Time to look forward

Strategic Equity Capital’s (SEC) shareholders have overwhelmingly approved proposals to address the trust’s discount and provide liquidity to those shareholders that need it. The focus should now switch to the trust’s much-improved track record under manager Ken Wotton at Gresham House Asset Management (GHAM).

SEC’s investment approach emphasises qualities such as balance sheet strength, free cashflow and structural growth. As we explore in this note, that should ensure that the overall portfolio is relatively resilient in the face of the current market turmoil.

Focused UK small companies portfolio

SEC aims to achieve absolute returns over a medium-term period, principally through capital growth. SEC is managed with a focused portfolio of investments selected on the same basis that a private equity investor would use to appraise its investments.

Drawing a line and moving on

In December 2021, just ahead of Christmas, SEC’s board announced that it had been approached by the board of Odyssean Investment Trust proposing a combination of the two companies. At the time, SEC had outperformed Odyssean over the previous 12 months, both in NAV and share price terms, but Odyssean was trading at a premium while SEC was trading at a meaningful discount.

The SEC board considered the proposal, talked to a selection of SEC shareholders and the company’s advisers and came up with a series of proposals of its own designed to enhance shareholder value creation and allow the continuation of SEC as a successful standalone vehicle. The Odyssean approach was rejected.

Understandably, SEC’s board has long been frustrated with the discount that SEC’s shares trade on relative to NAV. These proposals are designed in large part to address this.

Ken Wotton has had responsibility for the portfolio since 29 September 2020 and, as we show on page 7, has delivered good returns for shareholders since then. Adam Khanbhai, the last of the team from SEC’s GVQ days, has decided to leave GHAM. However, Ken is supported by a well-resourced public equity team of five at GHAM, as well as the 20-strong private equity team and the investment committee.

We think these proposals have the potential to draw a line under SEC’s recent turbulent history and allow the manager to focus on delivering good returns for SEC’s shareholders.

The board’s proposals

The implementation of a tender offer for up to 10% of SEC’s share capital. The initial tender offer will be at net asset value less costs and will replace the previously announced tender offer due to be completed in November 2022 which was to be implemented at a 3% discount to NAV (less costs).

- Following the completion of this initial tender offer, the implementation of a share buyback programme for up to an additional 9% of current NAV with shares repurchased during the 2022 calendar year at a discount to NAV of greater than 5%.

- A new buyback policy will be put in place in order to return 50% of proceeds from profitable realisations, at greater than a 5% discount on an ongoing basis, in each financial year, commencing in the financial year ending 30 June 2023. If the shares are trading narrower than a 5% discount, the cash will be reinvested in the portfolio to minimise cash drag.

- A commitment by Gresham House to use £5m of its cash resources to purchase shares by June 2023 at greater than a 5% discount.

- An ongoing commitment by the manager (GHAM) to reinvest 50% of its management fee per quarter in shares, if the shares trade at an average discount of greater than 5% for the quarter.

- The deferral of the continuation resolutions that would otherwise be proposed at the company’s annual general meetings in 2022, 2023 and 2024 in favour of the implementation of a 100% realisation opportunity for shareholders in 2025, the structure and timing of which will be communicated by the board in due course.

In addition, the board has decided to shift responsibility for marketing the trust from abrdn to the trust’s broker Liberum Capital.

Result of meeting

Shareholders approved the proposals on 23 March 2022 and the tender offer proceeded as planned. 6,329,685 shares were repurchased – at a tender price of 322.8748p per share – and cancelled.

Our view

The proposals offer a near-term exit, on improved terms, for those shareholders who need it. In addition, considerable effort is being directed towards narrowing the discount towards around 5%, although we see no reason why it should not narrow further as investors come to appreciate the trust’s improved performance.

Ken makes the point that he targets a doubling of the fund’s money from new investments. Returning half the proceeds of profitable realisations would still leave the trust with its starting capital, therefore. The considerable commitment envisaged by the manager towards supporting the strategy is welcome. Scrapping annual continuation votes in favour of an exit opportunity in 2025 will hopefully put paid to the constant speculation about the future of the trust and allow the manager to focus on the job of making money for shareholders.

