More to go for

Polar Capital Global Financials Trust (PCFT) has been having a good run of performance both in absolute and relative terms. It has also been re-expanding. The bounce in the financials sector coincided with last year’s good news on vaccines. Restrictions on distributions are being lifted and, as defaults have remained low, PCFT’s managers feel that banks are looking overcapitalised. They say that there is also a growing expectation of higher margins as rates/long bond yields rise in response to inflation.

PCFT appears to be capturing the benefit of the sector’s good fortune. The managers stress that its globally-diversified portfolio offers exposure to much better-quality financial stocks than are commonly available to UK investors. They are convinced that there is more to go for.

Growing income and capital from financials stocks

PCFT aims to generate a growing dividend income, together with capital appreciation. It invests primarily in a global portfolio, consisting of listed or quoted securities issued by companies in the financial sector. This includes banks, life and non-life insurance companies, asset managers, stock exchanges, speciality lenders and fintech companies, as well as property and other related sub-sectors.

Fund profile

Polar Capital Global Financials Trust (PCFT) has twin objectives of growing both investors’ income and their capital. Its global mandate is aimed at making it a useful alternative for UK-based investors looking to diversify their financials exposure.

PCFT launched on 1 July 2013 with a fixed life. In April 2020, in conjunction with a vote on prolonging the life of the trust, shareholders were offered a cash exit. Holders of 39.1% of PCFT’s then-issued share capital opted to sell their shares. The portfolio was reconstructed to facilitate this. Shareholders overwhelmingly approved an extension of the trust’s life beyond May 2020 and the trust now has an unlimited life, but with five-yearly tender offers, the first of which is scheduled for 2025.

Predominantly, the portfolio is invested in listed/quoted securities. The trust may have some exposure to unlisted/unquoted securities, but this is not expected to exceed 10% of total assets at the time of investment.

Since April 2020, the trust’s performance benchmark has been the MSCI All-Countries World Financials Net Total Return Index in sterling (MSCI ACWI Financials). A history of earlier benchmarks is given in previous notes (see page 20). We have used MSCI ACWI Financials for comparison purposes in this note.

PCFT’s AIFM is Polar Capital LLP which had AUM of £23.4bn at 30 September 2021 and employed 65 investment professionals spread across offices in Europe, the US and Asia.

PCFT’s lead managers are Nick Brind, John Yakas and (since 1 December 2020) George Barrow. More information on the management team is given on page 17.

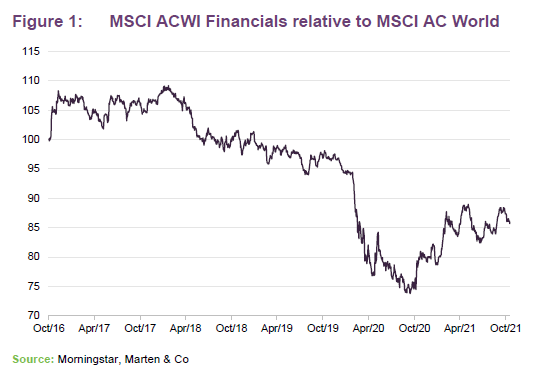

Market backdrop – recovery incomplete

The relative performance chart in Figure 1 confirms that the financials sector is yet to make up the ground it lost last March. In fact, the managers note that the recovery has been slower even than that following the 2008 global financial crisis (GFC). However, the sector was already out of favour ahead of the pandemic, as our note – Banks too cheap to ignore? – published in October 2019 highlighted.

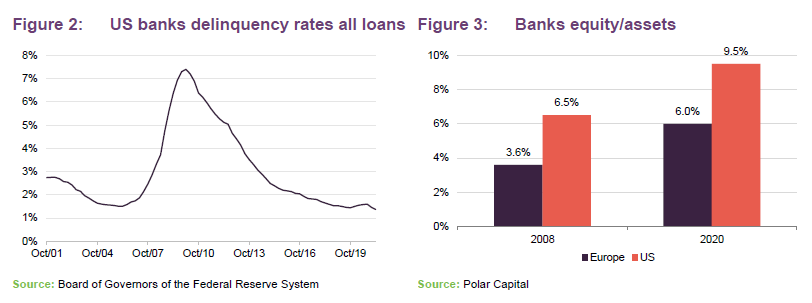

The financials sector was hit hard by the panic that set in last March in response to the pandemic. Factors such as fears of widespread defaults and slashed interest rates appeared to weigh on the sector. Many regulators imposed restrictions on buy-backs and dividends on banks, which may have compounded the problem.

Confirmation of the efficacy of vaccines in November 2020 seemed to catalyse a sharp recovery for the sector. Businesses that that have been hit by measures to control COVID-19 began to recover and restrictions on distributions by banks have been lifted.

In the event, the significant fiscal and monetary support provided by central banks and governments looks to have kept bad debts low. The cumulative effect of the restrictions on lending and tighter capital controls put in place following the GFC, coupled with the additional measures imposed last year, is that banks’ balance sheets are much stronger than they were after the GFC. The managers feel that the implication is that there is the potential for significant returns of capital.

