February 2024

Monthly | Investment companies

Kindly sponsored by abrdn

Winners and losers in January 2024

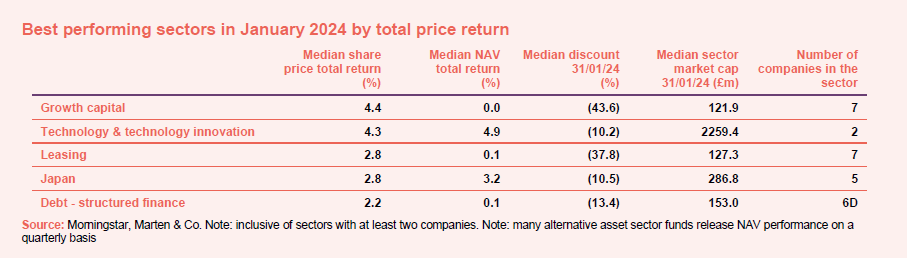

As with 2023, markets remained beholden to the trajectory of interest rates and inflation in January. Having steadily drifted downwards over the last month of the year, bond yields rose after an unexpected increase in inflation, with the data providing a timely reminder that although rate cuts remain likely in 2024, market pricing for imminent and rapid easing is too aggressive in light of the macro backdrop.

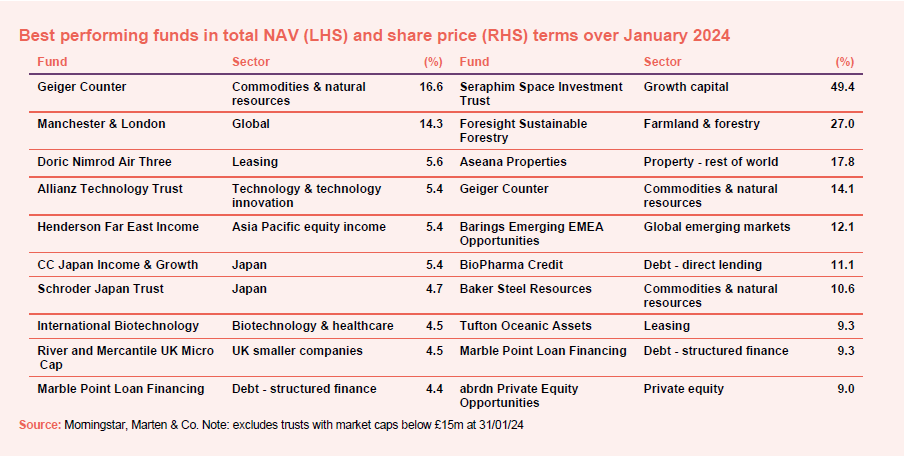

Growth capital led the best performers list thanks to a dramatic surge in Seraphim Space Investment Trust, which was up 49.4%. The rally appeared to be driven by portfolio company, AST SpaceMobile, which received a strategic investment from AT&T, Google, and Vodafone, worth around $155m. The trust also noted a positive update on its investment in HawkEye 360 relating to its exposure to the defence industry.

The technology & technology innovation sector was also up strongly as the NASDAQ-100 printed a fresh all time high thanks to the ongoing outperformance of US large cap tech. Interestingly, this came despite rising treasury yields which have traditionally acted as a handbrake for the sector, with the price action reminiscent of the post-recession expansion experienced after the GFC, and the period leading up to the dot com bust.

The Japanese market continues to rally after a strong 2023 where the Nikkei 225 returned more than 28%. January’s performance was catalysed by a more dovish policy outlook, while longer term, a combination of sustained inflation, corporate reforms and relatively low valuations has seen a considerable increase in investment.

After a dramatic fall over the back half of 2023, hotter than expected inflation data in January has helped stabilise the leasing and structured finance sectors which stand to benefit from elevated interest rates.

