Discount at odds with growth plans

A negative reaction to the UK budget sent gilt rates higher and saw investor caution return to real estate stocks. The recent share price weakness that followed this has seen Urban Logistics REIT’s (SHED’s) discount to net asset value (NAV) widen to more than 30%, which is at odds with the sector fundamentals and the work the company’s adviser is putting in. An asset recycling programme is underway. Here the adviser is targeting new assets, where it can work its asset management enhancement magic. This, coupled with the adviser’s expertise in driving up rents and capturing rental reversion (the rent that could be achieved if rent adjusts to the level of the estimated rental value – ERV) from its portfolio, should result in substantial earnings growth and much-coveted dividend cover.

Meanwhile, a more normalised occupier market is forming, with supply and demand fundamentals returning to pre-COVID levels, putting greater emphasis on landlords’ ability to achieve returns. This is where SHED has traditionally excelled and, with its active approach to asset management, the foundations are set for a re-rating of its shares.

‘Last mile’ logistics

SHED invests in a diverse portfolio of single-let, urban logistics properties located in the UK, with the aim of providing its shareholders with a 10% to 15% total return per annum.

At a glance

Share price and discount

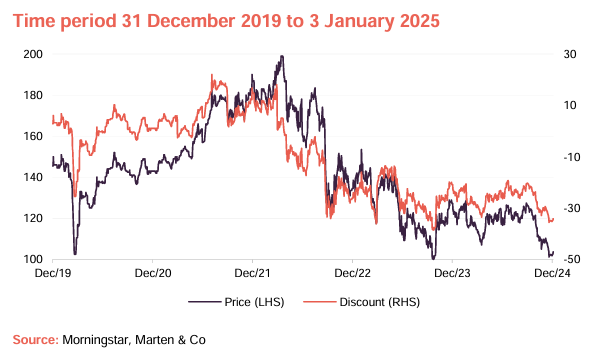

SHED’s rating is yet to recover after its shares plummeted to a wide discount to NAV in 2022, as high inflation and interest rates hit investor sentiment. The reaction to the recent budget saw the discount to NAV widen further and at 3 January 2025, it was trading at a 34.1% discount, well below its five-year average discount of 10.6%.

Performance over five years

SHED’s NAV has stabilised, having fallen steeply in March 2023 as higher interest rates impacted property yields and valuations. This followed a period of strong growth throughout 2021 and the first half of 2022, as yields in the sector sharpened and the company’s portfolio benefitted from intensive asset management initiatives.

| Year ended | Share price total return (%) | NAV total return (%) | Morningstar UK REIT total return (%) | Peer group price total return (%) | Peer group NAV total return (%) |

|---|---|---|---|---|---|

| 31/12/2020 | 3.3 | 5.2 | (16.9) | 13.6 | 12.8 |

| 31/12/2021 | 36.8 | 20.7 | 29.5 | 48.9 | 31.8 |

| 31/12/2022 | (24.5) | 16.5 | (32.0) | (34.4) | 6.2 |

| 31/12/2023 | 1.1 | (7.4) | 13.4 | 7.7 | (8.4) |

| 31/12/2024 | (14.1) | 2.5 | (13.2) | (12.7) | 4.3 |

Source: Morningstar, Marten & Co

Fund intro

The fund’s website is urbanlogisticsreit.com

SHED invests in and manages a portfolio of urban logistics assets – defined as smaller single-let warehouses (in the 20,000 sq ft to 200,000 sq ft size range) located close to major conurbations across the UK – which is diversified by tenant. SHED is the only real estate investment trust (REIT) wholly focused on these assets. The strategy aims to capture rental value growth through active asset management initiatives and upward momentum in rents and capital value.

Initially, SHED was listed on the AIM market of the London Stock Exchange on 13 April 2016 as Pacific Industrial & Logistics REIT. The group deployed the capital (and debt) from its initial public offering (IPO) into a portfolio of 11 urban logistics property assets across the UK and has since made several successful placings to grow its portfolio. It now has a portfolio of 133 assets, worth £1,140m at 30 September 2024. It changed its name to Urban Logistics REIT on 25 April 2018.

FTSE 250 constituent

SHED’s shares were admitted to trading on the main market of the London Stock Exchange on 7 December 2021. Since then, the company has been a constituent of the FTSE 250 Index. SHED has a conservative capital structure and a measured approach to the use of debt, with a target loan to portfolio value (LTV) of 30% to 40%. At 30 September 2024, the group’s LTV was 33.2%.

The adviser

The company’s investment adviser is Logistics Asset Management LLP, which took over from PCP2 Limited (part of the Pacific Investments Group) in May 2023. G10 Capital Limited succeeded PCP2 as the AIFM to the company at the same time. Logistics Asset Management is led by Richard Moffitt as chief executive, who has led the team since the inception of SHED, supported by Christopher Turner as property director, Justin Upton as chief investment officer, and Jamie Waldegrave as chief financial officer (profiles of the management team can be found on page 19). The investment adviser’s appointment was extended for a further three years from 12 May 2024 and may be terminated on one year’s notice from 12 May 2026 onwards.

Richard and the team have considerable sector knowledge and have a long track record of success in logistics and real estate, built up over more than 25 years. The adviser identifies and acquires assets (the majority of which have been sourced off-market, utilising its contacts and reputation in the sector) and implements its asset management strategy to create value for shareholders.

Market backdrop

Whilst green shoots of optimism are sprouting in the outlook for the UK commercial real estate sector, with valuations having bottomed out and investment activity growing, the Labour party’s first budget announcement at the end of October seemed to heighten fears of a higher-for-longer interest rate environment.

