rapid development of technology is creating a fundamental change in market behaviour, with digitalisation driving profound changes in economic and political systems, businesses, consumer habits and behaviours. The number of sectors and industries that are becoming digitalised and connected is increasing rapidly and there is growing awareness of these changes across the globe.

Commodities and the green transition

As we have discussed in previous notes, PHI’s manager identified an opportunity in materials, particularly the commodities required for the green energy transition, and increased PHI’s exposure to this space. Initially, the manager focused on ‘green metals’ copper and nickel, which are crucial for greater electrification, but this exposure was broadened out during the pandemic to include aluminium and steel at depressed valuations (the manager was keen to add some cyclicality to the portfolio and benefit from the subsequent economic recovery). Now that this recovery has come through, the manager has narrowed the focus back to green metals again (Vedanta Resources and Tata Steel have been sold, for example and he has added to Dechra Copper and Gold and MMG).

PHI’s manager expects to see massive demand for ‘green’ metals over the next five years, but thinks that there won’t be enough supply when the inflexion point is reached. He says that these will be crucial for the move to a net zero-carbon economy, but reflecting a lack of investment in recent years, mining companies will struggle to respond (it can take a decade to bring a new mine into production from scratch) and considerable capex is required just to maintain existing production levels.

PHI’s manager remains focused on companies with low-cost operational assets that can grow their production. He thinks that, at present, the market continues to give insufficient consideration to the fact that the value of these companies’ reserves could grow as the value of the end-product increases.

Vietnam

Vietnam is an off-index exposure for PHI. Its relatively low GDP per capita suggests it has very strong catch-up potential (a report by PwC in 2017 suggested Vietnam could be among the top 20 economies by 2050) and while its stock market is very retail focused and is therefore inherently volatile, this can create opportunities.

Vietnam has a young population, with around 1m people entering the workforce each year; education levels are relatively high, as is female participation in the workforce; and Vietnam is urbanising faster than every other country in Asia, except China. Unlike China, Vietnam has been very effective at managing COVID (it used western vaccines with much greater efficacy) and the period appears to have accelerated the country’s growth prospects.

Whilst the trade war risk has lessened, manufacturers are still looking to diversify supply chain risk away from China, and Vietnam could be well placed to benefit. PHI’s manager has been reducing exposure at the margin recently, on valuation grounds. For example, the broking business Saigon Securities saw its share price expand rapidly (it was trading close to 4x P/B). While the manager still likes the company, the holding looked fully valued and the manager reduced the position by 150bp. The manager has also sold some names that he believes are lower-quality as he has rationalised the portfolio.

Investment philosophy and process

The underlying approach

Baillie Gifford believes that markets are inefficient at pricing long-term growth, especially over a time horizon of at least five years, and that this creates an opportunity to generate alpha. For this reason, it aims to encourage a culture of long-term thinking within the firm. Baillie Gifford believes there is persistence of good company management, business models and stock prices. This translates into a culture of ‘sticking with the winners’.

The company uses proprietary research. The team undertakes much of this, but will often commission research from local research teams, academics and industry experts. Baillie Gifford also subjects some companies to forensic analysis, using the services of investigative journalists and forensic accountants. When it is talking to companies, the conversations with their management teams focus on the long-term prospects of the business.

Roderick is able to draw on the resources of the whole investment team, when analysing companies, and can sit in on meetings with companies outside his geographic remit. This is especially beneficial when he is trying to identify how his companies compare with competitors domiciled in other markets.

Each member of the team is assigned a geographical focus for research, and these responsibilities are rotated every few years. Investment ideas are presented to the group, but the lead portfolio manager makes the final decision. Pre-COVID, Roderick would usually spend four to five weeks visiting Asia each year. He has started to do this again.

The open-ended investment company (OEIC) and PHI are run in parallel, with some exceptions; a key driver being the need to keep the OEIC’s portfolio relatively liquid to allow for inflows and the funding of redemptions. There is an internal limit of holding no more than 10% of the portfolio in illiquid holdings, but within this constraint, PHI has greater freedom to hold more illiquid investments than the OEIC. The OEIC has ended up with more of a large-cap bias as a result, while PHI has more exposure to small-cap names. There is considerable commonality of the stocks held, although the individual weightings may differ. PHI, unlike the OEIC, also has the option of using gearing and invests in unlisted companies.

Building the portfolio

Baillie Gifford is an active investor and does not hold stocks just because they are large constituents of any benchmark. Consequently, there are few limits on country, sector or stock weightings imposed on managers. The initial size of a position will reflect the strength of the manager’s belief in the potential risks and rewards of the investment. One of the guiding principles of investing at Baillie Gifford is to ‘run the winners’ (reflecting the belief in the persistency of good business models). However, PHI has a ‘soft’ upper limit of 10% exposure to any one stock. Roderick looks at the shape of the overall portfolio to ensure that he does not have too many companies exposed to similar thematic dynamics.

The mandate allows the manager to use derivatives to control risk and to alter the portfolio’s exposure to markets. In practice, Roderick is not undertaking such activity. The manager has no plans to use hedging to alter the portfolio’s currency exposure.

Sell discipline

Loss of faith in a company’s management is an instant trigger for a sale. Roderick will also sell if he feels the business model is not working, or if the market has caught up with his expectations.

Portfolio allocation

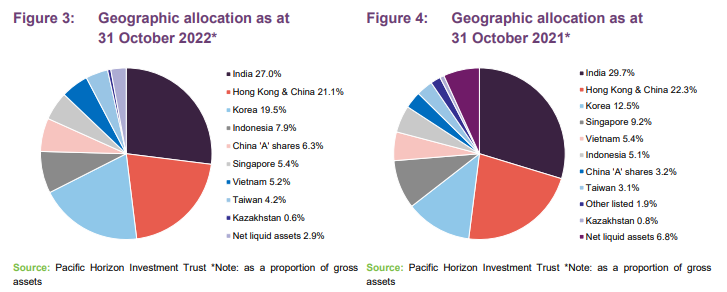

As at 31 October 2022, PHI held around 85 holdings in the portfolio, which is a significant reduction when compared to the 109 stocks it held at 31 October 2021. PHI believes that it can achieve an appropriate level of diversification for its strategy by holding 40–120 companies, although the current level is modestly above its long run average. The higher level a year ago reflects the fact that the manager broadened the portfolio following the market collapse in 2020 to take advantage of a wide range of opportunities that became available as a result of the market dislocation. More recently, the manager has been rationalising the portfolio, removing all stub holdings positions below 40bp if further significant upside is not visible. As we have previously explained, the manager considers that, if a position is below half a percent, he needs to have a strong view if it is to remain in the portfolio. As noted above, India has been sold down on valuation grounds, in favour of China and Indonesia.

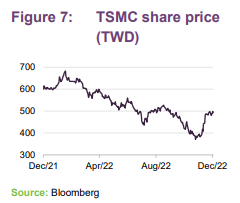

The allocation to Korea has moved up by seven percentage points, which is a reversal of the previous trend and largely reflects the relative performance of this market. The exposure to Vietnam is approximately the same and remains a significant off-index weight for the fund, illustrating that the manager constructs a portfolio that is distinctly different to the comparative index. The allocation to Taiwan has moved up at the margin. Exposure to Taiwan had previously been drifting down as the manager has been reducing PHI’s exposure to technology stocks (which includes TSMC, which was taken down to a zero holding), but the manager has been building a position again (see below). TSMC dominates the Taiwanese market and is a big component of the MSCI AC Asia Ex-Japan Index. Roderick says that, beyond TSMC, he struggles to find opportunities in Taiwan as he generally sees better investments elsewhere. Similarly, he continues to find little in the Philippines that he wishes to invest in, seeing better opportunities elsewhere.

