Rights and Issues Investment Trust

Investment companies | Initiation | 18 April 2023

Under new management, same high conviction approach

Following the retirement of Simon Knott, who managed Rights and Issues (RIII) for 39 years, RIII’s portfolio is now the responsibility of Dan Nickols and Matt Cable, part of the UK small and mid-cap team at Jupiter Asset Management.

The Jupiter team aims to ensure that RIII continues to offer access to a focused portfolio of handpicked UK small and mid-cap companies, though the team expects that RIII will be bolstered by a significant increase in the investment management resource dedicated to the portfolio.

RIII is designed to give investors access to the UK small-cap market, which the team believes is a dynamic one. Dan’s open-ended strategy has generated twice the returns of its benchmark since the start of his tenure in 2004. RIII gives the Jupiter team the opportunity to augment this with the opportunities provided by a closed ended structure, notably the greater ability to hold high-conviction weightings in a more concentrated portfolio.

Concentrated exposure to UK small and mid-caps

RIII’s objective is to exceed the FTSE All Share total return over the long term while managing risk. RIII invests in equities with an emphasis on small and mid companies. UK smaller companies include both listed securities and those admitted to trading on the Alternative Investment Market (AIM).

Fund profile

More information is available on the manager’s website.

Rights and Issues Investment Trust (RIII) aims to generate a total return that exceeds its benchmark index, the FTSE All Share, over the long term while managing risk. The company invests in equities with an emphasis on small and mid-cap (SMID) companies, and UK smaller companies will normally constitute at least 80% of its investment portfolio. For the purposes of RIII’s portfolio construction, UK smaller companies is deemed to include both listed securities and those admitted to trading on the Alternative Investment Market (AIM). The benchmark does not influence portfolio construction.

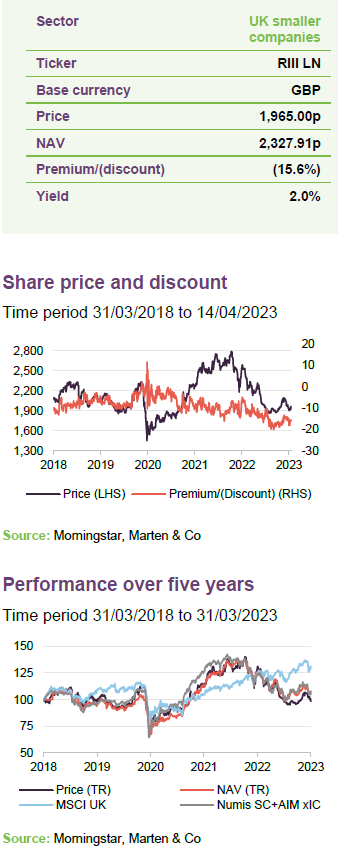

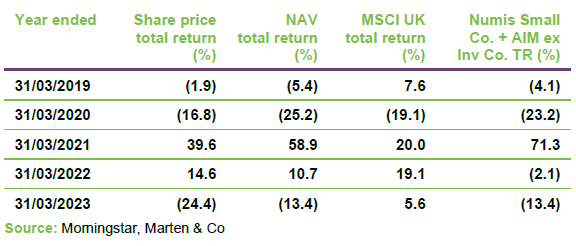

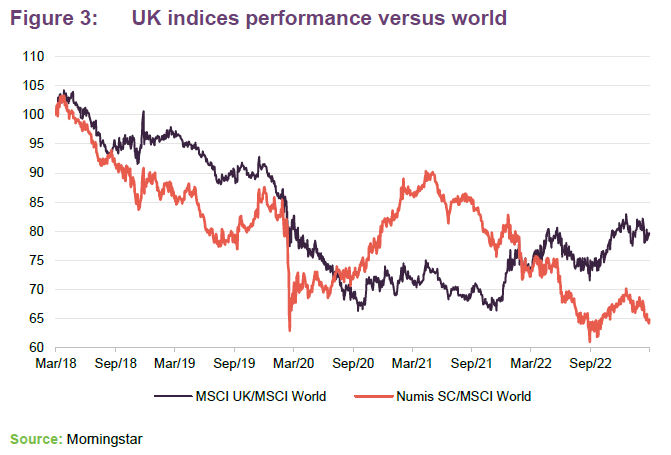

For the purposes of this note, we have used the MSCI UK Index as a proxy for the FTSE All-Share and added a comparison to the Numis Smaller Companies plus AIM ex Investment Companies Index, which is commonly used by its peers and may be more representative of the stocks in RIII’s portfolio.

RIII has, since October 2022, been run by Jupiter Asset Management’s UK SMID team. Dan Nickols is the lead manager and he is supported by Matt Cable (see page 6 for brief biographies of both). This appointment followed the retirement of Simon Knott, who was the in-house investment manager for RIII in its previous incarnation as a self-managed trust.

RIII’s portfolio is currently undergoing a period of heightened turnover, as the Jupiter team adjusts it to reduce the significant overweight positions at the top of the portfolio and to reflect its own investment views. However, the new manager was selected as the board believes that it will follow an approach that offers continuity of style with the one that RIII has followed since launch and for which RIII is well-known (a concentrated portfolio, based on fundamental analysis, constructed with a long-term view), but with more balance in terms of stock weights and with the benefit of the greater resource the Jupiter team has at its disposal. Reflecting this, several previous core holdings are being retained by the team.

The attractions of UK small-cap

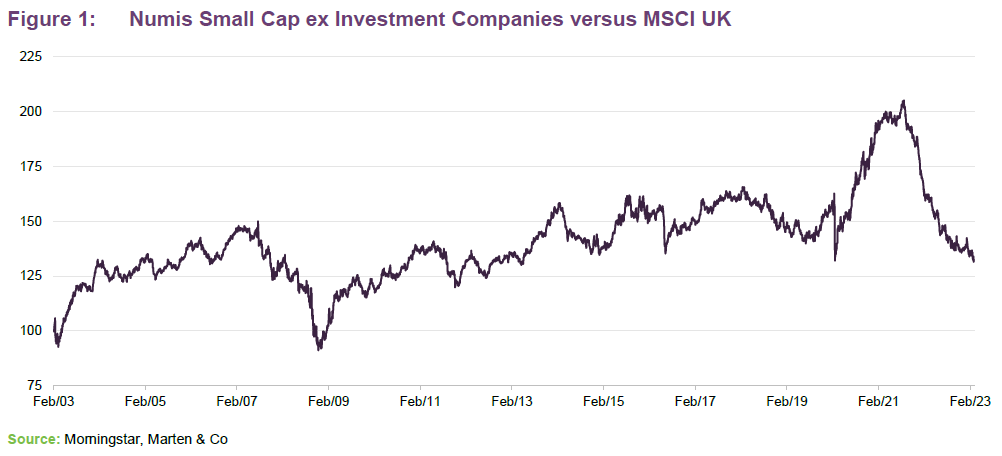

While the arguments for having an allocation to smaller companies as an asset class are well rehearsed, we think that it could be helpful to revisit some of the basics here as well as delving into why UK smaller companies are potentially interesting at present. It is worth noting that, while a lot of attention is given to large cap stocks, the UK small cap universe is significant, representing around 90%, by name, of all of the companies quoted on the London Stock Exchange. This provides UK small cap managers with a varied universe of potential investment opportunities, some of which may offer significant value potential. Jupiter’s SMID cap team point to the fact that these companies employ over two million people and make a significant contribution to the country’s economic output and tax take.

Why allocate to smaller companies?

Perhaps the most important reason for considering an investment in smaller companies is that, while often perceived as being riskier and therefore more volatile, they tend to outperform larger companies over the longer term. This may be due a variety of factors, but a key consideration could be that it is intrinsically easier for a smaller company to grow, perhaps doubling or quadrupling in size, than it would be for a comparable company that is much larger.

