Vietnam Holding Limited

Investment companies | Update | 20 June 2023

Building on firmer foundations

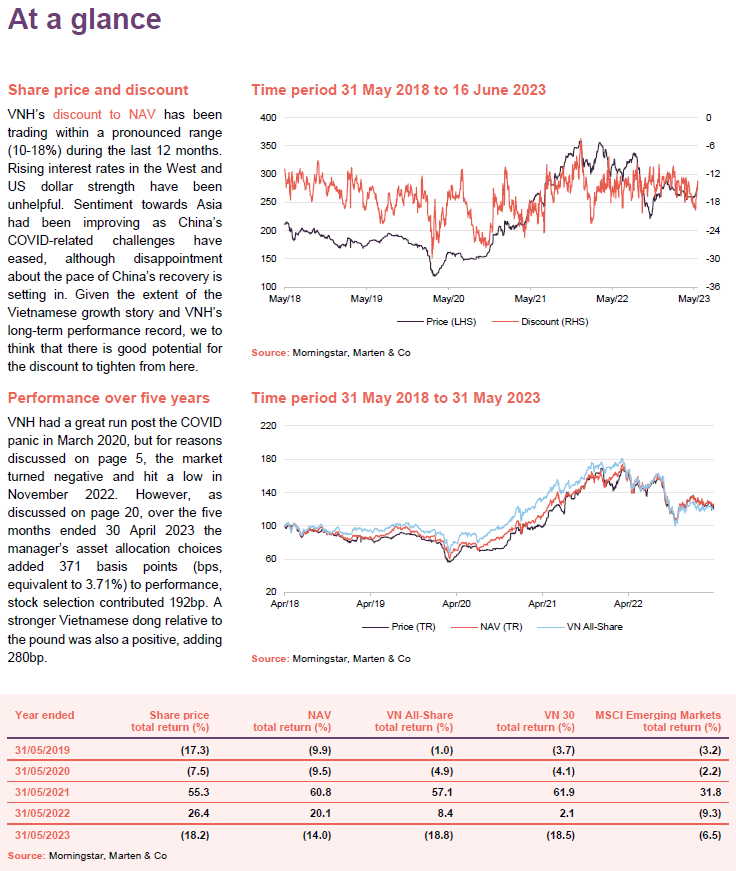

Vietnam Holding (VNH) has put in a compelling performance in net asset value (NAV) total return terms versus competing funds investing in emerging Asia (see page 24), but this is not being reflected in its share price. Presently, its share price is at a 13.5% discount to its NAV.

This is despite Vietnam’s long-term structural growth drivers remaining intact (see page 7) and a strong outlook for GDP growth over the next five years (the forecast is for an average of 6.7% a year through to 2028).

Within Vietnam, there was a meltdown in the corporate bond market last year, which affected its property sector and, while the Vietnamese government moved to address these issues and stabilised the currency, poor sentiment continues to weigh on the market, which does not seem justified.

VNH’s board has been authorising modest share repurchases to provide liquidity to shareholders, taking advantage of the recent high-teens discount (see page 29).

Capital growth from a concentrated portfolio of high growth Vietnamese companies

VNH aims to provide investors with long-term capital appreciation by investing in a portfolio of high-growth companies in Vietnam. These should come at an attractive valuation and demonstrate strong environmental, social and corporate governance awareness. It achieves this by investing primarily in publicly-quoted Vietnamese equities, but it can also invest in unlisted companies and can hold the securities of foreign companies if a majority of their assets and/or operations are based in Vietnam.

Market outlook and valuations update

Recent history and valuations

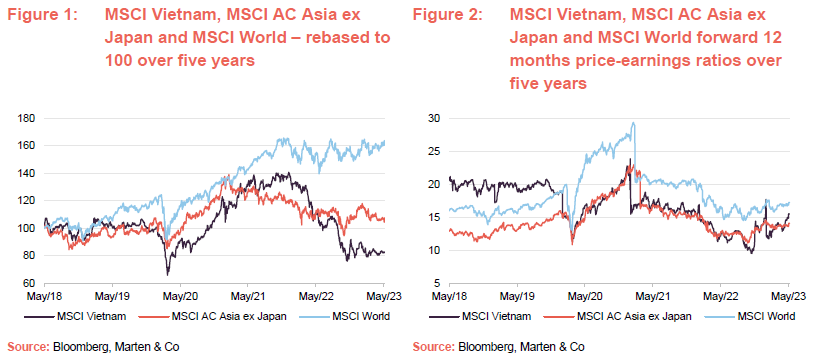

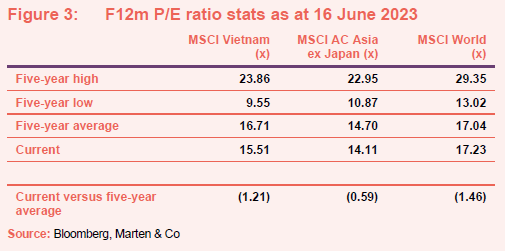

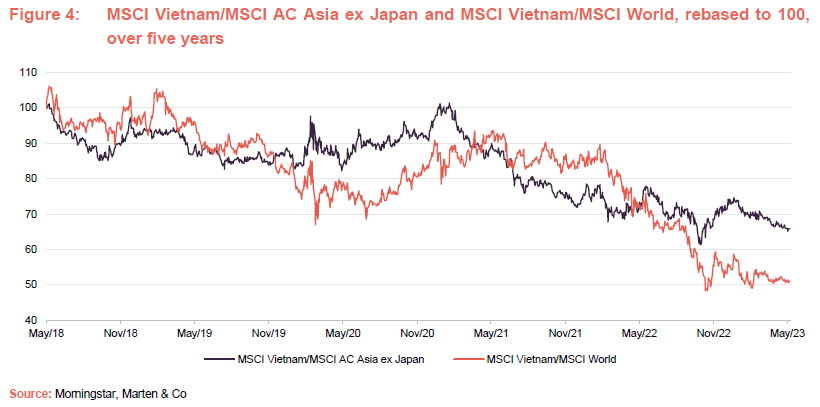

As is illustrated in Figure 1, over the course of 2022, Vietnam gave back the outperformance of emerging Asia and global equity markets that it had achieved in the aftermath of the COVID-related market collapse in March 2020. As is illustrated in Figure 2, Vietnamese, emerging Asia and global equities have become cheaper during the last couple of years, but in a turnaround in fortunes, have become more expensive in price-earnings ratio (P/E ratio) terms since we published in December last year (while share prices have retrenched, estimated earnings have moved down faster, nudging P/E ratios up). However, Vietnamese, emerging Asia and global equity markets forward 12 months PE ratios (F12m P/E ratios) all remain below their longer-term five-year averages (as is illustrated in Figure 3).

Vietnamese growth drivers remain in place

We have provided considerable discussion of Vietnam’s long-term term growth drivers in our previous notes, and we would recommend readers take a look at these (see page 30 of this note). However, to recap: the themes of strong GDP per capita catch-up potential (with Vietnam’s GDP per capita well below the average of its ASEAN peer group and significantly below world and developed market averages) – aided by factors such as a favourable demographic profile, natural resource wealth, and strong agricultural and traditionally strong tourism sectors – remain intact (pages 8 and 9 of our December annual overview provide a comprehensive list of Vietnam’s long-term structural growth drivers).

Furthermore, as we have discussed previously, Vietnam remains the largest of the frontier markets, and whilst it would appear to have receded for now, there remains the medium-term prospect that Vietnam could be upgraded from frontier market to emerging market status. This would almost certainly stimulate a lot of interest in the market as well as buying from index funds focused on the region.

Property debt and corporate bond market crisis

In September 2022, the Vietnamese government issued a new decree in relation to the offering and trading of privately issued corporate bonds (Decree 65/2022). The aim was to improve transparency for market participants by strengthening disclosure requirements, and the decree came in the wake of allegations of illegal activities, most notably in the property sector. The new decree acted as a brake on bond issuance, particularly for the property sector, precipitating a liquidity crunch in the fourth quarter of 2022 (unable to issue bonds to raise cash, some companies started to run out of money), with developers acutely affected.

During the decade to 2019, Vietnam’s real estate market experienced rapid growth (think of a virtuous circle of economic growth fuelling urbanisation), which required a significant level of financing. The property sector relied on the commercial banks, but these withdrew their lending in the aftermath of COVID-19 when buyers’ confidence waned and property sales slumped. The property sector turned to the bond market and there was a huge jump in corporate bond issuance. However, the slow collapse of Evergrande (a very large Chinese property company) in China brought Vietnam’s heavily indebted property sector increasingly into the spotlight. Around this time, there were reports of dubious dealings in the real estate market, which ultimately led to the arrest of Trinh Van Quyet, the chairman of real estate developer FLC. FLC is well known and has extensive interests in Vietnam and the arrest shook the sector, which started to grind to a halt again.