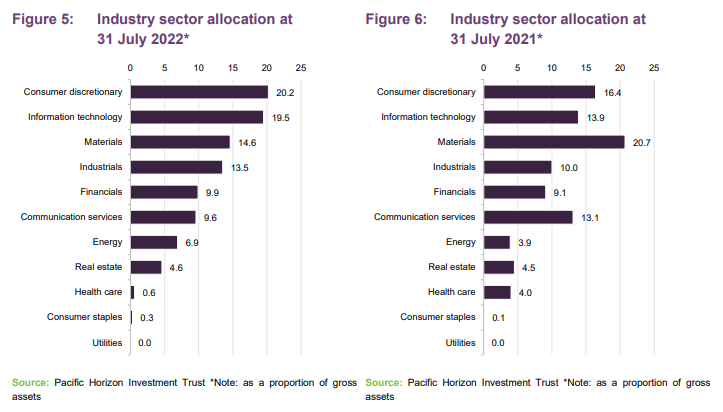

A comparison of the sector allocations above illustrates that the manager has taken down the exposure to commodities, taking down the exposure to base metals to focus on metals needed for the energy transition. The exposure to consumer stocks, reflecting increased exposure to Chinese stocks in particular. Information technology has moved down, which is partly a reflection of the weakness of these stocks as the likelihood of a global recession has grown, as well as the trimming back of some Indian names. The fall in communication services is largely a reflection of its relative performance. Energy has expanded, which largely reflects the price support that this sector has benefitted from so far this year.

TSMC – possibly the best company in Asia

Taiwan Semiconductor Manufacturing Company Limited (www.tsmc.com), or TSMC, is the world’s biggest contract chipmaker and design company. Its chips provide the computing power in many consumer electronic devices and its clients include Apple, Intel, Qualcomm, AMD and Nvidia. TSMC has over 50% market share for made-to-order chips and is estimated to control around 90% of the market for advanced processors. PHI’s manager has identified TSMC as a monopoly supplier of high-end services with a very strong structural growth outlook for the next decade. He comments that TSMC is possibly the best company in Asia at the moment, with a strong track record in innovation reflecting the significant investment the company makes each year (around US$40bn a year into the business).

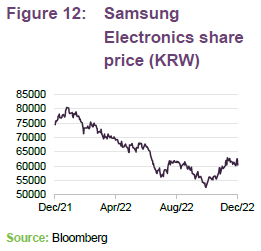

Previously, PHI had a low or nil weighting to TSMC because the manager had seen better opportunities outside of TSMC for the last few years, but he now thinks that it looks very attractive and has started to add it back into the portfolio. The manager observes that memory and non-memory chips are converging and thinks that TSMC, as a leading manufacturer of both, is very well positioned to benefit from this (Samsung Electronics, also a PHI holding, is the only other manufacturer that currently makes both).

Like its peers, TSMC’s share price has been under pressure over concerns that demand is slowing as the global economy tips into recession. TSMC warned clients in May 2022 (for the second time in less than a year) that it plans to raise prices, citing looming inflation concerns and its own expansion plans to help alleviate the global supply crunch. However, PHI’s manager considers that these are relatively short-term issues that do not outweigh the long-term growth prospects and that this weakness has created a buying opportunity. He observes that the chip market is tight and, with quality and precision being of paramount importance in chip manufacturing, there are limited alternatives to TSMC, which should be well placed to pass on price increases to its customers.

Midea Group – robotics is the kicker

Midea Group Co (www.midea.com) describes itself as the world’s largest producer of major appliances. It is a leading white goods and homewares brand in China and has a focus on making its products customer-friendly. PHI’s manager describes the appliance and homewares business as a very solid compounding business that throws off significant levels of cash flow.

Four years ago, Midea established its robotics and automation (R&A) business, which is now the fourth largest globally. Its product portfolio incorporates industrial robots and solutions, logistic automation and transmission systems as well as medical care and entertainment solutions. PHI’s manager thinks that the R&A business could be the kicker and observes that it could be the robotics champion for China over the next five years. At the time of purchase, Midea was trading at a mid-teens multiple, which PHI’s manager felt significantly undervalued the growth prospects of the robotics business, with the structural tailwinds and advantageous position he believes it benefits from.

Zheijang Supor – bolstering exposure to the consumer

Zheijang Supor (www.supor.com) describes itself as the leading cookware manufacturer in China and the second-leading cookware manufacturer worldwide. The company, which was added to PHI’s portfolio at the start of 2022, owns five R&D and manufacturing sites in Yuhuan, Hangzhou, Shaoxing, Wuhan and Ho Chi Minh City. It has more than 10,000 employees and its sales network covers more than 50 countries and regions. Supor was the first ISO-certified cookware manufacturer in China.

PHI’s manager says that it is a very high-quality business that generates very high levels of cash flow. It is 85% owned by Groupe SEB of France and benefits from both strong corporate governance and the international connections provided by its parent. For example, it makes all of Tefal’s Thermo-spot cookware (the pans with the red dots) as Tefal is also owned by Groupe SEB.

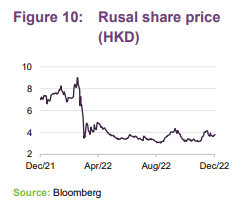

Rusal – a very quick exit

Rusal (rusal.ru) is one of the largest aluminium companies in the world. Its products include primary aluminium, billets, rolling slabs, primary foundry alloys, wire rod, high-purity aluminium and foil and packaging. Although primarily a Russian company with a listing in Moscow, it qualified for inclusion in PHI’s portfolio as it has a Hong Kong listing, where it can still be traded. Rusal is an example of a stock that the manager introduced to the portfolio in the aftermath of the COVID-19 collapse when valuations were extremely depressed, despite having sound operations, when the manager wanted to increase the cyclical exposure in the portfolio. More recently the manager has been reducing this exposure, but opted for a quick exit from Rusal after Russia’s invasion of Ukraine. The holding was sold at a price 10-15% off of the peak (around HKD 7.5), which has proven to be a good outcome for PHI as it currently trades around HKD 3.94.

Top 10 holdings

Figure 11 shows PHI’s top 10 holdings as at 31 October 2022 and how these have changed over the previous 12 months. Holdings that have moved into the top 10 are Samsung Electronics, Daily Hunt, Samsung SDI, Reliance Industries, Bank Rakyat Indonesia and Merdeka Copper Gold.

Names that have moved out of the top 10 are SEA Limited, Zomato, Li Ning, MMG Limited, Vedanta and ByteDance. We discuss some of the more interesting changes in the following pages. Readers interested in other names in the top 10 should see our previous notes, where many of these have been previously discussed (see page 31 of this note).