Better positioned to exploit a greater number of opportunities

With less complex corporate structures, smaller companies may tend to be nimbler than larger ones. In addition to being better able to exploit opportunities presented to them, it is argued that smaller companies are exposed to a greater volume of opportunities by dint of their size (larger companies, in comparison, will discount a raft of opportunities that are not big enough to shift the dial on their performance). Also, while not universally true, larger companies are more likely to have already been through a growth phase and so tend to be more developed businesses operating in more mature markets. Growth can be harder to achieve where much of this has to come from taking market share from competitors.

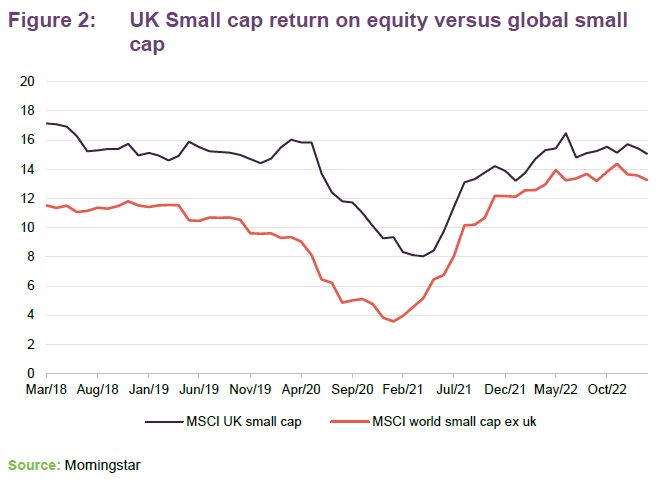

Superior growth and returns on equity as a result

The team believes that reflecting these considerations, SMID companies tend to offer stronger growth potential and high returns on equity than their larger cap peers. In addition, from an investors’ perspective, the SMID cap segment of the market tends to be less well-researched and so is usually less efficient, meaning that there should be greater potential to find mispriced securities, creating the opportunities for those investors that are prepared to do the research to achieve greater capital appreciation and superior returns.

UK SMID cap offers superior ROE to global SMID cap

As is illustrated in Figure 2, while the gap has closed over the last couple of years, UK SMID capitalisation companies offer a higher ROE than that of the global small cap universe. We expand on some of the reasons for this on pages 9 to 11.

A brief history – building on solid foundations

Simon Knott managed RIII for 39 years before retiring in 2022.

RIII has been a mainstay of the UK investment trust world for many years. This is not simply because the trust was listed more than 60 years ago, but because for well over half of its life, it was run by a single manager, Simon Knott. For most of its life RIII was a split capital trust with income shares and capital shares. However, the two classes of shares were merged in June 2016, and since then RIII has had a conventional capital structure.

RIII was, until very recently, a self-managed investment trust. In June 2022, the board announced that Simon Knott would retire on the appointment of a successor, and decided to look externally for a replacement. Simon’s approach to investing, during his 39-year tenure as RIII’s investment director, was one of managing a highly-concentrated, ultra-low-turnover portfolio, with a strong preference for UK smaller companies. At the time that his retirement was announced, then-chairman David Bramwell noted that the NAV of the ordinary shares had increased by 10,371% since Simon’s appointment, compared with a return from the All-Share of just 610%. RIII’s structure is different today (its ordinary share no longer benefits from the gearing provided by the trust’s previous split capital structure), but shareholders may appreciate the continuity that Jupiter’s appointment was designed to bring.

The new management team

Lead investment manager Dan Nickols and co-manager Matt Cable are part of Jupiter’s nine-strong UK SMID team, including a dedicated ESG investment director. The team manages £4bn of client funds in 10 portfolios across six investment strategies. They are supported by Jupiter’s wider investment platform and operational infrastructure.

Dan Nickols

Dan is co-head of Jupiter’s SMID team, having joined the company in 2020 following Jupiter’s acquisition of Merian. His career in the UK smaller companies sector started in 1997 at Old Mutual. Dan has a degree in Modern & Medieval Languages from Cambridge University and is an Associate of the Society of Investment Professionals.

At the time of the announcement of the management change, the board drew attention to Dan’s track record with the Jupiter UK Smaller Companies Fund. From 1 January 2004 (when he took on responsibility for the fund) to 30 April 2022, the fund generated a return of 875.6% compared to 463.6% for the Numis Smaller Companies ex Investment Companies Index.

Matt Cable

Matt joined Jupiter in 2019 as UK smaller companies fund manager, after holding a similar role at M&G for almost 10 years. Prior to his time at M&G, Matt worked in a variety of roles across financial services firms including Travelex, Bank of America and Capital One. He has a degree in Natural Sciences from Cambridge University and is a CFA Charterholder.

Investment process

Bringing greater balance

One of the factors that led RIII’s board to select Jupiter was its understanding that the team’s approach offered a continuity of style with that of Simon’s. As noted above, RIII will continue to maintain a concentrated portfolio, based on fundamental analysis, that is constructed with a long-term view, but the portfolio is expected to be more balanced, which is discussed in greater detail below. The management team also believe that RIII will benefit from the significant resource available to it within the Jupiter network.

A collegiate approach

Most of the team are both portfolio managers and sector analysts. The team says that this means that they work collegiately, inputting into each other’s portfolios. The team is tasked with researching and investing in UK-listed businesses outside the FTSE 100. The universe is fairly broad and stocks are continually being added to it. Stock ideas are put forward to the wider team for consideration and are discussed in weekly team meetings with ideas challenged in an open forum.

Driven by fundamental analysis

As is discussed in greater detail in the stock selection section below, the managers investment process incorporates a mixture of top-down and bottom up considerations, and is driven by extensive fundamental analysis of potential portfolio candidates.

Concentrated ‘high-conviction’ portfolio

20 to 30 high conviction best ideas.

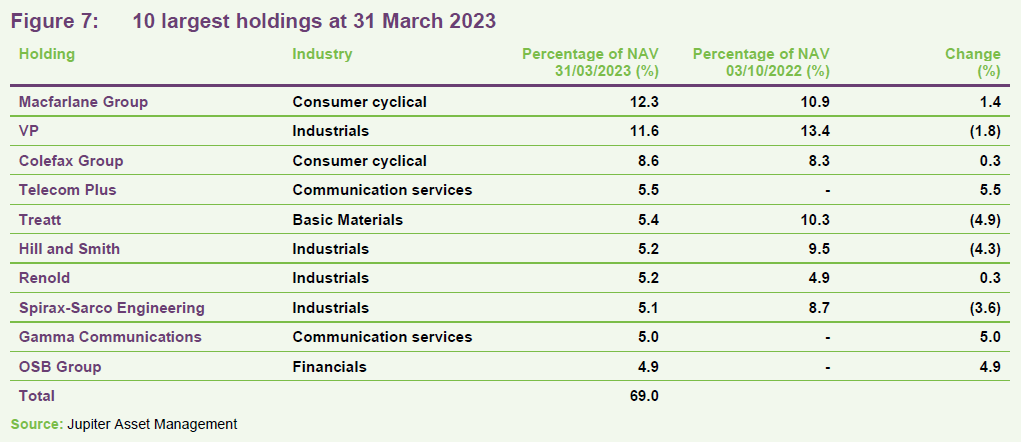

RIII’s portfolio will continue to be a concentrated one, comprising about 20 to 30 stocks, representing the team’s highest-conviction ideas (the other funds that the team manages tend to have about 60 positions). However, there will be a distinct change when compared to the previous approach, where there was a particularly heavy focus on the top few positions (when the managers assumed responsibility for the management of RIII’s portfolio in October 2022, the top ten holdings accounted for 84% of RIII’s assets, but as is illustrated in Figure 7 on page 12, this had fallen to 69% as at the end of March 2022; the managers expect it to fall further).