Fast forward to the second half of 2022, and there is persistently high inflation in two key markets for Vietnamese exports (the US and the EU), which is associated with interest rate rises. As the Vietnamese dong is a heavily-managed currency (a key focus for Vietnam’s central bank is keeping the currency within a target range against the US dollar), the State Bank of Vietnam (SBV) found that it was running down its foreign exchange reserves quickly (the SBV was selling down the foreign currency held in its reserve to buy the Vietnamese dong and therefore stabilise its price) and was ultimately forced to raise interest rates (this attracts money into the country and creates buyers for the dong), putting pressure on domestic bond issuers. The state of the bond market had not escaped the gaze of the authorities, which led to the announcement of Decree 65. Decree 65 required:

- that bond investors be certified as a ‘professional investors,’ meaning that they must confirm they had the knowledge to understand the risks they were taking;

- compulsory credit ratings for high-value bond issuances; and

- that firms could no longer issue bonds just to increase capital. Firms would only be able to use the capital raised for specific projects or to restructure debt.

The market did not have time to adjust to the new rules, and effectively froze, limiting flows to real estate firms in the process. However, the crackdown on the sector then saw the arrest of Truong My Lan, the chairwoman of real estate firm Van Thinh Phat Holdings, in October 2022, on the charge that she had committed bond fraud. It was rumoured that Van Thinh Phat Holdings was connected to Saigon Commercial Bank, and this led to a bank run (this was short-lived, as the SBV stepped in). The malaise in the corporate bond market and the real estate continued well into the new year.

To address these issues, a new Decree (Decree 08/2023) was issued in March 2023, which rolled back some of the bond market reforms included in Decree 65 and appears to have been broadly well-received by the market. Nonetheless, it has been a volatile period, with a number of projects put on hold. This has created uncertainty for prospective home buyers and sentiment towards the real estate sector remains challenged. VNH’s manager says that domestic investors are now returning to the market and there has been net foreign buying as well (cash-hungry domestic firms may welcome international support, which could offer an opportunity).

Taking a long-term view, urbanisation (the proportion of Vietnam’s population living in cities) is around 37%, which is where China was around 2000 and where the western world was around the end of the Second World War. This suggests that Vietnam’s cities will continue to expand and that millions more homes need to be built in Vietnam. In the short term, there has been a lot of volatility, but the long-term fundamentals and structural growth story remain intact. VNH’s manager thinks that many of Vietnam’s growing middle class still aspire to own their own homes and will be attracted to those companies with stronger brands and track records – the type that VNH invests in.

VNH’s manager thinks that the outlook is now improving, noting that the SBV was successful in stabilising the currency (having sold some US$10bn of reserves and raising its key policy rate three times in two months), to such an extent that it has since been able to ease monetary policy. The manager thinks that with the situation now under control, there could be room for further interest rate cuts from here, subject to inflation remaining in check. In the meantime, the government is in a position to indulge more accommodative economic policy and there are plans to cut VAT, which should boost domestic consumption.

Manager’s view – Vietnam: structural growth drivers remain in place, despite volatility

As we have discussed previously, Vietnam has benefited from a high and fairly stable growth rate during the last 30 years. With higher inflation and interest rates in its export markets, there are clearly challenges in the short term, but with strong structural growth drivers firmly in place, the manager expects this to continue. According to the IMF’s most recent World Economic Outlook (April 2023), Vietnam’s GDP growth is expected to dip to 5.8% this year, having surged in 2022, but is then expected to average 6.7% a year for the five years through to 2028. Vietnam looks set to return to its long-term (30-year) growth trend very quickly.

Vietnam has seen a marked uplift in its already positive trade surplus (US$6.35bn in Q1 2023 versus US$2.35bn for Q1 2022) and, even after the events described above, can still boast substantial foreign exchange reserves (about US$95bn, down from about US$110bn in January 2022).

VNH’s manager comments that, while there are challenges for its trading partners, much of Vietnam’s growth has been domestically driven in recent years. Although the manager is concerned for the outlook for the consumer, and has been adjusting the portfolio accordingly, consumer sectors are still booming and this has given Vietnam’s economy resilience in the past (for example, as the global economy was slowed by the pandemic).

VNH’s manager comments that there have been obvious challenges for the real estate sector but expects it will benefit from the new land law (discussed below). The manager notes that the outlook for public sector spending is also strong – public sector investment is set to rise from about US$20bn to US$28bn this year (it is already up 18% year-to-date) and the government has set out clear key performance indicators (KPIs) for how the money is to be used. Foreign direct investment (FDI) continues to be robust at c.US$20bn per annum and the manager expects this to continue (Taiwan, South Korea and Japan have traditionally been big investors into Vietnam, for example).

Considerable investment is required for Vietnam to shift its power generation to renewables and gas – VNH’s manager says that this is believed to be in the region of US$130bn over 10 years, or US$13bn per annum. As this is around 10% of GDP, this is a significant investment requirement and one that the government recognises needs the support of external investors if it is to achieve its goals. VNH’s manager says that the government is therefore keen to deepen the stock market and open up the bond market, and it expects that FDI and public expenditure will remain elevated for some time.

The new land law

The Vietnamese government is currently in the process of overhauling the regulations surrounding land-use rights and property ownership and in April issued a fourth draft of what will be the fifth enactment of land law in Vietnam (the previous one was enacted in 2013).

Broadly speaking, the most recent draft retains the fundamental principles of Vietnam’s previous laws – that is, land in Vietnam belongs to the people and the state acts as their representative. Reflecting this, the government’s role is to lease or allocate land to users, although in certain circumstances, it may recover land from existing users to lease or re-allocate to other users.

At present, key issues are centred on the mechanism by which a developer pays the government for land usage rights and how that price is determined (the uncertainty around these is deterring much needed investment that will, amongst other things, aid the process of urbanisation).

A process such as this needs to be transparent, but developers complain that it has not been, and the existing arrangements have become very controversial. As a consequence, government employees are reluctant to take the risk and sign off on new developments, which is holding up development. The new law, when enacted, is expected to deal with issues surrounding investor selection, land clearance, land price, land rent payment, and dispute settlement. VNH’s manager believes that the new law should help reduce corruption and increase the pace of development. For example, by clarifying the rules around owning the titles of condominiums (VNH’s manager thinks there may be a move towards a leasehold model), which should unblock demand as well. There are a number of real estate companies that the manager expects will benefit from the land law reform.

PDP8 – Vietnam’s roadmap for electricity generation to 2023

The Vietnamese government has recently published PDP8, its eighth national power development plan, which sets out a roadmap for the country’s electricity production through to 2030. The plan also includes a vision of what the country needs to achieve by 2045, if it is to achieve carbon neutrality by 2050. A summary of the key highlights from PDP8 is as follows:

- Vietnam’s total electricity generation capacity to increase to 150GW by 2030 (a 117% increase over its 69GW of capacity in 2020).

- Renewable energy production is a major focus of PDP8, which is targeting renewables accounting for almost 50% of the energy mix by 2030 – 19.5% from hydropower (down from 30% in 2020), 18.5% from wind (the majority will be onshore generation) and 8.5% from solar.

- Renewables could account for close to 67%, including hydropower, if the Just Energy Transition Partnership (JETP) pledges, to Vietnam, are met in full – see note below.

- Offshore wind generation capacity of 6GW by 2030, increasing to 70GW by 2050.

- Gas (both domestic and imported liquified natural gas – LNG) to account for 24.8% of the energy mix (37.3GW) by 2030. This is a fourfold increase in supply from 2020’s 9GW of capacity (while it still generates CO2 emissions, LNG is much cleaner than other sources of thermal generation – oil and coal, for example – and so is seen as a complimentary transition fuel on the path to net zero carbon emissions).

- The increase in gas capacity will come from 13 LNG-to-power projects which are expected to come online by 2030. A further 3GW of capacity is planned to come online by 2035 with the completion of two additional projects.

- PDP8 envisages a long-term plan to convert gas plants to run on hydrogen, with the development of a roadmap to achieve this, once the technology has become more affordable. There are targets to switch 7GW of gas plants over and between 16.4–20.9GW of LNG plants over, by 2050.

- Coal will remain a significant part of Vietnam’s generation but on a declining basis – accounting for 20% by 2030, compared to 31% in 2020. To phase-out coal in its entirety by 2050, the Vietnamese government has estimated that US$658bn of investment will be required, one-fifth of which will be needed within a decade.

- Electricity imports from both ASEAN and the Greater Mekong Subregion, with hydropower a potential source of generation, are also included in the plan. Under an agreement between Vietnam and Laos, there is a commitment to import 5GW of capacity from Laos by 2030, potentially increasing to 8GW by 2050. The 600MW Monsoon Wind power project is the first Vietnam-Laos cross-border wind project. All electricity generated is to be sold to Vietnam Electricity (EVN) under a 25-year PPA.

- Grid infrastructure needs to be updated, with links to other grids in the region to unlock the potential of renewables production within the region. The government has committed to building reliable 500 kV and 220 kV transmission grids and plans to accelerate the development of a smart grid construction roadmap.

- 300MW of battery storage capacity is being targeted by 2030 (note: the regulatory environment around grid scale batteries remains unclear. This will need to be developed if the government is going to attract the investment needed for substantial development in this area).

- Overall, the Vietnamese Government estimates that US$134.7bn of new funding will be required for the construction of new power plants and grid infrastructure laid out in PDP8, part of which it expects to come from foreign investors.

