Stellar performance with plenty of potential

Vietnam Holding (VNH) has provided strong absolute and relative returns during the last 12 months, expanding its record of outperformance of both peers and relevant benchmarks.

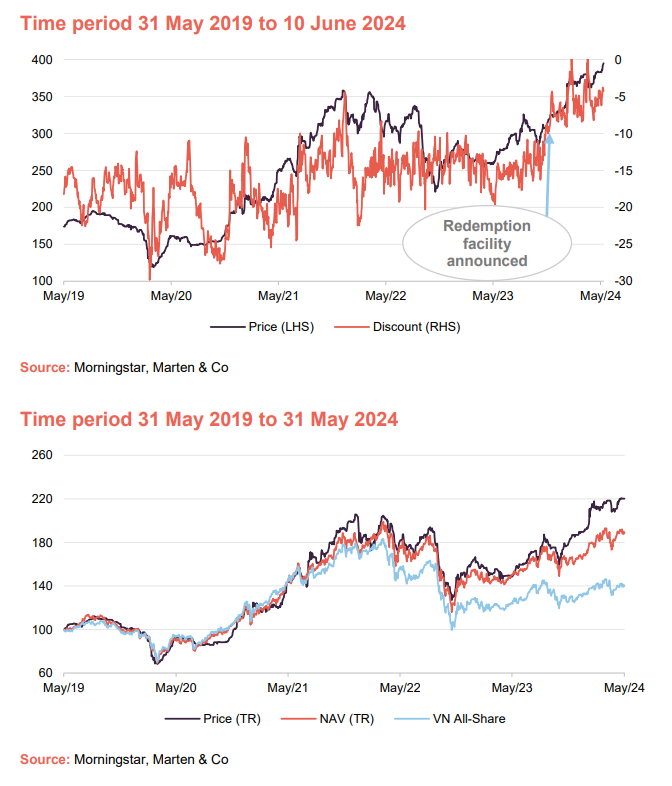

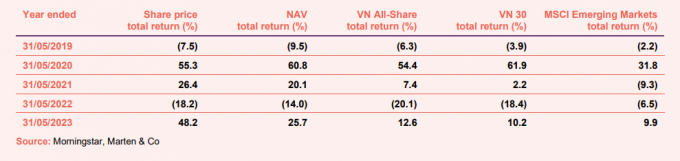

The introduction of a share redemption opportunity at net asset value (NAV) less associated costs (the first of which is on 30 September this year – see page 21) has significantly narrowed VNH’s share price discount to NAV so that a 25.7% NAV return translated into a 48.2% share price return over the 12 month period ended 31 May 2024.

However, with strong growth drivers still in place (see page 5) and attractive valuations, there could be lots more to come. We think that as current headwinds abate and become supportive tailwinds, VNH could shift to trade at a premium to NAV and be in a position to issue stock, with the benefits of increased efficiency (this should put downward pressure on its ongoing charges ratio) and liquidity that would bring.

Capital growth from a concentrated portfolio of high growth Vietnamese companies

VNH aims to provide investors with long-term capital appreciation by investing in a portfolio of high-growth companies in Vietnam. These should come at an attractive valuation and demonstrate strong environmental, social and corporate governance awareness. It achieves this by investing primarily in publicly-quoted Vietnamese equities, but it can also invest in unlisted companies and can hold the securities of foreign companies if a majority of their assets and/or operations are based in Vietnam.