The previously high level of concentration is very unusual, and the new approach should give the portfolio greater diversification, suggesting that the trust should be less vulnerable to the impact of difficulties occurring within a key holding, while still retaining enough weight to have a significant impact if the managers are correct in their investment thesis.

While discussing portfolio concentration, it is worth noting that the Jupiter team operates with a self-imposed 20% maximum position in a single investment, and the creation of any position size greater than 10% automatically triggers an internal approval process. However, in constructing RIII’s portfolio, position sizes are driven primarily by the managers’ level of conviction in a stock, while taking into account the factors such as market cap and liquidity.

Focusing on the small and mid-cap segments

Larger cap companies are being sold and industry bias made less extreme.

RIII’s portfolio is focused on SMID stocks as its managers feel that they have more of a competitive edge in this less researched segment. Reflecting this, the managers have been cutting the trust’s exposure to both larger stocks and micro-cap stocks (all of RIII’s holdings with a market cap of less than £50m have now been sold). All of these changes are being undertaken gradually and RIII’s managers expect that, once the portfolio is aligned with their approach, turnover will reduce. The managers emphasise that this is not change for change’s sake and that all portfolio changes have to stand up on their own merits. Creating value for shareholders is always their top priority.

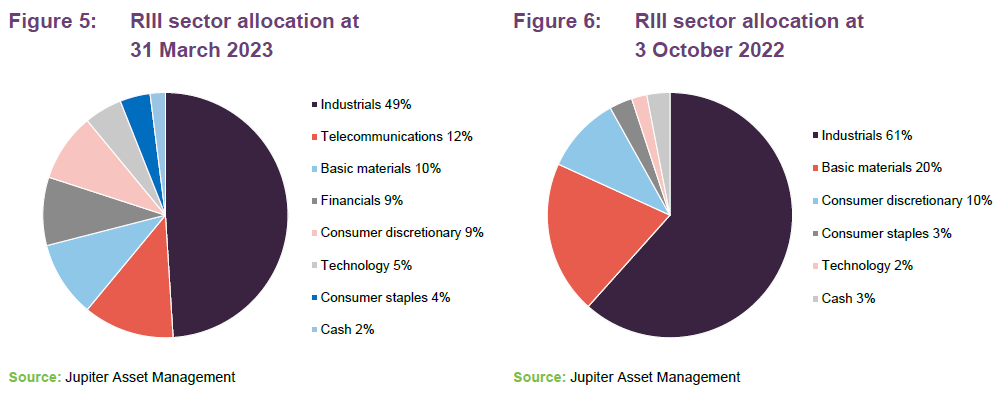

Sectoral rebalancing

With the aim of achieving a better balance within the portfolio, RIII’s managers have been reducing the portfolio’s heavy bias to industrial and engineering stocks. The proceeds of these sales have so far been largely reallocated into telecommunications, software and financial services. This is illustrated by comparing Figures 5 and 6 on page 12, which show RIII’s sectoral allocation as at 31 March 2023 and as at 3 October 2022, prior to the Jupiter team picking up the reins of the portfolio.

The stock selection process

The investment process is a mixture of both bottom-up and top-down considerations.

RIII’s portfolio is managed using a mixture of bottom-up and top-down inputs. In the top-down element of the process, the team considers macroeconomic factors, industry trends and the like to identify sectors and themes that it wishes to allocate to. However, when it comes to selecting stocks within these preferred areas, the process is driven by bottom-up fundamental analysis of companies. The Jupiter team think that this combination is unusual in the SMID space and sets their funds apart. However, the team emphasises that there is no one-size-fits-all approach to small-cap investing; companies’ idiosyncrasies prevent a cookie-cutter approach to analysis.

The quality of company management is considered to be important. The Jupiter team observe that the key decision makers within a SMID company can have a significant impact (the more complex structures frequently seen within larger companies can blunt this). Analysis of a businesses’ financials and its strategic direction are also very important.

Understand a company’s business model, its financial structure and the sustainability of its earnings.

Through its analysis, Jupiter seeks to gain a thorough understanding of a company’s business model, its financial structure and the sustainability of its earnings. The team says that sustainability can come in different forms – market leaders with strong balance sheets should be better positioned to ride out economic storms, for example, but it feels that adaptable management can also create opportunity out of adversity.

The team seeks to identify positive surprise opportunities by interrogating sell side forecasts that are genuinely representative of where market consensus views sit. Finding instances where companies are under-forecast can offer scope to add value by being positioned ahead of forecast upgrades that are not anticipated by the wider market. The team typically uses a short, two-year time horizon, and prefers simple metrics (such as P/E) when valuing a company. However, it emphasises that this is not always appropriate, and it is important to take a balanced and flexible approach in all aspects of the investment process.

Investments being considered for inclusion within the portfolio are assigned into three broad categories based on their potential for growth, rerating, or profit upgrades. These categories are not mutually exclusive, however, and ideally a company can demonstrate qualities of all three categories. It is worth noting that the team’s research output is applied to a range of funds and the team believes that RIII, with its closed end structure, is a strong fit with the range.

ESG

With RIII now part of the Jupiter stable, its managers say that they are also able to make greater use of ESG analysis in their investment process than was previously possible, by calling upon Jupiter’s in-house stewardship and data science teams, and the SMID team’s own dedicated ESG investment director. The data science team maintains a proprietary desktop tool – the ESG hub – which allows the investment teams to apply multi-factor ESG screening to their investment universe and to build custom reports.

Jupiter believes that it has an important role to play in the allocation of capital, both as active owners and long-term stewards of the assets in which it invests on behalf of clients. Analysis of ESG issues is embedded within the investment process and this is not an area that it feels it can or should outsource to third parties.

Investee companies should exhibit high standards of corporate governance, and where the managers feel that they are falling short in this area, the team will engage with companies.

With respect to environmental factors, the manager supports the Task Force on Climate Related Financial Disclosures (TCFD) and encourages companies to provide accurate and timely disclosure in line with the four thematic pillars of the TCFD framework.

The manager believes in quality over quantity when it comes to engagement. It must be focused and have well-defined targets, objectives, and outcomes.

Utilising RIII’s closed end structure

Closed-end structure allows for more illiquid positions, but the trust will not be geared.

The team feels that the investment trust structure complements the existing open-ended funds that it manages. For example, RIII is better able to hold larger positions in less liquid stocks, increasing the ability to find attractive but mispriced companies. However, the team does not feel that it is appropriate to use leverage with the fund structure and will not seek to add value through borrowings or the use of derivatives.

Market background

UK investors have faced considerable headwinds recently, with UK indices – both large and small-cap – lagging the global equity market over the last five years. There appears to have been a Brexit-discount that has been applied to UK equities for years now. The shift in the UK’s political and economic landscape that Brexit engendered, coupled with the general uncertainty around the shape of the final deal, may have caused investors to place an additional risk-premia on UK assets, even those that are multinational companies.

UK market dynamics have been further complicated by the developments of 2022, with global energy giants having had a big impact on the performance of the MSCI UK Index, as the outbreak of war in Ukraine drove up energy prices. Small-cap stocks appear to have faced the added headwind of a more risk-averse investor base, who seem fearful of the impact of rising interest rates and possible recession.