Samsung Electronics (5.9%) – the only viable alternative to TSMC

Samsung Electronics (www.samsung.com) is a global leader in semiconductors and electronics. Its primary focus is the manufacture and distribution of memory chips, phones and electronic components. The rationale for holding the position is similar to that of TSMC discussed above. PHI’s manager says that, like TSMC, Samsung Electronics is very cash-generative and reinvests heavily in its business; it also makes both memory and non-memory chips and is well positioned to benefit from their convergence. PHI’s manager considers that Samsung Electronics is the only viable alternative to TSMC and while he thinks TSMC is the higher-quality company, he thinks that Samsung Electronics offers superior upside potential. PHI’s manager comments that the group has the financial and human capital that permits it to invest and innovate at scale.

Dailyhunt (4.8%) – the TikTok of India

Dailyhunt (www.dailyhunt.in) is an Indian content and news aggregator application based in Bangalore, India that provides local language content in 14+ Indian languages from over 3000+ content providers. It is headquartered in Bengaluru, with offices in Delhi, Mumbai, and teams across multiple towns and cities in India.

Dailyhunt is PHI’s largest private investment. PHI’s manager describes it as the TikTok of India and says that its USP is its focus on local languages. He says that its hold on the space is so strong that it has effectively forced TikTok to exit India as it cannot get sufficient traction. It has a growing user base and PHI’s manager says that it is positioned to monetise in the next couple of years. ByteDance, which owns TikTok, was invested in Dailyhunt’s parent, VerSe innovation. The position has been sold recently; PHI’s manager thinks that the motivation is largely political and is more of a reflection of Chinese discord over the support that Taiwan is receiving on the platform than a view on the credibility of the business model.

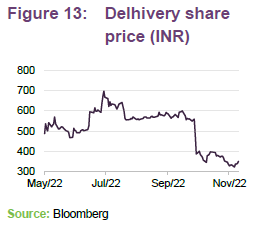

Delhivery (3.5%) – a play on Indian e-commerce

Delhivery (www.delhivery.com) is a pan-Indian logistics and courier services company that we last discussed in our November 2021 note. At that time, it was still an unlisted holding, but the company had filed plans with the Indian regulator for an IPO seeking to raise US$1bn. The company listed in May 2022 at a premium to its unlisted valuation, following an IPO that was 1.63x oversubscribed.

Delhivery, which began life in 2011 as a food delivery firm, is now a full suite of logistics services company with operations in over 2,300 Indian cities. PHI’s manager comments that e-commerce has around a 5% market penetration, which it could compound at around 50% for decades to come. Previously, a system of interstate taxes made it difficult to move products between States, but these have been swept aside by government reforms designed to liberalise the economy. In this environment, Delhivery looks to be prospering and scaling very quickly. Reflecting the strength of the manager’s conviction, it remains one of the largest overweights in the portfolio.

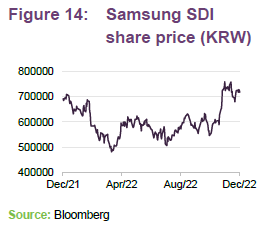

Samsung SDI (2.8%) – exposed to the energy transition

Samsung SDI (www.samsungsdi.com) is the battery-making unit of South Korea’s Samsung Group. The company has been a constituent of PHI’s portfolio since August 2016 (the rationale behind the original investment was discussed in our October 2017 note – see page 9 of that note) and is a play on the green energy transition.

Samsung has been focusing on its ‘prismatic’ lithium ion batteries, which are more expensive than traditional cylindrical batteries but offer a technology that is very scalable. However, it is now ramping up facilities to manufacture cylindrical batteries to supply its products to Tesla and other EV manufacturers. It has been reported that production is being expanded at the company’s Cheonan plant and some of this will be converted to make larger batteries for EVs. Samsung is currently testing to produce two different types of large-sized cylindrical batteries (same diameter but different lengths) with the aim that both can be produced with minimal production line changes so as to minimise costs. Mass-production is being targeted for 2025.

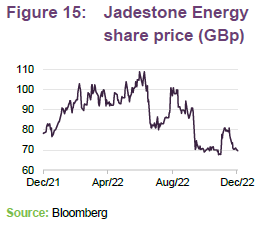

Jadestong Energy (2.8%) – benefitting from elevated oil and gas prices

As we explained in our November 2021 note (see page 16 of that note), Jadestone Energy (www.jadestone-energy.com) is a holding that falls into the manager’s ‘surprise’ bucket. It is an upstream oil and gas development and production company in the South East Asia-Pacific region. Its portfolio includes producing assets in Australia, Indonesia, Malaysia, Vietnam and New Zealand. Its speciality is acquiring small- to medium-size lots that have been poorly managed by their previous owners (typically SOEs) and investing to boost production and extend their useful lives.

During its most recent financial years, Energy was PHI’s second-best performing sector, which was led by Jadestone Energy’s performance. Jadestone has benefitted significantly from rising oil and gas prices since the invasion of Ukraine and PHI’s manager says that it has continued to sweat its assets.

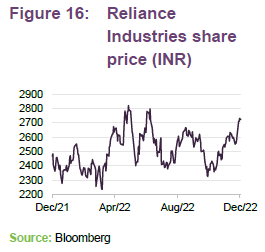

Reliance Industries (2.6%) – cash flow finances new India investments

Reliance Industries (www.ril.com) is an Indian multinational conglomerate with a diverse range of businesses including energy, petrochemicals, natural gas, retail, telecommunications, mass media, and textiles. The core of the business is its petrochemical and energy, which PHI’s manager describes as “a cashflow monster”. However, what makes the company interesting is that this cash is being invested in new India. For example, the company built India’s first 4G mobile network, marketed under the brand Reliance Jio, which completely disrupted the mobile telecoms market in India. This market now has two dominant players, of which Reliance is one. According to Roderick, the company has a very aggressive management team and this approach of entering and dominating a market is a repeatable formula for the company. The manager says that it is one of the most interesting companies in the portfolio and it could become the e-commerce digital media champion for India.

JD.com (2.5%) – added to on depressed valuations

JD.com (corporate.jd.com – also known as Jingdong) is a Chinese e-commerce company headquartered in Beijing. It is the largest Chinese retailer, via its dominant share in the online ecommerce 3C (computers, communications and consumer electronics) market, and it is the second player in overall Chinese e-commerce (along with Alibaba, it is one of the two massive B2C online retailers in China).

JD.com is a long-time PHI holding, having been held in the portfolio since May 2014. We last discussed it in our January 2021 note and explained how it had been given a boost by the pandemic as consumers have switched more and more of their purchases online (its one-stop-shop approach – an e-commerce platform offering a wide range of products, supported by its own logistics network – proved to be particularly resilient). PHI’s manager has been taking advantage of depressed valuations on the back of negative sentiment towards China to expand the position. He comments that the company’s strong logistics network and focus on customer service is driving increased revenue and market share.

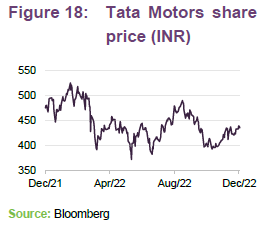

Tata Motors (2.3%) – building an EV ecosystem

Tata Motors (www.tatamotors.com) is the largest automobile manufacturing company in India and part of the Tata Group (an Indian conglomerate that is one of the biggest and oldest industrial groups in India). It offers an extensive range of passenger and commercial vehicles including passenger cars, trucks, vans, coaches, buses, sports cars, construction equipment and military vehicles. We last discussed it in our January 2021 note (see page 13 of that note) where we highlighted that the holding plays into the manager’s theme of investing in companies exposed to the structural move away from fossil fuel powered vehicles to electric vehicles.