VNH’s managers think that the government’s plans are suitably ambitious and, while there are plenty of hurdles to be overcome, PDP8 underlines a clear commitment by the Vietnamese government to making significant reductions to the country’s carbon emissions. A significant amount of foreign investment will be required to achieve PDP8’s goals and the government will need to provide a suitable regulatory framework to attract this investment. However, the scale of the opportunity is significant, and the plan is positive news for companies that are positioned to help support the energy transition in Vietnam.

(Note: Vietnam’s JETP was finalised in December 2020 and the international Partnership Group members include the European Union, the United Kingdom, France, Germany, the US, Italy, Canada, Japan, Norway and Denmark, who have collectively committed to provide Vietnam with an initial US$15.5bn of public and private financing, over the next three to five years, to support the country in achieving its decarbonisation targets).

Banking

Non-performing loans (NPLs) have been a concern. However, the managers think that in the current cycle, things are different from in the past. Banks and state-owned-enterprises (SOEs) were reformed prior to COVID and banks are better capitalised, so they are better prepared for the current downturn. This means that the banks can support the real estate sector, and their own income is more balanced by source of revenue than it has been in the past – for example, they earn more fee income. They also have better margins and cost ratios. As discussed below, the manager has been adjusting VNH’s banking exposure.

Asset allocation

Concentrated and low turnover portfolio of Vietnamese stocks

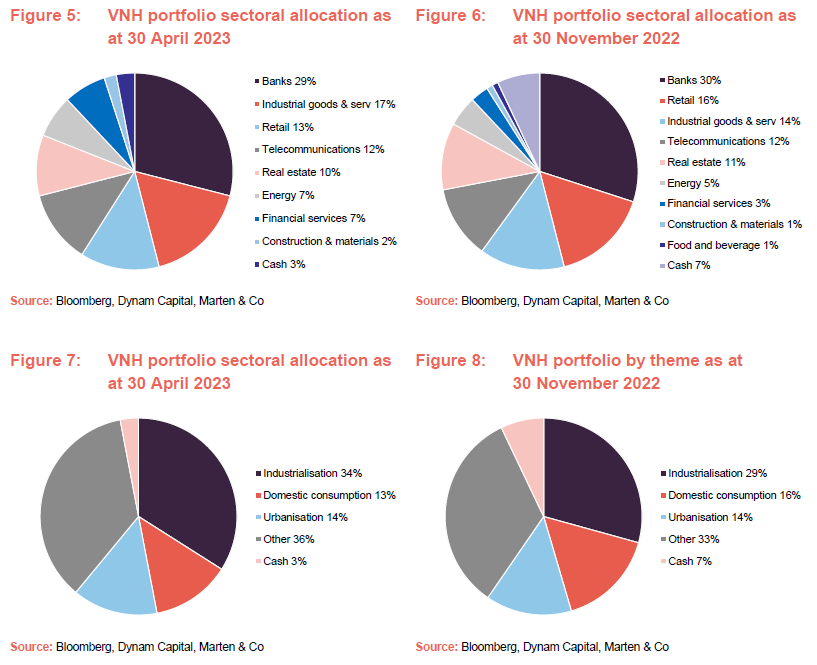

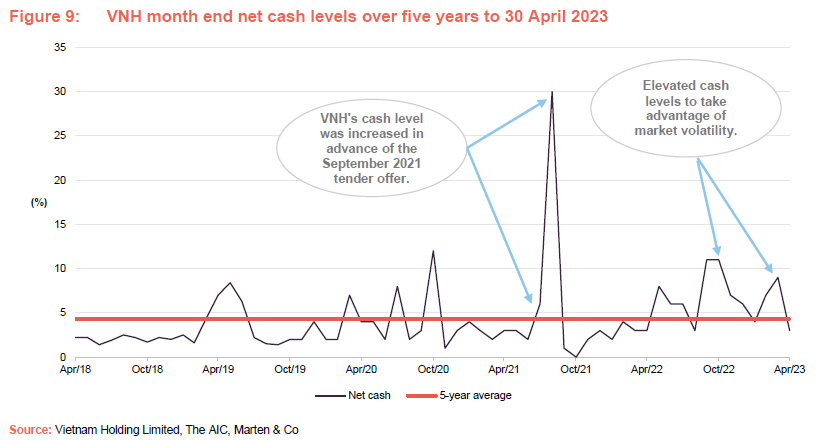

As at 30 April 2023, VNH’s portfolio had exposure to 23 securities, a modest increase from the 21 securities that it held at the end November 2022 (the most recently available information when we last published on VNH). As we have previously discussed, VNH’s portfolio is highly concentrated; it typically has exposure to between 20 and 25 securities (an average position size of between 4% and 5%), but actual position sizes can vary quite markedly (depending on valuation and the manager’s level of conviction).

As illustrated in Figure 10, the top 10 holdings accounted for 66.4% of VNH’s portfolio as at 30 April 2023, which is in line with the concentration at the end of October. The manager comments that while there has been a modest increase in the number of holdings, these are names that have been held previously and have been reintroduced to the portfolio.

The manager advises that recent portfolio turnover has been lower than the long-term average (typically around 35% per annum). Trading activity has centred around a shift within the exposure to the banking sector (away from more aggressive banks to more defensive ones), reducing exposure to consumer stocks and taking advantage of opportunities thrown up by higher volatility in markets.

Distinctly different from the index

VNH’s portfolio has a high active share.

As we have highlighted in our previous notes, VNH’s portfolio is distinctly different from the VN All-Share (or any Vietnamese-focused ETF for that matter). VNH’s portfolio has a high active share – typically 75–80% – and it should be noted that the index does not benefit from the manager’s strong focus on environmental, social and governance (ESG) considerations.

Banking sector exposure restructured

Since we last published, VNH’s manager has restructured the portfolio’s exposure to the banking sector to reflect a less certain economic environment, shifting away from what it describes as the more aggressive pro-cyclical banks into more stable defensive opportunities.

The key changes have been an increase in the allocation to Vietcombank and reductions in the allocations to VP Bank (discussed below) and MB Bank. VP Bank and MB Bank are smaller banking operations and have greater exposure to mortgage lending than some of their peers, meaning that they are more vulnerable to rising interest rates.

Other exposures

Exposure to retail has been reduced but VNH remains overweight the sector.

In addition to restructuring the banking sector exposure, the manager has also added to some small financial services companies, where it thinks that these will benefit from lower interest rates and will be early beneficiaries of the next cycle.

The allocation to real estate has seen a modest reduction although this is largely performance related (as discussed elsewhere, the real estate sector has been out of favour). The manager has added to smaller real estate companies as it thinks these will also be early beneficiaries of the next cycle.

As we have previously discussed, the portfolio has had a markedly higher allocation to mid- and small-cap stocks than the broader market (the VN All-share, by contrast, is heavily weighted towards stocks with market caps in excess of US$1bn).

Maintaining higher cash levels to take advantage of volatility

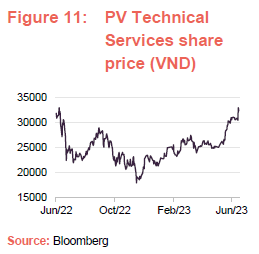

While VNH is permitted to borrow (up to 25% of its net assets), in practice, it does not have any debt facilities in place and generally maintains a small cash balance that is sufficient to meet its operating requirements. Figure 9 shows VNH’s month-end cash balance, as a proportion of net assets over the last five years. It illustrates that the cash level is not static and moves as the manager adjusts the portfolio to take advantage of prevailing opportunities.

It is clear from Figure 9 that, while the level has returned to just below its long-term average at the end of April, VNH’s cash balance has frequently been higher than its long-term five-year average during the last 12 months, particularly during the fourth quarter of 2022 and the first quarter of 2023. This is a period in which the manager was taking a relatively conservative approach to managing the portfolio, holding a higher cash balance both to take advantage of opportunities thrown up by volatility in the market and to provide some downside protection as the manager saw a number of macro and political risks. The last 12 months has seen some of the highest levels of cash that VNH has held apart from when it has been building up cash to fund previous tender offers – a more natural level of cash is 2-3%.

Top 10 holdings

Figure 10 shows VNH’s top 10 holdings as at 30 April 2023, and how these have changed since 30 November 2022 (the most recently available information when we last published). Seven of the top 10 holdings as at 30 April 2023 were constituents of VNH’s top 10 at the end of November 2022, although some of the relative positions have changed. New entrants to the top 10 are PV Technical Service, Hoa Phat Group and IDICO Corp, while Mobile World Corp, VP Bank and Khang Dien House have moved out.

We discuss some of the more interesting developments in the next few pages. However, readers interested in more detail on these top 10 holdings, or other names in VNH’s portfolio, should see our previous notes (see page 30 of this note).