Market backdrop

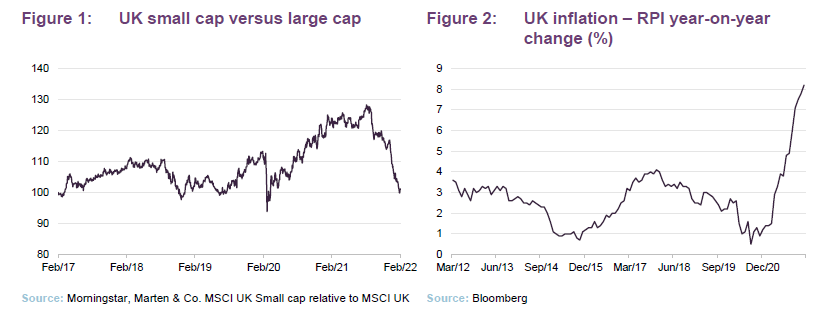

Our last note on SEC was published on 9 September 2021. Much has happened since then. As we approached the end of the year, investors grew increasingly concerned about inflation and began to anticipate interest rate rises. The Bank of England raised rates from 0.1% to 0.25% on 16 December 2021 and followed this with two increases of 0.25% in February and March 2022. This hit valuations of growth stocks and smaller companies disproportionately.

;

;

The Russian invasion of Ukraine has made investors more risk averse and exacerbated the inflation problem, driving up prices of a range of commodities including oil, gas, wheat and various metals.

SEC’s portfolio, with its focus on structural growth and good quality companies, is constructed in such a way that it should not be overly-exposed to external factors. One mark of quality is that a company should have pricing power, making SEC’s portfolio relatively well-positioned to cope with rising inflation. Good management teams are also better placed to react and adapt to changing market conditions.

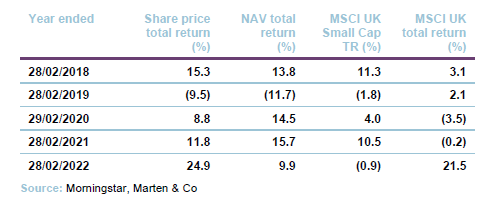

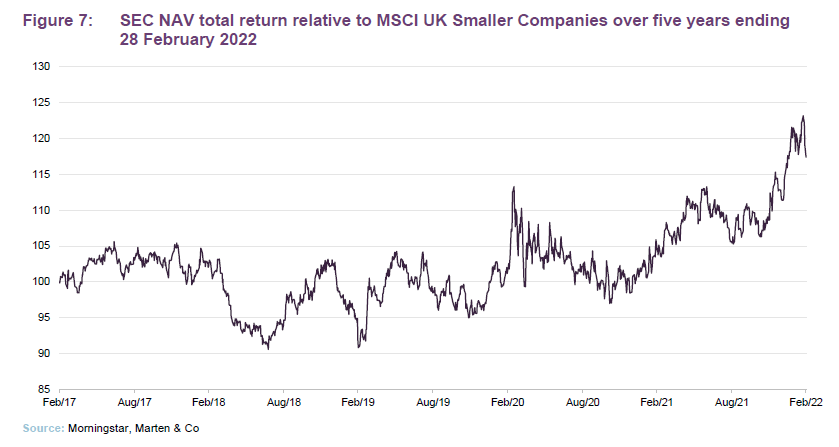

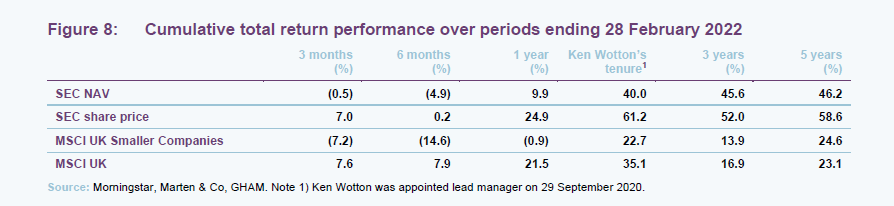

It was perhaps unrealistic to expect SEC to produce a positive return in this environment, but it has been much more resilient than the MSCI UK Smaller Companies Index, as we show on page 8. This likely reflects the manager’s distinctive investment approach and the focus on quality, in particular.

One factor that might be worth bearing in mind is that private equity managers are sitting on considerable ‘dry powder’ – $1.3trn at end September 2021, according to Preqin. As we describe later in this report, SEC’s portfolio has benefited from a number of bids in recent months. Recent market falls may encourage further activity. The cash freed up from these bids may allow the manager to take advantage of these volatile markets. Notwithstanding the commitment to the tender and buybacks, Ken recognises the attraction of SEC’s closed-end structure in the current market environment.

