Headed in the right direction

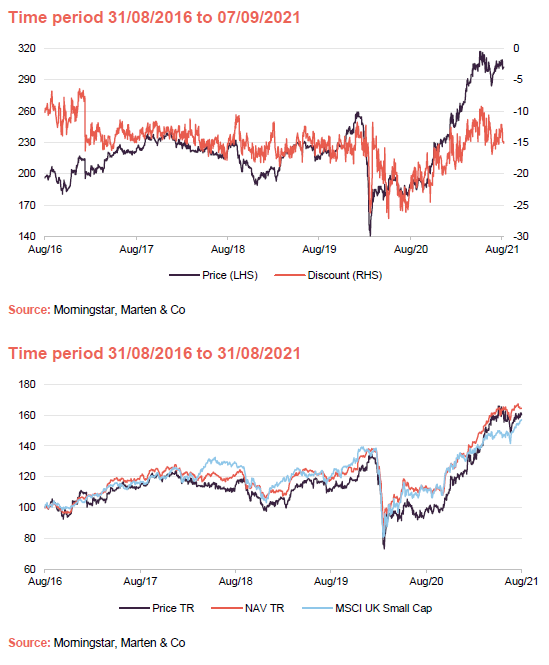

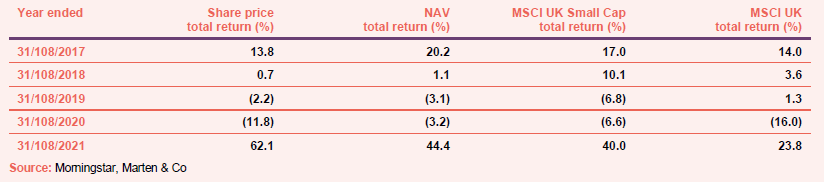

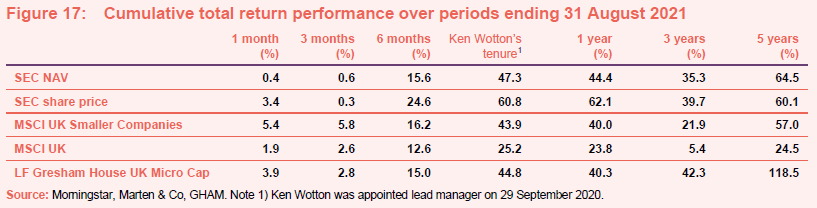

At the end of September 2020, Ken Wotton became the lead manager of Strategic Equity Capital (SEC) and, during the ten months since, SEC has provided NAV and share price returns that are significantly ahead of the MSCI UK Smaller Companies and even the broader MSCI UK Index. Despite this, and a comprehensive plan to reduce the discount, which now includes potential tender offers in both 2022 and 2024 (subject to certain triggers), the discount to net asset value has reduced but is still material.

We do not think that this will persist and, with the decision to shift the focus of SEC’s portfolio towards smaller companies now bearing fruit, combined with a UK market that is becoming increasingly investable for overseas institutions and attracting the interests of private equity buyers, now could prove to be a very good entry point.

SEC’s managers use a private equity style approach to managing public equity. SEC holdings, Equiniti and Proactis have recently succumbed to takeover bids and the managers think that there could be much more to go for in this regard.

Focused UK small companies portfolio

SEC aims to achieve absolute returns over a medium-term period, principally through capital growth. SEC is managed with a focused portfolio of investments selected on the same basis that a private equity investor would use to appraise its investments.

SEC shareholders benefitted from a sharp narrowing of its discount following the announcement of the contingent tenders om 28 May 2021, which are part of a broader discount reduction plan. The discount has experienced some widening since, but it remains comparable to its pre-pandemic levels. This reflects, in part, the increased popularity of the UK with investors now that much of the uncertainty around Brexit has been removed.

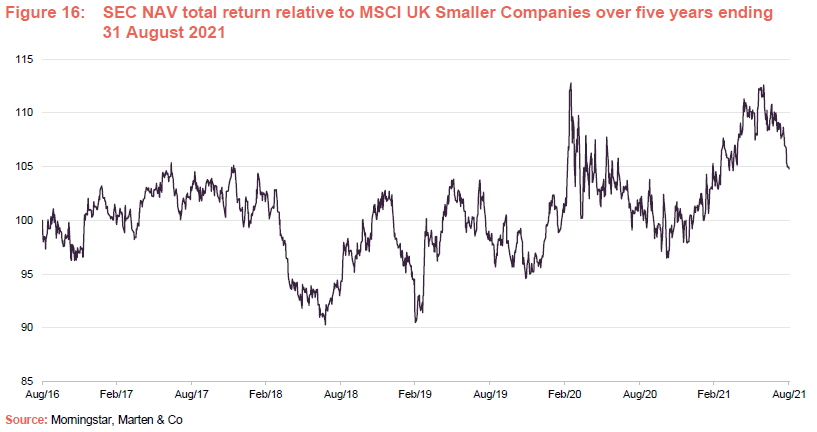

During the 10 months since Ken Wotton became lead manager, SEC has provided NAV and share price returns that are significantly ahead of the MSCI UK Smaller Companies and even the broader MSCI UK Index. It has lagged during periods where the outlook has improved as the previous focus on indications of quality, such as balance sheet strength, have receded. However, SEC has outperformed the MSCI UK Smaller Companies Index in both the first and second quarters of 2021.

Now with contingent tender offers

As we have discussed in our previous notes, SEC’s board has been frustrated at the level of the discount that the trust’s shares have been trading at during the last couple of years relative to the NAV. Despite the narrowing seen so far this year, it considers that the discount remains too wide. As such, the board has been actively considering options designed to target this persistent discount. On 28 May 2021, it was announced that SEC will offer its shareholders tender offers in 2022 and 2024 at a 3% discount to NAV. The tenders are contingent in that they will take place if SEC fails to meet specific targets, which are explained below.

Background to the contingent tender offers

SEC’s board believes, and we agree, that portfolio performance and the degree to which the trust is marketed will be the key determinants of the discount or premium over the medium and long term. In terms of performance, the board says that it is encouraged by SEC’s investment performance this year, under the management of Ken Wotton and Adam Khanbhai. The board also believes that SEC’s well-established investment process, coupled with the depth of resource now available to the investment team, makes SEC relevant to a wider range of investors. It believes that this, in combination with the collaborative marketing effort that SEC has in place with Gresham House, abrdn and its advisers, is well-placed to promote the company to those investors.

2022 contingent tender – discount related

If SEC’s shares trade at an average discount that is wider than 8% over the 12 months ending 30 June 2022, SEC will conduct a tender offer for up to 10% of its issued share capital (excluding shares held in treasury) shortly after the 2022 AGM (this has traditionally taken place in November). Where shareholders tender more than their basic entitlement of 10%, such applications will be satisfied on a pro rata basis to the extent that other shareholders have tendered less than their basic entitlement.

