An entry as well as an exit opportunity

The financials sector is a significant component of global markets, yet is often complex for many investors to analyse comprehensively. Polar Capital Global Financials Trust (PCFT) offers an accessible investment vehicle for gaining exposure to this sector. Its structure provides shareholders with regular exit opportunities, one of which is on the table now. This feature also allows institutional investors to acquire shares in substantial quantities.

The financials sector has performed strongly in recent years, having had a run of good performance (outperforming the broader market in four of the last five years). Those returns have been driven by earnings growth rather than valuation multiple expansion, which means that the sector still appears attractively valued. In addition, there are indications that earnings growth could persist; perhaps even accelerate. PCFT has outperformed its benchmark over the last five years, and its managers believe that it is positioned to continue this trend over the next five years.

Growing income and capital from financials stocks

PCFT aims to generate a growing dividend income, together with capital appreciation. It invests primarily in a global portfolio, consisting of listed or quoted securities issued by companies in the financial sector. This includes banks, life and non-life insurance companies, asset managers, stock exchanges, speciality lenders, and fintech companies, as well as property and other related sub-sectors.

| Year ended | Share price total return (%) | NAV total return (%) | MSCI ACWI Financials (%) | MSCI ACWI (%) |

|---|---|---|---|---|

| 30/04/2021 | 70.3 | 53.0 | 39.7 | 32.8 |

| 30/04/2022 | (2.7) | 2.4 | 7.4 | 4.3 |

| 30/04/2023 | (7.2) | (0.3) | 0.4 | 1.9 |

| 30/04/2024 | 20.9 | 18.6 | 20.9 | 17.9 |

| 30/04/2025 | 21.7 | 15.8 | 17.6 | 4.8 |

A new lease of life

Five-yearly tender opportunity

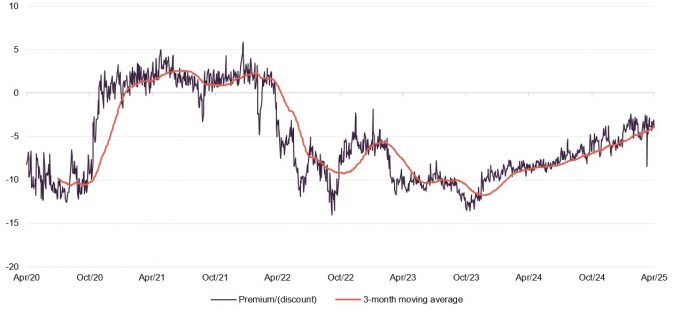

This note is being published following the publication of a circular that will provide details of PCFT’s latest 100% tender offer. It is considered that, by offering these at five-yearly intervals, investors are encouraged to exercise patience and consider PCFT’s long-term total return potential rather than a narrow focus on the discount. As shown on page 12, history demonstrates that the tender offers may have helped to keep the trust’s shares trading fairly close to NAV.

Institutional investors can use this opportunity to buy stock

Shares that are tendered will be available for purchase through a placing to institutional clients of Stifel (PCFT’s broker) at 100.5% of the tender price. Any shares not placed will be bought back into treasury and may be reissued if the trust trades at a sustained premium to NAV.

The board has considered the long-term strategic direction of PCFT and its structure

The board uses these opportunities to consider the long-term strategic direction of the company and its structure. On this occasion, the board sees no reason to change an investment strategy and a manager that has delivered outperformance of PCFT’s benchmark since the last tender offer. Nor will it change the trust’s 20% maximum gearing policy. However, in conjunction with the upcoming tender, it has made some changes that are intended to improve the appeal of the trust.

Lower fees

Fees:

- A new tiered management fee is being introduced with effect from 1 July 2025. The existing flat fee of 0.7% per annum will continue to apply on the first £500m, but the fee on the balance will be charged at a lower rate of 0.65%. At the time of publication, PCFT had net assets of £649m.

- In addition, rather than calculating the fee as a percentage of NAV, going forward, half the fee will be based on NAV and half on the lower of market capitalisation and NAV.

- The performance fee element of the fee structure will be completely removed.

