The Trump administration’s reshaping of American economic and political policy made many headlines throughout February. Despite the suspension of plans to place 25% tariffs on major trading partners, the White House confirmed the implementation of tariffs on steel and aluminium on imports from all countries. Concerns that these measures could induce inflationary pressure were confirmed by the sharp rises of prices in manufacturing supplies, shown by a thirty-three-month high in the Institute for Supply Management’s costs index. US jobs data for February has come in slightly lower than expected. Consumer confidence saw its largest monthly fall in over four years, citing tariff and inflation related worries.

‘European stocks are beating the U.S. so far this

year. Is American exceptionalism dead?’

Joseph Adinolfi, Morningstar

Across the Atlantic, UK consumer confidence was also at some of its lowest points in previous years, with the IoD’s Economic Confidence Index dropping to near pandemic levels. Moreover, the Bank of England made its third cut to interest rates in six months, signifying a twenty-month low of 4.5%. This came despite higher prices, such as food inflation’s five month high of 2.1%. Nevertheless, UK equities saw positive returns, with the FTSE 100 experiencing an approximately 1.6% growth over the month, notably closing 28 February at a record high. Major contributors to stock rallies included housebuilders, benefitted by increasing rents and natural resource companies saw strong returns, reflecting a resilient commodities market.

For a second month in a row, European stocks outperformed their American counterparts, in fact over the last three months, the MSCI Europe Index has shot up by 9%, as Morgan Stanely claimed this period to be the best relative European start to a year since 2000. Contributing factors include cheaper valuations, evidenced by the MSCI Europe’s forward to price ratio of 14x, considerably lower than the US’s 22x. It should also be mentioned that likely rises in European defence budgets prompted investor optimism. Furthermore, Eurozone inflation declined to 2.4% in February, ushered by the ECB’s continual rate cuts, reducing its main rate by 0.25% at the beginning of the month.

JPMorgan Global Growth & Income

‘There is a clear risk that President Trump’s mooted tariff increases may trigger a trade war that damages growth not just in the US, but globally’

Strategic Equity Capital

‘UK small caps across multiple sectors are trading at a steep discount compared to both global markets’

JPMorgan Global Emerging Markets

‘The valuation gap between EM and developed markets is wide and earnings growth prospects over the long term are strong’

At a glance

| Exchange rate | 28 February 2025 | Change on month % | |

|---|---|---|---|

| Pound to US dollars | GBP / USD | 1.2577 | 1.5 |

| Pound to euros | GBP / EUR | 1.2124 | 1.4 |

| US dollars to Japanese yen | USD / JPY | 150.63 | (2.9) |

| US dollars to Swiss francs | USD / CHF | 0.9031 | (0.9) |

| US dollars to Chinese renminbi | USD / CNY | 7.2784 | 0.5 |

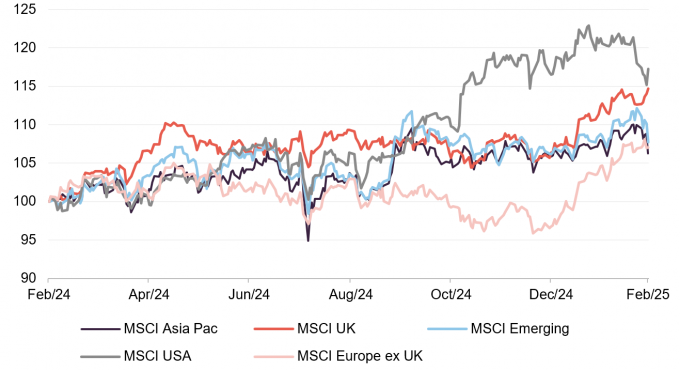

MSCI Indices (rebased to 100)

As discussed, MSCI Europe, and to a lesser extent MSCI UK, outperformed the MSCI USA index. Despite expectations that tariffs might support the dollar, in reality we saw the opposite, the ICE U.S Dollar Index dropped by 3.6%. Weakened economic data coming out of the US saw oil prices decline, falling to a two-month low on 25 February. The gold price continued to climb. Fears of economic slowdown weighed on long-dated bond yields (in anticipation of further interest rate cuts).

Time period 29 February 2024 to 28 February 2025

Source: Bloomberg, QuotedData. Converted to pounds to give returns for a UK-based investor.

| Indicator | 28 February 2025 | Change on month % |

|---|---|---|

| Oil (Brent – US$ per barrel) | 73.18 | (4.7) |

| Gold (US$ per Troy ounce) | 2857.83 | 2.1 |

| US Treasuries 10-year yield (%) | 4.21 | (7.3) |

| UK Gilts 10-year yield (%) | 4.48 | (1.2) |

| German government bonds (Bunds) 10-year yield (%) | 2.41 | (2.2) |

Global

Helge Skibeli, James Cook and Tim Woodhouse, portfolio managers, JPMorgan Global Growth & Income, 27 February 2025

The US economy now seems to be on a relatively stable growth trajectory, with employment and consumer spending rising. Further falls in interest rates will provide additional impetus for growth, even if the rate cuts arrive more slowly than previously expected. If market expectations prove correct, the new US administration’s policy initiatives will also support the domestic economy. However, this remains to be seen. There is a clear risk that President Trump’s mooted tariff increases may trigger a trade war that damages growth not just in the US, but globally.

The second half of 2024 delivered healthy returns for equities, despite several bouts of market volatility, with the US Presidential election and President Donald Trump’s victory dominating the market narrative in the latter months of the year.

US Mega Cap technology stocks continued to outperform during the period, while the prospects for deregulation under the new US administration boosted financials. A widespread easing in inflation pressures in the first half of 2024 led developed market central banks to begin normalising policy, and while challenges in the second half of the year tempered investors’ rate cut expectations, particularly in the US, this did little to dampen the market’s upward momentum.

. . . . . . . . . .

Louis Florentin-Lee and Barnaby Wilson, fund managers, Mid-Wynd International Investment Trust, 27 February 2025

Global stock markets rose during the first six months of the fiscal year (second half of calendar 2024), with investor optimism centred on the US. It is important to note that this rise was not simply a story of markets’ strength: it was also a story of their unusual narrowness.

The MSCI ACWI, a broad global index, returned 6.5% in GBP terms during the second half of 2024 and is up around 40% since the end of 2022. The US market, represented by the S&P 500 Index, gained 9.5% during the second half of 2024 and is up over 50% since the end of 2022. Such figures are well worth placing in broader context.