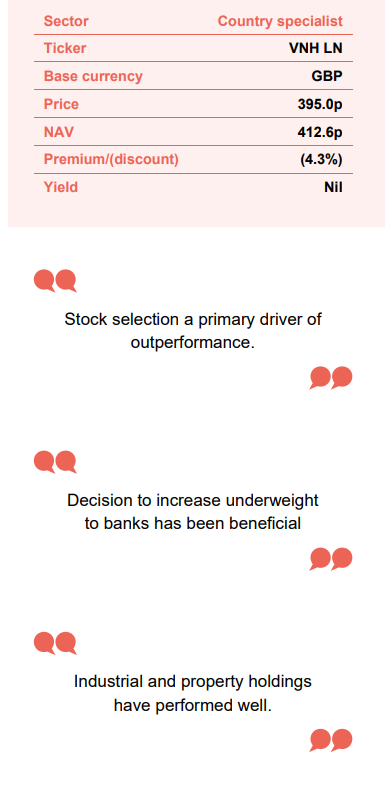

At a glance

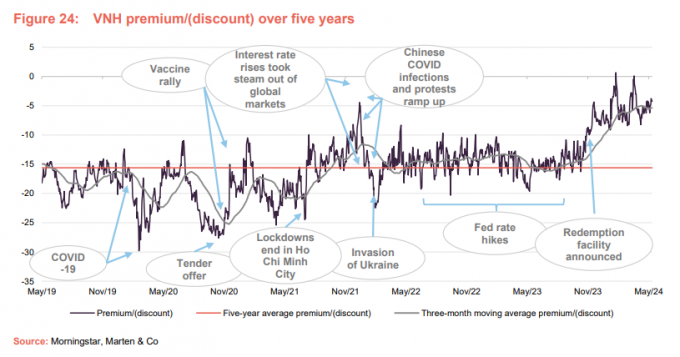

Share price and discount

The annual redemption facility gives investors certainty that they can exit VNH at close to NAV once a year and, since its announcement, VNH has been trading within a much narrower discount range – typically between zero and an 8% discount.

With this certainty, the Vietnamese growth story and VNH’s long-term performance record, we think there is good potential for the discount to tighten further and for it to trade at a premium and potentially issue stock.

Performance over five years

In addition to compelling absolute returns, VNH’s has provided strong outperformance of local indices and its wider peer group during in recent years, and stock selection has been the primary driver of this. Recently, the decision to increase the underweight to banks (still a significant exposure) was beneficial as these have struggled. VNH’s real estate holdings have also performed well against a difficult backdrop for property companies, and its industrial park holdings (for example, IDICO) have also outperformed.

Market backdrop

Recent history and valuations

As is illustrated in Figure 1, while global equities have surged ahead during the last couple of years, particularly during the last 12 months – largely on the back of a small number of large-cap tech stocks that have ridden the boom in interest in artificial intelligence (AI) – Asian markets, including Vietnam, have lagged significantly. Vietnamese and Asian equities still look cheap versus broader global markets and are modestly cheap versus their own history, as illustrated in Figure 3 below.

Vietnamese growth drivers remain in place

We have discussed in depth Vietnam’s long-term term growth drivers in our previous notes, and we would recommend readers see these for more details (see page 23 of this note). However, to recap: the themes of strong GDP per capita catch-up potential (with Vietnam’s GDP per capita well below the average of its ASEAN peer group and significantly below world and developed market averages) – aided by factors such as a favourable demographic profile, natural resource wealth, and strong agricultural and traditionally strong tourism sectors – remain intact (pages 8 and 9 of our December annual overview provide a comprehensive list of Vietnam’s long-term structural growth drivers).

New land law approved by the national assembly

In our June 2023 note (see page 8 of that note), we provided details of the new land law that was being brought forward by the Vietnamese government in a bid to overhaul the regulations surrounding land-use rights and property ownership in Vietnam. At that stage, the new law was on its fourth draft but, after 10 drafts, it was passed by Vietnam’s National Assembly in January of this year.

The new law retains the fundamental principle that land in Vietnam belongs to the people and the state acts as their representative. The state’s role is to lease or allocate land to users and, in certain circumstances, it may recover land from existing users to lease or re-allocate to other users. A key issue had been the mechanism by which a developer pays the government for land usage rights and how that price is determined – a process that developers had previously complained was not transparent, with the previous arrangements becoming complex.

The new law has simplified this process, with a marked shift towards promoting annual rental payments over previous one-off payments. It also allows for developers to shift from one-off to annual payments on existing agreements as well as a new ‘lease right’ for land leases that can be transferred or leased.

The new arrangements should reduce the upfront financial burden for investors and provide the state with more stable revenue streams. On the downside, developers will have less long-term cost certainty as rents will be adjusted over time, but they should benefit from a higher approval rate for projects as the new system makes it less risky for government employees, who had become reluctant to sign off on new developments under the previous system.

