New lease of life

New lease of life

As we approach the seventh anniversary of Polar Capital Global Financials Trust (PCFT)’s launch, its directors are proposing that the company continues beyond its planned wind-up date.

A decade after the financial crisis, the sector, and banks in particular, remain out of favour. The problem is compounded for UK-based investors by the narrow choice of banks available; it makes sense to look elsewhere for faster-growing, better-managed businesses. However, this is a complex sector. PCFT offers a way of capturing the upside when banks are eventually re-rated. It also offers a lower-risk, more diversified portfolio, managed by an expert team.

From launch to end December 2019, PCFT has matched the returns of its benchmark and paid out an attractive and growing dividend. More importantly, it has delivered strong risk-adjusted returns well ahead of UK-listed banks, for investors who wanted to diversify away from UK financials. As it moves to extend the life of the trust, the board has thought about how it can improve on the original structure and made a number of changes, including a five-yearly tender offer.

Growing income from financials stocks

Growing income from financials stocks

PCFT aims to generate a growing dividend income, together with capital appreciation. It invests primarily in a global portfolio, consisting of listed or quoted securities issued by companies in the financial sector. This includes banks, life and non-life insurance companies, asset managers, stock exchanges, speciality lenders and fintech companies, as well as property and other related sub-sectors.

Extended life comes with lower fees

Extended life comes with lower fees

PCFT was launched in July 2013 with a fixed life ending in May 2020. After consulting with major shareholders, PCFT’s board has resolved to offer investors the opportunity to continue their investment in the company beyond this date. Shareholders will be asked to approve the removal of the commitment to wind up the fund.

Any investor who wants to exit now will still be given the chance to do so. The plan is to hold a tender offer for up to 100% of shares in issue at a price that reflects NAV less the costs associated with holding the tender (described in the announcement as “costs and other appropriate adjustments”). The indication is that the price will be equivalent to about 99% of NAV. The tender offer is planned to complete in mid to late April.

The details will be firmed up when a circular convening the meetings to approve these proposals is issued (planned for early March). Highlights of the proposals are:

• No change to the investment strategy: a growing dividend and capital appreciation from a global portfolio of listed or quoted securities issued by companies in the financials sector operating in the banking, insurance, property and other sub-sectors.

• A new, simpler benchmark: dropping real estate from the benchmark and widening the geographic exposure by adopting the MSCI All Countries World Index Financials Net Total Return Index (in Sterling), better reflecting the portfolio’s allocation to emerging markets.

• Regular opportunities to exit close to NAV: Five-yearly tender offers commencing in 2025.

• Lower fees: A cut in basic management fees from 0.85% of the lower of market capitalisation and NAV to 0.70% of NAV. The performance fee will change too. A new, more challenging hurdle rate is proposed. More detail on this will be provided in the circular.

• Opportunity for higher gearing: PCFT will continue to use gearing judiciously but to a greater extent than it has done in the past. The proposal is for an increase in the maximum permitted level of gearing from 15% to 20% of NAV, which is still reasonably conservative in our view.

• Discount/premium control: In normal market circumstances, the board believes the shares should trade no wider than a 5% discount. The five-yearly exit opportunity should help in this regard. The company may also buy back shares into treasury when PCFT is trading at a discount and reissue shares from treasury (or issue new shares if there are no treasury shares) when PCFT is trading at a premium. Reissuance of shares from treasury will only be carried out if the trust’s share price is trading at a sustained premium to NAV.

PCFT has outperformed UK banks by some margin…

PCFT has outperformed UK banks by some margin…

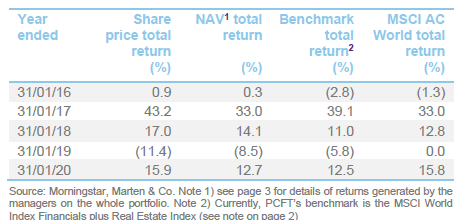

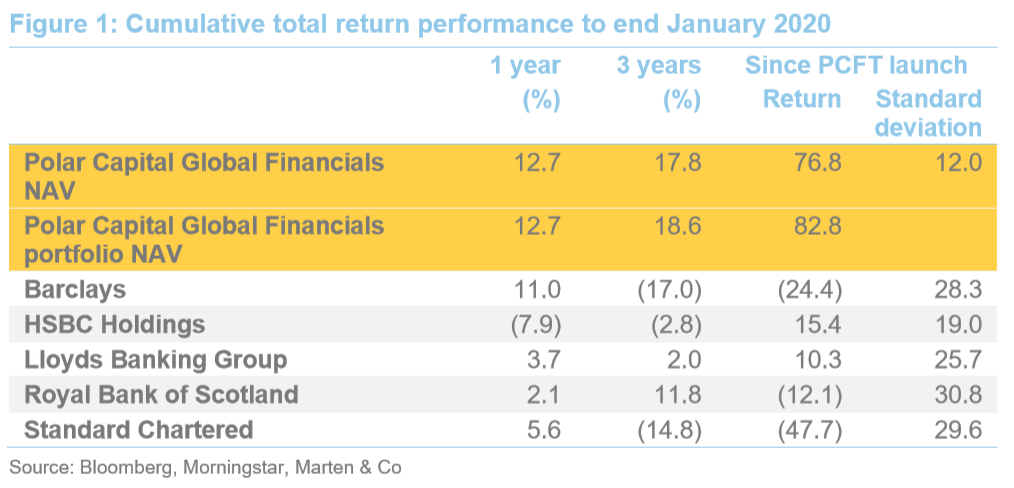

A key argument behind the launch of PCFT in 2013 was that it would provide UK-based investors a relatively lower risk exposure to the financial sector. The UK banks have provided pretty dreadful returns since then. Given that, perhaps it is not surprising that many UK investors write off the sector as a ‘value trap’. By contrast, PCFT has delivered returns well ahead of UK banks and has done so with a much lower volatility of returns. This is not an exchange rate story, although sterling weakness relative to the dollar has contributed to this a little (the dollar/sterling exchange rate was 11.4% lower at the end of January 2020 than it was at the start of July 2013, but the euro weakened slightly over this period).

