Economic and Political Monthly Roundup

Investment companies | Monthly | May 2023

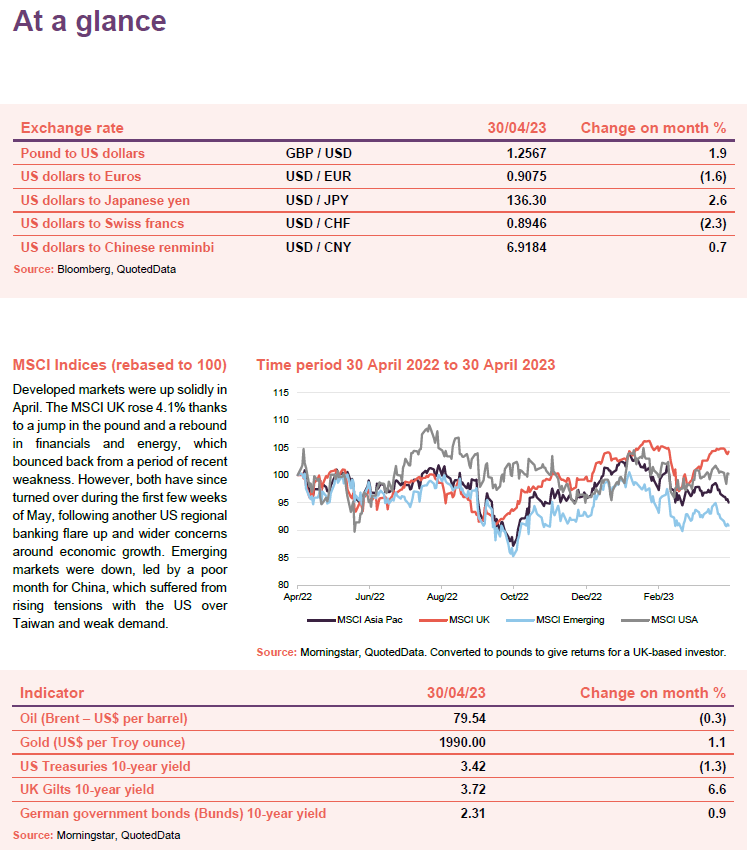

Much has been said about peak inflation and the possibility of easier monetary policy going forward, however the latest data showed prices accelerating in the Eurozone for the first time in seven months while the UK remains a complete basket case with inflation still running at over 10%. At least the US showed some positive signs. Nevertheless, there remains a remarkable amount of work to be done to achieve some form of price stability, especially given the strength in the labour market.

“The equity market continues to expect the best of both worlds – rate cuts and stable growth” Mike Wilson, chief US equity strategist from Morgan Stanley

Closer to home, equity markets have staged an impressive recovery in the UK, rebounding from the lows precipitated by the banking crisis which spread from US regional banks and ended up skittling Credit Suisse. With around 20% of benchmark indices made up of financials, the rebound in the sector led to a month of outperformance for UK equities, with the property sector also reaping the rewards of some relative market calm. Although relative seems like the operative word here. As mentioned above, inflation above 10% is hardly reassuring and following the hotter than expected reading, markets have begun to trend downwards once more on the expectation of more aggressive tightening from the Bank of England.

Investing is all about playing the probabilities and hoping you are right slightly more often than you are wrong. As most active traders know, this can be a challenge at the best of times. At present, on top of inflation investors must also deal with rising geopolitical tensions, a generational re-evaluation of supply chains, the ever-looming threat of climate change, and any number of other potentially disruptive events that are exceedingly difficult to price. Of course, these will also provide opportunities, but on balance it seems that the potential risks are heavily weighted to the downside.x

Global

(compare global and flexible investment funds here, here, here and here)

Jonathan Woolf, chairman, British & American Investment Trust– 27 April 2023

At this stage, it remains to be seen whether large wage settlements will embed inflation levels at above policy levels for the longer term. However, as a mitigating factor, the huge energy price rises seen last year as a result of the war in Ukraine, with crude oil rising by 50 percent (following a 100 percent rise in the previous year as the world economy re-awakened from the Covid pandemic) and natural gas prices rising by up to 300 percent as Russian gas supplies were cut off, have now receded to substantially below pre-war prices.

These lower prices will likely result in significant reductions in headline inflation levels over the next few months. This expectation is also driving governments, particularly in the UK and Europe, to stand firm and delay the agreement of above inflation public sector wage settlements despite significant industrial and public sector unrest until such time as the inflation background looks more benign. In the meantime and in order to avoid embedding higher inflation into the system, settlements have focused on one-off compensatory catch-up payments rather than multi-year increases in general pay.

In the absence of clarity around inflation and given the uncertainty about the duration and extent of central bank interest rate increase programmes, financial markets inevitably performed poorly in 2022 with the post-Covid recovery stalling and the major equity markets ended the year in negative territory, as noted in the Chairman’s statement above.

A more significant effect, however, was seen in the bond markets which suffered their sharpest falls since 2008 as the higher interest rate environment impacted prices significantly and large-scale government bond issuance programmes were implemented to repair central bank balance sheets following their multi-year quantitative easing programmes and to finance government deficits. These drivers pushed up yields for all issuers, governmental and corporate alike, and over all maturities.

In the UK in particular, this strain on the government bond market was exacerbated by the ill-advised but thankfully short-lived policy errors of the equally short-lived Truss government which in September attempted to introduce un-costed and unfunded tax reductions at a time of high government debt and financing needs, leading to meltdown in a particular part of the Gilt market in relation to pension funds which required fast and significant Bank of England intervention.

Since that time, bond market volatility and valuation issues derived from interest rate increases have caused other significant areas of difficulty. Notably, in relation to confidence in banks, particularly those with certain vulnerabilities for example a record of poor management or repeated scandals (such as Credit Suisse in Switzerland) or an underlying portfolio risk management problem (such as Silicon Valley Bank in the USA). Even though very large in size and considered solvent and ostensibly operating well within their regulatory capital requirements, confidence in even these institutions disappeared quickly over the last few months as deposits were withdrawn by their customers and their share prices collapsed, precipitating further deposit withdrawals and ultimately requiring rescues to be engineered by their respective governments in order to preserve vital confidence in the wider banking market.

This was a wholly unexpected and worrying development which prompts further and more specific examination of the workings of banks within today’s much more dynamic and customer/investor empowered world where deposits can be withdrawn or switched at the press of a button, even by smaller retail customers using internet banking apps, or by professional funds taking advantage of a speculative and self-fulfilling interplay between listed banks’ stock market values and confidence in their deposit bases.

It appears that, in addition to their loan portfolios, banks must now consider concentration and quality of risk in their deposit bases, which have proved to be more volatile and susceptible to adverse publicity than expected, if they are to avoid the contagion which has been seen in recent months between falling bank equity prices – likely exacerbated by professional short selling funds – and deposit withdrawals, leading ultimately to failure or enforced rescue by the authorities.

Further work is now also being undertaken by governments to re-assess the strength and coverage of bank capital adequacy rules, which had for instance been weakened in the USA in the case of banks not considered systemic during the Trump administration, and was possibly a contributing factor in the Silicon Valley Bank failure. An examination of the adequacy of state deposit guarantee schemes is also now being called for in response to the new and systemic risks to confidence in banks posed by the promulgation of misinformation via social media and 24 hour reporting.

This recent unexpected vulnerability in the banking sector, taken together with the undoubted pain which substantially higher rates have brought to companies, home owners and indeed investors as wages fall in real terms, mortgage interest payments double and the asset bubbles built up over years of ultra-low interest rates collapse will now be giving central banks some moment of reflection in relation to their continued programmes of interest rate rises and monetary tightening. As reductions in inflation levels become more evident, central banks will have to balance the risks of keeping inflation higher for longer with the risks of possible long term damage to their economies if interest rates are kept too high for too long.

