Ecofin Global Utilities and Infrastructure Trust

Ecofin Global Utilities and Infrastructure Trust

Investment companies | Annual Overview | 23 January 2024

Strong outlook as macro gloom lifts

Over the past 12 months, Ecofin Global Utilities and Infrastructure (EGL), along with the broader utilities and infrastructure sector, has been at the mercy of broader macro-economic conditions. However, its recent performance in no way diminishes the long-term opportunity that exists for the fund, which should become more apparent as interest rates retreat from their highs.

The company maintains exposure to a suite of investments that stand to benefit from an ever-growing list of tailwinds as global decarbonisation and electrification trends gather momentum. Earnings growth within the portfolio has remained strong, while indiscriminate selling has driven valuations of some stocks down to historically low levels, providing an incredibly attractive opportunity for long-term investors.

Developed markets utilities and other economic infrastructure exposure

EGL seeks to provide a high, secure dividend yield and to realise long‐term growth, while taking care to preserve shareholders’ capital. It invests principally in the equity of utility and infrastructure companies which are listed on recognised stock exchanges in Europe, North America and other developed OECD countries. It targets a dividend yield of 4% a year on its net assets, paid quarterly, and can use gearing (borrowing) and distributable reserves to achieve this.

At a glance

Fund Profile

Ecofin Global Utilities and Infrastructure Trust Plc is a UK investment trust listed on the main market of the London Stock Exchange (LSE). The trust invests globally in the equity and equity-related securities of companies operating in the utility and other economic infrastructure sectors. EGL is designed for investors who are looking for a high level of income, would like to see that income grow, and wish to preserve their capital and have the prospect of some capital growth as well.

Further information regarding EGL can be found on the manager’s website:

uk.ecofininvest.com/funds/ecofin-global-utilities-and-infrastructure-trust-plc

Reflecting its capital preservation objective, EGL does not invest in start-ups, small businesses or illiquid securities, as these may involve significant technological or business risk. Instead, it invests primarily in businesses in developed markets, which have ‘defensive growth’ characteristics (traditionally, companies able to maintain strong earnings even if economic conditions deteriorate): a betaless than the market average; dividend yield greater than the market average; forward-looking earnings per share (EPS) growth; and strong cash-flow generation.

It also operates with a strict definition of utilities and infrastructure as follows:

- electric and gas utilities and renewable operators and developers – companies engaged in the generation, transmission and distribution of electricity, gas, liquid fuels and renewable energy;

- transportation – companies that own and/or operate roads, railways, and airports; and

- water and environment – companies operating in the water supply, wastewater, water treatment and environmental services industries.

EGL does not invest in telecommunications companies or companies that own or operate social infrastructure assets funded by the public sector (for example, schools, hospitals or prisons).

No formal benchmark

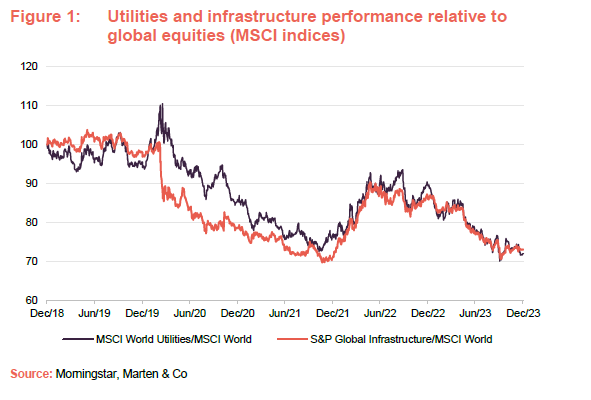

EGL does not have a formal benchmark and its portfolio is not constructed with reference to an index. However, for the purposes of comparison, the MSCI World Utilities Index, and the S&P Global Infrastructure Index are the global indices deemed the most appropriate by the manager. The company also supplies data for the MSCI World Index and the All-Share Index in its own literature for general interest. We consider the MSCI World Utilities to be the most relevant – although it should be noted that this index has a strong bias towards US companies and excludes transportation services and some environmental services which EGL may be invested in.

EGL does not have a formal benchmark and is not constructed with reference to any index.

Market backdrop – all about rates

In our last note we highlighted the impact of rising interest rates on EGL, and the repricing of markets more broadly. These factors predominated throughout 2023, with yields (which have an inverse relationship to bond prices) for US government debt (Treasuries) with longer-dated maturities gathering steam in response to uncontrolled inflation and the ever-resilient US labour market. 10-year Treasury yields briefly breached 5% for the first time since the collapse of Lehman Brothers in 2007, before more moderate inflation and a technical change to the treasury refunding process sparked a dramatic repricing in the final quarter of the year. This precipitated an equity market recovery as investors began to eye an end to ever-rising interest rates. Sectors of the market weighed down by rising discount rates and unwieldly financing costs were particularly receptive as 10-year Treasury yields continued their rapid retracement towards 4% and below.

10-year Treasury yields briefly breached 5% for the first time since the collapse of Lehman Brothers in 2007

The ebbs and flows of these dynamics have been exhaustively documented over the past six months, and while there is no guarantee that the bond rally will continue, (notably, yields have risen steadily off their year-end lows over the course of January), the dramatic fall in inflation across the developed world over the last few months suggests that we have seen interest rates peak for this cycle.

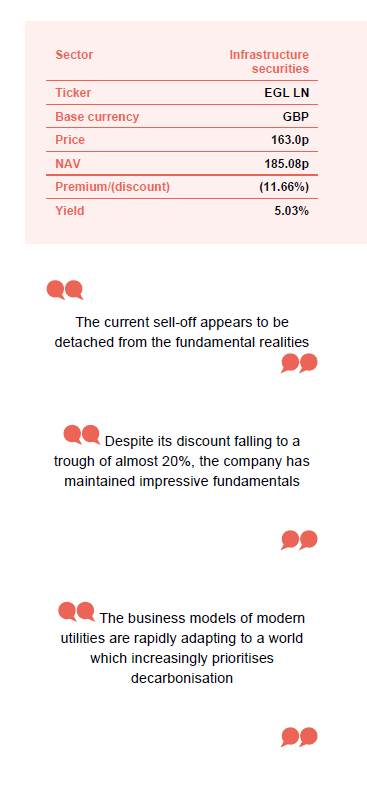

If rates are now on the way down, or have at least become less volatile, it removes a key pillar of uncertainty for capital intensive sectors such as infrastructure and utilities. These have been hit hard by what in many cases has been indiscriminate selling, and a pause should allow the market to take stock of companies which are now drastically oversold. This is certainly the case for EGL’s portfolio, as we will discuss below. Despite its discount falling to a trough of almost 20%, the company has maintained impressive fundamentals and remains well positioned to take advantage of an ever-growing suite of tailwinds.