Higher dividends

Dividends:

Currently, PCFT yields 2.1%. The board proposed and shareholders have approved the adoption of an enhanced dividend policy, using distributable reserves to top up PCFT’s revenue account so that it can pay quarterly dividends of 1% of NAV (approximately 4% of NAV per annum). The new policy will take effect for the financial year commencing 1 December 2025.

The managers suggest that the policy reflects the trend towards companies prioritising share buybacks over dividends in some markets. In addition, with less reliance on generating income to distribute, the managers may have additional flexibility to focus on maximising total returns for shareholders.

New discount control policy

Discount:

If, under normal market conditions: (i) PCFT’s three-month average discount is greater than 5%, and (ii) the discount is currently greater than 5%, PCFT will buy back shares with the intention of reducing the discount to a level of no greater than 5%.

A compelling opportunity?

Financials is the second-largest sector after IT

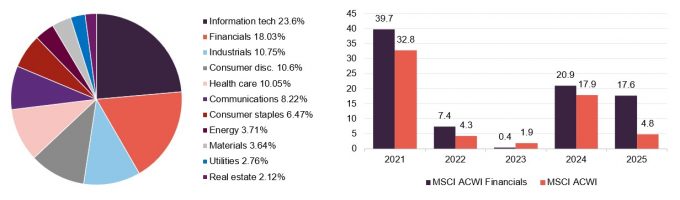

The financials sector is an important part of global indices – the second-largest sector after information technology – and in recent years it has been an important driver of market returns, outperforming the wider global MSCI All Countries World Index (MSCI ACWI) in four of the last five 12-month periods ending 30 April.

When PCFT was launched in July 2013, the key marketing message was around the potential for a recovery in the sector’s fortunes five years on from the disruption caused by the global financial crisis. Seven years later, when shareholders were first given an exit opportunity, any nascent recovery had been impacted by market volatility associated with the COVID pandemic. Shareholders who chose to redeem their holdings at that time missed the subsequent recovery.

Figure 1: MSCI ACWI sector split as at 30 April 2025

Figure 2: Total returns for periods ending 30 April 2025

Source: Morningstar, Marten & Co

Source: MSCI

Some readers might be surprised by the scale of the financials sector’s relative performance since the last tender offer, especially given that for a couple of years now the market has seemingly been fixated on US mega-cap technology businesses which have attracted attention as prominent participants in AI innovation. PCFT’s managers point out that the financials sector could potentially benefit from the adoption of AI technologies. The potential for banks and insurers to exploit it to cut costs is considerable, for example. However, recent market volatility associated with Trump’s tariff policy has contributed to renewed discussion about the risks of overconcentration in AI-focused investments, and that could support a more balanced distribution of returns and capital allocation across sectors.

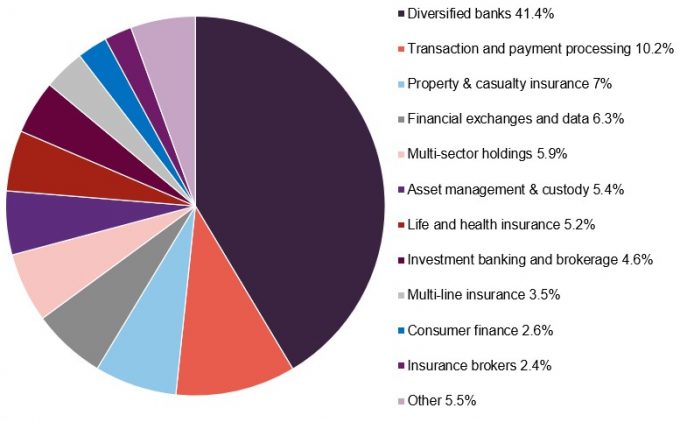

A diverse sector

The financials sector covers a diverse set of companies, some of which have quite complex business models and regulatory environments. The Polar Capital team (as detailed in our last note – or here on the trust’s website) has relevant expertise in this area.

