RIT Capital Partners

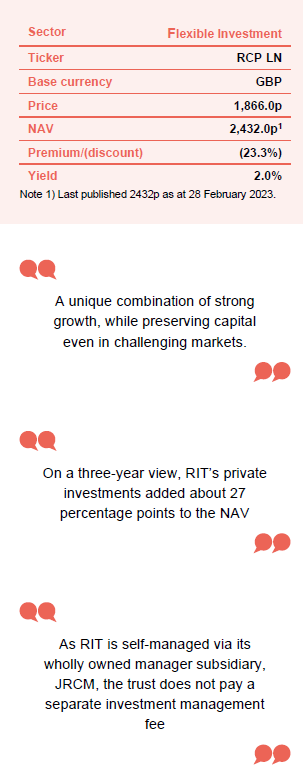

Investment companies | Initiation | 6 April 2023

A rare opportunity to buy a unique trust

Last year was a turbulent one for markets and, unusually, there were few places for investors to hide, with nearly all asset classes recording large declines. RIT’s net asset value (NAV) also fell in 2022, and this appears to have unnerved some investors who, after 10 years of consecutive NAV uplifts, may have come to believe that RIT‘s portfolio would never decline in value.

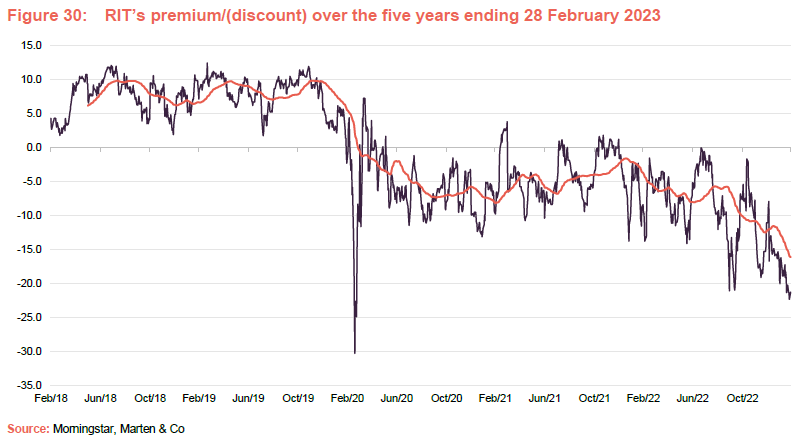

This has led to RIT Capital Partners (RIT) coming in for some criticism recently, with some investors claiming that RIT has ‘changed its stripes’. As a result, the shares have come under short-term pressure and have been selling at a record discount to NAV against recent history of around 23%. We believe this is unjustified and presents a rare opportunity to buy a unique trust with an impressive long-term track record (see page 33).

Grow and preserve shareholders’ capital

RIT aims to deliver long-term capital growth, while preserving shareholders’ capital. It invests without the constraints of a formal benchmark, but aims to deliver increases in capital value in excess of relevant indices over time. RIT invests in a widely-diversified, international portfolio across a range of asset classes, both quoted and unquoted. It allocates part of the portfolio to exceptional managers in order to ensure access to the best external talent available.

Why is RIT trading at a 23% discount, given its impressive long-term track record?

Over the decade ended 31 December 2022, RIT achieved a return of 140% with considerably less risk than equity markets

RIT Capital Partners (RIT) has an impressive long-term track record of generating returns for investors. Over the decade ended 31 December 2022, RIT achieved a return of 140% with considerably less risk than equity markets. In recent years it has also outperformed. Over the three years to the end of December 2022, the trust delivered an NAV per share total return of 24.8% compared to 17.7% for its equity performance benchmark (see below). Over five years, the equivalent figures were 40.9% and 35.5%.

The manager’s conversations with investors suggest that there are three key factors that have led to the current discount at which RIT is trading at: (i) concerns about a perceived lack of capital protection, (ii) worries about RIT’s exposure to private assets and the risk of further NAV declines, and (iii) questions regarding RIT’s cost base.

In two decades, the trust has never lost money over any rolling three-calendar-year period

Our conclusion is that much of this fear is misplaced. Each of these issues is addressed in this note, but in summary:

- RIT does not set out to produce absolute (positive-only) returns over the short-term, potentially sacrificing the potential for meaning capital gains in the process. Instead, it has done a good job of meeting its objective of delivering long-term capital growth, while preserving shareholders’ capital. As we show on page 1`, over the two decades to the end of 2022, the trust has never lost money over any rolling three-calendar-year period, while its average rolling three-calendar-year return over that period was more than 10% per year.

- The managers say that RIT’s private (unquoted) holdings are high-quality, established businesses with a strong growth runway. As we explain on page 17, the exposure to private investments is well hedged via the manager’s active risk management policy. In addition, exposure to this part of the portfolio has been further de-risked through around £1.1bn of realisations in the last three years.

- As we show on page 37, RIT’s ongoing charges figure of 0.89% compares favourably to other vehicles with a similar multi-asset approach. Its annual incentive scheme is subject to a cap of 0.75% of net assets, which has never been reached.

These misperceptions have given rise to some selling pressure, and a widening of its discount, which RIT is now countering with an aggressive share buyback policy (which, in turn, is enhancing the NAV for ongoing shareholders). In time, the discount will narrow, and valuations will recover. If the past is a guide, patient investors will be rewarded.

Fund profile

More information is available at the trust’s website www.ritcap.com

RIT aims to deliver long-term capital growth, while preserving shareholders’ capital. It invests without the constraints of a formal benchmark, and aims to deliver increases in capital value in excess of relevant indices over time.

In practice, RIT aims to deliver healthy participation in up markets with reasonable protection in down markets. Over time this should allow it to compound its asset value ahead of index benchmarks through market cycles.

74% of monthly market upside but only 41% of market declines

From RIT’s inception to the end of December 2022, it has participated in 74% of monthly market upside but only 41% of market declines. Over that period, a shareholder who invested in RIT at inception has seen a share price total return of 11.2% per annum (NAV return of 10.7% per annum), versus 7.0% for the global equity market.

Whilst the board establishes and oversees risk tolerances for the manager to work within, RIT does not seek to be an absolute return fund and does not perform like one (as we explore further on page 35). There will be periods, such as 2022, where the asset value falls, although over the medium-term, the trust’s performance compares favourably to even the top performing absolute return funds in the market.

Some history

RIT is a self-managed, UK-domiciled, investment trust. It evolved from the Rothschild Investment Trust, which was originally associated with the family bank, NM Rothschild & Sons. Lord Rothschild was appointed chairman of the Rothschild Investment Trust in 1971. It took on its current listed form as RIT Capital Partners Plc in August 1988.

The members of JRCM’s executive committee have worked together for over a decade

Rothschild Capital Management (JRCM), a wholly-owned subsidiary of RIT, acts as RIT’s manager. It is led by an executive committee who have worked together for over a decade, led by Francesco Goedhuis (chairman and chief executive of JRCM), and including Ron Tabbouche (JRCM’s chief investment officer). More information on RIT’s management team is given on page 41.

JRCM says that since taking over the helm as chief investment officer over a decade ago, Ron Tabbouche has successfully instilled a highly disciplined investment process that combines optimising the firm’s highest conviction ideas within a robust portfolio construction.

The manager’s global network also offers an unparalleled source of deal flow across asset classes and geographies. This network traces its origins to the Rothschild family, was cultivated by Lord Rothschild, and has been institutionalised under the leadership of Francesco Goedhuis. He has served as chief executive of the manager since 2014 and is responsible for many of the trust’s standout successes in recent years, including its investments in Coupang (see page 13), Acorn, and CSL.

At the end of December 2022, JRCM employed 49 people, comprising a mix of investment professionals and support staff. RIT also has a small wholly-owned subsidiary Spencer House Limited which employs 13 people. It is responsible for the management of the RIT property portfolio as well as the running of the Spencer House events business in St James’s, where Spencer House serves as the company HQ.

Widely diversified, hard to replicate portfolio

RIT invests in a widely diversified, international portfolio with investments across a range of asset classes, both quoted and unquoted. RIT is able to invest in less-liquid assets such as unquoted companies thanks to its closed-end structure. It can be patient and ignore the sentiment swings and short-termism often associated with listed equity markets and analysts. Unquoted (private) investments also allow RIT access to a broader range of opportunities. Public markets are shrinking, as companies stay private for longer; some are choosing never to list.

Tapping into outside expertise…

Part of the portfolio is allocated to exceptional managers in order to ensure access to the best external talent available. Many of these managers would be impossible for retail investors to access, and some are closed to new investment by all types of investors.

…helped by an extensive network of connections

The Rothschild ‘brand’ opens some doors, but chiefly RIT can invest where others cannot thanks to the extensive network of connections that the family and the management team have established over the years. This network is also a valuable source of intellectual capital and co-investment opportunities.

Good risk management is central to RIT’s investment approach. JRCM measures both quantitative and qualitative measures of risk and reports on these to the board. It seeks to hedge excessive factor exposures, and manage currency positions and RIT’s exposure to significant macroeconomic risk.

RIT measures its investment performance against an absolute comparator (inflation, as measured by UK CPI, plus three percentage points per annum) and an equity comparator calculated as 50% of the MSCI ACWI return in local currencies translated back into sterling and 50% of the sterling-hedged MSCI ACWI.

A fuller explanation of RIT’s approach to managing its assets is given on page 16.

