In April, the US economy faced mounting challenges as President Trump’s ‘Liberation Day’ tariff policies began to take a toll. These included a 145% levy on Chinese goods and a 10% blanket tariff on all imports, raising concerns about inflation and economic stability. Economists warn of a potential recession, with some forecasting a 90% chance of a downturn due to the tariffs’ impact on small businesses and consumer prices. Despite a stronger-than-expected jobs report in April, with 177,000 jobs added and unemployment steady at 4.2%, by the end of April the S&P 500 had declined by 11% year-to-date (in sterling terms), reflecting investor anxiety over trade tensions and economic uncertainty.

‘This is a disruption on the same scale as Covid…and possibly more so than the 2008 financial crisis’

Sir Martin Sorrell, on American tariffs

It seemed to be a pivotal month for the UK economy, marked by significant monetary policy adjustments and trade developments. The Bank of England cut interest rates to 4.25%, its fourth consecutive reduction since August 2024, aiming to mitigate the economic impact of global trade tensions. Simultaneously, the UK secured a trade agreement with the US, reducing tariffs on British car exports and eliminating duties on steel and aluminium. However, the deal also increased average tariffs on other UK goods, raising concerns among exporters. The economy faces other headwinds: GDP growth forecasts have been downgraded to 0.8% for 2025, and inflation is projected to rise to 3.2%. The FTSE 100 experienced a modest decline.

The Eurozone economy experienced relative difficulty as the effects of US trade tariffs began to materialise. While first-quarter GDP growth was reported at 0.4%, driven by a surge in exports ahead of tariff implementations, the momentum showed signs of waning. Inflation remained steady at 2.2% in April, with a notable increase in services prices offsetting declines in energy costs. The European Central Bank responded to these economic headwinds by cutting interest rates to 2.5%, marking its sixth reduction within a year, aiming to stimulate growth amidst the shockwaves from the US’s trade policies.

Fidelity Special Values

‘Despite their improved performance over recent years, UK equities remain relatively cheap compared to other markets‘

European Assets Trust

The prospect of further interest rate cuts makes Europe more attractive as an investment destination than the US

Vietnam Enterprise Investments

Due to the increasing trade headwinds for China, Vietnam could also be positioned to capture a larger share of manufacturing and export demand

At a glance

| Exchange rate | 30 April 2025 | Change on month % | |

|---|---|---|---|

| Pound to US dollars | GBP / USD | 1.3329 | 3.2 |

| Pound to euros | GBP / EUR | 1.1765 | (1.5) |

| US dollars to Japanese yen | USD / JPY | 143.07 | (4.6) |

| US dollars to Swiss francs | USD / CHF | 0.8258 | (6.6) |

| US dollars to Chinese renminbi | USD / CNY | 7.2713 | 0.2 |

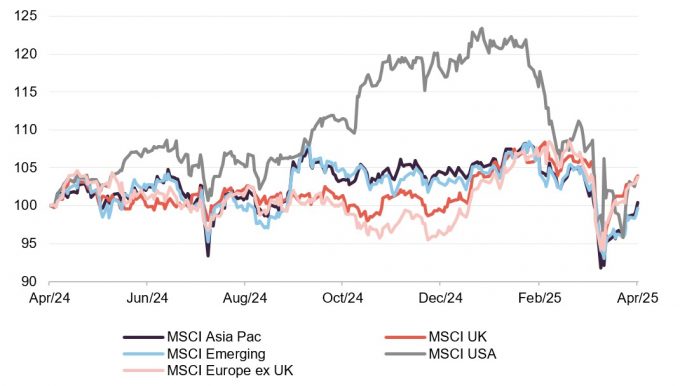

MSCI Indices (rebased to 100)

The dollar weakened notably as investor confidence waned due to new tariff implementations, whilst the euro was strengthened by fiscal stimulus and investor shifts away from US assets.

Oil prices experienced significant declines due to a combination of increased supply and concerns over global demand. Meanwhile, the price of gold reached an all time high on 22 April, breaching $3,500 per ounce, driven by geopolitical concerns.

Time period 30 April 2024 to 30 April 2025

Source: Bloomberg, QuotedData. Converted to pounds to give returns for a UK-based investor.

| Indicator | 30 April 2025 | Change on month % |

|---|---|---|

| Oil (Brent – US$ per barrel) | 63.12 | (15.5) |

| Gold (US$ per Troy ounce) | 3288.71 | 5.3 |

| US Treasuries 10-year yield | 4.16 | (1.0) |

| UK Gilts 10-year yield | 4.44 | (5.0) |

| German government bonds (Bunds) 10-year yield | 2.44 | (10.7) |

Global

David Seligman, British & American Investment Trust, 30 April 2025

A major new source of uncertainty has arisen with the election last November of President Trump in the USA on the promise of a radical programme of change and indeed disruption across almost all areas of domestic political, economic, social and financial policy as well as globally in terms of trade, defence and international relations.

The initial market reaction to his promises to reduce the costs of living and inflation, cut taxes and promote business was positive and the equity market and US dollar strengthened further in the last two months of 2024. However, this reaction soon dissipated after the new administration took office in mid January.

It had been expected that some of Trump’s more extreme plans – for example to slash the costs of government administration, abolish entire government departments and introduce penal international trade tariffs on goods – were intended more as a negotiating tactic rather than firm strategy, given Trump’s tendency to use extreme policy announcements as a crude lever and then change course abruptly to achieve quick commercial gains. However, this has not been the case and if anything has been doubled down upon as seen by the mass and indiscriminate layoffs of government employees, the nonchalant shedding of age-old alliances and earlier this month the imposition of a far harsher than expected regime of international trade tariffs on goods imported from all other countries.

The accumulation of all these disruptive and damaging policies, many of which upend long-established economic, defence and trade arrangements which have underpinned global prosperity and security as long as most people can remember, has resulted in extreme levels of uncertainty since the beginning of the year causing significant falls or re-alignments in all markets, be they financial, investment, currency, commodity, employment or trade, whether in the USA or worldwide.

It is too early to say how these unprecedented policy changes in the USA will play out over time, save to say that in the short to medium term increases in inflation, slower reductions in interest rates and lower levels of economic growth and therefore investment markets can be expected. For these reasons and the continuing high levels of uncertainty, the reaction of markets both in the US and internationally has been extremely negative with very high levels of volatility. US equity markets fell by up to 20 percent at one stage and the US dollar has retreated by almost 10 percent from recent highs. Economic indicators for consumer sentiment, business activity, employment and growth in the USA have fallen to their pandemic low levels and these can expected to be translated into hard data within months as actual out-turns confirm these predictions.

. . . . . . . . . . .

Zehrid Osmani, portfolio manager, Franklin Global Trust, 17 April 2025

There is plenty of uncertainty on all fronts as a result of the Trump administration’s unpredictable policy initiatives both domestically and internationally. The Trump presidency and notably the introduction of trade tariffs by the US directly impacts the magnitude of all five key risks that we foresee for 2025. These are: 1) stickier inflation, 2) less dovish monetary policies, 3) tariffs and trade wars, 4) geopolitical uncertainty in the Middle East, Ukraine and China/Taiwan, and 5) government debt and fiscal policies

With the announcement by the Trump administration initially on 2 April 2025 of a more significant and broader range of tariffs than expected across a wide range of trading partners, and ensuing escalations with China, we believe that there is an increased risk of a sharp slowdown in economic momentum this year if the announced tariffs are not reversed. A lot of the predictions for the remainder of 2025 will need to be reviewed in light of these and any further policy initiatives by the new Trump administration. Whilst we do not expect a full recession, the sharp slowdown which we expect could feel recessionary in the US, Europe and China. We are already seeing a rapid deterioration in both business and consumer confidence in the US, which could weigh negatively on economic momentum. This could translate into weaker corporate earnings growth, and a series of downgrades to market estimates. This will likely maintain a high degree of uncertainty in equity markets, whilst at the same time keeping share price volatility high. Investors need to be cognizant that there will be a heightened focus on shorter term considerations, although this could also open up more opportunities for investors with a longer term perspective.