Figure 3: MSCI ACWI Financials sector split as at 30 April 2025

Source: MSCI

Markets have been volatile in recent months and the sector has not been immune to this. However, the managers used this period of volatility to increase holdings in selected stocks. We discuss recent portfolio changes from page 6 onwards.

Currently, the managers express a constructive outlook for the following:

Trading platforms, data and exchanges were about 16% of the portfolio at end April 2025

- Trading platforms, which are considered to benefit from market volatility, the general shift from defined benefit to defined contribution pension schemes, the growth in cryptocurrencies, and greater appetite for short-term trading strategies.

Examples include flatexDEGIRO (see page 10) and Interactive Brokers.

- Data and exchanges, where market volatility is helpful in terms of driving volumes, but where the managers highlight what they see as monetising the data the platforms hold.

Examples include Nasdaq and Intercontinental Exchange (see page 8).

- European banks (13% of the portfolio), where the managers do not expect interest rates to fall to levels that would significantly impact margins, but they view valuations as attractive and balance sheets as strong, and note governmental efforts to stimulate economic activity.

Examples include Barclays, the Italian fintech bank Fineco, and Greece’s Alpha Bank.

- Property & casualty insurance (15% of the portfolio), where the managers attribute current margin levels to evolving risk environments, including climate-related risks.

Examples include Beazley, Swiss Re (see page 8), and Gallagher.

- Payments businesses, as electronic payments continue to take share from cash payments.

The managers are happy to have selective exposure to:

- US banks (16% of the portfolio), where there is an expectation that regulatory burdens on the sector will be eased, and where the managers view current provisions against loan books as prudent (banks could appear to be factoring in the potential for US unemployment rates of 5-6%), but where valuations are higher than in other markets.

Examples include Goldman Sachs, First Horizon, and BNY Mellon.

- Alternative asset managers, which was an area that PCFT had an overweight exposure to until the turn of the year that was reduced earlier this year on valuation grounds and has fallen further since as investors have responded to concerns about a more difficult environment for exits.

The managers are taking a more cautious stance for life insurance and traditional asset managers.

One other theme that runs across the various subsectors is the managers’ view of the potential for long-term demand growth within emerging markets as consumers in these countries make greater use of financial services (this accounts for about 16% of the portfolio).

Examples include MercadoLibre (see page 10), Nubank, and Indian non-bank finance company Shriram Finance.

Portfolio – asset allocation

At the end of April 2025, there were 77 positions in PCFT’s portfolio, down from 90 at the end of October 2024. Relative to the benchmark MSCI ACWI Financials Index, PCFT’s active share at 30 April 2025 was 68.2%.

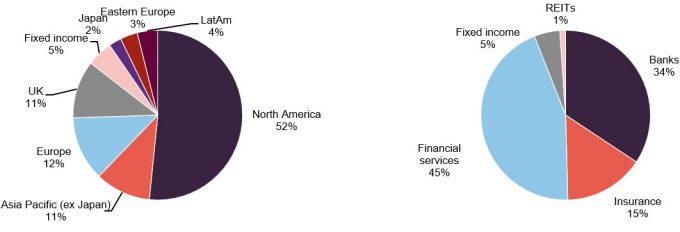

Figure 4: PCFT geographic exposure as at 30 April 2025

Figure 5: PCFT sector exposure as at 30 April 2025

Source: Polar Capital Global Financials Trust

Source: Polar Capital Global Financials Trust

Since we last published (using data as at 31 October 2024), PCFT has reintroduced some exposure to Eastern Europe and Latin America. This has been funded largely by a further reduction in fixed interest exposure, which the managers indicate may continue when the managers are freed up from the need to generate revenue to cover the dividend (as highlighted on page 3). At the same time, the allocation to financial services has risen, funded by a reduction in the exposure to insurance (although a large part of that could reflect a switch into Berkshire Hathaway, which has significant exposure to the insurance and reinsurance sectors but is classified within financial services).

