Real Estate Roundup

Kindly sponsored by abrdn

Performance data

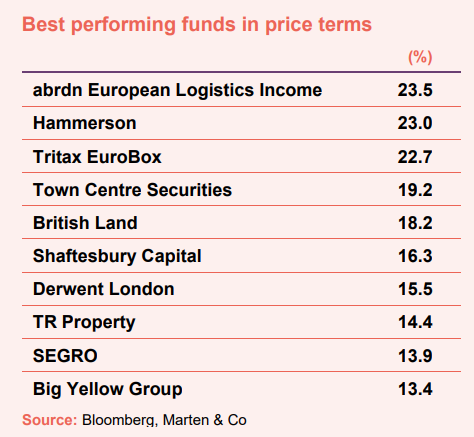

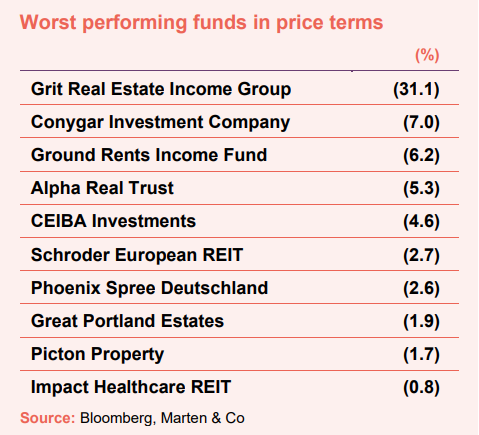

November’s biggest movers in price terms are shown in the charts below.

Property stocks bounced back in November after a difficult few months, with the median share price across the sector up 8.2%. Investor sentiment towards the sector improved as hopes that interest rates have hit peak levels grew following encouraging inflation figures and the Bank of England’s decision at the beginning of the month to hold the base rate at 5.25% for a second consecutive month. abrdn European Logistics Income (ASLI) saw its share price rally on the news that its board was conducting a strategic review into the future of the company (see page 3), having traded on a persistent discount to net asset value (NAV). A likely suitor would be peer Tritax EuroBox, and its share price similarly leapt in November. The company, which has made good progress with its disposal programme (see page 4), has obvious synergies with ASLI with comparable portfolios. The big named property companies all rallied on the improving macroeconomic outlook, with retail giant Hammerson up 23.0% over the month. British Land, Shaftesbury Capital, Derwent London and SEGRO all rallied on expectations that further valuation pain was over. Reflecting the shift in sentiment, real estate fund-of-funds TR Property was up 14.4%.

Grit Real Estate Income Group suffered a second consecutive month of heavy losses following the announcement that it would not pay a dividend for the second half of its financial year. It seems an overreaction, especially given the growth potential of the company through its development pipeline of US embassy-backed diplomatic housing and its intention to pay a special dividend or an increased dividend for the first half of the current financial year once new developments complete. Ground Rents Income Fund suffered further losses after the government proposed restricting ground rent for existing leases and is now down 33.9% this year. Schroder European REIT’s share price has been on a downward trajectory since it rebased its dividend in June and lost a further 2.7% in November. Phoenix Spree Deutschland has been on a similar path having axed its dividend earlier this year and is down 38.5% in 2023. Great Portland Estates was down marginally after reporting a heavy NAV fall in interim results (see page 2). Meanwhile, Picton Property, whose attempt to acquire its larger peer UK Commercial Property REIT was knocked back (see page 3), rounds off the list.