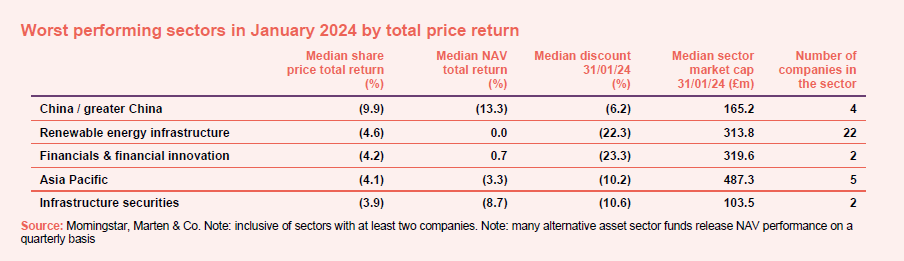

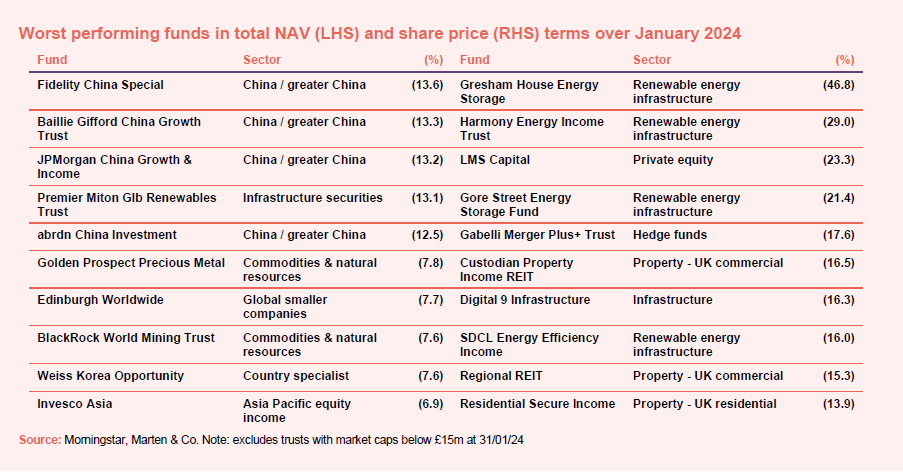

China was again the worst performing sector in January as it continues to be bogged down by its overburdened property and regional banking sectors, heavy handed tech regulation, and stagnant domestic demand. The economy is battling deflation, and the lack of a cohesive monetary response has weighed heavily on performance. China’s ongoing struggles have also had a considerable flow on effect with trade partners, including those in the Asia Pacific region, struggling with falling demand. A rising US dollar index has further compounded the issue. The remaining worst performers list is made up of rate sensitive sectors hurt by rising yields and a more hawkish policy outlook.

Best performing companies

Looking now at the best performing companies, Geiger Counter led the way, up 16% during the month thanks to soaring uranium prices as the nuclear renaissance gathers steam. Geopolitical concerns have also contributed to the rally with governments investing heavily in nuclear infrastructure and raw materials to reduce exposure to Russia which controls a considerable amount of the world’s supply chain.

Manchester & London was up strongly with more than 50% of its portfolio spread across two companies, Microsoft and NVIDIA which have been at the forefront of the ongoing AI revolution. This continued its rapid ascent in January, led by NVIDIA which was up 28%, and is up a whopping 229% over the past 12 months. Allianz Technology benefited from similar tailwinds. As noted above, the Doric Nimrod and Marble Point funds saw positive returns thanks to the rebound in bond yields, while CC Japan and Schroder Japan rallied on the back of outperformance from the Japanese market. The bulk of the Henderson fund’s outperformance was driven by its largest holding, Taiwan Semiconductor, which bounced strongly following a positive earnings update. The announcement continuing a period of solid growth for TSCM which has previously battled geopolitical concerns in addition to oversupply issues in the cyclical semiconductor sector.

In terms of share price movements, Seraphim Space was the best performer while leasing company Tufton Oceanic and structured financing provider Marble Point Loan financing also featured, benefiting from the stabilisation in bond yields discussed above. Foresight Sustainable Forestry was also up strongly as land prices have begun to recover following a steady decline over the past year.