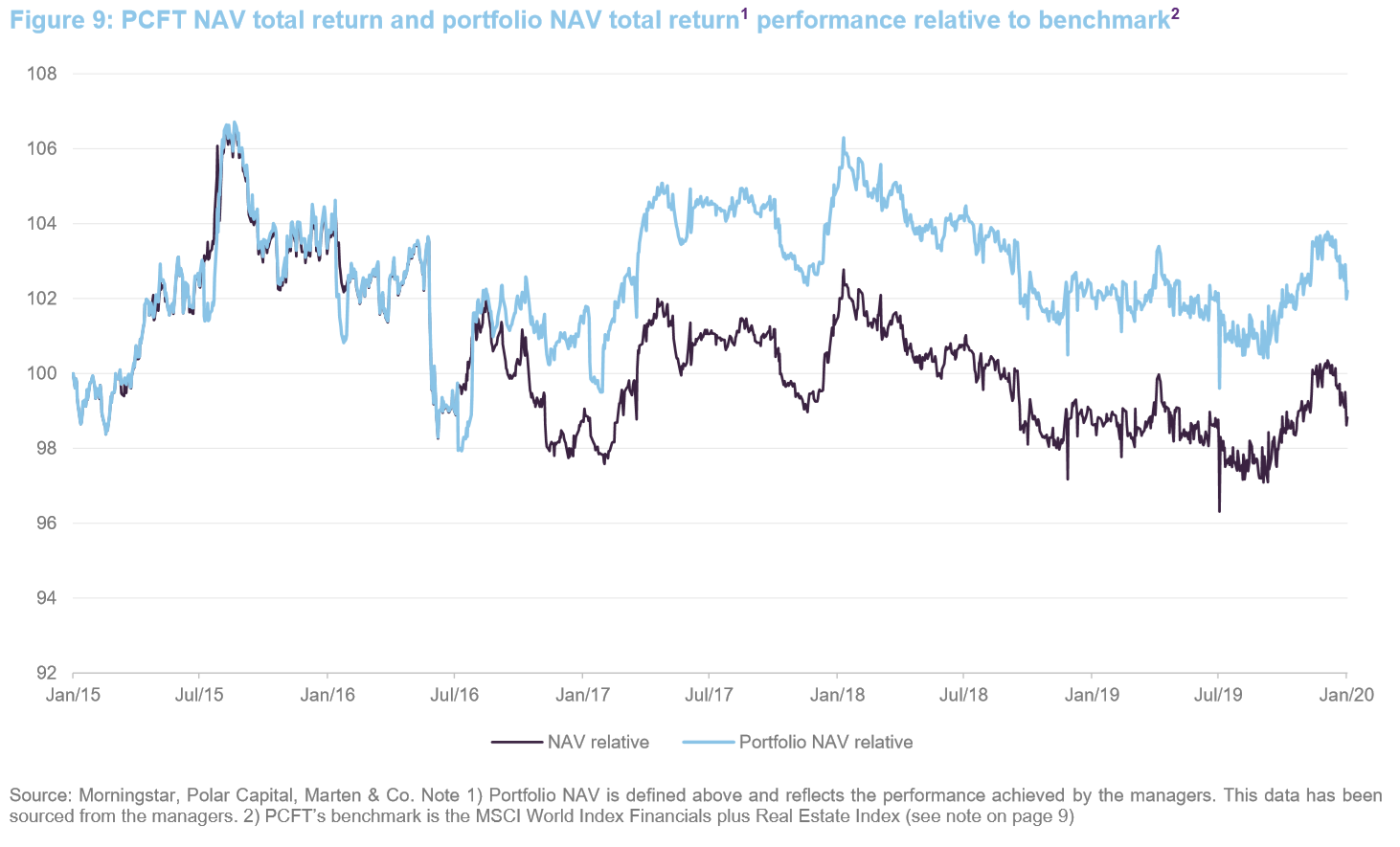

PCFT’s historic NAV and share price returns are distorted by the subscription shares that were given free to investors in the IPO on 1 July 2013. We have included ‘portfolio NAV’ returns in Figure 1, which better represent the performance achieved by the managers.

When PCFT was launched, investors were given subscription shares alongside their ordinary shares. Holders of subscription shares had the right to buy one ordinary share at a price of 115p on 31 July 2017 for each subscription share that they held. The effect was that, as PCFT’s NAV rose above 115p, returns to ordinary shareholders were diluted. The portfolio NAV (or undiluted NAV) shows the returns that the managers actually generated and represents the return that an investor who held onto their subscription shares and exercised them would have received. For periods beginning after 31 July 2017, the NAV and portfolio NAV returns are identical.

…but more time is needed

…but more time is needed

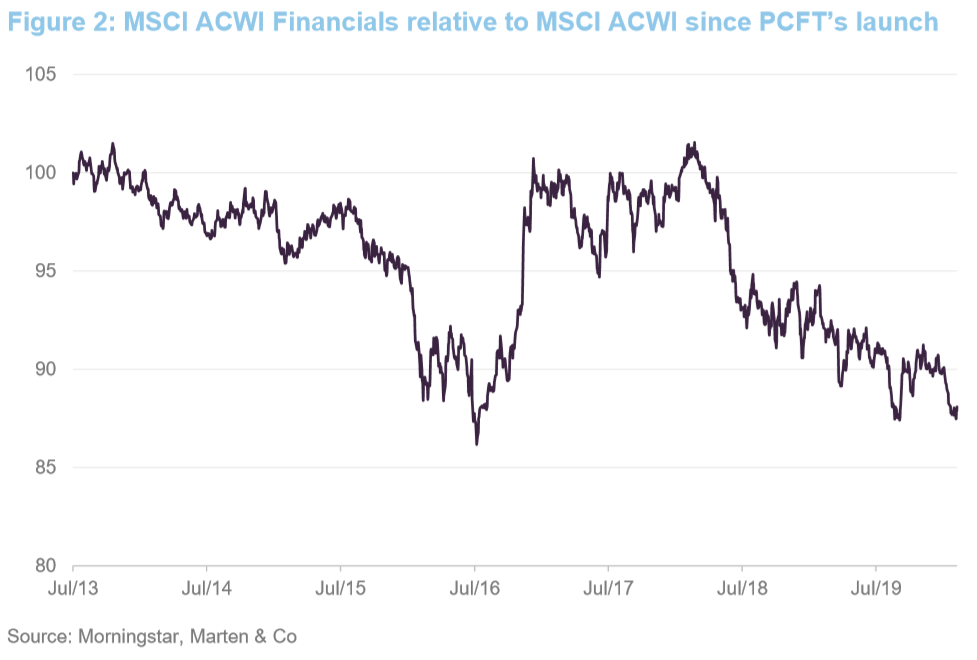

In some ways, the initial premise of PCFT has not been fulfilled. Whilst PCFT has met its objective of growing its dividend and has provided strong risk-adjusted returns matching those of its benchmark, banks – which make up the bulk of the financials sector – are still out of favour with investors. Until the sector has re-rated, the initial thesis – that the sector’s rating would mean-revert once it had put the financial crisis behind it – has not been fulfilled.

