Real Estate Annual Review

Kindly sponsored by abrdn

Things can only get better

The real estate sector endured a tough 2023, with much of the year characterised by falling values amid the high interest rate landscape. Values have since stabilised across sub-sectors. Optimism returned in the final couple of months of the year, on promising inflation data. This can be seen in the median share price performance graph on the right – where share prices fell on average 6.5% over the year, but within that were up 15.5% in the final two months. The feeling that interest rates have peaked has grown stronger – although a surprise uptick in inflation in December may have pushed back the timing of cuts.

A weak macroeconomic outlook forced many companies back to basics – that is to focus on the real estate fundamentals of growing income – and to get their balance sheets in order. On the former point, companies operating in sectors displaying strong occupational markets (such as logistics and student accommodation) were able to limit the damage of falling values with rental growth. While companies focused on sectors with lingering question marks over the strength of occupier markets, such as offices, were unable to do the same.

Perhaps understandably, investor sentiment towards the sector was negative for much of the year. This caused discounts to net asset values (NAVs) to widen across the sector to levels not seen since the global financial crisis. Attracted by the disconnect between share prices and NAVs, private equity funds circled, and merger and acquisition (M&A) activity was heightened. No fewer than six companies were de-listed during the year (either through a buyout or merger – see page 9 for more details) with further activity expected into 2024.

The property sector in 2023

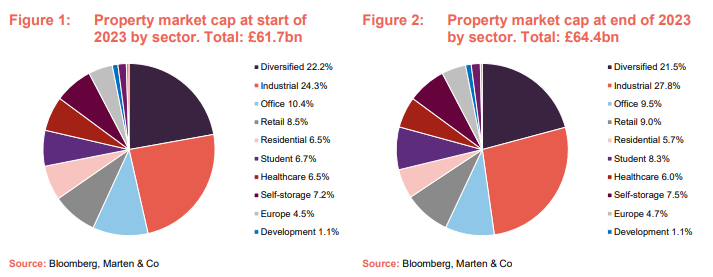

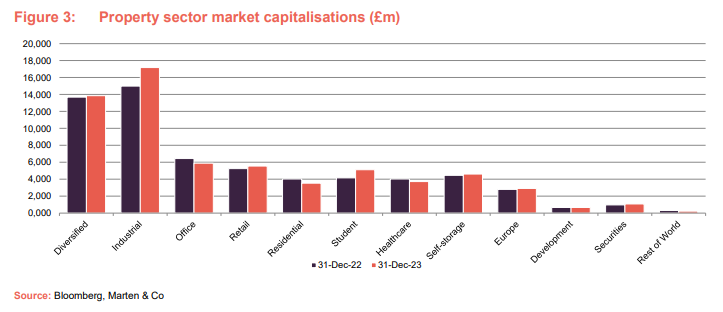

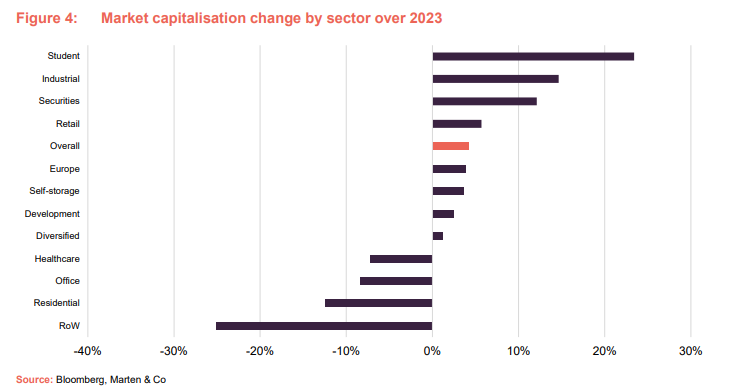

Much of 2023 was a painful affair for London-listed property companies and real estate investment trusts (REITs), as investor sentiment dwindled amid high interest rates and depressed valuations. However, encouraging inflation data at the end of the year saw optimism return. The total market capitalisation of the sector increased slightly to £64.4bn over the year.

A breakdown of the property sub-sectors, illustrated in Figures 1 and 2, show that companies focused on industrial and logistics saw the largest gain in share of market capitalisation over the year, while office landlords continued to suffer. Fundraises during the year (details on page 9) offset some the money that left the sector through take-private buyouts. The outperformance of large cap companies over small cap during the year meant the total market cap of the sector grew.

The market capitalisations of the seven companies focused on offices fell by an average of 8.4%, as the sector tries to navigate its way through several trends impacting demand including hybrid working and building sustainability credentials. The eclectic funds focused on different markets around the world had a year to forget with a 25.1% fall in market cap respectively.