Annual report notes portfolio’s underlying strength

EGL’s annual report was published on 18 December 2023. The return for the period ended 30 September 2023 highlights the challenges faced by the company throughout the year with an NAV total return of -8.6% and a share price total return of -21.9%, although it is worth noting that roughly half of the fall in NAV was attributable to sterling strength which rose 9% against the US dollar (USD), driving down the value of EGL’s US assets. This is in comparison to the MSCI World Utilities Index total return of -8.2% in sterling terms. Meanwhile, global equities as measured by the MSCI World Index rose 11.8%, driven by a small number of large-cap tech stocks, opening a considerable gap in performance. The second half of the financial year was particularly challenging, with EGL’s NAV falling 11.9%, reflecting the rapid rise in global bond yields discussed above.

The portfolio showed the virtues of diversification over the course of the financial year as its pan-European integrated (power generation and distribution) utility positions performed well, as did transportation and environmental services exposure, benefitting from strong trading revenues, sound pricing models, and contractual inflation hedges (details of which we discuss on page 8) . However, its North American exposure suffered, with issues around cost inflation, supply chains, and permit delays compounding broader concerns surrounding rising discount rates. Some stock-specific factors, which we discuss in more detail in the portfolio activity section on page 12, also weighed heavily on returns.

While headline performance for the year was disappointing, the portfolio continued to deliver solid investment income growth with net revenue return per share increasing by 9.2%.

Although headline performance for the year was disappointing, the portfolio continued to deliver solid investment income growth, with net revenue return per share increasing by 9.2%, even as the cost of borrowing rose dramatically. As of 30 September 2023, the portfolio yielded 5.1% (5.6% including the leverage).

Despite the challenges, the outlook for the company remains attractive, particularly when accounting for current discounts, as decarbonisation and electrification trends continue to gather momentum. A degree of indiscriminate selling across the infrastructure and utilities sector also opens up opportunities for Jean-Hugues and his team, who have been proactive in positioning the portfolio for future growth.

Valuations to the fore

To recap, although EGL’s NAV and share price have increased by 8.8% p.a. and 10.7% p.a. since inception (to 31 December 2023), globally, the utilities and infrastructure sectors have been underperforming wider market indices for some time now. These sectors have been weighed down by rising costs of capital, which lower the present value of long-term cash flows and also increase the costs of financing growth. In some cases (mainly outside of Europe), a lack of cost hedging (such as supplier contracts to mitigate rising inflation) and inflation indexation has also weighed on returns.

Readers may wish to refer to our earlier notes, a list of which is provided on page 21.

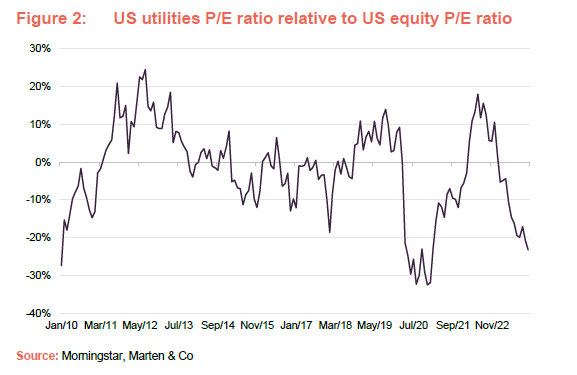

As a result, in the US, only financials trade on a cheaper price/earnings (P/E) multiple at the sector level, and although returns have held up better in Europe and the UK, they still trade at a discount to their own historical averages. Certainly, a degree of re-pricing is expected given the broad impacts of one of the fastest-tightening cycles in history, and the traditional perception of utilities as a bond proxy (shares that trade like bonds, offering stable returns). However, the current sell-off appears to be far detached from the fundamental realities, especially when we consider the earnings resilience of many of these companies.

The current sell-off appears to be far detached from the fundamental realities.

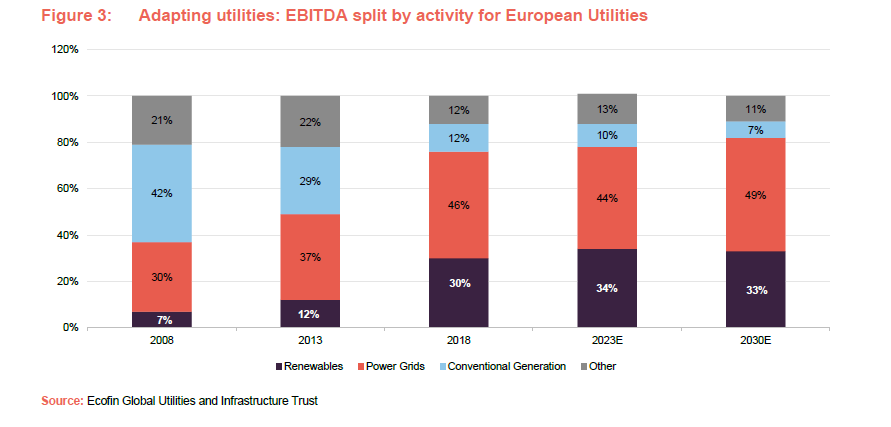

As the managers highlight and Figure 3 shows, the business models of modern utilities are rapidly adapting to a world which increasingly prioritises decarbonisation, and in many cases bear little resemblance to the lumbering oil and gas utilities of old, both in terms of revenue composition and asset mix.

The UK generates less than 1% of its power from coal compared to 48% back in 2008.

As an example, today, the UK generates less than 1% of its power from coal compared to 48% back in 2008 and this increasing focus on renewables means that companies benefit from a high portion of regulated and/or contracted cashflows (agreements which specify prices, generally over a prolonged period), reducing the risk because of highly visible and increasingly stable earnings. Often, these are also indirectly linked to inflation, due to positive exposure to commodity prices, offering valuable diversification and an upward skew to returns in periods of elevated volatility and inflation, as we have seen recently.

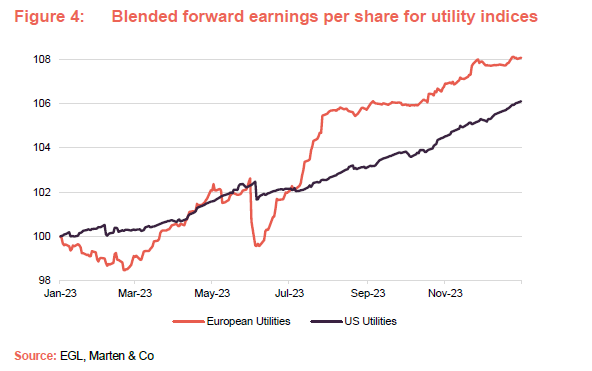

So, while capital was flowing out of the utilities and infrastructure sectors into areas such as money market funds (low risk, cash equivalent securities) and more defensive positioning overall in 2023, this has happened against a backdrop of a rising earnings for many of the companies that EGL invests in.

In addition to broader inflation uplifts, contracted power prices for new projects are adjusting upward even as the dramatic power price volatility seen throughout 2022 has moderated, driven, in part, by broader uncertainty and higher costs of capital. Many companies have been able to leverage this, forward selling power at prices which are significantly higher than those embedded in analysts’ current forecasts, dramatically increasing both the visibility and absolute level of earnings over the next few years. For example, EGL portfolio company, Engie, recently reported forward selling prices for a large proportion of its volumes for the next three years at prices between €100/MWh (2023) and €152/MWh (2025). These significantly exceed prices used in analysts’ earnings forecasts, which sit closer to the region of €60/MWh.