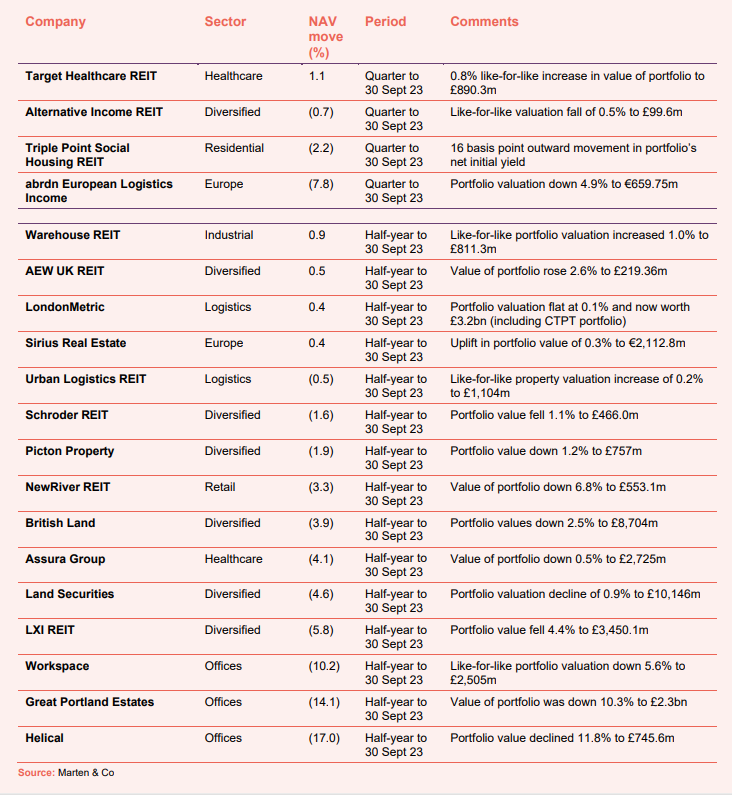

Valuation moves

Corporate activity

Sirius Real Estate raised £146.6m in a placing, with the money earmarked for the acquisition of a pipeline of light industrial assets in Germany and the UK. The capital raise comprised the issue of 170,417,384 new ordinary shares, which represent around 14.5% of the share capital of the company prior to the raise. The offer price of 86.0p represented a discount of 5.9% to the prevailing share price.

UK Commercial Property REIT (UKCM) ended talks with Picton Property over a possible merger of the companies. Picton had approached UKCM over an all-share merger on a NAV-by-NAV basis. UKCM’s largest shareholder – Phoenix Life, which has a strategic partnership with UKCM’s fund manager abrdn and owns 43.4% of UKCM – did not support the possible merger.

abrdn European Logistics Income launched a strategic review into the future of the company that could result in its sale or merger with another company. The company said that it is “facing a number of challenges, at both a macro and company specific level” and was trading on a discount to NAV of around 40%. With a continuation vote due at its AGM next year, the board said that it believed now was the time to look at its future. The board added that the company’s annual dividend remains materially uncovered, and a reduction would be required to achieve a fully covered, sustainable dividend.

NewRiver REIT refinanced its revolving credit facility (RCF) with a new £100m facility (which has a £50m accordion available). This replaces the previous £125m (plus £50m accordion) facility. Maturity has been extended from August 2024 to November 2026 with the option to extend the facility by two additional one-year terms (to November 2028), subject to lender approval. The annual cost of the debt has reduced – due to the headline margin and quantum have both been reduced. The new facility is with the existing lenders of the previous RCF, being Barclays, HSBC, NatWest and Santander.

LXI REIT extended the term of its existing £60m loan facility with HSBC from December 2024 to December 2026.The facility maintains the existing margin of 2.05% per annum above SONIA and benefits from an existing interest rate cap until December 2024 at 2.5%. The company said that it expects to hedge the cost of the facility during the additional term to expiry in due course.

Primary Health Properties appointed Harry Hyman, founder and chief executive of the company, as chairman – subject to shareholder approval. Hyman will step down as chief executive at the company’s AGM on 24 April 2024 and be succeeded by Mark Davies. Should shareholders approve, he will then take the reins as non-executive chairman, succeeding Steven Owen.

