Economic and Political Monthly Roundup

Kindly sponsored by Allianz

A collation of recent insights on markets and economies taken from the comments made by chairs and investment managers of investment companies – have a read and make your own minds up. Please remember that nothing in this note is designed to encourage you to buy or sell any of the companies mentioned.

Roundup

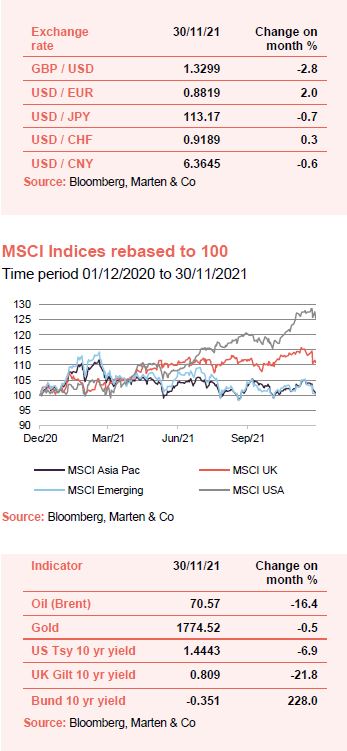

Just when we thought COVID-19 was behind us, the discovery of the new Omicron variant towards the end of November has shaken nerves and markets alike. For the bulk of the month however, investors were most concerned about rising inflation and supply chain issues around the world. In the UK, this has been heightened by a lack of skilled labour, especially in the run-up to Christmas when demand for goods and services is higher than usual. Brent oil, gold, treasuries and gilts all fell as did most markets around the world including the MSCI Asia Pacific, MSCI United Kingdom and MSCI Emerging Markets. The MSCI USA rose by 1.6% in November, continuing its 2021 trajectory, though it will be interesting to see what kind of impact the Omicron variant will have.

Global highlights

Kate Fox and Lee Qian, managers of Keystone Positive Change, believe the world is achieving breakthrough science and technological discoveries at an unprecedented pace; and these breakthroughs will reshape how we live and how we care for our environment.

Scottish Mortgage managers, James Anderson and Tom Slater, are optimistic and enthused over the next decade which will see many opportunities as a result of multiple drivers of change from continued digitalisation to the much-needed energy transition.

Joe Bauernfreund, manager of AVI Global, says the intertwined themes of inflation, interest rates and growth continue to dominate investor thinking and drive markets.

UK

The managers of Chelverton UK Dividend say that fears over supply chain disruption, availability of skilled labour and rising inflation have dampened expectations for the year.

Ian McCombie and Milena Mileva of Baillie Gifford UK Growth say they are more interested in the impact of supply chain disruption rather than COVID-19 or temporary cost headwinds.

Supply chain disruption is the biggest concern on investors’ minds at the moment

Jonathan Cartwright, chair of BMO Capita & Income, thinks that there are more issues of potential concern than usual, he also cites global supply chains and rising interest rates.

Montanaro UK Smaller Companies’ Charles Montanaro highlights the two market rotations that bookended the six months to 30 September 2021. He thinks that the UK looks attractive as the economy reopens and the overhang of Brexit fades.

The managers of Odyssean have become increasingly confident of the medium to long term value uplift potential of many companies.

James De Uphaugh and Chris Field, managers of Edinburgh Investment Trust, say the bottom-up picture in the UK continues to show signs of health, providing reasons for optimism.

Steve Bates of JPMorgan Elect says liquidity conditions are likely to remain benign which means interest rates will stay low, even as central banks try to engineer a return to normal monetary policy.

Some managers feel the UK economy should be able to adapt to the challenges it faces

Chelverton Growth’s David Horner says the UK economy is dynamic and should adapt to the challenges it faces and that there will always be opportunities for nimble businesses operating in niche markets.

The chair of Troy Income & Growth says that there is widespread commodity inflation and many eyes are now fixed on central bankers and the timescale of interest rate rises. This backdrop has been highly supportive for more economically sensitive parts of the UK market, including commodity-linked businesses such as mining and oil & gas.

The manager of Schroder Income Growth says the Covid-19 pandemic has proved to be the ultimate exogenous shock – an unpredictable, global event that has brought economies to a standstill and continues to impact supply and demand, companies and consumers,

Peter Dicks, chair of SVM UK Emerging, says the sharp recovery in the UK economy is creating value in some disruptive businesses.

The long-term impact of COVID-19 will continue to challenge markets

Fidelity Special Values’ manager, Alex Wright, see both risks and opportunities ahead.

Ronald Gould, chair of BlackRock Smaller Companies, says the longer-term implications of social and economic disruption from COVID-19 will continue to challenge markets.

Downing Strategic Micro-Cap’s chair thinks there is more uncertainty now than there has been for a while.