Engie reported forward selling prices for the next three years at prices between €100/MWh (2023) and €152/MWh (2025).

Such opportunity may be temporary (European power prices have been weak recently, notably due to declining natural gas prices), but no doubt the sector’s majors will have secured a non-negligible proportion of their medium-term profits

Looking ahead

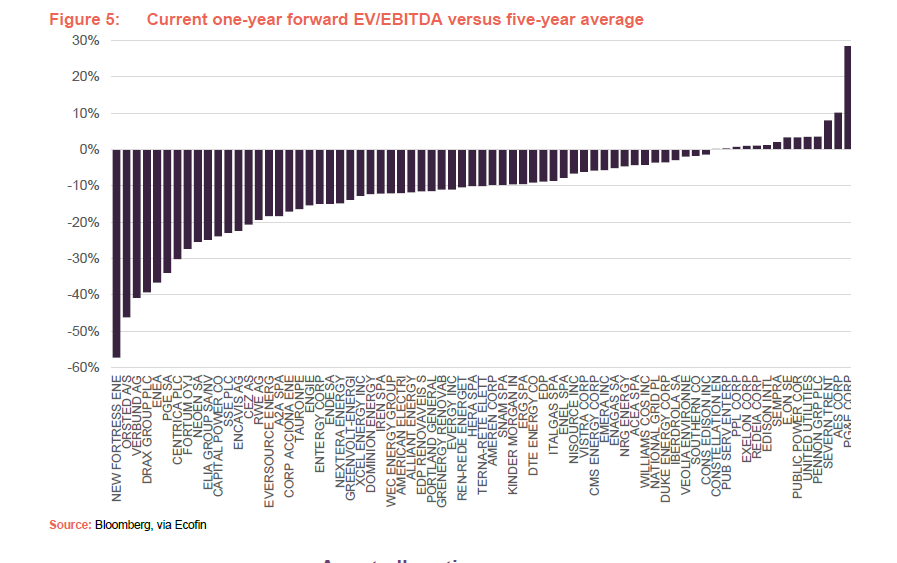

For EGL, ongoing earnings growth combined with the dramatic rotation out of the utilities and infrastructure sectors has resulted in a substantial de-rating of its portfolio. Figure 5 below illustrates valuations for utilities in major markets relative to their 5-year average. This has occurred at a time when the structural tailwinds driving utilities have arguably never been stronger, providing an attractive entry point for investors looking for reliable, long-term exposure to the energy transition and the broader infrastructure sector.

Asset allocation

Since we last published, there have been just modest changes to EGL’s geographic and sector allocations, however these mask a considerable amount of activity within the portfolio. Exposure to continental Europe increased thanks predominantly to the outperformance of the portfolio’s pan-European utilities, which as a rule benefitted from retail power markets and significant transmission and distribution businesses where returns are sustained by regulators. This increase occurred even though the manager was taking profits in several pan-European holdings during the period which had performed well on an absolute and/or relative basis, to allocate additional funds to US utilities which, as a sector, had underperformed significantly.

Share prices in EGL’s North American portfolio, especially the renewables developers, were weighed down by rising interest rates, supply chain disruptions, and permit delays which damaged sentiment much more than earnings in most cases. Disappointingly, these factors weighed on some of the portfolio’s largest holdings, as we discuss in detail on page 13.

Allocations to the rest of the world (other OECD plus emerging markets, i.e. China currently) also fell slightly, due predominantly to the underperformance of the portfolio’s small Chinese investments which include wind, solar and water supply companies.

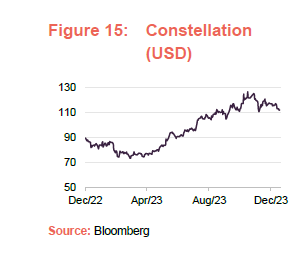

Interestingly, within the company’s sectoral allocations, the combined renewables and nuclear exposure fell due to the factors mentioned above. However, at the underlying level, there was a considerable dispersion in returns. Constellation was among the best performers in the portfolio thanks largely to its nuclear assets.

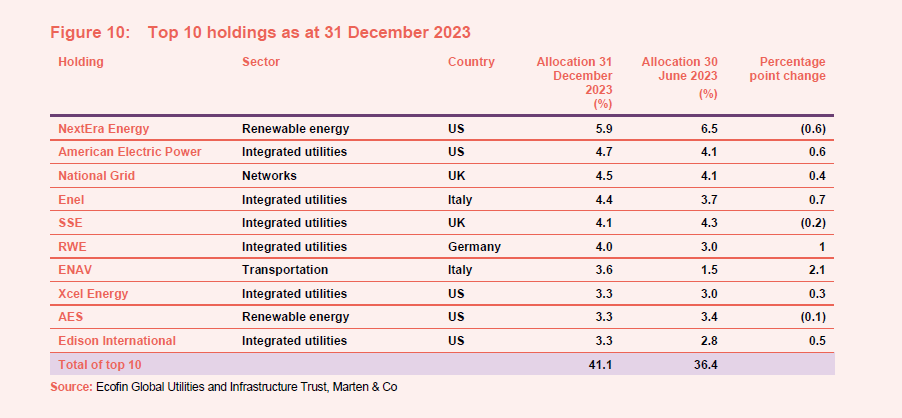

Top 10 holdings

Since we last published, RWE, Edison, and Xcel Energy have moved into the list of EGL’s top 10 largest holdings, with DTE, DRAX, and Exelon dropping out. Whilst no longer in the top 10, each remain in the portfolio. Exposure to DTE fell due to some profit taking, while Exelon was reduced further due to unusually harsh rate case decisions in Illinois, with low electric returns on equity (ROEs) and the rejection of the company’s grid investment plans there. DRAX suffered from a lack of clarity on subsidies and approvals for its bioenergy with carbon capture and storage project which led to a period of underperformance.

Readers interested in other names in the top 10 should see our previous notes (see page 21 for a list of these).

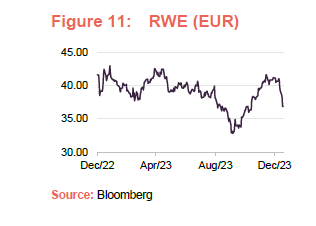

RWE

Earlier in the year, Jean-Hugues had reduced EGL’s position in RWE (RWE.com) as he felt that the company could suffer from its large exposure to power generation. This turned out to be prescient as the stock fell during the month of September before recovering over the next few months. Despite taking some profits, RWE remained a high conviction pick thanks to a dramatic operational transition which has seen it become one of the world’s largest renewable energy producers. Notably, the September fall in RWE stock actually corresponded with a considerable rise in the company’s earnings outlook and the managers took the period of share price weakness as an opportunity to add exposure once more.

The company continues to add to its already impressive scale, investing heavily in its M&A pipeline and in March 2023, closed the $6.8bn acquisition of Consolidated Edison’s clean energy business, doubling its presence in the US and making RWE the second largest solar owner-operator in North America.