Although interest rates have been cut to 4.75%, from 5.25% in July, the Bank of England is not expected to make more cuts until the impact of the chancellor’s spending plans on inflation is understood. This uncertainty has been reflected in the 10-year gilt yield, which spiked at 4.6% in early November but has since moved back down to around 4.3%. At the end of September, the 10-year yield was 4.0%.

The impact on investor sentiment towards rate-sensitive alternative assets, including real estate, has understandably been negative. This has been reflected in SHED’s share price, which fell by 18.9% during the final quarter of 2024. This followed a 10.3% uplift over the preceding six months to the end of September, illustrating the weight that investors are placing on macroeconomic drivers – most notably the interest rate outlook – when it comes to real estate stocks. The performance of real estate is intrinsically linked with interest rates – higher interest rates mean higher property investment yields and lower capital values and vice versa.

This fails to appreciate the real estate fundamentals underpinning rental growth prospects in certain sub-sectors and the ability of management teams to extract it. SHED falls into both these categories, with urban logistics benefiting from a severe supply and demand imbalance and the expertise that SHED’s adviser has in capturing rental growth. These fundamentals are at odds with the company’s discount to NAV, which has widened to 34.1% following the recent share price weakness.

Investment market

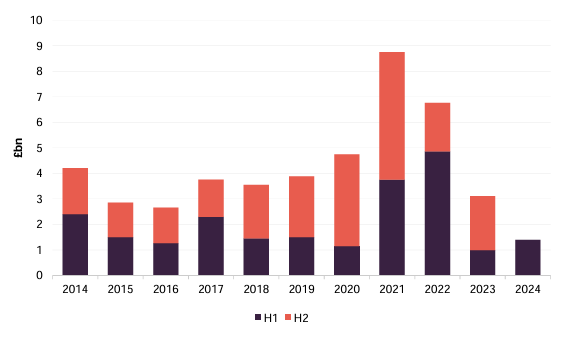

Investment volumes return to pre-COVID levels

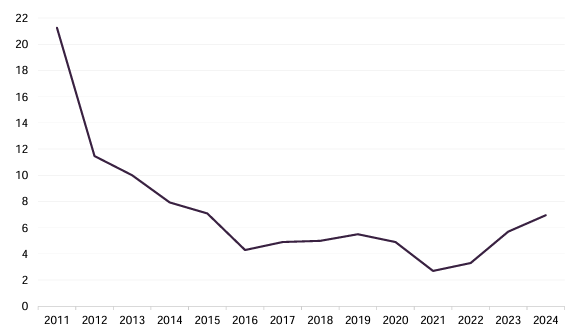

Market investment data shows that volumes in the first half of 2024 reached £1.4bn, according to Savills, a 41% increase when compared to the first half of 2023 and back to pre-COVID averages, as illustrated in Figure 1. Despite promising numbers, investment activity in the first half of 2024 was stymied by a wide bid/ask spread between sellers and buyers. SHED’s adviser states that investment activity is returning in earnest, with institutional investors becoming active again in the market after a two-year hiatus.

Figure 1: UK logistics investment volumes

Source: Savills Research, MSCI, Marten & Co

Prime logistics yields moved in 25bps to 5.0%

Prime logistics yields moved in 25 basis points (bps – the equivalent of 0.25%) to 5.0% in the first half of the year, according to Savills, reflecting the improved investment landscape. With the interest rate outlook faltering slightly, investment volumes and values could be negatively impacted, and prime yields may soften.

Occupier demand resilient

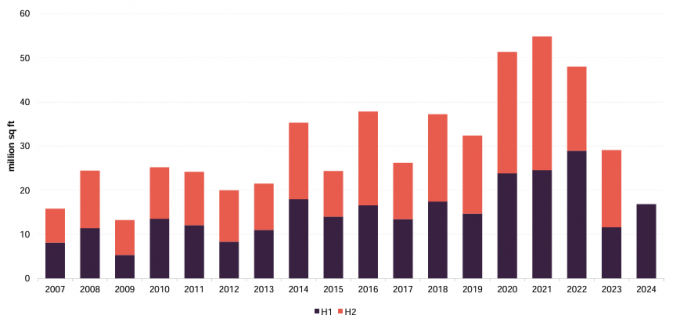

Logistics take-up 44% up on 2023 and back to pre-COVID norms

Take-up of logistics space in the first half of the year hit 16.8m sq ft, 44% up on the same period in 2023 and, again, in line with pre-COVID norms, as shown in Figure 2. Digging into the detail, 61% of take up was recorded in the second quarter, providing further evidence of improving business confidence. Savills also notes that the take-up of space was accounted for by a diverse occupier mix, with 33% of leasing deals signed by third-party logistics (3PL) operators, 28% by manufacturing-related companies, and just 5% from pure online retailers.

Figure 2: Logistics take-up

Source: Savills Research, Marten & Co

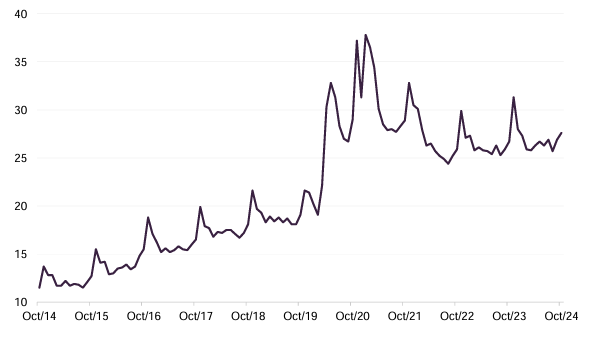

E-commerce penetration rates still on the rise

Online retailers have continued a trend of using 3PL operators for their logistics needs, instead of signing long-term leases themselves. 3PL refers to the outsourcing of e-commerce logistics processes and includes inventory management, warehousing, and fulfilment. Data for online retail sales is positive. Having fallen off the inflated peaks in 2020/21, the trend for the share of retail sales made online has continued its upward trajectory, and at October 2024 was 27.6%.

