Long-term dynamics remain strong

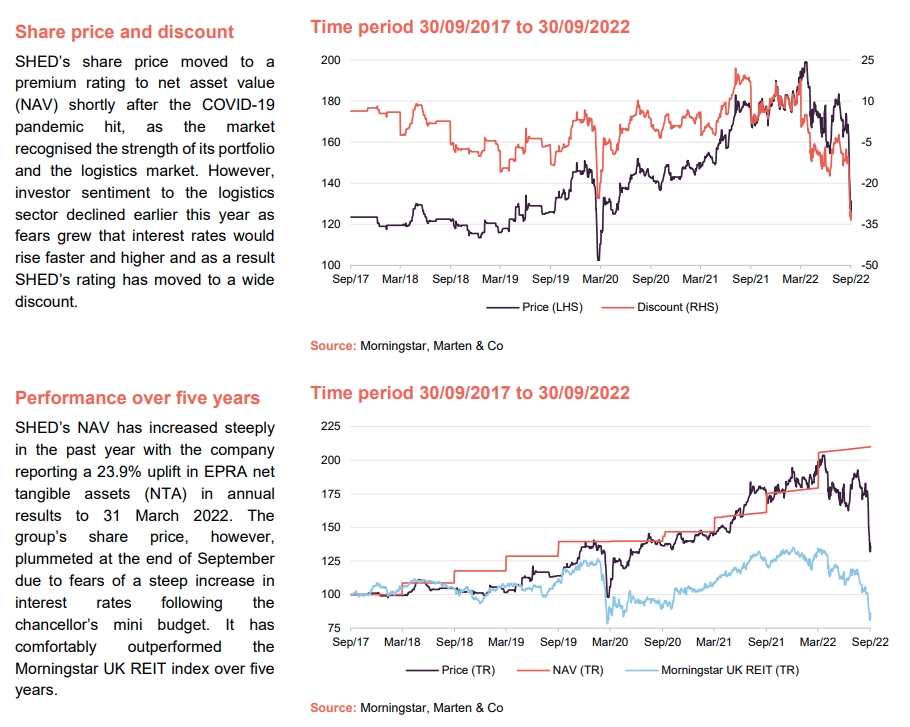

Recently, Urban Logistics REIT’s (SHED’s) share price has fallen to a wide discount rating to its net asset value (NAV), as the rising cost of debt and concerns over a protracted recession have hit sentiment towards the logistics property sector. However, the long-term trends that have characterised growth in the sector remain and are even more acute in the ‘last mile’ sub-sector that SHED operates. Supply of logistics space is at record lows, while tenant demand is robust, with lettings for the first half of the year at record highs.

The strength of SHED’s tenant base (86% rated low/low-moderate risk) gives the manager confidence going into a recession, while rental rises in line with inflation should be absorbed by the tenant base due to the essential nature of the goods they distribute. Most of SHED’s leases are subject to open market rent reviews, which capture the effects of inflation.

Around 83% of SHED’s borrowings are fixed or hedged and have an average maturity of over five years, giving it protection from rising interest rates. New loan facilities will give it extra firepower to expand its portfolio as it looks to take advantage of pricing opportunities in the current market.

‘Last mile’ logistics

SHED invests in a diverse portfolio of single-let, urban logistics properties located in the UK, with the aim of providing its shareholders with a 10% to 15% total return per annum.

Fund profile

SHED invests in and manages a portfolio of urban logistics assets – defined as smaller single-let warehouses (in the 20,000 sq ft to 200,000 sq ft size range) located close to major conurbations across the UK – which is diversified by tenant. SHED is the only real estate investment trust (REIT) wholly focused on these assets. The strategy aims to capture rental value growth through active asset management initiatives and upward momentum in rents and capital value.

Initially, SHED was listed on the AIM market of the London Stock Exchange on 13 April 2016 as Pacific Industrial & Logistics REIT. The group deployed the capital (and debt) from its IPO into a portfolio of 11 urban logistics property assets across the UK and has since made several successful placings to grow its portfolio. It now has a portfolio of 113 assets, worth £1,015m at 31 March 2022. It changed its name to Urban Logistics REIT on 25 April 2018.

SHED’s share capital was admitted to the main market of the London Stock Exchange on 7 December 2021. Since then, the company has been a constituent of the FTSE 250 Index. SHED has a conservative capital structure and a measured approach to the use of debt, with a target loan to portfolio value (LTV) of 30% to 40%. At 31 March 2022, the group’s LTV was 11.3%. The company plans to increase this to the lower end of the company’s target range with the drawing of new debt facilities (more information on page 18).

The manager – PCP2 Limited

The company’s manager is PCP2 Limited – part of the Pacific Investments Group, which was founded by Sir John Beckwith and has an extensive track record in real estate, having developed more than 65m sq ft of real estate assets globally. SHED’s manager is led by Richard Moffitt and Christopher Turner. Richard is chief executive and looks after investment management, while Christopher looks after the asset management. They are backed up by a financial team, led by Stuart Roberts.

Both Richard and Christopher have considerable sector knowledge and have a long track record of success in logistics and real estate, built up over more than 25 years. The manager identifies and acquires assets (the majority of which have been sourced off-market, utilising its contacts and reputation in the sector) and implements its asset management strategy to create value for shareholders.

Market outlook

SHED focuses on a specific sub-sector of the wider logistics market that enables the last part of a product’s journey in the supply chain to homes or businesses. The manager calls this ‘last touch’, but another popular term is ‘last mile’ logistics. SHED’s tenants are typically third-party logistics companies and UK businesses that deliver staple domestic products to homes and businesses and require ‘last mile’ or e-fulfilment services.