Major news stories

- LXI REIT to check out of £210m Travelodge portfolio

LXI REIT announced it was under offer to sell a portfolio of 66 Travelodge hotels for £210m, in line with the book value (at 30 September 2023), the company said. If completed, the majority of the sale proceeds would be used to pay down debt, reducing group LTV to 34% from 38%, and would reduce the Travelodge proportion of the total rent roll to 11% from 18%.

- Tritax EuroBox sells Swedish scheme at whopping premium

Tritax EuroBox sold its redevelopment site in Malmö, Sweden, to a data centre owner-occupier for SEK320 million (€28m), reflecting a 39% premium to the valuation at 31 March 2023. The sales proceeds will be used to pay down debt as part of the group’s programme to reduce leverage.

- Tritax Big Box REIT’s sales programme hits £327m in 2023

Tritax Big Box REIT has sold six assets so far in 2023 for a total of £327m. These disposals were conducted at or above most recent valuations, and delivered a blended net initial yield of 4.34%.

- UK Commercial Property REIT secures new lease at 30% premium

UK Commercial Property REIT secured a new lease at its Newton’s Court multi-let industrial estate in Dartford, Kent at a level 30% higher than previous passing rent.

- Home REIT sells homes at 65% discount to acquisition price

Home REIT sold a portfolio of 153 properties, representing 6.5% of the company’s portfolio by number, for a total of just over £24.3m at a series of public auctions – at a huge 65% discount to the price the company paid for them.

- Regional REIT sells office for student conversion

Regional REIT completed the sale of its Venlaw and Elmbank Gardens offices at Charing Cross, Glasgow for £6.25m, representing a substantial uplift of 26.3% against the most recent valuation. The purchaser of the 51,775 sq ft office intends to redevelop the space for student and residential use. Proceeds will be used to reduce the company’s debt.

- Sirius Real Estate continues asset recycling programme

Sirius Real Estate continued its asset recycling programme with the sale of an industrial park in Maintal, in Germany’s southwest Hesse region, for €40.1m and acquisition of a portfolio of three business parks in North London for £33.5m.

- LondonMetric offloads £24.5m of assets

LondonMetric sold four offices and two long-income assets in separate transactions, for a total of £24.5m. Four non-core assets were sold from the recently acquired CT Property Trust portfolio.

- Grainger to forward fund developments with Network Rail

Grainger entered a partnership with Network Rail and Bloc Group to deliver over 2,000 new purpose-built rental homes across sites in major cities across the UK. The partnership will see Network Rail bring forward potential sites for build-to-rent from its extensive, well located property portfolio, with the Bloc as developer and Grainger forward funding the scheme and ultimately owning and operating the completed buildings.

- Harworth secures planning for Leeds logistics scheme

Harworth Group secured planning approval for the development of 800,000 sq ft of industrial and logistics space across five units at its Skelton Grange site in Leeds.

Managers’ views

A collation of recent insights on real estate sectors taken from the comments made by chairmen and investment managers of real estate companies – have a read and make your own minds up. Please remember that nothing in this note is designed to encourage you to buy or sell any of the companies mentioned.

Logistics

Andrew Jones, chief executive:

Global economic and geopolitical uncertainty continues to dominate the investment backdrop. The conflict in the Middle East, together with the ongoing war in Ukraine and tensions with China, has added further volatility into the financial markets which continue to navigate uncertainty over interest rates, persistent inflationary pressures and worries about future growth.

The UK economy has been highly resilient with strong wage growth and near to full employment. 14 consecutive increases in interest rates are, however, now having the desired impact of dampening the economy and inflation, which has more than halved from c.11% at its peak to c.5% today. Whilst inflation has remained more persistent than most expected, there are suggestions that the economy is in fact weaker than the data is currently showing. Peering through the fog of data, there is evidence of a weakening labour market with gently rising unemployment. This indicates that the full impact of higher interest rates will take time, with economists suggesting that less than half of the BoE’s tightening has actually passed through into the real economy.

We believe that the UK consumer is well positioned to navigate these challenges, helped by healthy saving ratios, falling energy costs and good wage growth. Furthermore, more than half of all homeowners do not have a mortgage.