Even after the strong absolute and relative performance delivered by the trust over the past year, PCFT’s managers remain convinced that the sector and, PCFT’s portfolio in particular, remains attractively valued.

Inflation is transitory?

The sheer size of the fiscal stimulus injected into economies last year triggered inflation concerns. Supply chain bottlenecks, soaring energy and commodity prices and furlough schemes have all been cited as reasons for higher inflation. Most commentators said that these were likely to be temporary effects. However, in recent weeks the narrative appears to be shifting. Factory gate inflation in China just hit a 26-year high of 13.5%, for example.

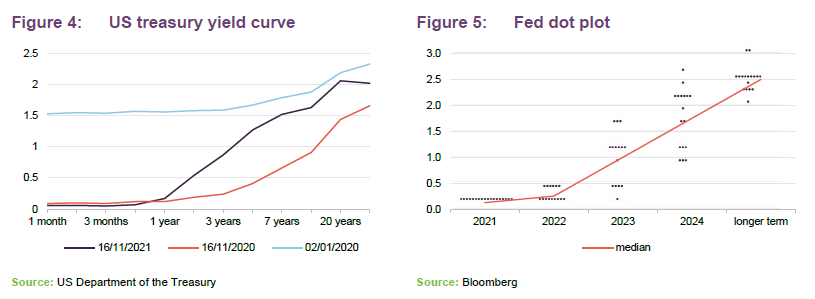

The yield curve is already steeper than it was a year ago and much steeper than it was at the start of 2020. This is generally perceived to be good news for banks. Calls are growing for rate rises to choke off the inflation threat. With UK inflation well above its 2% target, many commentators expected the Bank of England to raise rates at its last meeting but the MPC chose not to on that occasion. The Federal Reserve has decided to cut back on its quantitative easing programme but is not yet ready to raise rates. This delay is, some commentators think, allowing the inflation genie to escape from its bottle.

Figure 5 shows where each of the 18 members of the Federal open market committee projects that US rates will move to over coming years. They see rates rising from 0.125% in 2021 to between 2.0% and 3.0% beyond 2024. PCFT’s managers say that many analysts are not factoring rate rises into their models until 2023.

Higher rates are generally associated with higher bank margins. The manager quotes figures from Barclays Research which suggest that a 1% increase in rates translates into greater than a 10bps increase in average bank margins and around a 13% increase in average earnings per share. In addition, banks would see a greater impact in the year after an interest rate rise as more loans are reset at the higher interest rates. The managers say that, all things being equal, this is estimated to have a positive 20% impact on earnings per share.

European banks would likely see a more significant rise in earnings initially compared to US banks, due to European banks lower levels of profitability on average. However, European interest rates are not expected to be increased in the short-term.

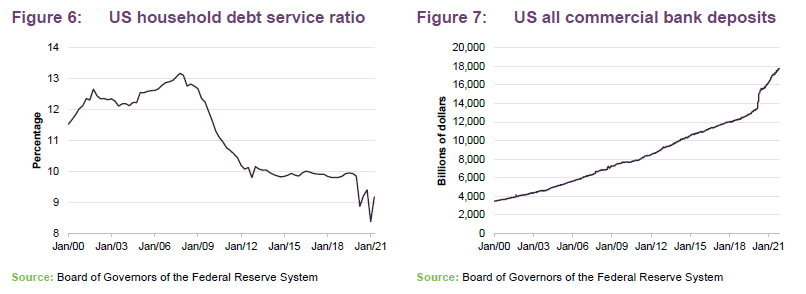

That could give rise to concerns about borrowers’ ability to service their debt. However, as PCFT’s managers highlight, debt service ratios are still close to historic lows and people have been adding to savings. The managers think that rates would have to reach 4%–5% before becoming a problem for most companies.

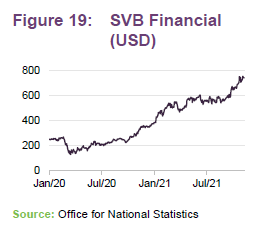

The US economy is recovering, but, as yet, the larger banks are finding that loan growth is subdued. However, PCFT’s managers highlight some impressive year-on-year loan growth numbers for the third quarter of 2021 from the small and medium-sized banks in the portfolio. The average loan growth for these banks was close to 20%, but SVB Financial, Western Alliance Bancorp and Signature Bank New York reported loan growth well above that.

Capturing growth within emerging markets

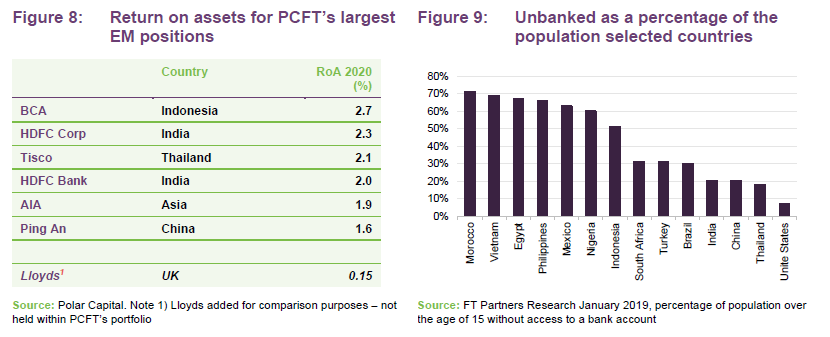

Around a fifth of PCFT’s portfolio is invested in emerging markets. This has been higher, but the managers grew cautious because of the slow rollout of vaccination programmes in many countries. PCFT’s managers highlight the attractive return on assets being generated by the largest emerging market positions within the portfolio and the potential for growth as emerging market populations open bank accounts and use more financial services, many for the first time. Banks in these markets are often able to take advantage of relatively high rates of mobile telecom penetration to develop higher-margin mobile banking products.