Since 1985, in US dollar terms, the US stock market has appreciated to such a degree on only a handful of occasions. All have tended to be clustered around key events in market history, including Black Monday (1987), the dot-com bubble (late 1990s/early 2000s), the recovery that followed the global financial crisis (2010) and the recovery that followed the COVID-19 pandemic (2021).

The extraordinary performance of NVIDIA underlines how the recent boom has been driven largely by stocks related to artificial intelligence (‘AI’). The chip designer’s weighting in the MSCI ACWI grew from 0.6% at the start of 2023 to 4.3% at the end of 2024.

The stock is up 789% over the past 24 months. This is nearly 20 times the return of the MSCI ACWI and nearly 80 times that of the MSCI ACWI Equal Weighted Index – a disparity that has caused a historically wide spread in returns between the two indices.

Just 27% of the S&P 500’s constituents outperformed the index over 2024 – only slightly better than 2023’s 26%. Such figures, which are even lower than those seen during the dot-com bubble, underscore the remarkable narrowness of markets.

Against this backdrop, US markets drove overall returns. Europe, Japan, Asia ex Japan and Emerging Markets all lagged. Information Technology and Communication Services were the best-performing sectors, while Materials and Health Care underperformed the wider index. In short, then, if you have not been in the narrow area that the market has rewarded you have been heavily punished.

. . . . . . . . . .

Carolan Dobson, chair, Brunner Investment Trust, 12 February 2025

Markets have been anything but calm or predictable and, in the world at large, we have seen the momentous toppling of the Assad regime in Syria, continuation of the conflict in Gaza up to a brokered ceasefire in January, a South Korean martial law crisis and the shock resignation of Justin Trudeau in Canada. Extreme weather events continued around the world including major storms at home in the UK and the recent wildfires devastating L.A.

Many western nations are becoming uneasy at the deepening military and trade links between Russia, China, Iran and North Korea (dubbed the ‘Axis of Upheaval’ amongst a collection of similar monikers). Whether this (as yet informal) alliance will exacerbate any of the current world conflicts or stand-offs remains to be seen, but what is certain is that it has refocused most nations on defence and assured spending in that area is both bolstered, but also more accepted by a public at large.

Trump’s second term has already seen both mixed signals and reactions. We will have to wait to see how much will change under his premiership. In investment terms we will also have to see whether the anticipative moves already made by markets will prove to be correct, or whether more volatility will ensue. The latter could be highly likely given the news flow sensitivity of markets, and what we have seen before of the Trump ‘playbook’.

Although we have come a long way in the taming of inflation across the globe and central banks have generally been able to start moderating interest rates, we must acknowledge that this is not a ‘done deal’ yet. Certainly, markets remain jittery over any contra-indications.

. . . . . . . . . .

UK

Ken Wotton, Strategic Equity Capital, 25 February 2025

The current macroeconomic and geopolitical volatility is driving mispricing opportunities across UK equity markets, particularly in the field of smaller companies. UK small caps across multiple sectors are trading at a steep discount compared to both global markets and historical M&A transaction precedents. This valuation discount underpins our expectations of sustained corporate takeover activity as we enter 2025. Buyers paid on average a 44% premium for UK companies in 2024, highlighting the appetite for undervalued assets despite elevated deal funding costs amidst higher interest rates. From conversations with our private equity network, we understand that corporate and private equity buyers are actively assessing UK deal-flow opportunities. We believe they will seek to compensate for elevated debt costs by capitalising on depressed UK equity valuations. Additionally, we anticipate that multi-sector arbitrage between UK trading multiples and precedent M&A transaction multiples may catalyse a re-rating of small-cap stocks.

We highlight an emerging nuance to this theme across UK listed businesses: carve-outs, where a parent company sells a subsidiary or business unit. There have been 20 meaningful carve-out instances through 2024, with several examples where businesses sold off divisions at valuations higher than their prevailing group valuation – sometimes exceeding the entire market cap. We believe that carve-outs represent an underrated but powerful tool for UK companies to unlock value and overcome market discounts, creating significant shareholder value.

. . . . . . . . . . .

Matt Cable and Tim Service, fund managers, Rights and Issues Investment Trust, 20 February 2025

The first half of the year was characterised by moderating inflation and increasing investor confidence that interest rates would fall and economic growth accelerate. As we noted in our interim report, the FTSE All-Share index gained 7.4% in the year to June. Inflation has remained broadly stable, as expected, through the balance of the year and there have been two cuts to the bank base rate. However, market interest rates have risen, with the yield on two- year government gilts reaching around 4.4% at the end of the year – well above the lows of about 3.6% in the summer.

As we have discussed before, higher interest rates generally have the effect of supressing economic activity, which in turn impacts the value of equities. At the same time, the newly elected Labour government spent much of the second half of the year strenuously attempting to lower expectations, with much talk of fiscal ‘black holes’ and ‘painful decisions’. In the event, the autumn budget was relatively benign (with the exception of an unwelcome increase in employer national insurance contributions). The damage to confidence, however, appeared to have been done, again reflected in equity performance.

In November Donald Trump was elected US President for a second time. Furthermore, the Republican Party gained full control of Congress which will allow the new administration much greater scope to implement its agenda. How much of the pre-election rhetoric around tariffs, immigration and foreign relations translates into policy remains to be seen, driving further uncertainty. Interestingly the US equity market seems to have taken this all in its stride, but elsewhere investors are once again taking a more cautious approach.

Despite these challenges the UK market was broadly stable through the second half of the year, with the FTSE All- Share returning 1.9%, and hence 9.5% for the year as a whole.

. . . . . . . . . . .

Sir Laurie Magnus CBE, chair, City of London Investment Trust, 20 February 2025

The UK economy is struggling to grow, with business confidence adversely affected by a combination of the rise in employer’s national insurance, the prospect of tighter labour regulations and the well-above inflation increase in the National Minimum Wage from April 2025. Although it seems likely that there will be further interest rate cuts from the current level of 4.5%, the Bank of England’s decision is made harder by the ripple effect of government induced cost pressures on inflation. Cuts in interest rates could be well received by investors, who will anticipate an improvement in corporate profits and consumer spending. The outlook for growth in Europe is also weak, with considerable political uncertainty in both France and Germany. The European Central Bank is expected to make further cuts in interest rates which may improve sentiment. Prospects for economic growth are stronger in the US, with its technology sector continuing to generate impressive returns. The policies of the Trump administration, such as in relation to tariffs, currently remain uncertain and the judgement of the potential impact of such policies will feature materially in the Federal Reserve’s determination of future interest rates.