Following its 2023 capital markets day in November, the company released a strategic update that included a fully funded investment plan worth €55bn that is expected to treble the company’s installed capacity of renewables by 2030. In addition, the announcement of a targeted EBITDA compound annual growth rate (CAGR) of 14% through to 2030 highlights the potential upside of the company, which continues to trade at a very attractive valuation, well below peer group and broader market multiples.

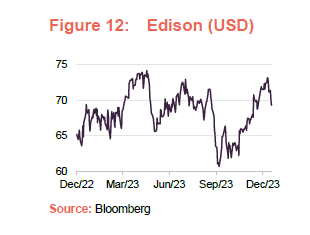

Edison International

Edison (edison.com) was a new name added to the portfolio in the summer to broaden and increase the portfolio’s US utility exposure. It was added to on weakness following a drop it its share price earlier in the year.

The company is one of the largest pure play electric transmission and distribution providers in the US. Operating through its principal subsidiary, Southern California Edison (SCE), it is a targeted play on California and its aggressive clean energy goals, with considerable investment required to upgrade its power grid to cope with the demands of the renewable transition. For example, Jean-Hugues notes that the company forecasts an 80% increase in electrical demand by 2045, due to 90% of vehicles and 95% of buildings going electric. To serve this load, the grid will need to expand to handle three times the clean energy flowing today, which means new transmission and distribution grid projects will need to be added at four times and 10 times their historical rates, respectively.

Despite ongoing fundamental execution and rapidly accelerating thematic tailwinds, the company has struggled over the last few years in part due to the continuing overhang of lawsuits initiated against SCE following the California wildfires, which remain unresolved. However, recent developments have been promising, particularly the announcement of a deadline for the completion of claims against SCE by February 2024.

Edison has also noted that it has made substantial progress in settling claims and moving toward recovering related costs. The company has also gone to great efforts to mitigate future wildfire related impacts through grid hardening and other programmes, which it claims will reduce its risk of losses from catastrophic wildfires by 85%.

With the pending resolution of legal challenges, and the threat of further impacts from wildfires greatly diminished, there appears to be considerable upside for the company which continues to trade at earnings and cashflow multiples below its peer group and its own historic averages. In addition, Edison remains positioned to benefit from the considerable investment associated with grid decarbonisation, particularly in California, with estimates suggesting that around $30bn needs to be invested in the state’s transmission system up to 2040 and a further $54bn in energy storage capacity. This is expected to drive earnings growth from 2025 through to 2028 of around 5-7%, a figure which seems conservative given the scale of the development required.

Portfolio activity and new holdings

Since our most recent note, the managers have been carefully balancing their desire to capitalise on current depressed valuations with the rising cost of borrowing, which in some markets was north of 6%, compared to around 1% previously. As such, Jean-Hugues and the team have maintained gearing at around 10% (or lower, at times) and have taken profits from several strong performers to fund acquisitions that they view as having a greater degree of risk-adjusted upside. Although at the margins, trimming profits from winning positions is a slight departure from the traditional targeted, high-conviction approach, it appears to be a sensible one given the increasingly attractive investment opportunities on offer. The dispersion of returns across the global infrastructure and renewables sectors also highlights the benefits of EGL’s broad investment remit, allowing the managers to take advantage of opportunities, such as excessive swings in sentiment, without restriction.

Transactions that returned a significant amount of cash back to the portfolio included a SPAC (special purpose acquisition company) deal where the managers deemed the ultimate takeover target as being outside EGL’s area of focus, and the takeover of TransAlta Renewables, which was bid for by its parent company. The position in Endesa was also sold outright.

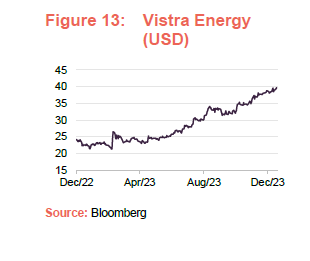

These moves were offset by the addition of new holding, Vistra Energy, in November along with top-ups to existing high conviction holdings on the recent share price lows including: AEP, Southern, Ameren, Terna, E.ON, RWE, Edison International, EDP, Drax, Engie and Enel.

Vistra Energy

Jean-Hugues and the team note that the new name, Vistra Energy (Vistra.com), is a targeted play on the undervaluation of US utilities as well as the growing opportunity in the Texas Energy market.

The company maintains a well-diversified, integrated model with over 90% fully dispatchable generation (i.e., power supplied to the grid can be turned on or off as required), providing baseload power (the minimum level of demand on an electrical supply system over 24 h) which is crucial for the successful development of broader renewable use. 46% of its generation capacity is located in Texas, an increasingly attractive destination for baseload generation as traditional thermal sources continue to be replaced by renewables, and the managers expect this to lead to structurally higher power prices going forward.

Fundamentally, the company boasts one of the strongest free cash flow yields in the sector, providing the foundation for its strong balance sheet and buyback program, which amounts to around 10% of its market cap. Relatively low gearing helps insulate the company from rising rates, as does an earnings outlook that continues to improve.

- The company has been actively transitioning its power generation profile over the last few years, with a particular focus on retail and, more recently, nuclear generation following the acquisition of Energy Harbor in March 2023. Capitalising on the Inflation Reduction Act’s nuclear production tax credit, the US$3.43bn deal creates the second largest nuclear fleet in the US, greatly increasing Vistra’s clean energy generation capability, while also adding to its growing energy storage portfolio. The deal is particularly notable given that it reduces some of the overhang from Vistra’s legacy fossil assets that have long been a concern for some analysts.

These factors may have contributed to the company’s current valuation which remains well below wider sector averages. Given the rapidly improving outlook and ongoing execution, this appears to be a very attractive opportunity.

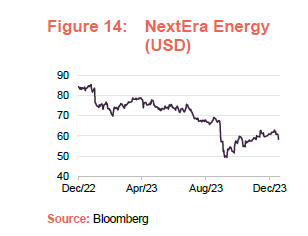

NextEra Energy

NextEra Energy (nexteraenergy.com) remains EGL’s largest position, accounting for 5.7% of the fund as of 30 November 2023. It has long been a pillar of the portfolio and has therefore been covered in our research on multiple occasions over the years. However, it bears mention again, given its share price set back and the effects this has had on both the EGL portfolio and the broader sector.

As the world’s largest electric utility, and the largest generator of energy from wind and solar in the world, NEE trades as a bellwether for the broader renewables sector, and as such, was hit hard by the sudden steepening at the long end of the US treasury curve which we have discussed throughout this note.

Unfortunately, the negative impact on NEE was compounded by an announcement from one of its subsidiaries, NextEra Energy Partners (NEP). Following the dramatic shift in yields, NEP wrong-footed the market by significantly lowering its growth ambitions and halving its target dividend growth rate from 12-15% to 5-8% p.a. for the next few years (bringing its growth rate in line with peers) in order to eliminate the need to raise equity while reducing its reliance on debt. This set off a very sharp slide in its shares and those of NEE, despite accounting for just a fraction of the parent company’s market cap. The effect on NEE went well beyond the direct mechanical impact of the announcement, raising question marks around the company’s financing and the sustainability of its growth in the current environment. For EGL, this episode removed about 2% from its NAV.