Other trends

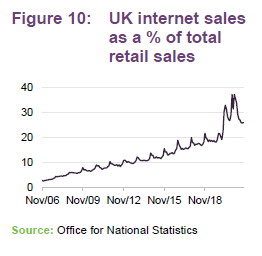

The mangers say that fintech remains an important theme within the portfolio, although they have been taking profits on some of the payments companies, such as PayPal and Mastercard. The dramatic growth experienced in online shopping during the pandemic and a growing aversion to the use of cash was a significant boost to these companies. As COVID-related restrictions are eased, there has been some reduction in ecommerce volumes but the overall trend remains upwards as Figure 10 (which has data from the UK) shows.

PCFT did not participate in the Wise IPO as the managers felt that the valuation was too rich and competition in this area might intensify.

In the insurance sector, the managers note that non-life pricing is firming. The managers say that the industry’s losses from business interruption insurance in relation to COVID-19 are expected to translate into the largest ever insured loss – they estimate between $60 and $70bn on top of about $85–90bn of natural catastrophe losses for 2020. The managers have been trimming exposure to this area.

Investment process

PCFT’s managers are stock-pickers and geographic and sector allocations are driven by their stock selection decisions. However, the breadth of opportunity is highest in the US, which dominates the benchmark. The maturity of the industry in that country is coupled with a fragmentation of the banking market.

The managers are actively involved in researching opportunities. Proprietary research is a core part of the investment process. The managers feel that, while some of it is useful, external research is too often short-term in focus. They prefer to take a medium- to long-term view. Access to companies’ management is an important part of the process.

The approach seeks to identify stocks with the potential to create strong risk-adjusted returns. An analysis of balance sheet strength plays a part in this.

Short-term profitability and rapid top-line growth may mask underlying problems with asset quality. Most financials stocks are very highly geared, and consequently there is a real need to focus on limiting the downside.

The remit is global and includes emerging markets. The universe is about 500 stocks (typically, the smallest stock that the managers would consider for PCFT’s portfolio would have a market cap of around $500m). The managers say that this is a manageable number of stocks for the team to cover. The likes of Goldman Sachs and JPMorgan are complex beasts, but most banks have relatively simple business models. In many areas, pricing is commoditised and so the sector is quite generic, but research is essential to sort the good from the bad.

The managers use a scoring system to look at a range of variables around risk, growth and value. These include balance sheet strength; how the company is funded; the composition of the loan book; historical quality of the loan book; and trends in margins. This model is a framework for analysis rather than an engine to produce a buy list.

The team meets about 400 companies each year but a lot of this is double-checking their research findings. They talk to customers and competitors, for example.

For banks and similar companies, any assessment of value is based on a variation of CAPM – using returns on equity and price to book. The managers find that, for the reasons outlined above, P/E ratios and measures of growth do not work as well.

The sector is not just about balance sheet businesses, however, and it is evolving. The managers use a more earnings-driven, traditional approach to valuing other companies.

Asset allocation

At the end of September 2021, there were 81 positions in PCFT’s portfolio and 83% of the portfolio was in stocks with market caps above $5bn.

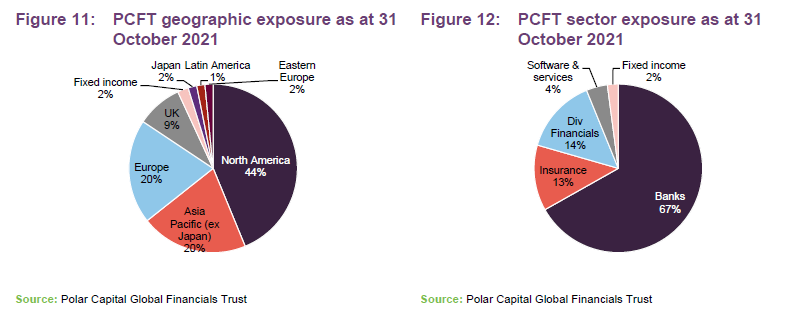

Exposure to Europe has grown modestly at the expense of North America since the end of January 2021 (the data that we used when we last published a note on PCFT). The percentage allocation to banks has risen at the expense of insurance.

Top 10 holdings

Since 31 January 2021 (the data we used for the last note) AIA Group, Signature Bank, MasterCard, Wells Fargo and PayPal Holdings have dropped out of the list of 10-largest holdings and have been replaced by Arch Capital, PNC Financial Services, Nordea Bank, UBS and BNP Paribas.

