Tritax EuroBox

Real estate | Update | 20 February 2024

Calmer waters

After a period of interest rate volatility, real estate seems to have entered calmer waters, with some evidence of asset values stabilising, while occupier markets could support rental growth. Tritax EuroBox’s (EBOX’s) manager says that it is sailing in these waters too, as demonstrated by a portfolio valuation that has changed little and a 30% uplift in earnings that now fully covers its 8.6%-yielding dividend.

The company is on the way to achieving its aim of reducing its already low-cost debt to a more conservative LTV level of 40% through the disposals of mature assets from its portfolio (with proceeds now totalling €139m). The manager is confident that even after allowing for the sales, the 2024 dividend will be fully covered. This, it says, is because the portfolio has built-in annual uplifts on current leases and substantial reversion potential from the letting up of vacant/development space. With the macroeconomic environment appearing brighter and the likelihood of interest rate cuts later this year growing, the company’s 39.4% discount could be an attractive entry point.

Big box logistics in Europe

EBOX invests in a portfolio of logistics assets in continental Europe, diversified by geography and tenant, targeting well-located assets, within or close to densely populated areas. The strategy aims to capture market rental value growth and deliver secure income and an attractive capital return. EBOX is targeting a total return of 9% per annum over the medium term.

Market overview

The macroeconomic landscape that appears to have played a major role in the weak performance of the real estate sector over the last 18 months seems to be easing, with inflation on a downward trend across most economies and the peak of interest rate volatility looks to be behind us. While interest rates may have peaked in the eurozone, the timing of any possible cuts is still unclear – although ECB president Christine Lagarde hinted that a summer reduction was on the cards when holding rates at 4% in January.

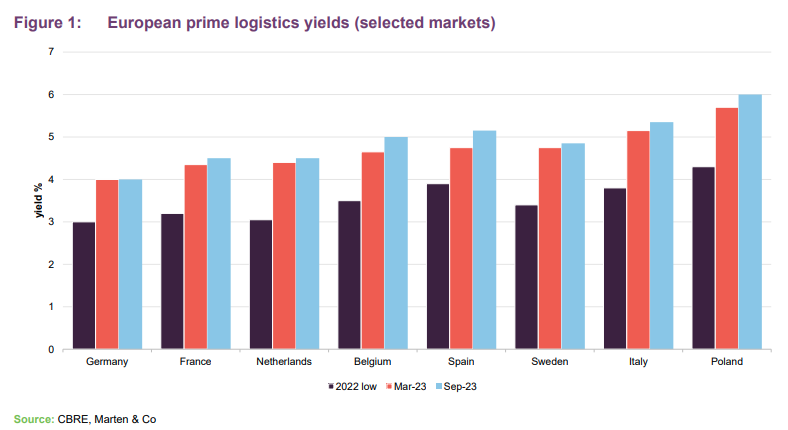

A rapid price correction was experienced in the European logistics sector in the second half of 2022 and early 2023, as prime yields moved out in step with interest rates from historic lows of around 3.5% to 5%. The worst of the yield expansion may have passed, with the current stable interest rate environment appears to be mirrored in valuations across the sector.

This was reflected in EBOX’s portfolio, which saw a 14.7% fall in values during the period September 2022 to March 2023, but just a marginal decline (0.3%) in the following six months to September 2023. EBOX’s manager says that the majority of the valuation decline has happened, but trying to predict when values will rebound remains difficult.

Investor interest remains strong for the right product in the right market, the manager says, as witnessed by the stable yields in Germany. Assets with strong occupier characteristics, such as good sustainability credentials, tenant strength, and located in established distribution hubs, are attracting strong investor demand, the manager adds.

