Real estate quarterly report

Desperately seeking a catalyst

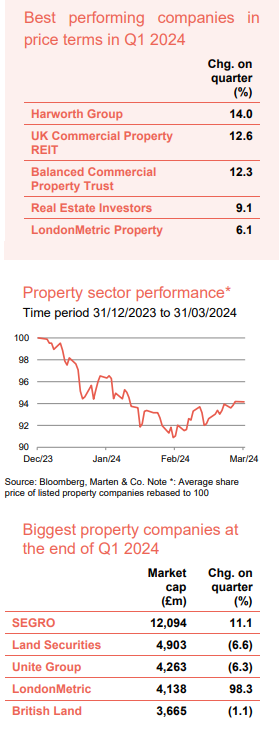

The real estate investment trust (REIT) and listed property sector seems to have been cut adrift and is desperately seeking a positive macroeconomic outlook on which investors can hang their hat and from which sentiment can grow. The first quarter of 2024 started as 2023 left off for the sector, with share prices drifting off on average by 5.8% (as shown in the chart to the right).

The life raft will surely come in the form of continued falling inflation and interest rate cuts, however the timing and gravity of these is still up in the air. Whilst interest rates have almost certainly peaked, it will not be until there is greater clarity on rate cuts that the real estate sector can stage a revival. The reporting season has thrown up a mixed bag, with valuation bright spots being found in the healthcare and residential sectors, while the challenged office sector is taking on more water.

While investors wait for an intervention, much of the sector continues to trade on substantially wide discounts to net asset value (NAV) – which has led to heightened merger and acquisition (M&A) activity and boards raising the white flag. LondonMetric Property completed its acquisition of LXi REIT, creating the UK’s fourth largest REIT, while a similar sized deal moved a step closer as Tritax Big Box REIT pursues UK Commercial Property REIT.

Performance data

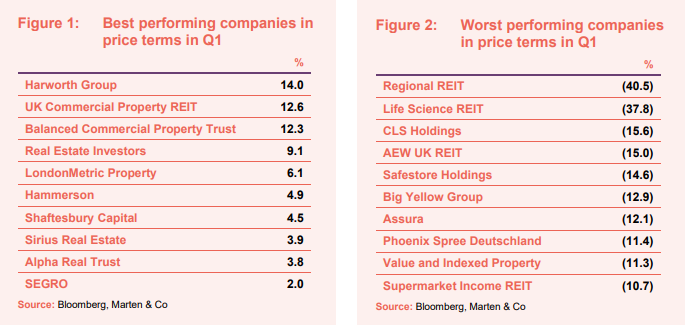

Best performing property companies

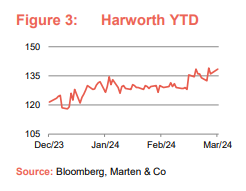

Developer Harworth Group headed the list of positive share price performance in the first quarter after reporting an encouraging trading update and NAV uplift due to positive progress with planning applications.

UK Commercial Property REIT’s share price was boosted after the terms of its proposed merger with Tritax Big Box REIT was established (see page 7).

After its own merger activity, LondonMetric saw its share price leap with the completion of its acquisition of LXi REIT during the quarter, which almost doubled the size of the company and made it the fourth largest UK listed property company.

Retail heavyweight Hammerson showed some encouraging share price momentum during the quarter, having suffered heavy losses over the years. Its share price was up almost 5% in the quarter and is now up 14.1% over 12 months. Another retail giant Shaftesbury Capital is also on the right trajectory and is now up 25.8% over 12 months.

Anglo-German business park owner Sirius Real Estate is making good progress in deploying the proceeds of its £147m capital raise at the end of 2023, which is reflected in its share price performance.

Worst performing property companies

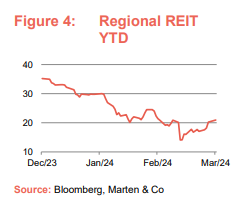

Regional REIT slid further down the slippery slope with another bruising share price fall during the quarter. It indicated that a heavily discounted rights issue was on the cards to service an impending bond maturity. The UK regional office landlord now trades on a seemingly unsustainably wide discount to NAV of over 60% (see Figure 6 on page 6).