Equity markets have recently begun to sense the approach of a potential pivot point in interest rates and have shown some resilience since the sell-off in the fourth quarter of 2022 following the mis-handled UK ‘mini-budget’ which had repercussions in both the bond and equity markets, and despite moments of uncertainty in the first quarter of 2023 when fears of a more widespread contagion in banks persisted and temporarily depressed markets.

This equity market resilience has been further supported by the unexpectedly firm economic performance of leading economies which so far have avoided expectations of downturns by the end of 2022 and into 2023, remaining flat instead. In the case of the USA, the economy grew by 2.5 percent in 2022 and is expected to grow by 3.0 percent in the current year.

In the UK, an expected technical recession in the last quarter of 2022, particularly in the aftermath of the mis-handled autumn mini-budget, did not materialise and the government expects recession to be avoided in 2023 with activity in retail, hospitality and construction continuing to perform better than expected, despite the recently announced misgivings of the IMF which has consistently under-estimated UK growth levels in recent years.

The reasons for this unexpected resilience in the UK economy could be partly the result of the high levels of savings built up during the Covid years when salaries were still being paid through government support schemes but not fully utilised due to general inactivity associated with the pandemic lockdowns. Since then, the sense of relief in the population at the end of the pandemic has encouraged a burst of spending, particularly in hospitality and travel, which has so far not been totally restrained by the sharply rising interest rates and costs of living.

. . . . . . . . . . .

Manager, Third Point Investors – 25 April 2023

We entered 2023 with more constructive trends in geopolitics and macroeconomics. Europe appeared to have sidestepped the worst fears related to the Ukraine war, high energy prices, and recession, leading to strong performance in equity markets. China accepted the course of herd immunity and is already showing signs of strength in its reopening, leading to expectations of significant pent-up demand for luxury goods and commodities. China seems to understand that restoring economic strength is central to its political ambitions, but any enthusiasm there must be tempered by realism about geopolitical risks.

This prevailing sense of optimism was of course tempered in March by convulsions in the banking sector, starting with several regional banks in the U.S. and moving on to Credit Suisse. While regulators swiftly stepped in to fortify confidence in the system, at the very least, this reckoning will further constrict lending activity as the cost of capital continues to rise. This will weigh on economic growth at a fragile time, but will also assist central bankers in their efforts to dampen down inflation.

This continued push and pull between monetary policy and the real economy will likely yield uneven results in the near term. However, the Investment Manager’s earnings outlook for 2024 is more favourable, and it believes conditions are now ripe for many types of eventdriven and activist investing. The stock market decline has created attractive valuations for many high quality companies, while Covid created aberrations in growth and a reluctance to let go of underperforming business units or bloated cost structures. To the extent companies have not addressed these issues themselves or have been slow to react, engaged shareholders have an opportunity to encourage more efficient operations and capital allocation.

. . . . . . . . . . .

Manager, Martin Currie Global Portfolio – 05 April 2023

Geopolitical risks will continue to contribute to volatility

The Russia-Ukraine conflict shows no sign of an early resolution and there is the risk of further escalation. The ongoing energy supply risk for Europe and the effects on commodity prices are likely to continue to have ramifications for inflation and economies around the world. On the other hand, a resolution to this conflict could be an important driver of a risk-on rally – particularly in European equities.

The China-Taiwan geopolitical risk is likely to remain for years to come. This is also spilling over into technological conflicts with the US administration. This will clearly have implications for corporates exposed to these regulatory changes. North Korea also continues to have the potential to destabilise its region and the wider world, as does Iran.

There is a tendency to rising nationalism in periods of economic challenge. In particular we are concerned about tensions between the US and Europe leading to increased protectionism which would damage economic growth.

All eyes to remain on inflation

Equity investors’ focus in 2023 is likely to remain on inflation and its impact on monetary policy. Whilst we have started to see some

undershooting in inflation numbers compared with expectations recently, there is a risk that current elevated inflation levels will persist. With current pressure largely related to supply chain disruptions and production bottlenecks, there is a good likelihood that inflation rates could be in the process of peaking.

However, this could be derailed by high wage inflation, which is a particular challenge in the US. This could lead to a risk of inflation turning more structural in the US, with a knock-on effect to other markets.

Extraneous risks to the inflation outlook include (i) further partial lockdowns in China disrupting supply chains and (ii) the continuing effect of the Ukraine/Russia conflict on energy and food supplies. In summary, inflation remains difficult to forecast.

Macro-economic outlook pointing to sharp slowdown particularly in Europe

With leading indicators continuing to deteriorate, we believe that 2023 will be a year of low economic growth at the global level and in particular in the US. A key determinant of the global economic cycle will be the Chinese economy, which is now the second largest in the world. The sudden and unexpected u-turn by China on its zero-Covid policy and the reopening of its economy could lead to a rapid improvement in the Chinese leading indicators in the months to come. Europe is particularly challenged and we maintain a high probability of stagflation. Europe’s economic momentum will in significant part be influenced by China. There could therefore be a chance of improvement as China reopens. However, any renewed risk of energy rationing as we approach the winter of 2023/24 could put further downward pressure on economic activity in the second half of the year.

Central banks will be playing a game of chicken in 2023

Central banks were clear in 2022 that they were focused on inflation – they effectively moved from whatever it takes to prop up growth to whatever it takes to reduce inflation. During the course of 2023, if inflation overshoots expectations interest rates will likely need to further adjust upwards. Conversely, if inflation undershoots and concerns of a recession increase then monetary policy expectations will adjust downwards. The recent turmoil in the banking sector could also result in lower interest rates than would have been the case. We could therefore have a scenario in 2023 where central banks tolerate somewhat higher inflation in order not to push economies into recession. One sure prediction for 2023 is that the word “pivot” will be used aplenty. Anticipation of monetary policies pivoting will drive volatility and will generate a healthy bull-bear debate in markets. We expect policy expectations to continue to be the dominant driver of share price returns in 2023.

Earnings growth lacklustre

Earnings momentum turned negative from early 2022, driven by the tragic Russian invasion of Ukraine and the Chinese regional lockdowns. Economic leading indicators have been deteriorating since then, which in turn led to earnings momentum shifting negative rapidly. We believe that earnings revisions are likely to remain negative in the current year. Our top down growth estimates imply -1% for MSCI World, 0% for MSCI North America, and -5% for MSCI Europe, with MSCI Asia at +2%, all of which are noticeably lower than consensus forecasts. We therefore expect downward revisions in consensus estimates and downgrades in the cyclical parts of the market. In this environment it is critical to continue to focus on companies with resilient earnings and pricing power that can protect their margins from the ongoing higher inflationary pressures.

Valuation levels are more supportive

With equity markets having sold off significantly during 2022, equity valuations are now more supportive across the US, EU and Global equity markets in our view. On a relative basis for developed markets, we see more valuation support in European vs US equity markets but against this the risks are higher for Europe. Asian equity valuations also show good support in our view, although there are again also some geopolitical risks in that region.

Mid-term opportunities still abound for long-term investors

Despite the many uncertainties that we highlight in the market outlook, we find opportunities as long-term investors to be exposed to businesses that generate high returns and have attractive structural growth opportunities. These businesses are likely to be able to navigate the difficult near term economic cycle headwinds, and should be able to come out of any market slowdown in a stronger position than many of their competitors.

In particular, we highlight that in a market where growth will be scarce, or indeed at risk of being negative for some areas such as Europe, we believe that there are good opportunities for structural growth across the three mega-trends that we have identified:

- Demographic Changes

- Future of Technology

- Resource Scarcity

As long-term investors, we believe that there are opportunities to capture some secular trends and structural growth opportunities, through exposures to themes that have supportive trends.