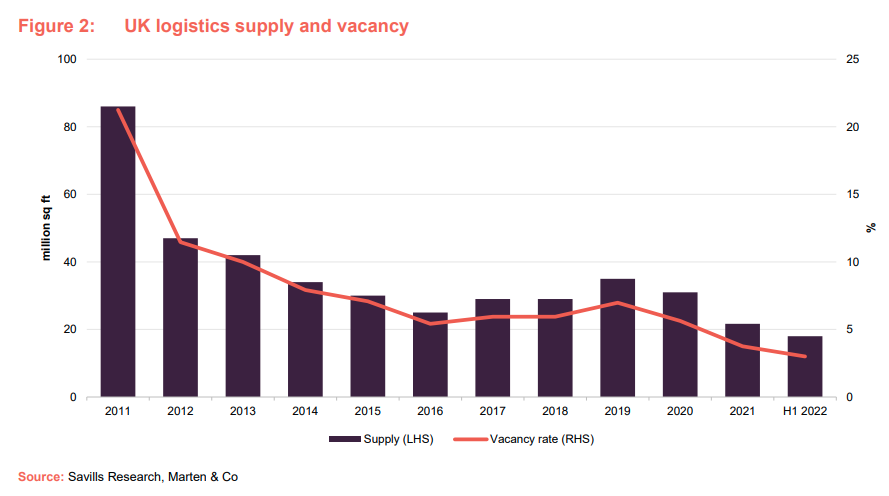

The properties that SHED invests in are typically located close to and on the fringes of major towns and cities in the UK. They are usually 20,000 sq ft to 200,000 sq ft in size and let to a single tenant. It is the part of the market that is the most supply-constrained and has also witnessed strong demand growth for many years. This supply-demand imbalance has led to rental growth across the sector, with SHED reporting 16.4% rental growth across its portfolio in the year to 31 March 2022.

Investor sentiment towards the logistics property sector has fallen in the past few months for a number of reasons, not least over fears of higher and faster interest rate hikes exacerbated by the chancellor’s ‘mini-budget’ announcement at the end of September. Higher interest rates increase the likelihood of investment yield erosion (capital values falling) in the real estate sector as the higher cost of borrowing is factored into potential investors’ return projections. Downbeat views on expansion from Amazon (the perennial market leader in logistics space take-up) have also heightened fears that demand for space from the online retailing sector is on the wane, especially given soaring inflation and the cost-of-living crisis. This has hit the share price of the UK logistics-focused REITs, including SHED, and has seen their ratings swing wildly from large premiums to NAV to substantial discounts. However, the underlying fundamentals that have propelled the sector to dizzying heights in the past few years – strong demand and a chronic lack of supply – are still evident and suggest favourable dynamics for at least the medium term. The logistics market, therefore, finds itself in an odd paradox of growing rents and an inevitable drop in values.

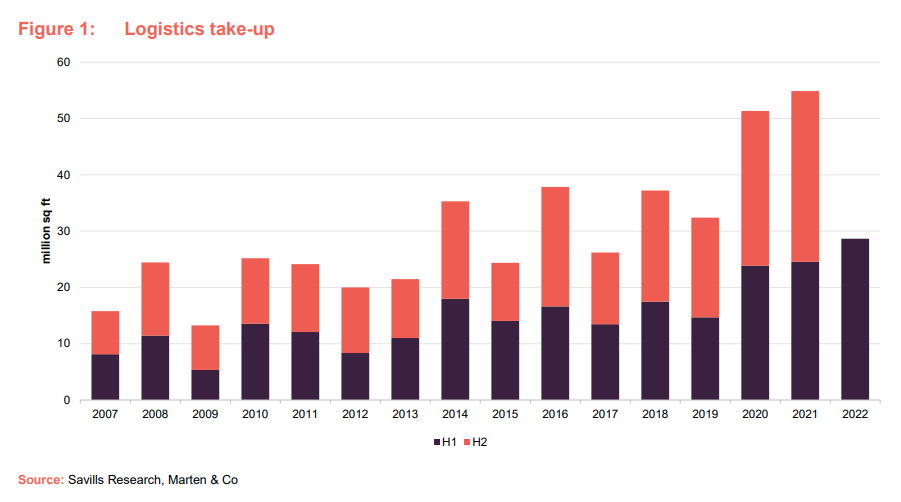

Occupier market still going strong

Around 15m sq ft of new leases were signed in the UK logistics sector in the second quarter of 2022, bringing the half-year take-up to a new record of 28.6m sq ft (surpassing last year’s half-year total of 24.5m sq ft), according to Savills.

Online retail, one of the largest factors behind the growth in demand for logistics space in the last few years, accounted for just 18% of the total (down from 35% last year) demonstrating that the market is not just reliant on the boom in e-commerce. There was a resurgence in demand from the manufacturing and automotive sectors, where concerns over supply chain resilience and the need to hold more inventory have become more important and are leading to more warehouse space requirements.

Online sales as a proportion of all retail sales in the UK stood at 24.8% in June 2022, the lowest level since before the onset of COVID-19 but still on the upward trajectory that has been witnessed over the past decade. The manager says that the reaction to Amazon’s first quarter earnings call – where Amazon’s chief financial officer, Brian Olsavsky, said that the company had overextended itself, and its aggressive expansion would slow – was over the top. The perception that Amazon is the market couldn’t be further from the truth, the manager adds, stating that the cyclical shift to online retailing is about a myriad of different businesses, such as pharmaceuticals and critical goods. Looking forward, there is 19.4m sq ft worth of new lettings under offer (including pre-let developments), according to CBRE and 200m sq ft of longer-term occupier requirements logged by Savills.

On the supply side, there is currently just 18.4m sq ft of available space, according to Savills, and CBRE estimates that ‘ready-to-occupy’ space remains at historically low levels of 1.2%. Figure 2 shows the supply and vacancy rate since 2011, with the current vacancy rate at 3.0%.

Construction of new buildings is unlikely to keep pace with demand. Savills is tracking 16.5m sq ft of speculative development (warehouses built without a tenant signed up to occupy the property) due for delivery in 2022 and 2023 (mainly in the ‘big box’ sub-sector where economies of scale can be achieved). Given the wider economic context, new announcements are expected to tail off. In the urban ‘last-mile’ sub-sector (where SHED operates) the supply/demand dynamics are even more constrained. For the first time, the majority of take-up was for ‘mid-box’ units (between 100,000 and 300,000 sq ft), while constraints on supply are even more acute.