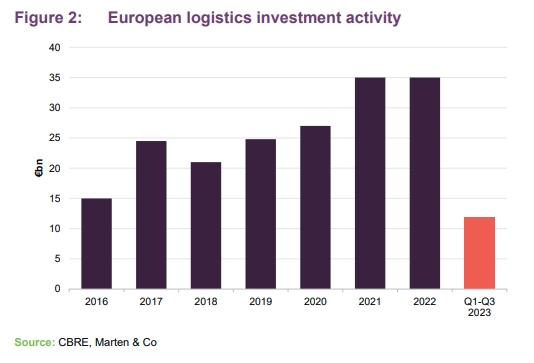

In fact, this has been echoed in EBOX’s disposal strategy (more details on page 8). It has sold three assets – two in Germany and one in Sweden – for a combined €139m and achieved a sub-4.5% yield and a sub-5% yield on the German sales. The manager expects investment activity to grow in 2024, as the macroeconomic landscape improves and liquidity returns to the market.

European logistics investment volumes were subdued in 2023 (we only have data up to the third quarter) when compared to recent years. Just under €12bn was transacted in the first three quarters of 2023 across France, Germany, Netherlands, Belgium, Italy, Spain, Poland, Czech Republic, Hungary, Romania and Slovakia, according to CBRE.

Occupier market

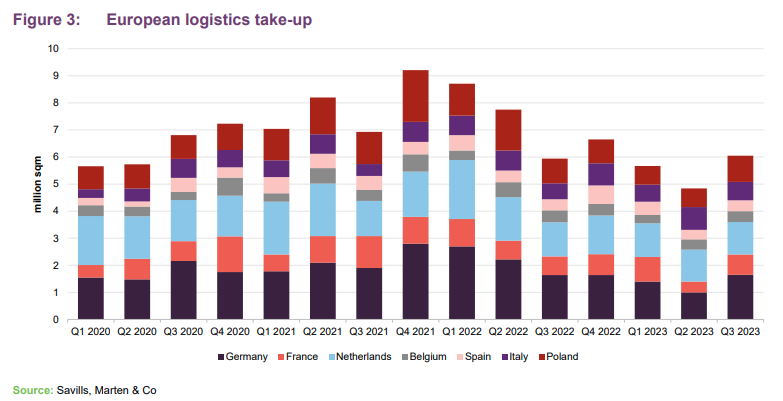

Whilst there was a welcomed uplift in lettings in the third quarter of 2023, caution amongst businesses continues to feed through to occupier take-up of European logistics space, the manager says. Take-up levels have, understandably, come off the heights of 2021 and 2022 and are now back to the pre-pandemic norms, as shown in Figure 3.

Data from Savills shows that while quarterly take-up in the majority of European countries was still below their five-year average, Belgium (up 27.3%), Italy (up 14.7%) and Poland (up 11%) were all positive versus their five-year averages. Overall European take-up was 12% below its five-year average.

Several occupier trends continue to play out, and the manager believes these will continue to be a source of demand for years to come. Near-shoring – which has been talked about as an occupier trend since the outbreak of the COVID-19 pandemic – is feeding through to actual take-up, the manager states, with manufacturing companies shifting their supply chain strategies to avoid the nightmare scenario that they experienced when supply chains were shut down almost overnight. Supply chains are becoming shorter, the manager comments, with some manufacturing moving away from the Far East and China and back to Europe.

As we have discussed in previous notes, the manager says that many occupiers are evolving their warehouse networks after adopting a ‘just-in-case’ mentality, as opposed to a ‘just-in-time’ mindset, to help alleviate any future shocks in the supply chain. This has seen inventory increase, it adds, and therefore warehouse space requirements grow.

One occupier trend that the manager expects to gain significance over the next few years is an increased corporate focus on the sustainability of the buildings that they are operating from. Buildings that do not meet sustainability requirements will eventually become obsolete without significant capital expenditure, the manager expects. Large multi-national corporate companies have ESG targets that they have to meet, which the manager says will benefit EBOX. The group’s portfolio is highly sustainable and the manager is focused on further enhancements with the roll-out of solar panel installations. Solar capacity in the portfolio has increased to 10.3MW from 7.5MW, with a further 9MW in the pipeline. The company has also been awarded the highest-possible industry accolades for the sustainability of its portfolio.