Figure 3: Online sales as a percentage of total retail sales in the UK

Source: Office for National Statistics

Online retail forecast to increase 7% year-on-year, equating to an additional 48m sq ft of logistics space to 2027

Online retail penetration rates are forecast to increase by 7% year-on-year, reaching 28.4% by 2027. Research by Prologis, one of the world’s largest logistics developers, suggests that this would equate to additional demand of up to 48m sq ft over the period.

When you break down occupier demand by building size, SHED’s adviser says that a ‘barbell’ is formed, with strong demand at the lower (20,000 sq ft – 150,000 sq ft) and upper (500,000 sq ft-plus) size brackets. These buildings form the basis of the traditional hub-and-spoke logistics model, with large distribution centres servicing a number of smaller logistics units close to urban populations.

Figure 4: UK logistics vacancy rate (%)

Source: Savills Research, Marten & Co

Vacancy rate has grown to 6.95%, but 4.5% in logistics sub-sector SHED invests

The vacancy rate across the logistics sector at the end of the first half of 2024 was 6.95%, according to Savills. Again, there was disparity between the different sub-sectors and location.

The middle size bracket (between 300,000 sq ft and 400,000 sq ft) has seen softening demand and is where most of the vacancy is attributed, the adviser adds. It is also the area of the market where most development is taking place, with the adviser citing 24 developments currently being constructed in the size band totalling 8.6m sq ft.

The vacancy rate in the ‘mid-box’ logistics space, which most accurately reflects the sub-sector that SHED focuses on (being single-let, in the range of 40,000 – 100,000 sq ft), stands at around 4.5%, according to CoStar.

Vacancy rate expected to fall in 2025

Vacancy rates are expected to gradually fall into 2025, with Savills estimating that 13% of available space at the end of June was under offer to be let. Also, the development pipeline has fallen due to the continued high financing costs. There was 10.16m sq ft of space being developed speculatively (without a tenant signed up) at the halfway point in the year, with most of that in the mid-size band, as mentioned earlier. New development at the urban end of the market is even more squeezed due to factors such as land constraint, land use competition, and planning.

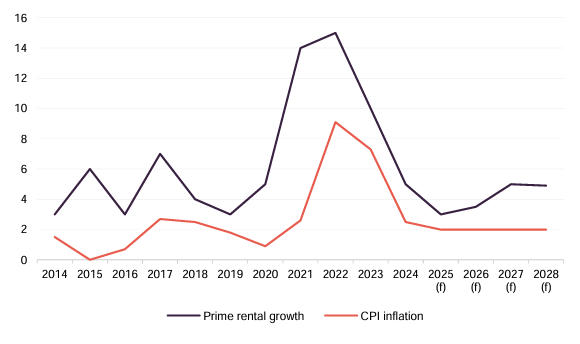

‘Normalised’ rental growth forecast

The positive fundamentals of resilient demand and lack of supply bode well for rental growth prospects. SHED’s adviser believes that the market is in for a more ‘normalised’ period of rental growth over the medium term of around 3.5% to 5% per year. Savills’s baseline forecast for rental growth in 2024 is 4.9%, with an average sustained around the 5% mark per annum between 2024 and 2028. This is echoed in research by Gerald Eve, which is illustrated in Figure 5. This shows prime logistics rental growth over the last 10 years with their forecast to 2028, alongside the Consumer Prices Index (CPI) inflation rate.

Figure 5: Annual prime logistics rental growth and CPI

Source: Gerald Eve, Office for National Statistics, Marten & Co

Open market value rent reviews has outpaced inflation-linked uplifts

We have included CPI inflation in Figure 5 to illustrate the superior rental growth gains achieved from annual open market rent value reviews versus inflation-linked rental uplifts. This is important for SHED as two-thirds (65%) of its leases are reviewed annually at open market value. This helped SHED achieve a like-for-like rental uplift of 21% on 13 deals in the six months to 30 September 2024. The adviser will look to grow the number of open market value rent reviews in the portfolio through its planned asset recycling programme (details of which can be found on page 11).

Now that the market seems to be moving back to a more normalised state – be that investment volumes, occupier trends or rental growth prospects – landlords will have to work harder to achieve returns (rather than realising returns from ‘buying the market’ in 2020 and 2021). The adviser says that this means that assets need to be occupationally relevant – that is, they are well-located, have good building and site fundamentals, such as eaves heights and yard space, and possess good sustainability credentials.

Investment process

The company focuses on good real estate in good locations, with limited supply and strong occupational demand. The majority of the company’s portfolio is currently invested in completed, let investments and pre-let income-producing forward-funded developments; however, a proportion may be invested in funding speculative developments, whereby a development scheme has yet to have a tenant signed up. These types of investments allow the group to source higher-quality, lower-priced assets than could be found in the investment market, but it takes on the letting risk.

All acquisitions must satisfy the following criteria:

- Location – good transportation links and workforce availability as well as strong tenant demand and limited supply of appropriate properties;

- Lot size – around £10m-£15m and 20,000 to 150,000 square foot in size, magnifying the results of active asset management;

- Tenancy – a focus on strong tenant covenants (avoiding the fashion sector), with a rating of low/low-moderate risk. Properties with riskier tenant covenants and/or short- to medium-term lease lengths are considered, enabling asset management initiatives to grow tenant covenant strength and lease length; and

- Price – at a level 30% to 70% of replacement cost, creating price resilience.

The majority of SHED’s acquisitions since it launched have been made ‘off market’ (whereby the property is not openly marketed), where vendors sometimes prefer the certainty of the deal, and are testament to its adviser’s connections within the logistics sector and reputation for swift and certain deal execution. The company can also provide funding to developers (no more than 20% of gross asset value on development activity at any one time) and provide a sale-and-leaseback option to an occupier.