The nature of urban logistics, being located close to large towns and cities, make gaining planning for this use class very difficult. In addition, build costs have been rising sharply, as well as the cost of land, resulting in the cost of building an urban logistics scheme exceeding the current values of a built property.

Impact of inflation

Inflation reached a 40-year high in July and tailed off slightly in August to 9.9% – driven primarily by surging energy and food prices following the war in Ukraine. SHED’s manager says that the company is well-positioned for an inflationary world, with its active asset management approach enhancing its ability to capture inflationary uplifts in rental income. The company has strong inflation protection baked into its leases, with the majority subject to annual open market rent reviews (76%), which mean the rent will rise to the higher of comparable deals in the market or indexation.

The squeeze on consumer spending is expected to hit retail expenditure and may see some businesses struggle with both rising costs and falling sales. The majority of SHED’s tenants deliver essential goods, are not under the same pressure as more discretionary goods retailers (details on SHED’s tenants are on page 11), and should therefore be in a good position to pass on inflationary price increases. A large proportion of SHED’s tenants (86%) are rated low/low-moderate risk by credit rating company Dun & Bradstreet (more detail on page 12), demonstrating the covenant strength of SHED’s income.

Investment market in a state of flux

In a bid to bring inflation under control, the Bank of England increased interest rates to 2.25% in September, with further rises forecast this year and next. The rise in the cost of debt is expected to see investment transaction volumes fall and prime yields, which have fallen to sub-3.5%, rise and capital values fall from their nadir point. The impact of a rising cost of debt on SHED is limited, with new debt facilities bringing its fixed-rate position to 83% and maturity to over five years (more detail on SHED’s gearing is on page 18).

Average UK commercial property values fell in July for the first time in more than a year, as capital markets reacted to the deteriorating economic outlook and interest rate environment. The logistics sector recorded the most significant decline, with a capital value fall of 1.4% against an all-property average fall of 0.5%, according to CBRE – the largest real estate valuer in the UK.

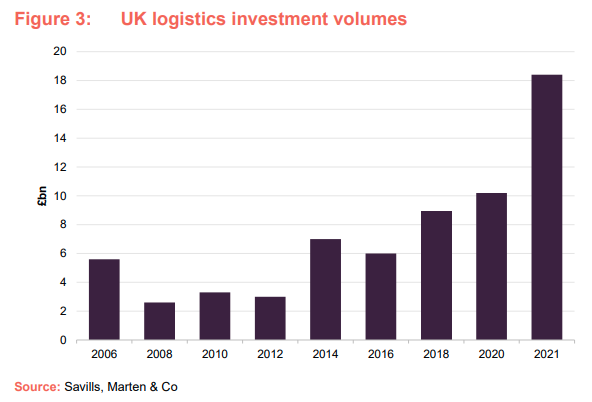

Meanwhile, total UK logistics investment volume of £4.2bn in the first half of 2022 was down 19% on the same period in 2021 as investors take stock and try to work out whether demand for logistics space will continue in the face of a wider economic slowdown.

A general reluctance to make capital investment decisions is expected to continue, with SHED slowing the rate of its investment as it looks to take advantage of potentially lower prices later in the year. Despite capital value growth stalling, robust demand and severe supply constraints mean the outlook for rental growth remains strong. Rental values increased 0.7% across the UK logistics sector over the month of July, with the South East posting a 0.9% monthly uplift.

The manager says that the supply and demand characteristics are more pronounced in the ‘last mile’ urban logistics sub-sector and SHED’s intensive asset management approach should generate greater returns than the wider market. In the year to 31 March 2022, 55% of the 25.4% like-for-like capital value uplift in its portfolio valuation was attributed to asset management initiatives (increasing rents and lease lengths) rather than market movement, which is quite some going, given the yield compression witnessed in the market over that period (more details on the asset management initiatives that has driven valuation growth is on page 12). Since launching in 2016, 71% of capital value growth is attributed to asset management.

Investment process

The company focuses on good real estate in good locations, with limited supply and strong occupational demand. The majority of the company’s portfolio is currently invested in completed, let investments and pre-let income-producing forward funded developments; however, a proportion may be invested in funding speculative developments, whereby a development scheme has yet to have a tenant signed up. These types of investments allow the group to source higher-quality, lower-priced assets than could be found in the investment market, but it takes on the letting risk.

All acquisitions must satisfy the following criteria:

- Location – good transportation links and workforce availability as well as strong tenant demand and limited supply of appropriate properties;

- Lot size – around £15m and 200,000 square foot in size, magnifying the results of active asset management;

- Tenancy – a focus on strong tenant covenants (avoiding the fashion sector), with a rating of low/low-moderate risk. Properties with riskier tenant covenants and/or short- to medium-term lease lengths are considered, enabling asset management initiatives to grow tenant covenant strength and lease length; and

- Price – at a level 30% to 70% of replacement cost, creating price resilience.

The majority of SHED’s acquisitions since it launched have been made “off market” (whereby the property is not openly marketed) where vendors sometimes prefer the certainty of the deal and are testament to its manager’s connections within the logistics sector and reputation for swift and certain deal execution. The company can also provide funding to developers (no more than 20% of gross asset value on development activity at any one time) and provide a sale-and-leaseback option to an occupier.

Active asset management

SHED likes to add value to an investment, and will favour assets that have asset management potential (such as near-term lease events or development opportunities) so it can increase rent and capital values. It will invest in properties where it has the potential to achieve rental growth and outperformance through:

- securing new tenants with stronger financial covenants;

- securing new lease terms focused on duration and rental growth built into the lease; and

- positive geographical characteristics, including age and repair; location; building quality; site cover; transportation links; workforce availability; and internal operational efficiencies.

In the year to 31 March 2022, SHED’s portfolio rose in value by 25.4%, with 55% of this valuation uplift attributable to asset management initiatives and 45% to market movement. Since inception 71% of the portfolio valuation uplift is due to asset management. More detail on SHED’s asset management initiatives is on page 12.