Arch Capital

Arch Capital (ir.archgroup.com) is a leading global speciality insurance, reinsurance and mortgage insurance company headquartered in Bermuda. The company has grown its book value per share steadily since 2008. For the third quarter of 2021, net premiums written were up over 30% year-on-year in both its insurance and reinsurance operations. Post-tax income was sharply higher over this period – 74 cents per share for Q3 2021 versus 29 cents for Q3 2020.

An increase in mortgage delinquencies, observed last year in the wake of the pandemic, is easing and strong US house price growth means that around 98% of delinquent mortgages have at least 10% equity.

PNC Financial Services

PNC Financial Services (thepncfinancialservicesgroupinc.gcs-web.com) is a leading US diversified financial services company. It recently acquired the US operations of BBVA (2.6m customers and 600 branches). The company estimates that it can achieve annualised cost savings of $900m, but for the moment, integration costs associated with that transaction are having a negative effect on profitability. Nevertheless, net income/earnings per share for Q3 2021 were only 2.7% lower year-on-year on revenues that were 21% higher.

Provisions for credit losses are falling. The bank had a tier one capital ratio of 10.2% at 30 September 2021.

Nordea Bank

Nordea Bank (www.nordea.com) is a leading Nordic bank and financial services company operating across Denmark, Finland, Norway and Sweden but with a global presence. Third-quarter figures show 6% growth in mortgage lending, 9% more lending to SMEs and a 21% increase in assets under management relative to the same quarter in 2020. A 17% increase in operating profits and 10.8% return on equity were aided by a lower cost-to-income ratio.

Taking advantage of its strong balance sheet, Nordea paid a catch-up dividend of €0.72 and initiated a €2bn share buyback. The bank has a policy of paying out 60%–70% of distributable profits to shareholders. An excess capital is distributed to shareholders through buy-backs.

Others

Other recent purchases include Webster Financial, a Connecticut-based bank serving the North East of the US, which expanded in April through a merger with Sterling Bancorp. The managers bought a position in Gresham House as a play on the growth of alternative investments. Gresham House has strong positions in areas such as forestry, renewable energy and housing. For the emerging markets part of the portfolio, the managers made an investment in Bandham Bank, a Kolkata-based microfinance lender. COVID triggered a rise in non-performing loans, depressing the share price. However, India now seems to be recovering strongly and the managers say that collections are improving.

Performance

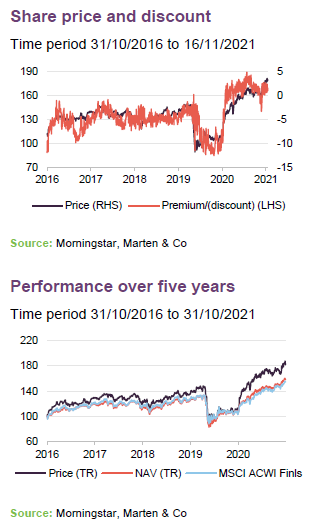

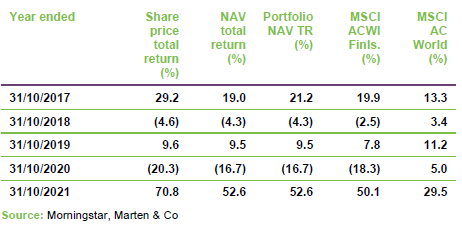

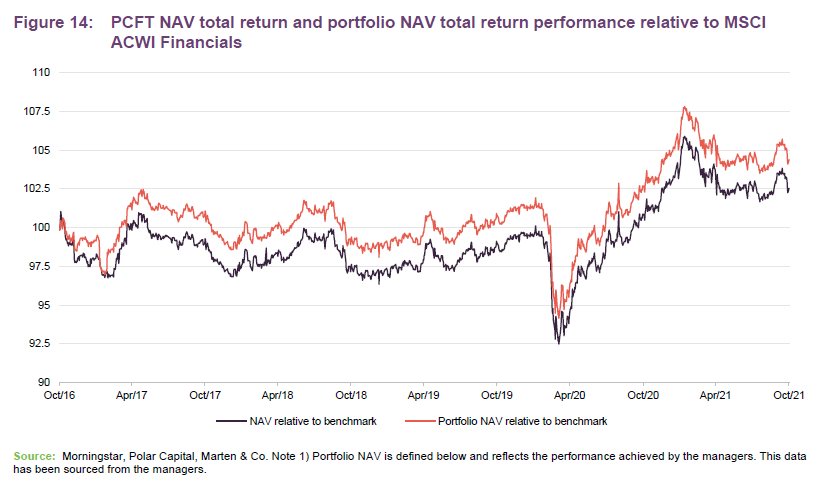

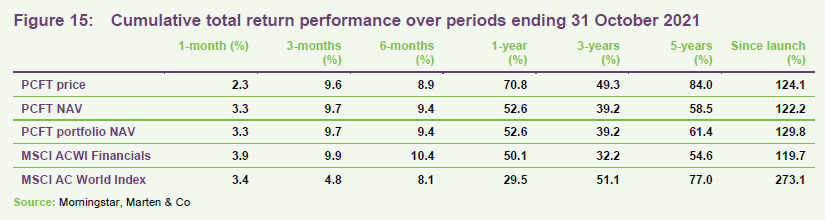

In the chart in Figure 14 and the table in Figure 15, we show returns both for PCFT’s IFRS NAV and also a ‘portfolio NAV’ which strips out the effects of the dilution attributable to PCFT’s subscription shares (which were exercised in 2017). The portfolio NAV gives a better indication of the returns achieved by the managers.