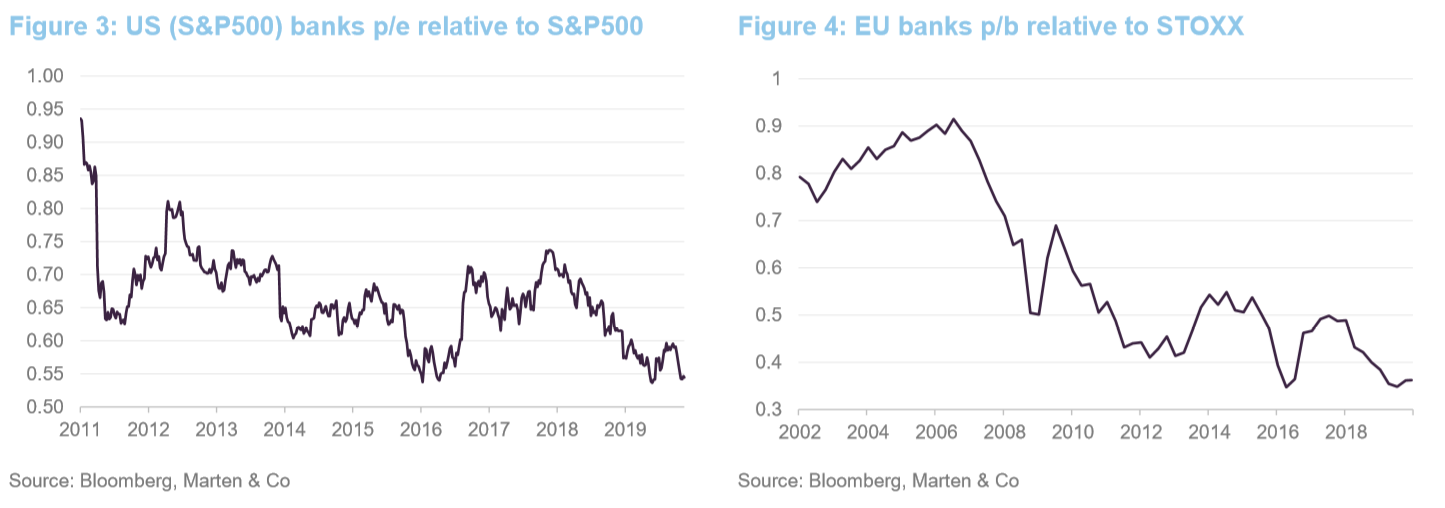

Globally, financials have underperformed other sectors since PCFT’s launch, as is evident in Figure 2. US banks, which dominate the global sector, are trading close to p/e relative lows. The chart in Figure 4, which is looking at the relative valuation of European banks, covers a much longer period and emphasises that banks were already cheap relative to history in 2013. The managers highlight that, on a price/book basis, MSCI Banks have never been cheaper (they were looking at data going back to February 1995).

There is still a perception amongst investors, unjustified in the managers’ view, that banks struggle to make money in an era of low interest rates, credit quality is poor, default rates are about to rise and fintech is coming to ‘eat the banks’ lunch’.

These are themes that we explored in our last note on PCFT. To recap:

• Whilst it is true to say that deposit margins have been hit by low interest rates, banks are still making money on their lending.

• In the overall lending market, credit quality may be poor and, if economic growth does stumble, default rates could rise. However, banks, constrained by regulatory requirements and a need to repair their balance sheets, have been focusing on better quality credits and have allowed the booming alternative lending sector to take up the slack. PCFT’s managers also think that consumers are not, on average, overly indebted.

• One consequence of lending restraint is that banks are now well-capitalised. There may be scope for a relaxation of regulations, which could translate into higher payout ratios. For example, last November, the ECB decided to allow 90bp of subordinated debt in banks’ Pillar 2 capital requirement (previously this had to be equity). However, in the UK, this was offset by a raising of the counter-cyclical buffer from 1% to 2%, another headwind for the UK banks.

• Lastly, banks have been cutting overheads and investing in technology. The challenger banks have not made the inroads into the sector that they had hoped for and some are running out of steam.

Current fund profile

Current fund profile

Polar Capital Global Financials Trust (PCFT) launched on 1 July 2013 and has a fixed life that expires in May 2020. Its twin objectives focus on growing investors’ income and their capital. Its global mandate makes it a useful alternative for UK-based investors looking to diversify their financials exposure.

Predominantly, the portfolio is invested in listed/quoted securities. The trust may have some exposure to unlisted/unquoted securities, but this is not expected to exceed 10% of total assets at the time of investment.

The trust was benchmarked against the MSCI World Financials Index from launch until 31 August 2016. Then, when MSCI spun the Real Estate sector out of the Financials index, the benchmark became the MSCI World Financials plus Real Estate Net Total Return Index (in Sterling) – effectively a continuation of the pre-September 2016 benchmark.

The manager

The manager

PCFT’s AIFM is Polar Capital LLP, which had AUM of £14.3bn at the end of September 2019. The lead managers on PCFT are Nick Brind and John Yakas. They are part of a seven-strong team, with over 115 years’ experience between them, dedicated to the financials sector.

Managers’ views

Managers’ views

The managers say that credit markets have had a good start to 2020. The CLO market had a wobble in Q4 2019 but they see no sign of slowing CLO issuance in 2020. Banks exposed to Asia have de-rated a little on fears of the effects of Covid-19, the coronavirus.

On the competitive pressures being faced by the banks, the managers point to research from KBW that suggests that risk-adjusted margins for US banks have returned to longrun averages, since the worst of the financial crisis. Most are finding ways of cutting costs and improving margins through investment in technology. The managers highlight DnB as one example of a bank that is cutting costs aggressively. Its return on equity has been rising as it drives out costs with investment in IT. Across the sector, spending on R&D (principally IT) is rising. Even fintech giants such as Ant Financial and PayPal are being outspent (by 1.5x-2x) by the likes of Bank of America, JPMorgan and Wells Fargo. Bank of America has developed a chatbot (virtual financial assistant) – Erica – to improve its mobile banking offer.