PDP8 approved by the prime minister

As we explained in our June 2023 note (see pages 8 to 10 of that note), the Vietnamese government published its eighth power development plan (PDP8) in May last year, which sets out a roadmap for the country’s electricity production through to 2030, including a vision of what the country needs to achieve by 2045, if it is to achieve net zero carbon emissions by 2050. The prime minister approved the implementation of the plan in April 2024.

There are many aspects of the plan but key amongst these are: the government’s commitment to upgrading the country’s dilapidated grid network to allow better linkage between Vietnam’s regional power grids and aid the increase in the provision of large scale renewable generation; targets for renewable generation; plans for domestic and imported liquified natural gas (LNG) power projects and domestic gas-fired projects (to facilitate the shift away from coal); and a rural supply programme to extend the supply of energy to various rural, mountainous and island areas that are currently off-grid.

Emerging market status remains a medium-term prospect

Vietnam remains the largest of the frontier markets by some margin, and although there remain some hurdles (foreign ownership limits in its equity market are chief amongst these), there is the medium-term prospect that Vietnam could be upgraded from frontier market to emerging market status. This would almost certainly stimulate a lot of interest in the market as well as buying from index funds focused on the region.

Manager’s view – Strong growth drivers; real estate turning corner, major push on infrastructure

Vietnam has benefited from a high and fairly stable growth rate during the last 30 years, with more predicted to come. Higher inflation and interest rates in its export markets have been a challenge over the last couple of years but its strong structural growth drivers remain firmly in place. We discussed these in detail in our previous notes (most recently in our December 2023 annual overview note – see page 23) and we would suggest readers see these for more details.

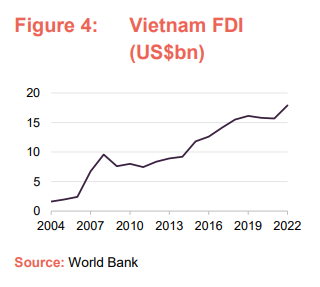

Reflecting these trends, the country has benefitted from significant foreign direct investment (FDI) in recent years – see Figure 4 (although full-year figures for Vietnam’s FDI for 2023 are not available from the World Bank yet, FDI inflows for the first 10 months were US$25.7bn – 14.7% higher than the previous period for the prior year). Vietnam continues to benefit from a positive trade surplus and has substantial foreign exchange reserves (these surpassed US$100bn in April 2024). Vietnam also continues to benefit from strong inward remittances from Vietnamese diaspora living overseas.

VNH’s manager has previously observed that there have been challenges for Vietnam’s trading partners, but recent US dollar strength and corresponding Asian currency weakness have been helping Asian exporters, Vietnam’s included. It adds that Vietnam has benefited in some respects as it imports a lot from countries with weaker currencies – for example, Japan and Korea – and exports to countries with stronger currencies – for example, the US. However, sticky US inflation has weighed on the Vietnamese market regardless, driving a period of profit-taking recently. VNH’s manager thinks much of this has been overdone, noting that much of Vietnam’s growth has been domestically driven in recent years, and has kept the portfolio close to 100% invested (see page 10) to take advantage of the opportunities on offer.

Reflecting the various economic uncertainties, VNH’s manager has been cautious on consumer sectors (it had previously reduced VNH’s exposure) but observes that these continue to be resilient and has been tilting the portfolio towards recovery in certain stocks (for example, it has added to the holding in Mobile World Group which has pushed it back up VNH’s rankings and in to its top 10 – see Figure 10 on page 11.

Light at the end of the tunnel for the real estate sector

In previous notes (see page 23), we have discussed the clear challenges the real estate sector has faced – key events being the commercial banks withdrawing lending in the aftermath of COVID (as buyers’ confidence waned and property sales slumped); the property debt and corporate bond market crisis towards the end of 2022; and the crackdown on the real estate sector that followed, which saw the arrest of Truong My Lan, the Vietnamese property tycoon and chairwoman of the real estate firm Van Thinh Phat Holdings, in October 2022, on charges of bond fraud.

It subsequently emerged that Lan was at the centre of a US$44bn fraud scandal that involved taking loans from the Saigon Commercial Bank – one of Vietnam’s largest banks and not a VNH holding – through a network of shell companies to purchase real estate in the most prime locations (these ultimately accounted for some 93% of the bank’s lending). A notable impact of these developments is that government officials have become reluctant to approve new schemes. This has created a hiatus in the system, which the new land law (discussed above) should help to address.