Crucially, for sentiment and some relief on sector multiples, NEE proceeded to deliver an impressive third quarter update, reconfirming earnings guidance of 6-8% p.a. and dividend growth of 10% p.a. out to 2026. This helped reassure the market of its growth trajectory, balance sheet, and the advantages of scale for renewables development, although the company still remains down 29.2% over the past year.

Constellation Energy

A recent top 10 holding until the team took profits in December, Constellation Energy (constellation.com) owed its ascent in EGL’s portfolio rankings to an impressive return of 46% over 2023, making it one of the top performers in the portfolio. Founded early in 2022 after a spin-off from Exelon, the company boasts the largest and most reliable clean energy fleet in the US including nuclear, solar, wind, and hydro, producing about 10% of the country’s carbon-free generation. CEG owns the largest nuclear fleet in the US and is investing heavily in the expansion of this capability, recently announcing the acquisition of 44% of the South Texas Project, expanding their annual nuclear production to approximately 180 TWh (180m MWh).

On top of its existing balance sheet strength and impressive free cash flow growth, the company is constantly pushing the boundaries with considerable investments in clean hydrogen, nuclear energy, and other innovations which have the potential to lift earnings dramatically going forward. One such example is its recent Carbon-Free Energy Matching strategy, which has seen contracts put in place with Commonwealth Edison and Microsoft. To date, many companies pursuing zero emissions still struggle to completely remove electricity from carbon-emitting power plants due to the volatility of renewable supply and demand. Utilising its diversified generation, supply management and data analytics capabilities, CEG is able to bridge the gap between a company’s real-time electricity demand and available carbon-free power sources, setting the standard for how companies across the U.S can achieve real emissions reductions. You can learn more about this process here. CEG also achieved a recent milestone with the Department of Energy awarding a $1bn grant to the Midwest Hydrogen Hub, which will contribute to costs of CEG’s LaSalle project, the world’s largest nuclear-powered hydrogen production facility. Whilst still a developing resource, the technology has almost unlimited potential to revolutionise global energy use.

With secular tailwinds, including well-documented fiscal support from the Inflation Reduction Act, and a management team driving innovation, CEG sits at the forefront of the renewable transition. Whilst shares trade at a slight premium to its peers, the valuation remains well below broader market averages and impressive growth prospects should see these multiples fall even more going forward.

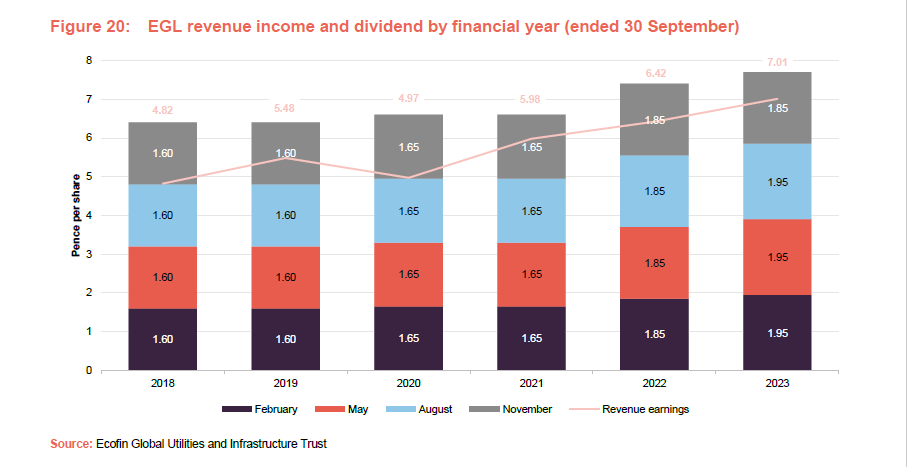

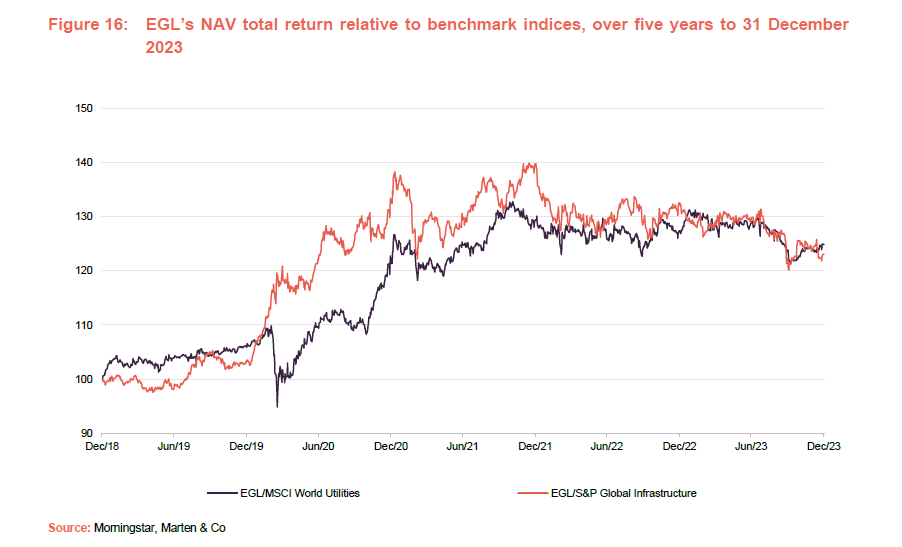

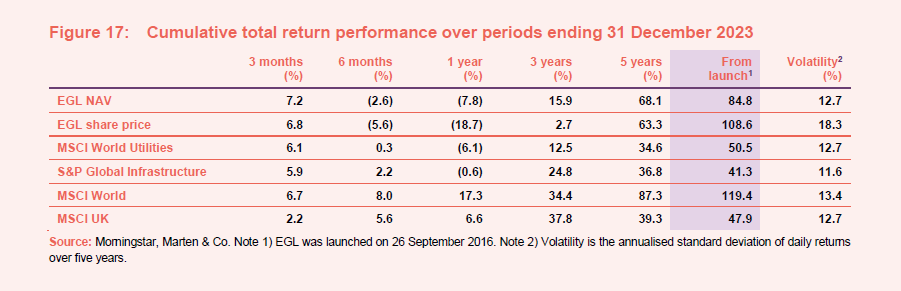

Performance

Despite recent challenges, EGL’s long-term performance remains well ahead of both the wider utilities and infrastructure sectors, highlighting the benefits of its diversified portfolio and the managers’ efforts.