Specifically, the eight mid-term thematic opportunities that we have identified previously still represent an important source of structural growth in our view. These eight opportunities are:

- Green and alternative energy investment is an important focal point as more governments focus on decarbonising their economies, whilst the alternative energy sources have been an important geopolitical imperative for Europe since the Russian invasion of Ukraine. We see this as a long-term structural theme.

- Greener infrastructure is an area of focus on decarbonisation, notably focusing on reducing the carbon footprint of buildings, which are an important source of carbon emissions.

- Electric transportation is an important thematic opportunity as part of the drive to reduce carbon emissions. In this field, we see opportunities both in high-speed railway infrastructure, and in the development of infrastructure for electric vehicles.

- Healthcare infrastructure is an important field of infrastructure-related thematic opportunity, as governments focus on the need to upgrade post the pandemic crisis. At the same time, with an ageing population in many regions the need for more bespoke healthcare and targeted therapies, and the use of genomics to achieve such developments, are interesting areas of opportunity.

- The upgrade cycle in 5G telephony is an important opportunity, as countries focus to make their economies more productive, with an upgrade in telecommunications infrastructure being a way to achieve this.

- Cloud computing trends in the mid-term are also very supportive, as more businesses migrate their presence online, creating more demand for cloud services. Related to this theme, as more corporates migrate their presence online, there is an increased need to invest in cyber security.

- Robotics and automation, and in particular Artificial Intelligence, is an important area of structural growth opportunity. Following the pandemic corporates are realising the need to make their production lines more robust, and their supply chains more resilient. Increased investment in robotics and automation is the way to do so. Trends towards onshoring or nearshoring of production bases will also accelerate this thematic trend.

- Finally, nascent but promising and fast growing opportunities exist in the metaverse and quantum computing fields. Notably, we believe that, given the sizable investments that big tech companies are channelling into this area, there are opportunities in the enablers of the metaverse.

All in all, there are sizeable infrastructure and capital expenditure drivers across these eight areas, which bring some interesting opportunities to capture areas of structural growth through companies exposed to these themes.

An ever more disruptive decade continues to affirm itself in 2023 and beyond

With the ongoing focus on investing for a transitioning world towards net-zero, innovation rates are likely to continue to increase and, with this, disruption risk to traditional businesses is likely to continue to rise. For long-term investors, this opens up interesting areas of opportunity. However, it also highlights the need to be vigilant in terms of disruption risk on established business models, and to ensure that disruption risk is assessed in a detailed and structured analytical approach. Equally important is the ability for companies to remain innovative, both to fend off competitive pressures and to stay ahead of the disruptive trends that could challenge their market positioning.

. . . . . . . . . . .

UK

(compare UK funds here, here, here and here)

Managers, Schroder Income Growth Fund– 28 April 2023

The market seems optimistic that the global economy will transition to a recovery phase, however, the Manager is cognisant of risks to this outcome. Recent banking turmoil, firstly in the US and more recently hitting Credit Suisse, has added to market volatility and points to how finely balanced the risks may be. The ramifications of Silicon Valley Bank’s collapse, swiftly followed by Credit Suisse’s buyout by UBS, have yet to fully play out. At both companies there were specific issues, however, this does not stop the question of who else is vulnerable and the Manager recognises the contagion risk. After more than a decade of easy money there will undoubtedly be other unforeseen casualties. At the same time, the Manager believes that global banks’ balance sheets are much better protected today within a regulatory framework designed post the 2008 global financial crisis explicitly to protect against these kinds of issues. Indeed, within UK based banks there is no evidence of deposit flight so far. In the US, where several regional banks have come under pressure, the US Federal Reserve has acted quickly, putting back two thirds of the quantitative easing it had taken from the market since its peak point.

The risk appetite which emerged late last year, continued in the new year, bringing more optimism for recovery than fear of deep recession globally. However, a banking shock that started in California, has reminded the world that banks are businesses that critically depend on the confidence of depositors and investors and that confidence loss can spread, whilst moves by OPEC+ to restrict oil supply is a reminder of both the importance of energy security and enduring inflationary risks.

. . . . . . . . . . .

Alex Wright, portfolio manager, Fidelity Special Values– 27 April 2023

Higher interest rates have allowed banks to significantly improve their profitability at a time where earnings in many industries are under pressure, yet many investors continue to avoid them because they are scarred from the 2008 global financial crisis. However, UK and Irish banks have become far higher quality businesses since the changes to the regulatory environment over the past decade. They have strengthened their balance sheets, trimmed bloated cost bases, and pulled back from riskier lending. Furthermore, they are subject to robust regulatory frameworks, transparent accounting practices and have diversified deposit structures. Some of these attributes were absent from several smaller regional US banks and at Credit Suisse, leading to recent negative headlines and outcomes for investors in these companies.

Ongoing value in some defensive areas remain, such as tobacco or hidden defensives, for example, Government outsourcer Serco. However, we steer clear of crowded areas comprising expensively valued dollar-earning companies and other consumer staples.

The relative attractiveness of UK valuations versus other markets and the large divergence in performance between different parts of the market continue to create good opportunities for attractive returns from UK stocks on a three-to-five-year view. The smaller end of the market cap spectrum is particularly rich in investment opportunities given the lack of research coverage. For us, this has always been a big structural overweight, and the Company’s portfolio currently has a mid and small cap exposure at around 60%. Smaller companies have incurred severe deratings over the past year as they are thought to be more cyclical and thus more susceptible to an economic slowdown or recession. However, in our opinion, some of the share price falls have been indiscriminate.

The attractive valuations in the UK have not gone unnoticed and after several months of limited activity there has been a recent uptick in M&A activity with private equity approaches for several UK companies. It demonstrates that valuations for UK stocks are low enough to maintain interest levels even in an uncertain market.

In our opinion, the UK market with its high dividends and low valuations offers better prospective returns than many other asset classes, including global equities.

. . . . . . . . . . .

Kevin Allen, chairman, Chelverton Growth Trust– 21 April 2023

As mentioned in my introduction, things are very uncertain across the UK and Europe. Sadly, the war in the Ukraine continues and currently there appears to be no end in sight. European countries have rebalanced their economies and have achieved major savings in energy which it is to be hoped will become embedded.

With the impact of the draconian lockdown in China and with the “Ever Given” container vessel blocking the Suez Canal it became clear to European buyers that they had been under-pricing the risk of sourcing so many key products from China. Coupled with the population issues in China, we believe there will be a rebalancing of production, bringing it much closer to home.

The UK economy is expected to flat-line in 2023 but to “bounce back” to near long term trend growth in 2024. Inflation is expected to decline sharply by the end of the year and it might well be that interest rates have already peaked. As the countries of Europe and the World return to “normal” there will be steady growth in the UK economy.

. . . . . . . . . . .

David Barron, chairman, Dunedin Income Growth– 18 April 2023

As we look forward, there are some reasons for cautious optimism. Commodity prices have retreated, particularly natural gas. This could lead to the prospect of falling energy bills for consumers as we move through 2023. Government finances are in better shape than anticipated at the time of the mini budget in October, as energy price caps have proved less expensive than originally expected. Supply chain disruption is easing, freight rates have fallen sharply and Europe has managed to navigate the energy price crisis. The US consumer has, so far at least, remained resilient and China has removed its Covid related restrictions far more quickly than had been envisaged. Meanwhile, the market valuation of UK equities is attractive on an absolute and relative basis.

That all said, inflation remains high and the impact of the significant tightening in monetary policy has arguably yet to be fully felt in the real economy. Yield curve inversion tends to be a precursor to a recession and it is likely still too early to signal that we will avoid an outright economic contraction. In such an environment, we think it is important to maintain a relatively well balanced portfolio. Against a challenging backdrop, the Investment Manager’s focus on investing in companies with pricing power, strong balance sheets and with greater exposure to structural, rather than cyclical, growth should offer greater resilience in both capital and income generation.