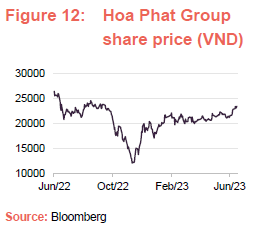

PV Technical Services (4.3%) – energy transition beneficiary

PV Technical Services (ptsc.com.vn), sometimes referred to as PVS, or more formally PetroVietnam Technical Services Corporation, provides an extensive range of technical services for the oil & gas, energy and industrial sectors. This includes EPCIC (engineering, procurement, construction, installation and commissioning) services for offshore facilities; EPC (engineering, procurement, and construction) services for industrial plants; geological surveys, remotely-operated vehicle (ROV) surveys and repairs of subsea facilities; offshore support vessels (the company owns and operates an extensive fleet); port and supply base operations (the company owns, manages and operates a nationwide network of ports and supply bases that run from the north to the south of the country); transportation, installation, operation and maintenance of offshore facilities; FPSO (floating production storage and offloading vessels) and FSO (floating storage and offloading units); and renewable energy.

The company, which is 51.38% owned by Vietnam Oil and Gas Group, has operations in Vietnam, Singapore and Malaysia. Its headquarters is in Ho Chi Minh and it employs around 8,000 people.

VNH’s manager has identified PV Technical Services as being well-positioned to benefit from the energy transition. The Vietnamese government has recently published PDP8, its eighth national power development plan, which sets out a roadmap for the country’s electricity production through to 2030 and beyond (see pages 8 to 10 for more discussion). The new master plan has a big focus on renewables, including offshore wind generation, onshore wind generation and solar photovoltaic (PV).

VNH’s manager believes that PVS, with its long history of offshore drilling services and fleet of tugs and equipment, will play a pivotal role in the development of offshore wind generation in Vietnam. However, the potential for the business runs beyond the energy needs of Vietnam. There are plans for a tie up with Singapore (a country with high energy demands and limited natural resources for production) including a proposal to build an 800km long undersea cable between Vietnam and Singapore which, if it is constructed, will be the world’s longest. PVS is advantageously positioned to play a major role in this development.

VNH’s manager observes that there is a clear commitment by Vietnam to cut its greenhouse gas emissions. In the short term, Vietnam needs more gas to make its energy production cleaner, while in the longer term, Vietnam needs more renewables; PVS has experience in both.

In terms of its ESG credentials, PVS has set out a number of aims. These are: to contribute to Vietnam’s energy security; respond promptly to oil and gas transportation and maritime related service demand; to operate at a profit, maintain and enhance shareholders’ capital; to ensure utmost benefits for shareholders, to ensure the welfare of and provide a favourable working environment for its employees; and to make a contribution to the community and to society.

Hoa Phat Group (4.2%) – long term structural growth from infrastructure development and urbanisation

Hoa Phat Group (hoaphat.com.vn/en) is a long time VNH holding that we have discussed in our previous notes – most recently in our December 2022 note (see page 17 of that note), where we discussed how VNH’s manager had taken profits on the position following a strong run of performance (it reduced the position significantly, taking it to below a 2% holding). However, since we last published, VNH’s manager has been adding to the position again, pushing it up the rankings and taking advantage of volatility in its share price.

To recap, Hoa Phat is primarily engaged in steel production (this is the core of the business accounting for over 90% of revenue and profit), where Hoa Phat is the largest domestic manufacturer, and it also has some agricultural and real estate interests. Hoa Phat has a uniquely integrated operation in Vietnam (from iron ore and coke production through to its finished products) and is a major supplier of rebar (reinforcing bar –a steel bar used as a tension device in reinforced concrete and other reinforced masonry structures to provide strength). There is a massive building programme in Vietnam, driven by the trend towards urbanisation and this demands a lot of rebar. Hoa Phat, as the key supplier, is a major beneficiary of this trend.

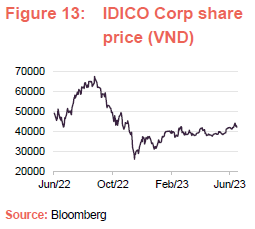

IDICO Corp (3.9%) – beneficiary of new energy master plan

In our December 2022 note, we discussed IDICO Corp (idico.com.vn) as a new VNH holding. To recap, this former SOE was established in 2000 to develop and construct industrial zones/parks, hydro power plants, road traffic schemes and urban and housing schemes. It was privatised a decade ago and has continued to develop and expand and now has one of the biggest landbanks in Vietnam.

VNH’s manager thinks that the industrial parks side of IDICO’s business is especially attractive and well-positioned to benefit from a number of long-term structural growth trends (see page 14 of our December 2022 note for more details of these trends, key assets and IDICO’s ESG credentials). This particularly applies to the development of infrastructure in Vietnam, specifically in Southern Vietnam, which will drive increases in value for IDICO’s assets (anecdotally, Northern Vietnam is benefitting from investment by Korean companies, while the South is benefitting from investment by Thai companies). IDICO is also benefitting from the ‘made in Vietnam’ policy.

IDICO already produces power for some of its tenants using rooftop solar and VNH’s manager believes that it is also advantageously positioned to benefit from PDP8 (as discussed on pages 8 to 10). Its portfolio has a significant area of rooftop space which could house solar panels, and PDP8 encourages this. IDICO can sell power both to its tenants and the grid though long-term power purchase agreements, giving it visibility of income on this investment. VNH’s manager has been adding to the position since we last published, which has helped push it up VNH’s rankings.

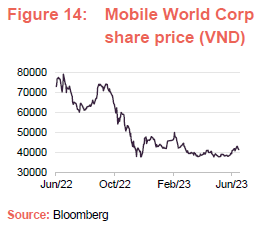

Mobile World Corp (3.9%) – trimmed to reduce exposure to retail

VNH has been invested in Mobile World (mwg.vn/eng) since September 2017 and we have discussed it in our previous notes (most recently in our March 2021 note, while more information on its ESG credentials can be found in our December 2019 initiation note – see page 16 of that note). The company is Vietnam’s largest retailer and is focused on three key areas: mobile phone retail (The Gioi Di Dong), consumer electronics retail (Dien May Xanh) and grocery retail (Bach Hoa Xanh). It also has investments in pharmacy retail (An Khang), which it increased its ownership interest in from 49% to 100% in 2021.

Mobile World has a 60% share of the domestic mobile phone market and a 50% market share of the consumer electronics market, which are very strong anchors for the business. However, VNH’s managers had previously been drawn to the stock by the company’s aspirations for its grocery retail business (a market worth around US$50bn per annum and one which it was targeting a 10% market share of by 2022), noting the company’s very strong record of execution (it operates in structural growth areas and has a strong track record of identifying winning sectors to enter). The company passed the 1,000-store mark within four years of opening.

The grocery business has been successful in taking market share from the traditional wet markets in Vietnam but there was a period of overstocking during COVID, as well as some challenges with logistics, which weighed on the unit’s profitability. To address this, the company restructured its inventory system, clearing out ineffective products; improved its quality control processes; and improved its logistics operations to allow it to better deliver fresh goods to stores in a shorter time frame. Following these improvements, a renovation programme to improve store layouts was rolled out, although supply chain issues slowed implementation. Nonetheless, VNH’s manager sees these as good examples of the types of innovation that it previously said that it believed would allow the company to keep its growth momentum, both from new store openings and existing store sales growth.

More recently, VNH’s manager has been trimming the holding, reflecting concerns that there could be a prolonged slowdown in retail, particularly at the lower end of the market. The company has also been preparing for a nationwide expansion in 2023, expanding its footprint in the north of the country significantly. Preparations for this saw the closures of some underperforming stores during 2022. The net effect has been improving operations and increasing margins and, with previous pent-up demand from COVID having rolled through, VNH’s managers felt it was a good time to reduce the position as it felt these positive developments were largely reflected in the share price (although the portfolio remains overweight retail as whole, given its exposure to Phu Nhuan Jewelry).

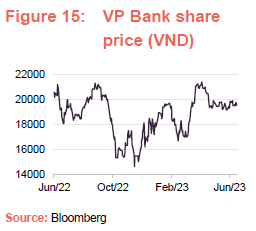

VP Bank (3.9%) – position trimmed as exposure to the banking sector has been rebalanced

Vietnam Prosperity Joint-Stock Commercial Bank, more commonly referred to as VP Bank (vpbank.com.vn) has been a constituent of VNH’s portfolio since its manager re-initiated a position in February 2020 (having previously divested its holding in May 2018 on the back of a strong performance). We have previously discussed how, in addition to its banking exposure, VP Bank also plays into the managers theme of gaining exposure to the consumer, through its consumer credit operation, FE Credit.

Established in 2015, FE Credit is the market leader in consumer finance in Vietnam and VNH’s manager says that it is a strong motor for growth within the wider business. There has previously been talk of a potential initial public offering (IPO) of FE Credit as a standalone business and, whilst such chatter has receded for now, VNH’s manager thinks this could return once the economic outlook improves – something which the manager thinks could crystallise additional value for existing shareholders.

VNH’s managers think that VP Bank is well-managed and, whilst it has tended to be more expensive than some of its peers, the manager thinks this is justified. However, as noted above, the manager has been trimming the position. VP Bank is more exposed to mortgages than some of its peers and so is more exposed to the effects of rising interest rates. Similarly, with a more challenging outlook for the consumer, growth could slow on the consumer credit side, which was another reason to trim the stock.