Tariffs, trade tensions, and geopolitical moves by the Trump administration could bring significant volatility in equity and bond markets during the year. It will therefore be important to continue to focus on long-term structural growth opportunities, whilst maintaining valuation discipline. This will not necessarily bring consistently strong performance in what will likely be a very volatile environment, reacting to headline news and policy announcements.

. . . . . . . . . . .

UK

Mark Niznik and William Tamworth, portfolio managers, Artemis UK Future Leaders, 29 March 2025

Investor sentiment has taken a hit following increases to corporate taxes announced in the Budget. The fear now is stagflation: no economic growth and higher inflation as companies try to recoup additional national insurance costs by raising prices. However, we are optimistic. Why? There are three main reasons.

UK consumers – Consumers are generally in good shape, with full employment and decent wage growth fuelling increased disposable income. Savings that were built up through Covid remain unspent, while household debt as a proportion of income is at a 17-year low. Although we acknowledge the risk of job losses as companies seek to recoup higher taxes by cutting costs, this is likely to be more than offset by rising consumer spending as confidence improves.

Businesses – Corporate balance sheets are strong. Now the interest rate cycle has turned, companies have the capacity to invest and the ability to withstand a tough backdrop.

Politics – Stability is important. The UK has a relatively centrist government with a large majority that is likely to remain in place until 2029. As the 2024 Budget was the last time the government can (credibly) blame the previous one for unexpected funding gaps, the emphasis must now shift to growth. There are already some tentative positive signs, for example with regard to planning, potential changes to mortgages and pension reforms.

What’s been missing? Confidence: consumer confidence, business confidence and investor confidence. But confidence can change quickly. Given the low starting point, we don’t need a ‘good’ outlook, we just need one that is ‘less bad’ than feared. As confidence recovers, we expect increased consumer spending, a rebound in business investment and asset managers to start allocating money back to UK small caps. Given low valuations, we would expect that to translate into a powerful recovery.

With regards to the recent developments around tariffs it is impossible to be prescriptive as to the impact. For context, the fund derives the majority of its revenues from the UK (approximately 60%) with around 15% coming from the US. The UK is not a heavily export dependent economy and is more reliant on services than goods.

. . . . . . . . . . .

Alex Wright, portfolio manager, Fidelity Special Values, 25 April 2025

Despite their improved performance over recent years, UK equities remain relatively cheap compared to other markets. Historically, the UK market traded at around 85-90% of global markets, but this has dropped to around 75% in recent years1. While other markets face excessive valuations and the risk of a de-rating, the UK market benefits from a meaningful margin of safety, offering protection if exogenous events impact markets. The market’s consensus last year was that US dominance would persist; however, trends have moved in the opposite direction so far this year.

While we are undoubtedly entering a turbulent period in global politics and economic uncertainty, as tariffs will likely impede global economic growth, the UK market is well-positioned to withstand this US-centric storm. Direct tariff exposure is minimal given the UK’s small export base and service-oriented economy. Moreover, the UK’s sector composition is skewed toward defensive areas such as consumer staples and utilities, which could provide resilience against global growth weakness and trade downturns. This is strikingly different to other regions with high export dependencies to the US and significant sector weightings in affected areas, such as technology, aerospace and manufacturing which are heavily reliant on dispersed globalised supply chains.

The UK market’s international nature means that it will feel some effects from the tariffs, but mostly from the broader implications of a likely deceleration in US and global economic growth, rather than direct tariff-related hits. Recession risks have clearly escalated, and the lingering uncertainty is what the market is currently pricing in. The Company’s diversified portfolio and its underweight positions to the most exposed areas, such as oil and pharmaceuticals, should prove relatively supportive, but its cyclical holdings will feel the effects of this. We have been strategically adding to attractively valued domestic-facing businesses that are relatively insulated from these events, supporting a meaningful overweight to UK revenues compared to the Benchmark. We believe there are numerous attractive opportunities prevailing in the current market, available at low valuations, and we continue to uncover compelling investment ideas, particularly in periods of high market volatility.

The unpopularity of the UK market has made it an attractive hunting ground for contrarian value investors. We believe that the combination of favourable valuations and the large divergence in performance between different markets provides a strong opportunity for attractive returns on a three-to-five-year view. Their unloved status means we are finding overlooked companies with good upside potential across industries and the market cap spectrum.

While domestic investors have yet to fully recognise this value, it is being acknowledged by other market participants. Overseas corporates and private equity firms are actively capitalising on these attractive valuations, as evidenced by the strong historical M&A activity in the UK market. We have experienced considerable success with M&A activity across the portfolio in the last year. The low valuations are also reflected in the substantial buyback activity among UK corporates.

We believe current market conditions continue to favour our value-contrarian investment style. The vulnerability of growth companies is that they tend to be priced for optimism, with share prices declining significantly if good news does not materialise. The opposite is true for value companies: If the consensus view is negative, an investor does not lose much if it turns out to be correct; in contrast, if it is wrong, the share price can move significantly higher.

Overall, we believe the UK market has an underappreciated richness of opportunity, combining strong earnings growth, high dividend yields and low valuations. The portfolio benefits from a favourable upside/downside profile and our holdings trade at a meaningful discount to the broader UK market, despite exhibiting resilient earnings, superior returns on capital and relatively low levels of debt. This quality profile reinforces our confidence in delivering attractive long-term returns for investors.

. . . . . . . . . . .

David Barron, chair, Dunedin Income Growth, 14 April 2025

There are of course risks to be aware of. At home in the UK, businesses now have to navigate the substantially increased costs that will come through from the Autumn budget. The economy remains stagnant and the confidence of consumers and companies is subdued. Global politics have become more volatile and the path and impact of US economic policy more difficult to ascertain. President Trump’s trade agenda has caused markets a great deal of discomfort since the year end, particularly since his tariff announcement on 2 April. Alongside this, there are already signs of an economic slowdown emerging as businesses grapple with the daily torrent of policy announcements.

While inflationary pressures in the UK have eased, they are still at elevated levels compared to central bank targets. Likewise, geopolitical tensions continue to persist across the Middle East, as does Russia’s conflict with Ukraine. Meanwhile, China’s economy remains subdued, unlikely to be aided by the current trade dispute with the United States. If there is a potential silver lining of this backdrop, it is that UK inflation may ease faster than expected – energy prices have fallen sharply and this may give the Bank of England greater scope to ease monetary policy, an essential boost to what remains a consumption led domestic economy.

. . . . . . . . . . .

Colin Clark, chair, Merchants Trust, 8 April 2025

As ever, it remains challenging to predict when investor interest will return to the UK stock market, when UK valuations will re-rate to more “normal” levels, or where markets will stand in 12 months’ time. In theory, the recent sharp sell-off in equity markets, led by the high-growth and technology stocks in the US, could serve as a catalyst, prompting investors to broaden their horizons and seek out quality and value – themes we believe would benefit our portfolio’s performance. However, we approach this possibility with humility, as we have made similar observations before. Investing is never straightforward, and it is rarely predictable.

The new US administration marks a significant shift, not only in global geopolitics, with Ukraine and the Middle East continuing to dominate headlines, but also in areas requiring the close attention of our manager. These include radical changes in trade and tariff policies, which will have implications for inflation and interest rate decisions, and global growth and profit outlooks. Domestically, following a Labour government’s first budget, which many commentators viewed as challenging for UK businesses, the market will be keenly focused on the fiscal and monetary policy actions of the UK Chancellor throughout 2025.