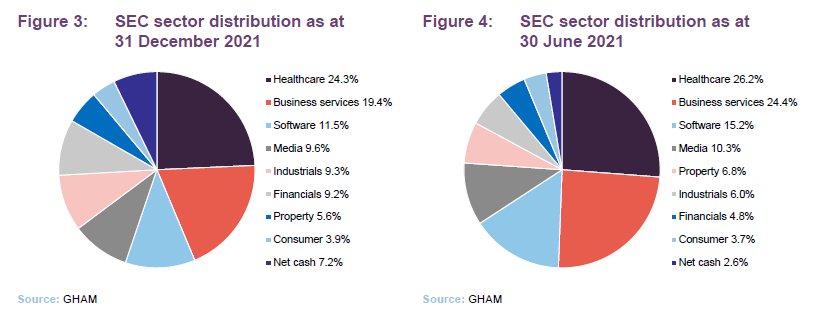

Asset allocation

The shape of the portfolio is driven by the manager’s stock selection decisions. The investment approach is described in detail from page 5 onwards of our February 2021 note – Back to its roots – and readers might wish to refer to that note.

Ken has been gradually repositioning the portfolio towards smaller stocks (where SEC can exert greater influence) and increasing the conviction within the portfolio. The portfolio realignment, now nearing completion, has been aided by a number of bids for portfolio companies.

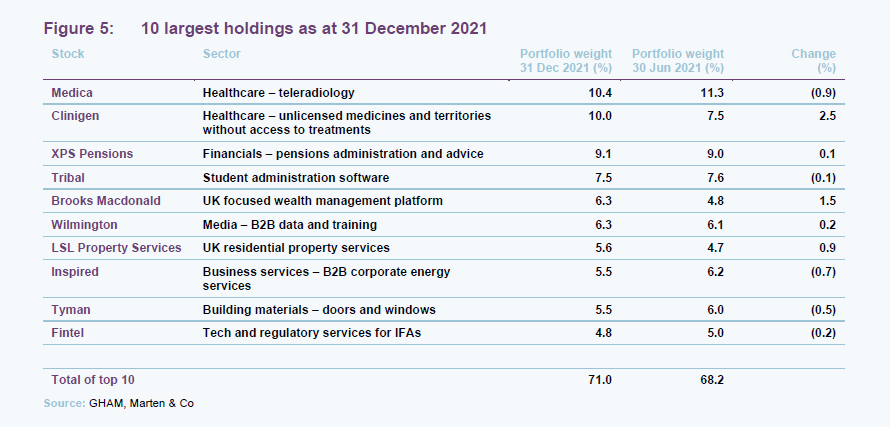

Top 10 holdings

There was no change in the constituents of the list of SEC’s 10-largest holdings over the second half of 2021. The higher weight in Clinigen reflects a bid for that stock, as we discuss below. Brooks Macdonald performed well over the second half of 2021, but Medica has de-rated following a trading statement in January. Ken believes that the company’s long-term prospects are good and is not too concerned.

Tyman was hit by concerns over supply chain bottlenecks and input cost inflation. However, its results were in-line with expectations. The statement was relatively upbeat.

Wilmington is undergoing a digital transformation, having had to adapt its business in the face COVID-lockdowns. GHAM is the second-largest shareholder in the company and is engaged with Wilmington’s management team.

Recent activity

Following on from the bids for Equiniti and Proactis that we discussed in our last note, SEC has since benefited from bids for Clinigen and River & Mercantile.

Clinigen

On 8 December 2021, Clinigen (clinigengroup.com) was the subject of a recommended all-cash offer by Triley Bidco Limited (a company indirectly owned by Triton Investment Management Limited) at 883p; a 40% premium to its undisturbed share price. On 17 January 2022, the terms of the offer were improved to 925p in cash for each Clinigen share. The deal is expected to close in April 2022. SEC says that its 2014 investment in the company has generated an IRR in the high teens.

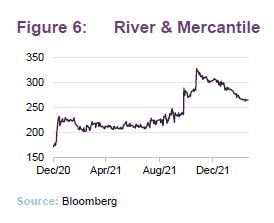

River & Mercantile

River & Mercantile (riverandmercantile.com) was a new investment for SEC in Q3 2021. Martin Gilbert’s Asset Co bought a stake in the business around the end of 2020. Ken felt that River & Mercantile’s share price was not reflective of the underlying value of the company. In addition to its conventional asset management activity, River & Mercantile had a growing pension fund advisory (Solutions) division with, Ken believed, exciting prospects. In October 2021, this was sold to Schroders for £230m, equivalent to River & Mercantile’s then market cap. A bidding war then developed between Premier Miton and Asset Co for the asset management business.