Active asset management

Investments with asset management potential are favoured

SHED likes to add value to an investment, and will favour assets that have asset management potential (such as near-term lease events or development opportunities) so it can increase rent and capital values. It will invest in properties where it has the potential to achieve rental growth and outperformance through:

- securing new tenants with stronger financial covenants;

- securing new lease terms focused on duration and rental growth built into the lease; and

- positive geographical characteristics, including age and repair; location; building quality; site cover; transportation links; workforce availability; and internal operational efficiencies.

More detail on SHED’s asset management initiatives is on page 13.

Environmental, social and governance (ESG)

87% of the portfolio has an EPC rating of A-C

SHED’s investment process involves the assessment of energy efficiency ratings to ensure properties are sustainable in the long term, while all new developments will have an Energy Performance Certificate (EPC) rating of A and a BREEAM sustainability rating of excellent or very good. The EPC rating across SHED’s portfolio was 60% A-B and 91% A-C at the end of September 2024 (55% and 87% at 30 September 2023).

The nature of SHED’s assets (being single-let, mainly to large global logistics operators) mean that there is constructive dialogue between landlord and tenant on improving the ESG credentials of a building, with both sides showing willing. This partnership between landlord and tenant not only drives change, but reduces capital expenditure (capex) requirements for SHED to achieve its ESG goals, as tenants share the costs to hit their own environmental targets.

SHED has seen significant improvement in external ESG ratings in recent years, with the MSCI ESG score moving from CCC to A, and GRESB score for standing assets moving from 1 star to 3 stars.

Portfolio

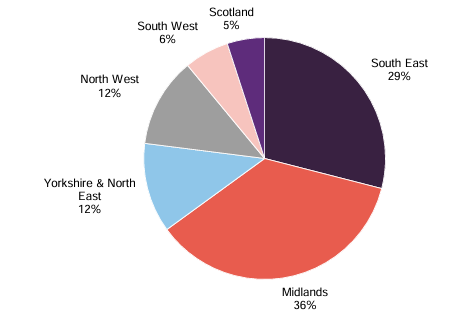

Portfolio worth over £1.1bn, with a focus on the South East and Midlands

SHED’s portfolio was valued at £1,140m on 30 September 2024, and distributed across 133 assets located around the UK, with a focus on the South East and the Midlands. The portfolio had a WAULT of 7.6 years, with a spread of short- and long-term leases. Just over half of SHED’s portfolio (51%) is categorised as ‘active asset management’ assets, which have shorter leases (average WAULT of 4.7 years) and provide the adviser with opportunities to increase rent (ERV 43% above current rent). Meanwhile 48% is ‘core assets’, typically let on longer leases (average WAULT of 10.3 years) and strong tenant covenants. A small portion of the portfolio (1%) is development land.

Figure 6: Portfolio by location (at 30 September 2024)

Source: Urban Logistics REIT, Marten & Co

Adviser’s focus on asset recycling to grow asset management portfolio

SHED’s adviser has made clear that over the medium term it aims to grow exposure to ‘asset management assets’ to around 65% of the portfolio by value and lower exposure to ‘core assets’ to 35%, allowing it to realise value in assets where the asset management is complete and value has been created to focus on assets where it believes it can grow rents and add value.

In September, the company announced the acquisition of four assets for £42.2m using the proceeds of a debt refinancing (details of which can be found on page 18). These will sit in the ‘asset management’ category portfolio. The acquisition represents SHED’s modus operandi, being let on short leases (blended average WAULT of 4.1 years) with the near-term potential to drive income and capital values through the capture of the reversion yield. The assets had a blended net initial yield (NIY) of 6.6% and reversionary yield of 7.1%. The portfolio consisted of:

- a 145,998 sq ft unit in Wolverhampton, acquired for £17.0m at a NIY of 6.3%, let to Ibstock Bricks Limited for a term ending in 2033, with a first break in 2028;

- a 130,676 sq ft unit in Doncaster, acquired for £11.7m at an NIY of 7.1%, with a two-year rent guarantee and immediate asset management potential;

- a 108,897 sq ft unit in Peterlee, acquired for £8.3m at an NIY of 6.6%, let to Caterpillar Ltd for a term ending in 2030, with a review in 2025; and

- a 28,938 sq ft unit in Dartford, acquired for £5.2m at an NIY of 6.2%, let to Booker Ltd for a term ending in 2033, with a review in 2028.

Five assets acquired at 6.7% blended net initial yield

In October the company acquired another property, a 19,317 sq ft asset in Dunstable, for £3.6m. The property was vacant but was let up by SHED’s adviser before the acquisition deal completed to a local occupier that resulted in a net initial yield of 7.1%.

SHED’s adviser says that its short-term focus is to continue its asset recycling programme from its ‘core’ portfolio to ‘asset management’ It has earmarked between £25m and £50m of assets for sale in the near-term and has identified acquisition targets from its investment pipeline. The adviser adds that it has already placed a number of assets ‘under offer’.

In November, it sold an asset in Peterborough let to Anglian Water for a sum of £7.7m, reflecting a net initial yield of 4.85%. The property, which the company developed in 2020 at a cost of £5.8m, was part of the ‘core’ portfolio. The sale price equates to a profit on cost of 33% and an ungeared IRR of 12.3%. The sales proceeds were used to fund share buybacks (see page 18 for details).