Top 10 holdings

Figure 6: Top 10 holdings as at 30 April 2025

| Country/region | Subsector | 30/04/2025(%) | 31/10/2024(%) | Change(%) | |

|---|---|---|---|---|---|

| JPMorgan | United States | Banks | 6.2 | 6.6 | (0.4) |

| Mastercard | United States | Financial services (payments) | 4.8 | 4.5 | 0.3 |

| Berkshire Hathaway | United States | Financial services (insurance) | 4.4 | n/a | n/a |

| Visa | United States | Financial services (payments) | 3.8 | 2.8 | 1.0 |

| Bank of America | United States | Banks | 3.3 | 3.9 | (0.6) |

| UniCredit | Italy | Banks | 2.5 | 2.6 | (0.1) |

| Barclays | United Kingdom | Banks | 2.4 | 1.9 | 0.5 |

| Swiss Re | Switzerland | Insurance | 2.3 | n/a | n/a |

| Intercontinental Exchange | United States | Financial services (exchange) | 2.2 | 1.8 | 0.4 |

| Progressive Corp | United States | Insurance | 2.0 | 1.8 | 0.2 |

| Total | 33.9 |

Since we last published (using data as at end October 2024), Fidelity National Information, Nasdaq, ICICI Bank, and Erste Group Bank have dropped out of the top 10 holdings, to be replaced by Berkshire Hathaway, Swiss Re, Intercontinental Exchange, and Progressive.

Berkshire Hathaway

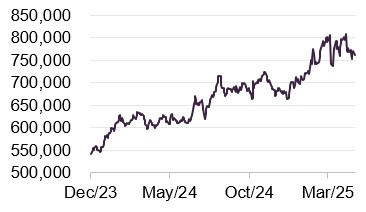

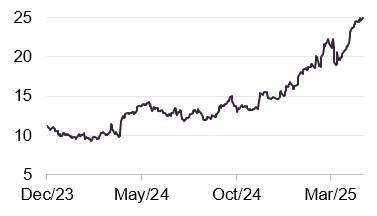

Figure 7: Berkshire Hathaway (USD)

Source: Bloomberg

Berkshire Hathaway (berkshirehathaway.com) has been in the news as Warren Buffett has announced that he will step down as CEO at the end of the year, after more than 60 in the leadership role. We discussed the company in our June 2024 note, but to recap, it is the largest stock in PCFT’s benchmark (accounting for 5.1% of it at the end of April 2025, although relative to the benchmark PCFT is still underweight). Sometimes described as a conglomerate, the company’s 189 subsidiaries span insurance and reinsurance, rail freight, utilities and energy, manufacturing services and retailing, as well as an investment portfolio with stakes in many other companies.

Rising cash and short-dated Treasury holdings have helped to mitigate the impact of market volatility. The shares declined by approximately 5% on news of Buffett’s retirement, but have still posted positive returns over the past year supported by performance in the company’s insurance and reinsurance businesses.

Swiss Re

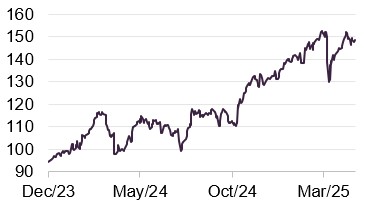

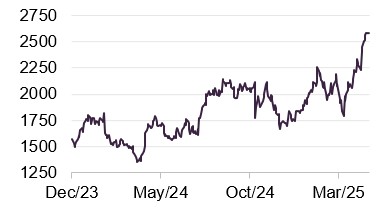

Figure 8: Swiss Re (CHF)

Source: Bloomberg

Swiss Re (swissre.com) is a major wholesale provider of reinsurance and insurance, across property & casualty, life & health, and corporate solutions. It reports a strong regulatory capital position (scoring 254% on the Swiss Solvency Test, against an internal target of 200–250%) and has stated its goal to be a market leader in its sector. It is expected to announce a new long-term strategy in H2 2025.

Quarterly results for Q1 2025 showed net income of $1.3bn and an ROE of 22.4% (up from $1.1bn and 20.7% for the same quarter last year). The result was achieved despite significant large loss events in its property and casualty businesses including the wildfires in Los Angeles. Concerns about the increased incidence of events such as this are seen as contributing to sustained profitability in the sector.