Life Science REIT has also come under intense share price pressure in recent months losing 37.8% in value so far in 2024. It appears a large seller in the market is putting significant stress on its share price. This is despite positive lettings progress across its portfolio (see page 9).

AEW UK REIT was hit by two retail tenant failures, putting considerable pressure on earnings and its long-term uncovered dividend.

Meanwhile, Berlin residential landlord Phoenix Spree Deutschland suffered more share price pain after revealing further valuation declines in a trading update.

Significant rating changes

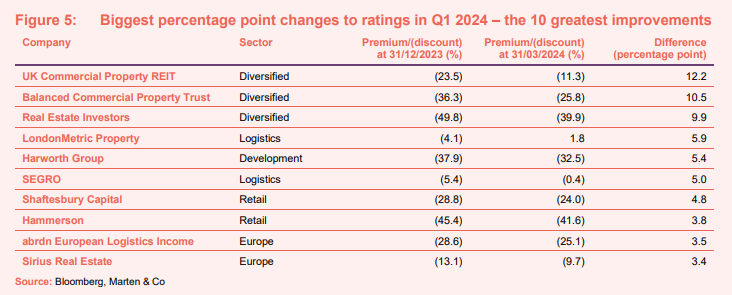

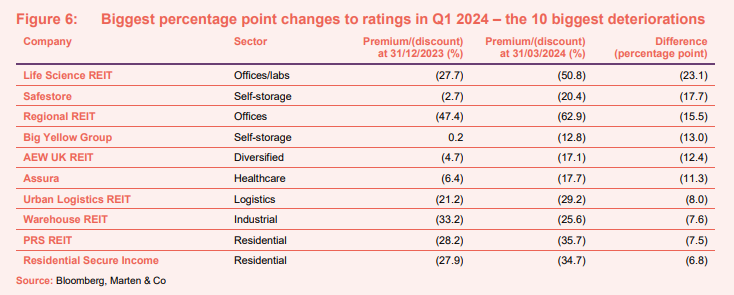

Discounts to NAV in the property sector remain some of the widest in the investment trust world. Figures 5 and 6 show how premiums and discounts to NAV have moved over the course of the quarter.

Many of the names listed here were mentioned in the previous section. Balanced Commercial Property Trust saw its discount narrow 10.5 percentage points over the quarter after a 12.3% increase in its share price (on positive news on the rebalancing of its portfolio away from offices – see page 9 for details) and a 3.6% drop in its NAV.

Real Estate Investors saw a similar narrowing of its discount after announcing that it would sell its entire portfolio over the next three years and return proceeds to shareholders.

SEGRO’s rating moved almost to parity over the quarter after it raised a mammoth £907m in a capital raise (more details on page 7) that will be spent on growth opportunities.

abrdn European Logistics Income, which effectively put itself up for sale last year, saw its discount narrow slightly after reporting a drop in NAV. Its share price held up after it revealed that it had received a number of proposals since launching its strategic review.

The plunge in the share prices of Life Science REIT and Regional REIT saw their discounts to NAV widen to 50.8% and 62.9% respectively at the end of the quarter.

Self-storage providers Safestore Holdings and Big Yellow Group both moved to a wide discount as economic uncertainty impacted on investor sentiment towards the sector. This was despite a leap in Safestore’s NAV announced during the quarter.

Urban Logistics REIT’s share price dropped off after it tabled a counter bid for abrdn Property Income Trust in February, rivalling Custodian Property Income REIT’s offer made in January (see page 7 for more details).

Private rented housing developer PRS REIT’s NAV uplift was not reflected in its share price, which fell 7.8% in the quarter.

Major corporate activity

Fundraises

There was just one capital raise conducted in the first quarter of 2024, with the largest listed property company, SEGRO, raising £907m in a placing in February. This single fundraise eclipsed the total amount raised by the sector in 2023 of just over £600m. The company increased the size of the raise from around £800m to £900m due to demand and also raised £7m from retail investors. The company said that the new equity will allow it to pursue additional growth opportunities, including new and existing development projects and to take advantage of potential acquisition opportunities.