More M&A activity is possible, given that this offers a way of delivering earnings enhancements, even in a difficult market environment, from the material cost savings available.

The strength of banks’ balance sheets is important when it comes to competing with new entrants. Moves to make it easier for customers to switch between banks could be seen as a threat for the incumbents, but evidence suggests that customers are sticking by the banks they know and trust.

This is unhelpful for the new entrants, as a number of these ‘Unicorns’ are still priced for perfection, in the managers’ view. Some examples of strain in the fintech revolution story are the recent write-down in the valuation of Zopa, as it raised £140m to shore up its balance sheet at a 47% lower valuation than previously; Monzo is still racking up losses as it seeks additional capital to target the US market; and N26 has closed its UK operation, blaming Brexit.

Regulation never goes away. With the US election cycle in full swing, some commentators have started talking about whether a Democrat win could pose a threat to the sector (one of President Trump’s first actions was to roll back some of the provisions of the Dodds Frank Act, which had been introduced by the Obama administration in the wake of the financial crisis. Much will depend on who wins the Democratic nomination and then the election itself, but the managers think the Democrats may be more focused on excesses within the tech sector.

The trust’s holdings in payments companies such as Mastercard and PayPal are still going strong. The managers acknowledge that these are not cheap, but say they are exhibiting strong earnings growth. They see the prospect for this subsector to make further inroads into the B2B area.

The managers remain cautious on alternative lenders, largely on concerns about underwriting standards. There is a fear that this area, which already has more than its fair share of problems in a relatively benign economic environment, will bear the brunt of any uptick in defaults.

In other parts of the sector, they have been cutting PCFT’s exposure to property and casualty insurance. The managers note that there has been inflation in the awards being made by juries in the US. After a run of significant catastrophe losses, retrocessional rates are rising but the managers see better value in banks for now.

Asset managers are finding life tough, in their opinion. The major growth areas are in alternatives and ETFs and there is always downward pressure on fees.

It is hard to pinpoint the catalyst for a future re-rating of the sector. Generally, investors are underweight and any sustained change in sentiment could lead to a meaningful uplift in the sector’s relative valuation. One possible catalyst would be an uptick in inflation/interest rates. In the meantime, the dividend yield offered by the sector means that you are being paid to wait. The managers would also re-emphasise that PCFT has demonstrated that UK investors worried about the poor choice/quality of financial stocks in the UK, can achieve better results, greater diversification and lower risk with an investment in PCFT.

Asset allocation

Asset allocation

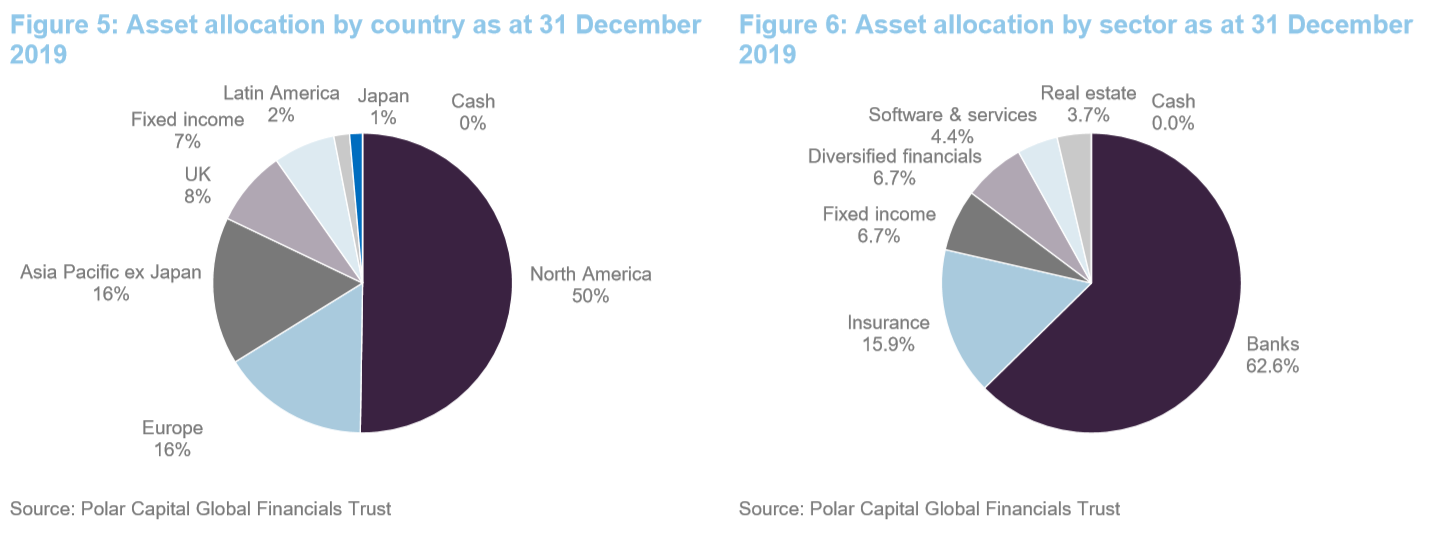

At the end of December 2019, there were 68 positions in PCFT’s portfolio.

The portfolio is well diversified by country and by underlying sector. The weighting in North America, whilst large, is not out of line with its weighting in the new benchmark as is indicative of the dominance of US financials within the global economy. US financials have outperformed most other geographic areas, and this is stretching relative valuations – there is potential for other financial stocks to play catch-up. PCFT’s emerging markets exposure is mainly in Asia.

Exposure to emerging markets is still an important theme within the portfolio, the managers say that some of the yields available here are very attractive. The higher GDP growth, low penetration of financial services within emerging economies, and the lack of effective competition from sclerotic state banks makes emerging financials attractive. In India, where PCFT holds HDFC, they are benefitting from the liquidity crisis that is stifling competition for lending. In Latin America, the main focus is in Brazil and Mexico. The trust also has a small exposure to Turkey and Russia.