2024 contingent tender – performance related

If, over the three-year period ending 30 June 2024, SEC’s NAV total return per ordinary share lags the FTSE Small Cap (ex Investment Companies) Index on a total return basis, SEC will conduct a tender offer for up to 15% of its issued share capital (excluding shares held in treasury) shortly after the 2024 AGM. As per the 2022 tender, the 2024 will be conducted at price that is a 3% discount to NAV (less costs) per ordinary share. As with the 2022 tender, where shareholders tender more than their basic entitlement of (15% for the 2024 tender), such applications will be satisfied on a pro rata basis to the extent that other shareholders have tendered less than their basic entitlement.

Discount reduction plan

The contingent tender offers detailed above form part of a broader discount reduction plan that is being undertaken by the board and manager. Readers may already be aware of certain elements of this, such as:

- the appointment of Ken Wotton as lead manager (to focus on leveraging the wider Gresham House platform and capability to support SEC);

- evolution of the investment portfolio by moving down the market cap scale to have a stronger impact with engagement and to better influence value creation;

- improved shareholder engagement and investor relations activity including the marketing agreement with abrdn Plc, which provides substantial resources in support of the marketing and distribution of the trust; and

- improved emphasis on Gresham House’s proprietary “Strategic Public Equity” process as a differentiator in marketing and public relations initiatives for SEC.

Additionally, in the second quarter of 2021, the manager has been supporting SEC with its own balance sheet, buying stock equivalent to 5.4% of SEC’s issued share capital. We welcome this initiative as it helps align the manager interests with those of external shareholders. SEC has tended to benefit from such alignment historically and we believe that shareholders will welcome this development.

The managers are also pleased to see SEC’s total net assets exceed £200m, as they think this increases its appeal, making it attractive to a wider range of investors.

Market outlook

During the height of the market collapse of 2020, the financial strength of the companies that SEC holds worked in its favour, as investors sought high-quality companies and those able to grow in the face of tough market conditions. More recently, as vaccine rollouts have started to take affect and restrictions have eased, investors have rotated towards value stocks that are felt to offer strong recovery potential in an improving economic environment.

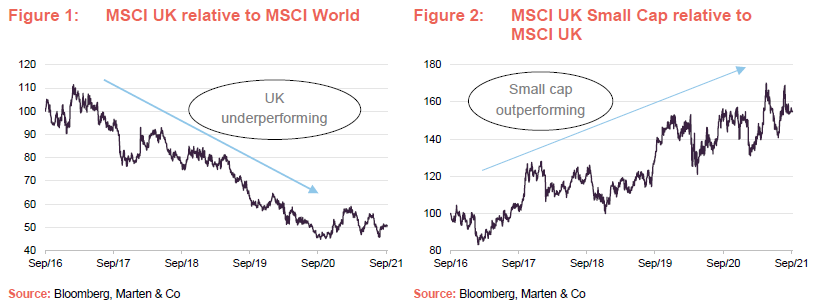

When we last wrote, we commented that international investors had been looking warily at Brexit and the UK’s poor handling of the coronavirus which, when combined with the UK market’s relative underweight exposure to higher-growth sectors such as technology, had also been unhelpful, and this was reflected in the UK’s protracted underperformance against broader global equity markets as illustrated in Figure 1. More recently, as Brexit uncertainty has receded and the UK has got a better handle on its management of the pandemic, the UK’s performance versus global markets has shown some stability (with market outperformance as positive news came through on vaccine development last November).

Relative to larger companies, UK smaller companies have continued on the path of recovery from the lows they hit in spring 2020, albeit with marked volatility as sentiment has ebbed and flowed. SEC’s managers acknowledge that valuations are high in some segments of the UK smaller companies’ space. Reflecting this, the managers are keeping a close eye on valuation and transaction multiples, but consider that their focus on the value of an investment to a private equity investor makes them disciplined and helps to give them an anchor.

Manager’s view

Small cap discount is still too wide – risk from private equity buyouts

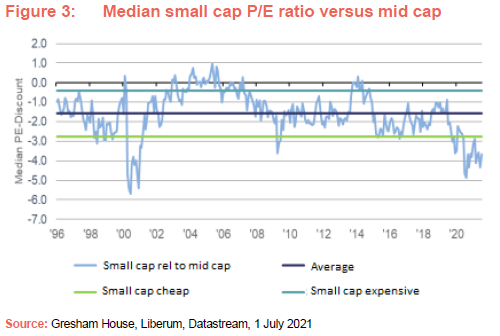

SEC’s managers make the case that, as illustrated in Figure 3 below, UK small cap stocks are trading at multi-year discounts relative to larger companies, which they attribute to concerns regarding liquidity, risk, and a reduction in resources dedicated to researching this segment of the market. They observe that this discount has narrowed as the UK economic outlook has improved, commenting that there have been significant inflows into the UK from international institutions as the UK is becoming investable again. However, the market as a whole remains undervalued in their view, particularly the small cap end, despite its recent outperformance. They say that this provides a distinct opportunity for their strategy but the discount makes this part of the market vulnerable to bids from private equity at excessively cheap valuations.

SEC’s managers highlight that its portfolio has not been selected to specifically identify companies that are likely to be targets for private equity buyers. However, because of the strategy’s focus on balance sheet strength, business quality and cashflow, it is likely that private equity buyers would find SEC’s portfolio attractive. As is discussed later in this note, the first half of 2020 has seen bids for two portfolio companies – Equiniti and Proactis (at premiums of 56% and 79% to the undisturbed prices respectively). In the case of Equiniti, SEC’s managers voted against the bid as they felt the valuation was at a substantial discount to previous transactions (for example, Link/Capita Asset Solutions, American Stock Transfer) and quoted peers (Link, Computashare). SEC’s managers think that opportunistic takeouts by overseas investors of UK assets ‘on the cheap’ remains a real risk for long term UK Plc investors. In the case of Proactis, the managers consider that the company has long term strategic potential but faces execution challenges to realise this; hence they supported the bid.

Overall, SEC’s managers think that the outlook for further activity, and that of the portfolio, is positive. They observe that, following a strong period of fundraising for private equity, many houses have a lot of capital to deploy and UK markets look cheap (as they show in the chart we have used in Figure 3, which suggests that one a relative price/earnings (P/E) basis, small caps are as cheap as they have been since the early 2000s). However, they are concerned that further companies could be taken out at valuations that will, in the fullness of time, prove to be unduly cheap.

Despite the success of value-style investing recently, SEC’s managers say that care is still required, and it is important to focus on quality businesses. The managers highlight concerns around rising inflation, the end of the furlough scheme and the potential for further COVID related restrictions, making it important to focus on the long-term winners. The managers say that their pipeline is pretty healthy and that they are focusing on doing their due diligence to identify stocks that can benefit from the current environment.

Investment themes

It is worth emphasising that SEC’s managers are not thematic investors per se, but when selecting investments, the managers are looking for companies that have a number of key attributes, such as:

- strong intellectual property, or differentiated products, with strong market positions;

- profitable cash generative companies with a high degree of revenue visibility;

- exposure to long-term structural growth drivers;

- strong business models with low cyclical exposure and self-help opportunities; and

- being well-positioned to develop new products and even consolidating their industry.