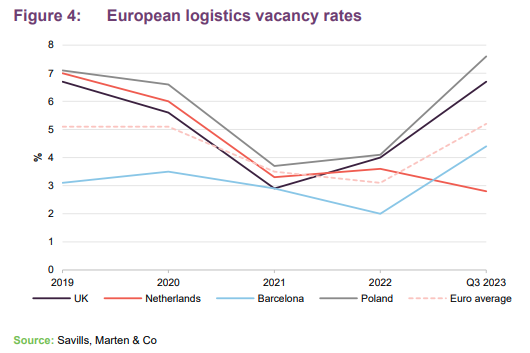

Vacancy trending up, but still at historic lows

The average vacancy rate across European logistics reached 5.2% at the end of the third quarter of 2023, according to Savills. This is up from an all-time low of 3.1% in 2022 but from a historical context is still low. This is also well below the perceived vacancy level where rental growth plateaus – CBRE has observed this level to be around the 8% vacancy level, while Savills has found the tipping point to be around 12%.

Developments started in 2022 have come onto the market and impacted the vacancy rate, the manager says. However, new development starts have fallen significantly due to several market conditions, including the cost of finance, the manager adds, and this slowdown in construction could help ease the pressure on vacancy.

Rental growth prospects remain strong

As mentioned previously, the vacancy rate remains at a level that tends to support rental growth. This was evident in EBOX’s portfolio where it recorded rental growth of 4.5% on a like-for-like basis in the 12 months to 30 September 2023.

The manager expects annual rental growth in the market this year to be in the mid-single digits. However, it expects high-quality buildings in locations of limited supply and robust level of occupier demand will continue to outperform.

Potential corporate activity

EBOX’s closest listed peer, abrdn European Logistics Income (ASLI), launched a strategic review into its future in November 2023, with all options on the table. Although this could result in the company being acquired or even continuing in its current form, one outcome could also be a merger with EBOX.

The two companies have portfolios that appear to be complementary, with ASLI’s portfolio consisting of 26 mid-box and urban logistics assets, located in the Netherlands, France, Germany, Spain and Poland, valued at €659.75m. The portfolio WAULT is 7.2 years to break and 8.6 years to expiry, with around two-thirds of the rental income subject to full uncapped indexation. The company has a NAV of €411.3m and a market capitalisation of £249m. EBOX’s manager Tritax Management is 60% owned by abrdn, which perhaps makes a marriage of the two funds more amiable.

A merger of the two companies would result in a sizable portfolio worth over €2.2bn, with a NAV of around €1.2bn and a market cap of around £660m. It seems reasonable that the combined entity could achieve cost savings. Both companies also trade on similarly wide discounts. There are potential issues within the ASLI portfolio, however, including vacancy in its French and Spanish portfolios.