Another key problem is that the real estate debt market has not yet recovered, which has frequently meant that developers have been forced to sell property when bonds have needed refinancing, depressing asset values further. However, April 2024 saw Lan sentenced to death for embezzlement of state property (the sentence is believed to be an incentive to return US$27bn that is missing), with others also receiving tough sentences. VNH’s manager thinks that, now the process has completed, a line can be drawn under real-estate market moves and two years of uncertainty is now over. It highlights that assets tied up in the scandal can now be sold off (the State Bank of Vietnam wants to clean up Saigon Commercial Bank) and it believes that the bond market should start to re-open, allowing developers to refinance existing bonds without resorting to asset sales.

Infrastructure push ahead of 50th anniversary of reunification

VNH’s manager observes that there is now a big push to accelerate the roll out and development of public infrastructure projects ahead of the country’s 50th anniversary of reunification in April next year. Reflecting this, total public investment in infrastructure is expected to be in the region of US$30bn, which is expected to have a big multiplier effect. The government has previously set out clear key performance indicators (KPIs) for how the money is to be spent.

Positive on digitalisation in Vietnam

VNH’s manager continues to be positive on the outlook for digitalisation in Vietnam and the opportunities it creates. It currently sees two key strands: domestic and exports, the latter being driven by the AI-boom. Domestic opportunities include broadband, e-commerce, pay TV, banking (despite the strong development of its banking sector, Vietnam still has more Facebook accounts than bank accounts) and datacentres. On the export side, Vietnamese companies are selling to a lot of Japanese companies and Fortune 500 companies in the US. Vietnam has a lot of other capabilities in these areas, for example: digital animation, game back-office development and related IT services.

Portfolio

Concentrated and low turnover portfolio of Vietnamese stocks

As at 31 May 2024, VNH’s portfolio had exposure to 24 securities, a net decrease of one from the 24 securities that it held at the end October 2023 (the most recently available information when we last published on VNH). As we have previously discussed, VNH’s portfolio is highly concentrated: it typically has exposure to between 20 and 25 securities (an average position size of between 4% and 5%), but actual position sizes can vary quite markedly (depending on valuation and the manager’s level of conviction).

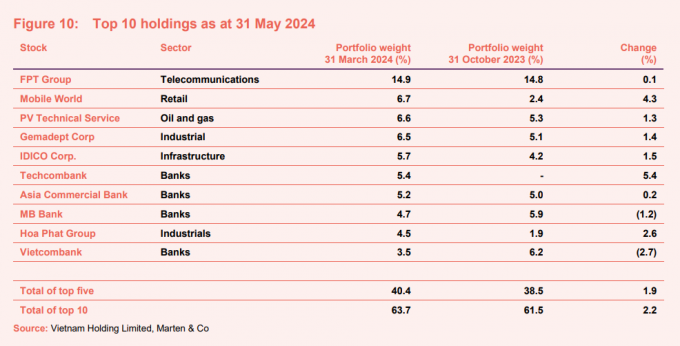

As illustrated in Figure 10, the top 10 holdings accounted for 63.7% of VNH’s portfolio as at 31 May 2024, which is 2.2 percentage points higher than as at the end of October.