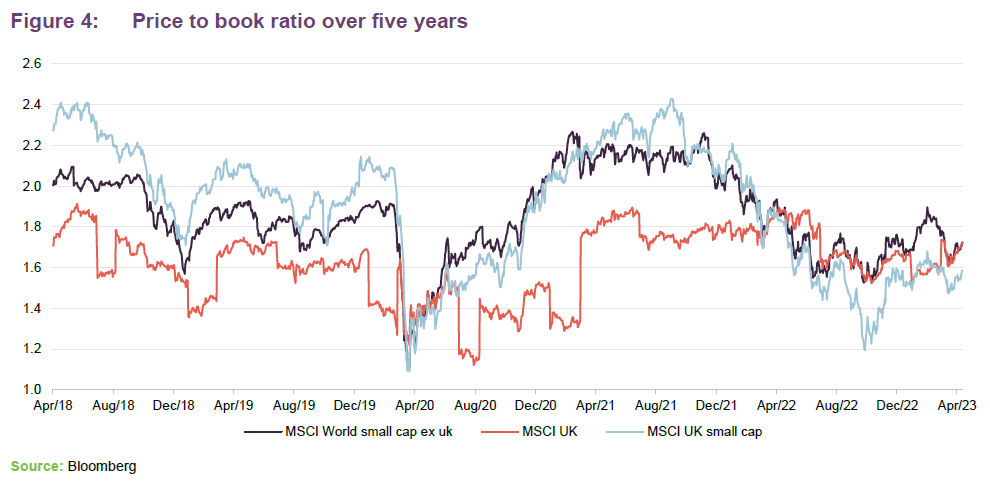

Global investors’ aversion to UK equities looks to have made the region increasingly attractive from a valuation standpoint, which is illustrated in Figure 4 below. This shows that, on a price-to-book (P/B) ratio basis, UK small cap equities are cheap relative to both broader UK equities and global small cap equities. This is in contrast to their longer-term averages, where UK small cap stocks have tended to trade at a higher rating (a five-year P/B ratio average of 1.90x) than both broader UK equities (1.62x) and global small cap equities (1.86x). (Note: we have used P/B ratios here as these tend to be more stable across periods that include difficult market conditions when compared to some other measures, such as price-earnings, price-to-free-cash-flow or earnings yield as these measures are less suited to periods with negative earnings or cash flows.)

The relative undervaluation of UK stocks does seem to be encouraging an increase in M&A activity, as overseas companies and private equity firms look to take advantage of compelling valuations, even if listed equity investors are not.

Manager’s views

Currently, the team is aiming for a balance of both growth and value styles within the portfolios it manages. Dan Nickols says that there has been an absence of clear thematic leadership recently, but he comments that the team is not too pessimistic about the prospects for the global economy, believing that the developed world is heading for a soft landing. However, Dan recognises that earnings are likely to slow, and downgrades will likely continue to come through.

UK inflation is proving persistent, as the February RPI figures demonstrated. However, the managers see inflationary pressures easing, especially in physical goods, though they note that labour markets remain tight. On balance, the team thinks that we are probably approaching the inflationary peak, and thus the peak of the rate hiking cycle. If so, this may open opportunities for a recovery in growth stocks in time, but the managers feel that it is still too early for a decisive shift.

In the context of constructing a portfolio that is currently balanced between growth and value themes, the managers are wary of running growth positions where multiples are already high or where the investment case is predicated on multiple expansion; for cheaper, more economically sensitive stocks, the focus is on identifying situations where the likely worst-case scenario has already been priced in.

Asset allocation

RIII’s portfolio is currently undergoing adjustments in order to bring it more into line with the new manager’s stock selection process. This does not mean that RIII’s portfolio is being completely rebuilt, however, as there are several companies the Jupiter team inherited from Simon that it envisages holding into the long term. However, as discussed on pages 6 and 7, the managers are rebalancing the portfolio, reducing the large cap and micro-cap positions in the process (all sub-£50m market cap positions have now been sold).

The Jupiter team is rebalancing RIII’s asset allocation.

The team has ’rejigged’ RIII’s asset allocation to create a better balance between sector weights, although the managers still intend to maintain a very high active share in the way that RIII demonstrated prior to the management change.

Given the current macroeconomic environment and uncertainty around which investment style will dominate in the near term, the team is aiming to strike a balance between growth and value companies. However, it has singled out UK consumer-focused companies as a specific sector that it is currently avoiding, highlighting the volatility in these companies share prices as being too great.

Top 10 holdings

Below is a snapshot of RIII’s 10-largest holdings as at 31 December 2022. Two companies – Videndum and IMI – that were in the top 10 when the Jupiter team took on the trust, have dropped out of the list but remain large positions.

Looking at some of these in more detail:

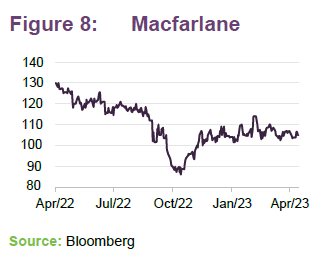

Macfarlane Packaging – packing value

RIII’s manager describes Macfarlane (www.macfarlanepackaging.com) as a value-added distributor of packaging, mainly to the UK industrial and online retail sectors. It develops solutions for its clients focussed on what it describes as the ‘significant six’ hidden costs of poorly designed packaging. On its estimates, 90% of a packaging operations costs are hidden and so these costs can far outweigh the value of the packaging itself, saving its clients money. These include expenses related to storage, transport and admin, as well as less obvious issues such as product damage, warehouse productivity and customer experience.

Macfarlane is the UK’s largest independent packaging distributor and has nationwide operations that allow it to support large clients on a national basis. It has also begun to expand into Europe to support existing multi-national clients. RIII’s manager comments that Macfarlane has a successful track record of consolidating smaller peers which, alongside solid organic progress, provides a strong growth profile at what it views as an attractive valuation.

Macfarlane is a longstanding RIII holding which the manager intends to retain within the portfolio, although it expects to a smaller weighting over time.

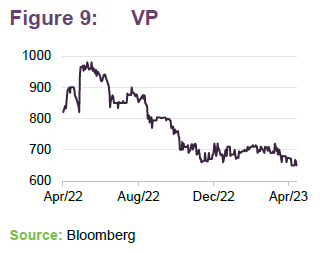

VP – non-cyclical rental business

VP (www.vpplc.com) describes itself as an “equipment rental specialist”. It provides equipment to niche markets, e.g. railway maintenance, where rental items have to be certified as fit for use. Unlike more conventional equipment rental firms, VP is not just arbitraging the value of acquiring an item versus the cost of renting it. The specialist sectors that it caters to, and the additional services that it provides (for example, training), are a barrier to entry and an extra source of margin for the company. The additional services help to diversify VP’s revenues.

Jupiter notes that family-controlled VP has good capital discipline, an attractive dividend yield, a high return and offers a less-cyclical exposure than one would normally associate with rental businesses. The managers also think that it is very undervalued.

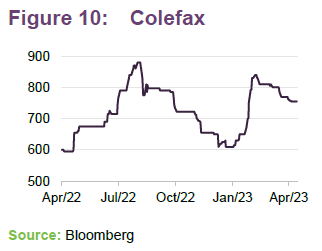

Colefax – unique high quality fabrics business

Colefax (www.colefaxgroupplc.com) is a high-end fabrics manufacturer, operating in the home furnishings market, with a strong presence in North American markets.

The Jupiter team believes Colefax to be a unique business, with a high-quality business model and conservative balance sheet (running a high, net cash position), though with some linkage to US housing demand.

The team is happy to hold onto a position in Colefax, but would prefer to reduce the trust’s absolute exposure, perhaps selling into buy-backs.