This tends to lead them in the direction of niche small companies exposed to long-term structural growth drivers, within which a number of themes tend to emerge. Current portfolio themes include:

- Healthcare and pharmaceutical services – these benefit from demographic changes and a structural trend of increasing demand for healthcare. Increasingly, solutions are technology led, with the rise in the digitalisation of healthcare. There is a structural trend of replacing legacy systems as well as the provision of remote healthcare to reduce costs and improve outcomes, and so there is an overlap with digitisation and data (see below). SEC’s holdings, which tend to be diversified and are not dependent on binary outcomes, include Clinigen, Alliance Pharma, Benchmark, Medica and previously Ergomed. Anecdotally, SEC’s managers say that, in the short-term, there has been a discontinuity between the winners and losers from COVID (for example, cancer diagnosis and treatment have suffered during the pandemic) but that the long-term trends for all of these companies are unchanged, creating opportunities.

- Pensions and savings – these benefit from the growing complexity of requirements and regulations as well as an ageing population, the decline of defined benefit schemes and the trend towards self-managed investments. Examples of holdings include XPS, Brooks McDonald (they have added to this position) and Fintel (which serves the IFA market). SEC’s managers comment that as the importance of individual savings grows, there is increasing demand for the right advice and, whilst this is a slow-moving theme, it has huge longevity.

- Regulation and compliance – these benefit from the structural trend of an increasing compliance and regulatory burden across all white-collar sectors, and not just finance. Across most professional markets, there is an ever-growing need for accurate, auditable, and cost-effective solutions, which are often technology led, and so there can be an overlap with digitisation and data (see below). Stock examples include Wilmington (which provides training and qualifications), LSL Property Services (which provides a range of services to the residential property market in the UK including mortgage broking and non-investment insurance products), Fintel (which provides compliance and business support for financial services, legal and workplace professionals) and Equiniti (recently bid for – which provides share registration administration and services and software to company’s risk and compliance functions).

- Digitisation and data – these benefit from the structural trends of using artificial intelligence (AI) and ‘Big Data’ in real world applications. This creates opportunities to drive new product development and monetise previously underappreciated data assets. As noted above, this applies across all of the other themes, and so is arguably the most important. Stock examples include Tribal, Wilmington, Inspired, Fintel, LSL Property Services and idox. SEC’s managers also comment that this also includes opportunities for businesses to upgrade their IT systems, incorporate AI / machine learning, and improve data analytics to improve efficiencies internally. As such, this is quite a broad theme but one that is quite prevalent in smaller companies.

- High-quality cyclical/COVID recovery – the managers are targeting niche companies, with high levels of intellectual property, whose recovery potential is underappreciated by the market, and are well-positioned to take market share as economic activity resumes. These will be long-term winners that have been hurt in the short term by COVID, thereby providing a good entry point. With the strong recovery that we’ve seen during the last 17 months, these opportunities are becoming rarer but continue to exist. Stock examples include Ten entertainment and Inspired; and

- Sustainability/energy transition – these provide products or services with positive environment, social and governance (ESG) outcomes and benefit from an ever-increasing demand both for these products and services, as well as growing demand from investors for these kinds of opportunities. There are many investments that play to this theme and it is not sufficient to be ESG-friendly – investments must also fulfil other investment criteria for the manager, for example, be profitable and cash generative. SEC’s managers highlight that they are not stepping away from their traditional investment strategy into speculative early-stage companies. They still want mature cash generative businesses with defensible intellectual property. The managers believe that as companies prove their ESG credentials, this will lead to a rerating. They see this as a long-term trend and expect to increase exposure to this theme over time.

Asset allocation – portfolio evolution continues

Portfolio activity

SEC’s managers say that portfolio activity was higher in the first quarter versus the second, reflecting the opportunities available in the market. However, while they have committed to reducing the average market cap of companies held within SEC’s portfolio, with the objective of achieving greater influence, the managers have not been liquidating the larger market cap positions as the default. Instead, portfolio turnover has been driven by the successful investments that have run their course, which have tended to be the larger positions. It is worth noting here that the managers are aiming to invest in smaller companies in the £100m-£300m market cap range, at the point of investment. They say that, by making this ‘at the point of investment’, it makes it realistic for them to build an influential stake in a company, as well as to benefit from the structurally cheaper valuations that tend to be seen further down the market cap scale.

Anecdotally, the managers think that turnover in the third quarter of 2021 will likely be quite high, as they expect to receive the money from the bids for Equiniti and Proactis (these occurred at premiums to the undisturbed share prices of 56% and 79% respectively), which will need to be re-deployed. However, they expect that turnover will normalise after that, assuming that there is not a flurry of bids received for portfolio companies. As at 31 August 2021, SEC had net cash of 5.3%, which is in line with its long-term target.

Q1 and Q2 sales and purchases reinforce shift down market cap scale

The managers have continued with the process of recycling the proceeds of these sales into smaller-cap holdings that better suit their investment approach going forward. In the first quarter of 2021 (Q1 2021), the trust made £18.2m worth of investments with an average market cap of £220m (equivalent to 9% of closing NAV at the end of the first quarter). In the same quarter, SEC sold £11.7m worth of investments with an average market capitalisation of £557m (equivalent to 7% of closing NAV at the end of the first quarter).

During the second quarter of 2021 (Q2 2021), purchases and sales were much more balanced; SEC made purchases totalling £14.8m (equivalent to 7% of the closing Q2 NAV with an average market cap of £450m) and sales of £13.3m (equivalent to 7% of the closing Q2 NAV with an average market cap of £632m).

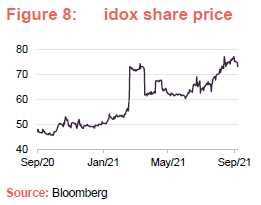

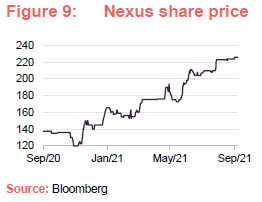

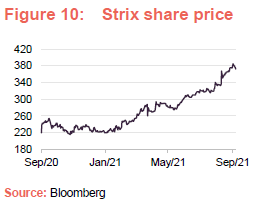

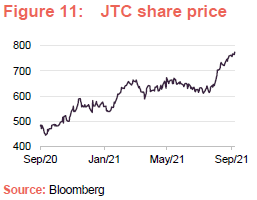

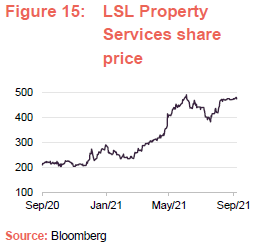

Examples of new investments made in Q1 2021 include LSL Property Services and idox. During the same quarter, the trust fully exited its holdings in JTC and Strix. During Q2 2021, SEC did not make any wholly new investments, but has initiated a position in Nexus post the period end (discussed further below). There were no full exits during the second quarter, but the managers top-sliced a number of strong performers.