The company has performed very strongly and was the largest positive contributor to performance in the last financial year, and reflecting this, the manager has been trimming back the position. However, Tata Motors has benefitted from a strong turnaround in its domestic and automotive business and, longer-term, is well placed to benefit from rapid growth in the EV market as the world decarbonises, in the manager’s view. In addition to having a strong EV pipeline, it has been working with other Tata Group companies, including Tata Power, Tata Chemicals, Tata Auto Components to build an EV ecosystem called the ‘Tata UniEVerse’.

Bank Rakyat Indonesia (2.3%) – benefitting from its network of 15,000 microlending units

Bank Rakyat Indonesia (also discussed on page 7 – www.ir-bri.com) is one of the largest banks in Indonesia. It specialises in small-scale and microfinance lending and borrowing to a client base of approximately 30m retail customers. It is the oldest bank in Indonesia, with a well-recognised brand, and 53% is owned by the state. It also has a corporate business, although this is relatively small.

Bank Rakyat has built out a network of some 15,000 microlending units on the Indonesian islands (a combination of over 4,000 branches, units and rural service posts). PHI’s manager says that this network gives the bank a huge advantage that is impossible to replicate; it effectively gives the bank a monopoly position. He also comments that the bank has demonstrably good lending and underwriting practices, having been profitable since 1987.

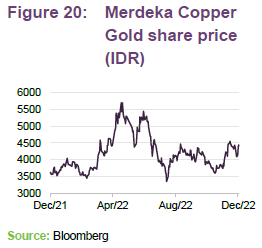

Merdeka Copper Gold (2.2%) – a play on demand for green energy

Merdeka Copper Gold (merdekacoppergold.com) is an Indonesian mining company that produces gold, silver and copper as well as various other minerals. Its operations are spread across a number of Indonesia’s islands, and it has the rights to the country’s second-largest copper and gold deposits.

Merdeka currently has two mines in production – the Tujuh Bukit Gold Mine and the Wetar Copper Mine as well as several development projects. These include the Tujuh Bukit Copper Project, an underground copper mine in Banyuwangi, which is one of the largest undeveloped copper deposits in the world; and the Pani Gold Project in Gorontalo, Sulawesi, which is set to become one of the largest primary gold mines in the Asia Pacific region.

Merdeka is also building its AIM (Acid, Iron, Metal) mineral processing plant in Morowali, Central Sulawesi. The AIM plant will produce raw materials for the batteries essential for green energy. PHI’s manager says that Merdeka fits neatly into its theme of gaining exposure to commodities that are essential for the energy transition and, operationally, the company offers an attractive combination of management with a good track record, as well as supportive local shareholders.

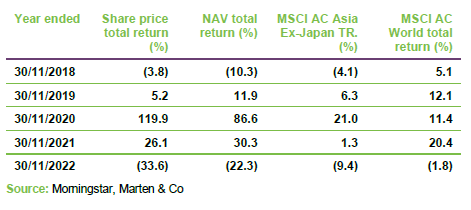

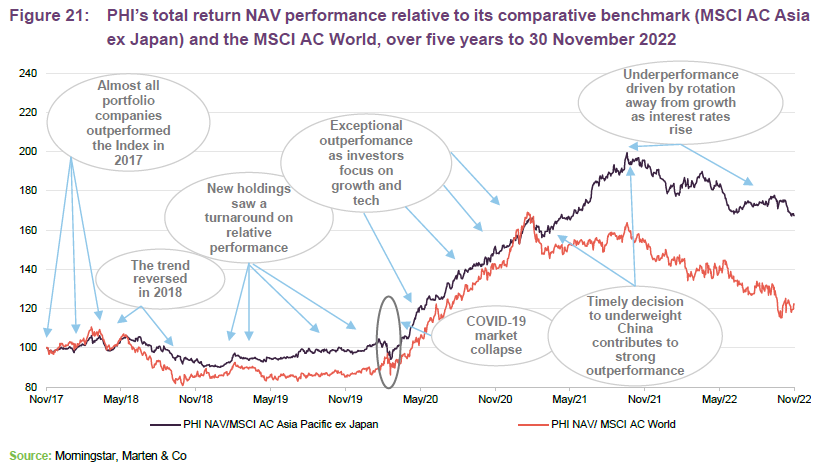

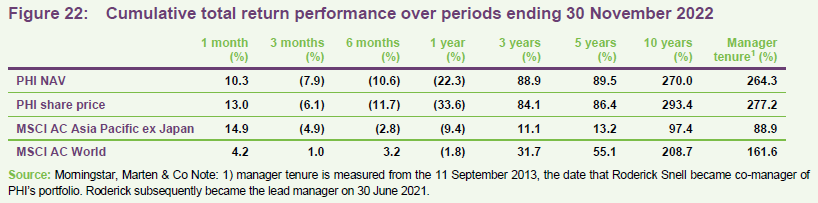

Performance – impacted by rotation away from growth and negative sentiment towards Asia

As we have previously discussed, PHI’s performance has seen a marked improvement during the last five years. This initially occurred as PHI successfully rejigged its portfolio in 2018, (which led to a performance-based tender offer in 2019 not being required) and, as is illustrated in Figure 21 above, PHI then found itself in a performance sweet spot following the COVID-related market collapse of March 2020 (in an environment of scarce growth and lower-interest-rates-for-longer, growth stocks were seemingly prized). This trend of strong outperformance continued until the fourth quarter of 2021, aided by a timely decision by the manager to slash PHI’s exposure to China. However, during the last 12 months, PHI has given back some of its previously strong performance, probably as growth stocks have moved out of favour – driven by rising interest rates that are in response to rising inflation as well as negativity towards Asia – likely a function of lockdowns in China, a slowing global economy and rising interest rates globally

There were signs of rising inflation in the Q4 2021 which took the edge off growth. However, the uptick in inflation accelerated rapidly following Russia’s invasion of Ukraine with its resultant impact on various commodities, particularly energy. Rising interest rates tend to impact growth stocks more heavily than value stocks, which tend to be more cash generative, as more of a growth stocks value tends to be discounted back from the future.

Roderick comments that, while we’re now in an environment of rising interest rates that tends to favour value and is a headwind to growth in the near term, growth can be a significant defence against inflation and he believes that it will ultimately outpace the returns of structurally-challenged companies with lower or no growth prospects.