Europe

The JPMorgan European team discusses how cyclical stocks have enjoyed a spectacular run and discounted much of the recovery.

Stephen Paice and Moritz Sitte, the managers of Baillie Gifford European Growth say in our post-pandemic world, it’s clear that supply chain disruption is one of its defining characteristics.

Supply chain disruption is currently a defining characteristic of European markets too

Montanaro European Smaller Companies’ chair also believes the aftershocks of the global pandemic continue to reverberate around the world as supply chains strain to support the recovery of demand.

The managers of BlackRock Greater Europe, Stefan Gries and Sam Vecht, expect nominal global gross domestic product growth to remain in a range of 3% to 6% and for interest rates to stay low for a prolonged period of time.

Biotechnology & Healthcare

Worldwide Healthcare managers, Sven Borho and Trevor Polischuk, note how the biotechnology sector has underperformed this year following record numbers in 2020.

The manager of Syncona says it is excited about cell and gene therapies, where data continues to be supportive and offers opportunity for innovative biotech companies.

After a strong 2020, the biotech sector has underperformed this year

Geoff Hsu, manager of Biotech Growth, explains why he exited COVID-19 related stocks shortly after the Delta variant surge and what next for the biotech IPO market.

The investment management team at International Biotechnology think the speed and success of the COVID-19 vaccination programme has had a profound impact on how the developed world was able to mitigate the impact of the pandemic and restore economic confidence.

Other

We have also included comments on global emerging markets from Templeton Emerging Markets and Utilico Emerging Markets; Asia Pacific from Aberdeen Standard Asia Focus and Schroder Oriental Income; Latin America from Aberdeen Latin American Income; Japan from Aberdeen Japan; China from Fidelity China Special Situations; India from Aberdeen New India; flexible investment from Personal Assets, Hansa, Caledonia, JPMorgan Global Core Real Assets and Capital Gearing; technology & media from Augmentum Fintech; private equity from 3i; debt from TwentyFour Income; infrastructure from HICL Infrastructure, Cordiant Digital Infrastructure and Sequoia Economic Infrastructure Income; renewable energy infrastructure from JLEN Environmental Assets and NextEnergy Solar and property from Shaftesbury, Helical, Great Portland Estates, British Land, Land Securities, LondonMetric, Urban Logistics REIT, Assura, Custodian REIT, AEW UK REIT and NewRiver REIT.

Full version

Click on the link at the bottom of the page to access the full report.

Kindly sponsored by Allianz

The legal bit

This note was prepared by Marten & Co (which is authorised and regulated by the Financial Conduct Authority).

This note is for information purposes only and is not intended to encourage the reader to deal in the security or securities mentioned within it.

Marten & Co is not authorised to give advice to retail clients. The note does not have regard to the specific investment objectives, financial situation and needs of any specific person who may receive it.

Marten & Co may have or may be seeking a contractual relationship with any of the securities mentioned within the note for activities including the provision of sponsored research, investor access or fundraising services.

This note has been compiled from publicly available information. This note is not directed at any person in any jurisdiction where (by reason of that person’s nationality, residence or otherwise) the publication or availability of this note is prohibited.

Accuracy of Content: Whilst Marten & Co uses reasonable efforts to obtain information from sources which we believe to be reliable and to ensure that the information in this note is up to date and accurate, we make no representation or warranty that the information contained in this note is accurate, reliable or complete. The information contained in this note is provided by Marten & Co for personal use and information purposes generally. You are solely liable for any use you may make of this information. The information is inherently subject to change without notice and may become outdated. You, therefore, should verify any information obtained from this note before you use it.

No Advice: Nothing contained in this note constitutes or should be construed to constitute investment, legal, tax or other advice.

No Representation or Warranty: No representation, warranty or guarantee of any kind, express or implied is given by Marten & Co in respect of any information contained on this note.

Exclusion of Liability: To the fullest extent allowed by law, Marten & Co shall not be liable for any direct or indirect losses, damages, costs or expenses incurred or suffered by you arising out or in connection with the access to, use of or reliance on any information contained on this note. In no circumstance shall Marten & Co and its employees have any liability for consequential or special damages.

Governing Law and Jurisdiction: These terms and conditions and all matters connected with them, are governed by the laws of England and Wales and shall be subject to the exclusive jurisdiction of the English courts. If you access this note from outside the UK, you are responsible for ensuring compliance with any local laws relating to access.

No information contained in this note shall form the basis of, or be relied upon in connection with, any offer or commitment whatsoever in any jurisdiction.

Investment Performance Information: Please remember that past performance is not necessarily a guide to the future and that the value of shares and the income from them can go down as well as up. Exchange rates may also cause the value of underlying overseas investments to go down as well as up. Marten & Co may write on companies that use gearing in a number of forms that can increase volatility and, in some cases, to a complete loss of an investment.