2022 – a turbulent year for almost all asset classes

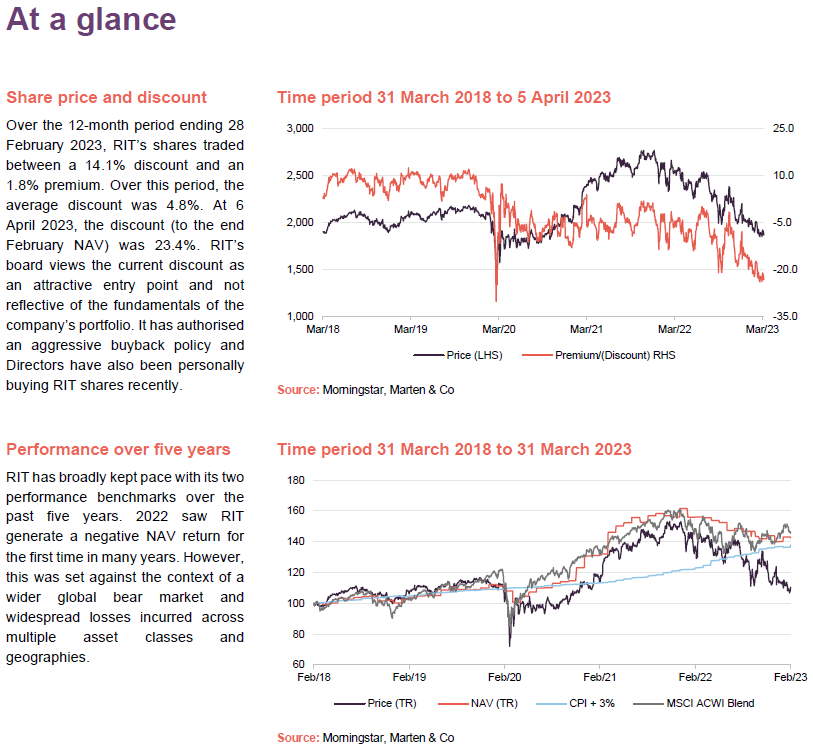

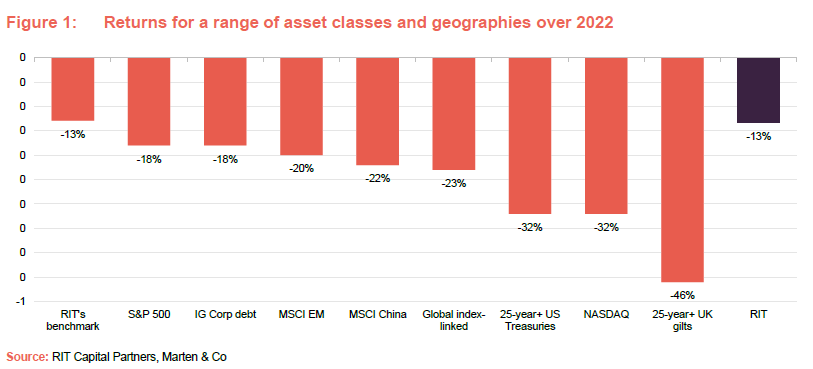

Over 2022, RIT’s NAV per share total return was -13.3%, roughly in line with its equity benchmark which fell by 12.9% over the period. As a result of the discount to NAV widening, RIT’s share price total return was -21.5%. Inflation was elevated, CPI +3% was 13.5% for the year.

The discount has continued to widen since the year-end, from 11% at the end of 2022 to 23% today. We discuss this and RIT’s efforts to tackle it from page 9 onwards.

As Figure 3 shows, 2022 was a very difficult year with poor returns from almost all asset classes and geographies (including investment grade (IG) debt and emerging markets as measured by the MSCI Emerging Markets Index). This was driven by a combination of factors including the outbreak of war in Ukraine, the soaring energy prices that accompanied it, COVID-related lockdowns leading to a weakening economy in China, rapidly rising inflation, much higher interest rates, and faltering consumer confidence. In his annual report, RIT’s chairman noted that it was the first calendar year in 150 years that both US stocks and bonds were down by more than 10% in the same year.

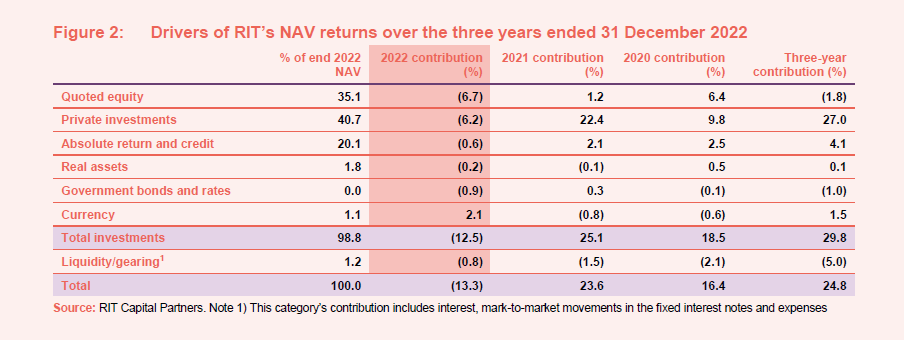

Drivers of RIT’s NAV

As Figure 4 shows, the two main drivers of RIT’s NAV fall over 2022 were its allocations to quoted equities and private investments, in both cases following healthy contributions in 2020 and 2021.

Quoted equity

Quoted equity took about 6.7% off the NAV over 2022

Within RIT’s portfolio, quoted equity took about 6.7% off the NAV over 2022.

The key asset allocation decision in 2022 was a proactive shift away from growth assets to value / reflationary themes. This impacted every part of the portfolio including quoted equities and included selling positions such as Alphabet. The manager also reduced the trust’s net quoted equity exposure, which averaged around 38% for the year.

The manager was also active in hedging exposures to high-growth names which experienced the brunt of market declines during the year. This included shorting baskets of highly valued technology stocks, and also shorting listed private equity managers. These efforts helped balance the trust’s overall exposure risk and mitigated the impact of broader market declines.

Value and Japanese strategies added to returns

Key performers during the year included Japan-focused managers 3D Investment Partners (3dipartners.com) and Morant Wright (morantwright.co.uk) and value-focused strategies, such as Discerene (discerene.com).

Exposure to China and biotech for their long-term potential despite short-term setbacks

The key detractor from RIT’s quoted equity portfolio was its allocation to Chinese managers, which suffered due to the economic headwinds caused by the country’s strict zero-COVID policy. As a result, Chinese equities lost ground over 2022, albeit much of this decline has since reversed during the recent rally in Chinese equities, following the country’s abandonment of its zero-COVID policy. A substantial portion of this rally occurred in early 2023 and hence is not reflected in the 2022 calendar year returns.

The manager also retains an allocation to biotech, an area the manager believes has long-term potential. A notable example is Pfizer’s announced acquisition of Seagen, in which RIT holds a meaningful position via its external equity managers, for $43bn or a premium of 35% to Seagen’s closing price before the announcement.

Private investments

2022’s fall in the private investment portfolio needs to be seen in longer-term context

Within RIT’s portfolio, its private investments took about 6.2% off the NAV over 2022, with most of the hit coming in the first half of 2022 during the wider market sell-off.

This figure excludes gains from the manager’s hedging activity, meaning the actual reduction in NAV over 2022 attributable to private investments was only about 4%. Moreover, the 2022 performance must be viewed in the context of an exceptional performance in 2020 and 2021. On a three-year view, RIT’s private investments added about 27 percentage points to the NAV (without taking into account gains from hedging).

Structural protection within deal structures cushioned the NAV fall

The manager notes the large majority of its private investments benefit from a degree of structural protection, which helped cushion the impact of falling valuations. For example, JRCM will typically invest via a convertible note or a preferred instrument, meaning it is not a pure equity investment as RIT’s holding would be treated similarly to a debt instrument in a liquidation scenario. An example is the trust’s largest holding, Motive (see page 28), where nearly 80% of the trust’s capital was deployed via a convertible debt instrument designed to provide downside protection as well as equity upside.

For the overall book, the decreases in valuations seen over 2022 were largely due to mark-to-market volatility given the de-rating seen in the public markets, as opposed to an actual impairment in the underlying business.

Other influences on 2022’s NAV returns

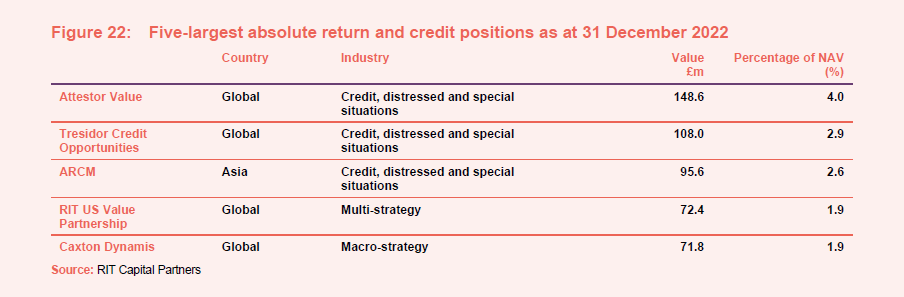

There was a dispersion of returns within the absolute return and credit portfolio (by design). The overall return from this part of the portfolio was flat. Given the substantial hit to credit markets over 2022 from rising rates and widening credit spreads (with corporate bonds, US Treasuries and UK Gilts all declining by 20-40% or even greater during the year, as shown in Figure 1), this was a decent result. This was achieved by virtue of credit hedges in place within the portfolio and RIT’s focus on specialist managers who were not following the herd.

Absolute return and credit were flat despite disappointing result from Eisler Capital

The manager also highlights mixed performance from macro managers, with one manager Eisler Capital in particular lagging during the year which was subsequently redeemed.

From a currency point of view, the manager kept around half of its exposure outside sterling with the largest portion of the non-sterling exposure being to the US dollar. This benefitted the trust during the year due to the strong rally in the dollar during the year. The remainder of the trust’s allocation was balanced across a number of currencies, notably the euro and the Japanese yen.

Why has RIT’s discount widened?

As set out above, 2022 was a turbulent year for markets where nearly all asset classes recorded large declines. RIT’s NAV also fell in 2022 and this appears to have unnerved some investors who, after 10 years of consecutive NAV uplifts, may have come to believe that RIT’s portfolio would never decline in value. This has led to some criticism recently with some investors claiming that RIT has ‘changed its stripes’. As a result, the shares have come under short-term pressure and have been selling at a record discount against recent history of around 23%.

We believe that three key factors that have led to the current discount: (i) concerns about a perceived lack of capital protection, (ii) worries about RIT’s exposure to private assets and the risk of further NAV declines, and (iii) questions regarding RIT’s cost base. Below, we cover each of these concerns in detail and conclude these worries are unjustified, and the current discount represents a rare opportunity to invest in this unique trust at a meaningful discount to the value of its underlying assets.

Concern #1: Is RIT delivering capital protection?

Recent criticism is undeserved and short-termist

RIT has come in for some criticism lately which we feel is undeserved and short- termist in nature. Impressive returns in past market downturns may have created an impression with some investors that RIT’s NAV would never decline even when markets are falling. However, RIT has never aimed to be that sort of vehicle. The trust’s objective has always been long-term and therefore its merit should be judged on its long-term returns.

Before 2022, the last calendar year where RIT lost money in NAV terms was 2011

It is easy to see how some investors could have gotten the wrong impression. Before 2022, you have to go back to 2011 to find a year when RIT last lost money in NAV terms over a calendar year, and all the way back to the collapse of the tech bubble over 2001/2002 to find two consecutive years when the NAV fell.