Performance attribution for the year ended 31 July 2022

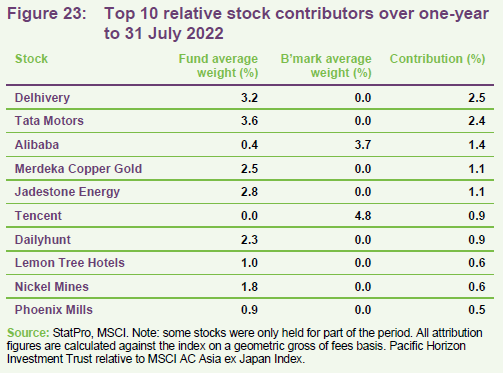

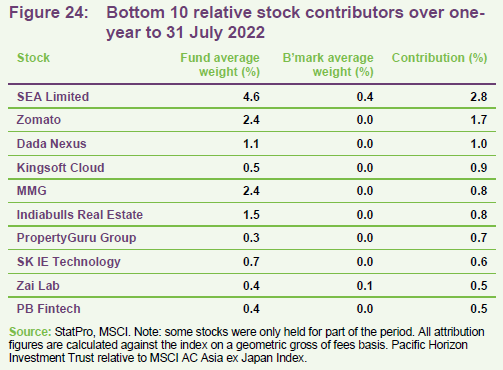

The top 10 and bottom 10 contributors to PHI’s performance, for the year to 31 July 2022, are provided in Figures 23 and 24.

The strongest positive contributions have come from:

- Delhivery – see page 15.

- Tata Motors – see page 17.

- Alibaba – PHI benefitted from being heavily underweight Alibaba, versus the comparator index, at a time when its share price was weighed down by concerns over ongoing lockdowns in China as well as a more stringent regulatory environment there. The manager re-initiated a position during the year. It is an example of a tech stock where the manager saw an opportunity to add to the position at depressed valuations.

- Merdeka Copper Gold – see page 17.

- Jadestone Energy – see page 16.

The largest negative contributions came from:

- SEA Limited – PHI’s manager comments that e-commerce companies in emerging markets have suffered heavily, particularly those that are unprofitable and have US listings, with very little discrimination between good and businesses as interest rates rose. The company also experienced some operational issues (it exited India altogether).

- Zomato – a Indian food delivery platform which has lagged as the economy has re-opened and diners appear to have moved back to in-restaurant eating.

- Dada Nexus – Chinese ecommerce distributor of online consumer products (discussed in our last two notes – see page 31 of this note) which, like Alibaba above, has been weighed down by concerns over ongoing lockdowns in China and negative sentiment over increased regulation. Alibaba was a contributor as PHI was heavily underweight, whereas Dada Nexus is a detractor as PHI is overweight as the company is an off-index holding.

- Kingsoft Cloud is a Chinese cloud computing company (we last discussed it in our January 2021 note – see page 18 of that note). It owns data centres in mainland China, Hong Kong, Russia, Southeast Asia, and North America and was a pandemic beneficiary as companies have sought to shift more and more of their operations online, alongside the growth in home-working. The company is loss-making and while it continues to grow, this slowed during the last financial-year, which appears to have weighed on its recent performance. It has also suffered from negative sentiment towards China and Chinese tech in particular.

- MMG – a Hong Kong listed mid-tier global resources company that has been a PHI holding for some time (we last discussed it in our January 2021 note – see page 18 of that note). The bulk of MMG’s production is copper, but it also produces zinc and other base metals. The company, which is 75% owned by China Minmetals Corporation (a Chinese SOE), appears to have been held back by growing fears of a global recession and economic difficulties in China (a function of the ongoing lockdowns) with base metals, including copper, inherently sensitive to the economic outlook. However, as noted on page 7, PHI’s manager believes that we are at the beginning of a new cycle for commodities such as copper and nickel, which he expects to be supportive of their prices.

Peer group comparison – Asia Pacific sector

Please click here for an up-to-date peer group comparison of PHI versus its Asia Pacific peers.

PHI is a member of the AIC’s Asia Pacific sector, which comprises six members. All of these are illustrated in Figures 25 through 27. All of these were members of the peer group when we last wrote about PHI. Members of Asia Pacific sector will typically have:

- over 80% invested in quoted Asia Pacific shares;

- less than 80% in any single geographic area;

- an investment objective/policy to invest in Asia Pacific shares;

- a majority of investments in medium to giant cap companies; and

- an Asia Pacific benchmark.

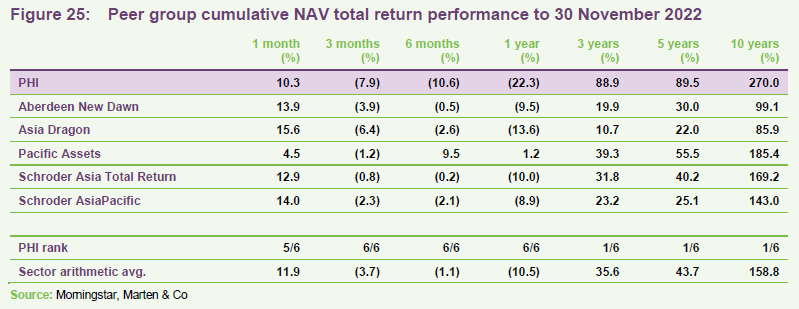

When we last published, we commented how PHI’s cumulative NAV total return performance ranked first out of the entire peer group for every time-period provided. At the time, we suggested that its strong emphasis on growth had been very successful over the longer term and that it had benefitted in the short term as investors had looked to growth in the aftermath of COVID. As discussed elsewhere in that note, there appears to have been a marked rotation out of growth and emerging Asia more broadly as interest rates have ramped up, particularly in the developed world, as central banks have moved to get inflation back under control. PHI’s strategy is the most growth-focused of its peers, and so it is perhaps not surprising that for the periods up to one-year in Figure 25, PHI’s NAV has underperformed the sector averages (its performance mostly ranks either 5/6 or 6/6 during these periods). It is clear that recent performance has eaten into the long-term performance records of all members of the peer group, although PHI still has a commanding outperformance of its peers over the longer-term three, five and 10-year periods. Longer-term periods may be better suited to assessing a long-term strategy such as PHI’s.

PHI’s manager continues to underline that the trust is very different to other funds in the peer group, with its particularly strong emphasis on growth. Roderick wants to be invested in the top 20% of the fastest-growing companies in the Asia Pacific region. It explicitly looks for companies that it believes can double their earnings over a five-year time horizon and has not been diverted from this mission by near-term distractions in markets.

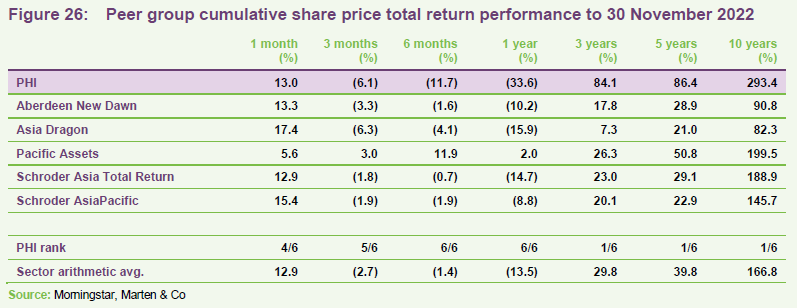

Figure 26 illustrates a similar story for share price total return, with PHI’s rankings for share price total return mirroring those of its NAV one-for-one. The superior share price performance over the NAV that is evident in the 10-year periods reflects the fact that PHI has generally traded on a much stronger rating in recent years.