In Q1 2021, the managers also added to SEC’s positions in:

- Medica – a provider of teleradiology services (for example to the NHS), which had suffered as screening volumes have reduced as healthcare services focused on fighting the pandemic. The company is now benefitting from a recovery in screening volumes as the COVID-disruption is on a reducing trend and healthcare looks to play catch-up in neglected areas.

- XPS – a pensions consulting business that SEC’s managers know very well (it is held across multiple Gresham House funds). The managers say that it is a very stable business, citing that it provided 6% organic growth over 2020, despite the market turmoil, yet its shares remain cheap in the managers’ view. The managers say that it is exposed to long-term structural growth due to an ongoing regulatory changes (for example, the guaranteed minimum pension equalisation legislation), which is driving increasing demand for the sort of specialist pensions advisory services that XPS provides.

- Wilmington – a long-term holding of SEC’s that provides business-to-business (B2B) data and training for the compliance, insurance, financial and healthcare sectors. SEC’s managers highlight that it is an investment in which they have undertaken significant engagement, over a long period, helping to strengthen the board and management team (they introduced William Macpherson who was appointed as a non-executive director earlier this year, for example). SEC’s managers added to Wilmington on weakness earlier this year and the company’s share price responded positively following the announcement of better than expected interim results in February. Despite not holding any face-to-face events, revenue only saw a 5% decline, and this was more than offset by cost savings from the move to virtual so that adjusted profit before tax rose by 1%.

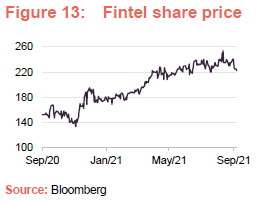

- Fintel (formerly SimplyBiz Group) – a provider of technology and regulatory solutions to IFAs that was a new addition to SEC’s portfolio in the fourth quarter of 2020 (Q4 2020). (This is discussed further below as it has moved up into SEC’s top 10 holdings both on the back of strong performance and the managers adding to the holding.)

- Ten Entertainment – a ten-pin bowling company that, despite recently issuing a good set of results, has seen little benefit in its share price. SEC’s managers attribute this to general negative sentiment about hospitality and recreational venues. We commented on the addition of Ten entertainment, as well as Fintel above, as a new holding in Q4 2020 in our February 2021 annual overview. Both were discussed in detail on page 13 of that note.

In Q2 2021, the managers continued to add to SEC’s positions in XPS Pensions and Fintel, which they were building in Q2. They also added to the following:

- Inspired (formerly Inspired Energy) – this position was initiated in 2020 and discussed in detail on page 12 of our February 2021 note. The company is a B2B corporate energy procurement and consultancy business that has been held by other Gresham funds, which have been investing in it since 2011. SEC supported a fundraise aimed at strengthening the company‘s balance sheet and providing it with the firepower to continue to consolidate its sector. SEC’s managers have built on the position further since the fundraise.

- LSL Property Services – which provides a range of services to the residential property market in the UK (discussed further in the top 10 holdings section below) – was topped up towards the end of the second quarter when its share price showed weakness on no real news other than the end of the stamp duty holiday coming to an end.

- Brooks Macdonald – an investment and wealth management services that is a long-time SEC holding (discussed further in the top 10 holdings section below). The managers topped up the holding when the share price drifted down on no real news.

- Clinigen – a speciality pharmaceutical and services company – issued a profits warning on 9 June 2021 caused mainly by delays to cancer diagnoses and treatments impacting its key product Proleukin (the drug needs to be administered in a hospital setting and so has suffered particularly heavily). However, SEC’s managers consider this COVID-related disruption to be temporary and see the potential for an earnings recovery as COVID disruption eases. The managers think the business is heavily discounted on a some-of-the-parts basis and see significant value in the services part of the business, which is actually winning market share in a growing market. At the beginning of August, Clinigen announced that it is appointing Elmar Schnee, who has broad experience from the international pharmaceutical industry as its new chairman. Subsequent to this the company announced that the chief financial officer would be also stepping down, with a search underway for a successor. SEC’s managers think that these developments could catalyse a more focused strategy going forward. Interestingly, Clinigen was the subject of a rumoured private equity bid from Advent last year. SEC’s managers think that it continues to look vulnerable.

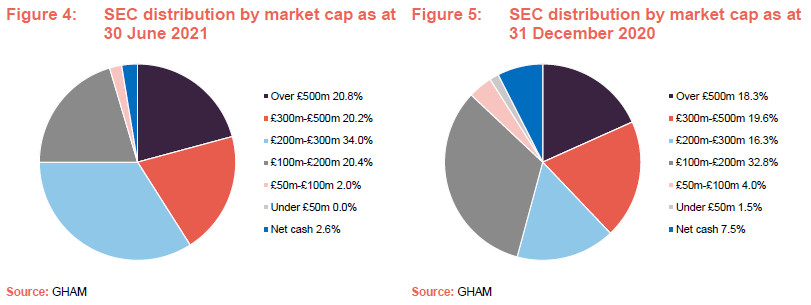

It can be seen from comparing Figures 4 and 5 that exposure to stocks over £300m has increased by around three percentage points (41.0% as at the end of June versus 37.9% as at the end of December), which in part reflects the strong performance of the portfolio during the period, which has tended to move portfolio companies up the market cap scale across the board (see pages 18 and 19 for details of SEC’s performance over the six months to 30 June 2021). By way of illustration, using end June 2021 prices, SEC’s portfolio had a weighted average market cap at the end of June 2021 of £367.2m. In contrast SEC had an average weighted market cap of £480.9m, as at the end of September 2020, using end of June 2021 share prices.

Previously, SEC’s managers’ hunting ground was the £200 million to £500 million market range, but it is now the £100m to £300m market range. Looking at the portfolio’s exposure to sub-£300m market cap stocks, it can be seen that stocks in the £200m to £300m range have increased significantly (34.0% as at the end of June versus 16.3% as at the end of December). Overall, SEC now has a higher proportion of its portfolio invested in sub-£300m stocks (56.0% as at the end of June versus 54.6% as at the end of December).

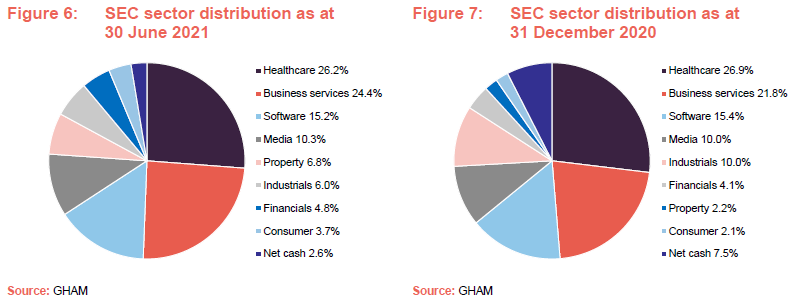

By comparing Figures 6 and 7, it can be seen that the exposure to property has increased by 4.6% – this reflects the investment in LSL Property Services, a provider of services, and in particular financial services, to the property sector, rather than a traditional ‘property company (see page 16) – while the exposure to business services has increased by 2.6%. In contrast, the exposure to industrials and consumer has fallen by 4% and 1.6% respectively. The largest change is therefore the reduction in cash of 4.9%, although this had moved back to normal levels by the end of July (this was due to the proceeds of the Proactis and Equiniti deals being received). All other changes are less than one percentage point. The managers say that these changes are purely the result of bottom-up stock selection decisions, and do not reflect any top-down, macro view. However, they continue to reflect the emphasis within the investment approach on businesses operating within areas of secular growth.