Top 10 holdings

Top 10 holdings

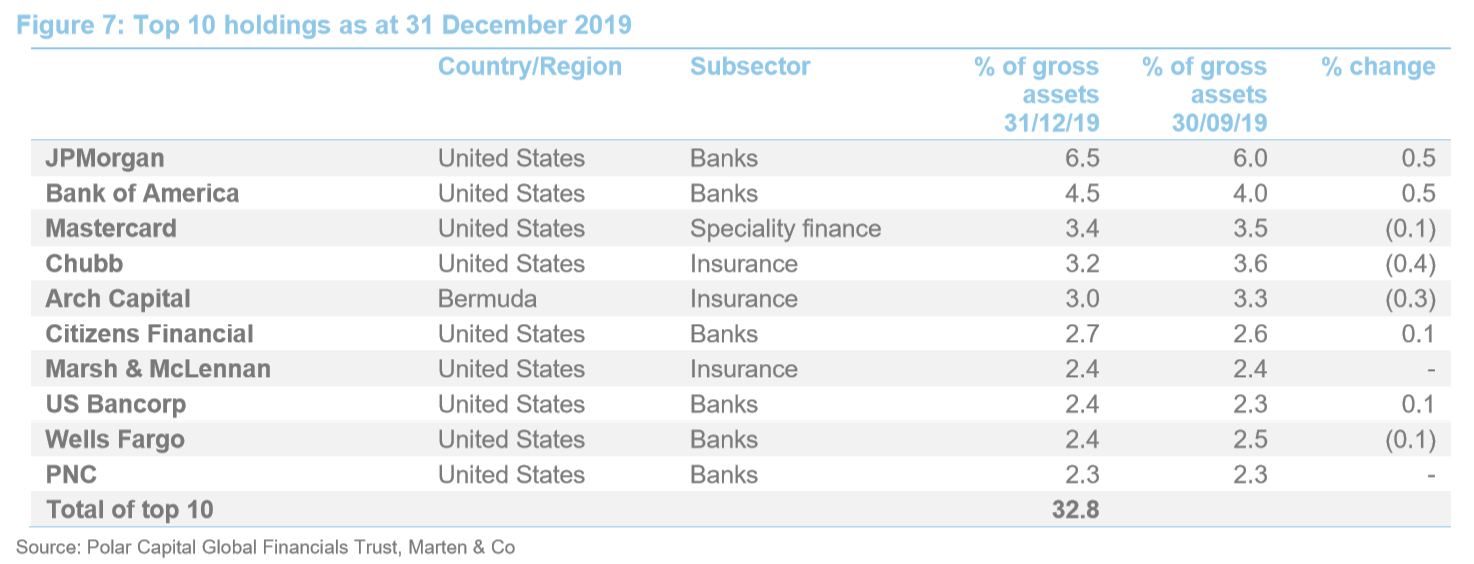

Reflective of the managers’ long-term investment approach, the composition of the top 10 holdings did not change much over the final quarter of 2019.

The trust has one unquoted investment in Atom Bank. This accounted for just over 1% of the portfolio at the end of December 2019. The bank raised £50m from investors in July 2019 at a price said to value the bank at around £530m. The £50m raised more or less matched the bank’s operating loss for the year ended 31 March 2019.

Performance

Performance

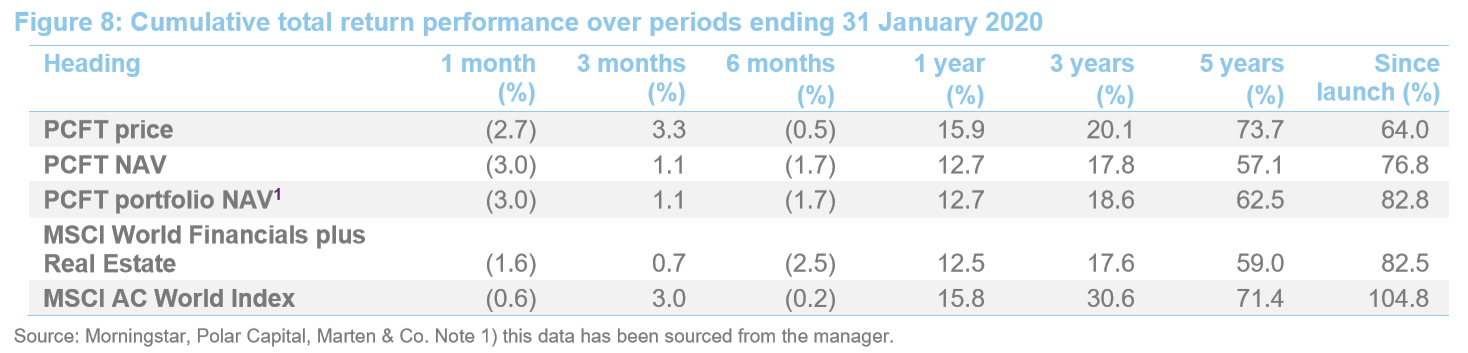

PCFT had a good final quarter of 2019 and this helped its long-term record. The trust’s Asian exposure has been a short-term drag, compounded by the emergence of covid19 (the coronavirus).

Longer-term, the trust has held its own against its benchmark, the portfolio NAV is a better indicator of the job done by the managers than the NAV, which was diluted by the subscription shares issued at launch.

PCFT’s manager provided us with some long-term performance attribution data, covering the period from the launch of the trust up to the end of December 2019. The trust’s geographic asset allocation detracted from returns as it had an underweight exposure to the US an overweight exposure to Europe. Those two factors cost it 4% and 5%, respectively. The asset allocation was influenced by the trust’s income requirement and the relative lack of yield available in the US market.

At a sector level, the trust benefitted from an overweight exposure to IT services but was held back by an underweight exposure to real estate. Those two factors more or less cancelled each other out, +4.0% and -3.9%, respectively.