Many domestic UK stocks remain on relatively depressed valuations, both absolutely and relatively when compared with their peers in overseas markets. The diversified Real Estate Investment Trusts exemplify this valuation discrepancy, trading on discounts to net asset value of 30% and dividend yields of 6%. It is important to recognise, however, that City of London’s portfolio is biased towards companies with overseas sales. At 31 December 2024, some 63% of the underlying sales of investee companies were made overseas. They are therefore well placed to benefit from global growth trends. It is also worth noting the possible signs of a lessening of geo-political tensions, such as the ceasefire in Gaza, and President Trump’s proactive engagement in efforts to end the war in Ukraine.

Given the relative attraction of UK equities to their equivalents in overseas markets, especially with regard to dividend yield, it remains the case that investors in UK equities “are paid to hold on”. It is encouraging to see many companies.

More takeovers can be expected from overseas companies and private equity firms while this low relative value of UK equities persists. The dividend yield of UK equities will also become increasingly attractive relative to bank deposit rates as interest rates decline.

. . . . . . . . . . .

The Investment Company, 14 February 2025

2024 was very much a year of two halves, with optimism and gains in the first half reined back by the downbeat tone of the new Government in the second half. The prospect of a majority Labour government that promoted fiscal prudence and a pro-business stance, meant investors were looking forward to political stability in the second half as the economy continued to improve. The reality unfortunately proved very different. The new government almost immediately started talking down the economy, undermining both business and consumer confidence, continually referencing the existence of a £22 billion black hole in public finances, which would need to be repaired by tax increases. With increases in VAT, Income Tax and individual National Insurance ruled out in the election campaign, the burden fell on business and savers.

The scale of the tax rises on business still surprised the market, with companies curtailing new investment and hiring plans, and either looking to pass on additional costs with inflationary price rises, where they can, or cutting back on staff to reduce costs in labour intensive operations where pricing power isn’t a feature, curtailing the prospect of private sector growth. At the same time, the Chancellor announced an increase in unfunded public sector spending, undermining any confidence in the new government’s fiscal propriety and putting upward pressure on bond yields, undermining the prospect of near-term rate cuts.

One issue that was particularly challenging for investors in UK smaller companies was speculation surrounding the possible removal of business relief from Inheritance Tax (IHT) on AIM shares. With the new government committing to retaining tax relief for EIS and AIM VCT investing, the lack of mention of AIM IHT relief caused a severe underperformance in AIM shares, where the Company is circa 55% weighted (to get exposure to growth sectors like Technology, Media and Healthcare). This underperformance was driven by investors’ concerns that relatively illiquid AIM IHT portfolios would need to be unwound into an unreceptive market. As it was, AIM IHT relief was partially withdrawn, moving AIM shares down the list of tax planning priorities but not causing a wholesale sell-off, with AIM stocks enjoying a brief relief rally on the budget, but only partially recovering the damage already done. With the tax incentive substantially reduced, an increasing number of AIM-listed holdings have either completed or proposed a move from AIM to the Main Market. We expect this trend to continue, particularly for larger AIM listed companies that could benefit from Index inclusion when moving to a full listing.

. . . . . . . . . . .

Gervais Williams and Martin Turner, Diverse Income Trust, 10 February 2025

Globalisation was a period when interest rates fell progressively, market liquidity was abundant, and budget deficits were relatively easy to finance. With nationalism and protectionism however, geopolitical tensions now predominate – along with the open-ended risks that they carry. In addition, with government debt costs rising, plus the extra defence spend and potential unemployment benefit to come in future, legislatures are currently upping their tax take, in a trend that may be set to crowd out others.

Globalisation favoured large and megacaps, such that strategies almost wholly invested in a limited number of industry sectors, via a limited number of large holdings were able to deliver perfectly good customer outcomes. With protectionism from here however, we worry that strategies aligned with the long decades of abundant ‘Goldilocks’ market liquidity may now deliver poorer outcomes.

During periods of persistent market liquidity challenge in the past, numerous corporates often ran short of ready cash. In contrast, those generating surplus cash didn’t just survive, but had the advantage that they could actively enhance their earnings growth potential. They could fund expansion into the markets vacated by insolvencies. They could acquire over-leveraged but otherwise viable companies – sometimes for as little as £1 – debt-free from the receiver. These deals typically delivered unusually strong returns on capital, such that mid and smallcap deals in particular, could sometimes deliver aggressive earnings upgrades.

For this reason, the UK exchange’s large cohort of equity income stocks is overwhelmingly important, given that Trump’s mandate of sweeping change runs the risk of unintended consequences. We believe equity income strategies are now set to gather increasingly expansive capital allocations, making the UK one of the best performing of global exchanges – as it was in the 1970’s.

Perhaps of even greater significance, UK-quoted mid and smallcaps greatly outperformed the majors during this decade, delivering returns that comfortably outpaced rising inflation, as well as being very considerably ahead of numerous international comparatives such as the US.

In short, whilst US protectionism may unsettle global stock markets and UK interest rates may remain higher than desired, we view all this positively. A weak UK exchange rate for example, would drive upgrades because the earnings of the largest UK stocks typically have a very large overseas component. Alongside, if companies with weak balance sheets did run into trouble more frequently, then those with strong balance sheets would have the advantage. We believe this would lead to productivity improvements, and quoted smallcap earnings upgrades.

. . . . . . . . . . .

Dan Whitestone, BlackRock Throgmorton Trust, 19 February 2025

It’s frustrating that only a few months ago I was writing about “robust” UK macro data, falling mortgage rates and a positive outlook for 2025. For as Keynes said “when the facts change, I change my mind”. Unfortunately, the UK Budget has had a chilling effect on UK economic momentum; the CITI Economic surprise index, which peaked at over +50 in the summer has fallen to -34, close to trough levels, UK GDP data has been revised down to close to 0 in quarter 3 with little growth expected in quarter 4, retail sales slowed to 0.4% growth in quarter 4, and business confidence has fallen sharply.

