Real Estate Roundup

Kindly sponsored by abrdn

Performance data

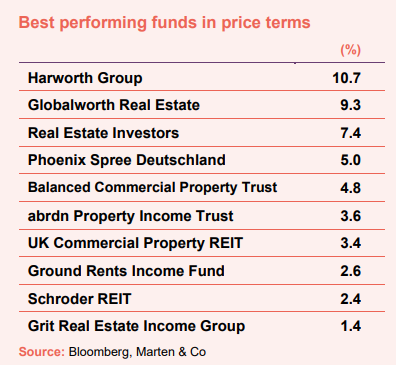

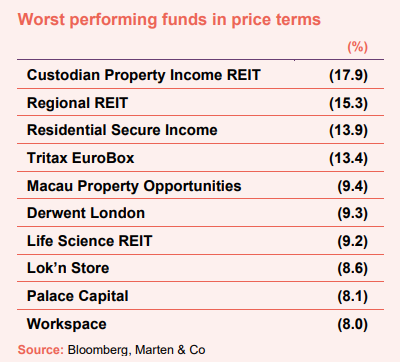

January’s biggest movers in price terms are shown in the charts below.

Investors seem to be taking a ‘wait-and-see’ approach to the real estate sector at the start of 2024, as inflation in the UK lags behind other developed economies and anticipated interest rate cuts may have been nudged back. As a result of the malaise, the median average share price fell 3.6% across the listed sector in January. There were some positive movers, however, with developer Harworth Group heading the list. In a trading update for 2023, the company said that it expects NAV to be ahead of analysts’ consensus due to positive progress with planning applications. The share price of Real Estate Investors was up after the company announced it was to sell down its portfolio and return money to investors (see page 3). Berlin residential landlord Phoenix Spree Deutschland also witnessed an uptick in its share price after revealing it had backed out of a development deal, saving itself €13m (see page 4). Balanced Commercial Property Trust continued to rebalance its portfolio away from offices with the sale of three assets during the month (see page 4). Meanwhile, abrdn Property Income Trust was the subject of a merger approach by Custodian Property Income REIT.

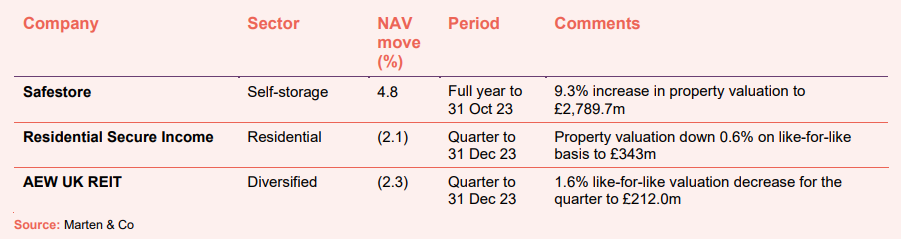

Custodian Property Income REIT’s share price plummeted following the announcement of the possible merger, with shareholders perhaps concerned with the increased debt cost it would take on as part of the deal. The fall in Custodian’s share price has been mirrored in the deal’s value for abrdn Property’s shareholders (see page 3). The worst share price performer in 2023, Regional REIT, started the year in similar vein falling another 15.3%. The office sector is facing several head winds, while the company is struggling with a high loan to value and portfolio vacancy rate. Residential Secure Income was another double-digit faller in January after it announced a drop in NAV for the final quarter of 2023 (see page 2). The share price of European logistics investor Tritax EuroBox suffered despite the company announcing strong leasing progress in recent months, which should cover the loss of earnings from sales and keep its dividend fully covered. The share prices of London office landlords Derwent London and Workspace seem to have suffered from weak investor sentiment towards the sector. Life Science REIT saw its share price fall, despite announcing further lettings success (see page 4).

Valuation moves

Corporate activity

The boards of Custodian Property Income REIT and

abrdn Property Income Trust agreed to a merger of the two companies that would see Custodian acquire the entire issued and to be issued share capital of abrdn Property – creating a combined company with a portfolio valued at just over £1.0bn. Each abrdn Property share would receive 0.78 new Custodian shares as part of the deal. This valued the company at £237m and each share at 62.1p at the time of the announcement, but due to Custodian’s subsequent share price fall the deal valued abrdn Property at around £214m and 56.1p per share at the end of January. This represents a premium of 14.3% to its three-month average share price at the time the deal was announced but a 28.4% discount to its 31 December 2023 NAV. The merger is dependent on both sets of shareholders voting for it.