Looking at the five-year chart, PCFT matches the MSCI ACWI Financials ahead of the pandemic panic in March 2020. A short period of underperformance is swiftly reversed and PCFT has a period of strong relative performance over the following year.

Figure 15 illustrates the much better performance of the MSCI ACWI Financials relative to MSCI World over the past year but financials still lag the broader market over longer time periods, perhaps highlighting the value opportunity in the sector. The elimination of PCFT’s discount has supercharged the trust’s share price returns.

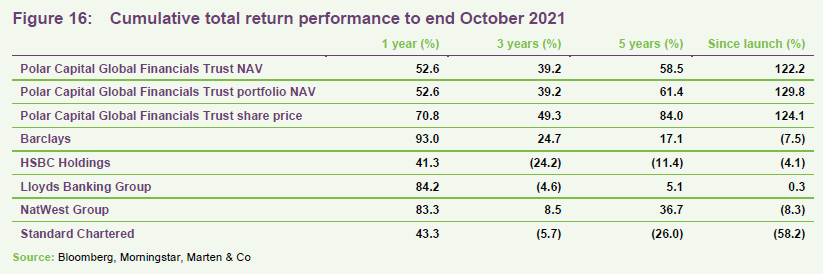

One of the drivers behind the launch of PCFT in 2013 was that it would provide UK-based investors with a relatively lower-risk exposure to the financial sector. Since then, PCFT has delivered returns well ahead of the major UK banks as is evidenced in Figure 16.

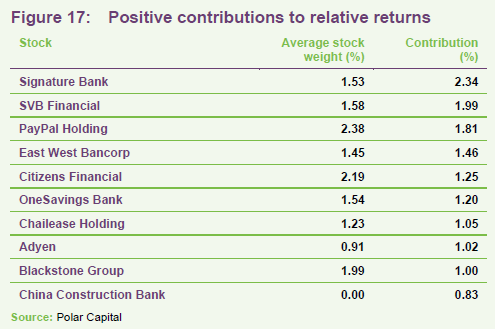

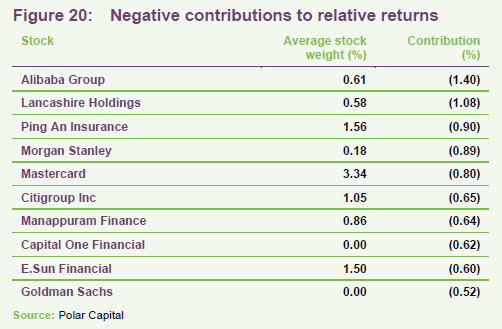

Performance attribution

The manager supplied us with some performance attribution data that covers the period from 22 April 2020 (the date of the company’s reconstruction) to end September 2021. Over that period, the trust’s portfolio returned 74.4% against a return of 55.0% for the benchmark.

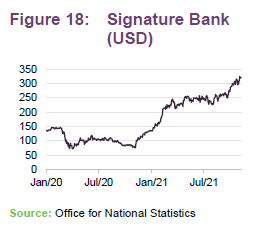

Signature Bank

Based in New York but also with offices in Connecticut, California and North Carolina, Signature Bank (investor.signatureny.com) offers a wide variety of business and personal banking products and services as well as investment, brokerage, asset management and insurance products.

Third-quarter results saw net income hit a record $241.4m up 74.2% year-on-year. We highlighted the bank’s strong loan growth on page 6. Deposit growth has been robust too, powered by the success of its Signet blockchain-based digital payments platform.

SVB Financial

SVB Financial (ir.svb.com) provides commercial, investment and private banking, asset management, private wealth management, brokerage and investment services and funds management services to companies in the technology, life science and healthcare, private equity and venture capital, and premium wine industries.

As its core customer base has thrived, so has the bank. Q3 2021 figures are distorted by the recent acquisition of Boston Private but, stripping this out, the bank generated 12% growth in average client funds. Income benefits from warrant and investment gains. The bank’s balance sheet is strong, with tier 1 capital of 14.66%, and this helps support ambitious growth targets.

Of the others, PayPal and Adyen have benefited from the boom in ecommerce, as described on page 7. East West Bancorp is the largest publicly-traded bank in Southern California. It has strong roots in the Chinese-American immigrant community and has a full banking licence in China. Chailease Holding is a Taiwanese bank with operations in mainland China and ASEAN markets. Blackstone is an alternative investment manager.

PCFT had exposure to Alibaba Group as a way of profiting from the planned IPO of Ant Group and was hit when that was pulled following Chinese regulatory intervention. Chinese stocks are generally out of favour and this hurt Ping An too. Lancashire Holdings has been selling off as investors focus on insured losses rather than rising premiums. Manappuram Finance’s share price has been volatile. The Indian gold, housing and vehicle finance company missed analysts’ estimates in the summer, but the share price has recovered since the end of September 2021.