Tenants

Figure 7: Top 10 tenants (at 30 September 2024)

| Company | Sector | % of rent |

|---|---|---|

| Culina Group | Third-party logistics | 5.0 |

| DHL | Third-party logistics | 4.8 |

| Delice De France | Food retailer | 3.1 |

| Giant Booker | Food wholesale | 2.9 |

| CEVA Logistics | Third-party logistics | 2.9 |

| XPO Logistics | Third-party logistics | 2.8 |

| DX Group | Third-party logistics | 2.7 |

| Kinaxia Group | Third-party logistics | 2.7 |

| Fidens Studios | TV and film location agent | 2.7 |

| Unipart Group | Third-party logistics | 2.2 |

| Total | 31.8 |

Source: Urban Logistics REIT, Marten & Co

SHED’s top 10 tenants accounted for 31.8% of its contracted rent at 30 September 2024 and is made up of largely global 3PL (third-party logistics) operators, as shown in Figure 7. They typically run contracts for e-commerce companies from their sites.

The 3PL sector has witnessed some distress in the last couple of years as smaller players struggled following overexpansion during the COVID pandemic period and the hyper-competitive and tight margin landscape. A period of consolidation in the sector has ensued, with the larger, well-capitalised operators taking on their smaller counterparts. SHED’s adviser says that many of the larger 3PL operators continue to take on new contracts and space. The importance of strong underlying real estate fundamentals cannot be overstated, it adds, which help make the asset attractive to a wide range of potential occupiers and give it the ability to let in times of stress. This was the case when a SHED tenant, Tuffnells, went into administration in 2023. Within weeks, the adviser had assigned the majority of the leases to DX Group, with the remainder assigned to Shift Logistics a couple of months later, all on the same terms.

SHED’s largest tenant, Culina Group, is the logistics arm of multinational dairy giant Müller Group. DHL is one of the largest 3PLs in the world – delivering over 1.5bn parcels a year. The Unipart Group runs a contract on behalf of the NHS from its sites. Other top 10 tenants that may not be household names include Fidens Studios, which provides production space for a large US film studio.

Figure 9 shows that 80% of tenants across SHED’s portfolio have been rated as low/low-moderate risk (as a percentage of contracted rental income) by Dun and Bradstreet.

Figure 8: Tenant diversity (30 Sept 2024)

Source: Urban Logistics REIT, Marten & Co

Figure 9: Tenant credit rating (30 Sept 2024)

Source: Urban Logistics REIT, Dun & Bradstreet, Marten & Co

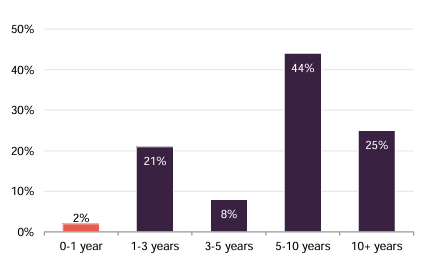

Asset management initiatives

As mentioned previously, around half of SHED’s portfolio is classified as ‘active asset management’ assets, where the adviser can increase rental income over a short period. Around 17% of SHED’s portfolio is subject to a rent review or expiry over the 12-month period to September 2025, as shown in Figures 10 and 11, providing the adviser with opportunities to grow rent and in turn capital values.

Figure 10: Lease expiry profile (30 Sept 2024)

Source: Urban Logistics REIT, Marten & Co

Figure 11: Contractual rent reviews (30 Sept 2024)

Source: Urban Logistics REIT, Marten & Co

SHED’s adviser says that its immediate priority is on letting up vacant space in the portfolio. The portfolio vacancy rate rose to 8.1% over the six months to September (from 5.8%). A large portion of this is accountable through planned vacancy where the company has purchased an asset with a short lease term with plans to re-let the properties at higher rents. To this end, more than a quarter of the overall vacant space (by ERV) was under offer to a tenant at the end of September. A further chunk of vacant space (around 14%) is currently being refurbished and being marketed.

Bulk of vacancy relates to one asset – positive outcome key to dividend cover

A substantial portion of the vacancy relates to vacant space across three buildings at East Midlands Logistics Hub near Melton Mowbray. The company bought the scheme in 2022 for £40.7m with short term leases on the three units, but as it became vacant, the adviser has not been able to let the space as quickly as planned. The adviser says that it is working hard to lease the property, which would not only boost earnings to provide dividend cover but result in an uplift in value for the property. Another route open to the company is a sale of the property, which would also achieve dividend cover once the proceeds are recycled into new acquisitions.

Reaching a positive outcome at East Midlands Logistics Hub and completing other leasing plans is key to achieving dividend cover (analysis of the dividend and dividend cover is on page 16).

Reflecting the vacant space and the upcoming rent reviews, the portfolio has significant reversion potential of 27% (or £16.8m) at 30 September 2024. Almost half of this (£7.1m) could be captured this financial year (by 31 March 2025).

Performance

Figure 12: SHED performance over five years

Source: Morningstar, Marten & Co. NB with effect from 1 May 2021, Morningstar’s NAV estimate includes an estimate of accrued income

SHED’s NAV has stabilised, having fallen steeply in March 2023 as higher interest rates impacted property yields and valuations. This followed a period of strong growth throughout 2021 and the first half of 2022, as yields in the sector sharpened and the company’s portfolio benefitted from intensive asset management initiatives. In terms of share price performance, the group’s share price had been fairly consistent over the last two years, but fell in the final three months of 2024 as the UK budget stoked fears of a higher-for-longer interest rate environment. Over five years, the company’s share price total return comfortably beats that of the Morningstar UK REIT index.

Peer group comparison

SHED has been allocated to the Property – UK Logistics sector by the AIC, a sector that also includes Warehouse REIT and Tritax Big Box REIT. As previously mentioned, there is no other listed company that is exclusively focused on the urban logistics sub-sector, and it is therefore difficult to make a like-for-like comparison.