. . . . . . . . . . .

Guy Anderson and Anthony Lynch, managers, Mercantile Investment Trust – 7 April 2025

As always, there are valid reasons to be apprehensive about the future: financial markets continue to be buffeted by the inter-connected forces of inflation, monetary policy, and their impact upon economic growth expectations, which in the UK could be described as lacklustre at best. Furthermore, the current geopolitical landscape appears to be primed for generating unanticipated shocks at any moment: the latest announcement from the President of the United States on tariffs is truly extraordinary, and while the UK is less directly impacted than many economies and the ultimate end game may look very different to the view today, this can only have a negative impact on global economic growth.

Despite this, and amidst the market turmoil that it is creating, there is cause for some cautious optimism. The valuation of the UK market remains at a steep discount to both its own history and relative to other developed markets. Within the UK, given their greater economic cyclicality and sensitivity to interest rates, medium and smaller size companies are trading at a discount relative to their usual level versus larger companies. These facts have not gone unnoticed, as we have seen a pick-up in the number of acquisitions by corporate buyers (focusing on medium and smaller companies), while the volume of share buybacks being executed by management teams has also soared.

While the changing economic landscape will impact our portfolio companies, most have been delivering healthy financial performance while executing their growth strategies, in many cases backed by substantial capital investments. The combination of these factors, and the breadth of exciting investment ideas that we have been finding, explain our current elevated level of gearing, sitting at around 15%. This action hopefully demonstrates most clearly our assessment of the opportunity before us.

Looking ahead, we will maintain our focus on investing in structurally robust businesses that operate in growing end markets and possess the ability to invest capital at attractive returns while being able to adapt to the changing environments in which they operate. We believe that a portfolio of such investments offers the best prospect of delivering compelling returns and outperformance for our shareholders over the long-term.

. . . . . . . . . . .

Asia ex Japan

Stewart Investors, manager, Pacific Assets – 29 April 2025

Given the number of attractively valued companies in Asia at present it’s hard not to get excited about future returns. As always, there are plenty of things that could go wrong at any time. Political risk is rising in almost every Asian country, with impeachments, International Criminal Court arrests and attempted coups a growing feature in the region. If the US economy falters and global demand falls, Asian economies will all be impacted, to differing degrees. Asia’s technology hub, built around Taiwan, South Korea and China, is particularly vulnerable. Elsewhere, India remains largely isolated from the global economy, while the Philippines would receive a significant economic boost from falling oil prices. Very recently we have seen dramatic share price moves as Asia markets caught up with US-imposed tariff announcements and subsequent global share price movements.

. . . . . . . . . . .

Ronald Gould, chair, Henderson Far East Income, 14 April 2025

Investor attention is understandably rivetted on current market developments in light of dramatic new tariff initiatives from the US. Is it a massive overreaction or a sensible short-term adjustment to a new reality? Will the impact be broadly similar in all economies or will some fare better than others? The future impact of these changes is being modelled by many analysts, but it is fair to say that an emerging trade war is unlikely to be good news in the near term. I will return to this later in my statement, but it is important to remember that Asian economies and markets are not joined in lock-step to the US.

Asian markets produced a positive return during our first half despite rising, but unpredictable, challenges from the new US administration. Whilst the outcome is likely to be a protracted period of volatility for some of our exporting markets, we have witnessed a more stable macro environment in China which has in turn supported more positive sentiment towards the entire APAC region. Asia Pacific equities outperformed the US over the quarter ending 28 February 2025 and there are a number of reasons to believe in a more sustainable reversal during the rest of the year after recent sharp setbacks for all equity markets. In general, APAC markets have performed relatively better in the recent market drops.

As we consider prospects for our second half, the likelihood of a weaker US dollar has traditionally been a positive for Asian markets. At the same time, recent US trade policy changes are likely to negatively impact US inflation, growth and employment. There are already signs of reduced consumer and business confidence that many analysts believe foreshadows a US recession. Asia meanwhile has benefitted from stabilisation in China with a raft of stimulus measures driving improved domestic consumption. This has long been a key government objective which has reduced the country’s dependence on exports. Chinese government measures have improved confidence amongst consumers and investors alike. The improved outlook in China has not only been about the consumer. Technology breakthroughs in electric cars and the emergence of China’s own version of an AI large language model, DeepSeek, has shocked technology investors with its low cost and high operating standards. China has the ability to surprise markets further given the immense investments it has already made in the industries of the future. The return on this investment in the form of improved operating metrics at the corporate level, is far more sustainable for the China recovery than recent stimulus and short-term boosts to consumption could provide.

. . . . . . . . . . .

Eruope

Stuart Paterson, chair, European Assets Trust, 2 April 2025

Since the start of 2025 European markets have been impacted by two primary factors: the threat of global trade tariffs from the new US administration and the attempt to negotiate a rapid peace deal in Ukraine.

Against this backdrop the “Magnificent Seven” and the technology index in the US have retraced. European equities have performed relatively much better. The European bourses have been led by large cap stocks with the small and mid-cap universe of the Company lagging.

The prospect of further interest rate cuts makes Europe more attractive as an investment destination than the US, where expansionary policies may boost inflation at least in the short term. The underperformance of Europe over the last years relative to the US does not reflect the better European macro environment. The US Federal Reserve has been cautious about interest rate cuts whilst the European Central Bank has a freer hand. Overall there is much to say about Europe which is positive. Economic growth may be low, but remains resilient, further interest rate reductions should stimulate activity, and valuations are lower than elsewhere, especially the US. As at February 2025, the MSCI Europe 12-month forward P/E traded on a 33 per cent discount to the S&P 500.

In terms of the outlook for European corporate performance, consensus expectations are for high single digit European earnings growth, which is only marginally less than the expectations for US average earnings growth. The Manager expects smaller companies’ earnings in Europe to match what is expected in large cap. The market has begun to look forward to the attractive combination of lower inflation leading to Central Bank easing, resilient economic growth, and good corporate profitability. A rejuvenation in Europe, prompted by economic growth, with the German government’s plans acting as a key stimulus, should boost earnings. This should be particularly helpful for smaller companies, which typically have a greater exposure to their domestic markets. Following three years of smaller company underperformance versus larger companies, valuations look attractive. History would suggest that these are good opportunities to buy into the long-term favourable characteristics of smaller growth companies.

. . . . . . . . . . .

Japan

Masaki Taketsume, portfolio manager, Schroder Japan Trust, 11 April 2025

Despite macroeconomic uncertainties – including the BOJ’s evolving monetary policy outlook, the US presidential election outcome and the US economic outlook – which contributed to volatility in the Japanese equity market, the structural trends that have supported Japan’s recent renaissance continued. Ongoing efforts by regulators and investors to change the culture of corporate Japan and improve governance and company profitability have maintained their strong momentum. With more and more businesses stepping up their efforts to structurally improve their behaviour and returns, global investors are becoming increasingly confident in the opportunity to drive a meaningful and sustainable revaluation of the Japanese equity market.

Meanwhile, although domestic consumer spending has remained lacklustre, the overall Japanese economic performance has been robust, helped by positive inflation, rising wages, increased business investment and export growth. This has allowed many Japanese businesses to maintain solid earnings growth.

1 The term ‘value stocks’ refers to shares of a company that appear to trade at a lower price relative to their fundamentals, such as dividends, earnings, or sales, making it appealing to value investors.

2 Carry trades involve borrowing money in a low interest rate currency such as the yen, to invest in higher-yielding currencies or assets. The strategy profits from the rate differential but can be undermined by sudden, unexpected changes in foreign exchange and interest rates.