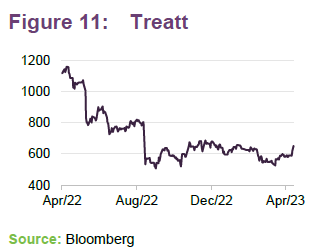

Treatt – positioned for an exciting phase of growth

Treatt (www.treatt.com) is another longstanding RIII holding. It is a specialist developer and manufacturer of flavouring and fragrance ingredients for the food and beverage industry. RIII’s manager considers that the strength of Treatt’s customer proposition is founded on many decades of research and development expertise and Treatt is rightly seen as a UK-based global champion, in its view, although its dominant market is the US (the UK only accounts for around 7% of revenue).

Over the last few years, the company has undergone a period of significant capacity expansion, including new state-of-the-art facilities in the US and UK. With this investment now made, RIII’s manager expects to see an exciting new phase of growth for the company across a range of categories such as alcoholic seltzers and coffee.

In August last year, Treatt issued a profit warning with profit expectations reduced to £15.3m from £21.7m for the financial year ended 30 September 2022. Key issues cited were a deteriorating outlook for the US consumer as well as input cost inflation exacerbated by a weaker pound.

The profit warning set the company’s shares back, but RIII’s manager thinks that this should be a short-term impact. It believes that, with a new finance director in place and with the company now taking a more conservative approach to setting expectations, Treatt can establish the foundations for more positive developments from here. The size of the position in RIII has been moderated by the Jupiter team to better reflect their view of the risk/reward balance, but the intention is to retain a holding.

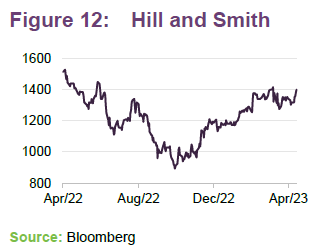

Hill and Smith – exposed to increased infrastructure spending

Hill and Smith (www.hill-smith.co.uk) is an engineering business with a strong presence in galvanising metal. It produces a wide range of products for infrastructure markets, ranging from road furniture to power transmission systems and components for power stations. Jupiter says that the company is a direct beneficiary of the increased infrastructure spending by western nations, in particular of the US’s recent fiscal stimulus package.

Hill and Smith has just acquired a US composites business to further expand its operations in what may be the next growth market for manufacturing.

The team notes the strength of Hill and Smith’s balance sheet and strong record of earnings growth, though with the shares on about a 16x P/E ratio, the team is starting to take some profits from the position.

OSB Group – conservative UK buy-to-let lender

OSB Group (www.osb.co.uk) is the listed entity and parent company of One Savings Bank. The group is a specialist mortgage lender, with a strong focus on buy-to-let mortgages in the UK, whose growth has come on the back of larger UK lenders retreating from the buy-to-let space.

RIII’s manager says that the group’s operations are conservatively managed, with a high tier 1 capital ratio of over 18%, which is enhanced by the fact that buy-to-let borrowers tend to have strong creditworthiness. The group’s lending business is supported by retail savings through its Kent Reliance and Charter Savings Bank operations.

OSB Group has shown loan-book growth of 11% per annum, while still trading on what the Jupiter team describes as a relatively cheap valuation of 1x book value. RIII’s manager comments that OSB Group’s valuation opportunity goes hand-in-hand with its attractive 6% dividend yield, which it believes will grow over time. It observes that part of OSB’s competitive strength comes from its modern operating infrastructure – for example, its IT systems and Indian back-office – both of which give it a cost advantage over legacy lenders.

Other holdings

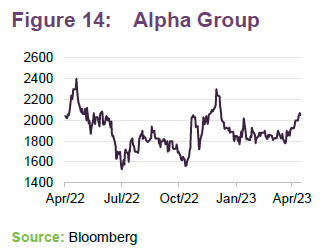

Alpha Group – disruptive innovator

RIII’s manager describes Alpha Group (formerly Alpha FX – www.alphagroup.com) as an innovative, founder-led provider of specialist financial services to small and mid-sized companies and investment funds. The company initially focussed on foreign exchange risk management for business, focusing on a long-term relationship driven approach. More recently, Alpha Group has added payment services to its suite of offerings and is now growing rapidly in the provision of bank accounts specifically designed for the legal entities (known as ‘special-purpose-vehicles’) that are used to hold assets for investment funds.

RIII’s manager says that Alpha Group has, in all of its activities, pushed for a move away from inefficient but widely accepted industry practices, bringing cutting-edge technology and business processes to deliver dramatic improvements in cost and client service. It thinks that this consistent mindset has allowed Alpha to grow rapidly (from nothing in 2009 to revenues of almost £100m), with a market capitalisation approaching £900m today. The Jupiter team has been involved in the journey since Alpha’s IPO in 2017 and believes there is much more growth to come, hence its inclusion in RIII’s portfolio.

Performance

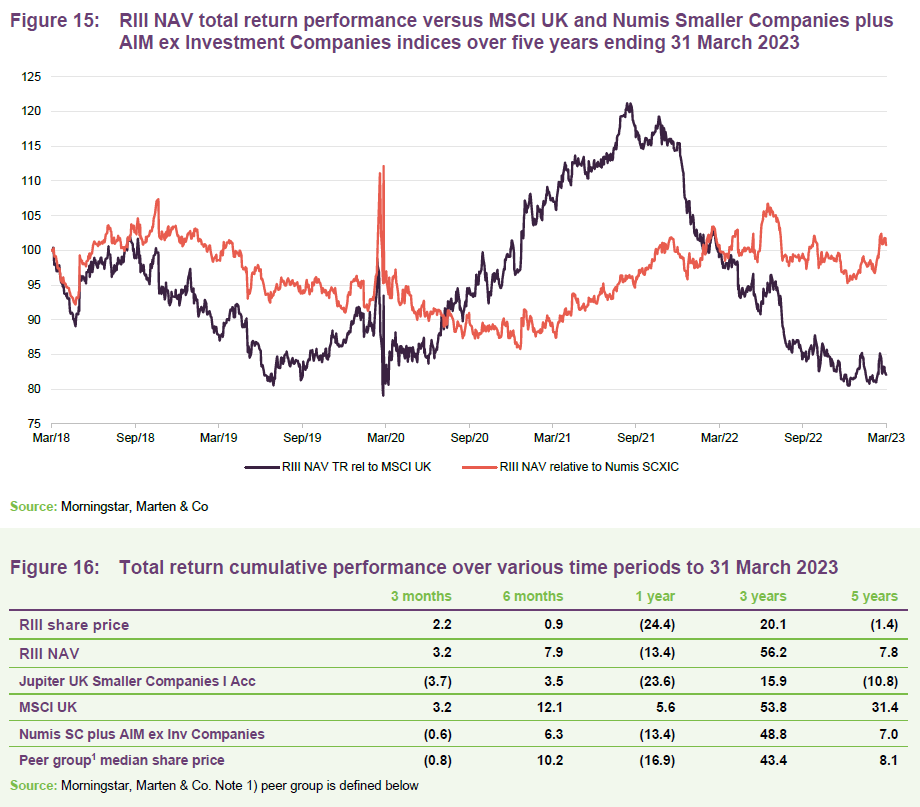

For the purposes of this initiation note the trust’s performance is shown both relative to the MSCI UK Index (as an approximation of its All-Share benchmark) and the Numis Small Companies Plus AIM ex Investment Companies Index, which might be more representative of the opportunity set available to the managers.

As Figures 15 and 16 show, in NAV total return terms, RIII has marginally outperformed the UK small cap market (the Numis SC plus AIM ex Inv Trusts) over five years but underperformed relative to the wider UK (the MSCI UK). Much of the underperformance of MSCI UK can be attributed to the outperformance of large cap versus small cap since investors seemingly became more concerned about the impact of inflation and rising interest rates on the global economy. A narrow group of very large stocks has driven the MSCI UK Index higher and almost everything else has underperformed.