Performance

In recent months, SEC has extended the run of outperformance of the MSCI UK Small Cap Index that began with the good news on vaccines in early November 2020. As Figures 7 and 8 show, its long-term returns are well-ahead of comparable indices. A narrowing discount has contributed to shareholders’ returns, but there is more to go for here as the proposals that we outline earlier work to drive the discount lower still.

Performance attribution

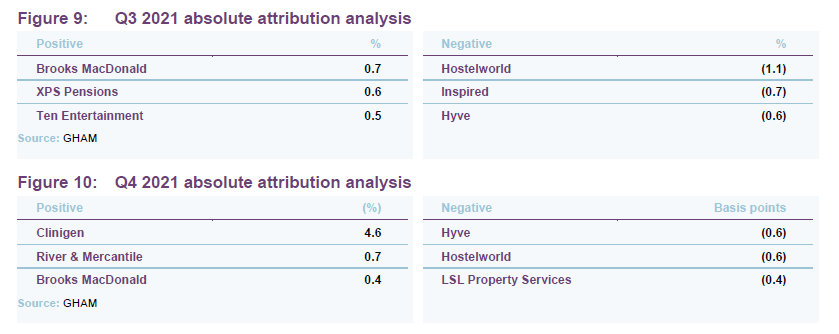

Our last note showed quarterly performance attribution data up to the end of Q2 2021. Figures 9 and 10 show the positive and negative contributions made to SEC’s performance over Q3 and Q4 2021, respectively.

Brooks MacDonald

Brooks MacDonald saw decent inflows into its business over the course of the second half of 2021. Falls in markets since the end of the year have had an impact on its share price, however. Ken notes that there has been some M&A activity in the area of wealth management.

XPS Pensions

Good results drove an uplift in the XPS pensions share price in June. Interims released in November showed 10% organic growth in revenue and a 5% uplift in adjusted earnings per share. More recently, the company has announced a strategic alliance with abrdn.

Ten Entertainment

Ten Entertainment’s business was hit by lockdowns but is now on a recovering path as its venues reopen. Ken thinks that there has been pent-up demand for consumers to return to leisure activities denied to them by COVID. Competing venues have struggled to survive and Ten Entertainment should now be in a stronger market position. A trading update released in January described 32% sales growth (29% like-for-like) and a sustained return to profit and cash generation.

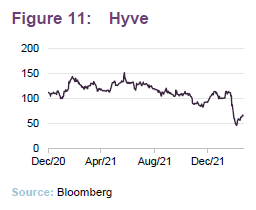

Hyve

Exhibitions and conferences business Hyve has been the biggest detractor to returns since we last published on SEC. COVID hit the company hard, although some of its business was covered by insurance, and the emergence of the Omicron variant delayed a return to more normal trading.

SEC took part in a £29m placing that Hyve undertook to build on its Mining Indaba business.

Hyve also has some exposure to Russia/Ukraine which is material to its revenue (about 30% of the total in the 2019 financial year) but not to its profits. Its share price has been hit hard in recent weeks. On 15 March it said that it would exit its Russian business. Ken decided to sell the position.

Hostelworld

Ken felt that Hostelworld managed its COVID-related forced closure well. The emergence of Omicron delayed a return to more normal trading, but the company should now be better placed, helped by a strong balance sheet.

Inspired

Inspired aims to help businesses buy energy competitively and use energy efficiently. A trading update released on 31 January said that 2021 revenue is expected to be 48% higher than 2020’s figure, organic growth delivered 38 percentage points of that. Higher energy prices are encouraging the take-up of its energy consumption optimisation services. However, they are also said to be delaying contract renewals.

LSL Property Services

Surveying, estate agency and financial services business LSL Property Services has just released its results for 2021. Profit before tax rose by 234% over the year, with growth in each of its divisions. Property transaction volumes are expected to be lower in 2022 relative to 2021 (without the benefit of the stamp duty reductions). However, growth in its financial services division is expected to make up for this.