Within the market, value stocks continued to outperform growth stocks, which assisted the Company’s performance given the bias towards value that is inherent in our investment approach. Smaller companies, however, generally lagged their larger counterparts, because inflows from overseas investors initially tend to focus on large-cap stocks. This underperformance of small-cap stocks represented a modest headwind.

. . . . . . . . . . .

Rosemary Morgan, chairman, Nippon Active Value – 7 April 2025

The regulatory environment continues to provide a supportive background for activist investors. In previous reports we have discussed the importance of JPX’s request, issued in March 2023, that listed companies have a greater focus on measures to improve mid to long-term profitability and corporate value, a principle established in the Stewardship Code of 2014. JPX has reclassified the Tokyo market into Prime and Standard divisions and companies not fulfilling their requirements will, over time, lose their Prime market listing, as well as their inclusion in Topix, the major market index. This continues to ensure that our own proposals to our investee companies are treated more seriously than might have been the case in earlier decades.

In 2024, JPX increased its focus on share liquidity. Since the 1950s, listed Japanese companies have held shares in their major business associates, for example group companies, suppliers, customers, or their banks. These holdings are not traded and therefore market capitalisation has not been an accurate indicator of the daily liquidity in a company’s shares. The strategic holders have also rarely, if ever, voted against management in contested shareholder proposals. JPX has stated that it will now adjust a company’s market capitalisation to remove strategic cross-shareholdings and that companies will need to have an adjusted market capitalisation in the top 97.0% of all listed shares to maintain their Prime market listing.

The issue of cross-shareholdings was also highlighted in the coverage of the insurance sector in 2024: the four major insurers were found to have violated antitrust law through fixing contract prices for more than 100 corporate clients, and as part of the penalty exacted by the Financial Services Agency, have had to pledge to eliminate their cross-shareholdings by 6.5 trillion yen (over £30 billion). They have since announced plans to reduce their long-term holdings by 6.5 trillion yen. Other companies, including Toyota, have used the occasion to announce their own plans for selling off holdings in affiliated companies. We are hopeful that the trend towards eliminating strategic holdings will have a positive impact on the success of activists’ proposals, in particular management buy-outs (‘MBOs’) or takeover bids (‘TOBs’). The increase in liquidity is already making it much easier to acquire stakes in target companies.

Another initiative, still to be formally announced, concerns the rules regarding MBOs. New regulations announced in February 2025 will require boards to provide a detailed justification of the proposed MBO process and price and to establish an external committee to ensure that minority shareholders have been fairly treated.

There were 18 MBOs in Japan in 2024, the third highest since 2001, and, according to CLSA, around 130 ‘activist events’. Japan is now the second largest market for activism after the US, 4.5x the third largest, the UK, with major global Private Equity firms allocating a larger proportion of their activities to Japan.

We believe that the opportunity set in Japan for an activist strategy remains strong and will continue to generate superior returns compared to the broader market.

As well as the supportive regulatory environment referred to above, the Japanese equity market still offers value, particularly the smaller and medium sized companies that form the majority of the target investments. Despite the JPX’s efforts, around half of listed companies in Japan still trade below book value, though there has been a significant improvement in larger companies’ valuations.

. . . . . . . . . . .

Norman Crighton, chair, AVI Japan Opportunity Trust, 4 April 2025

The TSE has continued to disclose a list of companies on a monthly basis that have provided information regarding actions to implement policies conscious of the cost of capital and share price. In 2024, the TSE increased the level of accountability for companies by critiquing the quality of disclosures and highlighting key points for foreign investors, such as the availability of English disclosures.

There are several other tailwinds for the strategy, including the unwinding of cross-shareholdings, increasing shareholder activism, private equity firms targeting the Japanese market, and the Japanese government encouraging unsolicited acquisition offers. The mounting pressure for corporate reform will not subside in 2025.

. . . . . . . . . . .

North America

Charles Park, chair, North American Income Trust, 17 April 2025

The trade tariffs announced by President Trump have created significant volatility and distress in the markets. We are yet to see the full extent of the retaliation (or not) of the countries involved and we do not yet know the extent of the earnings damage to US companies from higher costs and reduced demand. Trade tariffs harm all participants and other markets have also had setbacks. In the near term, it is likely that earnings estimates in the US will be reduced and conference calls this calendar quarter will be subdued. The unpredictability of the pronouncements has also had an effect on the bond market and the US currency. As Warren Buffett, in his latest Berkshire Hathaway annual report put it, ‘never forget that we need you (Uncle Sam) to maintain a stable currency and that result requires both wisdom and vigilance on your part’. We can but hope that wisdom will prevail. Ultimately the administration wants to bring down the deficit, reduce taxes and grow the economy and this would benefit the US market assuming this can be achieved.

. . . . . . . . . . .

Felise Agranoff, Jack Caffrey, Eric Ghernati and Graham Spence, portfolio managers, JPMorgan American Investment Trust, 2 April 2025

We are upbeat about the prospects for US equities over the coming year and beyond. The economy remains resilient, performing better than many had expected, the unemployment rate remains relatively steady, and consumer financial conditions are manageable and will be further supported by easing inflation pressures and declining interest rates. This combination of factors is fostering a stable economic environment, conducive to further growth. Against this positive backdrop, our research analysts are optimistic about the earnings outlook for the S&P 500, projecting a robust 12% growth in earnings for 2025 and 14% for 2026. These strong forecasts underpin our confidence in the market’s potential.

While we are encouraged by signs of improving growth prospects, we remain vigilant regarding potential risks that could induce volatility. These include ongoing geopolitical tensions and upcoming shifts in US trade, regulatory and fiscal policies. It is also possible that bond yields will have to rise to attract the funds needed to finance government debt. Any of these factors could trigger short-term market fluctuations.

We are committed to investing in high-quality businesses with strong competitive advantages, ensuring stability during uncertain times.

. . . . . . . . . . .

Global emerging markets

Elisabeth Scott, chair, JPMorgan Global Emerging Markets Income Trust, 3 April 2025

There are many good reasons to be positive. In addition to the strong long-term growth prospects of Emerging Market economies, their favourable demographics and the innovative, entrepreneurial nature of many businesses, there is huge potential for the AI revolution to support tech and other AI-related stocks across all markets, including Emerging Markets, over the foreseeable future. Other sectors are likely to benefit from the productivity gains AI promises to deliver over the longer term. India, one of the largest and most vibrant Emerging Markets, is now looking more attractive after its recent pull back. In China, there are finally signs of improvement in investor sentiment thanks in part to the authorities’ efforts to stabilise the property sector and support consumer demand. In addition, valuations of Chinese stocks are attractive, shareholder returns are improving, and the early success of DeepSeek is also bolstering confidence in this market.

Investors always face some uncertainties, especially in Emerging Markets. Foremost among these at present are the risk of a debilitating global trade war triggered by widespread US tariffs, and the adverse implications this may have for the US’s global trading relationships. The Trump administration’s policies may also exert upward pressure on US inflation, potentially strengthening the US dollar, and this could tighten financial conditions in Emerging Markets (although any appreciation in the US dollar or Emerging Markets currencies would support portfolio income).

. . . . . . . . . . .

China

Nicholas Pink, chair, Baillie Gifford China – 31 March 2025

The headlines are filled with uncertainty regarding the outlook for China. Commentators debate whether ‘de-coupling’ between the US and China will accelerate and include higher trade barriers or even economic sanctions; alternatively, there is an opportunity for a ‘grand bargain’ to be struck, reducing tensions. Experts discuss whether the China stimulus in September 2024 was a ‘whatever it takes’ moment to boost consumption and structural reform is an inexorable process; alternatively, it is piecemeal and insufficient. Corporate governance reform at Chinese companies drove a record dividend payout and share buybacks in 2024, implying higher valuations. However, this is offset by uncertainty over the costs of ‘serving the country’ and ensuring that companies support China’s national strategy.