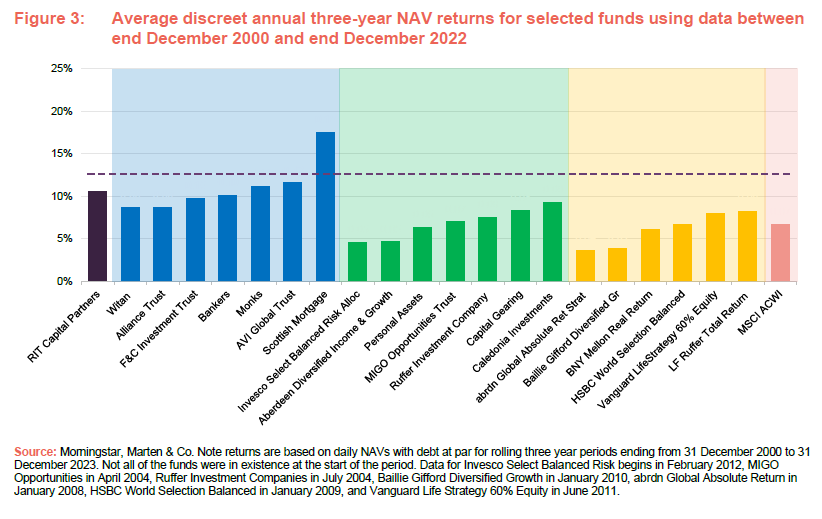

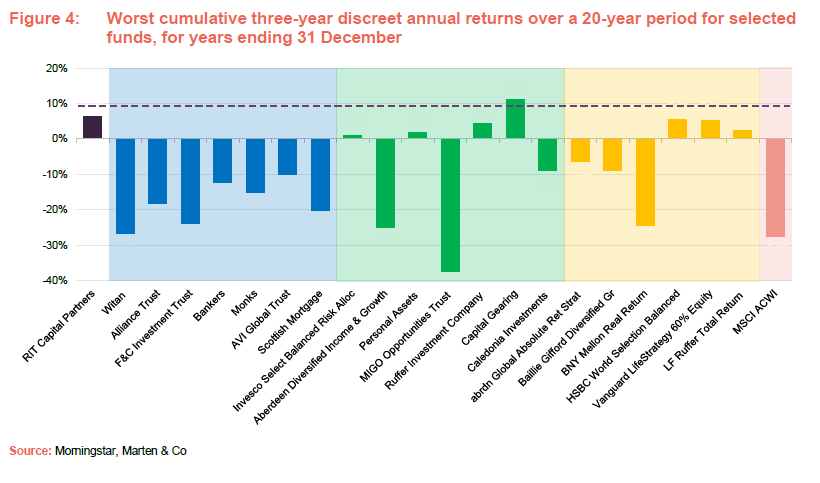

We think it is fairer to judge RIT over longer time periods. To illustrate, we looked at every rolling three-calendar-year period over two decades up to the one ending

31 December 2022. We then compare RIT against other well-known investment vehicles in different categories – both growth-focused and more defensive trusts, as well as broader, diversified, well-known multi-asset funds. The results are shown on Figures 3 and 4.

What stands out, as shown on Figure 4, is that RIT never lost money over any such period over the last 20 years, just one of a handful funds to do so within this investment company and multi-asset fund universe. Indeed, the worst rolling three- year period was the one that ended on 31 December 2003, which included the tech bubble collapse. Even over this period, RIT’s NAV still gained around 6%.

Moreover, as shown on Figure 3, RIT’s average returns in this period are also notably superior to both the equity market and to comparators in the flexible and multi-asset categories, and are also at the upper end of comparators in the global growth category. Over this period, RIT’s annual compound returns have averaged 10%, matching its long-term annualised returns since inception and over the last 10 years.

We feel that this unique combination of strong growth, while preserving capital even in challenging markets, delivers on RIT’s objective of generating capital growth with an element of capital preservation.

Given the trust’s long-term, multi-asset investment approach, it is not surprising there may be individual years where the trust’s value declines alongside wider market declines. This was the case during the market sell-off in 2022, as also in 2011 (Eurozone debt crisis), 2008 (global financial crisis) and 2001/2 (dotcom crisis).

Yet even in these periods, the manager’s asset selection and top-down risk management overlay (described further on page 17) helped ensure the trust’s NAV held up comparatively well and over a medium-term horizon of around three years, the NAV continued to achieve healthy growth.

RIT’s investment approach allows it to achieve meaningfully higher returns over the long term

Crucially, in line with the trust’s long-term focus, the manager also views these single-year declines as being within an acceptable range of outcomes, in order to achieve the superior long-term growth which is difficult to achieve for vehicles with a more rigid, absolute return mandate. RIT’s investment approach allows it to achieve meaningfully higher returns over the long term, as the trust is not forced to sacrifice too much of the upside in its pursuit of capital preservation ‘at all costs’, while at the same time still achieving a layer of capital protection over any reasonable time period.

The conclusion is that RIT offers an attractive blend of relative preservation of capital in falling markets and access to the upside in rising markets.

Concern #2: Is RIT’s private investments activity ‘risky’?

Much of the recent press commentary surrounding RIT has focused on the scale of its exposure to private assets and the potential for further valuation write-downs in this part of the portfolio as updated valuations come through. We believe much of this concern is misplaced.

New private investments made over the past decade have, on average, generated a 25% IRR

It is worth reiterating that the main reason why the private investments portfolio has increased as a proportion of the portfolio in recent years (see Figure 7 on page 21) is the impressive returns that it has generated. JRCM notes that new private investments made over the past decade have, on average, generated a 25% internal rate of return (IRR) and a 9.4x multiple of invested capital (direct investments did even better than funds: 32% IRR versus 22% IRR).

Regarding the first point on scale of exposure, RIT is differentiated from other vehicles in terms of its ability to hedge and its disciplined approach to realisations.

In terms of hedging, it is worth highlighting the headline exposure figures for private investments do not reflect the hedges the manager has put in place to offset some of the associated risk. As described on page 17, the manager was active in 2022 in hedging exposures, for example by shorting baskets of listed private equity managers. Thus, the manager is able to proactively adjust exposures to a given theme or asset class, while still holding on to its highest conviction assets to capture their long-term returns generation. Said another way, this implies that even where the manager’s exposure to private investments may appear to have increased, the actual market exposure net of the manager’s portfolio-level hedging and risk management may be considerably lower.

The manager can also hedge specific individual investments. Coupang offers an important case study of this. RIT initially invested $50m in Coupang in April 2018 via a convertible debt instrument (similar in structure to RIT’s investment in Motive, see page 28). The company listed in March 2021, following its initial public offering (IPO) with shares closing at $49.25 per share on the first day. Given the strong run-up in price, the manager quickly hedged the position to ‘lock in’ the gains achieved before IPO, thus mitigating the share price decline post-IPO. Through the end of 2022, the trust has generated $320m of proceeds from sales of Coupang shares alongside circa $20m in remaining shares, equating to 7x its original investment of $50m.

In terms of realisations, the trust has generated around £1.1bn of realisations from private investments in the 3 years ending 31 December 2022. This includes disposals in the direct book, such as the Coupang IPO and the sale of CSL in 2020, and distributions from asset sales within its private fund holdings. This has allowed the manager to meaningfully de-risk the trust’s overall exposure to private assets.

Regarding the second point on whether further write-downs are forthcoming, RIT is further differentiated by its use of structured instruments to protect on the downside.

Importantly, the large majority of the trust’s private investments benefit from structural protection, which helps cushion the impact of falling valuations. For example, the manager will typically invest via a convertible note or preferred instrument, meaning it is not a pure equity investment as RIT’s holding would be treated similarly to debt in a liquidation scenario. An example is the trust’s largest holding, Motive (see page 28), where nearly 80% of its capital was deployed via a convertible debt instrument designed to provide downside protection as well as equity upside. Because of this protection feature, declines in public equity markets do not necessarily correspond to the same decline in RIT’s private holdings.

From a process standpoint, holding values for RIT’s private holdings are set by the trust’s independent valuation committee, a sub-committee of the RIT Board consisting entirely of non-executive directors. All holdings are reported at fair value and are subject to audit. The manager regularly back-tests the carrying value of its private holdings and compares these to the proceeds achieved on realisations, as a check for the conservatism of its reported values. Over the last decade, the manager notes the average mark-up achieved from realisations from its direct private investments is 23%, suggesting its holding values are indeed conservative.

Within the funds book, the manager notes the example of Stripe, which raised a new funding round at a valuation around $50bn in early 2023, compared to $95bn in its prior funding in 2021. There are two funds in the trust’s private funds book which hold Stripe, and in both cases, the funds had already marked down their holding values for Stripe in the second quarter of 2022 to a level consistent with where the latest funding round has closed. Notably, this mark-down was done concurrently with the decline seen in public equity markets in the first half of 2022, and was also completed well in advance of the year-end audit cycle for the funds. Other holdings across the private funds book were also proactively adjusted to reflect the de-rating in public markets.

This implies much of the ‘pain’ is already reflected in the trust’s reporting of valuations for its private holdings. More generally, since the rate of increase in US inflation peaked last year, investors are starting to contemplate an end to rate hikes. There have been false dawns, but it feels to us as though we are closer to an inflexion point in this market cycle.