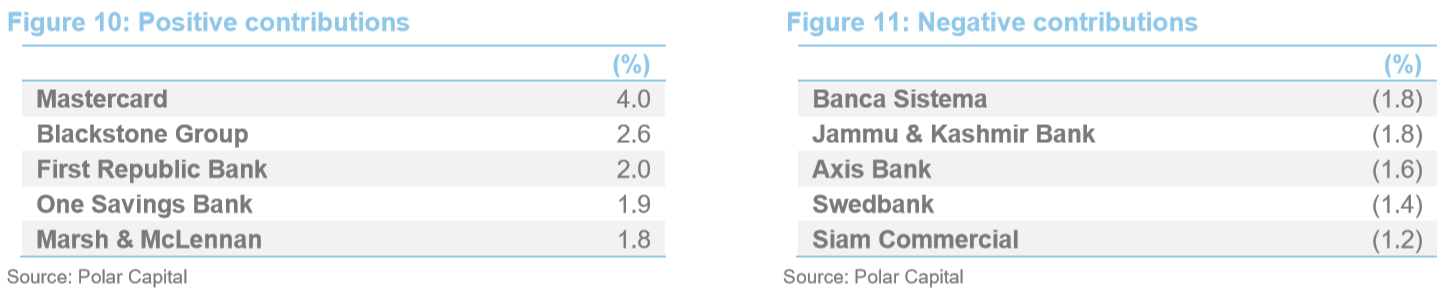

At a stock level, the five largest positive and negative contributors are listed in Figures 10 and 11. Good stock selection more than offset negatives elsewhere.

Investors have come to appreciate the strength of Mastercard’s business, especially relative to new entrants such as Square, which is relatively highly rated. Blackstone has been a beneficiary of the demand for alternative investments.

There are three emerging market banks on the negative side. Some of these experienced stock-specific issues. However, over the life of the fund to date, emerging markets exposure has not added the value that the managers felt it might when the trust was launched, despite offering attractive levels of growth. Just as financials remain an unloved sector, emerging market financials are yet to play catch-up with developed market peers.

Peer group

Peer group

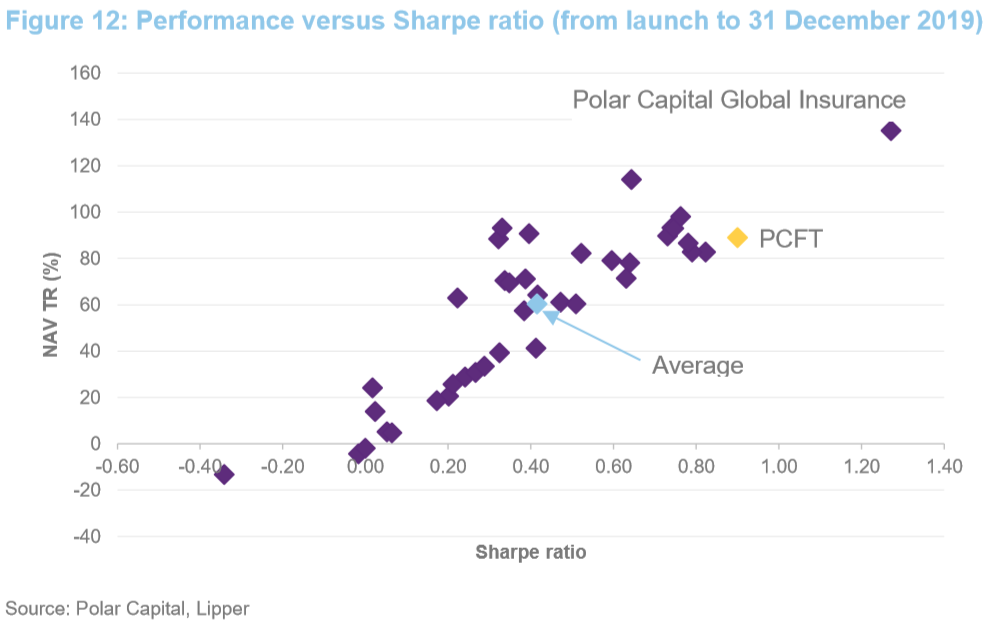

PCFT does not really have any direct competitors in the listed funds sector. It does compare itself to a range of open-ended financials funds, however.

As you can see from Figure 12, PCFT scores very well on a risk-adjusted return basis, only really outshone by the manager’s open-ended insurance sector fund.

Dividend

Dividend

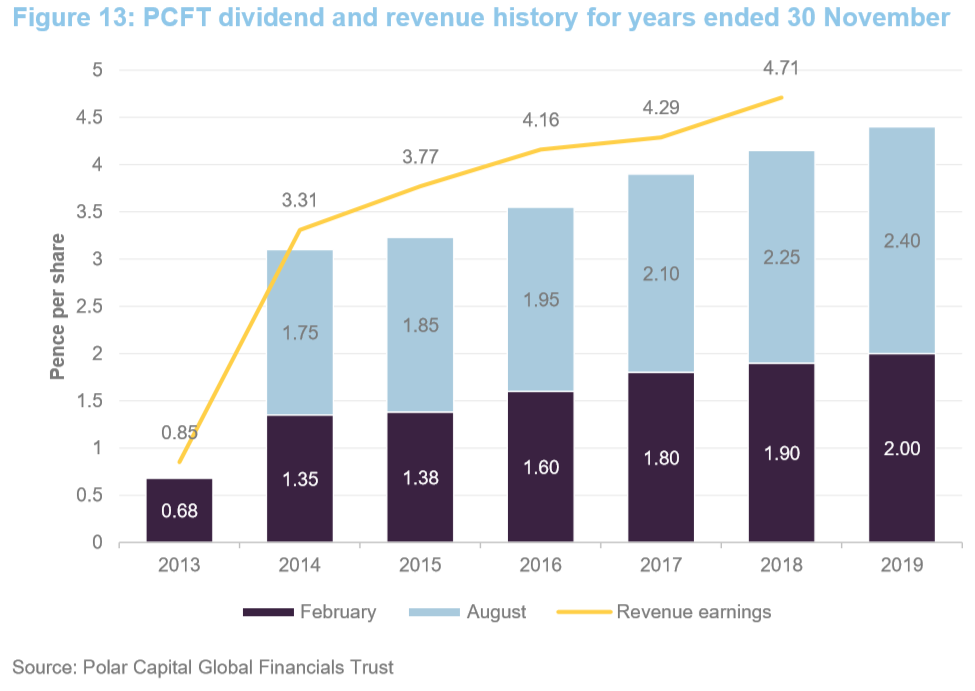

PCFT’s objective of dividend growth will not change under the proposals. Historically, PCFT has paid dividends semi-annually on its ordinary shares in February and August.

The company has a good track record of increasing dividends, while simultaneously building its revenue reserve. At the end of November 2018, that stood at £8m, equivalent to 2.52p per share or over six months’ dividend.