Whilst these debates continue, recent developments suggest there are opportunities for a growth orientated stock picker.

- Taking consumption, the ‘secure middle class’ in China is now around a third of the population (up from 10% in 2010) and would represent the third largest ‘country’ market in the world measured by population. One third of retail sales are online fostering innovation in e-commerce.

- In manufacturing China now produces one-third of global manufacturing output and according to a respected Australian think tank has the leading position in 37/44 critical global technologies, ahead of the US. DeepSeek symbolises that China rivals the US in the deployment of one critical technology, cost efficient AI. This is driving market share gain domestically and now overseas for leading Chinese companies.

- President Xi’s meeting with entrepreneurs in February 2025 is viewed in China as an important signal that the government views private capital as a key contributor to the development of the economy. This is an important reassurance for investors in private companies.

. . . . . . . . . . .

Linda Lin and Sophie Earnshaw, managers, Baillie Gifford China – 31 March 2025

While uncertainties persist, China’s economic transition towards an innovation-led model is taking shape, with encouraging progress in 2024. Policy measures to stabilize the property sector are gradually restoring consumer confidence, while technological and industrial advances continue to drive new growth opportunities. Sectors such as semiconductors, renewable energy, electric vehicles, and AI are at the forefront of this transformation, reinforcing China’s position as a global leader in high-tech industries.

Beyond its domestic evolution, China’s global influence is expanding, with increasing capital flows into south-east Asia, the Middle East, and other developing regions. This international reach is creating new opportunities for Chinese businesses, particularly in high-end manufacturing, automation and advanced computing. The resilience and adaptability of our portfolio companies reflects these shifts, with strong earnings growth and global competitiveness continuing to emerge.

Market sentiment toward China is showing early signs of stabilisation, with foreign fund flows turning net positive in Q4 2024 for the first time in two years, following a period of sustained outflows. Recent policy clarity and valuation support have led to renewed interest from global investors, with increased allocations from Asian and Middle Eastern sovereign funds. Domestically, retail investor participation surged, with over four million new A-share accounts opened in October alone, driven by government-led financial market reforms and buyback incentives. However, institutional investor participation remains subdued, reflecting ongoing caution.

While foreign capital remains selective, China’s 45% valuation discount to global equities and resilient earnings trajectory suggests that long-term capital allocation may gradually improve, particularly if policy execution continues to deliver tangible economic recovery.

The investment landscape is evolving, with broader interest from both regional and global capital sources. We remain committed to identifying and supporting China’s most innovative businesses. While challenges remain, there are significant opportunities. With structural tailwinds in place, we see 2025 as a year of renewed potential for long-term investors. As the Chinese proverb says:

长风破浪会有时,直挂云帆济沧海

“There will be times when the strong winds break through waves, and with sails as high as clouds, we can cross even the vast ocean.”

While these trends demonstrate resilience, challenges such as global trade uncertainties and evolving geopolitical risks remain key considerations for sustaining growth in 2025.

. . . . . . . . . . .

Cuba

Ceiba Investments – 28 April 2025

In 2024, Cuba once again faced immense economic challenges.

Numerous major sectors of the economy that generate hard currency income for the country were depressed.

Tourism, a major contributor of hard currency to the economy and which in 2022 and 2023 was slowly recovering from the shock of the Covid-19 pandemic, ceased its forward motion in 2024 with 2.2 million tourist arrivals during the year, representing a 9.6% decline compared to the prior year. The number of flights to the island remains far below pre-Covid levels and travellers from most European and other important outbound markets are disincentivised from travelling to Cuba by the U.S. SST designation, and the resulting U.S. ESTA electronic visa waiver ineligibility for persons having previously travelled to Cuba (Canada is excluded from this problem). In addition, negative press relating to the quality of Cuban tourism services, generalised power outages, and reduced availability of gasoline, food and other basic products have had a negative effect in the second half of the year leading into the present high season.

For the current year, it was initially projected by the Cuban government that some 2.6 million international tourists would visit the island in 2025 but looking at the poor arrival numbers during the first quarter of the year (in January 2025 there were approximately 196,000 tourist arrivals – 24.6% less than the prior year), it appears more likely that the decline of 2024 will continue.

Official family remittances remain far below pre-pandemic levels, limited by inadequate formal channels for sending money and currency exchange issues. Person-to-person and a variety of informal means of sending assistance to family members on the island partially compensate for lower official remittances, but these measures are difficult to track.

The tremendous liquidity shortage resulting from these negative factors has created a set of conditions that have brought the Cuban economy to a state of near collapse after five consecutive years of difficulties. Following the intense economic shock of the Covid-19 pandemic in 2020 and 2021, failed economic reforms in the period 2021-2023, and continued economic aggression from the United States throughout the first Trump administration and the Biden administration, the Cuban economy has been unable to recover to pre-pandemic levels, unlike similar economies in the region. In February 2024, Alejandro Gil, Cuba’s Vice Prime Minister and Minister of Economy and Planning in charge of the planning and implementation of the economic reforms and generally blamed for their failure, was released from his positions. In 2024, the downward spiral caused by the above factors coalesced into numerous country-wide failures of the national electrical grid and daily rolling power outages, sustained shortages of fuel and gasoline, lower agricultural and industrial production, and significant difficulties in meeting international payment obligations.

Economic Reforms

The economic and monetary reforms originally announced by Prime Minister Marrero in December 2023 in response to the failed 2021-2023 measures were largely left unimplemented in 2024. As the Prime Minister and various other government ministers made their year-end speeches and presentations to the National Assembly in December 2024, there were numerous admissions that the planned changes could not be implemented during the past year because the required conditions were not in place.

Few details have been made public about the nature of the coming reforms, although they generally appear to be the same as those outlined in the prior year:

- Partial Dollarisation: The Cuban government has repeatedly stated that certain activities will be partially dollarised and that a new system for allocating liquidity within the economy will be adopted. This will mean allowing the use of foreign currencies, particularly the U.S. dollar, alongside the Cuban peso. The aim is to increase the financial autonomy and availability of foreign currency for businesses that need it, based primarily on export businesses that generate hard currency. These rules are expected to be extended to the foreign investment sector and the new private sector to varying degrees.

- Currency Exchange: The government has announced and is expected to create a new foreign exchange market based on a floating rate of exchange between the Cuban peso and the U.S. dollar. No information is as yet available on the level of devaluation that will be implemented, the application to the foreign investment sector or how the floating rate will be managed or monitored.

- Legal Reforms: General statements have been made regarding the adoption of new rules aimed at attracting new foreign investment and stimulating economic growth. It is expected that foreign investment vehicles will be allowed to hire employees directly (rather than through a government employment agency).

These reforms reflect Cuba’s positive attempts to navigate its economic crisis and create a more resilient and attractive environment for both domestic and international stakeholders.

The new small and medium-sized enterprise (SME) private sector of the Cuban economy continues to develop rapidly and is already playing an important role in various segments of the Cuban economy, especially food supply, imports, construction, hospitality and others. However, significant banking and currency exchange difficulties impede their growth. A small number of well-financed SMEs are beginning to scale their activities to levels that would have been inconceivable in the past. At 31 December 2024, there were over 11,000 SMEs incorporated, which is an astonishing number given that the legislation permitting their incorporation was only adopted in August 2021.

Sanctions against Cuba

The maintenance of Cuba on the SST List throughout the Biden administration, right up to his final week in office, has been one of the most controversial and criticised aspects of Joe Biden’s policy towards Latin America.