Though the absolute amount of spending in the budget was not wildly different from our expectations, the mix of policies is definitely worse. The changes to National Insurance are a case in point, most expected the 1.2% higher rate for employer contributions which had been well trailed. The change to lower the threshold at which NI is paid was, however, unexpected and will disproportionately affect those in part time work and impose large costs on the businesses that employ them. Companies are telling us that they will respond to these inflationary impulses by reducing staff and seeking efficiency savings, which suggests the outlook for UK employment is weaker. For Industrials, to remain competitive, they will have to either absorb or mitigate mechanical NI costs should they wish to remain price competitive against global rivals, however, they should get a significant boost from weaker sterling which continues to depreciate against both the US Dollar and major European currencies too.

Despite Bank of England (“BoE”) cuts through quarter 4, bond yields are higher, with the 30-year bond at its highest level since 1998, and swap spreads, crucial for mortgage pricing, following suit. The outlook for the housebuilding sector and supply chain has darkened as funding rates appreciate. Labour will need to move at an even faster rate with supply side reforms if they want to stimulate a housing recovery. In recent days bond yields have pushed even higher, eroding the Chancellor’s fiscal headroom and raising speculation of another adjustment at the March Budget and spending review. Just like when banks state that their capital position is “very strong”, the sight of the Chancellor telling journalists her fiscal rules are “non-negotiable” does little to inspire confidence. The U.K.’s twin deficit combined with a weakening growth outlook doesn’t inspire external investment, which this country badly needs.

. . . . . . . . . . .

Global emerging markets

Aidan Lisser, chair, JPMorgan Global Emerging Markets, 24 February 2025

US interest rates may not ease to the degree previously predicted and the dollar could move higher still. Meanwhile the effect of recent trade and tariff skirmishes are hard to read but unlikely to be favourable.

On the other hand, the valuation gap between EM and developed markets is wide and earnings growth prospects over the long term are strong. Structural factors such as favourable demographics, urbanisation and rapid digital adoption continue to underpin the sector’s long-term potential.

. . . . . . . . . . .

Oleg I. Biryulyov, portfolio manager, JPMorgan Emerging Europe, Middle East & Africa Securities, 3 February 2025

A change in the US’s political leadership has recently occurred, conflict is ongoing in Ukraine and the Middle East, and it remains to be seen whether the new US President will be able to fulfil his commitment to end these wars. Furthermore, the collapse of the Al Basaad regime in Syria is widely expected to have profound implications for the entire region over the longer term, although it is unclear how events will play out. Given all these significant uncertainties, it is even more difficult than usual to predict the direction of EMEA markets over the near-term.

However, there are some observations we can make with reasonable confidence. For instance, it seems likely that interest rates will remain elevated over the coming year and are unlikely to return to the lows which were the norm over the past two decades. This will provide ongoing support for bank interest margins.

On a more sombre note, economic growth across the EMEA is likely to disappoint over the coming year. The reduction in oil production agreed in 2023, combined with the recent weakness in oil prices, is likely to weigh on energy companies and have an adverse impact on growth in the Middle East’s oil-producing nations. We expect the recovery in central and eastern Europe and Africa to remain lacklustre. European countries will face additional challenges related to energy security and rising military expenditures, which are required to support Ukraine and strengthen national defences to discourage Russia from broaden this conflict. We expect earnings growth to be specific to companies, rather than regions, and in general earnings growth is likely to be lower than currently forecast.

Despite pervasive near-term geopolitical uncertainty and the disappointing outlook for growth, we remain optimistic about the longer-term prospects of emerging markets in Europe, the Middle East and Africa. We believe the region already offers equity investors compelling opportunities for growth, value and income, at attractive levels. And these markets will continue to expand and change very rapidly as more companies, offering an increasing range of goods and services, enter the investment universe.

In our view, this remains a very exciting investment environment in which to seek out high quality, attractively priced investment opportunities.

. . . . . . . . . . .

North America

Tony Despirito, David Zhao and Lisa Yang, BlackRock American Income, 27 February 2025

After a banner year in 2023, US markets, defined as the S&P 500 Index, continued their momentum in 2024. Key drivers of performance may be attributed to a strong macro backdrop and above average earnings. The US economy continues to demonstrate a high level of resilience relative to the rest of the world. US gross domestic product (GDP) continues to grow at a healthy rate while employment remains low relative to long-term averages. At the same time inflation has come down meaningfully, leading to the US Federal Reserve’s (the Fed) first rate cut in September which has also driven excitement around a more sanguine outlook for equities. This supportive macro environment has translated into exceptionally strong performance for US equity markets, particularly for the largest tech-oriented companies that continue to see a boon from excitement around the development of artificial intelligence (AI). The market does continue to run at historically concentrated levels, but there has been signs of broadening taking place. Since June, the leading sectors in the S&P 500 Index in terms of absolute performance have been utilities, financials, real estate and industrials. Moving forward, a broadening market will be one of the key trends that will dictate the health and longevity of strong performance for US equities.

Like many, we see plenty of reasons to be optimistic in 2025: the US economy continues to hum along, a Republican-led administration has historically led to reduced regulation and lower taxes, which should support companies’ bottom lines, and AI infrastructure spend shows no signs of slowing down. However, in the face of excitement, experience tells us to maintain prudence. Multiples have continued to expand with current levels similar to those in the mid-to-late 1990s. This has coincided with a growing ‘valuation gap’ i.e. expensive companies getting more expensive and cheap companies getting cheaper despite, in many cases, company fundamentals not materially changing. We believe this opens the door for earnings growth to broaden out in 2025, shrinking the valuation gap. Lastly, high expectations for policy, economics and markets, may lead to harsher negative reactions if there are speed bumps.

. . . . . . . . . . .

Stephen White, chair, Brown Advisory US Smaller Companies, 18 February 2025

US equity markets gave another blockbuster showing in 2024 as the economy remained healthy, inflation trended lower, the Fed cut interest rates, and an Artificial Intelligence (AI) rally powered the technology sector. Adding to the positive returns of the year before the US markets achieved their best consecutive years’ performance since 1997 and 1998 during the lead-up to the bursting of the dot-com bubble.

With the economy holding up, US markets could well produce positive returns again in 2025. That said, there are a few factors which in the short term might limit the extent of any advance. First, interest rates may stay higher for longer than investors expect as the Fed take a more cautious view on the inflation outlook given the underlying strength of the economy, price rises still to come through the supply chain and several of the measures proposed by the new administration, such as widespread import tariffs, which would have inflationary consequences. Indeed, since the Fed has started cutting interest rates yields of longer dated paper have risen markedly, an unhelpful signal. Secondly, the rally of the past couple of years leaves much of the markets looking increasingly expensive. Stocks are trading at well above their long-term averages, even if flattered by the hefty presence of fast-growing tech stocks, with the greater risk therefore of disappointment. Finally, there is the risk that investors fall out of love with the tech sector itself as they become more cautious about AI and its returns on investment. All of this is without considering the very uncertain geopolitical background.