The two student accommodation specialists had very good years with an average jump in share price of 23.4%. Demand for university places keeps rising, while supply of student beds remains under pressure resulting in strong occupancy and rental growth. The retail sector also rebounded in 2023. Having already seen values fall over the past five years, the sector was less impacted by yield expansion but participated in the wider real estate bounce towards the end of the year.

Fund performance data

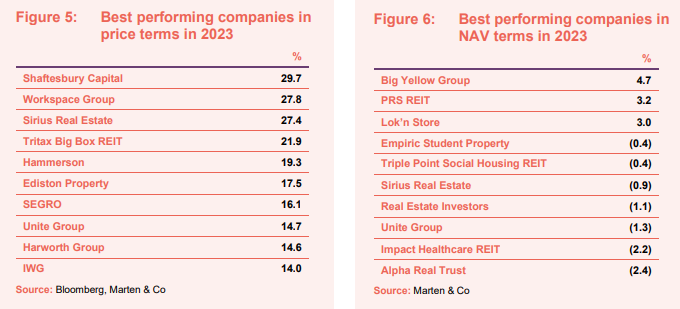

Best performing property companies

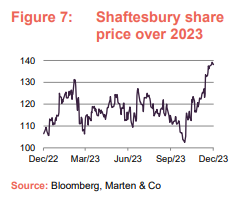

Investors have gotten behind the prospects of Shaftesbury Capital, the new entity to emerge from the merger of Capital & Counties and Shaftesbury in March (see page 9 for more details). The enlarged group, which owns large swathes of real estate in Covent Garden and Soho in London’s West End, saw its share price rise almost 30% in the year.

Workspace witnessed equally impressive gains during the year. The company has continued to post rental growth as demand for its flexible office space in London remains strong. Sirius Real Estate has also reported robust rental growth for its real estate – light industrial and offices in Germany and the UK.

There were green shoots of optimism for shopping centre giant Hammerson following years of suffering. It has worked tirelessly to bring its balance sheet into shape, and with liquidity returning to the retail sector, it appears to have a good launching pad for growth.

Ediston Property Investment Company saw its share price jump on news that it was selling its entire portfolio to US REIT giant Realty Income (see page 9 for more details).

Property NAVs suffered during the year due to the high interest rate landscape. There were just three positive NAV movers in 2023 – self-storage specialists

Big Yellow and Lok’n Store and build-to-rent specialist PRS REIT. The latter’s NAV growth reflected the favourable dynamics at play in the residential rental sector.

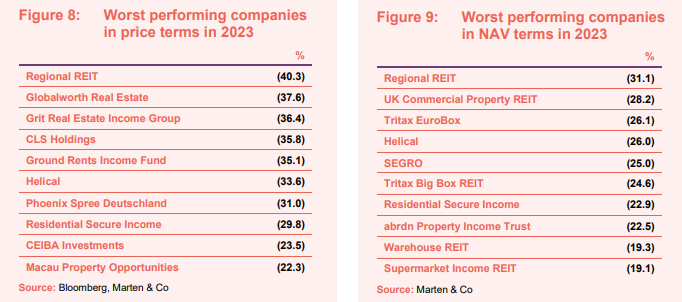

Worst performing companies

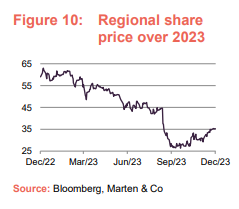

Regional REIT suffered a heavy sell-off of its shares after it announced that it would cut its dividend. The company also reported a drop in NAV, as values in the office sector continue to fall.

Investor sentiment towards the office sector continues to wane as several elements stack up against it. The long-term implications of hybrid working on demand and valuations, the consequences of any future energy regulations and the current economic uncertainty continues to weigh on the sector. UK and European office investor CLS Holdings and central London office developer Helical also suffered heavy share price falls during the year.

Grit Real Estate Income Group’s share price fell off following the announcement in October that it would not pay a dividend for the second half of its financial year before recovering slightly in December. The company said that it intends to pay a special dividend or an increased dividend for the first half of the current financial year once new lucrative developments (mainly US embassy-backed diplomatic housing) complete.

Ground Rents Income Fund has continued to be dogged by several legacy issues and ongoing headwinds relating to building safety and leasehold reform. The future of the company is in doubt after the government’s proposal to restrict ground rent for existing leases.

Phoenix Spree Deutschland has found the Berlin residential property market hard going this year, with a drop off in condominium sales resulting in the axing of its dividend in March.