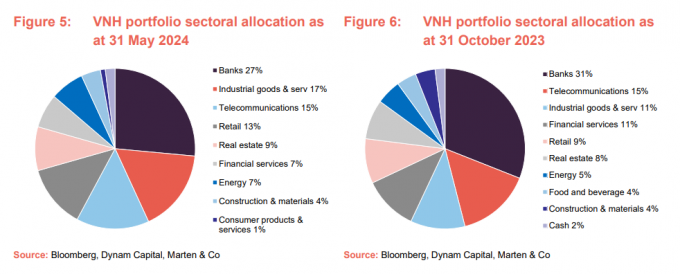

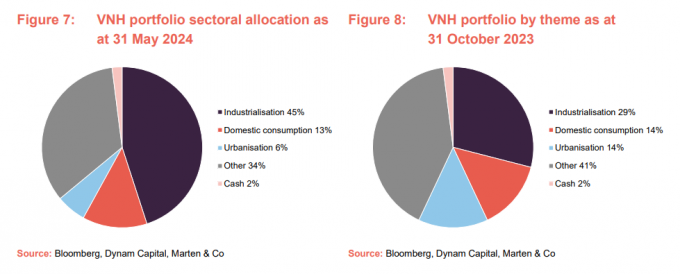

The manager advises that recent portfolio turnover has been higher than the long-term average (typically around 35% per annum). Trading activity has centred around a shift in the banking sector exposure (see below) and increasing exposure to industrial goods and services holdings, where the manager sees good value. Consequently, the industrialisation theme has moved up by 16 percentage points with urbanisation, domestic consumption and other moving down by eight, one and seven percentage points, respectively.

Distinctly different from the index

VNH’s portfolio has a high active share.

As we have highlighted in our previous notes, VNH’s portfolio is distinctly different from the VN All-Share (or any Vietnamese-focused exchange traded fund (ETF) for that matter). VNH’s portfolio has a high active share – typically 75–80% – and it should be noted that the index does not benefit from the manager’s strong focus on environmental, social and governance (ESG) considerations.

Continuing to reduce exposure to banking sector

When we last published on VNH in December 2023, we explained that VNH’s manager had been shifting the portfolio’s exposure to the banking sector, away from more aggressive pro-cyclical banks into more stable defensive opportunities, to reflect a less certain economic environment (see page 13 of that note). VNH inherently has a structural underweight to the banking sector, as this accounts for around 35% of the index, and it has a limit for one sector of 30%. However, reflecting the sector’s economic sensitivity, the manager has recently been reducing the portfolio’s overall banking sector exposure, which is down four percentage points since we last published. These changes have been beneficial to VNH’s performance given the recent pressure that Vietnamese banking and securities sector stocks have faced.

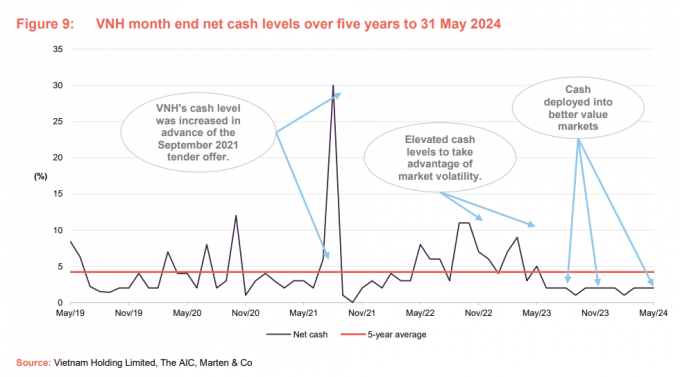

Deploying cash to take advantage of opportunities

While VNH is permitted to borrow (up to 25% of its net assets), in practice, it does not have any debt facilities in place and generally maintains a small cash balance that is sufficient to meet its operating requirements. When we last published in December 2023, we commented how the manager has been deploying this cash, increasing allocations to good stocks that had de-rated, including reallocating back into real estate, which had been reduced significantly in the first half of 2023. Reflecting valuations and the scale of the opportunities the manager is seeing, VNH continues to maintain a below average cash balance, as illustrated in Figure 9, which shows VNH’s month-end cash balance as a proportion of net assets over the last five years. As we have previously discussed, the cash level is not static and moves as the manager adjusts the portfolio to take advantage of prevailing opportunities.

Top 10 holdings

Figure 10 shows VNH’s top 10 holdings as at 31 May 2024, and how these have changed since 31 October 2023 (the most recently available information when we last published). Seven of the top 10 holdings as at 31 May 2024 were constituents of VNH’s top 10 at the end of October 2023, although some of the relative positions have changed. Holdings that have moved up into the top 10 are Mobile World Group, Techcombank and Hoa Phat Group, while Sacombank, VP Bank and Phu Nhuan Jewelry have moved out.

We discuss some of the more interesting developments in the next few pages. However, readers interested in more detail on these top 10 holdings, or other names in VNH’s portfolio, should see our previous notes (see page 23 of this note).