Whilst liquidity for real estate has improved from the days of the mini budget last year, the property market is still a long way from functioning normally. We remain of the view that we won’t start to see normal liquidity for real estate until five year swap rates fall materially towards 300bps. The five year swap rate is currently 415bps which, whilst down from its peak of 540bps, is still up from 400bps at the time we last reported. However, we expect liquidity to benefit from a growing assumption that base rates have peaked at 5.25% and will start to fall during 2024.

Furthermore, following material repricing of lower yielding and high growth real estate, some sub sectors have been experiencing much improved liquidity for a while now, and we have also seen good volumes for smaller lot sizes where debt is less of an issue. The logistics sector has been one of the few sectors transacting and this has helped price discovery and supported evidence for our valuations.

In our last set of results, I wrote that the more challenged sub-sectors of retail and offices had escaped the dramatic revaluation relatively unscathed. This seemed rather irrational and, not surprisingly, we are now seeing appraisers reassess the values within these sectors, even when there are few transactions.

We are now operating in a new paradigm where, if the property market won’t offer price discovery, then the debt market inevitably will. There is a significant amount of debt expiring and loans to be refinanced over the coming years. The overall property market remains over leveraged or under equitized and the banks are becoming increasingly active in forcing assets to the market.

This is creating some very interesting debt propositions and distressed sales, especially outside of our core sectors. Refinancings are exposing proper price transparency and highlighting to owners and debt providers that assets that once yielded a positive carry and attractive cash on cash metrics are now seeing equity holders being wiped out and lenders taking a loss. This is particularly acute in the office sector where new working patterns combined with ageing stock and growing ESG requirements is having a dramatic impact on valuations. Assets that made sense when in a QE World of free money are no longer viable when borrowing costs are at 7+%.

The good news is that the UK listed sector is in a much better position than the private sector or indeed many of the European REITs, where leverage is materially higher. Many of the lessons learned from the Global Financial Crisis were forgotten, but, in the UK, lower leverage was not one of them and so we are a long way away from a repeat of 2008/09.

Richard Moffitt, chief executive:

Of all areas in commercial real estate, the logistics market retains some of the strongest fundamentals. Our belief is that the urban logistics sub-sector, comprising well located, single let logistics warehousing serving the UK’s urban areas, remains the most exciting part of this market.

The macro-economic uncertainty that has plagued markets throughout 2023 has manifested itself in the wide discounts which the majority of listed REITs are currently traded at when compared to their underlying NAVs. These discounts reflect the uncertain outlook on where the interest rate cycle will settle and the inherent impact that will have on asset pricing.

Given the interest rate environment, capital market transactions have been subdued, and corporate decision making around leasing activity has slowed. It is only now as we move towards the end of the year, with the Bank of England pausing monetary tightening, that commentators anticipate a period of stability and correspondingly the market’s ability to price assets or benchmark risk free rates with any degree of certainty.

Offices

Gerald Kaye, chief executive:

During the six months to 30 September 2023, there has been a painful readjustment in the investment market as valuation yields have increased to reflect movements in ten year gilts and five year swap rates, the pricing of which is correlated to real estate property yields.

There are signs, however, with inflation falling and predictions that CPI will be in low single figures by the end of 2024, that base rates have peaked and may start to fall sooner than the “higher for longer” commentators suggest, allowing yields to stabilise.

Occupational demands are evolving in the office sector, with tenants using their premises to optimise the work experience for their employees. Amenity, connectivity, service and sustainability are encouraging businesses towards new buildings. At the same time, buildings that provide a poorer working environment are driving occupiers away. This bifurcation of the market between the “best-in-class” and the rest is accelerating with rental growth continuing for the “best” and values falling for the rest. This will provide opportunities to acquire potential developments and major refurbishments at levels that allow for strong capital returns.