Shares in Aseana Properties jumped following the announcement that the company had settled a court case relating to the non-payment of various debts by the parent company of its former development manager. The Barings EMEA trust bounced strongly following a positive portfolio update, however shares remain deeply depressed, down 31% over the past five years. Shares in BioPharma Credit rallied after an announcement that it will recover more than 80% of its loan to US diagnostics firm LumiraDx following the sale of its main assets to Roche. Shares in Baker Steel were up following an announcement that portfolio company Futura was opening a new coal mine. Sentiment in the trust has improved recently after a challenging 2023 where shares fell 48% due to slowing materials demand, a strong dollar, and the ongoing struggles in China, the world’s largest consumer of commodities. abrdn Private Equity Opportunities fund responded strongly to the announcement of a buyback programme following the sale of its €34.6m stake in European supermarket group, Action.

Worst performing companies

The worst performing funds were a clear reflection of the dominant themes noted on page 1, with the bulk of the list consisting of companies exposed to the ongoing struggles in China, either directly, or through reduced commodity demand. This included Weiss Korea – the Korean market was particularly weak in January – and Invesco Asia.

The rebound in inflation which drove an increase in bond yields also weighed on the commodities sector, driving the dollar higher while tighter financial conditions impacted the infrastructure (Premier Miton Global Renewables) and the smaller companies sectors. The gold price was a little weaker, which may have weighed on Golden Prospect.

It was a similar story in terms of share price movements, with capital intensive sectors such as renewable energy infrastructure and property bearing the brunt of the sell-off. Compounding these issues were trading updates from the two-battery storage funds, Gresham House and Harmony Energy, both of which cut dividend payments citing policy bottle necks and low utilisation of batteries by National Grid. Gore Street Energy Storage was dragged down too despite its protests that it is relatively much less affected by these issues. LMS Capital’s shares are down almost 40% over the last year and have continued to slide in January following an announcement that a receiver has been appointed to one of its investee company projects, the Mayfair development, due to sales which have been slower than expected. It is not clear what drove the fall in Gabelli Merger Plus, however, the trust trades on very thin volume which may have contributed.

Custodian Property Income REIT announced that it had agreed to a merger with the abrdn Property Income Trust and it may be that arbitrageurs selling one to buy the other drove down its share price. Digital 9 Infrastructure’s woes are deepening. It announced a managed wind down during January. There is no obvious reason for the fall in SDCL Energy Efficiency’s share price – we interviewed the co-manager during the month if you’d like to know more about it.

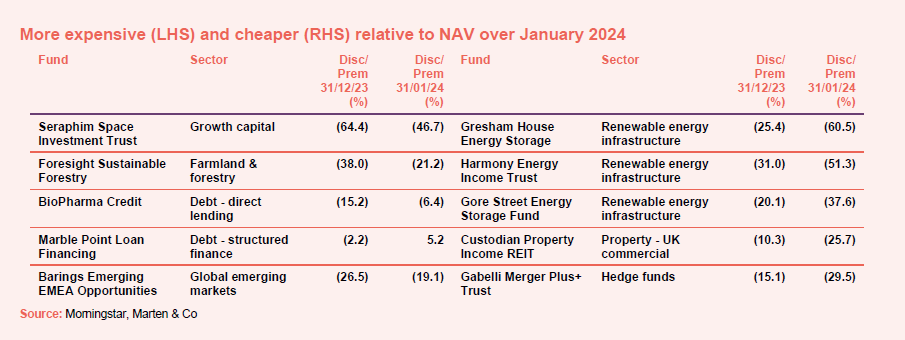

Moves in discounts and premiums

We have discussed all of these funds already. In an effort to tackle its discount, Gabelli Merger Plus+ announced a 12 cent dividend and small buyback – equivalent to 5% of the shares held by minority investors – at the end of the month.