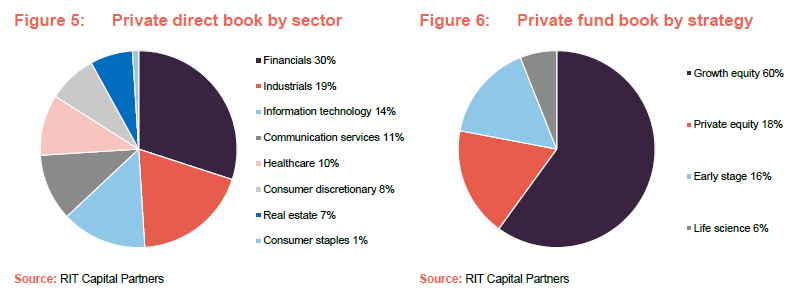

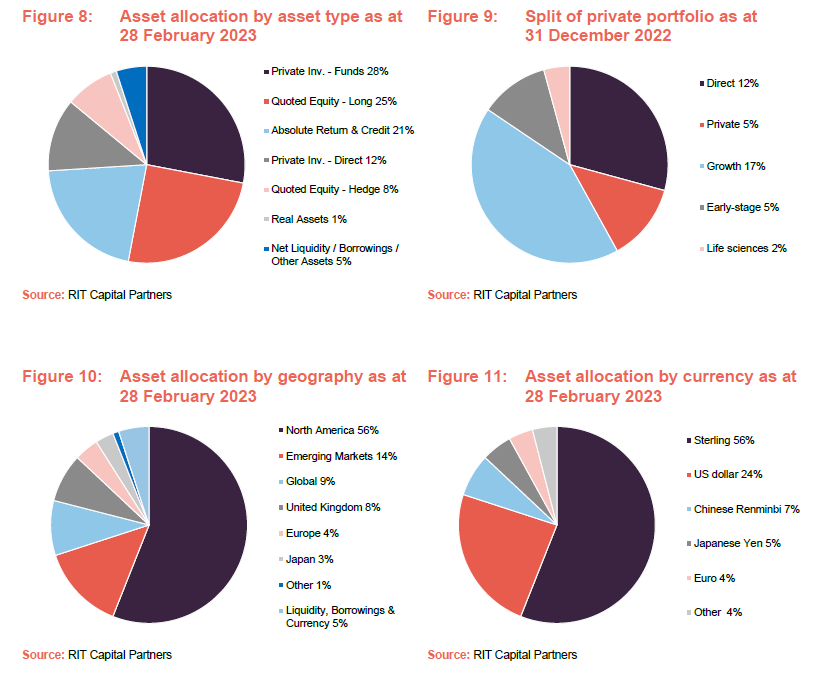

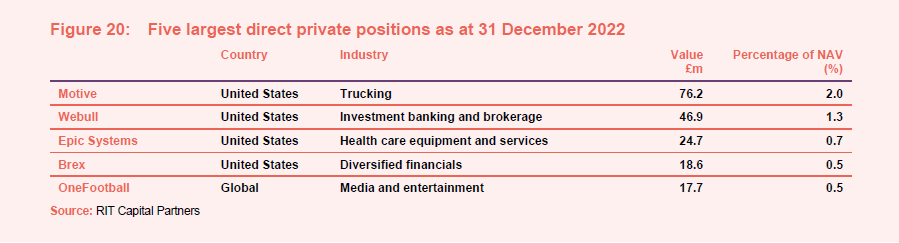

At the end of January 2023, RIT’s private direct investments accounted for 11% of its NAV, and the manager has disclosed the majority of the 10-largest direct holdings were profitable. The holdings are concentrated in large, established franchises, often with a strong growth runway ahead. We discuss the five largest positions in more detail on page 28.

The private fund investments accounted for a further 28% at the end of January 2023. We discuss the five largest positions in more detail on page 26.

Figure 5 below shows the composition of RIT’s private investments portfolio at the end of December 2022, as disclosed in the trust’s annual report and accounts. The direct investments are allocated across a wide range of sectors, with the largest holdings being financials and industrials, followed by information technology, communication services and healthcare.

Around 80% of the private fund portfolio consists of later stage growth and traditional private equity strategies. This includes many of RIT’s largest fund manager relationships including Thrive, Iconiq, BDT and others. A smaller portion of the book is allocated to early-stage funds, with the balance invested in the life sciences sector.

Concern #3: Is RIT’s cost base too high?

Amidst a challenging year across asset classes in 2022 and the broader backdrop of market volatility, there has unsurprisingly been a renewed focus on costs across the investment trust sector. In the case of RIT, attention has been focused primarily along two verticals: (i) its ongoing charges ratio, and (ii) the board’s approach to remuneration. We cover each of these in turn below.

Regarding RIT’s ongoing charges ratio, there has been considerable attention placed on the trust’s reported KID figure of 5.4%. The ongoing cost element of the fees paid to the managers of underlying funds was estimated at 0.87%. The bulk of the 5.4% figure consists of performance fees and carried interest paid to third party managers, such as private equity funds, which are only paid for performance above a hurdle rate.

A notable example is Coupang, where the trust’s investment was via a vehicle set up by a third-party manager. Up to the end of December 2022, RIT’s investment of $50m had generated total value of $340m, a figure which is net of all fees and carried interest paid to the third party manager for introducing the deal.

RIT’s own ongoing charges figure was 0.89% in 2022, as reported in the trust’s most recent annual report and accounts and calculated in accordance with AIC guidelines. This level of ongoing charges is consistent with that of other multi-asset, capital growth focused investment companies in the sector, and is considerably below the 2% level charged by many alternative investment managers, particularly in the private equity space. As RIT is self-managed via its wholly owned manager subsidiary, JRCM, the trust does not pay a separate investment management fee to its manager.

Remuneration for the manager is designed and implemented by the independent RIT remuneration committee, which is itself advised by independent remuneration consultants. Awards are designed to maximise the links to performance and alignment with shareholders. To reinforce this alignment, there has been a shift away from cash awards to share awards.

Much of the recent commentary has focused on headline cost figures included in RIT’s annual report and accounts. However, it is worth noting these are accounting figures and do not necessarily reflect the actual cost incurred by shareholders. For example, the remuneration figures reported for 2022 include awards which did not vest (and therefore no actual cost to the company). Awards are also subject to three-to-five- year deferrals.

Ultimately, all annual incentive awards are also subject to a cap of 0.75% of net assets, a level which has never been reached. This cap is designed to explicitly limit the quantum of any awards to the manager and ensure alignment with shareholders.

Outlook, positioning and investment process

In the following pages, we provide an overview of the manager’s latest views and its investment process. We also include a summary of the largest holdings within each area of the manager’s portfolio.

Manager’s view

JRCM is cautious and the portfolio reflects this

JRCM is cautious about the macroeconomic outlook, and this is reflected in RIT’s asset allocation. It acknowledges that the significant increase in risk free rates has compressed the equity risk premium and feel that this warrants a low net quoted equity exposure. As we show in Figure 7 on page 20, this is at historical lows within RIT’s portfolio. JRCM’s view on listed equities is corroborated by dividend yields – it says that, absent the expectation of strong earnings growth, yield on equity is too low compared to more predictable assets for it to take on additional risk.

The market selloff and panicky investors are creating opportunities for permanent capital vehicles such as RIT. JRCM says RIT has liquidity available to fund additions to RIT’s single stock and credit investments.

The pendulum of investor sentiment has swung too far away from growth. Disruptive, innovative companies can still make headway regardless of listed market valuations. This is especially true if they are backed by private capital, which has liquidity to fund opportunistic bolt-on acquisitions at distressed valuations.

JRCM feels that fundamentals will reassert themselves and indiscriminate selling of growth stocks seen in 2022 without regard to their cash flow potential will cease. It notes that RIT’s private investments book are largely established, mature, and well-capitalised companies delivering robust growth. When IPO markets reopen, RIT should see a pick-up in realisations from this part of the portfolio.

JRCM also sees opportunities in areas such as merger arbitrage, structured credit, and equity market-neutral strategies.

Investment process

RIT has a truly multi-asset portfolio. The overall aim of the investment approach applied to RIT’s portfolio is the generation of asymmetric long-term returns – participating in the upside but incorporating a reasonable degree of capital protection on the downside.

Responsibility for the day-to-day management of the portfolio rests with JRCM but it operates within parameters set by the board and its actions are scrutinised by an internal investment committee.

Risk management is at the core of the investment approach

The management of risk is central to the investment approach. RIT does not seek to preserve shareholders’ capital by ‘hiding’ in liquid assets, which offer low or even negative real returns. Instead, it allocates to investment strategies that offer the potential of returns uncorrelated with equity markets, and makes use of other strategies that offer downside protection in the event of market volatility.

A crucial aspect of JRCM’s risk management efforts is to reduce the degree to which the portfolio is exposed to overlapping drivers of risk and return. One way of achieving this is to seek to diversify RIT’s exposures. JRCM describes this as “fishing in different ponds” for investment returns.

Six cylinders

The manager’s core aim is to identify unique themes which have the potential for long-term compounding capital growth. This includes areas such as the digital transition, life sciences, emerging markets, clean energy and others. The manager can then deploy its unique, global network to target what it believes are the best assets to capture each theme. These themes are then expressed via investments across six distinctive investment ‘cylinders’, offering shareholders access to these themes in a diversified manner, and with a prudent risk-management overlay.

These six cylinders are listed below:

- thematic top-down;

- externally managed equities;

- single stocks;

- active currency management

- uncorrelated strategies; and

- private investments.

Each cylinder has different returns drivers which are unlikely to ‘fire’ at the same time, but if the team get the portfolio construction right, there will always be a part of the portfolio that is creating value for investors.

All new investments are comprehensively analysed by the investment team led by the chief investment officer, in the first instance and then brought to the investment committee for approval.

The committee meets weekly and in addition to scrutinising investment proposals is also responsible for monitoring overall exposures. Close scrutiny of investment performance also serves as a risk management tool in that alarm bells are rung by commonality of strong or poor performance from investments that are not supposed to be correlated.

ESG

The ability to hedge exposures against relatively short- term swings in sentiment is invaluable

The top-down, thematic, macro overlay and risk control element of the investment approach is a key ingredient in RIT’s success. Identifying macroeconomic themes (and the risk that comes with them) can expose attractive investment opportunities while also protecting the portfolio from potentially extreme market moves. As investment ideas sometimes take years to come to full fruition, the ability to hedge exposures against relatively short- term swings in sentiment is invaluable.

Thematic, top-down matters are a core consideration of the investment committee, which in turn draws on the expertise of both the internal team and JRCM’s extensive network. It sets overall risk levels and the asset allocation framework.

When the process identifies potential investment opportunities, the time horizon for these affects how it chooses to express its views. Typically, it would not recruit an external manager to exploit a short-to-medium-term opportunity; instead, it might use derivatives, exchange traded funds (ETFs) or have a basket of stocks curated for RIT.

Tail hedging is used when it is cost-effective to do so

The team does not apply tail hedging consistently to the portfolio and it does not buy such protection when it is expensive. In addition, when opportunities present themselves, it may look to benefit from upside tail scenarios.

Turnover within the core portfolio is low; however, positions are frequently adjusted to accommodate changes in the risk/return outlook for sectors, geographies and currencies.

The turbulence in markets in 2022 illustrated the importance of this ‘cylinder’ to the management of RIT’s portfolio. Part of this approach is to emphasise or de-emphasise parts of the portfolio to compensate for risk in other areas. The private investments part of the portfolio, for example, includes many long-term opportunities which leverage the trends from disruptive technologies. It would not be practical or productive to trade this part of the portfolio in anticipation of short-term shifts in investor sentiment. To offset this risk, the exposure to this theme within the quoted equity book was kept deliberately smaller, including at times for example being net short the technology sector in the quoted equity portfolio to offset any such exposure in the private investments portfolio. Additionally, JRCM used hedges to manage currency translation risk, and to reduce exposure to particular sectors or companies (such as Coupang, as discussed on page 13).