Environmental, social and governance (ESG)

SHED’s investment process involves the assessment of energy efficiency ratings to ensure properties are sustainable in the long term, while all new developments will have an Energy Performance Certificate (EPC) rating of A and a BREEAM sustainability rating of excellent or very good. The EPC rating across SHED’s portfolio was 76% A-C at the end of March 2022.

The nature of SHED’s assets (being single-let, mainly to large global logistics operators) mean that there is constructive dialogue between landlord and tenant on improving the ESG credentials of a building, with both sides showing willing.

Asset allocation

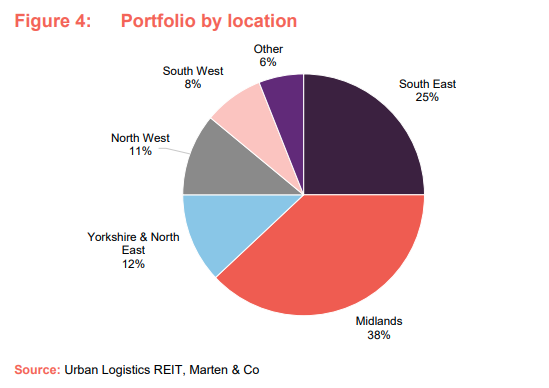

SHED has a portfolio of 113 assets worth £1,014.7m (at 31 March 2022) located across the UK, with a focus on the South East and the Midlands. The portfolio has a weighted average unexpired lease term (WAULT) of 7.7 years, with a spread of short- and long-term leases. Around half of SHED’s portfolio (51%) is categorised as ‘active asset management’ assets, which have shorter leases (average WAULT of 3.8 years) and provide the manager with opportunities to increase rent. Meanwhile 45% is ‘core assets’, typically let on longer leases (average WAULT of 12.2 years) and strong tenant covenants. The remaining 4% of the portfolio is forward-funded developments, either pre-let or speculative, with a target yield on cost of 6%.

Since the £250m equity raise in December 2021, SHED has deployed or committed £274m of capital and debt on 19 new acquisitions. The company deliberately slowed the pace of investment earlier this year to allow it to assess the impact of economic turbulence on the investment market and potentially take advantage of opportunities that may arise. The manager says that this approach was rewarded with the acquisition of five assets for £90m in August on “advantageous terms”. The majority of the recent acquisitions are income-producing assets with asset management potential, with one forward funding development commitment and one vacant property. The assets include:

- a 97,362 sq ft warehouse in Southall, west London, which was purchased for £46m in August at a net initial yield of 1.9%. The investment is highly reversionary, with the current tenant paying £10 per sq ft in rent and the market rent in the area being in excess of £25 per sq ft. The manager says that it is confident in quickly capturing the reversionary yield, with the current lease expiring in two months’ time, and anticipates signing a new long-term lease providing a yield of 4.2%;

- the £40.7m acquisition of a logistics asset at the East Midlands Logistics Hub at a net initial yield of 6.8%. The 72-acre site comprises four units totalling 672,300 sq ft and the potential for a further 175,000 sq ft of development. Three large units are let to Asfordby Storage & Haulage on short-term leases and the fourth unit is let to Royal Mail. The manager says that it is negotiating with potential occupiers about reletting the campus;

- a 249,211 sq ft logistics facility in Bardon, Leicestershire, acquired for £35.4m at a net initial yield of 4.7%. The property is let to DHL on a lease expiring in 2027;

- the group’s first central London property, acquired for £28m and a yield of 4.2%. The 94,841 sq ft Battersea property is let to Lookers Motor Group until 2041; and

- a 287,589 sq ft distribution warehouse in Goole, Yorkshire, purchased for £24m at a yield of 5.3%. The unit is let to E-Buyer (UK) Ltd until October 2036.

Tenants

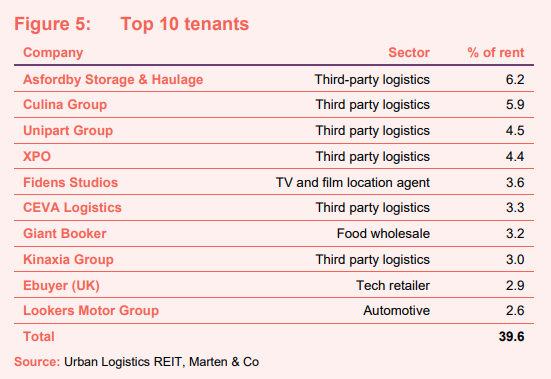

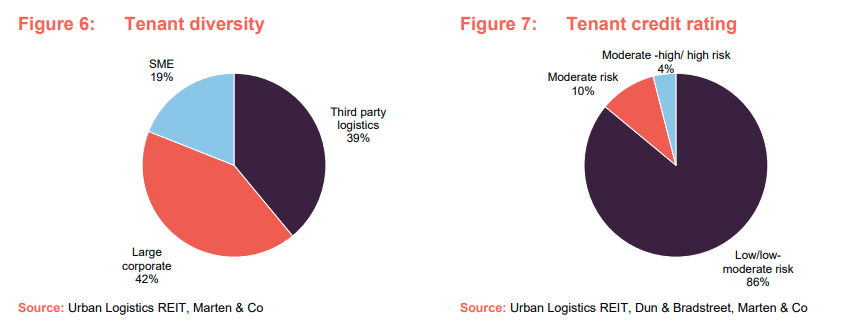

SHED’s top 10 tenants account for 39.6% of its contracted rent (down from 45.3% six months ago as it continues to grow and diversify its portfolio) and are made up of largely global third-party logistics operators, as shown in Figure 6.The manager states that a large proportion of the small and medium-sized enterprises (SME) category (19% of portfolio – as shown in Figure 6) is also made up of smaller third-party logistics companies. ‘Third-party logistics’ refers to the outsourcing of e-commerce logistics processes and includes inventory management, warehousing, and fulfilment. They typically run contracts for e-commerce companies from their sites. SHED’s second largest tenant, Culina Group, is the logistics arm of the Müller Group – the multinational dairy giant. The Unipart Group is running a contract on behalf of the NHS. SHED’s current largest tenant is Asfordby Storage & Haulage, which is the tenant at its recently acquired East Midlands Logistics Hub asset. The company will move out at the end of its lease in 2023, with SHED’s manager in discussions with prospective tenants. Other top 10 tenants that may not be household names include Fidens Studios, which provides production space for a large US studio.