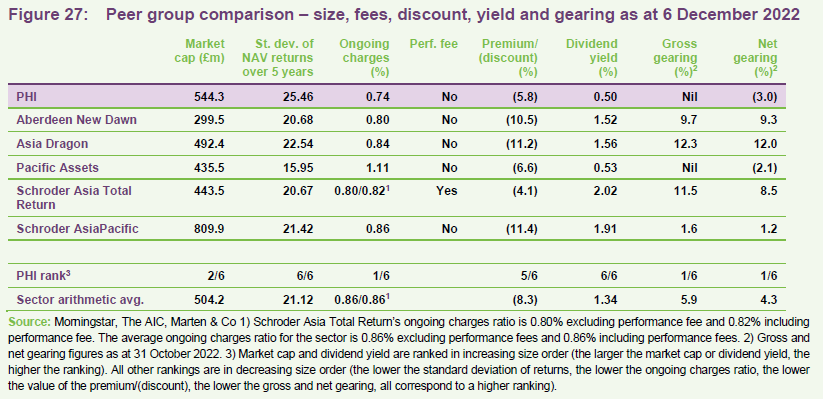

A common feature when looking at the market caps of PHI and its peers in

Figure 27 is that all have fallen noticeably since we last published in November 2021. Despite this, PHI has not slipped back down the size rankings and remains the second-largest fund in the sector by market cap (our previous notes have documented PHI’s move up the rankings – see page 31). PHI’s market cap is still some way ahead of that of Asia Dragon, which – as we explained in our January 2021 note – PHI overtook through a combination of strong performance and share issuance.

As discussed on page 27, PHI’s ongoing charges ratio has been on a declining trend in recent years and is now the lowest in the sector by a margin at 0.74% (the next lowest being Schroder Asia Total Return at 0.80% excluding its performance fee and 0.82% once its performance fee is included). All of the peers’ ongoing charges ratio have fallen since we published in November 2022. However, all have seen their asset bases retrench this year and this will, all things being equal, put upward pressure on the ongoing charges ratio across the sector.

As illustrated in Figure 27, all members of the peer group are trading at a discount, although PHI continues to enjoy a rating that is at a small premium to the sector average. This may reflect its peer group beating performance over the longer term, which is illustrated in Figures 25 and 26.

Perhaps not surprisingly, given its focus on capital growth (PHI has paid dividends to the extent required to maintain its investment trust status – see page 23), PHI’s dividend yield is the lowest in the sector (whilst PHI is paying a dividend for the year ended 31 July 2022, it should be noted that it frequently pays no dividend).

In terms of net gearing levels, PHI had the lowest levels in the sector average at the end of October 2022. Its NAV returns continue to exhibit the greatest volatility but, as we have previously observed, this does not appear high, and appear to be more than compensated for by its superior long-term performance.

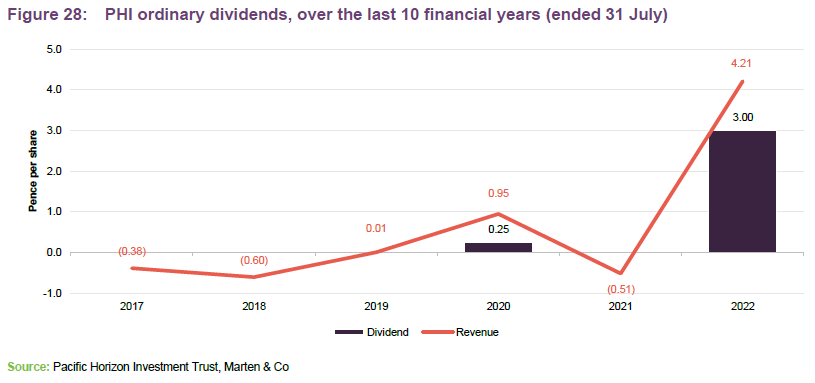

Dividend

PHI’s primary objective is to generate capital growth. Any dividend paid is by way of one final payment per year, following approval at the AGM. For the avoidance of doubt, PHI’s board has made it clear that investors should not consider investing in the company if they require income from their investment. The board has also said that it does not intend to draw on PHI’s revenue reserve to pay or maintain dividends.

Capital growth-focused; any dividend is the minimum required to maintain PHI’s investment trust statues.

For the year ended 31 July 2022, PHI generated a revenue surplus of £3.83m, equivalent to 4.21p per share (2021: a small revenue deficit of £402k, equivalent to -0.51p per share). Reflecting this, the board proposed a final dividend of 3.0p per share (payable on 29 November 2022) for the 2022 financial year, which is in contrast to the 2021 financial year (as illustrated in Figure 28) where PHI’s revenue deficit meant that it was not required to declare a dividend for the year.

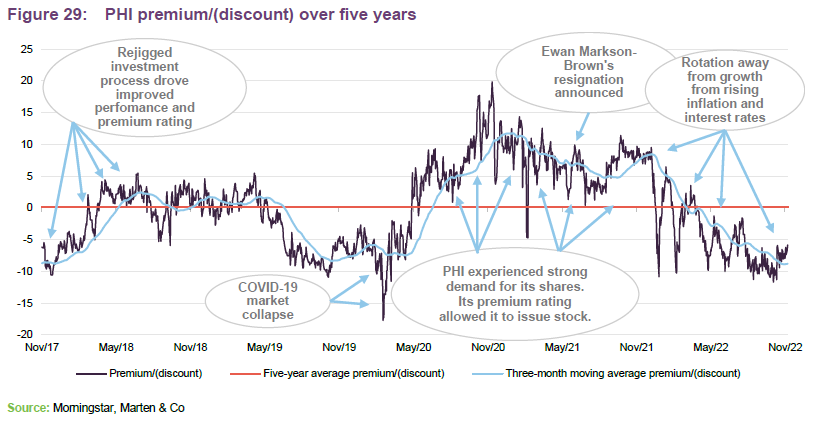

Premium/(discount)

As illustrated in Figure 29, PHI has, for much of the last five years, traded at a premium to NAV. As we have discussed in previous notes, this premium rating appears to have been driven by PHI’s strong performance – PHI moved to a premium rating in the second quarter of 2018 following a successful rejig of its portfolio that led to a marked improvement in performance.

There have been two key exceptions to the general trend. The first occurs during the summer of 2019, where PHI’s discount widened possibly as risk aversion increased (we discussed this in detail in our November 2019 note) but narrowed again as markets settled, before briefly spiking out to a five-year high of 17.7% on the 17 March 2020 as markets collapsed in the face of an accelerating COVID-19 infection rate. However, as illustrated in Figure 29, PHI found itself in a performance sweet spot and the extreme post-COVID discount was brief, with PHI quickly reverting to a strong premium (it reached a five-year high of 19.9% in December 2020). The second occurs from the beginning of this year as signs of rising inflation and interest rates caused investors to rotate away from growth stocks. As is illustrated in Figure 29, there has been considerable volatility in PHI’s discount YTD, which appears to have been a reflection of the market moving in response to expected interest rate rises. As is also illustrated in Figure 29, PHI is now trading at discounts that are at the wide end of its five-year range and are only surpassed by the extreme discount levels seen in the aftermath of the COVID-related market collapse.

As at 6 December 2022, PHI was trading at a discount of 5.8%, which is markedly wider than its one-, three- and five-year averages of a discount of 3.5%, and premium of 1.5% and a premium of 0.1% respectively. PHI’s one-year trading range is from a discount of 11.7% to premium of 9.5%.