Externally managed/advised equity portfolios

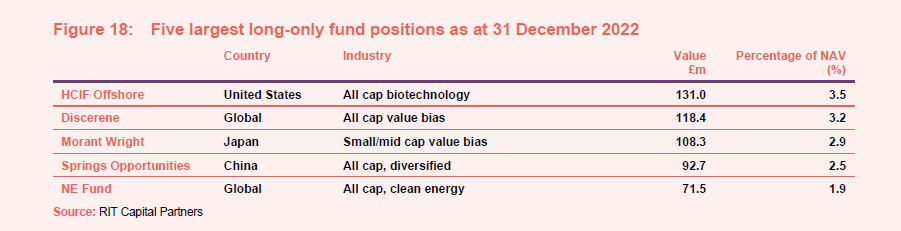

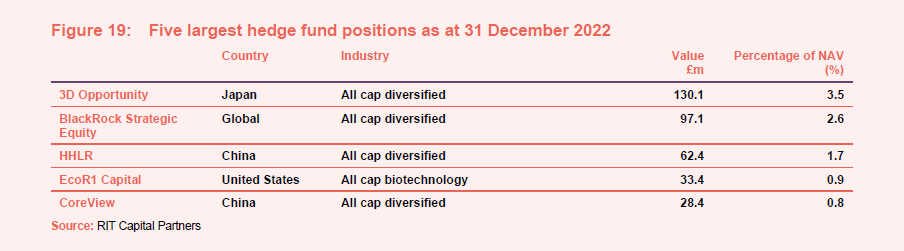

This next cylinder has historically been a large part of RIT’s portfolio. It can be broken down into long-only funds and hedge funds and RIT publishes the split between the two.

RIT’s readiness to commit capital for the long-term and maintain it through market cycles is attractive to the underlying managers. The majority of RIT’s external managers are closed to new money, and so a RIT shareholder has access to specialist managers that they would not otherwise be able to reach.

The RIT brand helps open doors. Having RIT as an investor can be perceived as a stamp of approval for a manager, and therefore the best of them are happy to provide capacity to RIT. In addition, the strength of the Rothschild family network and the executive team’s connections with the new generation of managers is invaluable. JRCM has close relationships with endowment funds and family offices with a similar long-term approach to investing as JRCM and such relationships provide fertile investment opportunities. RIT is often an early investor in funds and this helps secure favourable terms and build long-term relationships.

An internal funds team helps select potential new managers. It looks for managers with strength of conviction that are targeting excess returns of 7%–10% per annum. As the net equity exposure in RIT is kept within moderate levels, this allows the team to invest in riskier sub-portfolios without compromising its overall risk budget.

The ideal sub-portfolio is low beta and high alpha

The ideal sub-portfolio is low beta and high alpha. The macro/risk overlay is used to limit RIT’s participation in market drawdowns and to minimise the impact of tail events.

JRCM does not operate a strict rebalancing policy within the portfolio. It trusts its underlying managers to return excess cash and would terminate the relationship with a manager that it felt was focused on asset gathering rather than investment performance.

Single stocks

The single stock portfolio is managed internally by a team of two and JRCM highlights that it has become extremely cost effective to manage this cylinder in house. The team also provides a useful function in challenging the stock selection decisions of the external managers.

Single stocks can be used to express themes identified in the asset allocation process. The sorts of stocks in the portfolio tend to be large/mega cap and high-quality businesses. These are also relatively ‘safe’, easy-to-understand companies. The team does not buy recovery plays, turnaround situations or heavily operationally or financially geared companies. Typically, it is targeting double-digit annualised returns over three-year periods.

RIT is looking for cash-generative, relatively-low-risk private investments

RIT is looking for cash-generative, relatively-low-risk private investments that fall into one of two categories:

- ‘Compounders’ – investments that offer the potential of annualised returns of at least 15% in a base case, and high single digits returns in a worst case scenario. These deals are usually structured using debt instruments with a conversion option, preferred equity with warrants plus a regular cash coupon, and so forth. RIT has a five-to-10-year time horizon when assessing these investments, although it can also hold for much longer periods if it chooses to.

- ‘Multipliers’ offer the potential of about 25% annualised base case returns without leverage. These investments will be free cashflow-positive but possibly not sufficiently so to support structural cash coupons (interest payments). RIT is looking for return of principal in a worst-case scenario and tends to have a three-to-15-year time horizon for these investments.

ESG

JRCM is committed to the integration of environmental, social and governance (ESG) considerations across its investment analysis, investment management, active ownership and internal operations. It is a signatory to the UN PRI and has created a responsible investment framework and policy to govern its approach to ESG issues.

Analysis of ESG factors helps to deliver enhanced risk-adjusted returns

JRCM believes that carefully integrating the analysis of ESG factors in the investment process helps to deliver enhanced risk-adjusted returns over the long term.

JRCM has identified three central principles of responsible investment:

- ESG factors will influence a company’s performance. Therefore, those counterparties who take ESG factors seriously will more often than not produce meaningful long-term returns through the cycles;

- Applying an ESG lens gives JRCM a comprehensive understanding of both financial and non-financial risks, as well as return opportunities; this results in better decision making; and

- Continual engagement with RIT’s counterparties will help protect and enhance shareholders’ capital which is JRCM’s core corporate objective.

The team chooses not to use standardised checklists which invariably become ‘tick box’ exercises and hence do not give sufficient colour or nuance to ESG analysis. Rather, it is committed to a ‘deep dive’ which gives it a comprehensive understanding of relevant ESG factors for that particular investment. Crucially, the depth of JRCM’s relationships with many investee companies gives it leverage and enables it to press for practical improvements. JRCM monitors ESG practices and performance by counterparties, and will raise any issues as part of its general engagement processes with them.

JRCM is working with an external adviser to consider its ability to make additional climate-disclosures in relation to RIT’s investment portfolio, while acknowledging the likely challenges caused by having external funds.

Asset allocation

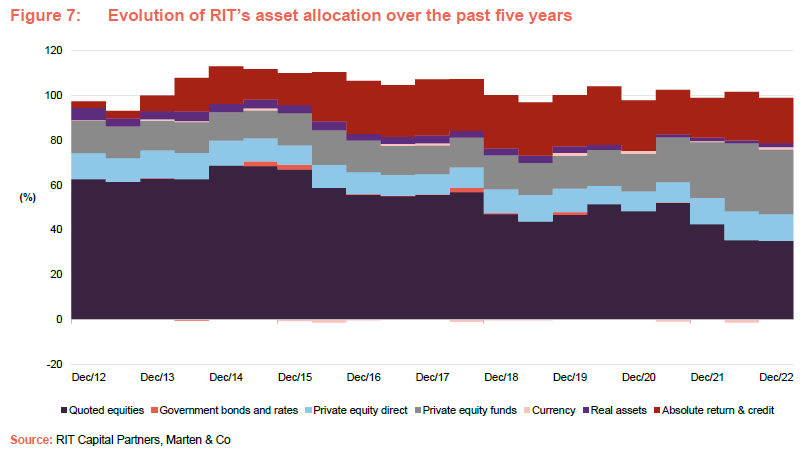

RIT publishes, on a monthly basis, an analysis of the breakdown of the trust’s portfolio by type of asset, and Figure 7 below provides an illustration of how this has evolved over the last decade (using data at six-monthly intervals – as at

31 December and 30 June each year). Key takeaways are as follows:

- The allocations are not static. Their evolution reflects both the performance of the different sleeves as well as a conscious decision on the part of the managers to allocate to the areas where they see the best opportunities, while maintaining balance within the portfolio.

- Quoted equities remain RIT’s largest allocation, but whilst this previously occupied around two-thirds of the portfolio at the start of the decade, this allocation has roughly halved so that it now accounts for a little over a third.

- The allocation to private equity funds has increased during the last few years. This comes despite RIT achieving around £1.1bn of disposals over the last three years, and is driven primarily by the continued growth in the trust’s underlying private holdings. The manager expects its private allocation will rebalance naturally over time, particularly as the IPO window re-opens and many of its larger holdings go public as a result.

- The position in absolute return and credit has increased meaningfully since the beginning of the decade (a sub 2% position is now around 20% today). The bulk of this expansion occurred between 2013 and 2018 and reflects a conscious decision by the manager to increase exposure in these areas, both as an additional source of diversification and reflecting the manager’s increasingly cautious view of broader equity markets.

A comparison of Figure 10 (RIT’s asset allocation by geography) and Figure 11 (RIT’s asset allocation by currency) gives a useful insight to the lengths that the managers go to achieve balance within the portfolio. The portfolio’s exposure by geography illustrates that the portfolio is very global in nature, with some 56% allocated to the US (reflecting its growth prospects and very business friendly markets) and just 8% in the UK. Equally, RIT’s currency allocation is 24% to the US dollar and 56% to sterling, with smaller allocations to the Euro, the Yen and the Renminbi. This illustrates the manager’s flexibility in managing its currency exposure, an important area of risk management particularly at times of heightened volatility in currency markets.

Largest holdings

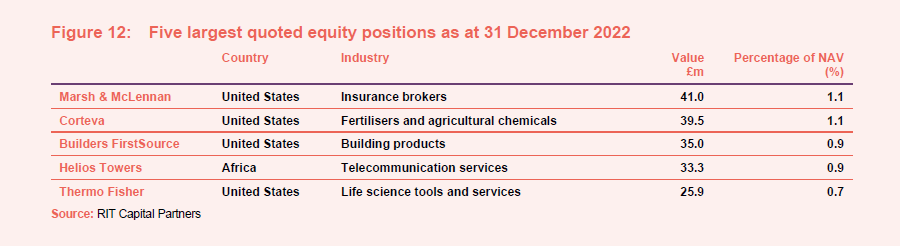

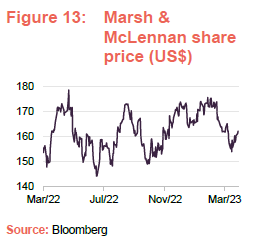

Marsh & McLennan – global leader in insurance broking

Marsh & McLennan (www.marshmclennan.com) is a professional services firm that offers risk management, insurance brokerage, and consulting services to clients across the global. The company operates through four main segments: Marsh (insurance brokerage and risk management services), Guy Carpenter (reinsurance and capital market services), Mercer (actuarial consulting and investment management services for employers and employees), and Oliver Wyman (management consulting services).