New investments

idox – purchased in the aftermath of a rebuffed bid

As noted above, idox (www.idoxgroup.com) was a new addition to SEC’s portfolio in Q1 2021. However, this is not the first time that SEC has held a position in the company, as it was previously held as an opportunistic investment back in 2015, as was discussed in our May 2016 note. At the time of writing, Gresham House owns around 5% of idox’s equity across all of its funds, making it an influencing shareholder (and it has been a long-time investor in the company through the Baronsmead VCTs). From their experience of supporting the company through its turnaround (which saw the appointment of a new management team, who rationalised and simplified the business), SEC’s managers have high confidence in the top brass at idox.

Idox is a software provider that primarily serves the UK public sector and, to a lesser extent industry, whose products allow its clients to work more efficiently and comply with regulations. For government, idox delivers process driven software that underpins the management of planning & building control, environmental health and licensing procedures. Idox also helps manage elections, drive collaboration in social services and brings health service information together. The company also supplies facilities management software that enables more efficient property management, as well document software that enables the management of large scale, complex engineering projects. As the only listed provider in its sector, SEC’s managers think idox has a uniquely attractive set of assets in a niche growth market.

In February 2021, idox received a series of three non-binding indicative bids from Dye & Durham, a provider of cloud-based software and technology solutions. These were for 67p, 70p and 75p per share on the 9th, 17th and 18th of February, respectively. These bids represented premiums of about 25%, 30% and 39% respectively to the undisturbed share price prior to the initial proposal.

SEC’s managers felt that even the best offer seriously undervalued the long-term prospects of the company and, after consulting with other shareholders, agreed to rebuff the bid. At this time, SEC was not an idox shareholder, but after Dye & Durham withdrew, SEC’s managers were able to purchase a small position for the trust (less than 2% of the portfolio) at a material discount to the best offer price and at a price that the managers consider to be well below its intrinsic value. SEC’s managers consider that idox has leading positions within the local authority market and that it is well-placed to conduct further acquisitions to consolidate this market in a value accretive way.

Nexus – long-term structural growth from electrification

Nexus Infrastructure (www.nexus-infrastructure.com) is a specialist engineering company that describes itself as a leading provider of essential infrastructure services to the UK housebuilding and commercial sectors. Its services include the design, installation and connection of gas, electricity, water, fibre networks and electrical vehicle charging infrastructure in new residential developments. It also provides electric vehicle charging and smart energy infrastructure for public settings.

The company has a strong focus on electrification, which SEC’s managers say offers it long-term structural growth opportunities and makes it attractive from an ESG perspective, as its services help in the drive towards net zero carbon emissions. SEC’s managers have established an initial position in the company and plan to expand the position opportunistically in the future.

Portfolio exits

As noted above, whilst there were no outright sales in Q2, SEC’s managers exited the trust’s holdings in JTC and Strix in Q1 2021. Strix (www.strix.com), which makes heating elements for kettles, is a holding we last discussed in our April 2020 note. At that time, we highlighted that Strix is a global leader in its niche, with a 38% global market share, and that the SEC thought that there was room for it to improve its margins, aided by a new manufacturing site in China (that was largely unaffected by the COVID-19 outbreak).

As illustrated in Figure 10, SEC has benefitted from strong share price performance as this thesis has played out. The managers say that the investment has provided a 48% IRR and, with recent strong share price performance and a market cap in the region of £660m, they were happy to sell down the holding and rotate into better opportunities elsewhere.

Jersey-based JTC is a global provider of administration services to trust, corporate and private clients. SEC first invested in the company in the first half of 2019 and, over the life of the investment, JTC has provided an IRR of 40% and now has a market cap in the region of £800m.

The rationale for the investment was that an increase in outsourcing of specialist administration services to external providers and a proliferation of the formation of alternative, multi-jurisdictional fund structures provided a runway for strong growth in both in profitability and cash flow. The managers also felt that solid growth, visibility and cash generation was driving private equity activity in this sector at attractive ratings. Like Strix, the managers were happy to take profits, freeing up funds for new investments.

Top 10 holdings

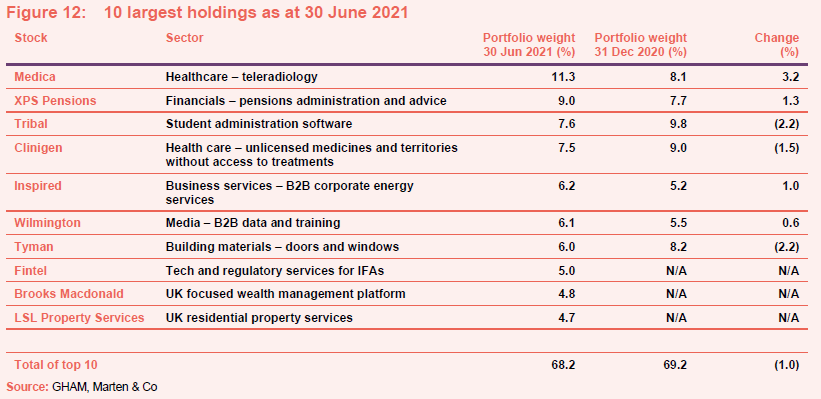

Figure 12 shows the list of the 10-largest holdings as at 30 June 2021 and how these have changed since the end of December 2020 (the most recently available information when we last published). New entrants to the top 10 are Fintel, Brooks Macdonald and LSL Property Services. Names that have moved out of the top 10 are Equiniti, Benchmark and Hyve, which accounted for 5.8%, 5.4% and 4.5% of SEC’s portfolio as at 31 December 2020.

All three were identified as stocks that had moved up into SEC’s top 10 when we last wrote, and all were discussed in detail on pages 10 to 13 of our February 2021 annual overview note, along with the other movers (prior to this, Equiniti had been a top 10 holdings for some time). We discuss some of the more interesting changes in the following pages. Readers interested in other names in the top 10 should see our previous notes, where many of these have been previously discussed.

Fintel (5.0%) – benefitting from a shift to an SaaS model

Fintel, formerly SimplyBiz (www.wearefintel.com) is the UK’s leading provider of compliance and business support for financial services, legal and workplace professionals. The company acquired the ratings business Defaqto in March 2019.