Peer group

PCFT’s listed peer group is eclectic and provides a poor comparison. PCFT’s reports tend to compare the trust with the average of the Lipper Financial sector. From the inception of the fund in 2013 to end September 2021, the trust returned 121.9% while the Lipper Financial sector average return was 89.0%. From the date of the reconstruction of the trust in April 2020 to end September 2021, the returns were 70.0% and 57.5%, respectively.

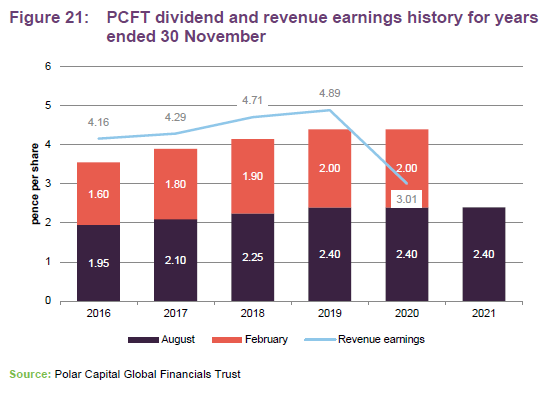

Dividend

PCFT pays dividends semi-annually on its ordinary shares in February and August. All dividends are paid as interim dividends. The payments are not necessarily of equal amounts. The company does not pay a final dividend.

Until its 2020 financial year, PCFT had a good track record of paying dividends that were covered by revenue. COVID-19 triggered the suspension or cutting of many dividends in the financial sector. However, the revenue reserves that PCFT had built up gave the board confidence to maintain the dividend in 2020.

At the end of May 2021, the revenue reserve stood at £7.3m (2.7p per share).

The board says that, in line with the dividend policy approved at the AGM held in May 2020, it continues to pursue a policy of dividend growth, although there is no guarantee that this can be achieved. Whilst significant uncertainty surrounds the outlook for dividend income, the board has available further income reserves to support dividend payments until the sustainable longer-term level can be determined.

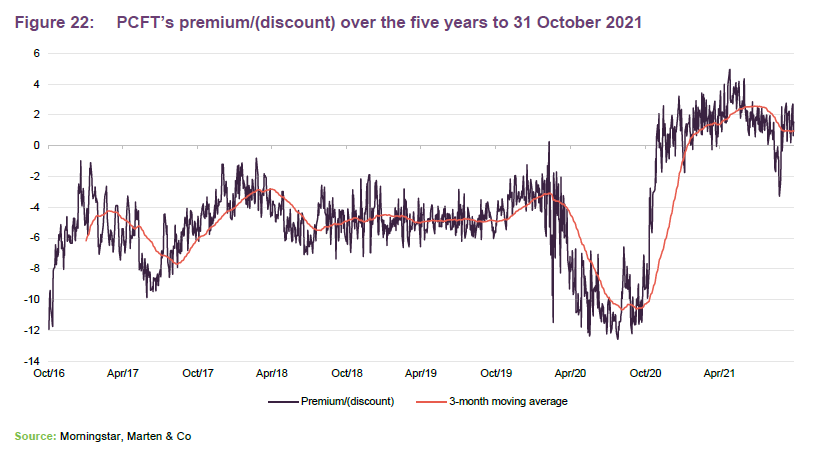

Premium/discount

Over the year to the end of October 2021, PCFT’s share price has moved within a range of a 9.9% discount to a premium of 5.0% and has traded at an average premium of 1.5%. At 16 November 2021, the premium was 1.1%.

The dramatic change in sentiment toward the sector following the vaccine news in November 2020 is clear from Figure 22. Since then, barring a brief wobble in September, the shares have been trading at a modest premium to NAV.

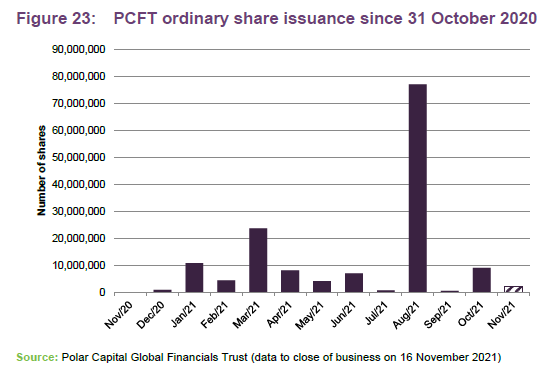

In April 2021, the board decided to expand the trust by way of a placing, open offer, offer for subscription and intermediaries offer of C shares. This process raised gross proceeds of £122m for the company. In August 2021, the C shares were converted into ordinary shares on the basis of 0.6275 new ordinary shares for each C share held.

In total, PCFT has issued 148,159,235 ordinary shares since 31 October 2020.

Fees and costs

PCFT’s manager is Polar Capital LLC (Polar). PCFT pays Polar a base management fee of 0.70% of NAV per annum. The investment management agreement may be terminated by either party giving 12 months’ notice. The base management fee is charged 80% to capital and 20% to revenue.