Figure 7 shows that 86% of tenants across SHED’s portfolio have been rated low/low-moderate risk (as a percentage of contracted rental income) by Dun and Bradstreet, which is reflected in rent collection figures during the pandemic of near-100%.

Asset management initiatives

In the year to 31 March 2022, SHED completed 25 lettings or rent reviews across 18% of the portfolio, achieving like-for-like rental growth of 16.4% overall and generating an additional £6.4m of annual rent. The deals consisted of 16 new lettings, worth £5.9m in new rent; five lease re-gears – worth an additional £0.3m of rent at a 16.4% uplift to previous rent; and four rent reviews at an average of 13.6% above previous rent adding £0.2m to the rent roll.

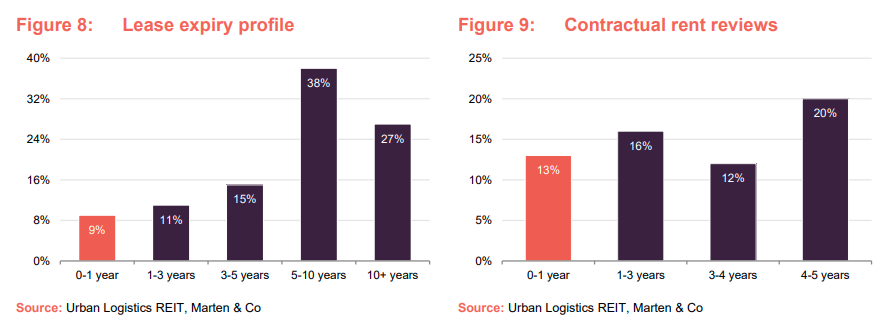

Around 22% of the portfolio is subject to a rent review or expiry over the 12-month period to March 2023, as shown in Figures 8 and 9, providing the manager with further opportunities to grow rent and in turn capital values.

Being able to grow the valuation of its portfolio through asset management (71% of portfolio valuation uplift since inception has been due to asset management initiatives) means that the value of the portfolio is less reliant on the wider market and it is somewhat shielded from a turn in market conditions and valuation falls.

SHED has also driven value through speculative and pre-let developments. It invested £52.9m in the year to March 2022 across nine forward-funded developments. It completed four schemes, totalling 172,433 sq ft, at a cost of £26.6m – with 57% of the space let or under offer worth £0.9m in rent. When the remaining space – which has an estimated rental value (ERV) of £0.6m – is let the yield on cost for all four completed projects would be 5.7%. The projects were valued (at 31 March 2022) at £34.2m, reflecting a 28.6% uplift on cost. A further five development projects totalling 547,304 sq ft are under construction or committed to with a gross development cost of £60.4m. These are expected to generate £4.3m in annual rent and provide a 7.2% yield on cost.

The risks associated with inflation rises in construction and wider supply chain issues is met by SHED’s developer partners, with fixed-price forward funding costs set at the outset.

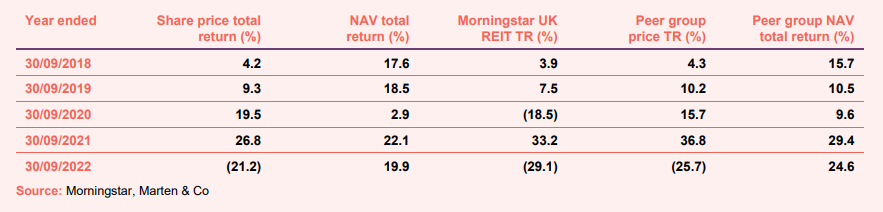

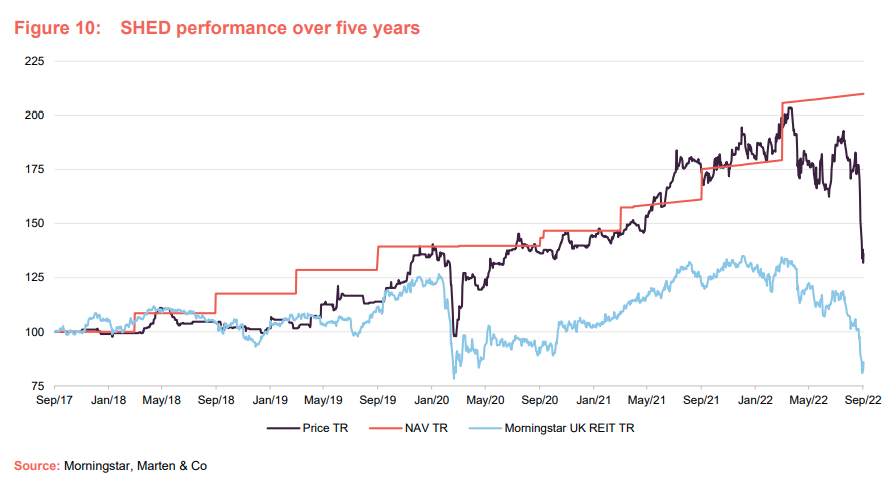

Performance

SHED’s NAV made strong progress since its inception, as the manager expanded the portfolio, and valuations increased through a combination of asset management initiatives and market movement. The NAV has increased steeply in the past year with the company reporting a 23.9% uplift in EPRA NTA in annual results to 31 March 2022. The group’s share price plummeted at the end of September due to fears of a steep increase in interest rates following the chancellor’s mini budget.