SEC established an initial position in the business in early 2021. At that time, the manager felt that the company was trading on a low rating because of its high leverage and the impact of COVID-19 (it had previously responded very positively to the positive news on vaccine development in November 2020). Since then, the stock has performed strongly, returning 22% in the year to date.

SEC’s managers continue to see the potential for margin recovery as well as continued revenue growth. Fintel provides software to automate very manual processes and the managers believe that a shift to a SaaS model will help as it seeks to migrate clients to and embed them in its digital platform. The company is targeting revenue growth of 5–7% a year over the next two to three years, and EBITDA margins of 35–40%.

Brooks Macdonald (4.8%) – long term structural growth from move to self-investment

Brooks Macdonald (www.brooksmacdonald.com) is a long-time constituent of SEC’s portfolio, with the managers originally initiating a position in January 2015. The company provides investment and wealth management services to individuals, pension funds, institutions, charities and trusts. As noted above, SEC’s managers topped up the holding in Q2 2021 when the share price drifted down on no real news. SEC’s managers say that, like XPS, Brooks Macdonald is exposed to long-term structural growth due to an ageing population and the move away from defined benefit pension schemes to self-investment.

SEC’s managers say that Brooks Macdonald has historically provided one of the strongest rates of organic growth in its sector, aided by its relationship with independent financial advisers and its large exposure to self-invested personal pension schemes. The company has benefitted from a refresh of its leadership team during the last couple of years and the company is now benefitting from ‘catch-up’ investment that was made to increase the size of the group and drive group margins. SEC’s managers say that the company is highly cash-generative and continues to benefit from both resilient earnings and a strong balance sheet with a healthy cash balance. The market also responded positively to the announcement of Andrew Shepherd’s appointment as Group chief executive officer (CEO) in May 2021 (Andrew was previously deputy CEO and is an internal appointment, having been with the company for over 20 years).

LSL Property Services (4.8%) – pivoting towards its financial services component

LSL Property Services (www.lslps.co.uk) provides a range of services to the residential property market in the UK. The company, which was created in 2004 following the management buy-out of Your Move and e.surv Chartered Surveyors from Aviva, operates a network of owned and franchised estate agency branches, with an extensive range of brands that collectively form the second-largest estate agent chain in the UK.

LSL is also one of the largest providers of services to mortgage intermediaries in the UK. Its range of services is extensive and includes surveying, specialist mortgage and protection advice, conveyancing support, valuation services and advice on mortgage and non-investment insurance products as well as mortgage broking services (it is one of the largest mortgage brokers in the UK).

SEC’s managers say that LSL is a diversified, largely B2B player in the UK real estate sector. Historically, the company has been focused on the estate agency part of the business, which is a highly fragmented and very competitive market that is also very cyclical. However, May 2020 saw the appointment of David Stewart as group CEO, who sees a big opportunity to pivot the company towards its financial services offering, which is a higher return on capital business with strong recurring revenues and is less cyclical (homeowners still look to re-mortgage their properties during downturns). SEC’s managers say that LSL has a great mortgage network, with high-quality revenues, which has been a good performer during the last six months, despite the recent share price retrenchment.

Performance

As was discussed in our February 2021 annual overview note, SEC’s portfolio was relatively resilient when compared to the broader MSCI UK Smaller Companies Index during the depths of the COVID-related market collapse of March 2020. However, following a war-time-type response, as governments and monetary authorities across the globe pumped exceptional stimulus into their economies, SEC gave up some of its relative outperformance. As markets regained confidence, their previous focus on indications of quality such as balance sheet strength, which had contributed to SEC’s outperformance, receded. In addition, the share prices of many businesses that had been severely impacted by covid bounced considerably. SEC’s managers comment that these were either cyclical stocks, or low-quality businesses, or both, which are areas of the market that SEC actively avoids. SEC’s NAV broadly tracked its benchmark in Q1 2021, while lagging it modestly in

Q2 2021. However, it has outperformed the MSCI UK Smaller Companies Index in both Q1 and Q2 2021.

SEC’s managers say that, during the first half of 2021, with the exception of the detractors noted below, most of SEC’s portfolio companies have done well, with the bids for Equiniti and Proactis being significant positives. The managers say that updates from portfolio companies have generally been positive, particularly in the first quarter. The managers think that moves have been more muted in the second quarter as a lot of positive news was already factored into share prices.

It is worth remembering that SEC’s portfolio is biased towards quality companies with low cyclical exposure. It has no exposure to resources (oil and gas, and mining companies) and no exposure to financials. Both of these sectors have performed well so far this year and, within this context, the managers are very happy with SEC’s NAV growth, which is now above the £200m mark.

As we have said previously, SEC’s managers are optimistic that the refinements that have been made to the investment approach and the outlook for the portfolio present an opportunity for SEC to improve its long-term record, both relative to indices and its peers. As an indicator of what might have been achieved had the new investment approach been in place for the past five years, we have included the returns of the LF Gresham House UK Micro Cap Fund within Figure 17 (these returns are for the class C accumulation units). This is a fund that has been managed by Ken since it was launched in May 2009.

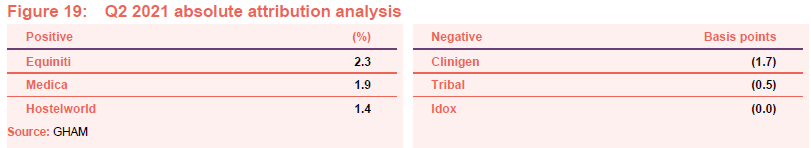

Performance attribution

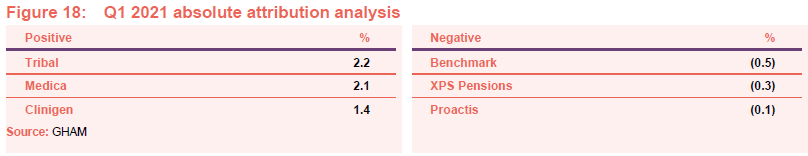

Our last note showed quarterly performance attribution data up to the end of Q4 2020. Figures 18 and 19 show the positive and negative contributions made to SEC’s performance over Q1 and Q2 2021, respectively.

Q1 contributors

Educational software provider Tribal made the largest positive contribution during the first quarter (its share price rose 22.2% during the period). This partly reflects an improving outlook for educational institutions as restrictions around students have eased, as well as significant strategic contract wins in 2020 driving upgrades. SEC’s managers consider that the bolt-on acquisition of Semestry for £4.5m is a positive development for the company that supports its strategy.

Medica, the second-largest positive contributor, saw its share price rise by 25.2% during the first quarter. As noted elsewhere in this report, the company has faced headwinds from COVID disruption in the NHS, but the managers say that it had otherwise provided a resilient trading performance and the stock benefitted from generally positive sentiment an improving outlook for the management of the virus. SEC participated in the placing to finance an accretive acquisition of RadMD, a US clinical trial imaging specialist.