. . . . . . . . . . .

Ben Ritchie and Rebecca Maclean, managers, Dunedin Income Growth – 05 April 2023

The market recovery since the mini budget has been strong as the political environment stabilised in the UK. The economic backdrop remains one of high and potentially persistent inflation plus tightening monetary policy. We maintain a cautious view of economic activity and corporate profitability as we go into the next financial year. In an uncertain environment, we believe our focus on quality companies provides protection through a downturn; those companies with strong pricing power, high margins and resilient balance sheets are better placed to navigate through a range of economic scenarios.

Against this backdrop, we see reasons to be positive. 2022 was a challenging year for the UK domestic focused FTSE 250 Index and, in turn, the portfolio’s overweight exposure to this index. The mid-cap underperformance relative to the large cap FTSE 100 Index was worse than during the 2008/09 global financial crisis. Valuations have been rebased and we believe the long run track record of alpha generation from UK mid-caps will return. There are signs that the UK consumer is in a healthier position than feared, with household wallets benefiting from wage inflation and lower energy costs. Finally, the UK equity market remains at a highly attractive valuation on an absolute basis and relative to global markets. This view is reflected in the bids for holdings in the portfolio, and presents an opportunity for positive prospective returns.

. . . . . . . . . . .

Jonathan Brown, portfolio manager, Invesco Perpetual UK Smaller Companies– 18 April 2023

The last three years have been unusually volatile, however we can see a more stable picture emerging. Energy prices have declined substantially from their peak, with oil and gas prices now below the level they were a year ago. Whilst there is always a lag to this feeding through to the cost of living, it seems likely that inflation will return towards its historical average of 4-5% as we move through the middle of the year. Tight labour markets are a blessing for job hunters, but wage demands could potentially cause inflation to be quite stubborn around this level. We would expect the Bank of England to halt interest rate increases this year, and this should be a positive for markets, but it seems less likely that we will see cuts to base rates in the short term.

The UK smaller companies sector is very cheap when compared to both its own history and other global markets. A more stable political situation in the UK, a peaking of the interest rate cycle and the prospect of economic recovery could all provide the catalyst for this discount to narrow. We continue to see interesting opportunities across a range of sectors and will continue to take advantage of these as they arise. So, whether we see a recession or not this year, we believe that the UK smaller companies sector continues to offer a wealth of opportunity for investors.

. . . . . . . . . . .

Jeremy Rigg, chairman, Henderson High Income– 05 April 2023

Whilst the near-term economic outlook remains uncertain, particularly given the strains within the global banking sector, there are some early signs that inflationary pressures are abating and whilst interest rates have continued to move higher with policy makers determined to dampen price rises and wage settlements, investors have started to believe that the peak of the tightening cycle may be in sight, even if we should expect interest rates generally to remain at slightly more normalised levels. At the corporate level, company balance sheets are in generally robust shape, the UK banking system appears well capitalised and continuing tight labour markets should help to support the economy. Key will be the upcoming results season, to establish how well UK companies are coping with supply side pricing pressure and softer end markets. That said, the valuation of the UK equity market in particular remains low in an international context and there has been some corporate takeover activity which should help to sustain the market.

. . . . . . . . . . .

David Smith, manager, Henderson High Income– 05 April 2023

Markets had rallied from their October lows as inflation has shown signs of slowing, leading to hopes that central banks may pare back further increases to interest rates. In addition, falling European gas prices have eased fears about an impending recession, and China has relaxed its stringent zero Covid policy. However, the impact of the rapid rise in interest rates globally is starting to be felt with some weaker banks in the US and Europe getting into financial difficulty. This will undoubtably lead to a higher level of volatility within equity and bond markets even though consumer and corporate balance sheets are strong, UK banks are well capitalised and unemployment remains low. Although disinflationary forces are emerging, there are reasons to believe that inflation will settle at levels higher than we have been used to and be more volatile in the years ahead. Labour markets remain tight, putting upward pressure on wages, while the move away from globalisation towards protectionism, the reshoring of manufacturing facilities and the move to net zero will all add to inflation in the developed world. Hence it is our belief that the age of ultra-low interest rates is over, and that the global economy is moving to a new more normalised world for interest rates. After an extended period where investors sought growth irrespective of value, now that the era of “free money” is over, asset valuations will become increasingly important once again. Although the macro economic outlook is uncertain and concerns within the banking sector need to be monitored, the UK equity market is attractively valued. The focus remains on finding good quality businesses at compelling valuations that can pay and grow attractive dividends.

. . . . . . . . . . .

Angus Gordon Lennox, chairman, The Mercantile Investment Trust – 04 April 2023

Even though there has been significant disruption in the global financial sector recently, following the collapse of some US regional banks and the takeover and rescue of Credit Suisse in Europe, and therefore the resultant jitters in markets, I am pleased to say that the outlook for your Company and our investments appears considerably brighter now than when I sat down in October last year to write my statement for the Company’s Half Year Report. As our Investment Managers have said, credit markets may tighten somewhat but the financial sector in the UK and our companies in particular are in a much healthier position. Although the tragic war in Ukraine drags on, its impact on energy and commodity prices is beginning to ease. There are signs that inflation may be peaking, and while central banks are unlikely to begin easing monetary policy any time soon, interest rates may stabilise, while monetary authorities take time to assess the medium-term inflation outlook. In addition, forecasts suggest that the UK economy, will, at worst, experience a mild recession this year. Furthermore, the UK’s political climate has calmed considerably, with an improvement in relations with the EU and a new Pan Pacific trade agreement. The potential for UK companies to increase business is encouraging.

The UK market remains attractively priced relative to many of its global counterparts, and with sterling still weak, the market is likely to see continued interest from foreign investors, and private equity firms and others seeking to acquire UK companies. These factors should continue to support the market.

. . . . . . . . . . .

Colin Clark, chairman, Merchants Trust – 04 April 2023

At the time I wrote to shareholders last year, the situation in Ukraine was rapidly unfolding and the world was coming to terms with the implications, though collectively we all hoped there would be a rapid end on the horizon. Unfortunately, over a year on, that hasn’t proved to be the case and the conflict continues. Closer to home we also continue to grapple with the effects of inflation and associated strain on the cost of living. The world certainly continues to be unsettled and as investors, our task is to try to find an effective way to navigate this backdrop.

It is not easy to give any robust predictions on what direction the economy might take or for that matter what short term challenges may arise, or what geopolitical issues the coming year may have in store. Whilst the issue appears to be contained, shareholders will be aware that during the first quarter of the current financial year the banking sector has come under pressure due to the collapse of Silicon Valley Bank in the USA and the takeover of Credit Suisse by UBS. Our investment manager gives a timely reminder in his investment review, though, that concentration on this type of issue is not the key focus in the investment process. Rather the concentration is on finding sound companies with attractive business models and to understand how those business models might react under different macroeconomic scenarios. As noted, sentiment-driven market volatility can be a good source of opportunity for the dedicated stock picker and a genuinely long-term investor needs to have the (not easy) skill of looking through short term pain to the potential of the mid- to long-term, whilst understanding where the risks lie to that potential for each individual business model.

Valuations in the UK market ultimately remain low compared to their own history and relative to other markets, giving our investment manager added confidence in the potential for generating long-term returns for Merchants shareholders. While Merchants’ investment strategy is not dependent on any outperformance of the ‘value’ investment style, should we see structurally higher interest rates persisting over the coming year, that should provide a welcome tailwind for the portfolio as investors will continue to favour nearer-term tangible cash flows from companies over future potential cash flows from higher growth companies.