Relative to the Numis index, and also the peer group that we have constructed (see below) the performance gap is not present. However, we have included the returns of the managers’ open-ended fund in Figure 17 and it is clear that it has had a poor run recently. The fact sheets for the Jupiter UK Smaller Companies Fund show that it ranks fourth quartile within its open-ended peer group over 2021 and 2022 and third quartile over the first couple of months of 2023.

The most likely cause for the recent underperformance is stock specific factors, as can often the case with many small-cap strategies. Small-cap indices are typically dominated by the outsized returns of a handful of constituents, and if a strategy fails to capture this than it often becomes difficult to outperform. However, since taking over the mandate, Jupiter has been able to generate a substantial amount of near-term outperformance, as seen by RIII’s relative performance in the last three months against both the Numis index and the Jupiter UK Smaller Companies fund.

Ultimately however these historic figures may not offer a useful indication of the likely future performance of RIII. The Jupiter team will follow a process which has clear deviations from Simon’s, with a more balanced allocation in terms of sector and concentration, while also running a portfolio which is far more concentrated than any of their open-ended funds, with a possibly greater bias to UK small companies.

Peer group

Up-to-date information on RIII and its peer group is available on the QuotedData website.

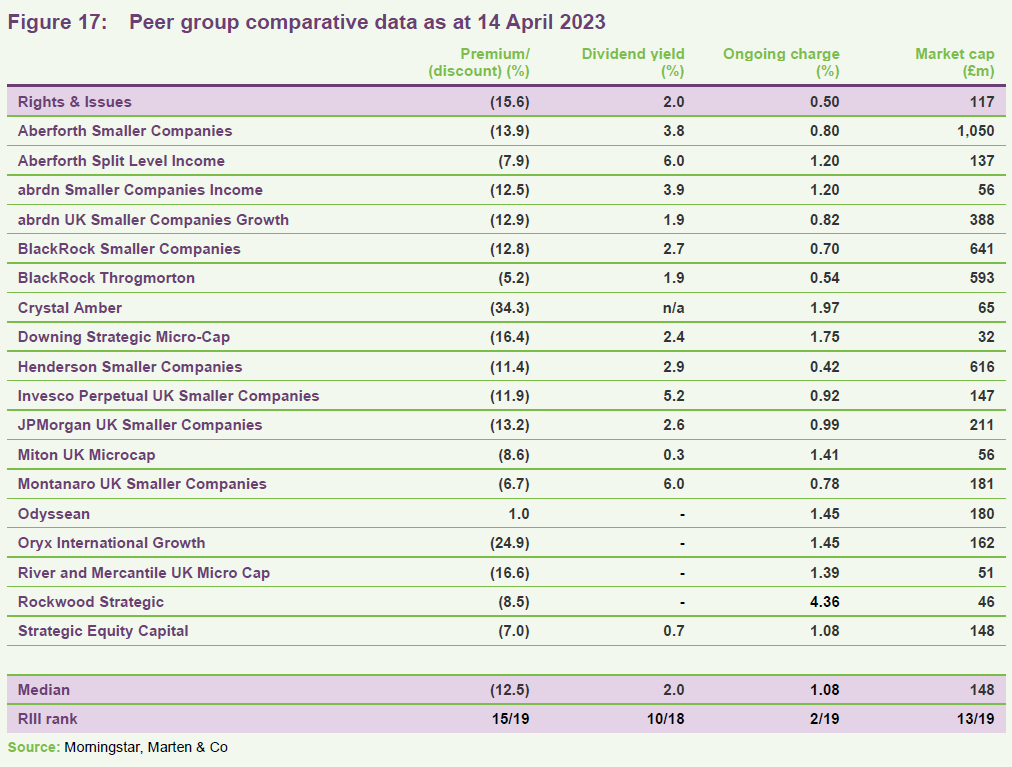

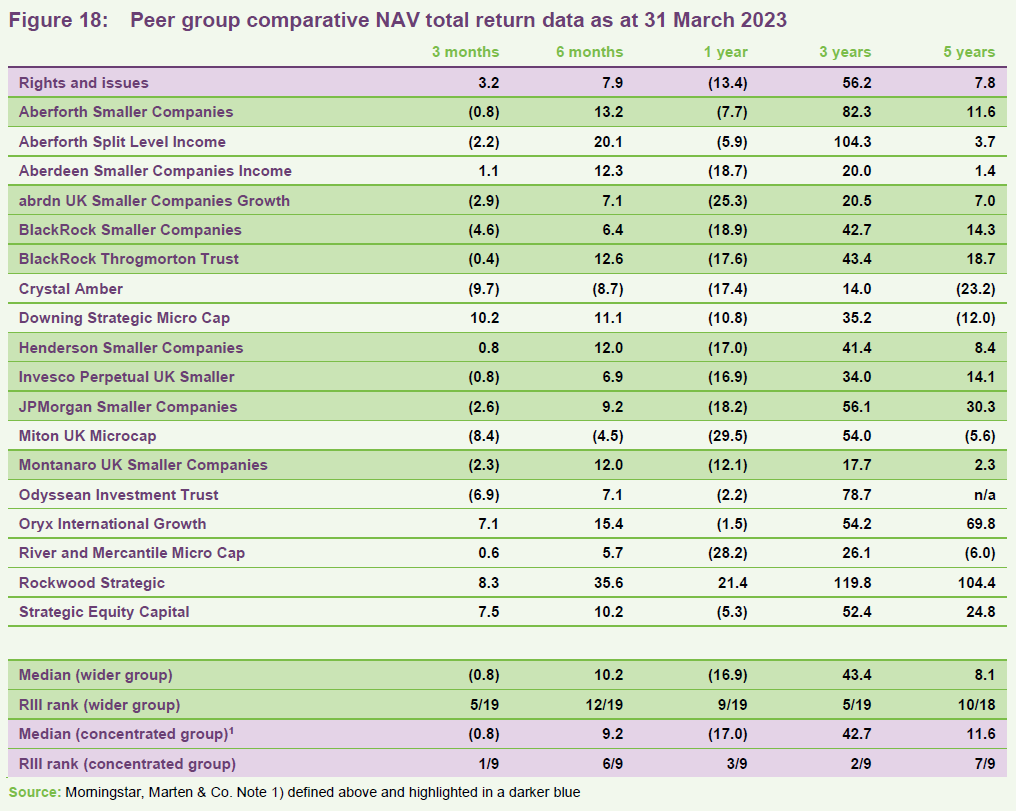

RIII is a constituent of the AIC’s UK Smaller Companies sector, and we have used this as the basis for our peer group comparison. The peer group represents one of the mainstays of the investment trust universe, given the long track records of some of these trusts, as well as the large number of funds in the peer group. For the purposes of comparison, we have removed a handful of very small funds from this peer group, and also Marwyn Value Investors, which follows a very different investment strategy from other members of this peer group.

The remaining funds listed in Figure 18 follow a variety of investment approaches. For performance comparison purposes, the manager has suggested a more concentrated peer group. This excludes Aberforth Split Level Income (on structural grounds), abrdn Smaller Companies Income (given its income mandate), the three micro-cap funds (Downing, Miton and River & Mercantile), and those with some element of an activist approach (Crystal Amber, Odyssean, Oryx, Rockwood and Strategic Equity Capital).

RIII’s discount is towards the wider end of the peer group. Like RIII, the majority of investment companies in this peer group are not managed to produce a yield (the median yield is 2.3%) and so RIII’s, at 2.1%, is towards the middle of the pack. RIII’s historic ongoing charges ratio is extremely competitive, reflecting its self-managed structure. The extra resources that Jupiter is bringing to bear on the trust do come at a price and it seems likely that the ongoing charges ratio for the current financial year will be higher, but the expenses cap (see page 21) should help in that regard. After the recent shrinkage, RIII is smaller than the median fund in the peer group, but still over £100m, which makes it investable for some wealth managers.