Clinigen, the third-largest contributor, saw its share price rise by 14.9% during the first quarter (although it became a significant detractor in the second quarter). The company announced results that were in line with expectations and showed improving cash generation, although there was a small headwind from currency movements. The onboarding of Erwinase, which is indicated for the treatment of Acute Lymphoblastic Leukaemia (ALL) – a type of cancer that particularly affects children – occurred earlier than had been expected.

Q1 detractors

Benchmark, the largest detractor, saw its share price fall 7.8% over the first quarter, although it traded sideways for much of the period. There was negligeable response to its results announcement, which indicated improving growth and profitability following strategy changes during 2020, or to the announcement of its first customer for BMK08 product (a sea lice treatment), which is a key pipeline product for the company. SEC’s managers comment that Benchmark’s shares are relatively illiquid and the share price today is pretty much the same as what it was at the start of the year and that this performance was primarily a function of volatility rather than anything fundamental to the business.

XPS Pensions, the second-largest detractor, saw its share price fall 5.4% during Q1. After the period’s end, it released a pre-close trading update that showed trading was in line with expectations with 6% organic growth over 2020. SEC’s managers believe that the company fundamentally undervalued by the market and have added to the position as they see the share price weakness as an opportunity rather than a concern. They comment that the company hit its numbers in 2020 and grew organically 6%, despite covid disruption, which they think demonstrates the quality and resilience of its business model.

Proactis, the third-largest detractor, saw its share price fall 8.6% during the first quarter, despite issuing an in-line trading statement and announcing a number of modest contract wins. However, whilst not one of SEC’s top three, Proactis made a good positive contribution during the second quarter, driven by a bid for the company from Pollen Street Capital, at 75p per share. As a significant shareholder, Gresham House was approached and asked to provide an irrevocable undertaking to sell the shares it controls in response to the bid. The managers say that they were happy to commit to selling these shares at the price offered. Whilst they think that Proactis has a very good long-term structural growth story, they recognise that there are significant hurdles to overcome along the way and they think the price offered by Pollen Street is fair.

Q2 contributors

The largest positive contributor during Q2 2021 was Equiniti, which was driven by the bid from Siris Capital on 28 April at 180p per share (17p higher than the previous day’s close). As discussed in the asset allocation section, Medica’s results were impacted by lower screening activity in the NHS. However, NHS screening volumes have been on the rise again recently and this has been reflected in an improvement in the company’s share price. Hostelworld, which we last discussed in our April 2020 note, is a travel-related stock that has been impacted by the COVID-19 outbreak. As we commented in that note, the managers were prepared to be patient, and this appears to be paying off as investors are taking an increased interest in the hospitality sector as restrictions ease.

Q2 detractors

The largest detractor in the second quarter was Clinigen, following the profits warning announced on 9 June, which relates primarily to a reduction in demand for Proleukin, due to delays in cancer diagnosis and treatment.

Student management software provider, Tribal, was the second largest detractor. SEC’s managers say that the company has provided strong underlying performance and was a big positive contributor in both Q1 2021 and Q4 2020 (which was beneficial as the managers topped up the holdings in Q3 and Q4 2020, prior to the share price increase). As such, it has been a very good story for SEC over the last nine to 12 months and the managers say that it was one of the biggest detractors in Q2 for two key reasons: 1) hardly any holdings delivered negative returns during the period, and 2) the shares (which are also quite illiquid) retrenched a little following a 70%+ rise over the prior six months.

The third largest negative contributor was idox, which made the tiniest of negative contributions to performance. SEC’s managers say that the company continues to perform well.

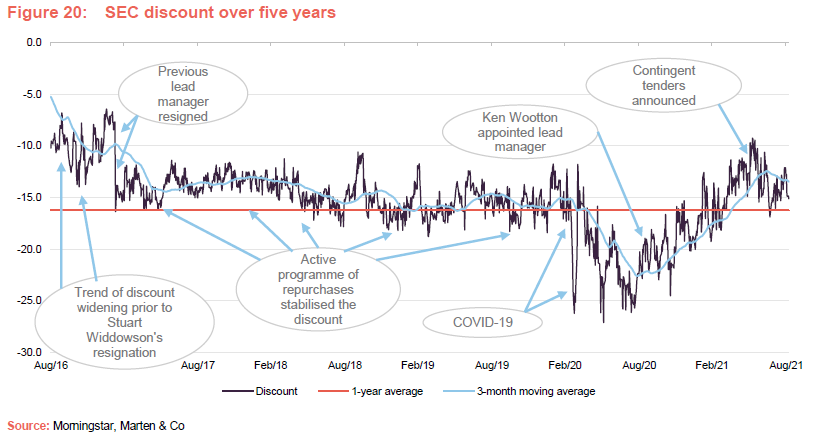

Premium/discount

As we have discussed in our previous notes, SEC’s discount widened over the course of 2016. Having narrowed modestly during the first part of 2017, the resignation of Stuart Widdowson in early 2017 created some uncertainty around that time that saw SEC’s discount move from around 8% to 16.4% on the day of the announcement. However, in part reflecting an active programme of repurchases, and investors becoming comfortable with the ongoing management team and investment performance, the discount stabilised, trading in a range of between around 10% and 18% prior to the COVID-related market collapse of March 2020.

Following the market collapse, which saw SEC’s discount move out to a near-five-year high of around 27%, the discount quickly reverted. However, reflecting the unpopularity of the UK and UK smaller companies in particular – which was compounded by the UK’s poor handling of the pandemic at the time; the company’s performance track record over recent years (although recent performance should provide some comfort to investors); and the uncertainty created by the move to Gresham House, SEC’s discount started to widen. This trend continued until around the middle of August 2020, when positive economic data started to come through and the discount started to narrow. This narrowing trend continued through September, (which included the announcement that Ken Wotton was to replace Jeff Harris as lead manager) and has continued since, aided by positive news on vaccine development as well as positive progress on the vaccine roll-out in the UK.

More recently, SEC shareholders benefitted from a sharp narrowing of its discount following the announcement of the contingent tenders detailed on page 4, which are part of a broader discount reduction plan. The discount has experienced some reversion since the announcement of the contingent tender offers, but remains comparable to its pre-pandemic levels. This reflects, in part, the increased popularity of the UK as an investment destination now that much of the uncertainty around Brexit has been removed.

As at 7 September 2021, SEC was trading at a discount of 15.1%, which is too wide, in our view. Over the last 12 months, SEC’s shares traded within a discount range of a 9.3% and 24.5%, with a one-year average of 16.3%. As we noted in the contingent tenders section on page 4, the board believes, and we agree, that improved absolute and relative performance should lead to a narrowing of the discount. If the changes that have been made to the investment approach translate into improved returns, investors could see a material uplift in the value of their investment as the discount narrows. We also believe that the additional marketing support provided by GHAM’s arrangement with abrdn should help.

Management team changes

There has been no change to SEC’s core management team since we last published. Within the wider UK equities team, Richard Staveley (managing director) and Paul Dudley (a consultant within corporate finance) have both left Gresham House. In their stead, Gresham House has recruited two new investment managers – Amber Stone-Brown and Cassie Herlihy.