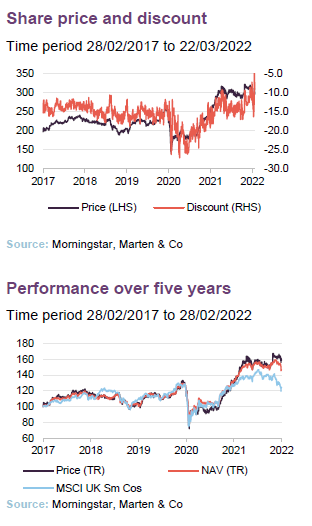

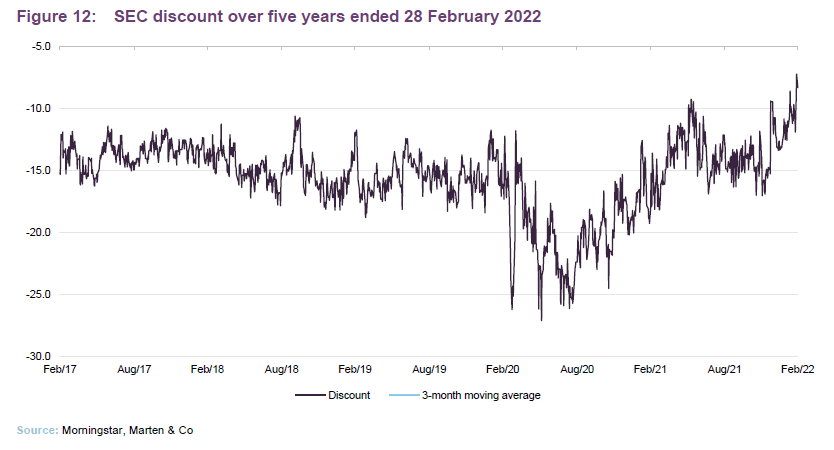

Discount

Over the 12 months ended 28 February 2022, SEC’s shares moved in a range of trading at a discount of 18.2% to a discount of 7.2% and averaged 13.6%. At 22 March 2022, the discount was 7.2%.

There has been a noticeable narrowing of SEC’s discount over recent months, despite a trend towards wider discounts across much of the investment companies sector, as inflation and the Russian invasion have unnerved investors. The Odyssean approach and the announcement of the board’s proposals for discount control have countered this. As we explained on page 4, the ambition appears to be to drive the discount down to 5% or less over time. That suggests that there is upside in the share price from current levels (all else being equal).

Board update

Annie Coleman has joined the board as a non-executive director with effect from 14 February 2022.

Annie was recently group people and culture officer at Unicredit, a leading retail corporate and investment banking organisation. She started her career in 1980 at British Petroleum in branding and communications. This was followed by reputational risk, branding and corporate communications roles from 1984-1992, including head of the London Stock Exchange press office; press officer in the Prime Minister’s press office and the Ministry of Defence.

In 1999 Annie moved to Goldman Sachs in London and in 2004 to New York to work for the then chair and CEO, creating the first chairman’s forum, a culture enhancing leadership and reputational judgment programme for partners and managing directors.

In 2006 she joined GAM Investments, the investment management firm, as global head of branding and employee engagement before creating her own consulting business Alpha Performance Consultants. Annie became global head of client marketing at UBS Investment Bank in 2011, taking on the additional role of global head of culture in 2015 until moving to Unicredit in 2021.

Fund profile

Launched in 2005, Strategic Equity Capital (SEC) is a London listed investment trust that invests in a concentrated portfolio of predominantly UK-listed equities (with the majority of the portfolio invested in 10–15 holdings).

SEC aims to achieve absolute returns over a medium-term period (targeting 15% IRR), principally through capital growth. SEC is managed with a focused portfolio of investments selected on the same basis that a private equity investor would use to appraise its investments. The investment manager looks for securities that it believes are undervalued and could benefit from strategic, operational or management initiatives. The approach is not constrained by any benchmark and does not currently employ leverage at the investment trust level.

The mandate permits investment in unquoted securities (up to 20% of gross assets at the time of investment), but this is not utilised currently.

The manager also has the flexibility to invest up to 20% in assets quoted on exchanges that are not operated by the London Stock Exchange, but the manager does not expect this to be a significant element of the portfolio.

Investment manager – Gresham House Asset Management Limited

On 21 May 2020, following a review by the board of the company’s management arrangements, Gresham House Asset Management Limited (GHAM) became SEC’s investment manager.

Ken Wotton became lead manager on 29 September 2020. He has considerable experience of working on public equity portfolios within a private equity environment. Ken leads a team of five dedicated to public markets investment. More information on this team is provided on page 19 of our February 2021 annual overview note, which covered these changes in some detail.

GHAM is a specialist alternative asset management group, dedicated to sustainable investments across a range of strategies, with expertise across forestry, housing, infrastructure, renewable energy and battery storage, public and private equity. The latter speciality provides an additional source of knowledge, expertise and synergy for SEC’s team.