. . . . . . . . . . .

Dagmar Kent Kershaw, chair, abrdn Smaller Companies Income – 03 April 2023

At the time of writing there is uncertainty about how long the bear market will last, notwithstanding the future of the Company, and every cycle that we have experienced has been different. This dynamic makes it harder to say with confidence how any recession or market recovery will develop, not least because there is also uncertainty on what any policy response from central banks will be. The outlook for both economies and businesses, globally, is tough and, whilst a high degree of earnings forecast reductions have already been seen, areas of risk remain. Smaller Companies indices have sold-off aggressively versus others, particularly within the UK, and so the opportunity for relative strength in the smaller end of the market remains attractive. Whilst market timing is difficult, smaller companies typically lead a market recovery. Looking to the coming year we believe that the Quality focus will prove relatively resilient in a recessionary environment. The Manager continues to adhere to a long-established investment process that selects high quality smaller companies with resilient earnings that lead to robust dividend payments. Given that we could be entering a recession, it would be unusual if this was dominated by cheaper value cyclical business where earnings are likely to be more challenged over the next year, although the Manager will continue to monitor the likelihood and depth and breadth of a recession as a factor in their decision making.

. . . . . . . . . . .

Asia

(compare Asian funds here)

Adrian Lim and Pruksa Iamthongthong, managers, Asia Dragon Trust– 26 April 2023

China’s faster-than-expected reopening post-Covid bodes well for the Asian region’s prospects in 2023. Global geopolitical risks remain while economic risks appear to be more focussed upon Europe and the US. That said, despite earlier fears, investors now expect the US Fed’s monetary policy tightening cycle to come to an end later this year. Moreover, Asia is in a demonstrably better position than developed economies in the West, with relatively strong consumer and corporate balance sheets, and more solid government finances in most of the region.

At the company level, it now appears that earnings downgrades in the Asia ex-Japan region – particularly in the technology sector – are close to bottoming. Just as Asia was the first region to see earnings forecasts being revised lower, it is likely to be one of the first to come out of the downgrade cycle.

. . . . . . . . . . .

Ronald Gould, chairman, Henderson Far East Income– 21 April 2023

The year ahead will hold many challenges but, on balance, we believe the prospects for improved earnings growth and dividend increases are positive. To a large extent, this is driven by the positive impact of a recovering China on the entire region. As the key economy in Asia Pacific, China’s improving prospects energise many other markets. China is the region’s biggest trading partner, its biggest consumer and its biggest investor. The recovery of China’s economy is gaining confidence, with a positive impact on companies across the region. In turn, this is fuelling the ability to expand dividends in a wide range of companies, a far broader dividend growth picture that will benefit our portfolio. With attractive valuations providing opportunities across the region, we expect 2023/24 to be a more satisfying investment environment for your Company, something to which we can all look forward to achieving.

. . . . . . . . . . .

Nitin Bajaj, portfolio manager, Fidelity Asian Values– 18 April 2023

The reporting period was one of two extremes; the first three months saw Asian markets fall due to inflationary concerns and persistent interest rate hikes. China and Taiwan underperformed the most due to geopolitical concerns, a slowing technology cycle and as a result of COVID-related restrictions, while the South Asian markets of India and Indonesia fared much better. However, China rallied sharply in the last three months of the reporting period as the government lifted COVID-related restrictions and decided to reopen its economy which led to a strong recovery.

Recent activity in Asian markets has been a useful reminder of why macroeconomic shifts are not necessarily a good guide to predicting what direction stock markets might take. While the reopening of China and India’s buoyant growth have undoubtedly galvanised the region’s stock markets, the timing has been unpredictable and the beneficiaries not always clear. Having said that, this type of environment does throw up opportunities that might be overlooked by others and we have maintained net gearing at approximately 8% to take advantage of this.

. . . . . . . . . . .

Susan Platts-Martin, Baillie Gifford China Growth– 04 April 2023

China’s macroeconomic, regulatory and pandemic policies are looking to align with a pro-growth stance, for the first time in three years. China is likely to be one of the very few major economies where growth could accelerate in 2023, enjoying a re-opening like much of the rest of the world experienced in 2022. In addition and unlike the majority of the world, China is experiencing extremely low inflation (averaging approximately 2% at December 2022). The rapid re-opening from Zero Covid, the increased household savings and clear domestic policy support for growth for 2023 all point towards the ‘need’ for a strong recovery. China has a very different development model from the West and it is important to understand the context of the changes happening in China. The Managers Report details the principles to be borne in mind when investing in China. There are several risks, not least geopolitical, where misjudgements notably in respect of Taiwan could lead to severe market disruption. However, whilst China is a market where there is likely to be ongoing short term volatility, the prospects for significant long term growth remain.

. . . . . . . . . . .

Ian Cadby, chairman, abrdn Asia Income – 04 April 2023

While growth prospects in Asia may have moderated slightly (the Asian Development Bank has reduced its 2023 outlook for GDP expansion to 4.6%), economic growth is still forecast to be ahead of many other parts of the world. The question now is whether the region’s growth prospects outweigh the potential for higher inflation creeping into Asian economies. Investors will also keenly watch the Fed’s monetary policy, with many Asian currencies pegged to the US Dollar, and China’s emergence from its zero-Covid policy, alongside other economies that continue to re-open, which is a positive sign for the region.

The Asia investment story remains as compelling as ever for investors. Long-term drivers of rising affluence, green energy and technology adoption provide opportunities for companies that have the ability to generate steady cash flow and pay stable dividends.

With a long heritage in Asia, the Investment Manager has a strong record of finding those proven, quality companies that benefit from structural trends while generating healthy income and capital growth for investors. The Board remains confident this will be to the benefit of shareholders over the long term.

. . . . . . . . . . .

Yoojeong Oh, Investment Director, abrdn Asia Income – 04 April 2023

We remain optimistic. Asia – long associated with growth – has often been considered a less obvious choice for investors in search of yield. In fact, dividend contribution in Asia has been on a steady upward path, helped by greater capital discipline and shareholder-friendly reforms. Dividends now comprise close to half of total returns to shareholders.

The source of these dividends is also broadening across countries and sectors. In addition to traditional high-yielding markets such as Australia, Singapore and Taiwan, we are starting to see dividend growth and better yields in emerging markets and countries not traditionally known for a dividend- paying business culture. India is a classic example, as companies have historically prioritised re-investing capital back into future growth. Increasingly, we are finding companies that can offer both earnings and dividend growth. Power Grid Corp of India, for example, offers a healthy yield of around 6%, while delivering earnings growth and investing in renewables generation. Opportunities are also spread across sectors ranging from banks and mining to technology and businesses exposed to the region’s growing consumer market. That said, persistent near-term macroeconomic uncertainty and Asia’s wide-ranging stock universe underline the value of fundamental analysis and stock picking.

Overall, Asian companies have stronger balance sheets relative to global peers, as is evident from the chart below. This puts them in a favourable position of being able to choose to invest in growth or improve returns to shareholders. We believe Asian companies are in a better position financially to raise dividends and our quality process enables us to filter this list down to companies that are more willing to increase total returns. Asian markets are also trading at lower price-earnings multiples relative to historical standards as well as world indices.

We are convinced that Asia continues to provide huge potential in both income and capital growth. We will remain discriminating in our selection of well-run and financially sound sustainable businesses with a long runway of growth.

. . . . . . . . . . .