Premium/(discount) management

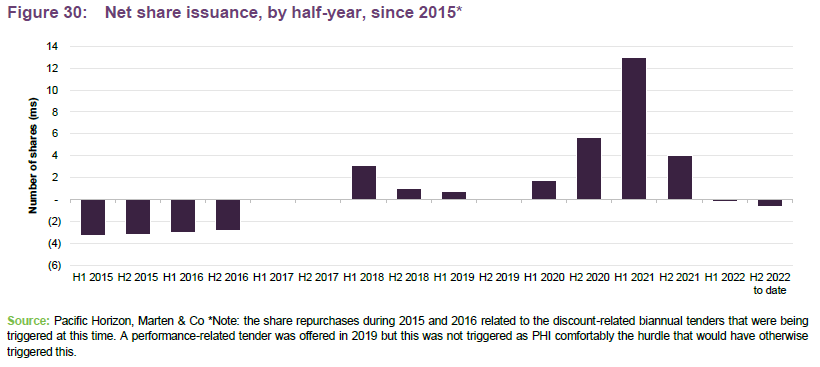

PHI has authority to repurchase up to 14.99% of its issued share capital, as well as to issue up to 10% at a premium to NAV. These authorities give the board mechanisms through which it can manage PHI’s discount or moderate any premium that should arise. Shares repurchased can be held in treasury and reissued by the company to meet demand. Any reissue of treasury shares would only be undertaken at a premium to NAV.

As discussed in our January 2021 note, proposals to allow PHI to issue up to 100% of its issued share capital, over a 12-month period, were detailed in a prospectus published on 11 December 2020 and approved by shareholders at a general meeting held on 19 January 2021. The measures had the desired effect of settling investors’ nerves regarding the scarcity of PHI stock, which helped to moderate its premium at that time. PHI’s prevailing premium enabled it to issue stock through to December 2021. However, the strong rotation away from growth stocks during 2022 has been accompanied by PHI moving to trading at a discount, which has curtailed its issuance activities. However, as is illustrated in Figure 30, PHI’s board has proved that it stands ready to provide liquidity in both directions, with PHI repurchasing some 0.9m shares YTD (equivalent to 1.0% of its issued share capital at the start of the year).

In taking action and repurchasing shares to help moderate the discount, this not only provides liquidity to exiting shareholders but also benefits remaining shareholders as repurchasing shares at a discount is NAV accretive to them. At the margin, this places upward pressure on PHI’s ongoing charges ratio as its fixed costs are spread over a smaller asset base, although the majority of the effect will come from the marked fall in the value of its investments YTD, as investors have rotated strongly away from growth. However, as is illustrated in the next section, PHI’s ongoing charges ratio has fallen markedly in recent years as it has expanded. As is illustrated in Figure 30, PHI’s share issuance in recent years dwarfs the repurchases made so far in 2022.

Fees and costs

Tiered management fee structure, with no performance fee.

Baillie Gifford & Co Limited acts as PHI’s alternative investment fund manager and has delegated portfolio management services to Baillie Gifford & Co. PHI’s management fee is calculated on a tiered basis. With effect from 1 January 2019, the annual management fee is 0.75% on the first £50m of net assets, 0.65% on the next £200m of net assets and 0.55% on the remaining net assets.

Management fees are calculated and paid quarterly in arrears and there is no performance fee. The managers may terminate the management agreement on six months’ notice and the company may terminate it on three months’ notice.

PHI’s ongoing charges ratio has been on a declining trend, reflecting both the management fee reduction and strong share issuance.

Reflecting both its tiered fee structure and strong share issuance during the last few years, PHI’s ongoing charges ratio has been on a declining trend. For the accounting year ended 31 July 2022, it was 0.74%, down from 0.78% for 202, 0.92% for 2020, and 0.99% the year before that. Baillie Gifford & Co Limited also provides company secretarial services, which are included as part of the management agreement. PHI’s ongoing charges ratio has been on a declining trend in recent years. This reflects both the reduction in the base management fee that is noted above, and the continued strong share issuance which means that PHI’s fixed costs are spread over a larger asset base.

Capital structure and trust life

PHI has a simple capital structure with one class of ordinary share in issue.

PHI has a simple capital structure with just one class of ordinary share in issue. Its ordinary shares have a premium main market listing on the London Stock Exchange and, as at 6 December 2022, there were 91,174,368 in issue with a further 900,593 held in treasury.

Each year, the company takes powers to buy back up to 14.99% of its shares at a discount to NAV. It also asks for permission to issue up to 10% of its issued share capital at a premium to NAV. As discussed on pages 25 and 26, these authorities give the board a means by which it can manage PHI’s premium/discount.

Gearing

PHI has a three-year £100m multi-currency revolving credit facility.

PHI has a three-year £100m multi-currency revolving credit facility with The Royal Bank of Scotland International Limited, which expires on 14 March 2025. Gearing parameters are set by the board and the manager operates within these. As of

31 July 2022, the range was set at -15% (i.e. a net cash position) to +15%.

PHI’s gross gearing was nil as at the end of October 2022 and it was running a net cash position of 2.1%. The main covenants relating to the RCF are that PHI’s borrowings should not exceed 30% of its adjusted net asset value, and its net asset value should be at least £300m.

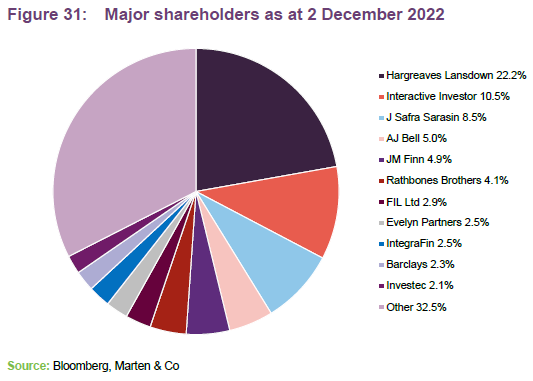

Major Shareholders

Five-yearly continuation votes

The next continuation vote is due at the 2026 AGM.

Shareholders are given the opportunity to vote on the continuation of the company every five years. Most recently, shareholders approved PHI’s continuation at the trust’s annual general meeting on 17 November 2021. The next continuation vote is due at the 2026 AGM.

Financial calendar

PHI’s financial year-end is 31 July. It usually publishes its annual results in September (interims in March) and holds its AGMs in October or November. Where applicable, it pays its annual dividend shortly after its AGM.

Board

PHI’s board comprises five directors, all of which are non-executive, considered to be independent of the investment manager and do not sit together on other boards. The directors put themselves forward for re-election at the first AGM following their appointment. Thereafter, directors submit themselves annually for re-election. Having seen some longer-standing directors retire during the last couple of years, PHI has a relatively young board with an average length of service of 3.7 years. The longest serving director is the chairman, who has just 5.7 years of service under his belt.

Director’s fees

There is a limit of £200,000 for the aggregate of fees paid to directors, which forms part of the company’s articles of association. Shareholders would have to vote to approve any change to this limit (the last change was at the November 2020 AGM where the limit was increased from £150,000).