The company has established itself as a leader in the insurance and risk management industry, consistently ranking among the top global firms in its sector. Its investments in technology and data analytics have enabled it to deliver value to its clients through enhanced risk management solutions, while its strategic acquisitions have expanded its global footprint and service offerings. These have collectively contributed to the company’s strong financial performance in recent years.

RIT is invested in Marsh & McLennan as a business with strong defensive moats benefitting from mega trends in business risk and complex labour markets, whose variable cost structure provides downside protection.

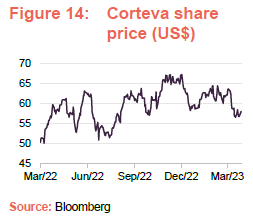

Corteva – major US agriscience company

Corteva (www.corteva.com) is a major American agricultural chemical and seed company that was created in 2019 from the spin-off of DowDuPont’s agricultural unit. Its products are designed to maximise yields and increase crop performance, ultimately providing farmers with a greater return on investment.

Corteva has a wide range of seed products that includes corn, soybeans, wheat, canola, and rice, among others, while its crop protection products include herbicides, insecticides, and fungicides, all of which are designed to help farmers protect their crops against pests, diseases, and weeds. Corteva also offers a range of digital solutions to help farmers optimise their operations. These solutions include precision agriculture tools, data analytics, and software platforms that can help farmers make more informed decisions about planting, harvesting, and crop management.

RIT invested in Corteva as a stable business driven by agricultural (as distinct from economic / cyclical) demand with a strong balance sheet that shows potential in self-help opportunities following a period of mismanagement.

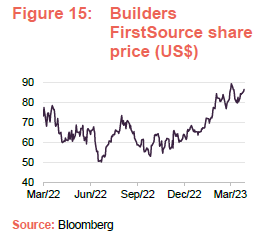

Builders FirstSource

Builders FirstSource (www.bldr.com) is a leading supplier of building materials, including lumber, roofing, insulation, and other related products, to professional contractors and builders in the US. The company operates in over 40 states and has a network of more than 400 locations, making it one of the largest suppliers of building materials in the country. It has grown both organically and by acquisition in recent years.

Builders FirstSource has a strong focus on customer service and offers a range of value-added services including design and engineering, project management, and installation. It also has made a significant commitment to sustainability and has implemented a number of initiatives to reduce its environmental footprint, including increasing its use of sustainable materials and reducing waste and energy consumption.

RIT purchased shares in Builders FirstSource at less than five times free cash flow. As the largest player in a highly fragmented industry, it has scale advantages and geographic reach, which, combined with innovation, JRCM believes should help the company to grow above its industry peers. JRCM also believes there is a healthy margin of safety from its scale, free cash flow generation, balance sheet strength, and a constructive approach to shareholder returns.

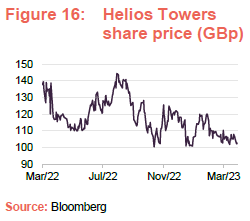

Helios Towers – exposed to high growth markets

London-listed Helios Towers (www.heliostowers.com) is a sub-Saharan telecoms tower infrastructure business that builds, owns and operates telecoms towers in high-growth countries in Africa and the Middle East (Helios is the leading independent tower company in seven of the nine markets in which it operates). Helios’s towers are capable of accommodating and powering the needs of multiple tenants (typically large mobile network operators and other telecommunications providers) and it also offers a range of tower-related operational services (site selection and preparation, maintenance, security and power management.

The markets in which Helios operates share similar growth characteristics: strong GDP growth, a young and urbanising population, and increasing smartphone adoption. As a consequence, these markets are experiencing rapid growth in demand for mobile data, which is driving demand for telecommunications infrastructure. Helios expects that these factors will drive an estimated requirement of 25,000 points of service over the next five years, each of which represents a potential new tenancy for its business. This organic growth opportunity exceeds the size of its portfolio today.

RIT invested in Helios as part of its private investments portfolio, in order to gain exposure to a structurally growing end-market through one of the leading franchises in the region with a strong focus on shareholder capital stewardship. Helios had its IPO in 2019 and RIT remains a shareholder in the company.

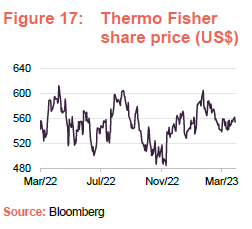

Thermo Fisher – benefitting from growth in testing

Thermo Fisher Scientific (www.thermofisher.com) is a global biotechnology company that provides products for life science research, clinical diagnostics, industrial biotechnology, and laboratory services. Its product portfolio includes laboratory equipment, reagents, consumables, software, and services and it has a large customer base that includes academic and government research institutions, pharmaceutical and biotechnology companies, hospitals and clinical laboratories, and industrial and environmental testing laboratories. It is benefitting from the growth in clinical testing, which is supported by strong long-term growth drivers.

The company has grown through strategic acquisitions, acquiring several businesses in recent years to expand its product offerings and geographic reach. Some notable acquisitions include the acquisition of Patheon, a contract development and manufacturing organisation, and Qiagen, a provider of molecular diagnostics and sample preparation technologies.

RIT invested in Thermo Fisher as a high quality company geared to attractive end markets whose product and geographic scale drives a competitive advantage. This has fed through to an excellent track record of execution that enables the company to drive a very attractive total shareholder return.

HCIF Offshore – global healthcare exposure

Launched in 2012, HCIF Offshore is a hedge fund that invests in healthcare companies globally. The fund’s manager is a healthcare-focused investment firm based in the US, with approximately US$17bn in assets under management (AUM). HCIF Offshore’s strategy involves identifying companies that are developing innovative healthcare products and services, as well as companies that are well-positioned to benefit from demographic trends such as aging populations and increasing healthcare spending. It has a diversified portfolio of investments, with a focus on early-stage biotechnology companies that are developing innovative treatments for diseases such as cancer, rare genetic disorders, and autoimmune diseases.

Discerene – quality investing in developed markets

Founded in 2017, Discerene is a Connecticut-based long-only investor focused on holistic fundamental research employing value investing principles with a long-term mindset. The team invests in businesses protected either by structural barriers to entry or hard assets, at attractive entry prices when out of favour, offering significant margins of safety. Discerene seeks private equity like structures to make truly long-term investments in public companies. The firm has built strong relationships with its capital providers with whom it closely shares philosophy, values, and investment horizons.

Morant Wright – Japanese fund with value focus

Morant Wright is a London-based hedge fund that was founded in 1999 by Stephen Morant and Ian Wright. The fund makes investments in Japanese companies with a disciplined value approach. The team aims to reduce the risk of capital loss by investing in companies with strong balance sheets, attractive business franchises and low valuations. They measure valuations primarily by a company’s price to book and enterprise value to operating profit ratios. The fund is well positioned to realise the value in its portfolio as Japanese companies come under increasing pressure to focus on shareholder returns, both due to government policies and increasing private equity and activist shareholder activity.

Springs Opportunities – RIT’s core Chinese holding

Managed by Hong Kong-based Springs Capital, The Springs Opportunities Fund is focused on investment in China. The manager operates a fundamental-driven investment approach, favouring companies with outstanding corporate governance, proven operation and management track record, and exceptional entrepreneurial drive. It also takes a contrarian approach, conducting deep-dive research into out-of-favour areas of the market, with the aim of identifying mispriced assets and key drivers that may change market perceptions.

NE Fund – leveraging the transition to clean energy

NE fund is managed by Clean Energy Transition LLP, composed of the team formerly managing a similar strategy at London-based manager Lansdowne Partners. The fund targets superior risk adjusted returns in markets serving the transition to a clean energy future. The team brings experience across utilities and energy, engineering, and industrials to form a holistic approach to this new vertical. In addition to strong investor returns, the fund is a strong proposition with an ESG lens as a capital provider to companies lowering carbon emissions.

3D Opportunity

3D Opportunity Fund is a hedge fund managed by 3D Investment partners, a Japan-focused value investor that makes opportunistic investment with a focus on quality. The manager, which was founded in 2015, engages with the management teams of its investee companies with the aim of releasing the considerable value that is locked up in certain Japanese Corporate entities. Following significant developments including a new corporate governance code, increased focus from the government, shareholder activism and private equity interest, there is renewed optimism in Japanese equity markets. 3D Opportunity is well positioned to capitalise on these changes as the ‘Japan discount’ unwinds and these companies achieve their potential.

BlackRock Strategic Equity

Launched in 2011, BlackRock Strategic Equity is a circa US$8bn hedge fund that focuses on long-short equity strategies. The manager seeks to identify companies with attractive valuations and long-term growth prospects, while also seeking to mitigate risk through the use of capital protection strategies (including short selling, options exposure, interest rate and foreign exchange hedges etc.) with the aim of generating consistent returns while minimising volatility through a low net exposure to the market. The fund has a diversified portfolio of investments in sectors such as healthcare, technology, and consumer goods. The fund which is manged by Alistair Hibbert, has a strong reputation for combining rigorous stock-picking with a thorough understanding of the impact of economic cycles on capital markets and the expression of this through factor and risk management.

HHLR

HHLR is managed by Hillhouse, among the leading investors in Chinese equities since their 2005 founding. The team carries out deep primary research in Chinese and related Asian companies with a focus on long-term defendable and monetisable franchises. It leverages its significant firm resources across its public and private equity investing strategies to generate unique insights, gain conviction then invest over the long term with its stable funding base. Hillhouse is renowned for being among the first investors in Tencent Holdings and JD.com, two of China’s most successful companies with hundreds of billions of dollars in market capitalisation.

EcoR1 Capital

Founded in 2013 by Oleg Nodelman, a former portfolio manager at BVF Partners, EcoR1 Capital is a fund that specialises in investing in the healthcare industry, particularly in biotechnology and pharmaceutical companies. Its investment strategy involves identifying companies that are developing therapies for rare or difficult-to-treat diseases. These often have significant potential for growth and can offer high returns for investors, with the benefits that strong intellectual property and the associated competitive advantages that can bring. The fund has invested in companies such as Vertex Pharmaceuticals, CRISPR Therapeutics, and Alnylam Pharmaceuticals, all of which have developed ground-breaking therapies.

CoreView

CoreView is a hedge fund managed by CoreView Capital Management, a Hong Kong based hedge fund manager with approximately US$2bn in assets. The fund invests in Chinese technology companies that are positioned to benefit from China’s rapid economic growth and increasing adoption of technology (a function both of China’s growing middle class and increasing demand for technology). These companies will typically be developing innovative technology solutions for the Chinese market. The fund also invests in other areas such as healthcare and consumer goods. It has a strong track record of successful investments in Chinese technology companies, having invested in such companies as Tencent, Alibaba, and Meituan, all of which have experienced significant growth and success in recent years.