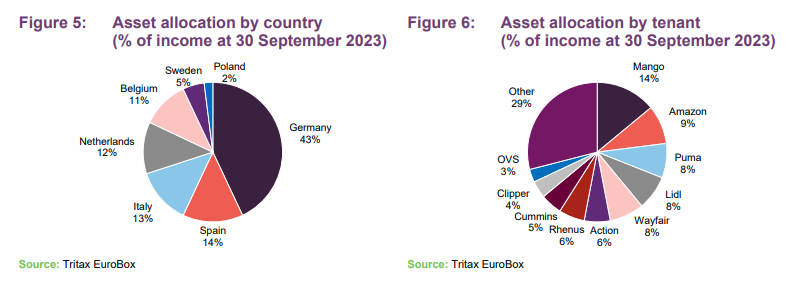

Asset allocation

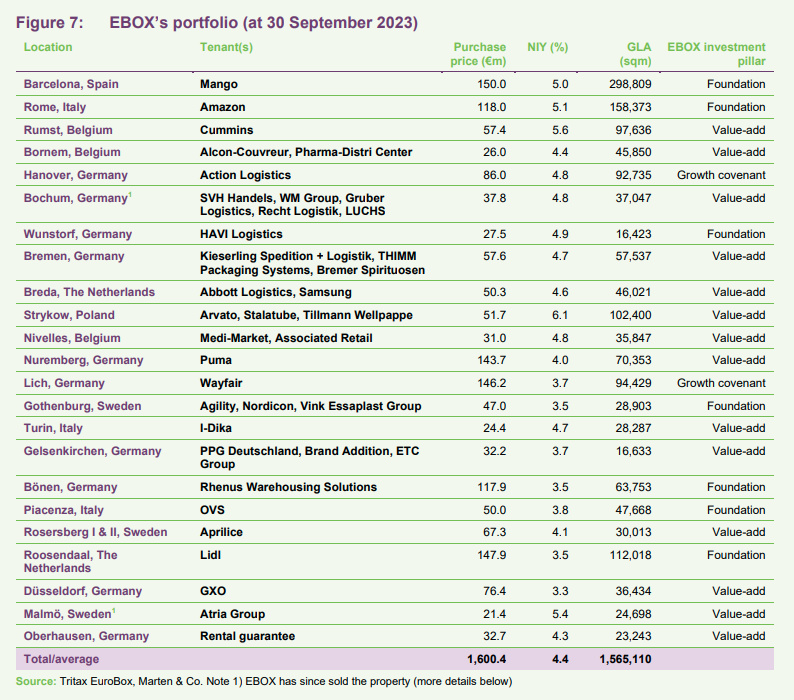

EBOX had a portfolio of 25 assets worth €1.561.9m at 30 September 2023 (down 2.2% from €1,596.7m at 31 March 2023). They have since sold two assets – detailed below. The portfolio is located across seven European countries.

The portfolio had an annual rental income of €76.3m at the end of September 2023, with a WAULT of 9.6 years (7.9 years to break). The portfolio is let to 35 tenants on a spread of long-term (41% of leases over 10 years in duration) and short-term leases (24% between 0-5 years and 35% between 5-10 years). The majority of leases are subject to some form of annual indexation, with 52% linked to uncapped local CPI. 16% of leases have a fixed yearly uplift at an average of 0.9%, while 29% have a combination of inflation linkage (capped at 4%) and a fixed uplift element.

Disposals

Changes in the portfolio since our last note six months ago include the sales of three assets (in Hammersbach, near Frankfurt, Germany for €64.6m, Bochum, Germany for €46.8m and Malmo, Sweden for around €28m).

In August 2023, EBOX made the first disposal from its portfolio, selling the multi-let property in Hammersbach for €64.6m, reflecting a net initial yield of 4.45%. The manager says that it had completed its asset management strategy at the building and took the opportunity to crystalise the corresponding uplift in value (it bought the property for €50.6m in 2019).

At the end of 2023, EBOX announced the sale of two further assets – in Bochum and Malmo. It sold the Bochum asset for €46.8m, a 4.88% net initial yield, after securing a new lease and bringing the property to fully let. Since acquiring the asset in 2018 for €37.8m, the company increased overall rent by 23%. It then announced the sale of its Malmo asset for SEK320m (around €28m) to a private data centre operator for a substantial uplift on the value of the building and a 14% uplift on the acquisition price (including transaction and developer-partner fees).

The circa €139m raised from the sales form part of EBOX’s disposal strategy, announced in May 2023, which targeted at least €150m of sales by the end of 2024. The sales proceeds are being used to reduce its debt level to a more conservative LTV level in the low-40% and to maintain its investment grade rating. EBOX has a low-cost (1.3% at 30 September 2023), but sizable debt pile (€777.5m – made up of a €500m senior unsecured green bond, a €200m US private placement, and €77.5 drawn from its RCF). Some of the sales proceeds could also fund higher-returning asset management opportunities from within the existing portfolio, if they were accretive to earnings, the manager says.