Discount

Discount

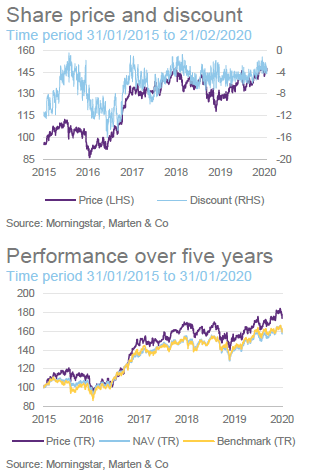

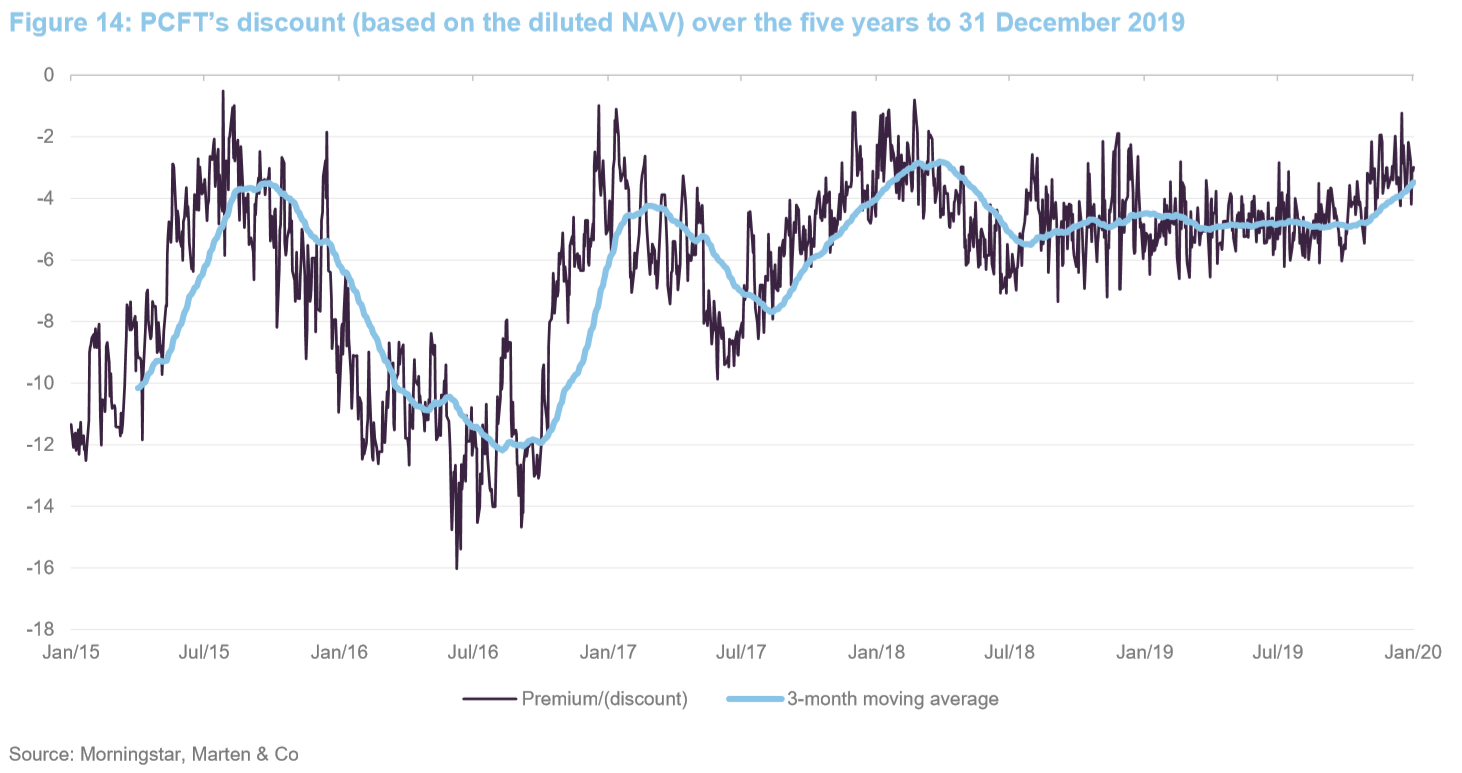

Over the year to the end of December 2019, PCFT’s discount has moved within a range of 6.6% to 1.2% and has traded at an average of 4.5%. At 21 February 2020, the discount was 3.3%. Reflecting the small narrowing of the discount achieved over the past six months and the relatively low volatility of the discount, no shares have been bought back since we last published on the company but the board does have the ability to do this should the need arise.

PCFT’s board has demonstrated its commitment to discount control by buying back 4.25m shares for cancellation since launch.

Management

Management

The seven-strong financials team at Polar Capital LLC (four fund managers and three analysts) was managing approximately $2.7bn at the end of 2019. PCFT is one of five funds for which the team has direct responsibility. The managers say that the trust sits at the conservative end of what the team does.

Two of the team focus on insurance companies. Nick Brind looks after the fixed-income element of portfolios. John Yakas specialises in emerging markets and Asian stocks. George Barrow covers Europe. There is considerable experience within the team, but they have quite diverse backgrounds.

Nick Brind

Nick Brind

Nick joined Polar Capital following the acquisition of HIM Capital in September 2010, and is manager of the Polar Capital Income Opportunities Fund and co-manager of PCFT. He has 25 years’ investment experience across a wide range of asset classes including UK equities, closed-end funds, fixed-income securities, global financials, private equity and derivatives. Prior to joining HIM Capital, Nick worked at New Star Asset Management. While there, he managed the New Star Financial Opportunities Fund, a high-income financials fund investing in the equity and fixed-income securities of European financials companies, which outperformed its benchmark index in all six years that Nick managed it. Previous to that, he worked at Exeter Asset Management and Capel-Cure Myers. At Exeter Asset Management, Nick managed the Exeter Capital Growth Fund from 1997 to 2003, which over this period was in the top decile of the IMA UK All Companies Sector. Nick has a Masters in Finance from London Business School.

John Yakas

John Yakas

John Yakas joined Polar Capital in September 2010 and is the manager of the Polar Capital Asian Opportunities Fund, Polar Capital Financial Opportunities Fund and comanager of PCFT. John has 30 years’ experience in the financial services industry. Previously, he worked for HSBC as a banker, based in Hong Kong, and was the head of Asian research at Fox-Pitt, Kelton. In 2003 he joined Hiscox Investment Management, which later became HIM Capital. John has won Lipper awards in the Equity Sector Banks and Other Financials Sector in 2010, 2011, 2012 and 2013 for the performance of the Asian Opportunities Fund. He has an MBA from London Business School and studied at the London School of Economics (BSc Econ).