Significant rating changes

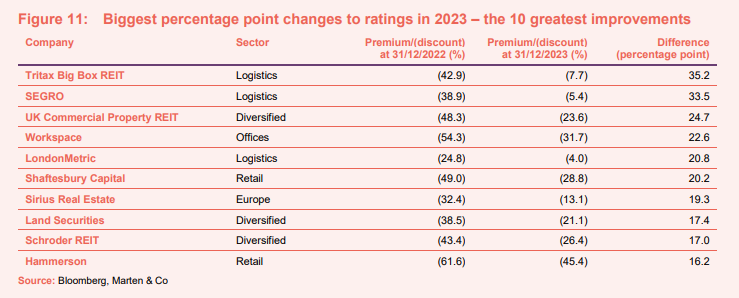

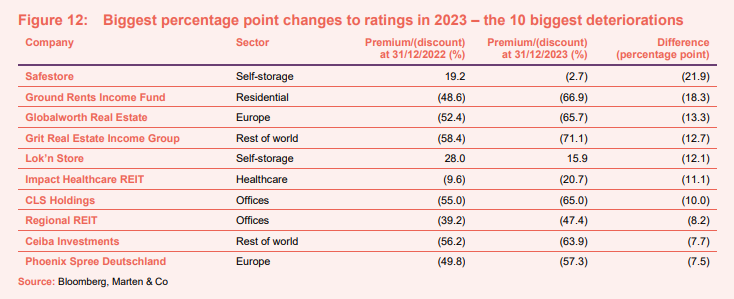

Figures 11 and 12 show how share price premiums and discounts to NAV have moved over the course of the year.

Logistics heavyweights SEGRO and Tritax Big Box REIT saw their share prices rebound in 2023 having suffered large losses in 2022 when interest rates jumped. Healthy demand for logistics space and continued lack of supply (vacancy rates have gone up but from a historical viewpoint are still low) means that rental growth prospects are good. Valuations have stabilised, but the backward-looking nature of the real estate valuation process means that their NAVs over the year declined significantly. The combined effect of share price gains and NAV decline has seen the discounts of the two companies come in by more than 30 percentage points over the year.

UK Commercial Property REIT, which owns a diversified portfolio of real estate weighted towards the industrial and logistics sector, reported a NAV decline of 28.2% over the year. Meanwhile its share price was up slightly, resulting in its discount coming in from almost 50% to just over 23%.

Fellow diversified trust Schroder REIT followed a similar course, with the twin effects of its NAV falling (by 19.1%) and a slight uplift in its share price resulting in its discount narrowing from 43.4% to 26.4%.

Many of the names in the biggest rating deteriorations table have been mentioned previously. Care home owner Impact Healthcare REIT saw its discount widen to just over 20% as its share price fell 14.2% despite its NAV holding up relatively well (down just 2.2% over the year).

Major corporate activity

Fundraises

Having gone more than a year without raising equity, the sector was growing again in the second half of the year – albeit it by a small amount.

By far the largest capital raise was conducted by Unite Group in July, raising a massive £300m in a placing of shares at an issue price representing a discount of 4.2% to the prevailing share price. The proceeds will be used to develop two new purpose-built student accommodation schemes and accelerate asset management initiatives.

Sirius Real Estate raised £146.6m in November, with the money earmarked for the acquisition of a pipeline of light industrial assets in Germany and the UK. The offer price of 86.0p represented a discount of 5.9% to the prevailing share price.

Big Yellow Group raised £110m in a placing in October. The placing price represented a discount of 2.9% to the closing share price. The proceeds will be used to fund the construction of six sites, all of which have planning consent, at a cost of £90m.

Shopping centre owner Capital & Regional raised £25m in an open offer, the proceeds of which was used to part-fund the acquisition of the Gyle Shopping Centre in Edinburgh. Growthpoint, the company’s largest shareholder, subscribed for over 80% of the money raised and as a result now owns 67.64% of the company.

Lok’n Store raised £20.5m through the issue of shares at a 12.1% discount to its prevailing share price. Proceeds will be used to fund its development pipeline.

Mergers and acquisitions

LondonMetric Property opened talks with LXi REIT over the possible merger of the two companies in December, that would see LondonMetric acquire the entire share capital of LXi. The possible merger, which has since been recommended by both boards, would create a combined company with assets worth £6.4bn and a market capitalisation of around £4bn. LondonMetric’s portfolio is weighted towards logistics, with a sizable portfolio of long-leased properties, while LXi’s portfolio is focused on long-leased income.

Earlier in the year LondonMetric completed the acquisition of CT Property Trust. As part of the acquisition 105.6m new LondonMetric shares were issued to CT Property shareholders.