The assets that have been sold to date, and future sales identified by the manager, are properties where asset management plans have completed (and therefore further rental income growth is limited) or assets that the manager believes display some risk – either on the part of the tenant or the building (if it did not meet sustainability credentials and would be too costly to implement). It could also mean exiting entire countries where the manager feels that it would be difficult to achieve critical mass in that country.

Rental growth potential

According to its manager, EBOX’s portfolio had a reversion potential of 17.6% at 30 September 2023, which equates to €13.4m of additional annual rental income if vacant space was let and assets were relet at their estimated rental values (ERVs). This is on top of the 4.5% like-for-like rental growth achieved within the portfolio in the year to 30 September 2023.

Some of this has been secured with the lettings at its Turin development (which is now fully let) and the first phase of its Rosersberg development (which was secured at a 3% premium to the ERV as at September 2023 and 20% above the underwritten level). The remaining vacant space in the portfolio is at the second phase of Rosersberg and in Strykow, Poland.

The manager expects the company’s development in Oberhausen, Germany, which is due to complete in the third quarter of 2024, to produce an annual rental income of €2.0m when fully let.

On top of this, the manager expects to capture further rental uplifts through inflation-linked leases. In the year to 30 September 2023, indexation accounted for a €2.3m uplift in rent. The manager predicts that over the next three years it could capture an additional €4.3m of rent from inflation uplifts, based on Oxford Economics’ average inflation forecast of 1.7% per year.

Longer-term, two further potential extensions exist at its Wunstorf and Nuremberg assets in Germany. The manager says that it is in discussions with the tenant at it Wunstorf asset regarding a 10,000 sqm extension and would expect the development to come with a yield on cost of 7%. It has also held talks with Puma regarding a 42,000 sqm extension at its global logistics centre in Nuremberg, along with an associated lease extension.

Top three assets

We looked at EBOX’s individual assets in detail in our last annual overview note published six months ago (see page 15 for a link). Here we detail the company’s top three assets by value.

Barcelona

Purpose-built in 2016, the property is the global distribution centre for fashion retailer Mango. It was acquired in September 2018 for €150m and is the biggest asset in EBOX’s portfolio. In 2021, the company funded a 93,931 sqm extension on the adjacent plot of land, at a cost of €31.5m, which completed in November 2022 bringing the building size to almost 300,000 sqm, including mezzanine space. The property is let on a 30-year full repairing and insuring (FRI) lease that commenced on 20 December 2016, with a tenant break option in 2036, 2039 and 2042. The rent is subject to annual upward-only indexation.

It is located 25km north of Barcelona and is directly accessible from the motorway network, with Barcelona’s port and airport within a 25-minute drive. The manager says that Barcelona is one of the most supply-constrained logistics markets in Europe, with strong occupier demand. There are no sites available in the greater Barcelona area – due to the landscape – for large-scale logistics development, and the manager says there is downside protection in that similar adjacent buildings are leased at higher rents. In the extreme event of the tenant going bust, the property can be sub-divided into up to four units and re-let, the manager adds.

Mango accounts for 14% of EBOX’s rental income, as at 30 September 2023. Two months of rent is held in deposit and EBOX has a bank guarantee for 10 months’ rent, which extends to 24 months if certain covenants are not met.

Nuremberg and Lich

EBOX acquired the Nuremberg and Lich properties in the same transaction with its development partner Dietz for a combined €290.9m, reflecting a combined net initial yield of 3.9%.

The 70,353 sqm property in Nuremberg is let to global sportswear manufacturer and retailer Puma. It serves as the European distribution headquarters for Puma, which signed a 15-year lease on the property in April 2020. The property produces an annual rental income of €5.78m, with the lease subject to annual indexation of 100% of German CPI, following a four-year indexation holiday from the start of the lease.

The property is carbon neutral, built to LEED Gold standard, benefits from certified green energy procurement, and has a roof-mounted photovoltaic system generating up to 1.5MW of electricity. The 20-hectare site comes with extension potential for an additional 42,000 sqm of floorspace. The manager says that the asset is categorised as a foundation asset by EBOX, due to the low-risk nature of the income. The manager is in discussions with Puma regarding the 42,000 sqm extension to their global logistics centre, together with an associated lease extension.