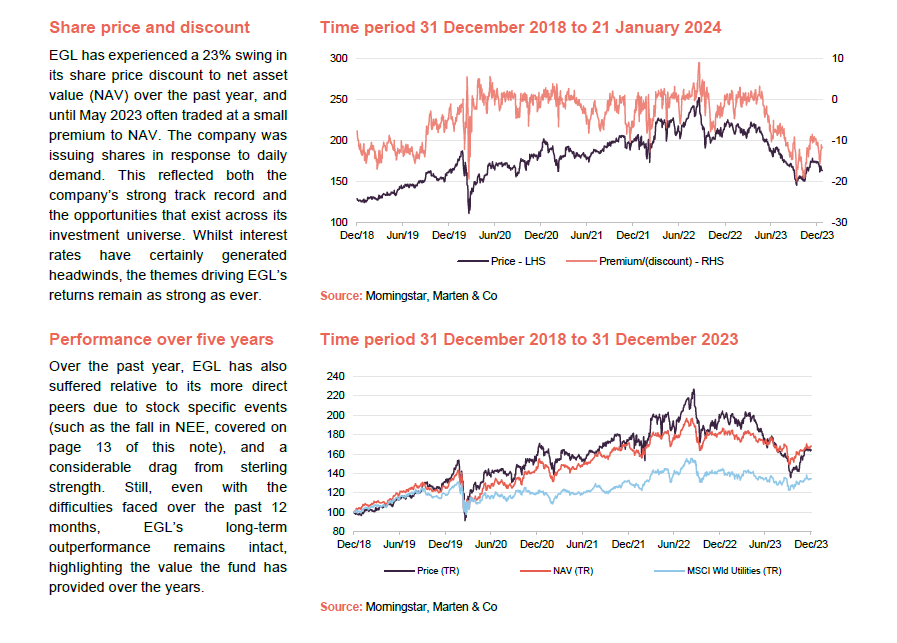

Figure 16 highlights the extent of the divergence that has opened up across global markets over the last year, with the returns of the MSCI World index in stark contrast to the other sectors shown in the chart, thanks to the AI bonanza which dragged global indices upward through 2023. Over the past year, EGL has also suffered relative to its more direct peers due to stock specific events (such as the fall in NEE, covered on page 13 of this note), and a considerable drag from sterling strength. Still, even with the difficulties faced over the past 12 months, EGL’s long-term outperformance remains intact, highlighting the value the fund has provided over the years.

Up-to-date information on EGL is available on the QuotedData website.

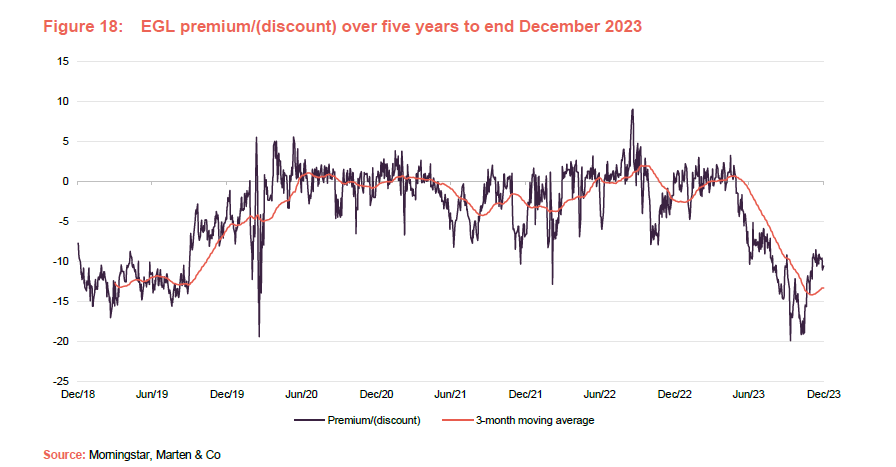

Premium/(discount)

Over the 12 months ended 31 December 2023, EGL’s shares have traded between a 19.9% discount to NAV and a 3.2% premium. The average over that period was a 6% discount. As of publishing, EGL was trading at a 13% discount

EGL has experienced a 23% swing in its discount over the past year.

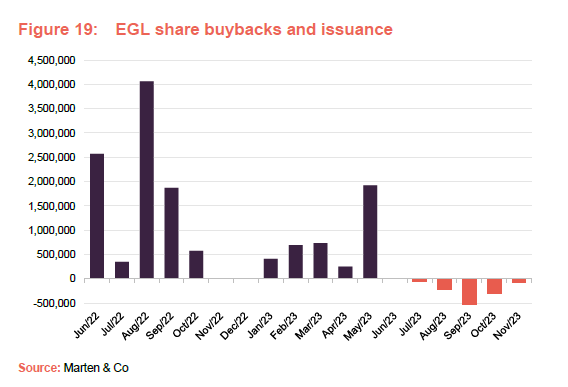

EGL has experienced a 23% swing in its discount over the past year, and until May 2023 often traded at a small premium to NAV (and the company was issuing shares in response to daily demand). This reflected both the company’s strong track record and the opportunities that exist across its investment universe, particularly relating to the energy transition and the renewal of infrastructure. Whilst interest rates have certainly generated headwinds for the sector, the secular themes driving returns remain as strong as ever, and in many cases have only accelerated as the urgency and required investment for alternative energy sources and sustainable infrastructure become even more clear.

As we have highlighted, the indiscriminate selling across the infrastructure and utilities sector and in EGL in particular has gone well beyond the mechanical impact of higher rates. Although this has certainly led to some short-term headaches, it has created opportunities and we have seen the managers of EGL be proactive, capitalising on depressed valuations in the sector and laying the foundation to continue its long track record of outperformance. Investors can benefit too, with the company trading at a significant discount to long-term averages, which looks increasingly attractive given its outlook

As Figure 18 highlights, EGL was steadily issuing shares over 2022 and the first part of 2023 with the company trading at a small premium. However, with the shares swinging to a discount, the board has authorised the repurchase of almost 1.5m shares since June 2023.

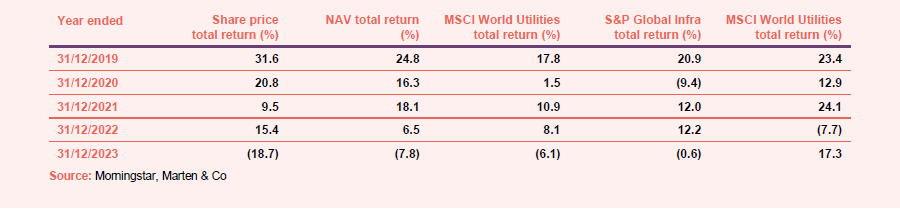

Dividend

As Figure 20 shows, EGL has tended to pay an uncovered dividend in recent years, supplementing its net revenue with modest amounts from its distributable reserves. These reserves are substantial, amounting to £114m at the end of September 2023. Therefore, in our view, there is minimal likelihood that the board would feel it was unable to pay its target dividend, as is evidenced by its actions in 2020 when COVID knocked companies’ distributions.

Supporting this is the ongoing growth of EGL’s investment income, with revenue return per share increasing by 9.2% year-over. Due to confidence in its growth prospects, the company also announced an increase in its quarterly dividend to 2.05p per share (8.20p per annum) with effect from the dividend to be paid in February 2024. At the current share price and increased dividend rate, the company’s shares yield around 4.94%.