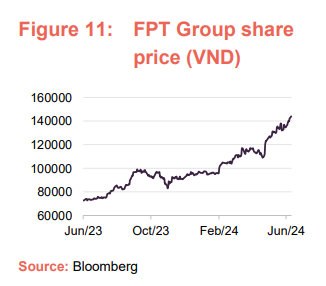

FPT Group (14.9%) – AI exposure a driver of recent strong performance

FPT is the largest IT services company in Vietnam (for example, employs the largest software engineer workforce in Vietnam and offers outsourcing services to more than 650 global customers and partners) and has been VNH’s largest holding for some time. In our December 2023 note (see page 24), we explained how VNH’s manager was particularly excited about the opportunities its then recent strategic partnership with Landing AI in the Asia Pacific region could provide. The market seems to share this enthusiasm as its share price has had another significant leg up in performance since we last published and it has been the strongest contributor to VNH’s performance recently.

In May 2024, it was announced that FPT has been ranked in Asia’s top 50 IT services companies and top 150 globally by revenue (Source: Gartner Market Share: Services, Worldwide, 2023). FPT is exposed to autos and AI through its chip design, where it is working to move up the value chain. The company launched its own microchip product and has made over 25m chips in just two years. VNH’s manager thinks that FPT is well positioned as Vietnam is trying to attract the semiconductor market and, while it is still early days, FPT has managed to secure a government order for its chips. VNH’s manager sees good synergies for FPT within this space and believes it can expand significantly in the future.

The partnership with Landing AI is expected to drive the application and education of AI in Vietnam (in areas such as automotive, manufacturing, healthcare, and education, for example), leveraging the company’s experience in the US market. The company is targeting over US$1bn of revenues from overseas.

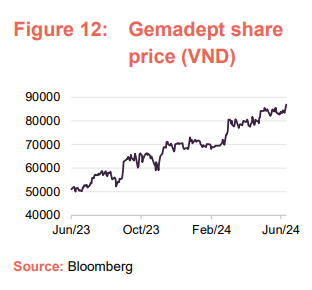

Gemadept (6.5%) – focused on developing key port assets in North and South of Vietnam

Gemadept Corporation (gemadept.com.vn) is a marine freight transportation company that owns and operates ports and provides related logistics activities, both in Vietnam and internationally. As the lowest cost port operator in Vietnam, the company is well-positioned to benefit from growing FDI and international trade. It has been a significant VNH position for some time and we last discussed it in our December 2023 note (see page 16 of that note) where we explained that its shares had experienced a strong re-rating in its share price 2023 as port volumes and earnings had recovered post-COVID.

We also covered the company’s sale of Nam Hai Dinh Vu, a mature port asset in the north of the country with modern facilities and equipment, which strengthened Gemadept’s balance sheet and gave it the cash to invest in less developed parts of the business, specifically phase 2 of Gemalink, a new deep-water port and container terminal at Cai Mep in Ba Ria-Vung Tau province that is designed to accommodate the world’s largest container ships. This project is a joint venture between Gemadept and CMA Terminals that is due to come into operation in 2025 (phase 1 came into operation in January 2021). Following the completion of phase 2 in May 2023, the company is also focusing on expanding Nam Dinh Vu Port into the largest river port in North Vietnam with its third phase of development.

VNH’s manager says that throughput on existing operations has been higher than expected and that with Gemadept’s ports almost at full capacity, growth will be sustained with new capacity coming online. The manager comments that the company has increased its port handling fees by 10% and the company is still sustaining its growth. The company has also been divesting non-performing assets – for example, it has a rubber plantation in Cambodia that is now commercially mature, which it is looking to offload. VNH believes that this will see Gemadept report a third-year one-off gain in its accounts.

VNH’s manager says it is very well engaged with Gemadept (they have very good access to management) and that the company is improving its ESG credentials. Gemadept has been measuring its carbon footprint since 2022 and is achieving reductions in this. Its operations are also undergoing a digital transformation in the way that traffic is handled at its ports, which will speed up the port handling process and help attract international customers. The company has a strong ESG focus and offers lots of training to its employees.