We have experienced a further significant outward yield movement in the period, and while interest from potential occupiers has been encouraging, lease negotiations are taking longer to conclude. However, having taken the pain of reductions in value, Helical is now well positioned to drive growth through the letting of the vacant space in its investment portfolio.

Diversified

Mark Allan, chief executive:

Since the start of the year, the reduction in inflation, return to real wage growth for consumers and better than expected resilience in UK GDP have been encouraging. Still, we remain mindful that the ongoing transition from a decade of free money and excess liquidity to a higher interest rate world could continue to create its dislocations and that higher-for-even-longer rates could eventually start to impact consumer and customer demand, even though we are not seeing any signs of this yet.

Investment activity remains subdued for now but the combination of recent relative stability in long-term rates and greater economic resilience so far means that we expect activity levels to pick up in 2024. The refinancing of cheap debt issued before 2022 across the sector remains a challenge, but the apparent availability of new equity and mezzanine finance to plug gaps in the capital stack means that we see the risk of disorderly sales putting significant pressure on the value of high-quality assets as lower than six months ago. As a result, for the best assets we expect values will start to stabilise during 2024, although secondary assets where the sustainability of cashflow is questionable will likely continue to fall.

Whilst macroeconomic signals remain mixed, with long-term rates seemingly beginning to stabilise and occupier demand for the best assets remaining robust, the outlook for values for best-in-class assets should start to improve.

Simon Carter, chief executive:

Despite the uncertain UK macroeconomic outlook, we are seeing an improvement in some leading indicators. While GDP forecasts continue to adjust from quarter to quarter, the UK has thus far avoided a recession, consumer confidence has been resilient and labour markets have remained robust with unemployment at 4%.

In the wake of the mini budget, searches for London office space paused, impacting take up in the first three quarters of 2023 (calendar year), which was 25% below the ten-year average. However, the forward-looking indicators in Q3 are very encouraging with the volume of space under offer 8% above the 10-year average and active demand 27% higher. Demand remains focused on core markets, with location a critical criteria for occupiers. The City is performing particularly well with take up in Q3 exceeding the long-term average by 5%. The banking and financial sectors continue to drive activity in both the City and West End, with most larger deals and under offers, originating from these sectors. We are also seeing increased demand for larger requirements. There are now 24 active requirements over 100,000 sq ft, compared with 11 at the start of the year. Furthermore, most of this demand is for best in class space, which is shown in the high proportion of take up for new buildings, reaching 71% in September. Supply is also constrained, with very low levels of best-in-class space being delivered beyond 2025. The result is that we are seeing strong rental growth for best-in-class space, particularly new space in the development pipeline.

Investment markets were subdued in the first half of the year with investors continuing to exercise caution in a high interest rate environment with ongoing macroeconomic and geopolitical uncertainty. Total volumes were £2.9bn across the City and West End compared to £6.6bn in the same period last year.

Laura Elkin, fund manager:

Despite uncertainty remaining in the wider economy, values in UK commercial property largely stabilised during the six months to 30 September 2023. UK property is expected to offer healthy return prospects over the coming periods, with consensus foreca222sts showing an expected return to positive rental growth across all major market sectors by 2025, and all UK property total returns to average 5.6% per annum over the next five years (2023-2027).

During the period, the industrials sector remained robust having been the sector which saw the steepest value declines at the end of 2023. Supported by resilient levels of occupational demand, the sector has continued to see the highest levels of rental growth and although this is expected to slow in coming years, it is expected to remain in positive territory, showing expected average annual growth of 3.3% between 2023 and 2027. We believe that the Company’s industrial portfolio, with a low average passing rent of £3.60 per sq ft, will be well placed to benefit. The Company has completed several sales from the sector during the period, where sales yields have compressed significantly compared to pipeline assets, due to vendors’ positive expectations on rental growth.