Intercontinental Exchange

Figure 9: Intercontinental Exchange (USD)

Source: Bloomberg

Intercontinental Exchange (ice.com) operates a number of exchanges – covering areas such as equities (including the New York Stock Exchange), interest rates, forex, metals, agricultural goods, energy, and credit – in Europe, US, Singapore, and Abu Dhabi. It also offers clearing services, indices, derivatives, trading applications, and access to data.

ICE’s Q1 2025 figures showed year-on-year revenue growth of 8%, and around half of revenues were recurring. That revenue growth translated into EPS growth of 16%. That extends a consistent pattern of year-on-year EPS growth that stretches back to 2006 and has averaged of 15% per annum.

Progressive

Figure 10: Progressive (USD)

Source: Bloomberg

Progressive (progressive.com) is primarily an automotive insurance company but also offers home insurance and life insurance products.

Its Q1 2025 figures showed a 17% year-on-year increase in net premiums written and a 10% uplift in net income. Its underwriting margins have been increasing over recent periods. That is reflected in a stronger balance sheet, with the book value per common share standing at $49.39 at end March 2025, up from $26.32 in December 2022.

Performance

Figure 11 shows the trust’s NAV and share price total returns alongside those of the MSCI All Countries World Financial Index for the period from reconstruction on 22 April 2020 to the end of April 2025. The drivers of PCFT’s historic performance have been covered in our previous notes, a list of which is provided on page 13.

Markets have been more volatile over recent months, with commentary attributing this primarily to developments in US trade policy under former President Trump.

Polar Capital shared some performance attribution data with us which covers the first four months of 2025. Over that period, the trust outperformed by 0.6%. The main drivers of this are shown in Figures 13 and 16.

Figure 11: PCFT NAV, share price, and MSCI ACWI Financials from 22 April 2020 to 30 April 2025

Source: Morningstar, Marten & Co

As Figure 12 shows, PCFT’s NAV and share price returns are ahead of its benchmark since the trust was restructured in April 2020. The sector has also markedly outperformed the wider global index over that period. The managers believe that the outperformance of the financials sector has much further to go.

Figure 12: Cumulative total return performance over periods ending 30 April 2025

| 3 months (%) | 6 months (%) | 1 year (%) | 3 years (%) | 5 years (%) | Since 22 April 20201 (%) | Since launch2 (%) | |

|---|---|---|---|---|---|---|---|

| PCFT price | (5.3) | 8.3 | 21.7 | 36.5 | 126.1 | 128.4 | 173.1 |

| PCFT NAV | (5.0) | 5.9 | 15.8 | 36.9 | 114.5 | 126.3 | 184.7 |

| MSCI ACWI Financials | (6.1) | 5.6 | 17.6 | 42.7 | 114.2 | 123.7 | 205.0 |

| MSCI AC World Index | (10.4) | (2.9) | 4.8 | 26.0 | 74.5 | 77.9 | 332.0 |

Figure 13: Five-largest positive contributions to relative returns YTD to 30 April 2025

| Average stock weight (%) | Active weight (%) | Stock return (%) | Total attribution (%) | |

|---|---|---|---|---|

| UniCredit | 2.32 | 1.78 | 36.17 | 0.53 |

| flatexDEGIRO | 1.01 | 1.01 | 60.92 | 0.45 |

| EURO STOXX Banks Index put options | 0.02 | 0.02 | 300.09 | 0.40 |

| MercadoLibre | 1.11 | 1.11 | 28.57 | 0.28 |

| Deutsche Boerse | 1.46 | 1.09 | 30.97 | 0.28 |

We last discussed UniCredit in our June 2024 note. Recently, the bank reported Q1 2025 results, describing the period as “the best quarter in our history”. Its share price has been hitting new highs, yet it still trades on a P/E of 9.4x and offers a dividend yield of 4.2%. The managers have been highlighting the valuation opportunity for European banks for some time and this stance has been reflected in recent NAV contributions, including from a derivatives position on the sector.