The £3.5bn merger of Shaftesbury and Capital & Counties completed in March after being cleared by the Competitions and Markets Authority (CMA), creating a REIT – named Shaftesbury Capital (SHC). The combined company has a substantial portfolio in the West End of London worth around £5bn across Covent Garden, Carnaby, Chinatown and Soho.

Ediston Property Investment Company completed the sale of its entire portfolio to RI UK 1 Limited (a subsidiary of Realty Income) for a total of £196.8m. The company was officially liquidated in January 2024 and cash returned to shareholders.

Civitas Social Housing was taken private by CK Assets in August after shareholders voted in favour of the 80p per share bid (which was made in May and represented a 27% discount to NAV but at a hefty premium to its share price).

Industrials REIT was also taken private, with US private equity giant Blackstone buying the company for £511m. Shareholder received 168p per share, again a sizable premium to its prevailing share price.

UK Commercial Property REIT (UKCM) fought off interest from peer Picton Property over a possible merger of the companies. UKCM’s largest shareholder – Phoenix Life, which has a strategic partnership with UKCM’s fund manager abrdn and owns 43.4% of UKCM – proved to be the thorn in the side of the deal.

Towards the end of the year, abrdn European Logistics Income launched a strategic review into the future of the company that could result in its sale or merger with another company. It said that it was “facing a number of challenges, at both a macro and company specific level” and was trading on a discount to NAV. With a continuation vote due at its 2024 AGM, the board said that it believed now was the time to look at its future.

Other major corporate activity

It was another turbulent year for embattled Home REIT (see page 12 for further details). The company changed its investment policy in an effort to stabilise its business and increase rent collection following the appointment of AEW as investment manager. Changes included extending the permitted use of properties to include any form of residential during a two-year stabilisation period. Following the stabilisation period, it proposes to invest in “social use” residential accommodation, including for homelessness.

Regional REIT’s manager, London and Scottish Property Investment Management, was acquired by ARA Asset Management. The board said that it believes the transaction will enhance the overall strength and capabilities of the asset manager.

Urban Logistics REIT changed its management agreement that saw Logistics Asset Management LLP take over as investment adviser from PCP2 (which is part of the Pacific Investments Group). Pacific transferred its interests in the investment adviser to Richard Moffitt and Christopher Turner – part of the existing management team. Under the terms of the agreement, the annual advisory fee is also reduced from May 2024.

Tritax Big Box REIT signed a £500m sustainability-linked unsecured revolving credit facility (RCF) with a syndicate of existing banks and new lenders. The new year-year RCF contains an uncommitted £200m accordion option. The new RCF refinanced the company’s existing £450m RCF, which was due to mature in December 2024, and retained the same pricing with an opening margin of 120 basis points (bps) over SONIA. Proceeds will be used to support future investment and development activities.

Land Securities launched a £400m Green Bond with a maturity of 9.5 years, paying a coupon of 4.875%. The transaction would help the company to deliver its pipeline of central London development opportunities.

Shaftesbury Capital signed a £300m unsecured loan agreement with Santander, HSBC and BNP Paribas. The facility has an initial maturity of three years, with the option to extend the tenor by a further two periods of one year each. The new loan, combined with the existing cash resources of the company, will be used to repay the remaining balance (£376m) of an unsecured loan, which was arranged at the time of the merger between Capital & Counties and Shaftesbury and drawn in April 2023. This loan was put in place to fund the repayment of the Shaftesbury secured bonds, that were due to mature in 2024.

Primary Health Properties appointed Harry Hyman, founder and chief executive of the company, as chairman – subject to shareholder approval. Hyman will step down as chief executive at the company’s AGM in April 2024 and be succeeded by Mark Davies. Should shareholders approve, he will then take the reins as non-executive chairman, succeeding Steven Owen.

Major news stories

- A valuation report on Home REIT’s portfolio revealed it had fallen in value by 57.7%. The company’s portfolio was valued at £412.9m at 31 August 2023, versus the £977.0m that it spent on purchasing its properties following its inception in 2020. Many of the homes are in a state of disrepair. Investigations into the conduct of the former investment manager are ongoing.

- LXI REIT sold a portfolio of 66 Travelodge hotels for £210m, in line with their book value at 30 September 2023. The plan was that the majority of the sale proceeds would be used to pay down debt, reducing group LTV to 34% from 38%, and reduce the Travelodge part of the total rent roll to 11% from 18%.