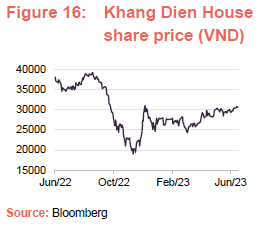

Khang Dien House (3.9%) – Fundamentals are intact, position trimmed tactically to take advantage of market volatility

Khang Dien House (khangdien.com.vn) is a Vietnamese real estate company focused on middle-income buyers, providing small ready-built villas and townhouses at relatively affordable prices. It has been a VNH holding since March 2015, and we have discussed it in a number of previous notes (most recently in our December 2022 note – see page 16 of that note). Khang Dien House is now one of the largest private property developers in Vietnam and has a landbank of some 400 hectares in the southwest of Ho Chi Minh City, where it intends to develop an ‘urban city’.

VNH says that Khang Dien House was, compared to its peers, an early adopter of sustainable practices and has been publishing a sustainability report since 2016 (achievements include an increased use of unbaked brick, exterior paints with high thermal insulation and landscaping that combines open spaces in high-rise buildings and planting trees at height to reduce heat absorption). Our December 2019 initiation note looked at Khang Dien House’s ESG credentials in some detail (see page 18 of that note).

When we discussed the stock in December 2022, we commented that while its share price had performed strongly during the post-COVID market recovery, it had suffered from negative sentiment towards the real estate sector in the aftermath of the arrest of the Vietnamese property tycoon Truong My Lan in October 2022 (this was despite the business having no relationship with the disgraced real estate magnate).

Since that time, Khang Dien House’s share price has recovered significantly (it has roughly doubled), although it still remains off its previous highs. VNH’s manager says that the fundamentals of the business are still very strong (it has a conservative debt ratio, retains its very good land bank and should be a big beneficiary of the new land law) but share price volatility has increased and it has tactically reduced the position to take advantage of this and opportunities elsewhere.

Vietcombank (3.5%) – low cost funding allows for a more conservative loan portfolio

Vietcombank (vietcombank.com.vn), sometimes referred to as VCB or more formally known as the Joint Stock Commercial Bank for Foreign Trade of Vietnam, is one of the largest commercial banks in Vietnam. It operates from around 600 locations (including 111 branches and 472 transaction offices), providing a full range of personal and corporate banking services. It has been a constituent of VNH’s portfolio since a position was re-initiated in December 2019 (a previous position was exited in June 2018 on valuation grounds) and is a VNH holding that we have discussed in previous notes (mostly recently in our December 2022 note – see page 17 of that note).

Historically, VCB was focused on lending to SOEs. However, over the last five years, it has refocused its business, increasing its exposure to retail banking. VNH’s manager says that VCB is now one of the best banks for wholesale and retail operations in Vietnam. It thinks that VCB’s strong network and reputation are two key competitive advantages versus peers. These allow VCB to attract a lot of deposits and consequently it has a lower cost of funding than many of its competitors. This means that it can afford to fund lower-risk loans, but nonetheless acts on the side of caution when it comes to making provisions for losses – provisions are typically in the region of three times total NPLs.

VNH’s manager thinks that VCB can increase its net interest margin. It also has a very strong retail market share, which continues to do well, albeit the manager recognises the outlook for the consumer looks like it will become more challenging. However, VCB exposure to the real state sector is conservative, so the manager thinks that its NPLs are well under control. The manager expects to see earnings growth for 2023 of around 15% and thinks that this is readily achievable, and growth of this level should be sustainable for a number of years.

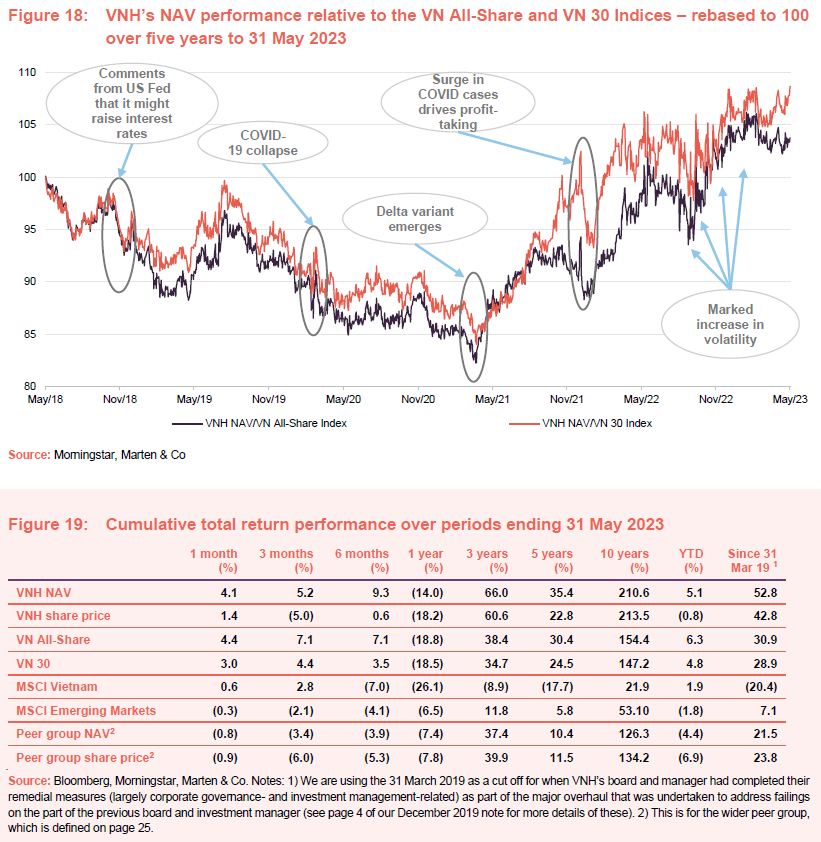

Performance

Figure 19 illustrates VNH’s share price and NAV total return performances in comparison with those of its country specialists: Asia Pacific ex Japan peer group, the VN All-Share, VN30, MSCI Vietnam and MSCI Emerging markets indices. An obvious feature of Figure 19 is the negative performance of VNH, its peers and the Vietnamese market over the last 12 months, which as we discussed in our December 2022 note was a function of negative sentiment towards Asia, itself a function of Chinese lockdowns, a slowing global economy, rising interest rates and, to a certain extent, negative sentiment towards growth.

While there is the further potential for rising interest rates in the US (traditionally a headwind for emerging Asian economies), the pace of these should slow and with the Chinese economy now open again, Vietnam should once again be able to benefit from its long-term structural growth story, which remains intact. One positive factor is that recent months have seen net-foreign buying in the Vietnamese stock market.

Recent performance

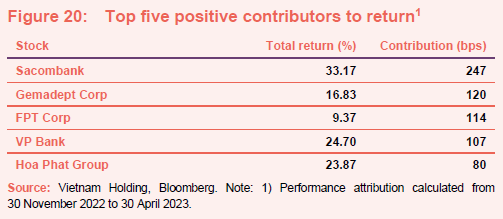

VNH’s manager has kindly provided some attribution data that covers the period from 30 November 2022 (the performance data cut off when we published our last note) and 30 April 2023.

During the period, VNH provided NAV and share price total returns of 5.0% and -0.8% respectively (in sterling terms). In comparison, the VN All-Share and VN30 Indices provided total returns of -6.3% and -5.3%, meaning that VNH outperformed comfortably.

Taking a closer look at VNH’s performance, VNH’s asset allocation was positive, adding 371 basis points (bp – one basis point is one-hundredth of a percent, so 100bp equals 1%) to performance, as was stock selection which contributed 192bp. Currency was also positive adding 280bp.

Looking at VNH’s sectoral exposures, an underweight exposure to real estate; an underweight position to food, beverages and tobacco; and an overweight exposure to industrial goods and services were the largest positive contributors, adding 202bp, 201bp and 84bp respectively to performance. On the downside, an overweight exposure to retail, a modest (28bp) underweight to financials and no exposure to basic resources detracted 130bp, 79bp and 18bp respectively from performance. As discussed earlier, the real estate sector, particularly the developers, has been impacted by the crash in the corporate bond market (they have struggled to raise finance and have experienced cash flow problems as a result).

Top positive contributors to performance from 30 November 2022 to 30 April 2023

Figure 20 provides the top five contributors to performance from the 30 November 2022 (the cut-off used for VNH’s performance data when we last published) to 30 April 2023. Sacombank, Gemadept, and FPT Corp are discussed below, while VP Bank is discussed on page 17 and Hoa Phat Group is discussed on page 15.

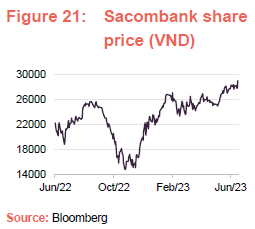

Sacombank – focused on booming retail sector, but challenges may be ahead

Saigon Thuong Tin Commercial Bank (sacombank.com.vn/en), more commonly known as Sacombank, made the largest positive contribution to VNH’s performance during the period under review. It was also a significant overweight (an average of 5.9 percentage points above the benchmark weight), so was a significant positive contributor to VNH’s relative performance as well.