For the current financial year, the chairman’s fee has increased by 12.0% to £42,000 (previously £37,500), the fee for the audit committee chair has increased by 16.7% to £35,000 (previously £30,000) and the fee for other directors has increased by 12% to £28,000 (previously £25,000). At these fee rates, the total directors’ fees amount to £161,000 (£142,500 for the prior year), which is comfortably within the £200,000 limit.

Recent share purchase activity by directors

Since we last published in November 2021, Wee-Li Hee has purchased an additional 5,000 shares (in October 2022), doubling her holding in PHI. All other directors’ holdings have remained the same.

With the exception of Sir Robert Chote, who is the most recent addition to PHI’s board, each of the directors has a significant personal investment in the trust (an average of 2.6 years of fees invested, excluding Robert). This is generally considered to be favourable as it suggests significant commitment to the trust and should help to align directors’ interests with those of shareholders.

Shareholders might also take some comfort that, against the difficult backdrop for growth-orientated investments (which has been reflected in a significant decline in PHI’s share price during the last 12 months), the board has also felt the impact of the decline. We also observe that, despite the challenging outlook, the board has been steadfast in its commitment to PHI, with not a single share being sold.

Angus Macpherson (chairman)

Angus was appointed to the board of directors in 2017 and became chairman of the trust on 12 November 2019, following the retirement of Jean Matterson from the board, at the company’s AGM the same day.

Angus was based in Asia between 1995 and 2004 in Singapore and Hong Kong, most recently as head of capital markets and financing for Merrill Lynch for Asia. Currently, he is chief executive of Noble and Company (UK) Limited, an independent Scottish corporate finance business. He is also currently chairman of Henderson Diversified Income Trust Plc, is a non-executive director of Schroder Japan Growth Fund Plc and is the former chairman of JP Morgan Elect Plc.

Angela Lane (audit committee chair and senior independent director)

Angela was appointed as a director on 1 October 2018, and became both the audit committee chair and senior independent director on 10 November 2020, following the retirement of Edward Creasy at the conclusion of PHI’s AGM that same day.

Angela is a qualified accountant and previously spent 18 years working as a private equity investor for 3i Plc. She has held several non-executive and advisory roles for small and medium capitalised companies across a range of industries. She is a non-executive director of Seraphim Space Investment Trust Plc, BlackRock Throgmorton Trust Plc and Dunedin Enterprise Investment Trust Plc, where she is also chairman of its audit committee. Previously, she held the role of non-executive chairman of Huntswood CTC.

Dir Robert Chote (director)

Robert is an economist, journalist and academic. He became chairman of the Northern Ireland Fiscal Council in 2021 and was chairman of the Office for Budget Responsibility, the nation’s top fiscal watchdog, from 2010 to 2020. He chaired the OECD’s network of parliamentary budget officials and independent fiscal institutions, and currently chairs the external advisory group of the Irish parliamentary budget office. Robert served as director of the Institute for Fiscal Studies from 2002 to 2010, as an advisor to senior management at the International Monetary Fund from 1999 to 2002, as economics editor of the Financial Times from 1995 to 1999, and as an economics and business writer on the Independent and Independent on Sunday from 1990 to 1994.

Robert is chair of the Royal Statistical Society’s advisory group on public data literacy. He is also a member of the Policy Committee of the Centre for Economic Performance at the London School of Economics, the advisory committee of the ESRC Centre for Macroeconomics, and the Council of Westcott House Theological College in Cambridge. He is a governor of the National Institute of Economic and Social Research (NIESR) and a visiting professor at the Department of Political Economy, Kings College London. Robert also serves on advisory boards at the Warwick Manufacturing Group and is a senior adviser to the governance reform consultancy, FMA.

Wee-Li Hee (director)

Wee-Li is an experienced Asian analyst, fund manager and CFA Charterholder. Brought up in Singapore, she speaks fluent Mandarin and studied in the UK at the University of Leeds and the London School of Economics and Political Science. After graduation, in 2002 she joined First State Investments in Singapore as an analyst, subsequently moving to the firm’s Edinburgh office in 2005. Having co-managed Scottish Oriental Smaller Companies Trust, Wee-Li became lead manager in 2014, stepping back as a result of family commitments to return to a co-manager role in 2017 and retiring at the end of 2019. She is a director of Melville Paisley Investments.

Joe Studwell (director)

Richard Frank (‘Joe’) Studwell has spent 25 years working in East Asia as a journalist, independent researcher at Dragonomics and author under the name of Joe Studwell. His published works include Asian Godfathers: Money and Power in Hong Kong and South East Asia and How Asia Works: Success and Failure in the World’s Most Dynamic Region.

Previous publications

Readers interested in further information about PHI may wish to read our previous notes (details are provided in Figure 33 below). You can read the notes by clicking on them in Figure 33 or by visiting our website.

Figure 33: QuotedData’s previously published notes on PHI

Source: Marten & Co

Legal

Marten & Co (which is authorised and regulated by the Financial Conduct Authority) was paid to produce this note on Pacific Horizon Trust Plc.

This note is for information purposes only and is not intended to encourage the reader to deal in the security or securities mentioned within it.

Marten & Co is not authorised to give advice to retail clients. The research does not have regard to the specific investment objectives financial situation and needs of any specific person who may receive it.

The analysts who prepared this note are not constrained from dealing ahead of it, but in practice, and in accordance with our internal code of good conduct, will refrain from doing so for the period from which they first obtained the information necessary to prepare the note until one month after the note’s publication. Nevertheless, they may have an interest in any of the securities mentioned within this note.

This note has been compiled from publicly available information. This note is not directed at any person in any jurisdiction where (by reason of that person’s nationality, residence or otherwise) the publication or availability of this note is prohibited.

Accuracy of Content: Whilst Marten & Co uses reasonable efforts to obtain information from sources which we believe to be reliable and to ensure that the information in this note is up to date and accurate, we make no representation or warranty that the information contained in this note is accurate, reliable or complete. The information contained in this note is provided by Marten & Co for personal use and information purposes generally. You are solely liable for any use you may make of this information. The information is inherently subject to change without notice and may become outdated. You, therefore, should verify any information obtained from this note before you use it.

No Advice: Nothing contained in this note constitutes or should be construed to constitute investment, legal, tax or other advice.

No Representation or Warranty: No representation, warranty or guarantee of any kind, express or implied is given by Marten & Co in respect of any information contained on this note.

Exclusion of Liability: To the fullest extent allowed by law, Marten & Co shall not be liable for any direct or indirect losses, damages, costs or expenses incurred or suffered by you arising out or in connection with the access to, use of or reliance on any information contained on this note. In no circumstance shall Marten & Co and its employees have any liability for consequential or special damages.

Governing Law and Jurisdiction: These terms and conditions and all matters connected with them, are governed by the laws of England and Wales and shall be subject to the exclusive jurisdiction of the English courts. If you access this note from outside the UK, you are responsible for ensuring compliance with any local laws relating to access.

No information contained in this note shall form the basis of, or be relied upon in connection with, any offer or commitment whatsoever in any jurisdiction.

Investment Performance Information: Please remember that past performance is not necessarily a guide to the future and that the value of shares and the income from them can go down as well as up. Exchange rates may also cause the value of underlying overseas investments to go down as well as up. Marten & Co may write on companies that use gearing in a number of forms that can increase volatility and, in some cases, to a complete loss of an investment.