Europe

(compare European funds here and here)

Jack Perry CBE, chairman, European Assets Trust – 04 April 2023

After a strong start to the year, markets have weakened substantially following the failure of Silicon Valley Bank, other smaller regional banks in the US, and the sell-off of Credit Suisse in Europe. Although investors have been encouraged by the recent bail out of Credit Suisse by UBS and the Swiss authorities, there is clear concern over the risk of contagion to the rest of the financial system and of a renewed financial crisis. While it is too early to draw conclusions we believe that regulators and central banks have reacted quickly and with substance. This combined with more stringent regulation, particularly in Europe, since the global financial crisis provides further support. We do hold banks in the portfolio but these are conservatively run, well capitalised and do not have any funding mismatches. Consequently, we believe they will navigate through this period operationally well. We will however continue to monitor the situation closely.

The market’s initial assessment of the impact of the banking crisis is that credit conditions are likely to tighten impacting economic growth and this may lower interest rate expectations. This more sober outlook is frustrating given that

is still a moderate component of the European smaller companies market that trades on multiples which are hard to reconcile to the fundamental cash generation capacity of these companies. We remain focused on pursuing investment ideas that can create a return on your capital by generating cash and delivering growth.

. . . . . . . . . . .

Japan

(compare Japanese funds here)

Philip Kay, chairman, Schroder Japan Growth Fund – 13 April 2023

Japan enters 2023 in a unique position amongst developed nations as it lacks many of the widespread challenges to economic growth that face many of its peers. In fact, it appears to be entering an unusual period of economic stability with sustainable price inflation, largely driven by global macroeconomic events, but arguably viewed as a positive given Japan’s history of deflation. Corporate earnings remain robust with quarterly results announcements consistently ahead of expectations despite the relatively slow removal of Covid-19 restrictions. Importantly, the trend towards improvements in corporate governance continues apace, with greater emphasis at the corporate level on increasing returns on equity and more disciplined approaches to capital allocation. These structural changes should encourage investors who are looking to allocate to Japanese companies and, as it has demonstrated over the last few years, the Company’s portfolio is well placed to benefit from them.

. . . . . . . . . . .

Managers, Schroder Japan Growth Fund – 13 April 2023

Japan entered 2023 as a clear outlier among developed markets, in terms of the outlook for economic growth, monetary policy and inflation. With the domestic economy finally reopening, we see many companies well-positioned to continue to grow profits in the coming year and the potential for Japan’s GDP to continue to grow above its long-term trend rate.

After decades of deflation, the Bank of Japan may be the one major central bank that is happy to see some upward pressure on inflation. While producer prices have been rising in Japan for some time, we are now seeing more evidence of companies looking to pass on these increases to customers, despite consumers remaining very price-sensitive after two decades of deflation. Nevertheless, inflationary pressures remain lower in Japan than in the west, which should allow interest rates to remain relatively low, providing support for the domestic economy and indeed the stock market.

Our positive view on Japan for 2023 is also supported by continuing improvements in corporate governance, which provides the scope to generate real value for investors. This is partly a qualitative assessment through our discussions with company managements, but there are also measurable impacts such as improving returns on equity and a record level of share buybacks. These factors improve potential returns for investors, as do continuing revisions to the Corporate Governance Code and improving disclosure on sustainability issues. Factors such as these should allow us to continue to generate interesting stock ideas across the market-cap spectrum.

We should also note that Japan has entered 2023 with a slightly lower level of political stability than expected. The strong result for the ruling Liberal Democratic Party in the Upper House elections in July 2022 should have provided a strong platform for Prime Minister Kishida. Since then, however, his public approval rating has come under increasing pressure as a result of internal party issues together with his handling of higher living costs. While any change in prime minister is unlikely before the G7 summit in May, Mr Kishida may find it harder to survive the second half of 2023. Nevertheless, with the Liberal Democratic Party remaining dominant, we would expect any successor to maintain the current policy mix.

On balance, we expect the Japanese economy to be able to sustain its recovery in 2023, but we do not expect any step change in its long-term growth rate. Instead, we anticipate that continuing improvements in corporate governance will lead to better capital allocation disciplines and corporate restructurings which should, in turn, generate further improvements to shareholder returns. By focusing the portfolio towards undervalued businesses capable of delivering improving returns, and avoiding opportunities that are less well-placed, we expect these factors to have a strong positive influence on the Company in the years ahead.

. . . . . . . . . . .

North America

(compare North American funds here)

Dame Susan Rice, chair, North American Income Trust – 04 April 2023

The Federal Reserve (the “Fed”) accompanied its rate hike at the start of December 2022 with a slightly less hawkish message around future policy, a near-term positive for equity markets. Indeed, a majority of policymakers are now forecasting an easing in the pace of future rate hikes. Also, following major central banks’ rapid monetary tightening to combat high inflation, certain banks’ balance sheets came under severe pressure in March 2023 as the value of their fixed income portfolios fell and customers withdrew deposits. Technology-focused Silicon Valley Bank (SVB), as well as cryptocurrency-industry lenders Signature Bank and Silvergate Capital, collapsed. SVB’s demise was the largest banking failure since the Global Financial Crisis of 2007-2008. A consortium of US banks also injected $30 billion into regional lender First Republic Bank. In Europe, UBS mounted a $3.3 billion government-backed takeover of Credit Suisse after the latter ran into financial difficulties. These events, which led to major central banks boosting dollar liquidity to ease strains in funding markets, have caused fears of a global banking crisis and deep recession.

While, as a result, investors have lowered their expectations of further monetary tightening, the Federal Open Market Committee remains determined to tame inflation, even if this comes at the cost of a recession. The continued strength of employment suggests that wage growth will continue to run at rates well in excess of those consistent with the Fed’s inflation target. The strength of wage growth has clearly contributed to surging services inflation, alongside very aggressive increases in rent measures and rebounding services demand as Covid-19 headwinds fade and in March 2023, the Fed increased rates again by 25bps as inflation hit 6% year-on-year in February. Your Manager’s view is that this will lead to further tightening by the Fed over the coming months as policy remains restrictive, adding to its conviction that the economy will enter a downturn in the middle of this year.

So, what does this mean for equity markets going forward? Despite the recent rise in markets, sentiment has remained under pressure due to the ongoing banking crisis, hawkish Federal Reserve comments and further negative macroeconomic readings, with equity levels still materially lower than their recent peak. The economic outlook, both in the US and abroad, remains challenging and earnings downgrades have continued to come through since the end of the third-quarter earnings season. Nonetheless, US equity levels now appear to have priced in a strong probability of slowing economic growth and that inflation has peaked. On that basis, your Manager is now seeing some target companies trading on attractive multiples and increasingly appealing valuation points for long-term investors, such as ourselves, and has, therefore, become cautiously optimistic on the outlook for US equities in particular as an asset class.

. . . . . . . . . . .

Global emerging markets

(compare global emerging markets funds here and country specialist funds here)

Johan Meyer, CEO, Fondul Proprietatea SA – 21 April 2023

According to the IMF, the global fight against inflation, Russia’s war in Ukraine, and a resurgence of COVID-19 in China weighed on global economic activity in 2022, and the first two factors will continue to do so in 2023. Global growth is projected to fall from an estimated 3.4% in 2022 to 2.9% in 2023, then rise again to 3.1% in 2024. For Romania, according to October 2022 World Economic Outlook published by IMF, the real GDP growth for 2021 was 5.9% and this is expected to decrease to 4.8% in 2022 and further to 3.1% to 2023. IMF projections from January 2023 forecast global inflation to fall from 8.8% in 2022 to 6.6% in 2023 and 4.3% in 2024. According to Eurostat, the EU annual inflation rate was 9.2% in December 2022, down from 10.1% in November.