Sacombank is one of the top 10 commercial banks in Vietnam and the private bank that VNH’s manager considers to be the most dynamic in the country. To recap from our December 2022 note where we discussed Sacombank in some detail (see pages 15 and 16 of that note), Sacombank has cleaned up its loan book during the decade and grown by acquisition (it has acted as a consolidator, absorbing smaller banks, and has been key in the restructuring of the country’s fragmented banking sector and addressing NPLs, which previously weighed on the sector).

VNH’s manager continues to think that Sacombank’s earnings could triple in the next two years (this follows five years of restructuring, which has seen earnings depressed by provisioning, and so there is an element of recovery). Sacombank is also focused on the retail sector, which continues to boom, although the prospect of more difficult times ahead seems to have weighed on the company’s share price in recent months.

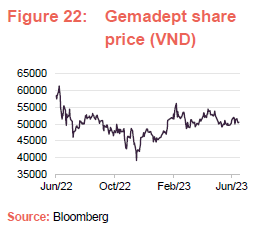

Gemadept – lowest cost port operator, well-positioned to benefit from growing FDI and international trade

Gemadept Corporation (gemadept.com.vn) is a marine freight transportation company that owns and operates ports and provides related logistics activities, both in Vietnam and internationally. This includes containers and oversize freight, as well as transportation by deep sea, inland water, land and air. The company also owns around 30% of Saigon Cargo Services (or SCS, another VNH holding which we discussed in previous notes), which is the leading air cargo terminal operator at Ho Chi Minh City’s Tan Son Nhat airport (its services include customs paperwork, security screening, packing, storing and airfreight consolidation). We last discussed Gemadept in our March 2021 note – see page 19 of that note for more details.

Gemadept plays into the manager’s industrialisation theme. As the cheapest operator in the space, VNH’s manager considers that it is very well-positioned to benefit from a long-term trend of growing international trade and FDI. Port volumes globally were impacted the zero-COVID policy in China and Western sanctions against Russia (due to the connection between ports and shipping routes, when one significant port becomes congested, other associated ports will be affected); however, there are additional tailwinds from China’s economy re-opening and, for the air side of the business, a recovery in travel and tourism.

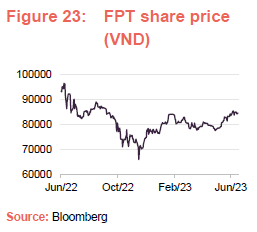

FPT – robust order pipeline

FPT is the largest IT services company in Vietnam. It develops software, provides IT and telecom services (including broadband internet), and is a distributor/retailer of IT and communication products. It is a long-term holding for VNH (it invested in FPT in January 2007, shortly after FPT listed in December 2006) that, with 49% foreign ownership, is at its foreign ownership limit (FOL). The company employs the largest software engineer workforce in Vietnam and offers outsourcing services to more than 650 global customers and partners. Software outsourcing is the largest component of its business, followed by telecoms. The company owns significant telecoms infrastructure, including a main north-south fibre link, and its private telecom network allows it to service all 64 of Vietnam’s provinces.

We last discussed FPT Group (fpt.com.vn/en) in our March 2021 annual overview note, while our December 2019 note has more details of FPT’s ESG credentials. VNH’s managers say that the software outsourcing business continues to do very well (it has very competitive labour costs versus India and China) and the outlook for this segment of the business remains bright. It has a very robust pipeline of orders, particularly from US and Japanese companies, and VNH’s manager believes that the company is well-placed to provide 20–30% earnings per share (EPS) growth for a number of years.

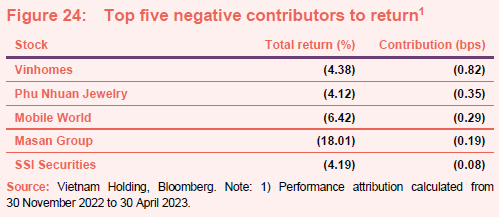

Top negative contributors to performance from 30 November 2022 to 30 April 2023

Figure 24 provides the top five detractors from performance from the 30 November 2022 (the cut off used for VNH’s performance data when we last published) to 30 April 2023. Vinhomes, Phu Nhuan Jewelry, Masan Group and SSI Securities are discussed below, while Mobile World is discussed in the asset allocation section on page 16.

Vinhomes – long-term beneficiary of urbanisation trend, with a tailwind from the new land law

Vinhomes (vinhomes.vn) is one of the largest real estate developers in Vietnam and, despite its recent retrenchment in its share price, remains one of the largest listed companies on the country’s exchanges. It was originally founded as a subsidiary of Vingroup, one of Vietnam’s largest conglomerates, but was spun off in 2018 with 10% of the company sold in its IPO.

We have discussed previously how VNH’s manager considers that the urbanisation trend in Vietnam, aided by infrastructure improvements and coupled with the growing middle class, is increasing the demand for the higher-quality modern apartments that Vinhomes offers. The manager thinks that, despite recent challenges (discussed below), the long-term investment case for Vinhomes (one of the largest residential property developers in Vietnam) is undimmed. Furthermore, it should also benefit from the new land law.

Vinhomes was the largest detractor in absolute terms during the period, suffering due to ongoing negative sentiment towards the real estate sector during the period. In part this was a hangover from high-profile arrests last year, which we discussed in our last note in December 2022; concerns that the risk of an economic slowdown is increasing; and the ongoing effects of the crash in the Vietnamese corporate bond market in the fourth quarter of 2022. Nevertheless, the manager is quite constructive on the stock and so the average position weight during the period, at 3.13%, was a mild underweight versus the VN All-Share’s.

Phu Nhuan Jewelry – long term growth outlook remains intact

Phu Nhuan Jewelry (www.pnj.com.vn), sometimes referred to as PNJ, has been a significant position within VNH’s portfolio for some time, and one that we have discussed in previous notes (most recently in our December 2021 note – see page 12 of that note). The company is the leading jewellery manufacturer in Vietnam and has expanded its production capacity in recent years from 4m units at the time of our December 2019 note (see page 14 of that note for more on PNJ and its ESG credentials) to 6m units for the current year. However, PNJ’s output has been below this maximum in recent years, suggesting there is considerable operating leverage remaining in the business.

To recap, PNJ’s operations cover the full value chain, giving it a key competitive advantage. It employs an experienced team comprising jewellery designers and over 1,000 skilled goldsmiths, which VNH’s manager says is one of the company’s strongest assets. The holding is an example of a consumer stock that benefits from a growing middle class in Vietnam, which on some estimates is growing by around one million people a year, due to continued wealth creation.

VNH’s managers say that, as their income grows, consumers tend to move up the value chain in search of better quality and, with a product range that covers the mid-end to luxury jewellery segments, PNJ is in a strong position to benefit from this long-term trend. PNJ was also a lockdown beneficiary (VNH’s manager had previously predicted that PNJ could emerge stronger from the pandemic as smaller rivals struggled), benefitting from strong growth in its online business.

PNJ’s share price has come under pressure this year as the market has fretted about the outlook for the consumer, but the manager thinks that this will be more acute at the lower end and that the fundamentals and growth outlook for the business remain strong. For example, PNJ continues to increase its store count – it is targeting 500 stores by 2025, which is a compound annual growth rate (CAGR) of around 14%.

Masan Group – small position, sold in its entirety

Masan Group (www.masangroup.com) is a Vietnamese consumer goods focused conglomerate. It describes itself as an integrated consumer ecosystem and its mission statement is “to be Vietnam’s pride by uplifting the material and spiritual lives of Vietnamese consumers”. Reflecting this, its main business segments are retail (WinCommerce), branded food and beverage (Masan Consumer), branded chilled meats (Masan MEATLife), financial services (Techcombank) and high-tech materials (Masan High-Tech Materials).

While over the long-term, the holding plays directly into the manager’s theme of gaining exposure to the consumer, and the consumer sector has been booming, VNH’s manager feels that in the short-term, the outlook for Masan’s consumer facing businesses could be challenged and decided to exit the holding altogether. These concerns were amplified by the holding in Techcombank, which is heavily consumer-focused and exposed to interest rate risk, as well as challenges within its brewing business, which is also highly exposed to consumer spending.

However, while the holding was the second largest detractor in absolute terms, the manager’s decision to significantly underweight what turned out to be a heavily underperforming position (it was the most negative total return during the period by a significant margin – Mobile World was the next largest negative total return at -6.42%, versus Masan Group’s -18.01%) was an overall positive for the portfolio relative to index benchmarks.

SSI Securities – manager started to rebuild a position having previously exited at a profit

SSI Securities (www.ssi.com.vn/en) is primarily a securities brokerage firm that offers its brokerage services to both retail and institutional customers. The company also offers related services including asset management, investment banking and treasury services and, of the around 90 securities companies operating in Vietnam, SSI Securities is the largest. The company has a network of branches/transaction offices, covering the major cities in Vietnam, such as Hanoi, Ho Chi Minh City and Hai Phong.

As illustrated in Figure 28, SSI Securities contribution to VNH’s portfolio performance, in absolute terms, was a small negative. This is because the company underperformed as investors became concerned about the market outlook, but fortunately, VNH had a very small holding in the company, where the manager had re-initiated a small position in the stock, having exited a previous holding in full during 2022 at a profit. The exit was part of the reduction of VNH’s exposure to financial services, which was discussed in our December 2022 note. VNH’s manager also took the decision to exit Ho Chi Minh Securities and Viet Capital Securities as part of that rotation.