Warehouse REIT’s portfolio is more focused on multi-let industrial assets (which have a completely different tenant base type and are more exposed to SMEs), while Tritax Big Box REIT is predominantly focused on the larger end of the logistics market (warehouses in the 500,000 sq ft plus size range), which perform a different role in the supply chain to urban logistics – although it has recently expanded its urban logistics portfolio and acquired UK Commercial Property REIT.

Figure 13: Peer group analysis

| Market cap (£m) | Premium/(discount) (%) | Yield (%) | |

|---|---|---|---|

| Urban Logistics REIT | 482 | (34.1) | 7.3 |

| Warehouse REIT | 334 | (38.3) | 8.1 |

| Tritax Big Box REIT | 3,302 | (26.8) | 5.5 |

| SEGRO | 9,402 | (20.5) | 4.1 |

| LondonMetric Property | 3,658 | (10.0) | 6.2 |

Source: Morningstar, Marten & Co

We have included other listed property companies focused on the industrial and logistics sector for further comparison. SEGRO is by far the largest, and has a mixed portfolio of big box assets, urban logistics and developments. LondonMetric has a big weighting to urban logistics assets, but also owns big box and a separate long-income portfolio.

Click here for an up-to-date comparison of SHED and its Property – UK Logistics peer group

SHED is on the smaller side of the peer group, which has three companies over £3bn market cap including the largest London-listed real estate company, SEGRO. Looking at Figure 14, SHED’s NAV total return performance compares favourably with the peer group over three years, but trails over five years. Its share price performance is in line with the peer group, where all have suffered to differing levels over the past three years. Given that the fundamentals in the logistics sector remain strong (as described in previous sections), as well as SHED’s adviser’s ability to add value through asset management, the company’s discount – which is one of the widest among its peer group – seems attractive.

Figure 14: Peer group analysis – performance over one year, three years and five years *

| 1-year NAV TR (%) | 3-year NAV TR (%) | 5-year NAV TR (%) | 1 year price TR (%) | 3-year price TR (%) | 5-year price TR (%) | ||

|---|---|---|---|---|---|---|---|

| Urban Logistics REIT | 2.5 | 10.2 | 38.6 | (14.1) | (34.4) | (7.3) | |

| Warehouse REIT | 8.7 | (4.9) | 53.5 | (7.7) | (45.9) | (5.6) | |

| Tritax Big Box REIT | 3.5 | (10.9) | 38.5 | (17.4) | (38.8) | 10.6 | |

| SEGRO | (1.2) | 5.7 | 51.2 | (18.3) | (46.7) | (10.2) | |

| LondonMetric Property | (0.5) | 3.3 | 40.1 | (0.4) | (25.8) | (4.1) |

Source: Morningstar, Marten & Co. Note*: performance calculated to 31 December 2024

NAV and portfolio valuation

SHED publishes its NAV twice a year, based on portfolio valuations, which are approved by the board prior to publication. Independent international real estate consulting firm CBRE performs the valuation, in accordance with Royal Institute of Chartered Surveyors (RICS) guidance. Each property is unique, and the fair value includes subjective selection of assumptions, most significantly the estimated rental value and the yield. These key assumptions are impacted by a number of factors including location, quality and condition of the building, tenant credit rating, and lease length. Whilst comparable market transactions can provide valuation evidence, the unique nature of each property means that key factors in the property valuations are the assumptions made by the valuer.

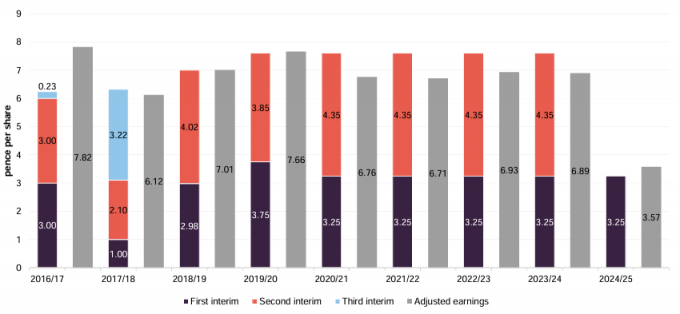

Dividend

SHED has declared an interim dividend of 3.25p for the first half of its 2025 financial year (in line with previous years). SHED’s annual dividend for the 2024 financial year was 7.6p per share – maintained at the same level for the fifth consecutive year.

The company said that it intends to maintain the dividend at the same level for the 2025 financial year, despite it not being covered by adjusted earnings for the past four years. In earlier years, this was mainly due to the impact of capital raisings during those years, but in the past 18 months, vacancy in the portfolio (as described earlier) and higher debt costs have impacted earnings.

In the first half of the 2025 financial year, SHED’s dividend cover improved to 93.9% on an annualised basis, from 90.7% for 2024. The company says that it is confident that its annual dividend of 7.6p would be covered by earnings in the 2025 financial year, through the leasing up of the vacant space in the portfolio and other asset management activities, its share buyback programme, as well as earnings-accretive acquisitions through its asset recycling programme.

Figure 15: SHED dividend history since launch

Source: Urban Logistics REIT, Marten & Co

Capital structure and life

SHED has a simple capital structure with a single class of ordinary shares in issue and trades on the main market of the London Stock Exchange. As at 6 January 2025, there were 465,088,000 ordinary shares in issue and 6,887,411 shares in treasury.

Borrowings

Target LTV of 30% to 40%

SHED borrows money with the aim of enhancing shareholder returns and had total drawn debt of £407.3m at 30 September 2024 and a loan to value (LTV) of 33.2%, at the lower end of its medium-term target of 30-40%.

The weighted average debt maturity was 5.1 years, and the weighted average cost of debt was 3.9%. The ongoing cost of debt was 4.15%, or 4.23% including non-utilisation fees on the undrawn portion of the revolving credit facility (RCF). Of the debt facilities, 100% was fixed or hedged.