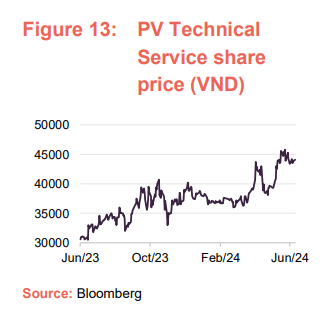

PV Technical Service (6.6%) – a business in transition

PV Technical Services (ptsc.com.vn), sometimes referred to as PVS, or more formally PetroVietnam Technical Services Corporation, provides an extensive range of technical services for the oil & gas, energy and industrial sectors. We last discussed it in our December 2023 note (see page 17 of that note) where we explained that VNH’s manager has identified the company, particularly with the advent of PDP8 (see page 5) which has a big focus on renewables, including offshore wind generation, onshore wind generation and solar PV. As is illustrated in Figure 13, PVS has performed very strongly during the last 12 months and has been one of strongest contributors to VNH’s performance recently.

VNH’s manager comments that PVS is waiting for a final investment decision on Block B – O Mon. This project comprises the development of a gas field and a 431km pipeline from Malay-Tho Chu basin, offshore Southwest Vietnam, to O Mon Power Centres in Can Tho province. The natural gas produced will be replacing coal fired production, which is a positive from an ESG perspective. This project is a key target for the company and VNH’s manager says that the process is proceeding in line with expectations. In the meantime, oil and gas and services fees have been higher than expected and the manager believes earnings-per-share (EPS) growth could be as high as 40% this year. Long term, VNH’s manager still sees PVS as a renewable energy story and the company’s progress in this (there has been lots of talk of small projects) remains in line with expectations. The manager notes that PVS is also looking at opportunities in the green ammonia and green hydrogen spaces (both of which use a combination of electrolysis, powered by renewable energy to produce the product in a more environmentally friendly way).

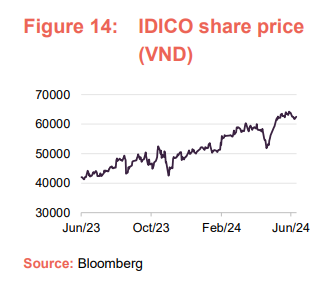

IDICO (5.7%) – Landbank value increase exceeded expectations

IDICO Corp (idico.com.vn) is a relatively new VNH holding, having entered the portfolio in February 2022. This former state-owned enterprise (SOE) was established in 2000 to develop and construct industrial zones/parks, hydro power plants, road traffic schemes and urban and housing schemes. It has one of the biggest landbanks in Vietnam. As we have discussed in our previous notes, VNH’s manager thinks that the industrial parks side of IDICO’s business is especially attractive and well-positioned to benefit from a number of long-term structural growth trends, particularly from the development of infrastructure in Vietnam, and specifically in Southern Vietnam.

VNH’s manager comments that the increase in the value of IDICO’s land has exceeded expectations and this puts the company in a strong position going forward. However, there is a short-term risk due to changes in the way that revenue is recognised in relation transactions that are in negotiation. This does not affect the businesses fundamentals but could have a short-term impact on sentiment towards the stock. Nonetheless, it has been one of strongest contributors to VNH’s performance recently.

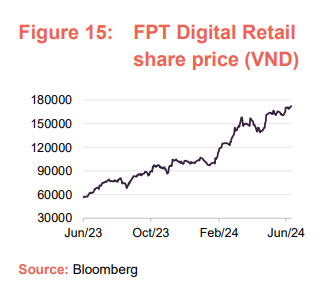

FPT Digital Retail – winner in the consolidating pharmacy retail segment

Established in 2012 and spun out of its parent FPT Group (see above) in 2017, FPT Digital Retail (frt.vn/en) is the retail arm of the group. Commonly referred to as FRT, FPT Digital Retail is the second largest retailer of information and communication technology products in Vietnam (after Mobile World – also a VNH holding – most recently discussed in our December 2023 note), selling items such as mobile phones, tablet computers, laptops and other electronic accessories under its FPT Shop brand.

FPT Shop has a network of around 800 stores in Vietnam spread across 63 provinces and cities and was the first retail chain in Vietnam to be granted the ISO 9001:2000 quality management certificate according to international standards. Its brand, F.Studio by FPT, operates a small number of high end retail outlets and is the Apple authorised reseller in Vietnam. Its most recent venture is in pharmacy retail where it operates under the FPT Long Châu brand. VNH says that this is the most interesting part of the business.