In addition, the manager has the opportunity to earn a performance fee. This is calculated over five-year periods, the first of which runs from 7 April 2020 to 30 June 2025. The performance fee will be 10% of the total return generated by PCFT in excess of a hurdle. The hurdle is the benchmark (MSCI ACWI Financials) plus 1.5% per annum.

For the year ended 30 November 2020, PCFT incurred administrative expenses totalling £640,000 (down from £661,000 for the previous financial year). The company’s ongoing charges ratio for FY2020 was 1.09%. The expansion of the trust since that date should have lowered the ratio since then. If the performance fee is included, the ongoing charges fee was 1.74%.

Capital structure and life

PCFT has a simple capital structure with a single class of ordinary shares in issue and trades on the Main Market of the London Stock Exchange. At 16 November 2021, there were 271,130,000 ordinary shares with voting rights and a further 8,200,000 shares held in treasury.

PCFT has an unlimited life. With effect from 2025, the board intends to propose tender offers at five-yearly intervals. These would allow any shareholder who wishes to exit the company to do so at a price close to NAV.

Shares bought back as part of the tender offer process and any other shares bought back in the normal course of discount control may be held in treasury and reissued at a premium to asset value.

PCFT’s accounting year end is 30 November and AGMs are usually held in April.

Gearing

As part of the package of measures approved by shareholders in April, PCFT may now borrow up to 20% of net assets at the time of drawdown. PCFT has a £60m unsecured facility.

At 31 October 2021, PCFT had net gearing of 5.9% of NAV.

Management

The five-strong global financials team at Polar Capital LLC was managing over £500m, as of September 2021.

Nick Brind

Nick joined Polar Capital following the acquisition of HIM Capital in

September 2010, and is co-manager of PCFT. He has 27 years’ investment experience across a wide range of asset classes including UK equities, closed-end funds, fixed-income securities, global financials, private equity and derivatives. Before joining HIM Capital, Nick worked at New Star Asset Management. While there, he managed the New Star Financial Opportunities Fund, a high-income financials fund investing in the equity and fixed-income securities of European financials companies, which outperformed its benchmark index in all six years that Nick managed it. Previous to that, he worked at Exeter Asset Management and Capel-Cure Myers. At Exeter Asset Management, Nick managed the Exeter Capital Growth Fund from 1997 to 2003, which over this period was in the top decile of the IMA UK All Companies Sector. Nick has a Masters in Finance from London Business School.

John Yakas

John joined Polar Capital in September 2010 and is the manager of the Polar Capital Financial Opportunities Fund and co-manager of PCFT. John has 33 years’ experience in the financial services industry. Previously, he worked for HSBC as a banker, based in Hong Kong, and was the head of Asian research at Fox-Pitt, Kelton. In 2003 he joined Hiscox Investment Management, which later became HIM Capital. John won Lipper awards in the equity sector banks and other financials sector in 2010, 2011, 2012 and 2013. He has an MBA from London Business School and studied at the London School of Economics (BSc Econ).

George Barrow

George was appointed as co-fund manager of PCFT in December 2020, alongside Nick Brind and John Yakas. He joined Polar Capital in September 2010 and is the co-manager of the Polar Capital Financial Opportunities Fund. George has 13 years’ industry experience and over 10 years’ experience analysing Europe, Asia and emerging markets. Prior to joining Polar Capital, he was an analyst at HIM Capital from 2008 where he completed his IMC. He has a Master’s Degree in International Studies from SOAS, where he graduated with merit.

Nabeel Siddiqui

Nabeel joined the Polar Capital Financials team as an analyst in August 2013 working closely with John Yakas and Nick Brind, focusing on the US, Latin America & Australia.

Prior to this, Nabeel worked as an operations executive at Polar Capital. He began his career in August 2008 with Habib Bank, where he worked within a variety of functions. He has a Master’s Degree in Money and Banking and has passed all three levels of the CFA.

Jack Deegan

Jack joined the Polar Capital Financials team as an analyst in October 2017 working closely with Nick Brind on the Income Opportunities Fund.

Prior to this, he worked at DBRS Ratings, covering the Swiss market as a lead analyst, as well as UK, Dutch, Japanese and Australian banks. Before DBRS, Jack worked in the Markets Division of the Bank of England for four years, assessing financial institutions with a view to determining access to the Bank’s Sterling Monetary Framework (SMF) facilities, and internal counterparty trading limits. He has a BA in Classical Archaeology & Ancient History from Oxford University and a Master’s Degree in Islamic Politics from SOAS.

Board

The board currently comprises five non-executive directors, all of whom are independent of the investment manager and who do not sit together on other boards.

It is intended that Cecilia McAnulty, who recently joined the board, will replace Joanne Elliott as chair of the audit committee when Joanne steps down from the board at the AGM to be held in April 2022. The number of directors will then revert to four.

Robert Kyprianou (non-executive chairman)

Robert was formerly the CEO of AXA Framlington until his retirement in September 2009. Previous appointments include: independent non-executive director of Gartmore Group Limited and Aviva Investors; global head of fixed income, and later deputy CEO and global head of securities at AXA Investment Managers SA; business head and global head of fixed income at ABN AMRO Asset Management Ltd and head of portfolio management at Salomon Brothers Asset Management Ltd.