At 30 September 2024, SHED’s cash balance was £29.3m, of which £6.1m was in restricted accounts.

Figure 17: Debt facilities at 30 September 2024

| Lender | Maturity date | Loan amount (£m) | Drawn (£m) | Interest rate (%) | Fixed/hedged |

|---|---|---|---|---|---|

| Barclays, ING, Santander | August 2027 | 140.0 | 140.0 | 4.99 | 100% |

| Barclays, ING, Santander RCF | August 2027 | 50.0 | 0.0 | 0.841 | 100% |

| Aviva Investors | March 2028 | 88.4 | 88.4 | 2.30 | 100% |

| Aviva Investors | May 2032 | 178.9 | 178.9 | 4.57 | 100% |

| Total/weighted average | 5.1 years | 457.3 | 407.3 | 4.23 | 100% |

Source: Urban Logistics REIT, Marten & Co. Note 1) Commitment fee on undrawn RCF facility

In September 2024, SHED’s adviser announced the refinancing of a £100m term loan and £51m RCF, which was due to expire in August 2025.

A new £140m term loan and a £50m RCF was provided by a group of banks consisting of Barclays, ING and Santander. The sustainability-linked facility has a three-year term, with two optional one-year extensions and a £100m accordion option (which is at the lender’s discretion).

The facility is priced at a margin above SONIA of 1.75% and is hedged through to maturity. Existing hedges in place mean the interest rate until August 2025 will be 4.48%, and from that date to maturity in 2027 forward dated hedges fix the rate at 4.99%.

Following the refinance, all debt facilities are 100% fixed or hedged through to term. The longer-term debt with Aviva Investors has a weighted average maturity of 6.3 years and is 100% fixed at an all-in rate of 3.82%.

Financial calendar

SHED’s year-end is 31 March. The annual results are usually released in June (interims in November) and its AGMs are usually held in July of each year. SHED pays two interim dividends per year in June and December.

Major shareholders

Figure 18: SHED’s major shareholders at 3 January 2025

Source: Bloomberg, Marten & Co

Management team

The adviser has a seasoned team of investment and asset management specialists, with specific expertise in the logistics property sector. The team has the ability to access off-market transactions in the logistics real estate sector through an extensive and established network across the UK.

Richard Moffitt (chief executive)

Previously an executive director at CBRE, where he was head of the UK industrial team, Richard has over 25 years’ experience of the UK industrial and logistics markets. He has an in-depth understanding of the market’s dynamics, credibility with owners and operators of real estate assets, a thorough understanding of owner and tenant requirements, and an extensive network, which includes institutional funds. Richard is a member of the Chartered Institute of Logistics and Transport.

Christopher Turner (property director)

Christopher is a Chartered Surveyor with more than 25 years’ experience in the UK and European investment markets, where he has built up extensive contacts with investors and developers of industrial, office and retail real estate. He has considerable experience in the acquisition, management and disposal of investments through all sectors, focusing on tenant management, covenant performance and active asset management to achieve overall investment returns.

Jamie Waldegrave (chief financial officer)

Jamie was appointed chief financial officer in 2023, having previously been chief operating officer. He has over 10 years’ experience as chief financial/chief operating officer, most recently at a proptech company offering software to REITs and other property owners. Jamie qualified as a Chartered Accountant while at PwC.

Justin Upton (chief investment officer)

Justin has over 20 years’ experience in the commercial real estate market, including spending 13 years at M&G running their open-ended real estate PAIF, which had a peak NAV of £4.9bn and 194 assets. While at M&G, he was responsible for £6.5bn of acquisitions and disposals, giving him considerable experience, contacts and understanding of the commercial property markets.

Board

SHED’s board comprises six directors, five of whom are considered to be independent of the investment adviser (Richard Moffitt is chief executive of the adviser). All directors stand for re-election on an annual basis. Since publishing our last note, the company has appointed Cherine Aboulzelof as a director.

Board members typically serve a nine-year tenure, including the chairman; however, it has been agreed that Bruce Anderson will continue for a period past his nine-year anniversary to assist with the selection process for the chairman’s successor, with the current chairman, Nigel Rich, due to stand down by the end of 2025.

Figure 19: Board member – length of service and shareholding

| Director | Position | Date of appointment | Length of service | Annual director’s fee (GBP) | Shareholding |

|---|---|---|---|---|---|

| Nigel Rich | Chairman | 1 January 2017 | 8.0 | 100,000 | 630,536 |

| Heather Hancock | Senior independent director | 15 June 2020 | 4.6 | 70,000 | 14,388 |

| Bruce Anderson | Non-executive director | 14 January 2016 | 9.0 | 60,000 | 100,000 |

| Lynda Heywood | Non-executive director | 1 May 2023 | 1.7 | 50,000 | 21,024 |

| Cherine Aboulzelof | Non-executive director | 1 July 2024 | 0.5 | 50,000 | – |

| Richard Moffitt | Non-independent director and chief executive | 14 January 2016 | 9.0 | – | 1,556,591 |

Source: Urban Logistics REIT, Marten & Co

Nigel Rich

Nigel has considerable board experience, having operated across the world in senior positions, most recently at SEGRO Plc. He served as the group chief executive of Trafalgar House Plc from 1994 to 1996 and previously spent 20 years at the Jardine Matheson Group in Asia, serving as a managing director from 1989 to 1994.

Nigel has served as the chairman of the board at Hamptons International, Excel Plc, Xchanging plc and SEGRO Plc, from October 2006 until April 2016. His other directorships have included Pacific Assets Trust Plc, Granada Plc, ITV Plc, Harvey Nichols, and AVI Global Trust Plc. He has also served as a member of The Takeover Panel (UK) and is a Chartered Accountant. Current external appointments include chairman of Foxtons Group Plc, a director of Matheson & Co Ltd and Chelsea Square Garden Ltd.