Given these potential headwinds, US markets may see some volatility in the short term. However, assuming the economy remains in good shape, the Fed continues to cut interest rates, even if less than originally hoped for, and corporate earnings hold up, the longer-term prospects remain favourable. We are hopeful that, coupled with a business-friendly administration in place, this may prove a favourable background for smaller companies with their more domestic bias. It may also persuade many investors to review their exposure to the US smaller company asset class.

. . . . . . . . . . .

Commodities and natural resources

Richard Horlick, chair of the board, Riverstone Energy Limited, 27 February 2025

2024 was another very active year for the energy markets in both the conventional and the low carbon energy sectors as demand growth highlighted that the world will continue to need all forms of energy for many years to come. At the same time geopolitical uncertainty, notably the conflicts in Ukraine and the Middle East, continued to impact oil prices and kept energy security at the top of the agenda. Towards the end of the period the U.S. election results heralded a likely change in approach towards the country’s energy and decarbonisation policies which could have potentially far-reaching consequences.

Nevertheless, there were signs of optimism in the sector in 2024. We saw further consolidation in upstream ventures particularly through merger and acquisition (M&A) activity as part of the global trend of increased M&A across the board. ConocoPhillips’ acquisition of Marathon Oil and the completion of ExxonMobil’s acquisition of Pioneer Natural Resources were emblematic of wider activity in the upstream sector. The drivers of much of this activity have largely been cost efficiencies, scaling portfolios and improving liquidity.

Despite the uptick in M&A activity, oil price weakness and volatility continued to weigh on public market valuations in 2024. The volatility reflects how finely balanced price drivers are currently. The bullish outlook argues that conflict-related supply disruption combined with Chinese stimulus propping up demand will support prices in the medium term. However, the bear case is that weaker demand in the West plus strong US shale growth and OPEC+ oversupply will suppress prices. Both views have their merits and until a clearer picture on demand or supply emerges we expect the swings in sentiment and price to continue into 2025.

The polarising effect of geopolitics and macroeconomic factors has meant that despite volatility over the course of the year the oil price has stayed flat during 2024. The average annual WTI oil price was $76.79 in 2024, largely in line with the 2023 average of $77.58 per barrel. Henry Hub gas prices trended a little lower in 2024, averaging $2.21 per MMBtu compared with $2.57 per MMBtu in 2023. This was a result of mild weather holding back demand at the same time as a global supply glut.

Despite this challenging economic backdrop and continued commodity price weakness, operational performance has improved in the sector. Drilling costs have declined 15 per cent. this year and 50 per cent. over the last three years. Similarly, we have seen completion costs fall by a third over the last three years. These material improvements in productivity and cost efficiency support current and future free cash flow growth and improved returns over time.

Macro-economic uncertainty is expected to continue in 2025, compounded by the arrival of a new U.S. administration with a radically different set of energy policy priorities. The new U.S administration’s plans include prioritising expanded U.S. drilling, renewed focus around natural gas exports, and rolling back climate commitments and clean energy incentives, all of which have positive and negative downstream effects on the portfolio. Despite this, there are signs that the development of decarbonisation technologies and renewable energy assets will continue to be a priority for governments and investors as the world strives to achieve a sustainable power mix of conventional and renewable energy sources.

. . . . . . . . . . .

Financials & financial innovation

Nick Brind, George Barrow and Tom Denver, co-managers, Polar Capital Global Financials, 19 February 2025

We continue to believe the investment background has fundamentally changed from the challenges of the last decade. Interest rates are ‘normalising’ and there is demand for significant investment in reshoring, defence and decarbonisation. We believe the sector will be a key beneficiary of these trends and is underpinned by household and corporate balance sheets being in healthy shape.

The playbook from Trump 1.0 following the 2016 US election was a significant rally in financials but also broader equity markets which lasted around 18 months. The starting point for valuations is higher this time and much higher for wider equity markets which may temper the size of any sustained rally from Trump 2.0. There is concern that Trump will double-down on tariffs, negatively impacting non-US markets. Understandably, US equities have benefited already from being seen as more defensive versus other regional markets with significant inflows into US-focused ETFs.

In November 2016, US equity markets outperformed non-US equity markets by ‘only’ 5.9%, compared to 7.2% this time, but a year after the election US equities had given back that outperformance, albeit still rising by a very credible 24.3%. Will US equities give back the outperformance we have seen in 2024? US financials did not give back their relative performance in 2017 but the permutations this time, exacerbated by ongoing wars in Ukraine and the Middle East, and a president who has unfinished business, are bigger so will likely make 2025 a more volatile year for financial markets than 2024.

Against this background, the Fed is pushing back further on the number of interest rate cuts amid concerns that inflation is stickier than central banks’ forecasts. This will require us to be pro-active in positioning the Trust’s portfolio to benefit from the sector’s tailwinds and to navigate the risks. Nevertheless, it is worthwhile reminding ourselves that high quality financial companies continue to compound earnings and/or book value despite the significant economic and geopolitical noise.

Over the last year we have consciously reduced the portfolio’s exposure to banks. The reasons for this are two-fold: while we believe many banks have huge incumbency advantages so are well positioned looking forward, in the shorter-term we have seen more attractive opportunities in diversified financials. We have to be conscious that the share prices of banks are also prone to sharp corrections, when sentiment for outlook deteriorates.

Banks have not grown their loan books materially over recent years so it would take a significant economic downturn to generate losses that could justify the lowly current multiples that some of them trade on. Equally they are not risk-free and not immune from a downturn. As a UK banks analyst from KBW, a research firm summed it up succinctly in a recent note (and the analogy can be extrapolated to other banking markets), “In recent years UK banks have survived a fall in GDP of 10%, interest rates rising by 5% and inflation peaking at more than 11% with zero credit problems.” Consequently, we continue to believe the market is not giving banks the credit they deserve for that reduction in risk.

. . . . . . . . . . .