Mergers and acqusitions

LondonMetric completed the merger with LXi REIT in March. The company acquired the entire issued and to be issued ordinary share capital of LXi for around £1.9bn – creating the fourth largest REIT with a market cap of around £4bn and a portfolio worth around £6.2bn.

The boards of Tritax Big Box REIT and UK Commercial Property REIT (UKCM) reached agreement on the terms of a £3.9bn merger of the two company. Both boards, excluding UKCM chairman Peter Pereira Gray, have recommended an all-share offer at an exchange ratio of 0.444 new ordinary Tritax Big Box shares per UKCM share. The possible offer implied a value of 71.1p per UKCM share and around £924m for the company (at the time of the announcement). This represented a premium of 10.8% to UKCM’s share price, but a discount of 9.7% to its NAV at 31 December 2023. The deal has the support of UKCM’s two largest shareholders – Phoenix Life and Investec – who combined own 56.5% of the company.

The proposed and recommended merger of abrdn Property Income Trust (API) and Custodian Property Income REIT (CREI) fell through after not receiving enough support from API shareholders. Just over 60% of votes cast were in favour of the merger, below the 75% threshold to sanction the deal. The API board will now take steps to implement a managed wind-down of the company subject to the approval of API shareholders at another general meeting.

Other major corporate activity

Regional REIT announced that it was exploring a possible equity capital raise of around £75m through a rights issue that would be at a material discount to the current share price. The rights issue was one of a range of refinancing options it was exploring, including the issuance of new debt, the proceeds of which would be used to service an existing £50m retail bond that matures in August 2024.

Real Estate Investors announced it was to conduct an orderly strategic sale of the company’s portfolio over the next three years. Assets will be sold individually, as smaller portfolios or as a whole portfolio sale, with the initial priority to repay the company’s debt. The company said that the ongoing substantial discount between the share price and NAV, combined with a lack of liquidity in its shares, was behind the decision. The pace of the disposals will depend on market conditions, however the company said it intends to secure disposals at book value or higher to maximise returns to shareholders.

The chairman of scandal-hit Home REIT, Lynne Fennah, was replaced by Big Yellow Group director Michael O’Donnell. Fennah will remain on the board as a non-executive director for “continuity”. The remaining directors of Home REIT’s board will all step down when the company publishes its financial results (slated for the second quarter of 2024).

NewRiver REIT appointed Lynn Fordham as chair designate. She will succeed Baroness Ford OBE as non-executive chair of the board on 30 May 2024. Fordham has extensive board level experience gained as an executive director and non-executive director of listed companies. She is currently non-executive director and of NCC Group plc, Caledonia Investments plc, Domino’s Pizza Group plc and Enfinium Group Ltd.

Land Securities launched and priced a £300m bond with a maturity of 7.5 years and a coupon of 4.75%, representing a spread of 103 basis points over the reference gilt rate. This followed the maturity of two bonds in February 2024, totalling £417m. The bond will extend the group’s weighted average debt maturity to 9.4 years.

Major news stories

- British Land sold a 50% stake in its 1 Triton Square office, in London’s Regent’s Place, to Royal London Asset Management Property for £192.5m. This was the building that Meta (Facebook) surrendered its lease on last year, paying British Land £142m in order to walk away from its lease agreement.

- Shaftesbury Capital bought 25-31 James Street, Covent Garden, London for £75.1m. The properties have a contracted rent of £3.9m and comprise 21,000 sq ft of lettable area.

- Sirius Real Estate acquired Vantage Point Business Village, a business park in Gloucestershire, for £48.25m, representing a net initial yield of 10.2%. The purchase was made using proceeds from the company’s £147m capital raise.

- Life Science REIT leased 7,497 sq ft of space at the Innovation Quarter at Oxford Technology Park to ColdQuanta UK Limited at a substantial premium to the rent level of the park. ColdQuanta will pay an annual rent of £337,365, equating to £45.00 per sq ft for 10 years.

- Supermarket Income REIT acquired a Tesco omnichannel supermarket in Stoke-on-Trent, Staffordshire, for £34.7m, reflecting a net initial yield of 7.5%. The asset comprises 54,451 sq ft net sales area and a petrol filling station.