The SST designation is amongst the most punishing sanctions in the U.S. arsenal in its long-standing economic war against Cuba, since its extraterritorial implications effectively exclude the country from the global banking system, amplifying the effect of all of the other sanctions levied against the island, affecting trade, investment, tourism and a host of other legitimate interests. As the compliance aspects of international banking have taken on greater importance in recent years, together with the rise of automated systems, it is far too difficult in practice to challenge or circumvent the negative impact of the designation. It affects all aspects of economic life on the island.

Just days before the inauguration of the new administration, and in parallel with announcements made by the Cuban authorities to release 553 persons that were convicted and jailed following acts of protest that took place on 11 July 2022, President Biden (i) removed Cuba from the U.S. SST List, (ii) cancelled the 2017 Trump measures defining the harsh U.S. policy against military assets in the Cuban economy (the “Cuba Restricted List”), and (iii) suspended the right under Title III of the Helms Burton Act for U.S. Persons to file civil claims against persons deemed to be trafficking in confiscated property. These positive steps to relax the U.S. embargo against Cuba were reminiscent of the policies of engagement maintained towards the island during the Obama administration, and many observers were surprised that they were not adopted earlier.

However on 20 January 2025, in the flurry of executive orders adopted on the day of his inauguration, President Trump signed an executive order rescinding the Biden relaxation measures, reinstating once again the inclusion of Cuba on the SST List, the Cuba Restricted List and the right to sue under Title III of the Helms-Burton Act, thereby setting once again a very aggressive tone for U.S. policy towards Cuba for the coming four years.

The Trump administration went even further than simply reinstating the status quo ante, however, and added Orbit S.A., the principal remittance receiver on the island through whom all official family remittances from the United States were channelled during the Biden administration, to the Cuba Restricted List, thereby effectively shutting down the principal formal source of U.S. remittances to families on the island. This move is expected to further exacerbate the already tense economic and humanitarian crisis on the island, and to have a devastating impact on Cuban families, who rely on these remittances to satisfy their basic needs.

Now that the second Trump administration is underway and Cuban American Marco Rubio is directing the foreign policy of the U.S. government, it is expected that U.S. policy towards Cuba will harden further. The most recent announcement made by the U.S. administration in March 2025 is that it has ended a humanitarian parole program that allowed hundreds of thousands of migrants to live and work in the United States. Established under President Joe Biden, the initiative offered legal status and work authorisation to Cubans, Haitians, Nicaraguans, and Venezuelans (CHNV) who passed security screenings and had U.S.-based financial sponsors. Approximately 530,000 migrants used the program to come to the U.S. legally — suggesting that many people will choose an accessible legal pathway over illegal entry. Ending the CHNV program eliminates that choice for future migrants and penalises those who want to immigrate to the U.S. “the right way.”

. . . . . . . . . . .

Vietnam

Vietnam Enterprise Investments, 29 April 2025

The potential for tariffs under a second Trump administration has been widely discussed, but the proposed 46% tariff rate is unexpectedly high and has caught many by surprise. While there may be room for negotiation toward a lower rate in the near future, the announcement has nonetheless impacted investment activities and import-export dynamics in Vietnam. In response, the Vietnamese government is accelerating efforts to shift the economy toward more domestically driven growth, supported by public investment and proactive government policies, rather than relying heavily on external demand. In addition, a range of support packages is expected to be introduced to cushion the impact of a potential global trade war.

Due to the increasing trade headwinds for China, Vietnam could also be positioned to capture a larger share of manufacturing and export demand, in addition to Vietnam remaining well positioned to benefit from the continuing shift of supply chains and manufacturing hubs, much like it did during the previous Trump administration. This environment could even create momentum for Vietnam to drive significant policy shifts, and overall, the net impact of new opportunities – even with additional scrutiny – remains in Vietnam’s favour.

Notwithstanding external challenges, Vietnam’s macroeconomic fundamentals remain strong, positioning the country well for the coming year. Inflation remains controlled, exports continue to grow at double-digit rates, and a robust trade surplus supports a strong current account position. Public debt remains low at just 37% of GDP, providing ample fiscal flexibility.

Over the past decade, Vietnam has consistently delivered annual GDP growth of 6.5-7.0%. The government targets GDP growth of 8% or higher in 2025, with ambitions for double-digit GDP growth from 2026 to 2030. These targets have now become more challenging since the US tariff announcements, but the ongoing structural reforms should help provide the necessary framework to sustain the government’s 5-year plan from 2026 onward.

For the equity markets, an upgrade for Vietnam to FTSE Secondary merging Market (EM) status is likely in 2025, with key barriers such as the pre-funding requirement for foreign investors getting progressively addressed. An upgrade would bring increased liquidity as both passive and active funds should deepen market activity. The revival of the IPO pipeline and the inclusion of more Vietnamese firms in global indices would significantly expand investment opportunities, creating a broader, more accessible market for both local and international investors. The government’s ambitious development plan has increased the demand for capital, both through private placements of listed companies and an anticipated new wave of IPOs. Capital market transactions have been an historical strength for VEIL. The management team is identifying suitable transactions and unique opportunities that fit into its long-term investment vision.

The anticipated implementation of a new trading system and the introduction of a Central Counterparty Clearing service will further help enhance market efficiency and liquidity. While the direction of foreign capital flows remains difficult to predict, these reforms are expected to increase domestic investor participation, a trend observed over the past four years. Early indicators suggest a potential turnaround in Vietnam’s real estate sector in 2025, supported by improving liquidity, policy measures to assist developers, and renewed demand in the residential segment. A recovery in real estate would benefit both VEIL’s direct property holdings and its banking exposure, as banks are the primary providers of credit to developers and mortgage borrowers. Additionally, credit expansion driven by urbanisation and infrastructure development could further support growth in both sectors.

. . . . . . . . . .

Environmental

Jon Forster, Fotis Chatzimichalakis and Bruce Jenkyn-Jones, investment managers, Impax Environmental Markets, 2 April 2025

There has been a clear shift in the market narrative. Performance has broadened beyond a narrow group of mega-cap technology stocks. US exceptionalism has given way to stronger performance for Europe and China. Notably, shares in electric vehicle manufacturer Tesla – the only “Magnificent Seven” stock which falls within IEM’s investable universe – have fallen more than 40%. The move reflects some of the investment managers’ concerns about valuation and governance risk, which drove their decision not to invest. At the time of writing, this is favourable to IEM’s portfolio, which is overweight Europe, has 99% active share and holds many attractively valued stocks recovering from cyclical headwinds. Current volatility is also creating opportunities for active managers to initiate positions in companies harnessing long-term structural trends.

Artificial Intelligence remains a powerful force that will shape many industries. However, some companies delivering that change are spending hundreds of billions to do so, without the earnings growth to justify it. Elevated valuations, and the prospect of falling interest rates, means investors are tactically reallocating to cheaper areas of the market with comparable earnings potential.

US economic confidence is weakening. Donald Trump’s willingness to deploy tariffs for geopolitical, as well as economic ends is driving up consumer and manufacturing uncertainty. As a result, Conference Board indicators are falling to recessionary levels1, PMIs are pulling back2 and growth expectations are weakening. The outlook for tariffs and trade wars remains volatile and uncertain. We remain in close contact with portfolio holdings on plans and scenarios to navigate this uncertain period but – like them – are avoiding knee jerk reactions until more clarity emerges.