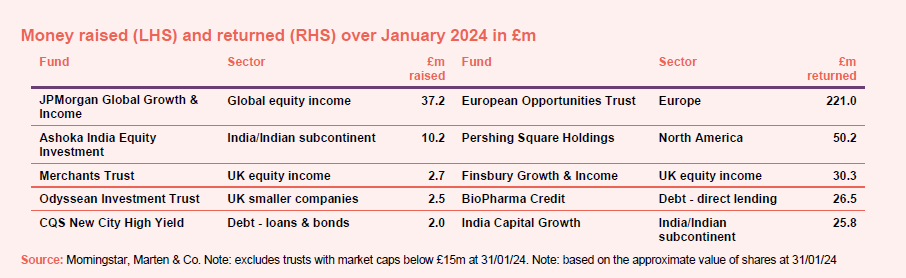

Money raised and returned

The market for new shares remains subdued, and it was a case of the usual suspects once again in January with JPMorgan Global Growth & Income leading the way. In terms of money being returned to investors, the European Opportunities Trust announced that it had brought back 25% of its outstanding shares following its tender offer. India Capital Growth handed back £26.2m to shareholders in respect of its end 2023 redemption facility, but has issued some stock since.

Upcoming events

Here is a selection of what is coming up. Please refer to the Events section of our website for updates between now and when they are scheduled:

Major news stories and QuotedData views over January 2024

Visit www.quoteddata.com for more on these and other stories plus in-depth analysis on some funds, the tools to compare similar funds and basic information, key documents and regulatory news announcements on every investment company quoted in London

Interviews

Have you been listening to our weekly news round-up shows? Every Friday at 11 am, we run through the more interesting bits of the week’s news, and we usually have a special guest or two answering questions about a particular investment company.

Research

Chrysalis Investments (CHRY) seems to have turned a corner. The welcome 6.5% jump in the NAV over the final quarter of 2023 (see page 11), encouraging news from many portfolio companies, an NAV enhancing (but unnamed) disposal in the works (see page 6), and the prospects of a more supportive interest rate environment all help underscore the trust’s attractions.We expect that shareholders will be happy to support the continuation vote scheduled for the AGM in March.

There is no doubt that 2023 was a challenging year for GCP and the broader infrastructure sector as a confluence of factors weighed on performance, particularly the rapid increase in interest rates. Despite this, the company was still able to generate positive NAV returns thanks to inflation linkages and contracted earnings, which helped offset the impact of rising discount rates. Disappointingly, negative sentiment continued to weigh on the company’s shares, with the share price discount to net asset value (NAV) widening to a record low, despite the stability of the underlying portfolio.

Gulf Investment Fund (GIF) has demonstrated an ability to be one of the best-performing strategies focusing on the Gulf region, as illustrated by its net asset value (NAV) outperformance and its ability to generate sector-leading alpha (a measurement of manager skill). The team has recently expanded into the healthcare sector, which has benefitted from both government initiatives and the growing wealth of the GCC consumer. GIF is also benefitting from the success of local financial institutions, which reflects the increasing mass affluence of the region.

Over the past 12 months, Ecofin Global Utilities and Infrastructure (EGL), along with the broader utilities and infrastructure sector, has been at the mercy of broader macro-economic conditions. However, its recent performance in no way diminishes the long-term opportunity that exists for the fund, which should become more apparent as interest rates retreat from their highs. The company maintains exposure to a suite of investments that stand to benefit from an ever-growing list of tailwinds as global decarbonisation and electrification trends gather momentum.

Optimism driven by rapidly developing corporate governance reforms, a divergent economy cycle, and still-negative interest rates saw a dramatic rally in benchmark Japanese indices over 2023, with the TOPIX index (the Tokyo Stock Price Index) climbing to its highest level in more than 30 years. With the rally driven by more value-focused sectors of the market, returns for the JPMorgan Japanese Investment Trust (JFJ) failed to keep pace for much of the year due to a portfolio more targeted towards high-quality growth stocks (generally speaking, for JFJ, this means companies with strong franchises, balance sheets and cash-flow generation, which have the potential to compound earnings over the long term).

If an inflexion point in the interest rates cycle has been reached, as seems to be the case, Urban Logistics REIT (SHED) is a compelling proposition. Valuations have stabilised – as evidenced by a 0.2% uplift in the value of SHED’s portfolio in the six months to September 2023 – while the company has substantial reversion baked into its portfolio (reversion is the rental growth potential of the portfolio, being the difference between current portfolio rents and the estimated rental value of the portfolio).