Turning to RIII’s performance relative to the peer group, it is noticeable that the trust’s returns are largely middle of the pack over most time periods. However, based on the narrower peer group definition, RIII’s returns look relatively better over one and three years, though much worse over five. Within the wider group, the leading investment companies such as Rockwood Strategic and Odyssean have adopted a more activist value strategy. The Aberforth funds that follow a value approach have also done well. More growth-focused funds such as BlackRock Throgmorton and JPMorgan Smaller Companies have good long-term track records but have lagged recently.

The median fund in the wider peer group underperformed the Numis index over the 12 months ending 31 March 2023. This is a disappointing result for the sector. Gearing will have had an impact, but this may be a reflection of the environment that UK small-cap managers have faced in recent times.

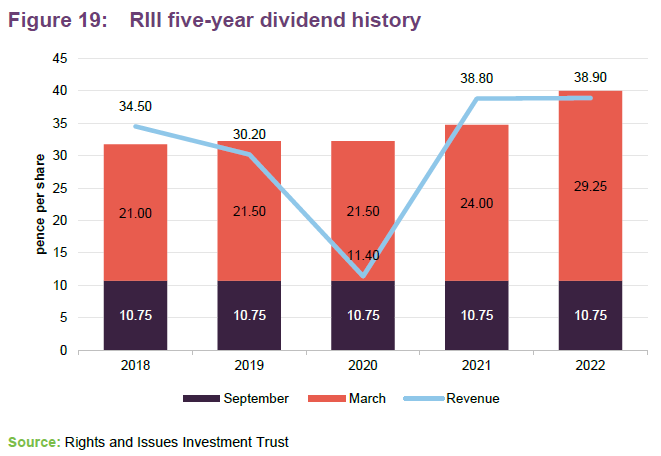

Dividend – biannual payments

RIII’s accounting year ends on 31 December. It pays an interim dividend in September and final dividend in March. The board continues to operate a progressive dividend policy. Despite continuing uncertainty, as a result of the pandemic and the political and economic outlook, the board has increased the annual dividend from 34.75p in 2021 to a recommended 40.0p per share to shareholders for the financial year ended 31st December 2022, a 15.1% increase. This will be made up of an interim payment of 10.75p, paid on 26 September 2022, and a final payment of 29.25p which, if approved by shareholders at the forthcoming AGM, will be payable on 31st March 2023.

RIII has also improved its revenue reserve over the year, which now stands at £2.3m, up from £2.1m in 2021. All dividends paid in 2022 have so far been paid from revenue after 2.94p of the 2021 final dividend was paid from capital.

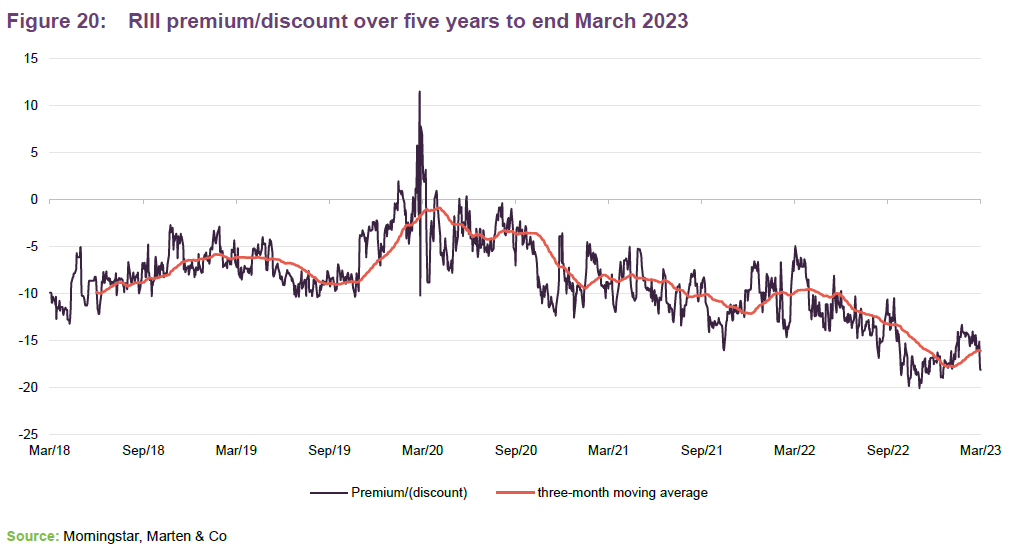

Premium/(discount)

Along with much of the rest of the investment companies sector, and UK small-cap trusts in particular, RIII’s share price has struggled over the past year, with the discount falling to 20.1% at its lowest point. By 14 April 2023, this had narrowed to 15.6%, which is still wider than its 12-month average. Over the 12 months ended 31 March 2023, RIII traded between a discount of 20.1% and one of 4.9%, with an average discount of 14.1%.

RIII’s discount has widened beyond its historic average in recent months.

There are a number of possible reasons for the recent weakness. As discussed, the company’s change of manager after 39 years of stewardship could well have contributed, particularly given elevated market volatility. Whilst the board has selected an experienced management team and a well-respected investment manager in Jupiter, Simon’s departure after such a long period may have affected sentiment. However, the discount widening may have created an attractive entry point for new investors.

On a macro-level, the recent market has been a difficult one for UK SMID in general. With rising inflation – and, by association, interest rates – coupled with signs of weak economic growth, investors have adapted an increasingly risk-off stance over 2022. Assets perceived to be higher-risk, such as small-cap equities, appear to have been hit hardest.

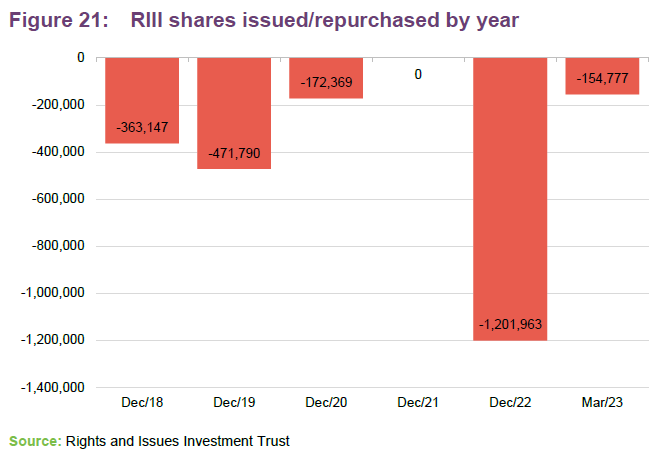

RIII’s board operates a share buyback programme, which was implemented in December 2020, with the intention of keeping the discount narrower than 10%. In August 2022, the board announced an extension to the share buy-back programme. As can be seen in Figure 20, prior to 2022 the policy appeared to function well, preventing the discount from exceeding 10%.

Figure 21 shows that 2022 saw an usually large number of repurchases. This reflects a tender offer that saw 706,904 shares repurchased at a cost of £15.1m.

Fees and costs

RIII’s fees remain highly competitive.

Following the appointment of Jupiter as investment manager on 3rd October 2022, a management fee is payable on the following basis: 0.6% per cent per annum on the NAV up to and including £200m, and 0.5% per cent per annum on the NAV in excess of £200m. Jupiter will also be responsible for increasing the marketing of the company to a wider audience of investors and potential investors.