Motive

Motive (gomotive.com) operates in the transportation logistics sector and provides fleet management services to businesses with the aim of reducing their operating costs, improving their efficiency, and increasing their profitability. Its services include vehicle acquisition, financing, maintenance, fuel management, telematics, and driver safety training. Motive’s fleet management software provides real-time data on vehicle performance, driver behaviour, and fuel consumption. This enables businesses to make informed decisions and optimise their operations as well as improving their safety and compliance – the company’s telematics data can help to identify and address unsafe driving habits before they lead to accidents. The company also helps businesses stay compliant with regulations and industry standards.

JRCM invested in Motive as a candidate for its multiplier portfolio with a strong management team executing on a growing segment with high margin potential. 80% of the investment is in the form of a convertible note that protects shareholder capital in a downside outcome while retaining equity upside through the conversion feature. The company continues to deliver strong recurring revenue growth and raised $150m in new equity during 2022 at a 20% premium to its most recent funding round in 2021.

Webull

Webull (www.webull.com) is a stock and fund brokerage platform bringing together traditional investor services on a single platform with a modern and accessible user experience. The product has seen growing adoption as new and existing market participants seek greater control over their financial affairs.

JRCM sees Webull as an outstanding expression of the growth in self-directed investing made possible by advances in cloud computing and smartphone technology. Webull’s strong technical offering supports its leading position among more sophisticated investors in the US and in expansion markets. RIT’s investment is in preferred shares that rank above prior issues, providing protection in a downside outcome.

Epic Systems

Epic Systems (www.epic.com) is a US software company that specialises in creating electronic health records (EHR) and other healthcare-related software. The company is very well-established, having been founded in 1979, and is now one of the largest providers of EHR software in the world – over 280m patients currently have an electronic record in Epic. Epic’s system is able to integrate with a wide range of healthcare systems and providers. This allows Epic’s customers to share patient data seamlessly, which can improve the quality of care and patient outcomes. Epic Systems’s software can also help healthcare providers manage their operations more efficiently, saving time and reducing costs. The company’s software is also designed to be easy to use and accessible to patients, which can help improve patient engagement and satisfaction.

JRCM views Epic’s commanding market position and sticky, multi-year contracts as a very strong defensive moat that has supported growth in the business over several decades. This profile places Epic in RIT’s ‘compounder’ portfolio that has the potential to grow shareholder capital ahead of the market with less risk over the long-term.

Brex

Brex (www.brex.com) is a US financial services company serving the needs of modern businesses. It offers expense management, accounting software and financial products, which can help businesses save time and improve their financial management. Brex describes itself as “the number one spend platform for strategic finance teams”, aiming to allow its users to control all of their spend in a single unified system.

The company has grown meaningfully under RIT’s ownership as maturation of the business has expanded its market position and earned follow-on investment from blue-chip private equity investors.

OneFootball

OneFootball (onefootball.com) is a popular mobile application that provides users with live streaming, highlights, news, and blogs from the world of football. Launched in 2008, OneFootball’s app has since become one of the most popular football apps globally, with over 100 million active users in more than 200 countries. The app, which has a user-friendly interface, provides comprehensive coverage with real-time updates on matches, scores, and news from leagues and teams. It also provides users with personalised news feeds based on their favourite teams and players, ensuring that they receive the most relevant and up-to-date information. OneFootball has also become a popular platform for social interaction among football fans, building a vibrant global community and increasing the relevance of the platform to media rights owners and advertisers alike.

The company maintains deep relationships with the clubs, leagues, and federations, as well as media rights owners and advertisers. RIT invested in OneFootball as an emergent ‘one-stop-shop’ platform for football fans offering many routes to monetisation through advertising, subscription, and pay-per-view, among others.

Thrive funds

Thrive Capital (thrivecap.com) is a New York-based venture capital firm founded in 2009 by Joshua Kushner. It specialises in making investments into technology companies – particularly those in the consumer, software, and financial services sectors – focusing on companies that are poised to disrupt traditional industries and create new markets. Thrive seeks out companies with strong leadership teams and a clear vision for the future, and then works closely with them to provide the resources and guidance needed to develop their businesses.

Iconiq funds

Iconiq Capital (www.iconiqcapital.com) is a privately-held investment firm, founded in San Francisco in 2011, whose primary focus is on providing investment management services to ultra-high-net-worth individuals, families, and institutions. It manages a range of funds, including private equity, growth equity, and real estate; its investment philosophy is centred around a long-term, fundamental approach to investing. Iconiq Capital seeks to identify high-quality companies with strong growth prospects and to hold these investments for the long term. The firm has a reputation for working closely with its portfolio companies to help them achieve their growth objectives, and has a strong network of industry experts and strategic partners that it can draw on to support its portfolio companies. Reflecting this, it has a diverse portfolio of investments across a range of industries, including technology, healthcare, consumer, and financial services.

Iconiq are investors alongside RIT in Epic Systems, the leading US Electronic Health Records provider, and invested with RIT in the buyout of CSL, a UK-based alarm signalling business which returned 2.6x on RIT’s private equity investment in 4 years.

BDT Capital funds

BDT Capital Partners (bdtmsd.com) is a Chicago-based investment firm that specializes in providing private equity and advisory services to family-owned and entrepreneurial businesses. The firm was founded in 2009 by Byron Trott, a former vice-chairman of investment banking at Goldman Sachs, and renowned as ‘the only banker Warren Buffett has ever trusted’, and has since grown into a global investment platform with over US$20bn in AUM. The firm provides a range of investment solutions, including equity capital, structured debt, and hybrid securities, and works closely with management teams to drive growth and operational improvements in its investments. BDT understands the unique challenges and opportunities that family-owned businesses face, and has developed a range of tools and resources to support their growth and development – including access to a network of experienced family business leaders, as well as customised solutions for governance, succession planning, and other key areas. Reflecting this, BDT has a diverse portfolio of investments across a range of industries, including consumer and retail, healthcare, industrial and business services, and technology and media.

BDT invested alongside RIT in its Acorn Holdings investment, a packaged coffee and ready-to-drink business holding famous brands such as Keurig, Kenco, Green Mountain, Dr Pepper, and Schweppes that formed part of the ‘compounder’ portfolio. The investment returned 2x RIT’s invested capital for the equivalent of a 20% compounded annual rate of return.

Greenoak Capital funds

Founded in 2010, Greenoak Capital (greenoak-capital.com) is a private equity firm that focuses on investing in companies in the technology, healthcare, and consumer sectors. Its latest fund closed in 2021 with US$1.75bn in commitments and its total AUM is in the region of US$7bn. The company has a disciplined approach to investing, seeking to identify companies with strong fundamentals and long-term growth potential.

RIT invested alongside Greenoaks in Coupang, the Korean ecommerce company, that went on to generate a return that was approximately seven times its original investment or around $340m in total value for a $50m initial investment.

Ribbit Capital funds

Founded in 2012, Ribbit Capital is a venture capital firm that focuses on investing in disruptive financial services companies that have the potential to displace traditional gatekeepers in the space, as well as create entirely new markets. The firm has raised several funds since its launch – its latest fund closed in 2021 with US$900m in commitments – and has become one of the most prominent investors in private financial services companies. Ribbit Capital has a strong track record of identifying promising businesses and providing them with the support they need to grow and succeed. The firm has a strong network of industry experts and entrepreneurs that it can leverage to support its portfolio companies.

RIT is invested alongside Ribbit in Brex, the corporate expenses management platform, and formerly Credit Karma which returned around 2x RIT’s invested capital over a two-year investment until its 2020 acquisition by Intuit.

Attestor Value

Attestor Value is a circa US$3bn fund managed by Attestor Capital (www.attestor.com), a private investment firm that was founded in 2012 in London. The firm specialises in distressed debt and special situations investments, focusing on opportunities in the European market. The manager is known for its expertise in complex, illiquid investments, and its ability to create value through active management and operational improvements. The firm’s investment philosophy is centred around a disciplined, value-oriented approach. It works closely with management teams of its investee companies to unlock value and generate returns, especially through balance sheet actions.

Tresidor Credit Opportunities

Tresidor Credit Opportunities is managed by Tresidor Investment Management LLP, a London-based alternative investment manager that uses a disciplined fundamental research process to invest across the full spectrum of tradeable European credit opportunities, including distressed debt, and special situations investments. It focuses on high quality companies’ credit which have low probability of impairment driven by collateral, asset value, business quality, liquidity, cashflows, structural, and legal features.

ARCM

Founded in 2011, Asia Research and Capital Management, or ARCM (arcmcap.com), is a privately-owned asset management firm, based in Hong Kong, that manages investment vehicles focused on investing in debt and equity securities primarily in Asia. It takes a value-focused approach, focusing on cyclical assets with a cross-capital structure lens. It invests with a strong focus on downside protection, typically in companies with quantifiable, tangible assets.

Caxton Dynamis

Launched in 2019, Caxton Dynamis is a global macro hedge fund managed by Caxton Associates (www.caxton.com), a privately-held investment firm that focuses on alternative investments in the global markets – principally foreign exchange and credit in developed markets. The firm takes a quantitative approach, using data-driven analysis combined with proprietary algorithms and models to identify trading opportunities in a strategy typically uncorrelated to other markets. It also employs a risk management framework that is designed to mitigate potential losses and preserve capital.

The real assets portfolio

The real assets portfolio is made up of a number of properties in St James’s, London – principally Spencer House and nearby properties – plus gold bullion, futures and related equities.

Spencer House Limited (SHL) provides premises management for Spencer House (which RIT holds on a long lease) as well as the other investment properties that RIT owns in St. James’s. In addition to providing some office accommodation to JRCM, Spencer House is available for hire for events and is open to the public at certain times of the year. These activities are overseen by SHL, which has a staff of 13.

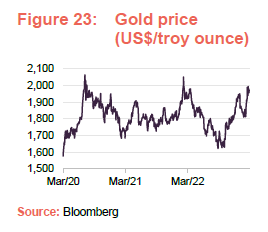

Gold is seen as a natural inflation hedge, and it has therefore been surprising that it has not performed more, given the marked uplift in inflation seen during the last couple of years. RIT’s managers say that, despite this, they continue to see a place for gold in the trust’s portfolio. There is ongoing demand from central banks in emerging markets as they seek to diversify away from fiat currencies that recent events have shown can be heavily impacted by sanctions or poor political decisions. The manager also think that gold can serve as a good asymmetric hedge to a potential central bank ‘pivot’, a reversal of a strong US dollar, or against the growing risk of a broad market dislocation.