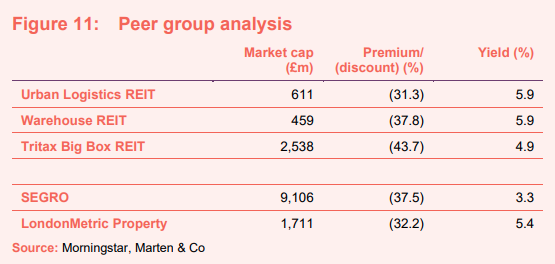

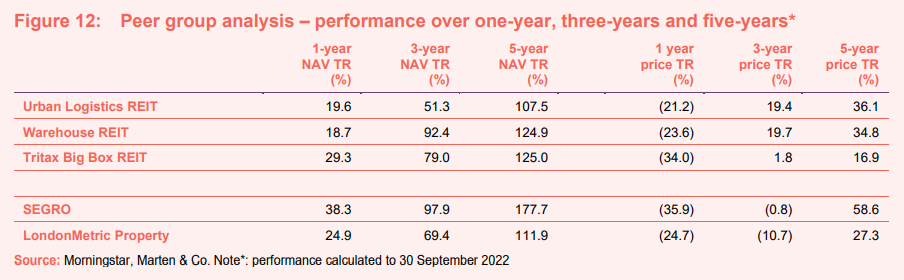

Peer group comparison

SHED has been allocated to the Property – UK Logistics sector by the AIC, a sector which also comprises Warehouse REIT and Tritax Big Box REIT. As previously mentioned, there is no other listed company that is exclusively focused on the urban logistics sub-sector and therefore it is difficult to make a like-for-like comparison.

Warehouse REIT’s portfolio is more focused on multi-let industrial assets (which have a completely different tenant base type and is more exposed to SMEs), while Tritax Big Box REIT is focused on the larger end of the logistics market (warehouses in the 500,000 sq ft plus size range), which perform a different role in the supply chain to urban logistics.

We have included other listed property companies focused on the industrial and logistics sector for further comparison. SEGRO is by far the largest and has a mixed portfolio of big box assets, urban logistics and developments. LondonMetric has a big weighting to urban logistics assets, but also owns big box and a separate long-income portfolio.

SHED is on the smaller end of the peer group but has a comparable NAV and share price total return performance and a superior dividend yield. Given the acute supply and demand characteristics in the urban logistics sector, as described in previous sections, the strength of SHED’s tenants, and the manager’s ability to add value through asset management, the company’s discount and dividend yield are particularly attractive.

NAV and portfolio valuation

SHED publishes its NAV twice a year, based on portfolio valuations, which are approved by the board prior to publication. Independent international real estate consulting firm CBRE performs the valuation, in accordance with the Royal Institute of Chartered Surveyors (RICS) guidance. Each property is unique, and the fair value includes subjective selection of assumptions, most significantly the estimated rental value and the yield. These key assumptions are impacted by a number of factors including location, quality and condition of the building, tenant credit rating and lease length. Whilst comparable market transactions can provide valuation evidence, the unique nature of each property means that a key factor in the property valuations are the assumptions made by the valuer.

In October 2019, the European Public Real Estate Association (EPRA) published new best practice recommendations for financial disclosures by public real estate companies and introduced three new measures for reporting net asset value: EPRA net reinstatement value (NRV), EPRA net tangible assets (NTA) and EPRA net disposal value (NDV). SHED considers EPRA NTA to be the most relevant measure for its operating activities and has been adopted as the group’s primary measure of net asset value, replacing previously reported EPRA NAV.

Dividend

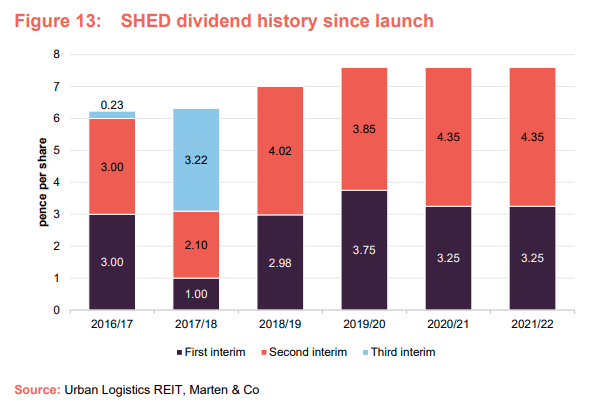

SHED declared a second interim dividend for the year to 31 March 2022 of 4.35p per share, bringing total dividends paid to shareholder for the year to 7.6p – in line with the previous year, despite new shares being issued. The annual dividend has grown steadily since it launched in 2016, as shown in Figure 13, and the level been maintained over the past three years. The board says that it intends to at least maintain the dividend at the current level for the year to March 2023.

Premium/(discount)

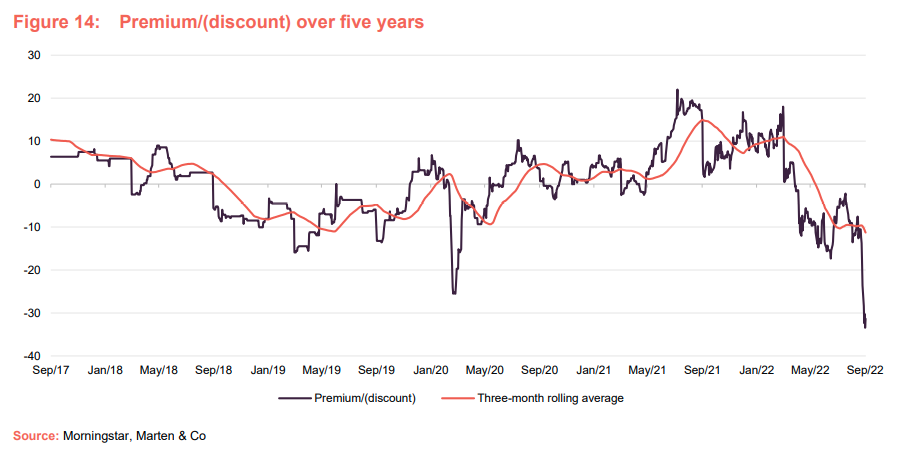

SHED fluctuated between trading at a discount to NAV and a premium for much of its existence (the early days were skewed by a lack of liquidity in its shares). It moved to a premium rating shortly after the COVID-19 pandemic hit, as the market recognised the strength of its portfolio and the logistics market. At one point it was trading at a 20%-plus premium in August 2021. As investor sentiment to the logistics sector declined earlier this year as fears that interest rates would rise faster and higher (exacerbated by the chancellor’s ‘mini-budget’ on 23 September), SHED’s rating moved to a wide discount. At 3 October 2022, it was trading at a 31.3% discount.