Amber Stone-Brown ACA (investment manager)

Amber qualified as a chartered account in 2016. Prior to joining Gresham house as an investment manager in July 2021, she spent almost eight years at EY, where she studied for her ACA exams. During this time, Amber worked her way up to become manager, strategy and transactions – financial services, a post that she held for almost three years prior to leaving to join Gresham House. Amber graduated in 2012 with a degree in Economic and Business Management from the University of Newcastle.

Cassie Herlihy (investment manager)

Cassie joined Gresham House in July 2021 as an investment manager. Prior to joining Gresham, she spent just over a year at Citi as an investment banking analyst, which was preceded by almost three years at Investec where she was also an investment banking analyst. Cassie has a degree in Geography from the University of Cambridge, as well as an MSc in Psychology of Economic Life, gained from the London School of Economics and Political Science in 2017.

Board changes

On 30 March 2021, SEC announced that David Morrison had retired from SEC’s board with immediate effect. At the time of his retirement, David – who has spent most of his career in venture capital – had been on SEC’s board for just over two years, having been appointed at the beginning of February 2019. Following his departure, SEC’s board now numbers four and there has been no announcement as to whether the board are looking to recruit a replacement. As the shortest-serving member of the board, David’s retirement has effectively increased the average length of service, which stood at a respectable 6.7 years as at 7 September 2021. It seems reasonable that SEC’s board will want to consider its succession plans for the longer serving directors over the next couple of years, although there is in our view no immediate rush to do this.

Fund profile

Launched in 2005, Strategic Equity Capital (SEC) is a London listed investment trust that invests in a concentrated portfolio of predominantly UK-listed equities (with the majority of the portfolio invested in 10–15 holdings).

SEC aims to achieve absolute returns over a medium-term period (targeting 15% IRR), principally through capital growth. SEC is managed with a focused portfolio of investments selected on the same basis that a private equity investor would use to appraise its investments. The investment manager looks for securities that it believes are undervalued and could benefit from strategic, operational or management initiatives. The approach is not constrained by any benchmark and does not currently employ leverage at the investment trust level.

The mandate permits investment in unquoted securities (up to 20% of gross assets at the time of investment), but this is not utilised currently.

The manager also has the flexibility to invest up to 20% in assets quoted on exchanges that are not operated by the London Stock Exchange but the manager does not expect this to be a significant element of the portfolio.

Investment manager – Gresham House Asset Management Limited

On 21 May 2020, following a review by the board of the company’s management arrangements, Gresham House Asset Management Limited (GHAM) became SEC’s investment manager. The investment team moved across from GVQ Investment Management.

Then, on 29 September 2020, Ken Wotton became lead manager, working alongside Adam Khanbhai, who has been working on the fund since 2014 and co-managing it since 2017. Ken has considerable experience of working on public equity portfolios within a private equity environment. He leads a much better-resourced team than was available to SEC under its previous manager. More information on this team is provided on page 20 of our February 2021 annual overview note, which covered these changes in some detail.

GHAM is a specialist alternative asset management group, dedicated to sustainable investments across a range of strategies, with expertise across forestry, housing, infrastructure, renewable energy and battery storage, public and private equity. The latter speciality provides an additional source of knowledge, expertise and synergy for SEC’s team.

The parent company, Gresham House Plc, is quoted on the London Stock Exchange (GHE:LN). Its CEO is Anthony (Tony) Dalwood, who was SEC’s lead manager when it was launched in 2005. He now heads up the investment committee that oversees the management team’s investment decisions (see page 21 of our February 2021 annual overview note for more details). Gresham House Plc’s assets under management stood at £4.7bn at the end of June 2021.

GHAM offers a much better-resourced investment and marketing team than was available at the previous manager. In addition to GHAM’s own in-house marketing resources, SEC benefits from a distribution and marketing agreement that GHAM has with abrdn.

Previous publications

Readers interested in further information about SEC, such as investment process, fees, capital structure, trust life and the board, may wish to read our annual overview note Back to its roots, published on 2 February 2021, as well as our previous update notes and our initiation note.

Different, in a good way, initiation note, published January 2015

Measured expansion on strong performance, update note, published July 2015

Cashing up!, update note, published May 2016

Business as usual, update note, published March 2017

Quality small cap focus, annual overview, published August 2017

Confident, despite short-term setback, update note, published August 2018

Discounted opportunity, annual overview, published July 2019

Focused on fundamentals, update note, published April 2020

Back to its roots, annual overview, published February 2021

The legal bit

Marten & Co (which is authorised and regulated by the Financial Conduct Authority) was paid to produce this note on Strategic Equity Capital Plc.

This note is for information purposes only and is not intended to encourage the reader to deal in the security or securities mentioned within it.

Marten & Co is not authorised to give advice to retail clients. The research does not have regard to the specific investment objectives financial situation and needs of any specific person who may receive it.

The analysts who prepared this note are not constrained from dealing ahead of it but, in practice, and in accordance with our internal code of good conduct, will refrain from doing so for the period from which they first obtained the information necessary to prepare the note

until one month after the note’s publication. Nevertheless, they may have an interest in any of the securities mentioned within this note.

This note has been compiled from publicly available information. This note is not directed at any person in any jurisdiction where (by reason of that person’s nationality, residence or otherwise) the publication or availability of this note is prohibited.

Accuracy of Content: Whilst Marten & Co uses reasonable efforts to obtain information from sources which we believe to be reliable and to ensure that the information in this note is up to date and accurate, we make no representation or warranty that the information contained in this note is accurate, reliable or complete. The information contained in this note is provided by Marten & Co for personal use and information purposes generally. You are solely liable for any use you may make of this information. The information is inherently subject to change without notice and may become outdated. You, therefore, should verify any information obtained from this note before you use it.

No Advice: Nothing contained in this note constitutes or should be construed to constitute investment, legal, tax or other advice.

No Representation or Warranty: No representation, warranty or guarantee of any kind, express or implied is given by Marten & Co in respect of any information contained on this note.

Exclusion of Liability: To the fullest extent allowed by law, Marten & Co shall not be liable for any direct or indirect losses, damages, costs or expenses incurred or suffered by you arising out or in connection with the access to, use of or reliance on any information contained on this note. In no circumstance shall Marten & Co and its employees have any liability for consequential or special damages.

Governing Law and Jurisdiction: These terms and conditions and all matters connected with them, are governed by the laws of England and Wales and shall be subject to the exclusive jurisdiction of the English courts. If you access this note from outside the UK, you are responsible for ensuring compliance with any local laws relating to access.

No information contained in this note shall form the basis of, or be relied upon in connection with, any offer or commitment whatsoever in any jurisdiction.

Investment Performance Information: Please remember that past performance is not necessarily a guide to the future and that the value of shares and the income from them can go down as well as up. Exchange rates may also cause the value of underlying overseas investments to go down as well as up. Marten & Co may write on companies that use gearing in a number of forms that can increase volatility and, in some cases, to a complete loss of an investment.