The company’s ongoing charges ratio was 0.5% in 2022, up from 0.3% in 2021. That reflected, in part, the shrinkage of the trust. Given the higher management fee, it seems likely that RIII’s ongoing charges ratio could be higher again in 2023. However, Jupiter will apply a 0.8% cap on all operating expenses, which could help RIII to remain competitive relative to peers.

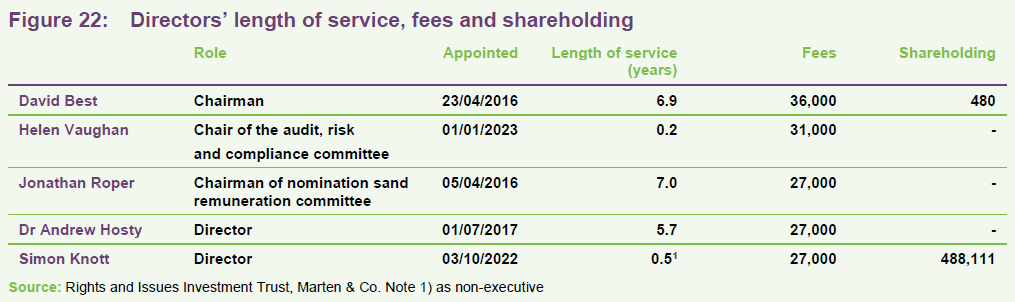

The only other expenses of note for the year ended 31 December 2022 was the non-executive directors’ fees which were increased following a remuneration committee review. These fees increased from £94,000 in 2021 to £136,000 for the year.

Capital structure and life

As at 14 April 2023, RIII has 5,968,661 shares in issue, with no shares held in the treasury, thus the total number of voting rights is also 5,968,661. The board has the authority to repurchase shares of up to £1m worth of shares each month until July 2023 (subject to the renewal of the buy-back authority at the forthcoming AGM).

RIII’s year end is 31 December, and its AGMs are typically held in March.

A 10×1 share split that was proposed for 23 March 2023 was withdrawn.

Major shareholders

At 13 February 2023, the directors were aware of the following disclosed stakes in the trust:

- Dartmoor Investment Trust 609,258 shares (10.01%)

- SJB Knott 488,111 shares (8.02%)

- J Knott 471,074 shares (7.74%)

- Rathbone Brothers 305,998 shares (5.03%)

Gearing

The company has not historically used any form of gearing, nor does the Jupiter team intend to in the future. The managers highlight the already-high level of volatility associated with SMID investing compared to other strategies.

Board

RIII has five directors, all of whom are non-executive. Four are considered to be independent, with Simon Knott not deemed independent by virtue of his previous position as investment director. All other directors have had no material connection other than as directors of the company. The board delegates all investment matters to the investment manager but retains all decisions concerning unquoted investments. Previous chairman and non-executive director David Bramwell retired from the company on 31 December 2022. He was replaced on the board by Helen Vaughan on 1st January 2023. Existing director David Best was appointed chairman of the company.

Few of the directors have made an investment in the company.

David Best (chairman)

David is a Chartered Accountant and has been a director of a number of private companies. He was previously group finance director of Peterhouse Group Plc and a managing director of YFM Group, a private equity business. He has over 35 years of investment experience across a number of businesses; since 2011 he has been involved with Mercia Asset Management Plc and its predecessor operations as its board representative advising on a number of portfolio companies. His involvement in operating companies allows him to share insights with the board on the issues that businesses face across a number of varied sectors.

Helen Vaughan (chair of the audit, risk and compliance committee)

Helen is a Chartered Accountant and a certified independent fund director. She has over 30 years of investment management experience. As the chief operating officer for the J O Hambro Capital Management Group, Helen oversaw the transformation of its operating model to one which supported rapid growth and also significantly reduced operational risk to the business. She retired from this company in September 2019. Prior to this, Helen was director of business development at Credit Suisse Asset Management and before that, head of investment operations at SLC Asset Management and head of client accounting at Framlington Group Limited.

Jonathan Roper (chairman of the nomination and remuneration committee)

Jonathan is a solicitor and, until his retirement from practice, was a partner in Eversheds Sutherland (formerly Eversheds LLP.) He has more than 35 years’ experience of commercial practice in the City, advising primarily on public and private company mergers and acquisitions, joint ventures and equity and other financing arrangements for UK and overseas clients, including many in the financial services sector, and often at a strategic board level. Until recently, Jonathan was a member of the Council of the London School of Hygiene & Tropical Medicine and chair of its Audit & Risk Committee.

Dr Andrew Hosty (director)

Andrew is a Chartered Engineer and Fellow of the Royal Academy of Engineers. He is an international business leader with over 20 years of non-executive board experience and 30 years of executive and management experience, spanning private equity, UK Plc and global blue-chip corporates. From 2016 to 2018 Andrew was the CEO of the Sir Henry Royce Institute, the UK’s home of advanced materials research and innovation. Andrew was chief operating officer of Morgan Advanced Materials and served on the Plc board as an executive director from 2010 to 2016. These experiences and his current work with other operating companies mean that he can contribute to a range of business matters over a wide spectrum of end markets.

Simon Knott (director)

Simon served as investment director of the company from 1983, focusing on UK smaller companies. Following the appointment of Jupiter as investment manager on 3 October 2022, Simon retired as investment director but remains a non-executive director of the company.

Legal

Marten & Co (which is authorised and regulated by the Financial Conduct Authority) was paid to produce this note on Rights and Issues Investment Trust Plc.

This note is for information purposes only and is not intended to encourage the reader to deal in the security or securities mentioned within it.

Marten & Co is not authorised to give advice to retail clients. The research does not have regard to the specific investment objectives financial situation and needs of any specific person who may receive it.

The analysts who prepared this note are not constrained from dealing ahead of it, but in practice, and in accordance with our internal code of good conduct, will refrain from doing so for the period from which they first obtained the information necessary to prepare the note until one month after the note’s publication. Nevertheless, they may have an interest in any of the securities mentioned within this note.

This note has been compiled from publicly available information. This note is not directed at any person in any jurisdiction where (by reason of that person’s nationality, residence or otherwise) the publication or availability of this note is prohibited.

Accuracy of Content: Whilst Marten & Co uses reasonable efforts to obtain information from sources which we believe to be reliable and to ensure that the information in this note is up to date and accurate, we make no representation or warranty that the information contained in this note is accurate, reliable or complete. The information contained in this note is provided by Marten & Co for personal use and information purposes generally. You are solely liable for any use you may make of this information. The information is inherently subject to change without notice and may become outdated. You, therefore, should verify any information obtained from this note before you use it.

No Advice: Nothing contained in this note constitutes or should be construed to constitute investment, legal, tax or other advice.

No Representation or Warranty: No representation, warranty or guarantee of any kind, express or implied is given by Marten & Co in respect of any information contained on this note.

Exclusion of Liability: To the fullest extent allowed by law, Marten & Co shall not be liable for any direct or indirect losses, damages, costs or expenses incurred or suffered by you arising out or in connection with the access to, use of or reliance on any information contained on this note. In no circumstance shall Marten & Co and its employees have any liability for consequential or special damages.

Governing Law and Jurisdiction: These terms and conditions and all matters connected with them, are governed by the laws of England and Wales and shall be subject to the exclusive jurisdiction of the English courts. If you access this note from outside the UK, you are responsible for ensuring compliance with any local laws relating to access.

No information contained in this note shall form the basis of, or be relied upon in connection with, any offer or commitment whatsoever in any jurisdiction.

Investment Performance Information: Please remember that past performance is not necessarily a guide to the future and that the value of shares and the income from them can go down as well as up. Exchange rates may also cause the value of underlying overseas investments to go down as well as up. Marten & Co may write on companies that use gearing in a number of forms that can increase volatility and, in some cases, to a complete loss of an investment.