Debt

Ian ‘Franco’ Francis, CQS New City High Yield, 26 February 2025

Bond markets in the UK and United States (“US”) have focussed on the increasing costs of financing Government deficits and this has led the benchmark of 10-year bond yields to increase markedly. The UK 10-year gilt yield has increased from 4.20% at the end of June 2024 to 4.60% at the end of December 2024. The US 10-year bond has moved over the same period from 4.40% to 4.60%. This has real implications as the costs of financing debt climb higher, cutting into the ability of governments to spend and grow.

With inflation still a factor, it becomes more difficult for central banks to reduce interest rates. In the UK, rates reduced by 50 basis points during the period to reach 4.75% at the end of December 2024 and in the US, sticky wage inflation has caused the US Federal Reserve to resist reducing rates aggressively with only a 1.00% reduction to 4.50% seen in the second half of 2024.

We believe that the UK is at risk of entering a period of stagflation, with inflation increasing on the back of budget changes and National Insurance, minimum wage and business rates increases. Small businesses, particularly in hospitality and retail are likely to suffer the most, with many already on the brink. Longer term in the UK, we would like to see cuts in public sector costs and a focus on greater efficiencies throughout the public sector, making the cost side of the UK balance sheet more efficient. The private sector is being placed in a precarious position with its ability to grow being seriously curtailed by increased taxes and changes to employment laws.

Globally there is a vast amount of noise being generated from the US with tariffs being weaponised against other countries and not for financial reasons e.g. Canada and Mexico.

Given the backdrop I have outlined above with the current high levels in equity markets and Government bond markets being slightly more cautious, it is my view that markets are being too complacent. Events which would have shocked markets historically are far-reaching but largely being ignored. Whilst the US economy is doing well, we can expect the Federal Reserve to be more cautious about cutting rates despite pressure from Donald Trump.

Overall, despite our negative view of the current UK economy, we are comfortable with the portfolio of investments we hold. It remains well diversified across sectors, instruments and currencies. We continue to see opportunities coming from new issues and we expect the Bank of England to cut rates at least twice during the rest of the calendar year which should be positive for us.

. . . . . . . . . . .

Private equity

Helen Steers MBE and Charlotte Morris, partners at Pantheon and co-lead managers, Pantheon International, 27 February 2025

The macroeconomic environment in 2024 was marked by a gradual easing of inflation and initial reductions in interest rates from their recent highs, amid persistent geopolitical tensions. Central banks, having raised interest rates significantly since the inflation peaks of 2022, began to cut rates as inflation in both the USA and Europe moderated by the end of 2024, although still above target levels.

In 2024, public and private markets benefitted from a stabilising macroeconomic environment and increasing business confidence although challenges have remained. However, public market performance was concentrated, driven by the so-called “Magnificent 7” stocks1 which account for a large and growing slice of the market.

Furthermore, the ongoing shrinkage in the number of public companies globally, as the number of private equity-backed companies increases, presents additional challenges for investors. Over the past 20 years, the number of publicly traded companies in the USA has reduced by 13% while the number of US private equity-backed companies has increased by over 270%2, and this phenomenon has been repeated all over the world. With public markets becoming increasingly concentrated and inaccessible or unattractive to smaller, fast-growing businesses, having exposure to the private company opportunity set could become increasingly important for investors.

The last two years have been characterised by a prolonged period of lower deal activity, which has led to subdued exit activity and low distribution rates across the private equity industry. We have seen this reflected in PIP’s own portfolio both during the six-month period and during the financial year before that. However, the reduction of interest rates from recent highs, and the gradual return of business confidence has started to positively impact the mergers and acquisitions (“M&A”) market, creating a more conducive environment for deals. In 2024, global M&A deal value increased by 15% year-on-year3, while private equity deal volume in 2024 exceeded USD$1.5tn, an 11% increase from 2023, though still below the 2021 peak4. Sentiment has improved as the interest rate environment has improved and inflation has stabilised. Further cuts in interest rates are likely to stimulate more dealmaking.

In 2024, business confidence and M&A activity was also impacted by a number of government elections being held around the world, and was delayed in particular by the US elections. Many PE managers waited for more certainty about what a change in administration might mean for policy decisions, and therefore the impact on targeted investment opportunities. At the period end, just over half of PIP’s portfolio was invested in the USA. It is too early to predict what might happen under the new Trump administration, and the potential imposition of tariffs could result in a range of outcomes that affect portfolio companies in different ways. Nevertheless, the indications are that this administration is in favour of deregulation and the potential expansion of tax cuts for corporations, both of which should be beneficial for private equity managers and their portfolio companies in the region, especially those with domestic activities.

Although it will not be immediate, we anticipate an increase in deals and exits over the next couple of years. We expect to see a gradual increase in activity in 2025, with further growth next year rather than a sudden surge of deals hitting the market. Sales processes in private markets can be lengthy, since deal negotiations and legal processes take time to complete, but we are encouraged to see that, as confidence returns to the overall M&A market, an increasing number of companies within PIP’s portfolio are already on the exit ramp.

We believe that good-quality and scarce assets will continue to attract buyers at compelling valuations. Corporate buyers, many of which are sitting on cash, do not want to miss out on an interesting acquisition opportunity and risk the target being purchased by a competitor or by a private equity manager and then having to wait a further five or six years before having another chance to acquire the company.

Despite the challenging macroeconomic environment, institutional investors have been clear about their intentions to allocate more to private equity in 20255. Investors are attracted to private equity primarily because of the return potential. An inherent characteristic of private equity managers is their flexibility and ability to respond nimbly to changing market conditions. Private equity-backed businesses benefit not only from capital investment, but also from having access to operational expertise, ranging from specialist consultants to former CEOs acting as advisers or board members. Private equity’s long-term investment horizon, coupled with direct control through which private equity managers can bring operational skill to bear, means that private equity managers are afforded the time to effectively execute their value-add theses without being burdened by mark-to-market volatility, or the pressure to hit short-term profitability targets. Given investment returns have remained strong and the asset class continues to be compelling, there is likely to be a notable uptick in fundraising activity across private equity this year.

. . . . . . . . . . .

Renewable energy infrastructure

Lucinda Riches CBE, chair, Greencoat UK Wind, 26 February 2025

Wind continues to be the most mature and widely deployed renewable energy technology in the UK (30 per cent of GB electricity generation in 2024).

The change in government during the year has resulted in a significant increase in aspirations for the wind sector and for renewable generation in general. Were the government’s targets of doubling onshore and triple offshore wind capacity to be realised by 2030, we estimate an additional £175 billion of investment would be needed.