The 94,429 sqm distribution unit in Lich, near Giessen, is let to online furniture retailer Wayfair. The distribution centre plays a key role in Wayfair’s European operations, which is focused on Germany and the UK. It signed a 15-year lease on the property that commenced in May 2021 at an annual rent of €5.6m, linked to German CPI, following a three-year indexation holiday at the commencement of the lease. The property is certified to DGNB Gold standard, and it benefits from a range of operational energy reduction measures. The roof has the capacity to support the installation of solar PV panels, and discussions with the tenant concerning the installation underway.

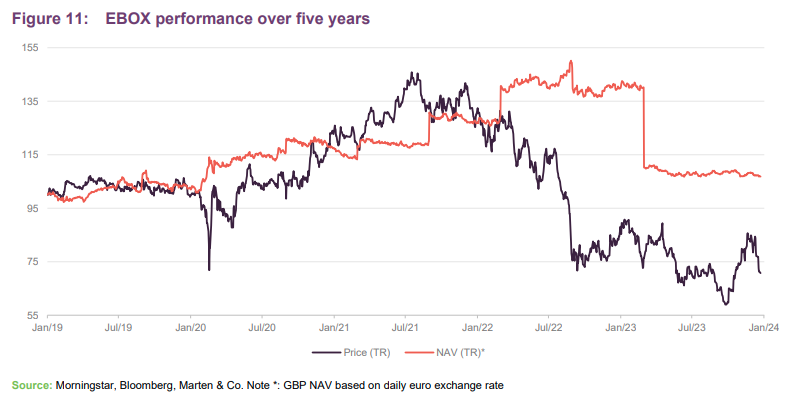

Performance

EBOX’s NAV has stabilised over the past nine months, following a small drop in September 2022 and a larger drop in March 2023 due to the impact of higher interest rates on property yields and valuations. The NAV had made steady progress from launch, and grew significantly with the deployment of the proceeds of equity raises in March and September 2021. EBOX’s NAV is quoted in euro, and the NAV in Figure 11 is the sterling NAV based on the daily exchange rate.

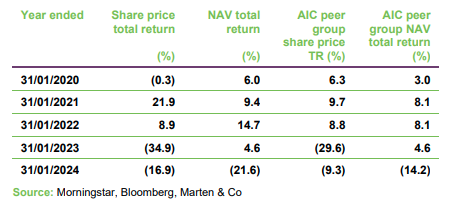

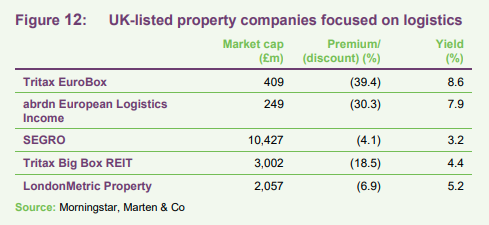

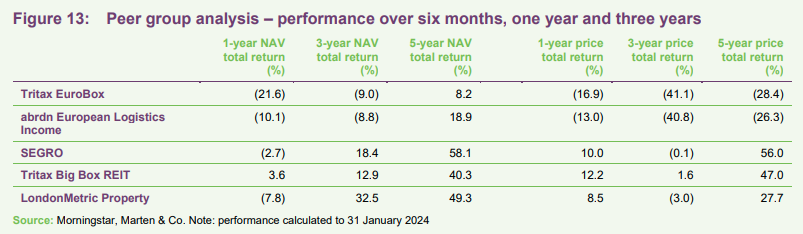

Peer group comparison

Most property companies investing in European logistics are unlisted funds or subsidiaries of larger groups. The listed peer group we have assembled consists of EBOX’s closest peer, abrdn European Logistics Income (ASLI); SEGRO, which owns a mixture of ‘big box’, urban and industrial space, about a third of which is located in continental Europe; Tritax Big Box; and LondonMetric Property. The latter two are UK-focused.