The parent company, Gresham House Plc, is quoted on the London Stock Exchange (GHE:LN). Its CEO is Anthony (Tony) Dalwood, who was SEC’s lead manager when it was launched in 2005. He now heads up the investment committee that oversees the management team’s investment decisions (see page 20 of our February 2021 annual overview note for more details). Gresham House Plc’s AUM stood at £6.5bn at the end of December 2021.

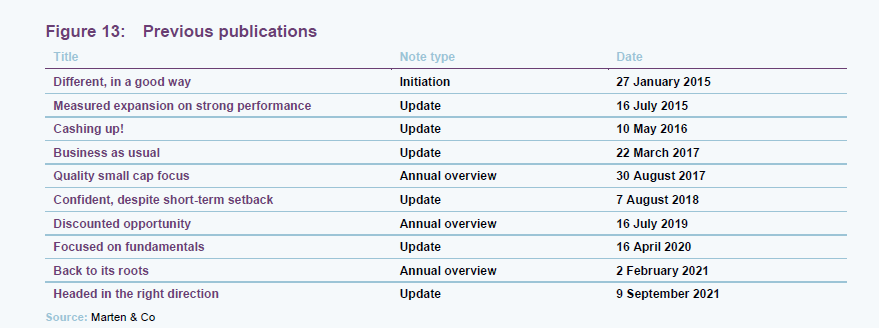

Previous publications

Readers interested in further information about SEC, such as investment process, fees, capital structure, trust life and the board, may wish to read our last annual overview note Back to its roots, published on 2 February 2021, as well as our last update notes. You can read the notes by clicking on them in Figure 13 or by visiting our website.

The legal bit

This marketing communication has been prepared for Strategic Equity Capital Plc by Marten & Co (which is authorised and regulated by the Financial Conduct Authority) and is non-independent research as defined under Article 36 of the Commission Delegated Regulation (EU) 2017/565 of 25 April 2016 supplementing the Markets in Financial Instruments Directive (MIFID). It is intended for use by investment professionals as defined in article 19 (5) of the Financial Services Act 2000 (Financial Promotion) Order 2005. Marten & Co is not authorised to give advice to retail clients and, if you are not a professional investor, or in any other way are prohibited or restricted from receiving this information, you should disregard it. The note does not have regard to the specific investment objectives, financial situation and needs of any specific person who may receive it.

The note has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. The analysts who prepared this note are not constrained from dealing ahead of it but, in practice, and in accordance with our internal code of good conduct, will refrain from doing so for the

period from which they first obtained the information necessary to prepare the note until one month after the note’s publication. Nevertheless, they may have an interest in any of the securities mentioned within this note.

This note has been compiled from publicly available information. This note is not directed at any person in any jurisdiction where (by reason of that person’s nationality, residence or otherwise) the publication or availability of this note is prohibited.

Accuracy of Content: Whilst Marten & Co uses reasonable efforts to obtain information from sources which we believe to be reliable and to ensure that the information in this note is up to date and accurate, we make no representation or warranty that the information contained in this note is accurate, reliable or complete. The information contained in this note is provided by Marten & Co for personal use and information purposes generally. You are solely liable for any use you may make of this information. The information is inherently subject to change without notice and may become outdated. You, therefore, should verify any information obtained from this note before you use it.

No Advice: Nothing contained in this note constitutes or should be construed to constitute investment, legal, tax or other advice.

No Representation or Warranty: No representation, warranty or guarantee of any kind, express or implied is given by Marten & Co in respect of any information contained on this note.

Exclusion of Liability: To the fullest extent allowed by law, Marten & Co shall not be liable for any direct or indirect losses, damages, costs or expenses incurred or suffered by you arising out or in connection with the access to, use of or reliance on any information contained on this note. In no circumstance shall Marten & Co and its employees have any liability for consequential or special damages.

Governing Law and Jurisdiction: These terms and conditions and all matters connected with them, are governed by the laws of England and Wales and shall be subject to the exclusive jurisdiction of the English courts. If you access this note from outside the UK, you are responsible for ensuring compliance with any local laws relating to access.

No information contained in this note shall form the basis of, or be relied upon in connection with, any offer or commitment whatsoever in any jurisdiction.

Investment Performance Information: Please remember that past performance is not necessarily a guide to the future and that the value of shares and the income from them can go down as well as up. Exchange rates may also cause the value of underlying overseas investments to go down as well as up. Marten & Co may write on companies that use gearing in a number of forms that can increase volatility and, in some cases, to a complete loss of an investment.