Values in the retail sector also faired robustly during the period, buoyed by positive sector indicators. Retail sales volumes increased 0.3% over the three months to August 2023 and the proportion of online retail sales fell marginally in the month to August. These figures, however, mask a divergence in performance of the underlying retail sectors, with retail warehousing remaining more robust on a total return basis than its high street equivalent. Vacancy levels across retail warehousing have fallen to 4.7%, the lowest level seen since 2018. Performance on the high street remains significantly polarised from town to town, with the top tiers remaining robust and those now deemed to be lower quality struggling, both for occupational and investor demand.

The period saw the failure of Wilko, which affected both high street and retail warehousing locations. Tenant failures and CVAs have not been as common as compared to the more regular occurrence seen during the Covid pandemic, however we remain cautious of further distress in the sector.

The office sector saw a stronger post-Covid recovery in 2022 than some may have expected, with office-based employment growing in 2022. This trend started to reverse during 2023, resulting in negative capital growth seen across most locations. Occupational uncertainty remains across the sector, as businesses continue to transition to new working patterns. Tenants have also become more discerning in recent years, with occupiers now wishing to benefit from strong sustainability credentials as well as surrounding amenities and top-quality space. This is particularly the case for large corporate tenants, but it is increasingly becoming a key factor for smaller businesses too. As a result of all these factors, we have seen investor demand for the sector remain light, with investors further deterred by the high costs associated with delivery.

Across alternative sectors, visibility of performance in trading updates is key to investor demand and where these have remained robust, despite the squeeze on consumer discretionary spend, investment volumes have held up. Generally, leisure has historically fared relatively defensively during periods of economic uncertainty. Operators carrying unsustainably high levels of debt are seen as a concern, however. We find the sector attractive on a selective basis, particularly for assets that offer a superior income return and occupy larger land holdings, or sites in urban areas that can often be underpinned by alternative use values, most likely residential.

Alastair Hughes, chairman:

There are early signs that the recent volatile period of historically high inflation and interest rates may be easing, but risks remain due to a fragile economy and geopolitical uncertainty. Whilst an easing in monetary policy rates should provide support to real estate values in 2024, there will be no return to the ultra-low rates of the past 15 years. Consequently, future returns will be led by income and rental growth, driven by long-term structural trends such as urbanisation, technological change, demographics and sustainability.

Industrial

Warehouse REIT

Tilstone Partners, investment adviser:

The long-term trends underpinning the wider industrial market, including the dominance of e-commerce and focus on supply chain resilience continue to play out albeit demand was more muted at the big box end of the market, with take up back to pre-Covid averages at 12.5 million sq ft for the six months to June (source: Savills). Multi-let assets increasingly attract a broad range of uses including innovation / technology, trade counters, retail, quasi-office and business storage meaning the occupier pool is more diverse and demand more resilient.

Void rates across the multi-let space have ticked up marginally over the period to 8.2% for London and the South-east and 8.7% for the rest of the UK (source: Gerald Eve) but remain well below historic averages of 9.3% and 10.8% respectively. In London and the South-east, where there is more reversion to capture and occupier covenants are strong, landlords appear happy to hold out for the right occupier rather than compromising on rents, explaining part of the increase in vacancy. Vacancy is also notably lower in the North-west, West and East Midlands at 6% or less.

For multi-let assets, where build cost per sq ft is typically above capital value, new development is uneconomic in many regions. Gerald Eve estimates that there is only 3.2 million sq ft of multi-let space under construction with at most only 0.5 million sq ft in any one region, having relatively limited impact on supply. The higher cost of finance makes profitable development highly challenging for all but those with the lowest cost of capital and Savills report that in the big box space, there have been just 22 speculative announcements in the first half of the year compared to 39 over the comparable period last year. These dynamics are supportive for long-term rental growth; multi-let ERVs are estimated to be growing at an annualised rate of 7.0% in London and the Southeast and 7.8% across the rest of the UK as at Q1 2023.

Having adjusted rapidly in the prior reporting period, industrial yields have now effectively stabilised. This has been driven by increased confidence in the prime end of the market and supported by the weight of global equity which continues to target the industrial space reflecting relatively attractive forward total return prospects at 5.8% annualised for 2023-5, ahead of retail and offices.