flatexDEGIRO

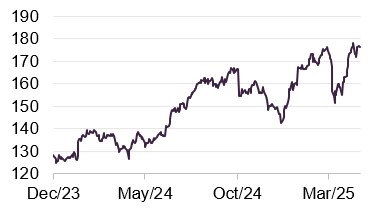

Figure 14: flatexDEGIRO (EUR)

Source: Bloomberg

flatexDEGIRO (flatexdegiro.com/en) describes itself as the leading and fastest-growing European online broker. Having started life in 2006, with an online brokerage operating in Germany and Austria, it now has over 3m customer accounts across 16 countries. It also offers its services to professional investors under its Vitrade brand. The business is highly profitable, with a cost-income ratio of 50%. The company increased its net income by 55% on revenues up 23% in 2024 relative to 2023, and announced that it aims for a further 75% increase in net income by 2027.

The managers see the potential for a further acceleration in growth if Germany legislates to encourage private pension provision. They suggest that the positive shift in investor sentiment within the country, following its commitment to sharply higher defence and infrastructure spending, was also helpful.

This was likely also a factor in Deutsche Boerse’s strong returns.

MercadoLibre

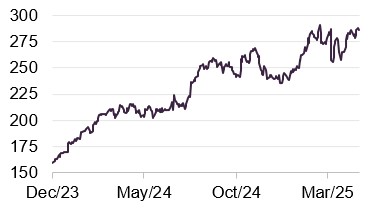

Figure 15: MercadoLibre (USD)

Source: Bloomberg

MercadoLibre (mercadolibre.com) is a major online marketplace in Latin America. It is described as a fast-growing business– it recently reported 17% year-on-year growth in gross merchandise value traded through its sites in Q1 2025, and 37% year-on-year growth in net revenue and financial income (all is US dollar terms). It incorporates a fintech services business Mercado Pago, which is the largest digital payment platform in Latin America and a provider of buy-now-pay-later and other credit provision services. Its credit portfolio has grown by 75% year-on-year.

Figure 16: Five-largest negative contributions to relative returns YTD to 30 April 2025

| Average stock weight (%) | Active weight (%) | Stock return (%) | Total attribution (%) | |

|---|---|---|---|---|

| Ares Management | 1.62 | 1.39 | (19.54) | (0.38) |

| Berkshire Hathaway | 2.94 | (1.91) | 9.99 | (0.29) |

| Bank of America | 3.78 | 1.58 | (15.25) | (0.26) |

| Banco Santander | 0.00 | (0.68) | 42.16 | (0.24) |

| Allianz | 0.00 | (1.02) | 26.64 | (0.24) |

After a period of strong performance, Ares Management appeared to be hit by expectations of a more difficult environment for private assets as Trump’s policy announcements increased the possibility of recession. For most of the first four months of the year, PCFT had a meaningful underweight exposure to Berkshire Hathaway, which was a relatively strong performer. The managers have been adding to the position, however, as discussed on page 7. Underweight exposures to Banco Santander and Allianz also contributed negatively to PCFT’s relative returns.

US bank stocks including Bank of America, which had been trading higher in anticipation of regulatory easing, may have been knocked by fears of US recession and the prospect of an associated uptick in defaults.

Fund intro

PCFT looks to grow investors’ income and their capital

More information on the trust is available on its website www.pcgft.com

Polar Capital Global Financials Trust (PCFT) has twin objectives of growing both investors’ income and their capital. Its global mandate makes it an option for UK-based investors looking to diversify their financials exposure.

PCFT launched on 1 July 2013 with a fixed life. In April 2020, in conjunction with a vote on prolonging the life of the trust, shareholders were offered a cash exit. Holders of 39.1% of PCFT’s then-issued share capital opted to sell their shares and the portfolio was reconstructed to facilitate this. At the same time, shareholders overwhelmingly approved an extension of the trust’s life beyond May 2020 and the trust now has an unlimited life, but with five-yearly tender offers, the first of which is currently underway (see page 3 for details).

Predominantly, the portfolio is invested in listed/quoted securities. The trust may have some exposure to unlisted/unquoted securities, but this is not expected to exceed 10% of total assets at the time of investment.