- Tritax EuroBox sold its redevelopment site in Malmö, Sweden, to a data centre owner-occupier for SEK320m (€28m), reflecting a 39% premium to the valuation at 31 March 2023. The sales proceeds will be used to pay down debt as part of the group’s programme to reduce leverage.

- Meta (Facebook) surrendered its lease with British Land at 1 Triton Square – one of the two buildings it has leased at Regent’s Place in London – paying the landlord £149m. The decision reflects the shift in office occupation with firms scaling back space as more employees work from home.

- Empiric Student Property is exploring bringing on board a joint venture partner to grow its portfolio of student accommodation properties. The company has engaged PwC to find a suitable partner to put up the capital to buy properties that would be operated under Empiric’s student brand.

- Grit Real Estate Income Group concluded the final phase in the acquisition of controlling interests in developer Gateway Real Estate Africa (GREA) and asset manager APDM. Grit now owns a direct interest of 51.48% in GREA and a 78.95% shareholding in APDM. The acquisitions are expected to have a positive impact on group LTV and future growth.

- Helical signed contracts with the Transport for London (TfL) for a joint venture to develop offices above or close to London tube stations at Bank, Paddington and Southwark, totalling 600,000 sq ft.

- Supermarket Income REIT completed the sale of its interest in a portfolio of Sainsbury’s-let supermarkets for £430.9m. Sainsbury’s acquired 21 of the 26 stores and entered into new 15-year leases on four of the five remaining stores (which SUPR has an option to acquire for £28.3m).

- abrdn Property Income Trust reduced its portfolio vacancy rate to 4.4% over the year, whilst also capturing strong rental growth within its industrial portfolio.

- The dedicated real estate stock exchange – IPSX (International Property Securities Exchange) – wound down having struggled to attract new investment. Launched in 2019, the exchange had just three companies listed.

Selected QD views

- Positive inflation data to reignite real estate sector

- Time is right for this European logistics specialist

- REIT mergers could combat vicious discount circle

Recent real estate research notes

An annual overview note on Urban Logistics REIT (SHED). The company appears to be a re-rating candidate as values stabilise and management extracts the rental reversion in the portfolio.

An update note on Lar España Real Estate (LRE SM). The company continues to defy the doom and gloom surrounding the retail sector, posting strong financial and operational numbers.

An update note on Grit Real Estate Income Group (GR1T). The company has been reborn, with the acquisitions of a developer and asset manager making annual return targets of 12-15% more achievable.

An update note on abrdn Property Income Trust (API). The manager’s focus focus continues to be on growing income, and asset management initiatives within the portfolio have seen its vacancy rate drop to below 5%.

Legal

This report has been prepared by Marten & Co and is for information purposes only. It is not intended to encourage the reader to deal in any of the securities mentioned in this report. Please read the important information at the back of this note. QuotedData is a trading name of Marten & Co Limited which is authorised and regulated by the Financial Conduct Authority. Marten & Co is not permitted to provide investment advice to individual investors categorised as Retail Clients under the rules of the Financial Conduct Authority.

Accuracy of Content: Whilst Marten & Co uses reasonable efforts to obtain information from sources which we believe to be reliable and to ensure that the information in this note is up to date and accurate, we make no representation or warranty that the information contained in this note is accurate, reliable or complete. The information contained in this note is provided by Marten & Co for personal use and information purposes generally. You are solely liable for any use you may make of this information. The information is inherently subject to change without notice and may become outdated. You, therefore, should verify any information obtained from this note before you use it.

No Advice: Nothing contained in this note constitutes or should be construed to constitute investment, legal, tax or other advice.

No Representation or Warranty: No representation, warranty or guarantee of any kind, express or implied is given by Marten & Co in respect of any information contained on this note.

Exclusion of Liability: To the fullest extent allowed by law, Marten & Co shall not be liable for any direct or indirect losses, damages, costs or expenses incurred or suffered by you arising out or in connection with the access to, use of or reliance on any information contained on this note. In no circumstance shall Marten & Co and its employees have any liability for consequential or special damages.

Governing Law and Jurisdiction: These terms and conditions and all matters connected with them, are governed by the laws of England and Wales and shall be subject to the exclusive jurisdiction of the English courts. If you access this note from outside the UK, you are responsible for ensuring compliance with any local laws relating to access. No information contained in this note shall form the basis of, or be relied upon in connection with, any offer or commitment whatsoever in any jurisdiction.

Investment Performance Information: Please remember that past performance is not necessarily a guide to the future and that the value of shares and the income from them can go down as well as up. Exchange rates may also cause the value of underlying overseas investments to go down as well as up. Marten & Co may write on companies that use gearing in a number of forms that can increase volatility and, in some cases, to a complete loss of an investment.