The Company continues to support the UK Government’s commitment to achieve Net Zero by 2050 through acquiring operational wind farms and thereby allowing developers and utilities to recycle their capital into further renewable energy projects, and by demonstrating the attractive long term returns in the industry through our prudent management of wind farms, thereby reducing the cost of capital.

Demand for green electrons continues to strengthen further. The continuing decarbonisation of transport and heating through electrification, as well as green hydrogen production, will require a further 30TWh of renewable electricity per annum by 2030. This represents approximately one tenth of the UK’s current annual electrical demand and approximately five times the Group’s current annual electrical output.

. . . . . . . . . .

Property

Colin Godfrey, chief executive, Tritax Big Box REIT

Shifting consumer behaviour, evolving supply chains and a corporate drive for sustainability are underpinning demand for high-quality, mission critical, modern logistics real estate and data centre facilities.

Consumer demand for an ever faster and more convenient purchasing/returns experience is driving e-commerce and the omnichannel retail network evolution. This includes network consolidation and realignment, and a shift to larger, high-quality, modern buildings that help lower the cost to serve. Meanwhile, our increasingly digital world is driving greater demand for data centres to house burgeoning cloud and AI demand.

For occupiers navigating a fast-moving and often volatile market environment, resilience is now a priority, alongside optimising for efficiency, productivity and cost. This has translated into solutions such as holding higher stock volumes and a focus on supply chain visibility and technology adoption/automation.

Building performance, clean energy and fleet transition are top of mind for many occupiers, as they look to enhance the sustainability of their operations and meet more stringent regulatory and stakeholder requirements. Meanwhile, the need to attract and retain skilled labour (in a tight employment market) has seen a focus on the provision of a better working environment, including onsite amenities.

Combined, these drivers mean that not only is location and access to skilled labour vital, but provision and resilience of power supply is increasingly in focus as energy needs increase.

Big box logistics transaction activity totalled £3.1bn in 2024, with a further £4.9bn of multi-let and urban deals. Significant pools of global capital continue to look to access the market. Two of the largest deals completed late in the year were, for example, by new entrants to the UK logistics sector.

Prime market pricing for logistics buildings remains at 5.25%. Deal activity has continued to evidence market pricing with a significant pool of prospective purchasers for high-quality, prime product.

Investor interest in the sector remains high with prospective purchasers underwriting further rental growth on top of repriced yields. As a result, logistics pricing continues to look attractive despite ongoing uncertainty in global capital markets. The composition of returns also continues to appeal to investors with ongoing rental growth underpinning the scope for further income growth. Moreover, many buildings continue to have reversionary potential given the healthy market rental growth that leases often fail to capture fully during their term.

London remains the largest data centre market in Europe with 1,141MW in operation across an estimated 135 data centres. 2024 take up in London totalled 116MW which exceeded new supply (65MW) for the third consecutive year. Strong demand and low availability have resulted in rental rates increasing. Providers are, however, having to develop data centres in areas further afield to meet growing demand given the severe land and power constraints that exist in London.

With the same planning designation as logistics buildings, data centres have become an additional source of demand, further constraining the supply of land for logistics real estate. Furthermore, in September 2024, UK data centres were designated as Critical National Infrastructure: strengthening industry resilience, regulatory support and reinforcing the UK as an attractive destination for data centre users.

. . . . . . . . . .

David Sleath, chief executive, SEGRO

Inflation falling back towards central bank targets and initial interest rate cuts helped liquidity return to investment markets during 2024 and there continues to be good investor appetite for industrial and logistics assets.

This has led to higher investment volumes and has helped yields to stabilise. Prime yields in the UK were flat during 2024 (CBRE prime yield remained at 5.25 per cent throughout the year) and although there was some small further outward yield shift in certain European markets in the first six months of the year, most markets were stable in the second half of the year. (CBRE prime yield France +15 basis points and Germany +10 basis points, all in the first six months of 2024).

Finance costs remain elevated which means most debt-backed buyers have been active in the higher yielding end of the market. This has resulted in less capital chasing lower yielding, prime assets. Investors have been selective, focusing on assets in the best locations with the highest sustainability credentials and where there is reversionary potential that can be captured quickly.

The outlook for yield and asset valuations is notoriously hard to forecast. The recent ‘higher rates for longer’ narrative has so far not had a discernible impact on investment market liquidity. However, as active portfolio managers, we do not rely on yield compression but aim to create value across the property cycle through asset and portfolio management and driving rental growth.

. . . . . . . . . .

Harry Hyman, chair, Primary Health Properties

The commercial property market continues to be impacted by economic turbulence and the uncertainty of interest rates continues to weigh on the real estate sector. The UK budget and rising debt levels along with the US election continue to pose ongoing risks and create added uncertainty.

We believe healthcare, and in particular primary care real estate, remains a structurally supported sector and benefits from the demographic tailwinds of a population that is growing, ageing and suffering from increased chronic illnesses, which is placing a greater burden on healthcare systems in both the UK and Ireland, which in turn compounds the need for both fit for purpose and additional space. However, future developments will now need a significant shift of between 20% to 30% in rental values to make them economically viable. We continue to actively engage with the NHS, ICB and DV for higher rent settlements. Despite these negotiations typically becoming protracted, we are starting to see positive movement in some locations where the health system’s need for investment in new buildings is strongest such as our recent development at South Kilburn, London.

Primary care asset values have continued to perform well relative to mainstream commercial property due to recognition of the security of their government backed income, crucial role in providing sustainable healthcare infrastructure and more importantly a stronger rental growth outlook enabling attractive reversion over the course of long leases.

In the first half of 2024, the continued lack of recent transactions in the period resulted in valuers continuing to place reliance primarily on sentiment to arrive at fair values. However, in the second half of the year there has been a small pool of transactional evidence, with a limited number of purchasers in the market, including distressed asset sales, which have enabled valuers to have regard to these comparables with lesser reliance on market sentiment. Yields adopted by the Group’s valuers have moved out by 17bps in the year to 5.22% as at 31 December 2024 (31 December 2023: 5.05%).

We believe further significant reductions in primary care values are likely to be limited and we have now reached an inflexion point with a stronger rental growth outlook offsetting the impact of any further yield expansion.

We have also seen significant real estate sector consolidation in the UK over the last few years where poor structures and investment strategies have resulted in material share price discounts to net asset values. As a result, we believe that there are further opportunities for consolidation, with investors increasingly focused on larger, more scalable and efficient cost structures.