Benchmarked against MSCI ACWI Financials

Since April 2020, the trust’s performance benchmark has been the MSCI All-Countries World Financials Net Total Return Index in sterling (MSCI ACWI Financials).

PCFT’s AIFM is Polar Capital LLP, which had AUM of £21.4bn at 31 March 2025 and employs 14 investment teams, spread across offices in Europe, the US and Asia. PCFT’s lead managers are Nick Brind, George Barrow, and Tom Dorner.

Previous publications

QuotedData has published a number of notes on PCFT. You can read these by clicking the links in the table below or by visiting the QuotedData.com website.

Figure 18: QuotedData’s previously published notes on PCFT

| Title | Note type | Date |

|---|---|---|

| Don’t fear a slowing economy | Initiation | 30 April 2019 |

| Banks too cheap to ignore | Update | 29 October 2019 |

| New lease of life | Update | 22 February 2020 |

| Too much pessimism? | Annual overview | 22 October 2020 |

| The tide has turned | Update | 25 February 2021 |

| More to go for | Annual overview | 18 November 2021 |

| Riding out the storm | Update | 5 April 2022 |

| Don’t fear the dog that is yet to bark | Annual overview | 30 November 2022 |

| Avoiding mishap | Update | 7 June 2023 |

| Pessimism overdone, time to buy | Annual overview | 12 December 2023 |

| Handful of themes to drive performance | Update | 13 June 2024 |

| Taking advantage of a favourable landscape | Annual overview | 12 December 2024 |

IMPORTANT INFORMATION

Marten & Co (which is authorised and regulated by the Financial Conduct Authority) was paid to produce this note on Polar Capital Global Financials Trust Plc.

This note is for information purposes only and is not intended to encourage the reader to deal in the security or securities mentioned within it. Marten & Co is not authorised to give advice to retail clients. The research does not have regard to the specific investment objectives financial situation and needs of any specific person who may receive it.

The analysts who prepared this note are not constrained from dealing ahead of it but, in practice, and in accordance with our internal code of good conduct, will refrain from doing so for the period from which they first obtained the information necessary to prepare the note until one month after the note’s publication. Nevertheless, they may have an interest in any of the securities mentioned within this note.

This note has been compiled from publicly available information. This note is not directed at any person in any jurisdiction where (by reason of that person’s nationality, residence or otherwise) the publication or availability of this note is prohibited.

Accuracy of Content: Whilst Marten & Co uses reasonable efforts to obtain information from sources which we believe to be reliable and to ensure that the information in this note is up to date and accurate, we make no representation or warranty that the information contained in this note is accurate, reliable or complete. The information contained in this note is provided by Marten & Co for personal use and information purposes generally. You are solely liable for any use you may make of this information. The information is inherently subject to change without notice and may become outdated. You, therefore, should verify any information obtained from this note before you use it.

No Advice: Nothing contained in this note constitutes or should be construed to constitute investment, legal, tax or other advice.

No Representation or Warranty: No representation, warranty or guarantee of any kind, express or implied is given by Marten & Co in respect of any information contained on this note.

Exclusion of Liability: To the fullest extent allowed by law, Marten & Co shall not be liable for any direct or indirect losses, damages, costs or expenses incurred or suffered by you arising out or in connection with the access to, use of or reliance on any information contained on this note. In no circumstance shall Marten & Co and its employees have any liability for consequential or special damages.

Governing Law and Jurisdiction: These terms and conditions and all matters connected with them, are governed by the laws of England and Wales and shall be subject to the exclusive jurisdiction of the English courts. If you access this note from outside the UK, you are responsible for ensuring compliance with any local laws relating to access.

No information contained in this note shall form the basis of, or be relied upon in connection with, any offer or commitment whatsoever in any jurisdiction.

Investment Performance Information: Please remember that past performance is not necessarily a guide to the future and that the value of shares and the income from them can go down as well as up. Exchange rates may also cause the value of underlying overseas investments to go down as well as up. Marten & Co may write on companies that use gearing in a number of forms that can increase volatility and, in some cases, to a complete loss of an investment.