For Romania, according with National Statistics Institute the annual inflation rate in December 2022 was 16.4%. According to the monthly BVB report for December 2022, BVB reached a new record in 2022 in terms of liquidity, with the total trading value on all markets exceeding RON 24 billion. The average daily liquidity reached a new high of RON 95.6 million (11% increase compared to 2021). Also, the number of investors reached over 128,000 at the end of September 2022, an all-time high for the Romanian capital market. In terms of performance, the BET index, which includes the 20 most liquid companies listed on the BVB decreased by 10.7% in 2022, following the trend of international stock markets, in the context of rising interest rates and increasing fears regarding the possibility of a recession in developed markets. On 11 January 2023, the Board of the National Bank of Romania once again raised its key monetary policy rate by 0.25% to 7.0%, the eighth consecutive rate hike in the last 12 months, in line with the trend followed by most central banks across the world. Whilst the potential for further interest rates increases is high, we expect inflationary pressure to be more subdued through 2023. With the right mix of fiscal and economic policy, Romania once again has strong prospects to become one of the best performing economies in the European Union.

. . . . . . . . . . .

Elisabeth Scott, chair, JPMorgan Global Emerging Markets – 03 April 2023

We continue to observe a fragile world characterised by heightened risks. Global growth may be slower than hoped in 2023 and some economies, including the USA, may slip into recession. Economic volatility may remain elevated in the near term.

However, despite these negatives, recent US dollar weakness and the reopening of China after the covid-19 restrictions have benefited Emerging Markets. While a number of risks remain, lower inflation and the likelihood of lower interest rates from some Latin American central banks, should mean that Emerging Markets will continue to be attractive to investors.

. . . . . . . . . . .

Debt

(compare debt funds here)

Charlotte Valeur, chair, Blackstone Loan Financing Limited– 27 April 2023

The Board maintains an optimistic but cautious outlook heading into 2023, as markets continue to react swiftly to macroeconomic data and central bank actions. Global economies have proven resilient so far, but persistent inflation suggests that central banks will keep rates higher for longer. The Board expects additional volatility until rates stabilise. Furthermore, the recent failures of Silicon Valley Bank (SVB) and Credit Suisse has perpetuated volatility with an expectation of tightening of financial conditions as banks and other lenders become more conservative. That said, corporate fundamentals are expected to remain solid, supported by better-than-feared earnings and stable interest coverage ratios.

Bank loan market overview

The global loan market started 2022 in a fundamentally good position following the strong economic recovery in 2021 that generated record supply and healthy risk adjusted returns across the asset class. However, the resurgence came to a halt in February with Russia’s invasion of Ukraine and as the market realised that inflation would be more persistent than originally thought. Supply chain issues remained as a major headwind for issuers although they eased as the year progressed. Loans were also caught up in the UK’s LDI pension crisis which swept through global credit markets.

Despite the barrage of headwinds, investors generally viewed loans as a safe haven against the most pressing concern of 2022: rising inflation and interest rates. The Federal Funds rate started the year off at 0.00% to 0.25% and by year-end, reached 4.25% to 4.50%, representing one of the most aggressive tightening policies in history. Similarly, the ECB hiked base rates in the Eurozone from (0.50)% to 2.00% during the year. The S&P 500 recorded its worst annual return since 2008 at (18.8)% as a result. By comparison, loans outperformed other debt and equity markets in 2022, generally due to their floating rate nature. Total returns for European and US loans ended the year at (3.3)% and (1.1)% respectively versus high yield at (11.6)% in Europe and (11.2)% in the US. Average prices for the European and US leveraged loan indices fell to €91.56 and $91.89 from €98.71 and $98.39 at the end of 2021, respectively.

Loan outperformance came against a thin primary pipeline and global loan volume stood at just $505 billion (€473 billion) in 2022, roughly half of that during 2021’s record breaking year. Issuance was weighted toward higher quality issuers looking to term out maturities.

Turning to fundamentals, many companies reported ‘better-than-feared’ earnings in 2022 after strong refinancing activity post COVID-19 left balance sheets in good shape. Still, rising credit concerns pushed spreads across European and US loans (represented by 3-year discount margin) wider by 248bp and 213bp to 661bp and 652bp respectively as the year progressed. Rolling 12-month loan defaults ticked up in the second half of 2022, ending the year at 1.1% in the US and 1.9% in Europe, although these remain within the 10-year historical averages of 2.2% for both regions.

Looking ahead to 2023 and despite kicking off the year with a more constructive market tone, we expect ongoing volatility as credit markets adjust to the higher-for-longer narrative and digest the recent bank failures of SVB and Credit Suisse. We expect credit fundamentals to remain solid and for corporates to continue to access debt capital markets to both refinance and raise new debt. Interest coverage ratios have remained stable through all signs of volatility in the market and reported earnings could continue to deliver.

CLO market overview

In stark contrast to the prior year, throughout 2022, the CLO market experienced numerous headwinds but nonetheless, ended the year with robust primary issuance of €28 billion in Europe and $129 billion in the US. 2022’s CLO issuance volume marked the third largest year on record, following a record year of issuance in 2021 and brought the total outstanding volume of CLOs globally to nearly $1.1 trillion. That was despite technically driven volatility at the top of the CLO debt stack, due in part to LDI-related weakness. Reduced demand from US and Japanese banks, the dominant buyers of CLO AAAs, was another factor.

Underlying the full year headline issuance volume, the running spread between assets and liability costs (known as CLO arbitrage) came under pressure in the second half of the year, due in part to the sustained high cost of liabilities as some dominant buyers of CLO AAAs remained side-lined following the LDI-related, technically driven secondary market sell off in CLO AAAs. While the impact of a diminished spread arbitrage on CLO equity performance can be offset to some degree through the purchase of discounted loans, capturing that price arbitrage during periods of volatility requires access to warehouse financing that remains open and available for use, which is not always the case across all managers. Issuance in 2022 skewed heavily to larger, more established managers and demonstrates advantages of greater access to warehouse financing in order to better achieve an attractive equity arbitrage.

Within the broad market, the weighted average cost of capital for new issue European CLOs widened by 134 basis points to 324 basis points and similarly by 132 basis points to 311 basis points for US CLOs over 2022. The higher cost of debt resulted in a lower net interest margin, to CLO equity investors of new issue deals. However, as noted above, the expected return in new issue CLOs is based on buying loans at discounted prices, thereby benefitting from the ‘pull-to-par’ effect, in addition to the traditional return from net interest margin.

Though volatility creates a challenging environment for primary CLO creation, it also provides opportunities for more seasoned vintages of CLOs to improve performance through portfolio rotation into higher quality and or wider spread loans, which highlights a key benefit of the CLO structure and its long term, non-mark-to-market financing, particularly for those CLOs which have longer remaining reinvestment periods.

Despite that rating downgrades outpaced upgrades, CLO fundamentals remained resilient throughout the year, underscoring the impact of active management on the portfolio quality and robustness of CLO structures. Commonly used measures of CLO portfolio quality showed improvements as managers have been taking advantage of the volatility in order to improve quality, as measured by reduced exposures to CCC-rated assets and stable WARF levels. Caa-rated buckets in European CLOs finished 2022 at 3.1% on average, down from 3.6% at the end of 2021, and in the US, Caa-rated buckets ended the year at 3.7%, compared to 4.1% at the end of 2021. Similarly, WARFs ended the year at 2892 in Europe and 2833 in the US, below the 5-year averages of 2924 and 2897, respectively.

While volatility and technical factors have become a more constant market feature, we believe that we are at the start of a period of transition where the CLO primary market and CLO formation will continue to be more heavily influenced by fundamental credit performance as well as liability performance, as measured by rating stability and liquidity.

Additionally, looking forward, returns across floating rates assets, including senior loans and CLOs, should continue to benefit from further central bank rate hikes in 2023.

. . . . . . . . . . .