Conversely, European stocks are benefiting from multiple tailwinds. Valuations were and remain more attractive, with Europe’s Stoxx 600 trading at 14.2x forward price to earnings (PE) at the start of the year, compared to the S&P 500’s 24.0x. Inflation in the EU is at 2.4%, trending downwards, and the ECB has cut interest rates twice.3 A possible end to the Russian/Ukraine war may also lower energy prices and instigate a c.$486 billion rebuilding programme.4 Lastly, US isolationism has galvanised European political action, with Germany advocating a 500bn EUR infrastructure fund (of which 20% will likely be allocated to Environmental Markets), looser state debt rules and a 150bn EUR EU-wide rearmament package. These actions have potential to accelerate economic growth in the EU, where IEM is c.18% overweight vs MSCI ACWI.

The events of 2025 so far this year are testament to the limited value of macroeconomic prognostication. Within IEM, the investment managers focus on purchasing well-run companies, harnessing structural trends driven by economic need, at reasonable valuations. Long-term themes such as electrification, digitalisation and adaptation to climate change are transitions which cut across sectors and will continue regardless of which political party is in office.

. . . . . . . . . . .

Commodities and natural resources

Fiona Perrott-Humphrey, chairman, Baker Steel resources – 25 April 2025

The immediate outlook for commodities demand from slower economic growth in China had already become a concern in the second half of 2024. Since the change of administration in the US at year end, the multiple and variable tariff measures imposed on America’s trading partners have introduced another level of uncertainty into the outlook for global economic growth. While precious metals continue to be beneficiaries of investment flows seeking a safe haven from the upheaval in the global geopolitical context, the demand and pricing impact on base metals and bulk commodities is less clear.

The impact of disrupted global trade flows and tariffs on the inflation outlook (and hence mining costs) is particularly difficult to forecast. What is already becoming clear, however, is that the current environment of uncertainty is causing many companies to slow investment decisions. It has also increased the volatility in exchange rates and borrowing costs, making financial forecasting significantly more challenging.

. . . . . . . . . . .

Debt

Rhys Davies and Edward Craven, managers Invesco Bond Income Plus – 2 April 2025

2024 was a less volatile year in our markets than many foresaw. Growth was stronger than expected and this slowed the rate of interest rate cuts. Along with positive flows into the asset class, this better growth underpinned support for corporate bonds.

We expect to see more rate cuts in 2025. Though few are predicting recessionary conditions, the outlook is for only modest growth, particularly in Europe. This should mean that there is room for the central banks to cut. But there is a lot of uncertainty. The new US administration has stated policies which could impact significantly on growth and inflation in the US and elsewhere, and we expect that the financial markets will need to digest a lot of newsflow from this source.

Away from this ‘macro’ view, we will need to continue to assess the creditworthiness of companies across our universe. We are still in a higher interest rate environment than we had a few years ago and this is a challenge for borrowers seeking to refinance. The level of demand for corporate debt was very supportive of the market in 2024 but there were still individual borrowers that came under strain. We are sure there will be more this year.

The initial market reaction to President Trump’s victory was positive and corporate credit spreads remain tight. This reduces the reward for credit risk. Prudently balancing risk and reward is central to our investment approach, for the portfolio and for each security. Our positioning is more cautious now than in the last couple of years. We think this is the right positioning for current conditions.

. . . . . . . . . . .

Infrastructure

Managers, Pantheon Infrastructure – 31 March 2025

Are you concerned about your exposure to AI and whether it is an over-hyped thematic?

Increasing demand for AI is significantly driving the related need for more data centres and base load power supply, both sectors in which the Company is significantly invested. However, the Company’s original basis for investing in these sectors was underpinned by different factors – the growth of cloud computing and the internet of things driving increased data centre demand, and the need for stable base load power to facilitate the decarbonisation agenda. The rapid emergence of AI in the last two years has therefore been an additional driver of returns.

Looking forward, we believe that the potential benefits of AI are widespread, and that its continued adoption will be critical for all organisations to not only thrive, but to survive.

Are there any infrastructure sub‑sectors you are concerned about?

We remain cautious about some areas of consumer-linked transportation. Looking at the past few years and the impacts of COVID-19, it’s clear that although an area of interest, investment in airports requires a very disciplined approach. Digital infrastructure also faces a confluence of challenges to sustain the levels of growth witnessed in recent years. These include competition for scarce resources such as power, materials, and labour. Some parts of the fibre sector in particular are also facing obstacles, and we expect that more consolidation will be needed across the smaller altnets in the near future.

What are you expecting for the infrastructure fundraising environment this year?

Fundraising volumes are a key determinant of future transaction activity that underpins long-term exit assumptions.

Infrastructure fundraising over the last two years has dipped following consecutive record highs in 2021 and 2022. We do not expect a dramatic change in fundraising in 2025, even with a significant uptick in M&A volumes potentially returning capital to investors. However, we do anticipate more interest in the mid-market segment. This part of the market has demonstrated better value-add capabilities, and that is proving attractive to investors looking for differentiated opportunities.

We also believe there will be an increased focus on strategies delivering yield, and a further potential catalyst is inflation, increases in which could result in higher allocations to infrastructure as an inflation-hedge. These trends may be dependent on US policy under the new administration.

What would be the impact of the return of high inflation on the infrastructure sector?

Infrastructure investments can inherently be a hedge against inflation, with cash flows often linked directly to inflation indices, providing long-term steady returns and relatively low volatility in times of market dislocation.

If there is renewed inflation, we expect that allocation preferences may be tilted towards core holdings that benefit more expressly from the linkage (e.g. assets with subsidies or regulated revenues). Certain recent fiscal policies in the US (tariffs), as well as in the UK (increased employer’s NI), appear to us to have the potential to be inflationary.

How AI is driving demand for data

The recent emergence of Artificial Intelligence (AI) has proven a significant tailwind benefiting many of the investments in the Company’s portfolio, notably those in the Digital Infrastructure and Power & Utilities sectors. This section details what AI is and how the growth of it is translating into PINT’s strong performance.

AI is a machine-based system that can, for given objectives, make predictions, recommendations or decisions influencing real or virtual environments. The AI market has experienced significant growth in recent years, with the global AI market estimated to be worth $298 billion in 2024 and projected to grow to $795 billion by 20272. Before the end of the decade, a majority of enterprises are expected to have adopted AI tools, driving greater digital infrastructure demand. As a result, the global outsourced hyperscaler data centre market is projected to increase at a c.20% CAGR for the next eight years given the combination of projected AI and cloud demand1.

Generative AI key applications

AI adoption is on the rise as governments, corporations and individuals worldwide evaluate its potential impact.

Generative AI can automatically generate texts, software, code, images, videos, audio and other new content in response to written prompts. The systems are trained on data from publicly available online content and generate outputs by identifying and replicating common patterns.

A large number of generative AI tools have been developed over the past decade, enabling users to improve productivity, creativity and decision-making processes.

AI technology has transformed various industries, driving efficiency, innovation and cost reduction. Retail and e-commerce companies leverage AI to create personalised shopping experiences and streamline inventory management. In healthcare, cognitive technologies are used to support health data analytics and diagnostics. The financial sector uses AI to improve risk management, enhance security and automate customer services. In manufacturing, AI tools are used to analyse large volumes of data from production lines to improve quality and reduce downtime. The emerging market for technology services relating to AI, including generative AI, could be worth more than $200 billion by 20291. The potential benefits are significant – enterprises that implement a comprehensive, long-term AI transformation strategy are expected to realise two to three times more value compared to those that have only adopted cloud services1.

Globally, governments are driving the AI agenda through public funding, legislation frameworks, research collaborations and infrastructure development, including US, UK and EU, regions in which PINT is invested in. Just recently, the UK Government announced the AI Opportunities Action Plan, a strategic initiative backed by leading technology firms, some of which have collectively committed £14 billion towards various projects. Shortly after, US President Donald Trump issued an Executive Order to enhance the US’s global AI dominance and promote economic competitiveness.