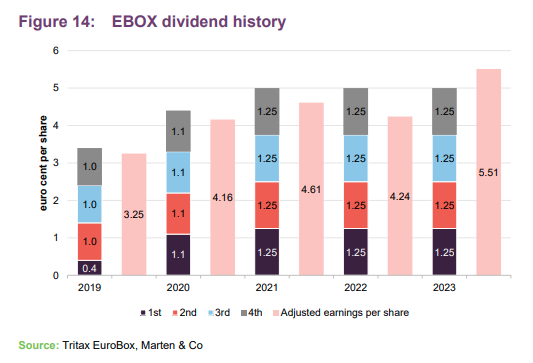

Dividend

EBOX paid 5 euro cents per share in dividends in its financial year to 30 September 2023, in line with the previous two years. The dividend was 110% covered by adjusted earnings per share, and the group has now recorded five consecutive quarters of dividend cover (including the final quarter of its 2022 financial year).

Adjusted earnings per share was boosted 30% to 5.51 euro cents, which the manager attributes to combination of higher rental income and lower operational costs (including a reduced investment management fee), together with full-year contributions from the completion of building extensions and developments. The manager states that it expects the full-year 2024 dividend to continue to be covered by adjusted earnings, even with the loss of earnings from any sales.

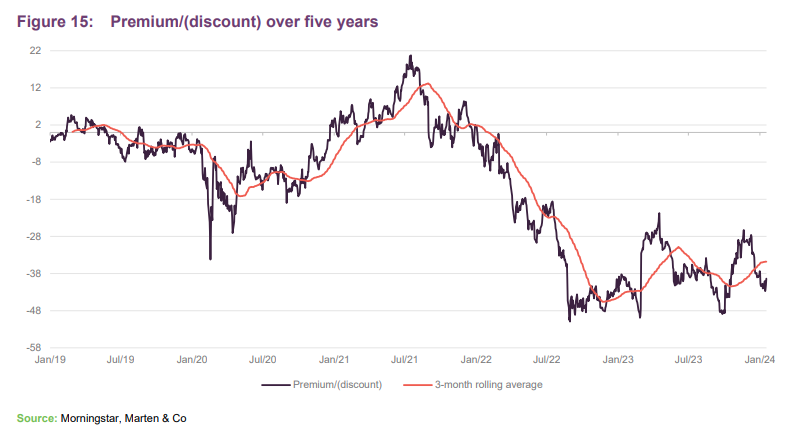

Premium/(discount)

Having been trading at a healthy premium to NAV throughout 2021, EBOX moved to a discount during the course of 2022 perhaps due to the market pricing in substantial valuation declines across real estate due to higher interest rates. Its discount widened to 50%-plus at one point, but has narrowed slightly and at 16 February 2024 was 39.4%.

Fund profile

EBOX invests in and manages a portfolio of logistics assets in continental Europe, diversified by geography and tenant, targeting well-located assets in established distribution hubs close to densely populated areas, with the aim of capturing market rental value growth.

EBOX was launched on 9 July 2018 after raising gross proceeds of €339.3m (£300m) at IPO. Following full deployment of the capital into a portfolio of nine continental European logistics real estate assets, the company successfully raised additional gross proceeds of €135m (£119.1m) in 21 May 2019, €230m in March 2021, and €250m in September 2021.

EBOX’s shares are traded on the premium segment of the London Stock Exchange, with both a sterling and euro quotation. These are the same class of shares and trading line, are fully fungible, and have no impact on overall liquidity of the stock. On 1 October 2021, the group was added as a constituent of the FTSE 250 index. To enhance equity returns, the company uses gearing, with a medium-term target LTV of 45% of gross assets and a maximum limit of 50%.