SHED has the authority to buy back or issue ordinary shares to address anomalies in the share price performance, if necessary. In the event that the ordinary shares trade at a discount, SHED has authority to repurchase up to 14.99% of its issued share capital. Similarly, should the shares trade at a premium, SHED has the authority to issue new shares that could be used to satisfy any excess market demand.

Fees and costs

SHED’s management fees are charged according to the following structure: 0.95% per annum of the group’s EPRA NTA up to, and including, £250m; 0.90% per annum in excess of £250m and up to and including £500m; and 0.85% per annum in excess of £500m. The management agreement runs until April 2024, with a 12-month termination provision.

A long-term incentive plan (LTIP) is in place, which has both NAV and share price elements. It is assessed for the period from 7 February 2020 to 30 September 2023 and is capped at three times the average annual management fees paid in that period. The NAV element is calculated as 5% of the excess return on EPRA NTA between the two dates, with an annualised 10% hurdle. The share price element is calculated as 5% of the amount by which the market cap of the company has grown between the two dates, with an annualised 10% hurdle.

The LTIP will be settled, at the board’s discretion, in either shares or cash, or a combination of both.

Cost ratio

SHED’s EPRA cost ratio was 21.8% at 31 March 2022 (March 2021: 21.3%). The manager expects this to reduce as gross rental income will benefit from a full period of rental income from acquisitions made in the year.

Capital structure and life

SHED has a simple capital structure with a single class of ordinary shares in issue and trades on the main market of the London Stock Exchange. As at 3 October 2022, there were 471,975,411 ordinary shares in issue and no shares in treasury.

Borrowings

SHED borrows money with the aim of enhancing shareholder returns and had total drawn debt of £239.4m at 31 March 2022. Following the equity raise in December 2021, the group’s loan to value ratio (LTV) was on the low side at 11.3% at 31 March 2022. The company plans to bring the LTV back up to its target range of between 30% and 40%, with the drawdown of new debt facilities worth around £122m (in May it secured a £47m loan with Aviva Investors and in August it secured a new facility worth £75m). This, it estimates, would put its LTV at around 31% once drawn down.

The weighted average debt maturity was 3.7 years and the weighted average cost of debt was 2.6% at 31 March 2022. Of the debt facilities, 74.2% was fixed. With the post-year-end £122m debt facilities secured, the average maturity will move to over five years, cost of debt to 3.3% and around 83% fixed.

The group’s debt facilities consist of:

- a £151m loan facility with Barclays, Santander and Lloyds (which replaced an existing loan facility, totalling £76m, which was due to expire in December 2022). This facility matures in August 2024;

- a £48.4m sustainable green debt facility with Aviva Investors, which was entered into in March 2021, providing a seven-year term, and comes at a fixed cost of 2.34%;

- a further £40m loan facility with Aviva Investors, secured in February 2022, with a term of seven years and a fixed rate of 2.26%;

- a £47m facility, again with Aviva Investors, agreed in May with a term of 10 years and a fixed rate of 3.52%; and

- a £75m loan facility with Aviva Investors, agreed in August, with a 10-year term and a fixed rate of 3.99%.

At 31 March 2022, SHED’s cash balance was £127.4m, of which £40.6m is earmarked for new developments.

Financial calendar

SHED’s year-end is 31 March. The annual results are usually released in June (interims in November) and its AGMs are usually held in July of each year. SHED pays two interim dividends per year in June and December.

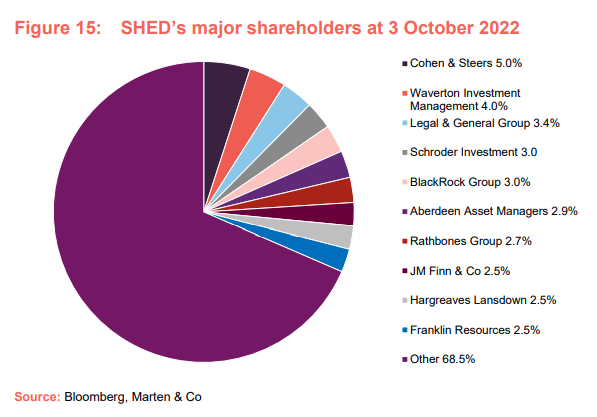

Major shareholders

Management team

The manager has an experienced team of investment and asset management specialists, with specific expertise in the logistics property sector. The team has the ability to access off-market transactions in the logistics real estate sector through an extensive and established network across the UK. Key senior personal include:

Richard Moffitt (chief executive)

Previously an executive director at CBRE, where he was head of the UK industrial team, Richard has over 25 years’ experience of the UK industrial and logistics markets. He has an in-depth understanding of the market’s dynamics, credibility with owners and operators of real estate assets, a thorough understanding of owner and tenant requirements and an extensive network, which includes institutional funds. Richard is a member of the Chartered Institute of Logistics and Transport.

Christopher Turner (property director)

Christopher is a Chartered Surveyor with more than 25 years’ experience in the UK and European investment markets, where he has built up extensive contacts with investors and developers of industrial, office and retail real estate. He has considerable experience in the acquisition, management and disposal of investments through all sectors, focusing on tenant management, covenant performance and active asset management to achieve overall investment returns.