George Barrow

George Barrow

George Barrow joined Polar Capital in September 2010 and is the co-manager of the Polar Capital Financial Opportunities Fund. He has twelve years’ industry experience and works on the Polar Capital Financial Opportunities Fund, Polar Capital Asian Opportunities Fund and the Polar Capital Global Financials Trust Plc. George as built up a broad knowledge of the sector, expanding his initial European focus to also cover Asia and emerging markets. Prior to joining Polar Capital, from 2008 he was an analyst at HIM Capital, where he completed his IMC. George has a Master’s degree in International Studies from SOAS, where he graduated with merit.

Nabeel Siddiqui

Nabeel Siddiqui

Nabeel Siddiqui joined the Polar Capital Financials team as an analyst in August 2013 and works closely with John Yakas and Nick Brind, focusing on the global banking sector. Prior to this, he worked as an operations executive at Polar Capital. Nabeel began his career in August 2008 with Habib Bank, where he worked within a variety of functions. He has a Master’s degree in Money and Banking and has passed all three levels of the CFA.

Jack Deegan

Jack Deegan

Jack Deegan joined Polar Capital in October 2017 and works closely with Nick Brind on the Income Opportunities Fund. Prior to this, he worked at DBRS Ratings, covering the Swiss market as a lead analyst, as well as UK, Dutch, Japanese and Australian banks. Before DBRS, Jack worked in the Risk Management Division of the Bank of England for four years, assessing financial institutions with a view to determining access to the Bank’s Sterling Monetary Framework (SMF) facilities, and internal counterparty trading limits.

Nick Martin

Nick Martin

Nick Martin joined Polar Capital in September 2010 and is manager of the Polar Capital Global Insurance Fund (previously the Hiscox Insurance Portfolio Fund). He has 21 years’ experience in the financial services industry. The Fund was founded in 1998 by Alec Foster at Hiscox Plc and Nick has worked on the Fund since 2001. Nick became co-manager in 2008 and subsequently the sole manager in 2016. He participated in the management buyout of Hiscox Investment Management in 2007 when the business was renamed HIM Capital Ltd. Polar Capital acquired HIM Capital Ltd in 2010. Nick has developed a broad knowledge of the insurance sector during this time and from working for the chartered accountants, Mazars Neville Russell, where he specialised in audit and consultancy work for insurance companies and brokers. He is a qualified chartered accountant and obtained a first-class Honours degree in Econometrics and Mathematical Economics at the London School of Economics.

Dominic Evans

Dominic Evans

Dominic Evans joined Polar Capital in October 2012 and is an investment analyst working with Nick Martin on the Polar Capital Global Insurance Fund. He has over 10 years insurance experience having previously worked as part of KPMG’s insurance segment which he joined as a graduate trainee. At KPMG Dominic obtained broad experience working on a range of global insurance companies through roles within transaction services, audit and markets. Prior to KPMG he worked for a year in corporate finance focusing on natural resource companies. Dominic is a chartered accountant and member of the ICAEW. He graduated in History with a first-class Honours degree with distinction from the University of Newcastle upon Tyne.

Previous publications

Previous publications

Marten & Co has published two notes on PCFT. You can read these by clicking the links or by visiting the martenandco.com website.

Don’t fear a slowing economy; initiation note, published 30 April 2019. Banks too cheap to ignore; update note, published 29 October 2019.

The legal bit

The legal bit

This marketing communication has been prepared for Polar Capital Global Financials Trust by Marten & Co (which is authorised and regulated by the Financial Conduct Authority) and is non-independent research as defined under Article 36 of the Commission Delegated Regulation (EU) 2017/565 of 25 April 2016 supplementing the Markets in Financial Instruments Directive (MIFID). It is intended for use by investment professionals as defined in article 19 (5) of the Financial Services Act 2000 (Financial Promotion) Order 2005. Marten & Co is not authorised to give advice to retail clients and if you are not a professional investor, or in any other way are prohibited or restricted from receiving this information you should disregard it. The note does not have regard to the specific investment objectives, financial situation and needs of any specific person who may receive it.

The note has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. The analysts who prepared this note are not constrained from dealing ahead of it but, in practice and in accordance with our internal code of good conduct, will refrain from doing so. Nevertheless, they may have an interest in any of the securities mentioned in this note.

This note has been compiled from publicly available information. This note is not directed at any person in any jurisdiction where (by reason of that person’s nationality, residence or otherwise) the publication or availability of this note is prohibited.

Accuracy of Content: Whilst Marten & Co uses reasonable efforts to obtain information from sources which we believe to be reliable and to ensure that the information in this note is up to date and accurate, we make no representation or warranty that the information contained in this note is accurate, reliable or complete. The information contained in this note is provided by Marten & Co for personal use and information purposes generally. You are solely liable for any use you may make of this information. The information is inherently subject to change without notice and may become outdated. You, therefore, should verify any information obtained from this note before you use it.

No Advice: Nothing contained in this note constitutes or should be construed to constitute investment, legal, tax or other advice.

No Representation or Warranty: No representation, warranty or guarantee of any kind, express or implied is given by Marten & Co in respect of any information contained on this note.

Exclusion of Liability: To the fullest extent allowed by law, Marten & Co shall not be liable for any direct or indirect losses, damages, costs or expenses incurred or suffered by you arising out or in connection with the access to, use of or reliance on any information contained on this note. In no circumstance shall Marten & Co and its employees have any liability for consequential or special damages.

Governing Law and Jurisdiction: These terms and conditions and all matters connected with them, are governed by the laws of England and Wales and shall be subject to the exclusive jurisdiction of the English courts. If you access this note from outside the UK, you are responsible for ensuring compliance with any local laws relating to access.

No information contained in this note shall form the basis of, or be relied upon in connection with, any offer or commitment whatsoever in any jurisdiction.

Investment Performance Information: Please remember that past performance is not necessarily a guide to the future and that the value of shares and the income from them can go down as well as up. Exchange rates may also cause the value of underlying overseas investments to go down as well as up. Marten & Co may write on companies that use gearing in a number of forms that can increase volatility and, in some cases, to a complete loss of an investment.