Peer group

Please click here for an up-to-date peer group comparison of VNH versus its Country Specialist peers.

Since the end of March 2021, VNH has been a member of the AIC’s Country Specialist sector, having previously been a member of the discontinued Country Specialist: Asia Pacific-ex Japan sector. However, our analysis has tended to include both figures for the old broader sector, which included Chinese and Indian funds, as well as a narrower peer group that looks at the three pure Vietnamese funds (which we describe as its direct peer group). We have continued with this approach.

It is worth noting that, in addition to the three Vietnamese funds, the Country Specialist peer group includes Weiss Korea Opportunity Fund. We include this in our broader peer group, but not in our direct peer group as we do not believe that a fund of Korean preference shares provides a meaningful comparison for VNH.

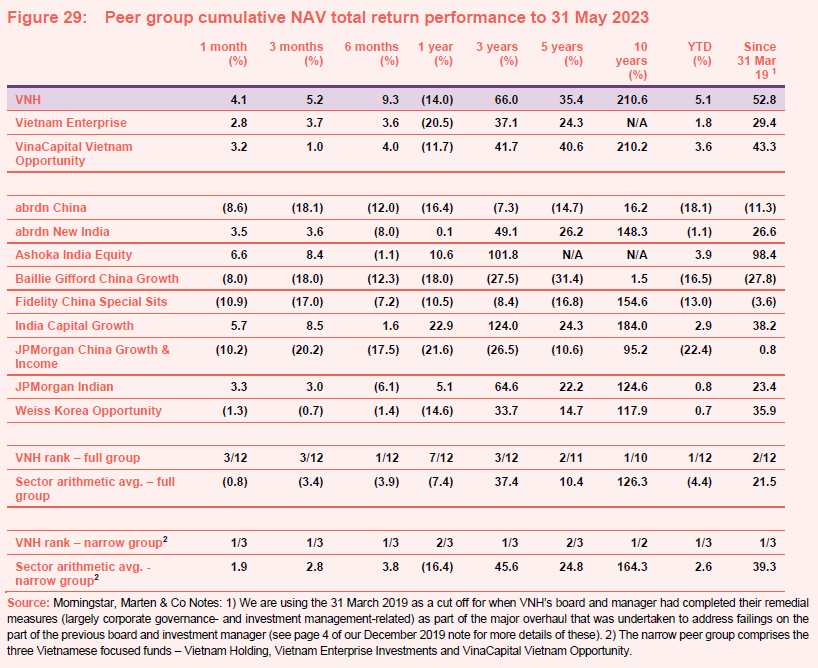

Inspection of Figure 29, which shows the NAV total return performance of the funds in the wider peer group over various periods ending 31 May 2023, reveals a number of trends, most of which relate to the geographies in which the individual funds are focused.

First, as noted above, the performance over the one-year period is negative across the period for the entire peer group – although, as can be seen in Figure 29, the exception to this is the funds that are focused on India.

Second, the funds focused on China have suffered from an ongoing period of difficult performance so that they have provided negative absolute returns over all of the periods provided, up to and including five years (China has faced a series of headwinds which includes, for example, both rising interest rates in the US and the fallout from its own COVID-related lockdowns).

Third, returns from the Vietnam focused funds have, with the exception of the one-year period, have been almost universally positive in absolute terms, and when compared to the wider peer group, VNH’s absolute returns are top quartile for all periods, with the exception of the one-year period.

Fourth, when compared to its narrow peer group of the three Vietnam-focused funds, VNH ranks first or second over all of the periods provided. Interestingly, over the period since 31 March 2019 which we have used as a cut off for the completion of remedial measures (implemented to address shortcomings from the previous manager and board) VNH is the top-performing fund within the narrow peer group and the second-best-performing fund in the wider peer group – in both cases, producing returns that are significantly ahead of the peer group averages.

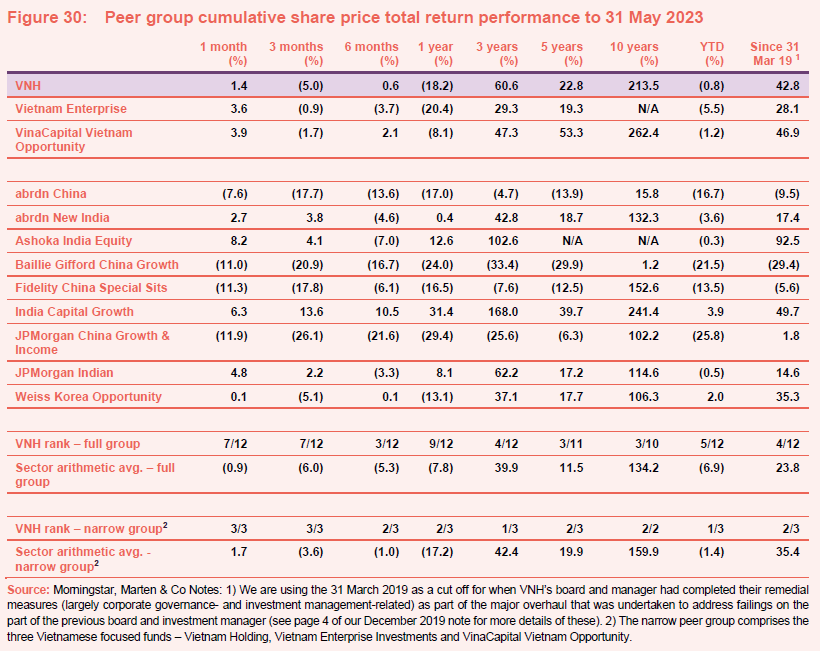

Looking at Figure 30, the general trends of superior performance of the India funds and poorer performance of the China funds remain. However, the absolute share price performances are generally poorer over all time frames, for all funds, reflecting a general trend of widening discounts during the last year, across the investment companies sector, particularly for investments that are more growth focused (as tends to be the case in the Asia Pacific ex Japan region). However, while VNH’s long-term share price performance is more representative of its NAV performance, it has suffered from a greater degree of discount widening during the last year so that it is further down the performance rankings, although this suggests that there is an above average prospect for a rerating from VNH if conditions settle.

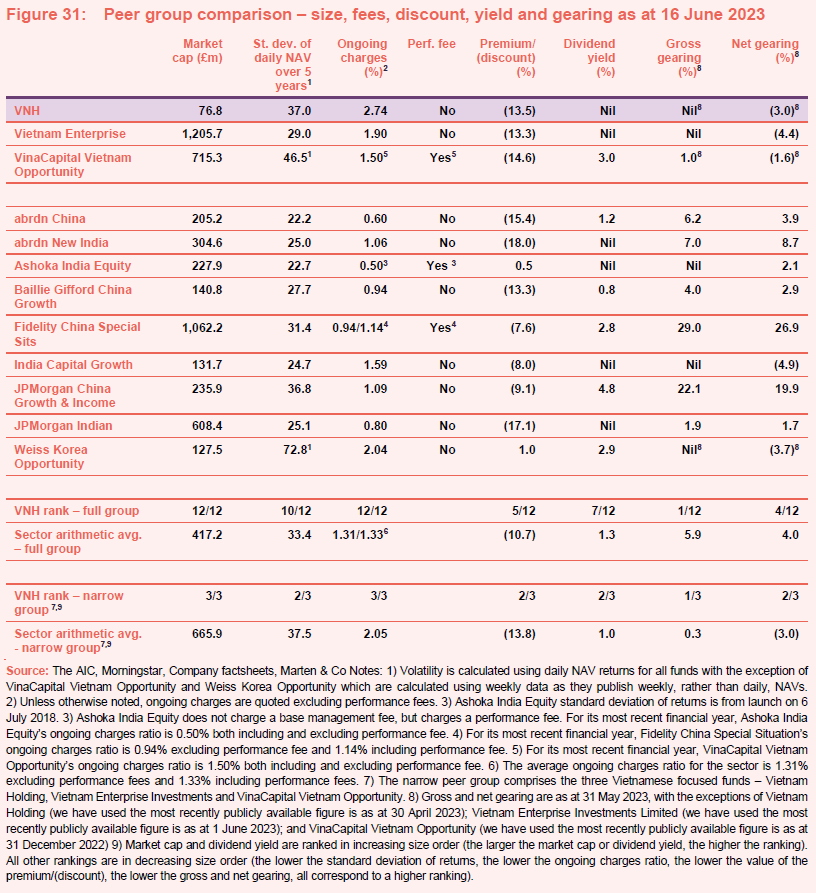

Looking at Figure 31, the volatility (measured here by the standard deviation of the NAV returns over five years) of VNH’s NAV returns is fractionally below the average of its Vietnam’s focused peers although, of the wider peer group, it is one of the widest (ranking 10th highest out of 12). However, as we have previously noted, for the majority of the five years over which these NAV volatility figures have been calculated, abrdn China and Baillie Gifford China Growth (BGCG) operated with markedly different strategies. abrdn China was Aberdeen New Thai (before its merger with Aberdeen Emerging and the accompanying change of strategy), while BGCG was Witan Pacific (this operated a multi-manager funds of funds approach, which is inherently more diversified, and therefore likely to exhibit lower volatility than a more-focused single-country fund).