If an inflexion point in the interest rates cycle has been reached, as seems to be the case, Urban Logistics REIT (SHED) is a compelling proposition. Valuations have stabilised – as evidenced by a 0.2% uplift in the value of SHED’s portfolio in the six months to September 2023 – while the company has substantial reversion baked into its portfolio (reversion is the rental growth potential of the portfolio, being the difference between current portfolio rents and the estimated rental value of the portfolio).

Polar Capital Technology’s (PCT’s) manager Ben Rogoff’s conviction levels on the potential of artificial intelligence (AI) have risen, reflecting the all-encompassing possibilities of the technology. His bullishness is displayed in the make-up of PCT’s portfolio, which is weighted almost 80% towards stocks that he believes are AI beneficiaries or enablers. The potential for huge productivity gains – which could boost global GDP by 7%, according to Goldman Sachs – and few barriers to mass adoption puts the technology sector at a profound moment in time, with corporate spend on AI set to rocket. While the mega-cap technology stocks outperformed in 2023, Ben expects a broadening of performance among mid- and small-cap AI beneficiaries this year. PCT’s active management style (trying to beat the benchmark through asset allocation) could prove valuable after several challenging years.

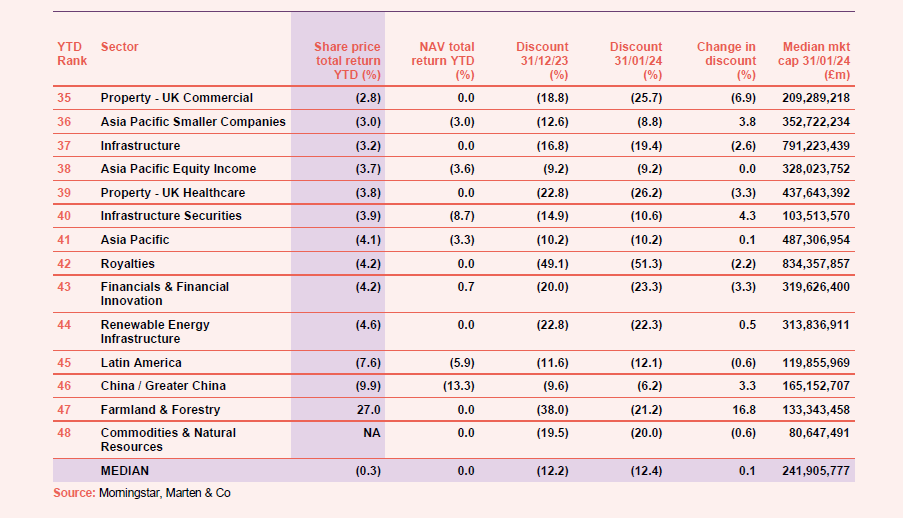

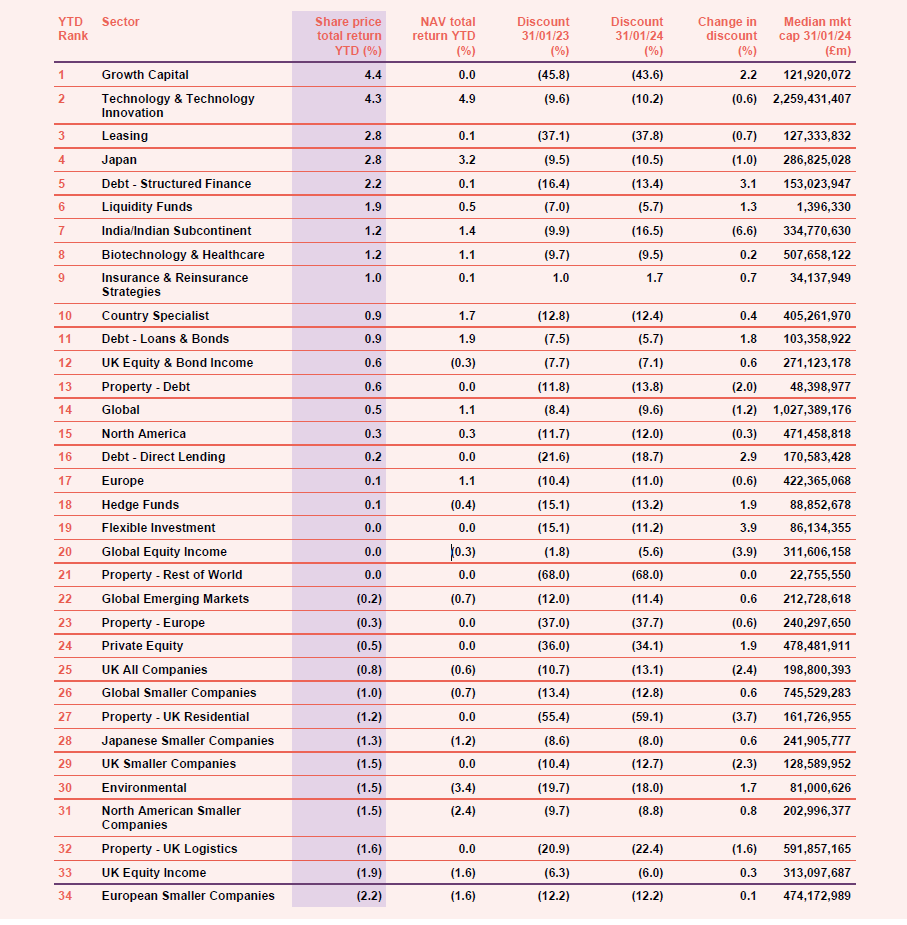

Appendix 1 – median performance by sector, ranked by 2024 year to date price total return

Guide

Our independent guide to quoted investment companies is an invaluable tool for anyone who wants to brush up on their knowledge of the investment companies’ sector. Please register on www.quoteddata.com if you would like it emailed to you directly.

IMPORTANT INFORMATION

This note was prepared by Marten & Co (which is authorised and regulated by the Financial Conduct Authority).

This note is for information purposes only and is not intended to encourage the reader to deal in the security or securities mentioned within it.

Marten & Co is not authorised to give advice to retail clients. The note does not have regard to the specific investment objectives, financial situation and needs of any specific person who may receive it.

Marten & Co may have or may be seeking a contractual relationship with any of the securities mentioned within the note for activities including the provision of sponsored research, investor access or fundraising services.