Performance

Valuation

The valuation of RIT’s portfolio is the responsibility of a valuation committee, composed entirely of independent non-executive directors of RIT. It oversees valuations of illiquid holdings. In addition, all year-end valuations are also subject to audit by the company’s auditors.

The approach to valuations aims to come up with fair values that are at the most conservative end of the valuation range. Empirical evidence of this is provided by the average 23% mark-up achieved on realisations from the direct private investments book, relative to their undisturbed carrying value.

JRCM cites a recent case study of RIT’s sale of Infinity (a large direct position), which closed in early 2023. The sale price was at a premium of 30% to Infinity’s pre-sale carrying value.

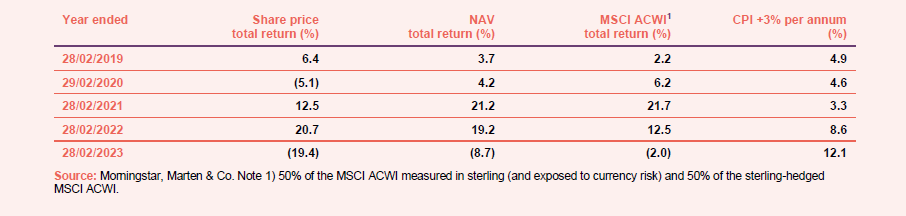

Five-year track record

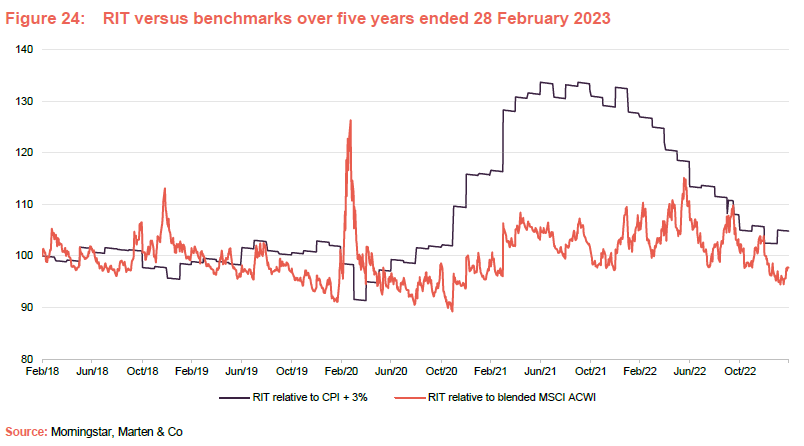

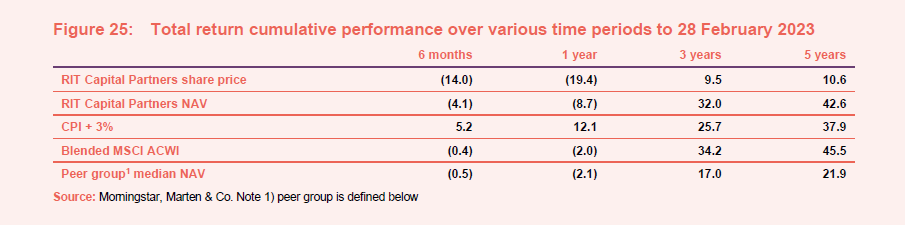

As Figure 24 shows, RIT has broadly kept pace with its two performance benchmarks over the past five years.

2022 saw RIT generate a negative NAV return for the first time in many years. However, this was set against the context of a wider global bear market and widespread losses incurred across multiple asset classes and geographies.

We explore the drivers of RIT’s returns over 2022 from page 7 onwards.

The diversified multi-asset nature of RIT’s portfolio will inevitably lead to deviations between its returns and the 100% equity benchmark of the blended MSCI ACWI index.

Speculation that we have reached ‘peak inflation’, and by implication the peak interest rates that would follow, is creating equity and bond market volatility.

Significant interest rate rises have put upward pressure on discount rates and are calling into question the profitability of heavy indebted companies.

RIT’s core aim is to target long-term capital growth, through the cycles, with a degree of capital preservation on the downside. As such, RIT is defined by more than its total returns, as the team also aims to dampen down the degree of risk that RIT’s shareholders are exposed to.

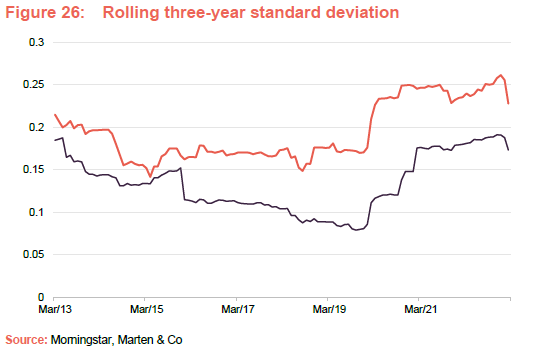

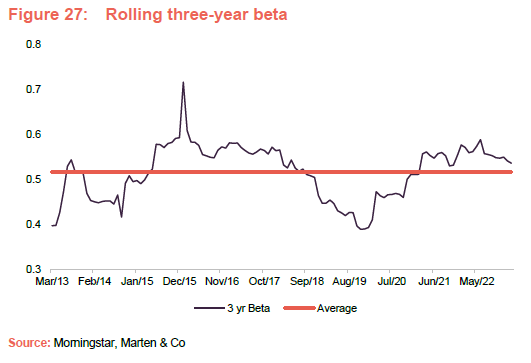

There are two straight-forward metrics by which one could judge the RIT team’s ability to manage risk. The first is the volatility of the NAV returns (which can be measured by their standard deviation), and the other is RIT’s beta, which measures the degree to which RIT’s NAV returns are driven by moves in global equity markets (a very useful indicator of how good a job JRCM is doing of diversifying RIT’s portfolio).

Figures 27 and 28, which show the respective standard deviation and beta data over a rolling three-year period (sampled monthly), illustrate that RIT has been able to offer investors a historic beta that has remained predominantly between 0.4 and 0.6 relative to global equity markets, with a 10-year average of 0.52 (a beta of one means that a share moves in line with an index, while a beta of less than one means that the share price doesn’t rise as fast as the rising market).

In addition, for the large majority of the last 10 years, RIT has generated a three-year standard deviation less than that of its blended ACWI benchmark, while still generating, on average, a three-year NAV return in excess of the ACWI benchmark and most of its peers. This not only lends to a superior risk-return profile, but it may also make RIT more attractive to more cautious investors.

Peer group

Up-to-date information on RIT and its peer group is available on the QuotedData website

RIT is a constituent of the AIC’s Flexible Investment sector. These funds have investment objectives and/or policies that allow them to invest in a range of different asset types – multi-asset funds, therefore. However, this encompasses a wide variety of funds with very different performance objectives. The full AIC sector would make a poor comparison for RIT.

The list of funds that we have selected for Figures 28 and 29 exclude Hansa Investment Company (a family-controlled trust with a strong bias to Brazil), the tiny Investment Company (which is seeking to reinvent itself as a UK growth trust), JPMorgan Core Real Assets (which has no equity exposure), JZ Capital Partners (a private equity fund that strayed into real estate with disastrous results), Livermore Investments (which has a strong bias to structured finance), New Star Investment Trust (which is run largely for the benefit of ex-employees of New Star), RiverFort Global Opportunities (which provides financing to very small companies), Schroder BSC Social Impact (which aims to make investments that have a positive social impact), Tetragon Financial Group (which invests in a wide variety of alternative investments including an asset management business), and UIL (a split capital company with an eclectic portfolio).

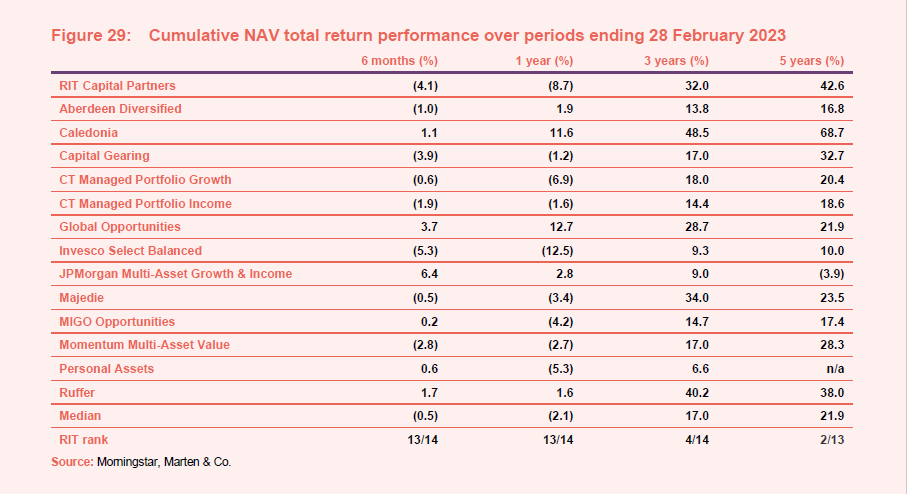

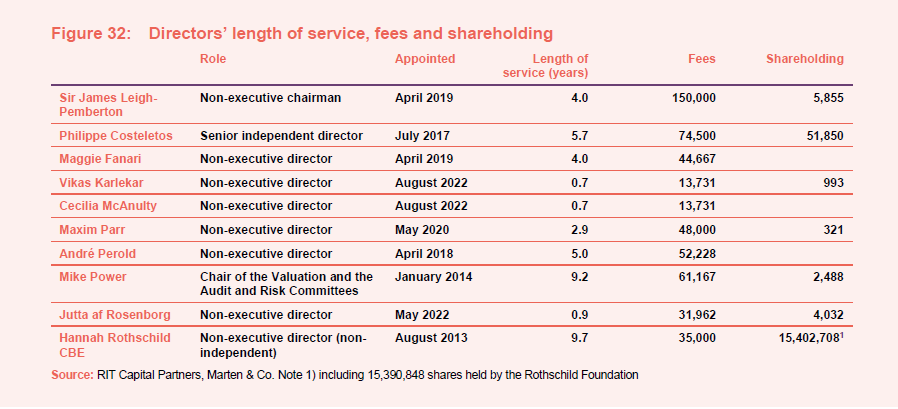

RIT is by far the largest trust within our selected peer group, eclipsing its second-highest peer by £1bn. Thanks in part to its scale RIT also has an ongoing charges ratio in the top third of its peers, made more impressive by the complexity of RIT’s investment process, which often comes with a premium cost given the increased resources needed in its execution.