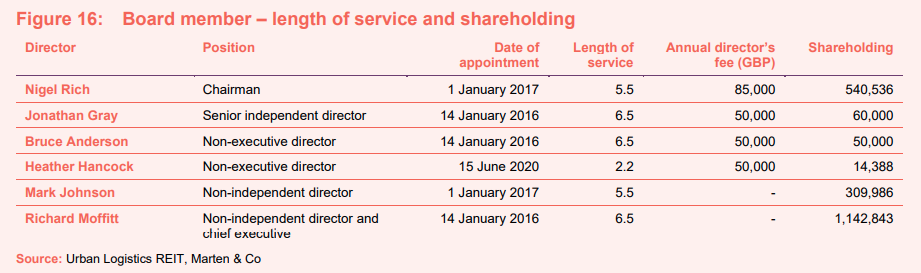

Board

SHED’s board is comprised of six directors, four of whom are considered to be independent of the investment manager (Mark Johnson and Richard Moffitt both have an interest in the manager). All directors stand for re-election on an annual basis.

Nigel Rich

Nigel has a wealth of board experience, having operated across the world in senior positions, most recently at SEGRO Plc. He served as the group chief executive of Trafalgar House Plc from 1994 to 1996 and previously spent 20 years at the Jardine Matheson Group in Asia, serving as a managing director from 1989 to 1994.

Nigel has served as the chairman of the board at Hamptons International, Excel Plc, Xchanging plc and most recently at SEGRO Plc, from October 2006 until April 2016. His other directorships have included Pacific Assets Trust Plc, Granada Plc and ITV Plc. He has also served as a member of The Takeover Panel (UK) and is a Chartered Accountant. Current external appointments include Matheson & Co Ltd and AVI Global Trust Plc.

Jonathan Gray

Jonathan has extensive financial services experience, having worked in senior roles at HSBC, UBS and NCB. He has worked on numerous flotations, including a number of property companies such as Property Fund Management, Cleveland Trust and CLS Holdings. From 2010 to 2014 he was the non-executive chairman of PGF II SA, a London-based £200m private property fund. Jonathan currently works as a financial adviser/consultant to a variety of international companies.

Bruce Anderson

Bruce has considerable real estate and financial services experience, having worked in senior roles at Lloyds, HBoS and Bank of Scotland with 15 years of investment-led boardroom positions. He has experience with both real estate companies and REITs across the UK, Europe and the Far East. At Lloyds he was head of joint ventures for the specialist finance division, responsible for a mixed portfolio of real estate, including both equity and debt elements. Bruce is a Chartered Accountant and currently a non-executive director at Green Property Limited.

Heather Hancock

Heather has many years of high-level experience in strategy, governance and leadership gained in the real estate sector and wider economy. She is currently Master of St. John’s College, Cambridge, and was previously chairman of the Food Standards Agency. Heather was executive director of Yorkshire Forward between 2000 and 2003 leading on asset realignment and the assembly of a £350m property portfolio. She then spent a decade at Deloitte’s strategy consulting business, serving as a managing partner from 2008 until her 2014 retirement. Heather is a director of Amerdale Limited, a non-executive director of Rural Solutions Limited and a trustee of the Chatsworth Settlement Trust.

Mark Johnson

After qualifying as a lawyer, Mark worked in corporate finance at Barclays Merchant Bank and Barclays de Zoete Wedd before co-founding Pacific Investments Management Limited with Sir John Beckwith. He is a founding partner and shareholder/director of Pacific’s investment portfolio and private equity companies, including Liontrust, Thames River Capital, River & Mercantile, Argentex and Pacific Asset Management. Previously, Mark was chief executive of the Riverside Group, one of the UK’s leading leisure companies, under the chairmanship of Sir John, and oversaw its successful sale.

Previous publications

QuotedData has published two previous notes on SHED – our initiation note Shed load of growth to come, published on 10 August 2021, and our update note In the sweet spot, published on 22 December 2021. You can read them by clicking the links.

The legal bit

Marten & Co (which is authorised and regulated by the Financial Conduct Authority) was paid to produce this note on Urban Logistics REIT Plc.

This note is for information purposes only and is not intended to encourage the reader to deal in the security or securities mentioned within it.

Marten & Co is not authorised to give advice to retail clients. The research does not have regard to the specific investment objectives financial situation and needs of any specific person who may receive it.

The analysts who prepared this note are not constrained from dealing ahead of it but, in practice, and in accordance with our internal code of good conduct, will refrain from doing so for the period from which they first obtained the information necessary to prepare the note until one month after the note’s publication.

Nevertheless, they may have an interest in any of the securities mentioned within this note.

This note has been compiled from publicly available information. This note is not directed at any person in any jurisdiction where (by reason of that person’s nationality, residence or otherwise) the publication or availability of this note is prohibited.

Accuracy of Content: Whilst Marten & Co uses reasonable efforts to obtain information from sources which we believe to be reliable and to ensure that the information in this note is up to date and accurate, we make no representation or warranty that the information contained in this note is accurate, reliable or complete. The information contained in this note is provided by Marten & Co for personal use and information purposes generally. You are solely liable for any use you may make of this information. The information is inherently subject to change without notice and may become outdated. You, therefore, should verify any information obtained from this note before you use it.

No Advice: Nothing contained in this note constitutes or should be construed to constitute investment, legal, tax or other advice.

No Representation or Warranty: No representation, warranty or guarantee of any kind, express or implied is given by Marten & Co in respect of any information contained on this note.

Exclusion of Liability: To the fullest extent allowed by law, Marten & Co shall not be liable for any direct or indirect losses, damages, costs or expenses incurred or suffered by you arising out or in connection with the access to, use of or reliance on any information contained on this note. In no circumstance shall Marten & Co and its employees have any liability for consequential or special damages.

Governing Law and Jurisdiction: These terms and conditions and all matters connected with them, are governed by the laws of England and Wales and shall be subject to the exclusive jurisdiction of the English courts. If you access this note from outside the UK, you are responsible for ensuring compliance with any local laws relating to access.

No information contained in this note shall form the basis of, or be relied upon in connection with, any offer or commitment whatsoever in any jurisdiction.

Investment Performance Information: Please remember that past performance is not necessarily a guide to the future and that the value of shares and the income from them can go down as well as up. Exchange rates may also cause the value of underlying overseas investments to go down as well as up. Marten & Co may write on companies that use gearing in a number of forms that can increase volatility and, in some cases, to a complete loss of an investment.