The boards of LondonMetric and LXi REIT reached agreement on the terms of a recommended all-share merger. LondonMetric will acquire the entire issued and to be issued ordinary share capital of LXi, with each LXi share receiving 0.55 new LondonMetric shares, valuing LXi at about £1.9bn. This represented a premium of around 9% to LXi’s pre-announcement share price and a discount to net tangible assets (NTA) of 4%.

Real Estate Investors announced it was to conduct an orderly strategic sale of the company’s portfolio over the next three years. Assets will be sold individually, as smaller portfolios or as a whole portfolio sale, with the initial priority to repay the company’s debt. The company said that the ongoing substantial discount between the share price and NAV, combined with a lack of liquidity in its shares, was behind the decision. The pace of the disposals will depend on market conditions, however the company said it intends to secure disposals at book value or higher to maximise returns to shareholders.

The chairman of scandal-hit Home REIT, Lynne Fennah, has been replaced by Big Yellow Group director Michael O’Donnell. Fennah will remain on the board as a non-executive director for “continuity”. The remaining directors of Home REIT’s board will all step down when the company publishes its financial results (still no date for this).

Major news stories

- Grit Real Estate sells assets to fund US Embassy diplomatic housing developments

Grit Real Estate Income Group subscribed to its share of a $100m capital call from its development subsidiary GREA, which will use the funds to construct US Embassy-let diplomatic housing and other real estate. To fund the $51.5m capital call, the company sold its interest in Bora Africa and part of its interest in Acacia Estate to GREA.

- Home REIT auctions off further chunk of portfolio

Home REIT sold a further 103 properties at auction for £6.6m. The sales price was 8.4% below the August 2023 valuation (when the wider portfolio was marked down by an average of 57.7% from their acquisition price). Sales proceeds will be used to reduce borrowings and provide working capital.

- Urban Logistics REIT realises rental growth

Urban Logistics REIT announced a lettings update in which it had completed seven lease events (covering more than 400,000 sq ft) since 1 October 2023 that achieved like-for-like increases in passing rent of 31% and generated an additional £0.5m in rental income.

- Balanced Commercial Property Trust rebalances portfolio with office sales

Balanced Commercial Property Trust sold three office holdings for £42.8m in a strategic move to reduce its office exposure. The sale comprised two regional out-of-town business park holdings in Edinburgh and Aberdeen and a multi-let asset in London’s West End.

- LondonMetric buys Next warehouse for £21.2m

LondonMetric acquired a distribution warehouse in Doncaster let to Next for £21.2m, reflecting a net initial yield of 6.3%. The lease benefits from annual fixed rental uplifts of 2.5%, which will increase the purchase net initial yield to 7.1% within three years. Separately, LondonMetric sold an 18,000 sq ft office investment in Chiswick for £7.4m.

- Phoenix Spree Deutschland pulls out of development

Phoenix Spree Deutschland terminated its forward funding commitment to develop 34 houses in Brandenburg, on the outskirts of Berlin, due to the decline in property values observed across Berlin during the past 18 months and more expensive financing conditions. The termination removes the requirement to fund a further €13m of development payments in 2024, although the company loses the €5.5m initial payment it made in March 2022.

- Tritax EuroBox secures Swedish letting

Tritax EuroBox let the first phase of its two-unit development in Rosersberg, near Stockholm. The 5,007 sqm letting to a leading Scandinavian photovoltaic (PV) company reduces the company’s portfolio vacancy rate to 4.3%. A new five-year lease has been signed at a rent that is 3% above the estimated rental value and 20% above the underwritten level. The rent will increase annually in line with CPI, and the lease includes an option to be extended for a further five years.

- Custodian REIT sells Milton Keynes industrial unit at premium

Custodian Property Income REIT sold an industrial unit in Milton Keynes for £8.0m, representing a 9.5% or £0.7m premium to the 30 September 2023 valuation. The company also sold an office in Derby for £2.05m, 36% ahead of book value.

- Lettings success for Warehouse REIT

Warehouse REIT completed 0.9m sq ft of lettings in the three months to 31 December 2023, securing £5.2m of contracted rent, on average 22.1% ahead of previous contracted rent.

- Life Science REIT bags tenant for Innovation Quarter

Life Science REIT let 5,551 sq ft of space at the Innovation Quarter (IQ) at Oxford Technology Park to Quantum Advanced Solutions, an expert in quantum dot sensors/materials development and manufacturing. Quantum Solutions will pay an annual rent of £122,122 (equating to £22 per sq ft) for 10 years.

Managers’ views

A collation of recent insights on real estate sectors taken from the comments made by chairmen and investment managers of real estate companies – have a read and make your own minds up. Please remember that nothing in this note is designed to encourage you to buy or sell any of the companies mentioned.