Robert is a director of Eurobank Cyprus Ltd and an independent non-executive director of Pimco Europe Limited.

Simon Cordery (non-executive director)

Simon has almost 40 years’ experience working within financial services, of which nearly 30 years have been focused on the wealth management industry. Most recently he was head of Investor Relations and Sales at BMO Global Asset Management, where he spent almost 25 years in senior roles, and previously he held roles with Invesco Fund Managers, Jefferies & Co, Kleinwort Benson Securities and Rea Bros Merchant Bank. Simon has considerable and detailed knowledge of the investment trust industry, is actively involved with the AIC and is a Chartered Fellow of the Chartered Institute for Securities and Investment.

Joanne Elliott ACA (non-executive director)

Joanne is currently CFO of the property team at Thames River Capital and has been the finance manager for TR Property Investment Trust Plc since 1995. Joanne previously held the position of director of property, finance and operations Europe at Henderson Global Investors. Previously she was corporate finance manager with London and Edinburgh Trust Plc, and prior to that she was an investment/treasury analyst with Heron Corporation Plc.

Whilst Joanne is a director of a number of private companies in connection with her role at Thames River Capital, she holds no other active external appointments.

Katrina Hart (non-executive director)

Katrina spent her executive career in investment banking, advising, analysing and commentating on a broad range of businesses. Initially working in corporate finance at ING Barings and Hawkpoint Partners, she then moved into equities research at HSBC, covering the general financials sector. Latterly, Katrina headed up the financials research teams at Bridgewell Group Plc and Canaccord Genuity, specialising in wealth and asset managers.

Katrina is a non-executive director of Keystone Positive Change Investment Trust Plc, Blackrock Frontiers Investment Trust Plc and AEW UK REIT Plc.

Cecilia McAnulty (non-executive director)

Cecilia is an experienced non-executive director and Chartered Accountant with over 20 years’ investment and financial services experience. She has a number of years’ experience as an investment analyst, portfolio manager and executive director at Royal Bank of Scotland, Barclays Capital and Centaurus Capital. Cecilia is a non-executive director and audit chair of Northern 2 Venture Capital Trust Plc. She is also an independent non-executive director of Alcentra Ltd, a private company, and a member of the Industrial Development Advisory Board.

Previous publications

QuotedData has published a number of notes on PCFT. You can read these by clicking the links in the table below.

| Don’t fear a slowing economy | Initiation | 30 April 2019 |

| Banks too cheap to ignore | Update | 29 October 2019 |

| New lease of life | Update | 22 February 2020 |

| Too much pessimism? | Annual overview | 22 October 2020 |

| The tide has turned | Update | 25 February 2021 |

The legal bit

Marten & Co (which is authorised and regulated by the Financial Conduct Authority) was paid to produce this note on Polar Capital Global Financials Trust Plc.

This note is for information purposes only and is not intended to encourage the reader to deal in the security or securities mentioned within it.

Marten & Co is not authorised to give advice to retail clients. The research does not have regard to the specific investment objectives financial situation and needs of any specific person who may receive it.

The analysts who prepared this note are not constrained from dealing ahead of it but, in practice, and in accordance with our internal code of good conduct, will refrain from doing so for the period from which they first obtained the information necessary to prepare the note until one month after the note’s publication. Nevertheless, they may have an interest in any of the securities mentioned within this note.

This note has been compiled from publicly available information. This note is not directed at any person in any jurisdiction where (by reason of that person’s nationality, residence or otherwise) the publication or availability of this note is prohibited

Accuracy of Content: Whilst Marten & Co uses reasonable efforts to obtain information from sources which we believe to be reliable and to ensure that the information in this note is up to date and accurate, we make no representation or warranty that the information contained in this note is accurate, reliable or complete. The information contained in this note is provided by Marten & Co for personal use and information purposes generally. You are solely liable for any use you may make of this information. The information is inherently subject to change without notice and may become outdated. You, therefore, should verify any information obtained from this note before you use it.

No Advice: Nothing contained in this note constitutes or should be construed to constitute investment, legal, tax or other advice.

No Representation or Warranty: No representation, warranty or guarantee of any kind, express or implied is given by Marten & Co in respect of any information contained on this note.

Exclusion of Liability: To the fullest extent allowed by law, Marten & Co shall not be liable for any direct or indirect losses, damages, costs or expenses incurred or suffered by you arising out or in connection with the access to, use of or reliance on any information contained on this note. In no circumstance shall Marten & Co and its employees have any liability for consequential or special damages.

Governing Law and Jurisdiction: These terms and conditions and all matters connected with them, are governed by the laws of England and Wales and shall be subject to the exclusive jurisdiction of the English courts. If you access this note from outside the UK, you are responsible for ensuring compliance with any local laws relating to access.

No information contained in this note shall form the basis of, or be relied upon in connection with, any offer or commitment whatsoever in any jurisdiction.

Investment Performance Information: Please remember that past performance is not necessarily a guide to the future and that the value of shares and the income from them can go down as well as up. Exchange rates may also cause the value of underlying overseas investments to go down as well as up. Marten & Co may write on companies that use gearing in a number of forms that can increase volatility and, in some cases, to a complete loss of an investment.