The manager – Tritax Management

The company’s manager is Tritax Management, part of the Tritax Group, which manages more than £7.8bn of assets (including EBOX), consisting of more than 50m sq ft. Tritax has a particular specialisation in the acquisition and management of logistics portfolios, most notably through Tritax Big Box REIT, a UK FTSE 250 REIT launched in December 2013. Tritax is headquartered in London with over 60 professionals and is authorised and regulated by the FCA. In 2021, abrdn acquired a 60% interest in Tritax Management. As part of the deal, Tritax now leads abrdn Real Estate’s global logistics team.

In September 2022 the company appointed a new fund manager, with Phil Redding taking over from Nick Preston. Phil joined Tritax in November 2020 as director of investment strategy. Prior to that, he spent 25 years at SEGRO Plc, holding the position of chief investment officer from 2011, and was appointed to the board as an executive director in 2013.

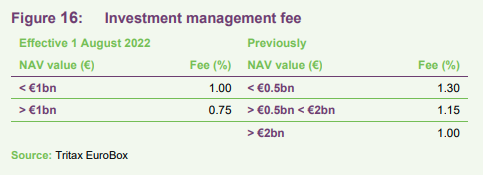

In 2022, EBOX amended its investment management agreement with Tritax Management. The key change was a reduction in the base management fee (as displayed in Figure 16). This resulted in a management fee reduction of €2.4m between full-year 2022 and 2023.

Previous publications

QuotedData has previously published five notes on EBOX. You can read them by clicking the links below.

Figure 17: QuotedData’s previously published notes on EBOX

Source: Marten & Co |

IMPORTANT INFORMATION

Marten & Co (which is authorised and regulated by the Financial Conduct Authority) was paid to produce this note on Tritax EuroBox Plc.

This note is for information purposes only and is not intended to encourage the reader to deal in the security or securities mentioned within it.

Marten & Co is not authorised to give advice to retail clients. The research does not have regard to the specific investment objectives financial situation and needs of any specific person who may receive it.

The analysts who prepared this note are not constrained from dealing ahead of it but, in practice, and in accordance with our internal code of good conduct, will refrain from doing so for the period from which they first obtained the information necessary to prepare the note

until one month after the note’s publication. Nevertheless, they may have an interest in any of the securities mentioned within this note.

This note has been compiled from publicly available information. This note is not directed at any person in any jurisdiction where (by reason of that person’s nationality, residence or otherwise) the publication or availability of this note is prohibited.

Accuracy of Content: Whilst Marten & Co uses reasonable efforts to obtain information from sources which we believe to be reliable and to ensure that the information in this note is up to date and accurate, we make no representation or warranty that the information contained in this note is accurate, reliable or complete. The information contained in this note is provided by Marten & Co for personal use and information purposes generally. You are solely liable for any use you may make of this information. The information is inherently subject to change without notice and may become outdated. You, therefore, should verify any information obtained from this note before you use it.

No Advice: Nothing contained in this note constitutes or should be construed to constitute investment, legal, tax or other advice.

No Representation or Warranty: No representation, warranty or guarantee of any kind, express or implied is given by Marten & Co in respect of any information contained on this note.

Exclusion of Liability: To the fullest extent allowed by law, Marten & Co shall not be liable for any direct or indirect losses, damages, costs or expenses incurred or suffered by you arising out or in connection with the access to, use of or reliance on any information contained on this note. In no circumstance shall Marten & Co and its employees have any liability for consequential or special damages.

Governing Law and Jurisdiction: These terms and conditions and all matters connected with them, are governed by the laws of England and Wales and shall be subject to the exclusive jurisdiction of the English courts. If you access this note from outside the UK, you are responsible for ensuring compliance with any local laws relating to access.

No information contained in this note shall form the basis of, or be relied upon in connection with, any offer or commitment whatsoever in any jurisdiction.

Investment Performance Information: Please remember that past performance is not necessarily a guide to the future and that the value of shares and the income from them can go down as well as up. Exchange rates may also cause the value of underlying overseas investments to go down as well as up. Marten & Co may write on companies that use gearing in a number of forms that can increase volatility and, in some cases, to a complete loss of an investment.