Self-storage

Frederic Vecchioli, chief executive:

There are numerous drivers of self-storage growth. Most private and business customers need storage either temporarily or permanently for different reasons at any point in the economic cycle, resulting in a market depth that is, in our view, the reason for its exceptional resilience. The growth of the market is driven both by the fluctuation of economic conditions, which has an impact on the mix of demand, and by growing awareness of the product.

Safestore’s domestic customers’ need for storage is often driven by life events such as births, marriages, bereavements, divorces or by the housing market including house moves and developments and moves between rental properties. Safestore has estimated that UK owner-occupied housing transactions drive around 8-13% of the Group’s new lets.

The Group’s business customer base includes a range of businesses from start-up online retailers through to multi-national corporates utilising our national coverage to store in multiple locations while maintaining flexibility in their cost base.

The self-storage market has been growing consistently for over 20 years across many European countries but few regions offer the unique characteristics of London and Paris, both of which consist of large, wealthy and densely populated markets. In the London region, the population is 13 million inhabitants with a density of 5,200 inhabitants per square mile, 11,000 per square mile in Central London and up to 32,000 per square mile in the densest boroughs.

The population of the Paris urban area is 10.7 million inhabitants with a density of 9,300 inhabitants per square mile in the urban area but 54,000 per square mile in the City of Paris and first belt, where 69% of our French stores are located and which has one of the highest population densities in the western world. 85% of the Paris region population live in central parts of the city versus the rest of the urban area, which compares with 60% in the London region. There are currently c. 245 storage centres within the M25 as compared to only c. 122 in the Paris urban area.

In addition, barriers to entry in these two important city markets are high, due to land values and limited availability of sites as well as planning regulation. This is the case for Paris and its first belt in particular, which inhibits new development possibilities.

Real estate research notes

An annual overview note on Urban Logistics REIT (SHED). The company appears to be a re-rating candidate as values stabilise and management extracts the rental reversion in the portfolio.

An update note on Lar España Real Estate (LRE SM). The company continues to defy the doom and gloom surrounding the retail sector, posting strong financial and operational numbers.

An update note on Grit Real Estate Income Group (GR1T). The company has been reborn, with the acquisitions of a developer and asset manager making annual return targets of 12-15% more achievable.

An update note on abrdn Property Income Trust (API). The manager’s focus focus continues to be on growing income, and asset management initiatives within the portfolio have seen its vacancy rate drop to below 5%.

Legal

This report has been prepared by Marten & Co and is for information purposes only. It is not intended to encourage the reader to deal in any of the securities mentioned in this report. Please read the important information at the back of this note. QuotedData is a trading name of Marten & Co Limited which is authorised and regulated by the Financial Conduct Authority. Marten & Co is not permitted to provide investment advice to individual investors categorised as Retail Clients under the rules of the Financial Conduct Authority.

Accuracy of Content: Whilst Marten & Co uses reasonable efforts to obtain information from sources which we believe to be reliable and to ensure that the information in this note is up to date and accurate, we make no representation or warranty that the information contained in this note is accurate, reliable or complete. The information contained in this note is provided by Marten & Co for personal use and information purposes generally. You are solely liable for any use you may make of this information. The information is inherently subject to change without notice and may become outdated. You, therefore, should verify any information obtained from this note before you use it.

No Advice: Nothing contained in this note constitutes or should be construed to constitute investment, legal, tax or other advice.

No Representation or Warranty: No representation, warranty or guarantee of any kind, express or implied is given by Marten & Co in respect of any information contained on this note.

Exclusion of Liability: To the fullest extent allowed by law, Marten & Co shall not be liable for any direct or indirect losses, damages, costs or expenses incurred or suffered by you arising out or in connection with the access to, use of or reliance on any information contained on this note. In no circumstance shall Marten & Co and its employees have any liability for consequential or special damages.

Governing Law and Jurisdiction: These terms and conditions and all matters connected with them, are governed by the laws of England and Wales and shall be subject to the exclusive jurisdiction of the English courts. If you access this note from outside the UK, you are responsible for ensuring compliance with any local laws relating to access. No information contained in this note shall form the basis of, or be relied upon in connection with, any offer or commitment whatsoever in any jurisdiction.

Investment Performance Information: Please remember that past performance is not necessarily a guide to the future and that the value of shares and the income from them can go down as well as up. Exchange rates may also cause the value of underlying overseas investments to go down as well as up. Marten & Co may write on companies that use gearing in a number of forms that can increase volatility and, in some cases, to a complete loss of an investment.