. . . . . . . . . .

Paul Williams, chief executive, Derwent London

London is a leading global city which continuously adapts and evolves. With unrivalled international connectivity and world-leading universities, it is Europe’s tech and innovation hub attracting more venture capital investment than any other European city. Appealing to talent across a variety of sectors, it supports a highly skilled workforce. It is a city with all the elements for a promising and strong future: ongoing growth in office-based jobs, GDP expected to maintain its outperformance, and an enduring competitive advantage which appeals to a broad range of businesses. We are excited about the outlook for London and the office sector despite the volatile macroeconomic environment.

The importance of the office is widely endorsed by companies across sectors, as they place increasing emphasis on ensuring their talent is primarily in the workplace. High quality, well-located space across a broadening variety of price points is being prioritised, which aligns well with our portfolio.

London’s occupational market was strong in 2024, with take-up in line with longer term levels and active demand rising significantly in the year. At the same time, the vacancy rate for high quality London offices is very low and the medium-term development pipeline is constrained. In 2024, we delivered another successful leasing performance and portfolio ERV growth more than doubled year on year to 4.3%, the highest level since 2016. We expect this positive activity to continue.

The investment market was subdued last year. Sentiment improved in the first half, with inflation and long-term interest rates reducing, optimism leading up to the General Election and UK GDP forecasts being revised upwards. However, Q4 saw a reversal in sentiment as concerns around growth and inflation re-emerged.

In spite of this, and in line with our guidance, property yields stabilised, following two years of substantial outward movement. Investment activity is expected to increase in 2025, with a rise in the number of assets being brought to the market and more investors looking to invest in the sector.

. . . . . . . . . .

Ian Hawksworth, chief executive, Shaftesbury Capital

London and particularly our West End portfolio continues to display its enduring appeal as a leading global destination, with international arrivals now ahead of 2019 levels. Vacancy rates, not only in our portfolio but across prime West End retail units continue to reduce and are also back in line with pre pandemic levels creating competitive tension for prime space. Footfall has been consistently high, with the Elizabeth Line enhancing transport connectivity for visitors, shoppers, workers and tourists alike. Despite the well-documented macro-economic uncertainty, the West End continues to perform. Footfall is high, with continued customer sales growth, limited vacancy and a strong leasing pipeline.

. . . . . . . . . .

Joe lister, chief executive, Unite Group

Many university cities are facing housing shortages, and our investment activity is focused on those markets with the most acute need. Over half of students who need term-time accommodation live in HMOs where many private landlords are choosing to leave the sector due to rising mortgage costs and increasing regulation. In some markets, delivery of Build-to-Rent accommodation is partially mitigating reduced availability of HMO stock, albeit at higher price points.

New supply of PBSA is also down 60% on pre-pandemic levels, reflecting viability challenges created by higher costs of construction and funding as well as planning backlogs and time required to secure Building Safety Act approvals. Weekly rents now need to be at least £200 for new PBSA development outside of London to be viable, meaning there is little prospect of new supply in many markets.

We expect obsolescence of older university accommodation to further impact supply, with 5,000-10,000 beds being removed from the market each year due to building age and the need to operate buildings more sustainably.

The combination of these factors has significantly increased demand for our accommodation in many cities. Our strong, established relationships with universities position us as a long-term partner to help solve their housing needs. The Government has also set ambitious targets for new housing, and we will play our part in delivering new student accommodation which frees up local housing for families.

International student demand is improving for 2025 after the disruption created by changes to visa policy in early 2024. Visas granted to students were down 14% in 2024 as a result of this policy change and uncertainty created by the review of post-study visa policy ahead of the UK general election. The new government has been vocal in its support of international students coming to the UK, recognising the value they bring to the UK and its universities, and we are not expecting any further visa changes in the near term. Recruitment data is encouraging, with indications of a 14% increase in the intake for January 2025 and a 3% increase in international applicants for the 2025/26 academic year, with 9% growth from China.

. . . . . . . . . .

IMPORTANT INFORMATION

This note was prepared by Marten & Co (which is authorised and regulated by the Financial Conduct Authority).

This note is for information purposes only and is not intended to encourage the reader to deal in the security or securities mentioned within it. Marten & Co is not authorised to give advice to retail clients. The note does not have regard to the specific investment objectives, financial situation and needs of any specific person who may receive it.

Marten & Co may have or may be seeking a contractual relationship with any of the securities mentioned within the note for activities including the provision of sponsored research, investor access or fundraising services.

This note has been compiled from publicly available information. This note is not directed at any person in any jurisdiction where (by reason of that person’s nationality, residence or otherwise) the publication or availability of this note is prohibited.

Accuracy of Content: Whilst Marten & Co uses reasonable efforts to obtain information from sources which we believe to be reliable and to ensure that the information in this note is up to date and accurate, we make no representation or warranty that the information contained in this note is accurate, reliable or complete. The information contained in this note is provided by Marten & Co for personal use and information purposes generally. You are solely liable for any use you may make of this information. The information is inherently subject to change without notice and may become outdated. You, therefore, should verify any information obtained from this note before you use it.

No Advice: Nothing contained in this note constitutes or should be construed to constitute investment, legal, tax or other advice.

No Representation or Warranty: No representation, warranty or guarantee of any kind, express or implied is given by Marten & Co in respect of any information contained on this note.

Exclusion of Liability: To the fullest extent allowed by law, Marten & Co shall not be liable for any direct or indirect losses, damages, costs or expenses incurred or suffered by you arising out or in connection with the access to, use of or reliance on any information contained on this note. In no circumstance shall Marten & Co and its employees have any liability for consequential or special damages.

Governing Law and Jurisdiction: These terms and conditions and all matters connected with them, are governed by the laws of England and Wales and shall be subject to the exclusive jurisdiction of the English courts. If you access this note from outside the UK, you are responsible for ensuring compliance with any local laws relating to access.

No information contained in this note shall form the basis of, or be relied upon in connection with, any offer or commitment whatsoever in any jurisdiction.

Investment Performance Information: Please remember that past performance is not necessarily a guide to the future and that the value of shares and the income from them can go down as well as up. Exchange rates may also cause the value of underlying overseas investments to go down as well as up. Marten & Co may write on companies that use gearing in a number of forms that can increase volatility and, in some cases, to a complete loss of an investment.