Fees and costs

Under the terms of its investment management agreement, Ecofin Advisors Limited is entitled to a management fee of 1% per annum of EGL’s net assets up to £200m, and 0.75% per annum of net assets thereafter. The management fee is calculated and paid quarterly in arrears. There is no performance fee. For accounting purposes, with effect from 1 October 2022, the management fee and borrowing costs are allocated 60% to the capital account and 40% to the revenue account.

Aside from the management fee and the directors’ fees (which are listed on

page 20), the main expenses incurred by EGL relate to administration, depositary and legal and advisory fees. BNP Paribas Securities Services S.C.A., London branch, provides administrative services to EGL; Apex Fund Administration Services (UK) Limited, is EGL’s company secretary; Citibank UK limited acts as EGL’s depositary; Citigroup Global Markets Limited acts as EGL’s prime broker and custodian; and EGL’s solicitors are Norton Rose Fulbright LLP.

For the 2023 financial year, the ongoing charges ratio decreased to 1.27% from 1.35%.

Capital structure

EGL has a simple capital structure with one class of ordinary share in issue. EGL’s ordinary shares have a premium main market listing on the LSE and, as at 31 December 2023, there were 115,115,663 in issue with none held in treasury.

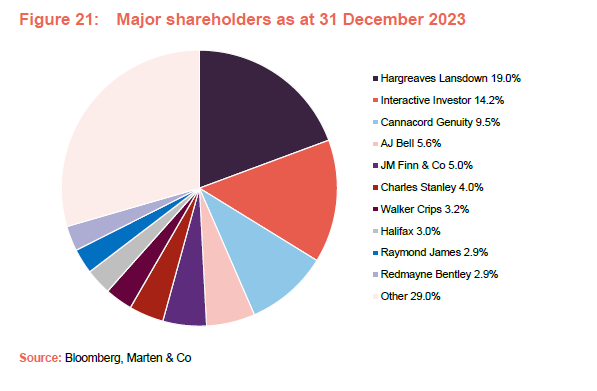

Diversified share register

EGL’s share register is well diversified with an array of institutions, private wealth managers and retail holders. The top 10 largest investors accounted for 71% of EGL’s issued share capital as at 31 December 2023.

Gearing

EGL’s manager has discretion to borrow up to 25% of EGL’s net assets, but its articles of association state that it will not have any structural gearing.

EGL has a has a prime brokerage facility with Citigroup Global Markets Limited and benefits from a flexible borrowing arrangement. The interest rate on borrowings under the Prime Brokerage Agreement depends on the currency of the borrowing but is generally 50bps over the applicable benchmark rate. Citigroup introduced a minimum monthly fee for its services, equivalent to $200,000 per annum, effective 1 April 2022. The gearing is not structural in nature and borrowings can be repaid at any time. As at 31 December 2023, the level of gearing was 7.7%.

Unlimited life with five-yearly continuation votes

EGL has been established with an unlimited life, but offers its shareholders a continuation vote at five-yearly intervals. The last continuation vote was conducted at the AGM in March 2019. The resolution was passed with 97.5% of votes cast in favour of continuation. The next continuation vote is scheduled for the company’s AGM in March 2024.

Financial calendar

The trust’s year-end is 30 September. The annual results are usually released in December (interims in May) and its AGMs are usually held in March of each year. EGL pays quarterly dividends on the last business day of February, May, August and November each year.

Board

EGL’s board is composed of four directors, all of whom are non-executive and are considered to be independent of the investment manager. The board has undergone a modest refresh recently with the appointment of Joanna Santinon as a non-executive director of the company on 12 September 2023. Joanna, an experienced accountant and financial professional, will become the chair of the audit committee when Iain McLaren retires from the board at the AGM in March 2024.

EGL’s articles of association require that all board members offer themselves for re-election annually and limit total directors’ fees to £200k per annum. Other than EGL’s board, its directors do not have any other shared directorships.

David Simpson (chairman)

David is a qualified solicitor and was a partner at KPMG for 15 years until 2013, culminating as global head of M&A. Before that, he spent 15 years in investment banking, latterly at Barclays de Zoete Wedd Ltd. He is chairman of M&G Credit Income Investment Trust Plc, and a director of Aberdeen New India Investment Trust Plc, the British Geological Survey and ITC Limited, a major listed Indian company. David was appointed as a director of the company at admission on 26 September 2016.

Iain McLaren (Audit Committee chairman and senior independent director)

Iain is a chartered accountant and was a partner at KPMG for 27 years, including senior partner in Scotland from 1999 to 2004, retiring from the firm in 2008. He is a director of Wentworth Resources plc and of Jadestone Energy Inc. He is a past president of the Institute of Chartered Accountants of Scotland. Ian was appointed as a director of the company at admission on 26 September 2016.

Malcolm (Max) King (chairman of the remuneration committee and director)

Max is a chartered accountant and has over 30 years’ experience in fund management having worked at Finsbury Asset Management, J O Hambro Capital Management and Investec Asset Management. He is also a columnist for MoneyWeek magazine. Max is currently a director of Gore Street Energy Storage Fund Plc. He was appointed as a director of the company on 11 September 2017.

Susannah Nicklin (chair of the management engagement committee and director)

Susannah is an experienced non-executive director and financial services professional with 25 years of experience in executive roles in investment banking, equity research and wealth management at Goldman Sachs and Alliance Bernstein in the US, Australia and the UK. Susannah is chair of the Schroder BSC Social Impact Trust Plc and a non-executive director of Baronsmead Venture Trust Plc, The North American Income Trust Plc and Frog Capital LLC. She holds the Chartered Financial Analyst qualification. Susannah was appointed as a director of the company on 9 September 2020.

Joanna Santinon (Non-executive Director)

Joanna is a chartered accountant and chartered tax adviser. She specialised in tax, transactions and private equity, and gained wider experience including mergers and acquisitions, strategic investments, capital raisings and listings in her 24-year career at EY. Joanna was a founder member of the 30% Club in the UK. She is a non-executive director and audit committee chair of Octopus Future Generations VCT Plc and of Guinness VCT Plc. She is also a trustee of The Centre For Entrepreneurs. Joanna was appointed as a director of the company on 12 September 2023.

Previous publications

Figure 23: QuotedData’s previously published notes on EGL

| Title | Note type | |

| Structural growth, low volatility and high income | Initiation | 23 May 2017 |

| Delivering the goods | Update | 9 November 2017 |

| On the contrary… | Update | 29 March 2018 |

| Staying nimble | Annual overview | 15 October 2018 |

| Unrecognised outperformance | Update | 11 April 2019 |

| Compelling three-year track record | Update | 17 October 2019 |

| Resilient income | Annual overview | 25 June 2020 |

| A wealth of opportunities | Update | 16 December 2020 |

| Happy birthday to ya! | Annual overview | 28 October 2021 |

| A portfolio for all seasons | Update | 22 November 2022 |

| Utilities and infrastructure at low tide | Update | 22 August 2023 |

Source: Marten & Co

Readers interested in further information about EGL may wish to read some of the earlier notes that we have published, a list of which is provided above

Appendix – investment process

EGL’s portfolio is managed using an investment process that is driven primarily by bottom-up stock selection, based on extensive fundamental research of potential investments, which is coupled with a top-down overlay that informs the overall geographical and sector positioning.