This note has been compiled from publicly available information. This note is not directed at any person in any jurisdiction where (by reason of that person’s nationality, residence or otherwise) the publication or availability of this note is prohibited.

Accuracy of Content: Whilst Marten & Co uses reasonable efforts to obtain information from sources which we believe to be reliable and to ensure that the information in this note is up to date and accurate, we make no representation or warranty that the information contained in this note is accurate, reliable or complete. The information contained in this note is provided by Marten & Co for personal use and information purposes generally. You are solely liable for any use you may make of this information. The information is inherently subject to change without notice and may become outdated. You, therefore, should verify any information obtained from this note before you use it.

No Advice: Nothing contained in this note constitutes or should be construed to constitute investment, legal, tax or other advice.

No Representation or Warranty: No representation, warranty or guarantee of any kind, express or implied is given by Marten & Co in respect of any information contained in this note.

Exclusion of Liability: To the fullest extent allowed by law, Marten & Co shall not be liable for any direct or indirect losses, damages, costs or expenses incurred or suffered by you arising out or in connection with the access to, use of or reliance on any information contained in this note. In no circumstance shall Marten & Co and its employees have any liability for consequential or special damages.

Governing Law and Jurisdiction: These terms and conditions and all matters connected with them, are governed by the laws of England and Wales and shall be subject to the exclusive jurisdiction of the English courts. If you access this note from outside the UK, you are responsible for ensuring compliance with any local laws relating to access.

No information contained in this note shall form the basis of, or be relied upon in connection with, any offer or commitment whatsoever in any jurisdiction.

Investment Performance Information: Please remember that past performance is not necessarily a guide to the future and that the value of shares and the income from them can go down as well as up. Exchange rates may also cause the value of underlying overseas investments to go down as well as up. Marten & Co may write on companies that use gearing in a number of forms that can increase volatility and, in some cases, to a complete loss of an investment.