Heather Hancock

Heather has many years of high-level experience in strategy, governance and leadership gained in the real estate sector and wider economy. She is currently Master of St. John’s College, Cambridge, and was previously chairman of the Food Standards Agency. Heather was executive director of Yorkshire Forward between 2000 and 2003 leading on asset realignment and the assembly of a £35m property portfolio. She then spent a decade at Deloitte’s strategy consulting business, serving as a managing partner from 2008 until her 2014 retirement. Heather is a board member of the Department of the Environment, Food and Rural Affairs (Defra), a director of Amerdale Limited, a non-executive director of Rural Solutions Limited and a trustee of the Chatsworth Settlement Trust.

Bruce Anderson

Bruce has considerable real estate and financial services experience, having worked in senior roles at Lloyds, HBoS and Bank of Scotland, with 20 years of investment-led boardroom positions. He has experience with both real estate companies and REITs across the UK, Europe and the Far East. At Lloyds he was head of joint ventures for the specialist finance division, responsible for a mixed portfolio of real estate, including both equity and debt elements. Bruce is a Chartered Accountant and currently chairman of Hire and Supplies Limited. He is also an adviser to the Housing Growth Partnership Fund and a former non-executive director of Green Property Limited.

Lynda Heywood

Lynda has a wealth of experience as group treasurer at FTSE 100 companies from her 20-year tenure at Kingfisher and six years at Tesco. In her role in the finance leadership team at Tesco, she was responsible for capital structure, liquidity and financial risk management, and was instrumental in delivering the group’s property joint venture acquisitions. She also sat on the investment and risk committee of the Tesco Pension Scheme, which holds a significant real estate portfolio. Lynda has also been a member of the money markets committee of the Bank of England and is a qualified Chartered Accountant, a fellow of the Association of Corporate Treasurers and holds a BA in accountancy from the London Metropolitan University. She currently a non-executive director of Atrato Partners Ltd.

Cherine Aboulzelof

Cherine is an experienced senior real estate executive with 19 years of real estate investment tenure, having managed real estate funds, assets and portfolios for several large real estate investment managers. Prior to her real estate career, Cherine spent eight years in investment banking. She is currently global co-head of BGO Strategic Capital Partners (part of BGO, a global real estate investment firm with $84bn AUM). She previously held the positions of managing director at The Carlyle Group and partner at 90 North Real Estate Partners. Cherine sits on the board of the Women in Safe Homes Fund, a for-profit social impact fund providing rental accommodation to vulnerable women and children across the UK.

Previous publications

QuotedData has published a number of previous notes on SHED. You can read them by clicking the links in the table below or visiting our website.

Figure 20: QuotedData’s previously published notes on SHED

| Title | Note type | Date |

|---|---|---|

| Shed load of growth to come | Initiation | 10 August 2021 |

| In the sweet spot | Update | 22 December 2021 |

| Long-term dynamics remain strong | Annual overview | 4 October 2022 |

| Fundamentals strong as market stabilises | Update | 17 May 2023 |

| A re-rating candidate | Annual overview | 10 January 2024 |

Source: Marten & Co

IMPORTANT INFORMATION

Marten & Co (which is authorised and regulated by the Financial Conduct Authority) was paid to produce this note on Urban Logistics REIT Plc.This note is for information purposes only and is not intended to encourage the reader to deal in the security or securities mentioned within it.Marten & Co is not authorised to give advice to retail clients. The research does not have regard to the specific investment objectives financial situation and needs of any specific person who may receive it.

The analysts who prepared this note are not constrained from dealing ahead of it but, in practice, and in accordance with our internal code of good conduct, will refrain from doing so for the period from which they first obtained the information necessary to prepare the note until one month after the note’s publication. Nevertheless, they may have an interest in any of the securities mentioned within this note.

This note has been compiled from publicly available information. This note is not directed at any person in any jurisdiction where (by reason of that person’s nationality, residence or otherwise) the publication or availability of this note is prohibited.

Accuracy of Content: Whilst Marten & Co uses reasonable efforts to obtain information from sources which we believe to be reliable and to ensure that the information in this note is up to date and accurate, we make no representation or warranty that the information contained in this note is accurate, reliable or complete. The information contained in this note is provided by Marten & Co for personal use and information purposes generally. You are solely liable for any use you may make of this information. The information is inherently subject to change without notice and may become outdated. You, therefore, should verify any information obtained from this note before you use it.

No Advice: Nothing contained in this note constitutes or should be construed to constitute investment, legal, tax or other advice.

No Representation or Warranty: No representation, warranty or guarantee of any kind, express or implied is given by Marten & Co in respect of any information contained on this note.

Exclusion of Liability: To the fullest extent allowed by law, Marten & Co shall not be liable for any direct or indirect losses, damages, costs or expenses incurred or suffered by you arising out or in connection with the access to, use of or reliance on any information contained on this note. In no circumstance shall Marten & Co and its employees have any liability for consequential or special damages.

Governing Law and Jurisdiction: These terms and conditions and all matters connected with them, are governed by the laws of England and Wales and shall be subject to the exclusive jurisdiction of the English courts. If you access this note from outside the UK, you are responsible for ensuring compliance with any local laws relating to access.

No information contained in this note shall form the basis of, or be relied upon in connection with, any offer or commitment whatsoever in any jurisdiction.

Investment Performance Information: Please remember that past performance is not necessarily a guide to the future and that the value of shares and the income from them can go down as well as up. Exchange rates may also cause the value of underlying overseas investments to go down as well as up. Marten & Co may write on companies that use gearing in a number of forms that can increase volatility and, in some cases, to a complete loss of an investment.