Idea generation

Ideas are generated through a number of sources, both quantitative and qualitative. Analysis of industry drivers and subsector trends direct the manager and analysts’ research effort, informing them on where to look for potential opportunities.

Ecofin is a recognised specialist in the utilities and infrastructure space.

Further to this, Ecofin is a recognised specialist in the utilities and infrastructure space, and due to its strong reputation, management teams of investee or potential investee companies are keen to meet the Ecofin team. EGL’s manager says that this supports ideas generation, and with its access to management teams, Ecofin is able to undertake superior analysis and gain stronger insight than a non-specialist manager might be able to achieve.

Analysis

Ecofin does not rely on sell-side analysts’ estimates, and instead conducts its own in-house research and builds its own proprietary models. This allows it to identify situations where it has a different view to that of the market and where there may be a potential opportunity.

Portfolio construction

EGL maintains a diversified portfolio of between 40 and 60 holdings. Position sizes will typically range between 1.25% and 5.0% and are determined by the manager’s assessment of risk versus reward. A position could be outside these bounds where, for example, the manager is working to increase or reduce a holding or has a particularly strong view. However, the manager is disciplined in trimming holdings as they rise (although the formal limit is 15% of NAV, the manager says that 8% is his limit as he wants to avoid a situation where one position dominates the portfolio). The manager expects portfolio turnover per annum to be in the range of 40–60%.

EGL’s manager is agnostic on the split between utilities and infrastructure.

When constructing the portfolio, no consideration is given to the split between utilities and infrastructure – the manager is looking for the best opportunities at any given time, but likes to maintain a balance between regulated and unregulated exposures. The portfolio is constructed to have what the manager describes as ‘defensive growth’ characteristics.

Risk management

The performance of the company depends primarily on the investment strategy, asset allocation and stock selection decisions taken by the manager within the parameters and constraints imposed by the company’s investment policy. The investment policy guidelines can only be materially changed by proposing an ordinary resolution at a general meeting for shareholders’ approval. The company invests in securities which are listed on recognised stock exchanges so that it is regularly exposed to market risk and the value of the company’s portfolio can fluctuate, particularly over the short term, in response to developments in financial markets. The board has put in place limits on the company’s gearing, portfolio concentration, and the use of derivatives, which it believes to be appropriate to ensure that the investment portfolio is adequately diversified and to manage risk. The board meets formally at least four times a year with the investment manager to review the company’s strategy and performance, the composition of the investment portfolio and the management of risk.

Investment restrictions

The company’s assets are primarily invested in the equity and equity-related securities of utility and infrastructure companies in developed countries, although up to 10% of the portfolio may be composed of investments in debt securities and a significant portion of the portfolio may also comprise holdings in cash or cash-equivalents from time to time.

For the purposes of investment, utility companies are those involved in the generation, transmission and distribution of electricity, including the production of electricity from renewable sources; the transport, storage and distribution of gas; the abstraction, treatment and supply of water and the treatment of wastewater; and the provision of environmental services such as recycling and waste management. Infrastructure companies are those that own and operate assets which are essential to the functioning of developed economies and to economic development and growth, notably transportation-related assets such as roads, railways, ports and airports.

The portfolio is diversified with respect to geography and sub-sectors of the global utility and infrastructure investment universe. While the portfolio comprises principally investments in companies listed on recognised stock exchanges in the UK, Continental Europe, the US, Canada and other OECD (Organisation for Economic Co-operation and Development) countries, the company may invest up to 10% of the portfolio, at the time of acquisition, in the securities of companies quoted on recognised stock exchanges in non-OECD countries.

The total of the company’s investments in the US may amount to 60% of the portfolio and, with the approval of the directors, that limit may be increased to 70%. The limit for each other country is 40%, although it is highly unlikely that these limits will be reached. Up to 15% of the portfolio may be composed of investments in collective investment vehicles, including UK investment companies.

The company does not invest in any collective investment vehicles managed by the investment manager or its affiliates. Other investment policy restrictions include:

- Single investments by the company must not exceed 15% of the portfolio;

- No unquoted investments, save for bond or derivative instruments which are typically not listed;

- The company does not invest in telecommunications companies, nor in companies which own or operate social infrastructure assets funded by the public sector such as schools, hospitals or correctional facilities; and

- No early-stage listed companies which involve significant technological or business risk.

IMPORTANT INFORMATION

Marten & Co (which is authorised and regulated by the Financial Conduct Authority) was paid to produce this note on Ecofin Global Utilities and Infrastructure Trust Plc.

This note is for information purposes only and is not intended to encourage the reader to deal in the security or securities mentioned within it.

Marten & Co is not authorised to give advice to retail clients. The research does not have regard to the specific investment objectives financial situation and needs of any specific person who may receive it.

The analysts who prepared this note are not constrained from dealing ahead of it, but in practice, and in accordance with our internal code of good conduct, will refrain from doing so for the period from which they first obtained the information necessary to prepare the note until one month after the note’s publication. Nevertheless, they may have an interest in any of the securities mentioned within this note.

This note has been compiled from publicly available information. This note is not directed at any person in any jurisdiction where (by reason of that person’s nationality, residence or otherwise) the publication or availability of this note is prohibited.

Accuracy of Content: Whilst Marten & Co uses reasonable efforts to obtain information from sources which we believe to be reliable and to ensure that the information in this note is up to date and accurate, we make no representation or warranty that the information contained in this note is accurate, reliable or complete. The information contained in this note is provided by Marten & Co for personal use and information purposes generally. You are solely liable for any use you may make of this information. The information is inherently subject to change without notice and may become outdated. You, therefore, should verify any information obtained from this note before you use it.

No Advice: Nothing contained in this note constitutes or should be construed to constitute investment, legal, tax or other advice.

No Representation or Warranty: No representation, warranty or guarantee of any kind, express or implied is given by Marten & Co in respect of any information contained on this note.

Exclusion of Liability: To the fullest extent allowed by law, Marten & Co shall not be liable for any direct or indirect losses, damages, costs or expenses incurred or suffered by you arising out or in connection with the access to, use of or reliance on any information contained on this note. In no circumstance shall Marten & Co and its employees have any liability for consequential or special damages.

Governing Law and Jurisdiction: These terms and conditions and all matters connected with them, are governed by the laws of England and Wales and shall be subject to the exclusive jurisdiction of the English courts. If you access this note from outside the UK, you are responsible for ensuring compliance with any local laws relating to access.

No information contained in this note shall form the basis of, or be relied upon in connection with, any offer or commitment whatsoever in any jurisdiction.

Investment Performance Information: Please remember that past performance is not necessarily a guide to the future and that the value of shares and the income from them can go down as well as up. Exchange rates may also cause the value of underlying overseas investments to go down as well as up. Marten & Co may write on companies that use gearing in a number of forms that can increase volatility and, in some cases, to a complete loss of an investment.