- abrdn European Logistics Income completed the sale of a 30,180 sqm warehouse in Meung sur Loire, France, to Castignac for €17.5m. The disposal price of the vacant asset was in line with the 31 December 2023 valuation but a 7% discount to the 30 September 2023 valuation.

- abrdn Property Income Trust sold two assets for a combined £16.55m, reflecting a very slight discount of 0.3% to their 31 December 2023 valuations. The sales comprised the London office building 15 Basinghall Street for £9.8m and the industrial assets Opus 9 for £6.75m.

- The Financial Conduct Authority (FCA) launched an investigation into

Home REIT, after allegations of serious wrongdoing by its former manager Alvarium – the most serious of which centres on paying vastly inflated prices for assets to boost its NAV. - Hammerson agreed the sale of Union Square, a 52,000 sqm shopping centre in Aberdeen, for £111m. The price represents an 8% discount to the 31 December 2023 book value of £121m and a net initial yield of 11%. The sale concludes Hammerson’s £500m non-core disposal programme.

- Balanced Commercial Property Trust sold its largest office holding as it continues to reduce its exposure to the challenged UK offices sector. Contracts were exchanged for the sale of the Leonardo Building in Crawley, a 110,000 sq ft out-of-town business park office, for a price of £26.1m, representing a 6.1% discount to the December 2023 valuation.

Selected QuotedData views

Real estate research notes

An update note on Tritax EuroBox (EBOX). is sailing in calmer waters as demonstrated by a portfolio valuation that has changed little and a 30% uplift in earnings that now fully covers its 8.6%-yielding dividend.

An annual overview note on Urban Logistics REIT (SHED). The company appears to be a re-rating candidate as values stabilise and management extracts the rental reversion in the portfolio.

An update note on Lar España Real Estate (LRE SM). The company continues to defy the doom and gloom surrounding the retail sector, posting strong financial and operational numbers.

An update note on Grit Real Estate Income Group (GR1T). The company has been reborn, with the acquisitions of a developer and asset manager making annual return targets of 12-15% more achievable.

Legal

This report has been prepared by Marten & Co and is for information purposes only. It is not intended to encourage the reader to deal in any of the securities mentioned in this report. Please read the important information at the back of this note. QuotedData is a trading name of Marten & Co Limited which is authorised and regulated by the Financial Conduct Authority. Marten & Co is not permitted to provide investment advice to individual investors categorised as Retail Clients under the rules of the Financial Conduct Authority.

Accuracy of Content: Whilst Marten & Co uses reasonable efforts to obtain information from sources which we believe to be reliable and to ensure that the information in this note is up to date and accurate, we make no representation or warranty that the information contained in this note is accurate, reliable or complete. The information contained in this note is provided by Marten & Co for personal use and information purposes generally. You are solely liable for any use you may make of this information. The information is inherently subject to change without notice and may become outdated. You, therefore, should verify any information obtained from this note before you use it.

No Advice: Nothing contained in this note constitutes or should be construed to constitute investment, legal, tax or other advice.

No Representation or Warranty: No representation, warranty or guarantee of any kind, express or implied is given by Marten & Co in respect of any information contained on this note.

Exclusion of Liability: To the fullest extent allowed by law, Marten & Co shall not be liable for any direct or indirect losses, damages, costs or expenses incurred or suffered by you arising out or in connection with the access to, use of or reliance on any information contained on this note. In no circumstance shall Marten & Co and its employees have any liability for consequential or special damages.

Governing Law and Jurisdiction: These terms and conditions and all matters connected with them, are governed by the laws of England and Wales and shall be subject to the exclusive jurisdiction of the English courts. If you access this note from outside the UK, you are responsible for ensuring compliance with any local laws relating to access. No information contained in this note shall form the basis of, or be relied upon in connection with, any offer or commitment whatsoever in any jurisdiction.

Investment Performance Information: Please remember that past performance is not necessarily a guide to the future and that the value of shares and the income from them can go down as well as up. Exchange rates may also cause the value of underlying overseas investments to go down as well as up. Marten & Co may write on companies that use gearing in a number of forms that can increase volatility and, in some cases, to a complete loss of an investment.