Healthcare

Jonathan Murphy, chief executive:

The critical need for investment in infrastructure to support the services delivered by the NHS is as pronounced as it has ever been. We have an ageing population, and it is cheaper for the NHS to deliver health services in a primary care setting. Waiting lists are longer than they have been for decades because hospitals are overburdened, and appropriate space doesn’t exist in a community setting to deliver care where it is needed.

The existing NHS estate is not fit for purpose and requires significant investment to meet this demand. Healthcare professionals openly admit that the premises they work in are constraining the services they can provide, hindering recruitment of staff and holding back progress on tackling the care backlog. The recent restructuring of the NHS into Integrated Care Partnerships should provide a greater opportunity for stronger collaboration across health professionals, services and the property estate.

This all means there will be increasing numbers of diagnostic, specialist treatment and mental health services moving out of hospitals and into a community setting. It also means there is a growing demand for health services from private providers – both from patients electing to be treated privately and for NHS-referred work being delivered by private providers.

Real estate research

An update note on Lar España Real Estate (LRE SM). The company continues to defy the doom and gloom surrounding the retail sector, posting strong financial and operational numbers.

An update note on Grit Real Estate Income Group (GR1T). The company has been reborn, with the acquisitions of a developer and asset manager making annual return targets of 12-15% more achievable.

An update note on abrdn Property Income Trust (API). The manager’s focus focus continues to be on growing income, and asset management initiatives within the portfolio have seen its vacancy rate drop to below 5%.

An annual overview note on Tritax EuroBox (EBOX). After rapid value declines due to higher interest rates, optimism has grown that prices are stabilising. The company’s is in a good place to increase annual rent through its quality portfolio.

Legal

This report has been prepared by Marten & Co and is for information purposes only. It is not intended to encourage the reader to deal in any of the securities mentioned in this report. Please read the important information at the back of this note. QuotedData is a trading name of Marten & Co Limited which is authorised and regulated by the Financial Conduct Authority. Marten & Co is not permitted to provide investment advice to individual investors categorised as Retail Clients under the rules of the Financial Conduct Authority.

Accuracy of Content: Whilst Marten & Co uses reasonable efforts to obtain information from sources which we believe to be reliable and to ensure that the information in this note is up to date and accurate, we make no representation or warranty that the information contained in this note is accurate, reliable or complete. The information contained in this note is provided by Marten & Co for personal use and information purposes generally. You are solely liable for any use you may make of this information. The information is inherently subject to change without notice and may become outdated. You, therefore, should verify any information obtained from this note before you use it.

No Advice: Nothing contained in this note constitutes or should be construed to constitute investment, legal, tax or other advice.

No Representation or Warranty: No representation, warranty or guarantee of any kind, express or implied is given by Marten & Co in respect of any information contained on this note.

Exclusion of Liability: To the fullest extent allowed by law, Marten & Co shall not be liable for any direct or indirect losses, damages, costs or expenses incurred or suffered by you arising out or in connection with the access to, use of or reliance on any information contained on this note. In no circumstance shall Marten & Co and its employees have any liability for consequential or special damages.

Governing Law and Jurisdiction: These terms and conditions and all matters connected with them, are governed by the laws of England and Wales and shall be subject to the exclusive jurisdiction of the English courts. If you access this note from outside the UK, you are responsible for ensuring compliance with any local laws relating to access. No information contained in this note shall form the basis of, or be relied upon in connection with, any offer or commitment whatsoever in any jurisdiction.

Investment Performance Information: Please remember that past performance is not necessarily a guide to the future and that the value of shares and the income from them can go down as well as up. Exchange rates may also cause the value of underlying overseas investments to go down as well as up. Marten & Co may write on companies that use gearing in a number of forms that can increase volatility and, in some cases, to a complete loss of an investment.