At 2.74%, VNH has the highest ongoing charges ratio, both for the wider peer group and for the three Vietnamese-focused funds. The higher-than-average ongoing charges ratio does in part reflect its relatively-small size. However, it is notable that while VNH’s ongoing charges ratio is 84bp higher than VEIL’s, VEIL is a significantly larger fund (VEIL’s market cap is 15.5x that of VNH). Like the majority of the funds in the wider peer group, VNH does not charge a performance fee. Of its direct peers, VOF charges a performance fee, while VEIL does not.

Like many funds in the sector, VNH does not pay a dividend reflecting both its capital growth focus and the underlying market in which it invests. In terms of gearing, whilst VNH is permitted to borrow, the managers have chosen not to, and instead aim to maintain a modest cash balance that is sufficient to meet its ongoing cash needs. All of the Vietnam-focused funds tend to run with net cash position to some degree. VNH’s level of net cash is in line with the average of its direct peer group and the fourth-highest within the wider peer group.

Premium/(discount)

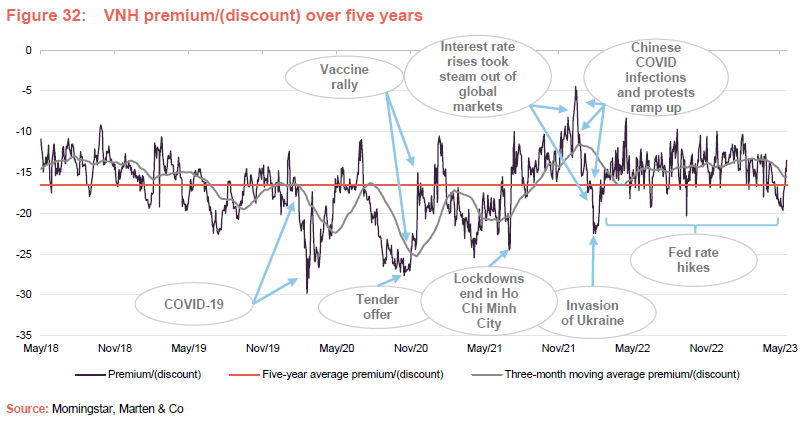

VNH’s discount has exhibited strong mean-reversion tendencies.

As illustrated in Figure 32, VNH’s discount to NAV continues to exhibit the strong mean-reversion tendencies that we have discussed in our previous notes (see page 29 of this note) and has been trading within a pronounced range (10-18%) during the last 12 months. Rising interest rates in the West and US dollar strength have been unhelpful. Sentiment towards Asia had been improving as China’s COVID-related challenges have eased. However, now disappointment about the pace of China’s recovery is setting in.

Discount control and tender offers

VNH has an active discount control policy.

VNH is authorised to repurchase up to 14.99% and allot up to 10% of its issued share capital, as well as an active discount control policy that seeks to address the imbalance between the supply of and demand for its ordinary shares (this process is overseen by VNH’s broker, finnCap Ltd, and is monitored by the board).

VNH has provided bi-annual tender offers for a number of years. The last was a 15% tender offer undertaken in September 2021, which was conducted at a 2% discount to VNH’s NAV as at 31 August 2021 (see page 24 of our December 2022 annual overview note for more details), with payments date in November 2021. The tender was taken up by most shareholders (including both VNH directors and members of VNH’s management team).

As at 16 June 2023, VNH was trading at a discount of 13.5%, which is narrower than the high-teens discounts it has recently been trading at. In comparison, the average discounts over one-year, three-years and five-years are 14.1%, 16.5% and 16.5% respectively. The closing discount on 16 June 2023 is towards the middle of its one-year trading range (9.7% to 20.3%).

Given the extent of the Vietnamese growth story and VNH’s long-term performance record, we continue to think that there is good potential for the discount to tighten from here. Potential catalysts would include signs that inflation is under control in the west, thereby signalling the potential for an end to interest rate rises and possibly some reversal, further signs of an improving outlook for China, and evidence emerging that Vietnamese companies continue to be profitable despite the prevailing headwinds.

Recent share purchase activity by VNH’s management team

Craig Martin (chairman of Dynam Capital, VNH’s investment manager) purchased 7,400 VNH shares on 14 April 2023 at 270p per share. Craig says that with the current market backdrop, VNH is able to purchase high-quality names at compelling valuations, while also trading at a significant discount to NAV itself, which makes the opportunity even more attractive for him. Other principals within VNH’s manager share this view, but as Vietnamese nationals, there are legal restrictions that prevent them from making direct investments in non-Vietnamese assets such as VNH.

As discussed on pages 27 and 28 of our December 2022 annual overview note, all of VNH’s directors have personal investments in the fund. None of the directors have disposed of any shares during the last year. The has been no purchase or disposal activity by members of the board during the last 12 months in relation to their personal holdings, although the board has authorised the repurchase of shares by VNH.

Recent share repurchases activity – strongly NAV Accretive

Most recently, this occurred on 16 June 2023 when VNH repurchased 57,984 shares at an average price of 274.25p per share (equivalent to an average discount of 13.9% based on the closing NAV of 318.5p that day), which is strongly NAV-accretive to remaining shareholders. This latest repurchase brings the total shares repurchased since VNH’s AGM to 945,228 shares (equivalent to 3.28% of its issued share capital at the close of the AGM).

Fund profile – listed Vietnamese equities with a strong ESG focus

VNH is a closed-end fund, domiciled in Guernsey, that aims to provide investors with long-term capital appreciation by investing in a concentrated portfolio of high-growth companies in Vietnam that demonstrate strong environmental, social and corporate governance awareness.

Further information on VNH can be found at the manager’s website: www.vietnamholding.com.

VNH invests predominantly in publicly-traded companies in Vietnam, but it may also, subject to certain restrictions, invest in foreign companies if a majority of their assets and/or operations are based in Vietnam (up to a maximum of 25% of its net assets). It can invest in equity-like securities, such as convertible bonds, and may also hold private companies (up to a maximum of 20% of its net assets). Further information on the manager’s ESG-orientated investment process, including investment restrictions, is provided on pages 10 to 12 of our December 2022 annual overview note (see previous publications section below). VNH has been a signatory of the UNPRI for over a decade.

Previous publications

Readers interested in further information about VNH, such as investment process, fees, capital structure, life and the board, may wish to read our annual overview A real growth story that remains intact, published on 15 December 2022, as well as our previous notes (details are provided in Figure 33 below). You can read the notes by clicking on them in Figure 33 or by visiting our website.

Figure 33: QuotedData’s previously published notes on VNH

Source: Marten & Co

Legal

Marten & Co (which is authorised and regulated by the Financial Conduct Authority) was paid to produce this note on Vietnam Holding Limited.

This note is for information purposes only and is not intended to encourage the reader to deal in the security or securities mentioned within it.

Marten & Co is not authorised to give advice to retail clients. The research does not have regard to the specific investment objectives financial situation and needs of any specific person who may receive it.

The analysts who prepared this note are not constrained from dealing ahead of it, but in practice, and in accordance with our internal code of good conduct, will refrain from doing so for the period from which they first obtained the information necessary to prepare the note until one month after the note’s publication. Nevertheless, they may have an interest in any of the securities mentioned within this note.

This note has been compiled from publicly available information. This note is not directed at any person in any jurisdiction where (by reason of that person’s nationality, residence or otherwise) the publication or availability of this note is prohibited.

Accuracy of Content: Whilst Marten & Co uses reasonable efforts to obtain information from sources which we believe to be reliable and to ensure that the information in this note is up to date and accurate, we make no representation or warranty that the information contained in this note is accurate, reliable or complete. The information contained in this note is provided by Marten & Co for personal use and information purposes generally. You are solely liable for any use you may make of this information. The information is inherently subject to change without notice and may become outdated. You, therefore, should verify any information obtained from this note before you use it.

No Advice: Nothing contained in this note constitutes or should be construed to constitute investment, legal, tax or other advice.

No Representation or Warranty: No representation, warranty or guarantee of any kind, express or implied is given by Marten & Co in respect of any information contained on this note.

Exclusion of Liability: To the fullest extent allowed by law, Marten & Co shall not be liable for any direct or indirect losses, damages, costs or expenses incurred or suffered by you arising out or in connection with the access to, use of or reliance on any information contained on this note. In no circumstance shall Marten & Co and its employees have any liability for consequential or special damages.

Governing Law and Jurisdiction: These terms and conditions and all matters connected with them, are governed by the laws of England and Wales and shall be subject to the exclusive jurisdiction of the English courts. If you access this note from outside the UK, you are responsible for ensuring compliance with any local laws relating to access.

No information contained in this note shall form the basis of, or be relied upon in connection with, any offer or commitment whatsoever in any jurisdiction.

Investment Performance Information: Please remember that past performance is not necessarily a guide to the future and that the value of shares and the income from them can go down as well as up. Exchange rates may also cause the value of underlying overseas investments to go down as well as up. Marten & Co may write on companies that use gearing in a number of forms that can increase volatility and, in some cases, to a complete loss of an investment.