AI-focused government initiatives are expected to eliminate barriers to and accelerate sector growth, foster innovation, enhance public service efficiency and position AI as a key driver to global economic growth. The increasing prevalence of AI opens up new opportunities rather than threatens traditional patterns of work.

Challenges and regulations

The development of AI raises ethical challenges that require careful regulation.

The advancement of AI technology raises ethical concerns, including the use of personal data, the potential for biased outputs, the dissemination of misleading information and the creation of fake or altered material, ensuring accountability remains a critical challenge as technologies continue to evolve.

The European Union introduced the EU AI Act, its landmark regulatory framework in August 2024, and marked the first major compliance milestone in early 2025. Certain types of AI systems are prohibited while high‑risk AI systems are regulated under the new legislation, and non‑compliance penalties can reach up to $36 million (€35 million) or 7% of global turnover.

Data centre and power demand

AI growth is acting as a substantial tailwind for data centre developers and baseload power generators.

The rapid growth of AI and cloud computing is driving unprecedent demand for data centres, leading to a potential supply deficit. Research shows that the demand for AI-ready data centre capacity is expected to increase at an average rate of 33% a year between 2023 and 20301. This suggests that c.70% of total demand for data centre capacity will be for data centres equipped to host advanced AI workloads by 2030, and generative AI will account for c.40% of the total1.Global demand for data centre capacity in 2023 was 55GW and is projected to grow at a CAGR of between 19% to 27%, reaching as much as 298GW by 20301.

Over the past two years, average power densities have more than doubled from 8kW to c.20kW per rack. With the growing demand for generative AI and high-performance computing, the average power density is expected to increase to between c.30kW and c.50kW per rack by 2027, and global data centre electricity consumption, accounting for continuous improvements in AI and data centre processing efficiency, is expected to increase from 300 TWh in 2022 to c.1,000 TWh by 20301,2. Training models like ChatGPT can consume more than 80kW per rack, and Nvidia’s latest chip combined with its servers may require power densities of up to 120kW per rack1. Significant upgrades to the legacy mechanical and electrical systems in existing data centres will be required to accommodate the increasing demand for higher rack density.

Grid power supply remains the key bottleneck in growing global date centre capacity. Data centres consumed 1.3% of global electricity in 2022, with demand expected to rise to 3.7% by 2030. In the US, data centres accounted for 4.4% of total electricity consumption in 2023, with projections indicating an increase to between 6.7% and 12.0% by 20283.

As hyperscalers across the globe pursue decarbonisation targets, the power market has seen gradual retirement of coal-fired power plants, which traditionally provided consistent baseload generation, and a surge in renewable energy adoption. However, given that renewable energy production is intermittent in nature, there is an increasing reliance on flexible gas generation and battery storage systems to ensure grid reliability, which will only become more acute with load growth driven by data centres.

Emerging players and market outlook

DeepSeek launched its R1 model on 20 January 2025, closing the performance gap with OpenAI’s GPT-4 on legacy GPUs.

DeepSeek, a Chinese-based AI startup, developed its innovative R1 model using innovative software techniques and legacy GPUs, achieving significant reductions in both training and inferencing costs. The software takes a selective activation approach which only activates a small fraction of the models’ parameters for any given tasks, resulting in significantly lower computational costs. Additionally, the models learn through trial and error instead of supervised fine-tuning, which allows them to develop more sophisticated reasoning abilities and adapt to new scenarios more effectively.

- AI power: Expanding data center capacity to meet growing demand, McKinsey & Company.

- As generative AI asks for more power, data centers seek more reliable, cleaner energy solutions, Deloitte.

- DOE Releases New Report Evaluating Increase in Electricity Demand from Data Centers, US Department of Energy.

While questions remain around DeepSeek’s fully-loaded cost of developing the model, including data collection, model development and deployment and monitoring, and the infrastructure on which the model was trained, the next level of evolution in the AI theme is likely to shift from the infrastructure layer to the application layer. The emergence of DeepSeek’s R1 model could encourage major market players to increase their research and development spending in order to maintain their lead in AI capability.

The emergence of DeepSeek has prompted investors to reassess the capital investment required to scale the AI industry. The data centre sector has been struggling to meet the overwhelming demand for capacity, and if the emergence of DeepSeek and its innovative software techniques were to reduce the market demand, it could ease sector‑wide pressure to meet unsustainable capacity growth expectations. While a more efficient training model may reduce the need for large‑scale AI training campuses, low latency data centres, which are required to run cloud computing‑based, AI-powered software, could benefit from a boom of AI‑based applications. It is worth noting that even without increased demand for AI-focused facilities, global data centre demand is still expected to grow by 16% annually in the next five years.

. . . . . . . . . . .

Private equity

Managers, NB Private Equity – 25 April 2025

Tariffs and their impact on private equity

The Trump administration’s introduction of a 10% baseline tariff on all goods imports, excluding Canada and Mexico (25%), with higher tariffs ranging from 11% to 50% targeting countries with significant trade deficits, has caused significant market uncertainty.

While private equity (PE) investors are not entirely immune, PE portfolios may be less affected due to their strategic focus on sectors driven by innovation and intellectual capital, such as IT, healthcare, and financial services, rather than import-heavy industries like industrials and consumer goods. This positioning can mitigate impacts from supply-chain disruptions and fluctuating input costs caused by tariffs.

Industrials and consumer discretionary sectors, heavily reliant on imports, contribute 45.3% to U.S. GDP but only 22.9% to PE portfolio NAV. In contrast, IT and healthcare are less import dependent and comprise 43% of PE NAV, offering potential insulation from tariff-related challenges.

In 2018, tariffs were imposed on imports like steel, aluminium, and Chinese goods, challenging the manufacturing sector, while IT and services were less affected. Though pharmaceuticals and semiconductors may face future tariffs, PE portfolios are expected to be less impacted due to limited exposure to import-dependent areas within IT and healthcare, such as semiconductors, pharmaceutical components, and medical equipment.

Other challenges include potential inflation or macroeconomic headwinds from large-scale tariff implementation, which could affect PE alongside the broader economy. However, PE has strategic advantages: near-record dry powder ($1 trillion in the U.S.), enabling resilience and opportunistic acquisitions, and the ability to swiftly make operational decisions like cost-cutting, vendor changes, or product adjustments.

Despite potential challenges, including tariffs, the PE industry remains well-positioned to navigate the current environment. Neuberger Berman has – alongside the underlying private equity sponsors across its platform – worked to assess potential impacts of tariffs on its investment holdings. Specific to NBPE, we believe the direct impact of tariffs is generally expected to be limited. We believe that 14% of the portfolio’s fair value could be directly impacted by tariffs, with approximately 1% of fair value likely to be meaningfully impacted. This analysis only considers the direct impact from tariffs and not second-order impacts resulting from any potential economic slowdown. We continue to believe the portfolio’s emphasis on companies with lower expected cyclicality and/or long-term secular growth drivers, alongside reasonable leverage, generally positions it well.

The impact of interest rates on private equity performance

In 2022 and 2023, following a prolonged period of low interest rates, the U.S. Federal Reserve fought the post-pandemic inflation shock with one of the most rapid rate-hiking cycles in history. As monetary policy evolves and inflation begins to normalise, with the Federal Reserve starting to cut rates, understanding the relationship between interest rates and private equity performance remains essential. Interest rates influence valuations, financing costs and investor returns, making them a key factor in decision making. Using historical data, investors must assess how interest rates impact private equity returns.

Do interest rates actually matter?

Historical data going back to 1985 shows there are surprisingly small, statistically insignificant correlations between private equity returns and various interest rate-related indicators. However, when splitting the dataset into periods before and after the Global Financial Crisis (“GFC”), patterns emerge.