David Simpson, chairman, M&G Credit Income Investment Trust – 25 April 2023

The technical backdrop in fixed income markets is much stronger now; all-in bond yields compare favourably to other asset classes, thus attracting capital back into the market. Your Investment Manager believes there is now attractive value to be found in credit, with investors being well paid to take risk. Unlike during the early part of 2022, when risks were not appropriately priced in and the compensation investors were receiving was extremely low, today’s investment grade credit investors are in a much better position. The elevated yield provides a good cushion with which to navigate volatile markets although selectivity and fundamental credit analysis will remain key to the way in which the Investment Manager shapes the portfolio in the year ahead.

. . . . . . . . . . .

Managers, M&G Credit Income Investment Trust – 25 April 2023

After a positive start to 2023 for bonds and equities, hopes of a ‘soft landing’ have given way to recessionary fears and a ‘mini banking crisis’. Silicon Valley Bank and Credit Suisse were the first major casualties to emerge from the most synchronized and aggressive global rate hiking cycle in 40 years. The evidence so far is that the current banking episode is a crisis triggered by fear rather than fundamentals, fuelled by specific instances of idiosyncratic risk rather than something more systemic. Despite this, markets remain fragile and fears of wider contagion in the financial sector remain close to the surface. What is clear is that there has been an adjustment in the risk appetite of investors which has resulted in a notable widening in credit spreads. Additionally, increased risk aversion from lenders is causing credit conditions to tighten and in our opinion will only worsen already anaemic growth forecasts. Although the banking sector is where the first visible stresses have occurred, the viability of capital structures in the non-financial corporate bond market look set to be tested by weaker growth and tighter financial conditions in the next 12-18 months. The private sector, both corporate and consumer, has so far been largely shielded from the impact of higher interest rates because of a lag in policy rate transmission. This lag has been extended by the increased liquidity built up through corporate issuers extending maturity profiles on their debt and consumers building up savings in the aftermath of COVID-19. However, we are starting to see signals in economic data which indicate a deterioration in macroeconomic conditions and a recession in late 2023 has re-emerged as the base-case amongst market participants.

Given the more challenging operating environment, fundamental credit analysis at this stage of the economic cycle becomes even more imperative and our experience in fixed income investing alongside our large in-house credit research capacity will be key in navigating markets over the next 12 months. Our bottom-up investment approach, which has been consistent since launching the Company in 2018, ensures each investment is made based on an analysis and understanding of individual credit fundamentals. We have constructed a sector agnostic, well-diversified portfolio, designed to provide protection from the type of valuation drawdowns that can occur from overexposure to any one sector, region or issuer, particularly during periods of market stress. Also, by investing predominantly in the higher quality (investment grade) part of credit markets we look to mitigate the potential impact of rising default rates which typically occur in the lower-rated (sub- investment grade) space. We maintain an overall c.23% exposure in the Company’s portfolio to sub-investment grade issuers, however half of this is in invested in private assets where we take comfort from enhanced controls and monitoring that exists in these largely bilateral transactions, with robust covenant packages designed to prevent write- downs or capital loss.

2022 witnessed a material shift for fixed income investors. After a decade of depressed bond yields and credit spreads remaining largely within a (tighter) lower range, we are now seeing an increased volume of opportunities in the public market to purchase good quality, investment grade credits which can offer returns in line with the Company’s dividend objective. Additionally, in the private space, a prolonged period of adjustment to the higher interest rate environment has meant we are seeing fewer opportunities which offer attractive relative value versus public comparators or that match the Company’s return objective. In many instances there is an insufficient illiquidity premium on offer and relative value analysis has not supported allocation of capital over a multi-year horizon, particularly considering the uncertain economic outlook. We therefore expect the ratio of private to public assets to trend lower in the short term, although as always this will remain dependent on our appraisal of where the most attractive relative value can be found.

. . . . . . . . . . .

Norman Crighton, chair, RM Infrastructure Income – 25 April 2023

A very challenging macro environment persisted throughout the year. The key driver was inflationary pressure which was exacerbated by the Russian invasion of Ukraine in the spring. Central banks then started their tightening phase with the Bank of England raising interest rates 9 times during the year to the highest levels seen in 14 years. Credit spreads were also volatile with two spikes during the year seen after the initial days of the Russian invasion and then after the poorly received “mini-budget” in September.

In conjunction with widening credit spreads underlying government bond yields rose dramatically with 5 year UK Gilt yields rising from 0.80% to finish the year at circa 3.6%, 280bps higher. This caused fixed income as an asset class to have a very poor year as the absolute level of spread and yield widening from such a low initial base meant that any instrument with duration and any credit exposure saw material declines in value.

Market opportunities

The focus of the strategy remains on relatively short-dated lending. The widening seen over the last 12 months in credit spreads combined with the increase in underlying UK Gilt yields means there are opportunities to increase the coupons charged. Such new lending is also targeting senior secured loans thus seeking to improve the overall credit quality of the portfolio.

2022 was a very poor year for fixed income markets. The stage is set for a better 2023 and with 2-year UK government bond yields touching 4% and wider credit spreads and corporate bond yields look appealing in the short end. The Company is now able to recycle its capital and earn higher returns which absent of an increase in credit losses should allow for greater distributions for investors. This is therefore a promising outlook.

. . . . . . . . . . .

Thomas Shandell, CEO, Marble Point Loan Financing Limited – 12 April 2023

As mentioned earlier, during 2022, credit markets experienced significant bouts of volatility in the wake of the Russian invasion of Ukraine and interest rate increases by central banks to combat inflation. However, the US leveraged loan market was resilient with a total return of (1.06%), faring better than many other credit products and equity markets. While we believe there is a reasonable chance for a recession in 2023, we expect it will be a shallow one and that the impact on leveraged loans will be more company and portfolio specific and less broadly distributed. Certain business models and industries have proven resilient to supply shocks and higher costs that might impact their margins. Still we expect headline loan default rates to increase from their current historically low levels, and for rating agencies to continue downgrading loan issuers on the lower end of the credit quality spectrum.

The market continues to pressure issuers that miss their earnings, and we believe more defensive loan portfolios should perform better in such an environment in 2023. We remain cognizant that tail risk measures in loan portfolios have increased throughout 2022 and indicate areas of concern in certain business models and sub-sectors. Our focus remains on business fundamentals, earnings and cash flows in this market, and we are less concerned about potential loan maturity issues as many companies were able to extend the tenor of their debt in recent years. As at January 2023, only 5.85% of the Morningstar/LSTA Leveraged Loan Index has a maturity prior to 2025. We expect 2023 may be a challenging year to navigate leveraged loan markets, but we also believe the team’s capabilities and investment process are designed to deliver strong relative performance, particularly in the face of potential volatility. We continue to believe in the benefits of the CLO financing structure, particularly in periods of volatility. In the midst of current events exposing the degree of duration mismatch in traditional banks’ balance sheets, it is important to reiterate that CLOs finance their portfolio of floating rate loan assets with 12-year floating rate non mark-to-market liabilities. The reinvestment period within CLOs effectively allows CLOs to borrow long-term and lend short-term, further mitigating any duration mismatch. We remain vigilant in our research process and remain committed to a portfolio management strategy that relies on a relative value driven active trading approach. Consequently, the Investment Manager believes the Company’s portfolio is well positioned to take advantage of opportunities within dislocated markets and continue to achieve the Company’s investment objectives.

Toward the end of Q1 2023, secondary loan prices have been impacted by broader market volatility in the wake of turmoil in the banking industry instigated by the collapse of Silicon Valley Bank (“SVB”) with the average indicative bid price of the CSLLI ending the quarter at 92.67%. While at this point we do not believe any of our underlying obligors have material direct exposure to SVB or other regional banks whose recent problems have been highlighted in the media, we are closely monitoring the situation for any follow-on impacts to loan markets.

. . . . . . . . . . .

Manager, NB Global Monthly Income – 05 April 2023