In 2017, FRT acquired a small but established pharmacy retail chain, Long Châu Pharmacy that operated four stores in Ho Chi Minh City. The company has invested and grown this very quickly so that, by the end of 2023, FPT Long Châu had over 1,600 pharmacies, making it Vietnam’s largest pharmaceutical retail chain. Its offering includes a variety of prescription and non-prescription drugs, supplements, medical equipment, functional foods and cosmetics and it has over 20,000 SKUs – significantly more than its competitors.

Pharmacy retail is a very fragmented market in Vietnam that is worth some US$7bn annually and FPT Long Châu is consolidating this space and taking market share. VNH’s manager believes that FPT Long Châu is the winner in the pharmacy retail space, noting that it is growing quickly, both organically and by acquisition, and that it has a very disciplined approach to opening new stores, which it can do faster than its competitors. Reflecting the pace of this growth, the company made a loss at the consolidated level during 2023 but is expected to turn profitable this year.

VNH’s manager says that FRT has good ESG practices baked into its DNA, having been established by FPT, which is a governance leader in Vietnam. By providing healthcare services for its customers, it is well-aligned with SDG 3 (of the United Nations’ sustainable development goals) – good health and well-being – and its latest initiative (launched in 2023) is vaccination centres, which will further support this goal. Vietnam’s vaccination coverage is around 4% of the population. This is low compared to many other countries in the region (this typical ranges from 15% to 30%), indicating significant potential for improvement and a strong growth runway.

VNH’s manager says that FRT is very good with the social aspects of ESG, highlighting that staff surveys show that employees are very happy. The company also offers extensive training – for example, over 100 training courses with top global pharmaceutical partners. The company has its own social media channel for employees, which shows that they are very interconnected and engaged. The company also has an initiative focused on reducing packaging, which helps with waste management too.

VNH’s manager says that FRT’s approach to ESG is a competitive advantage for it, as is its online pharmacy offering. FPT Long Châu customers can get consultation from a pharmacist online and get products delivered to them the same day. The company owns the two largest retail pharmaceutical depots in Vietnam (which meet good distribution practices and good distribution practices), which are in Hanoi and Long An. These have an average operational capacity of around 70,000 orders with over 200 trips per day and AI is utilised within these to optimise medicine pick-up routes and order preparation processes.

SSI Securities – benefiting significantly from Vietnamese equity market development

We last discussed SSI Securities (www.ssi.com.vn/en) in our June 2023 note where we explained how VNH had started to rebuild a position in the company following a setback where investors had become concerned about the outlook for the market in Vietnam. SSI Securities is primarily a securities brokerage firm that offers its brokerage services to both retail and institutional customers. VNH’s manager highlights that, as the number one portfolio company in Vietnam, it has benefited significantly from the development of Vietnam’s equity market in recent years and should be a significant beneficiary in the event that Vietnam is promoted to emerging market status.

VNH’s manager comments that SSI Securities has retail, wealth management and institutional clients, as well as an investment banking arm, and that it is very strong in all of these areas. It feels that the long-term trend of development in Vietnam’s equity market is here to stay, and that SSI’s universal banking model approach places it in a strong position as financial literacy and inclusion expand in Vietnam. The setback was therefore a good opportunity to re-initiate a position and VNH has benefited as the stock has re-rated since, pushing it up VNH’s rankings.

Performance

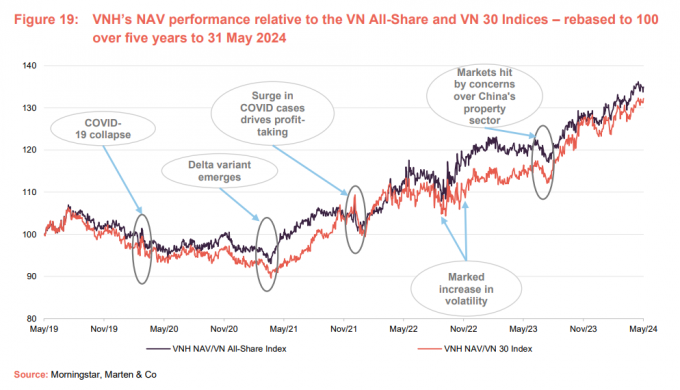

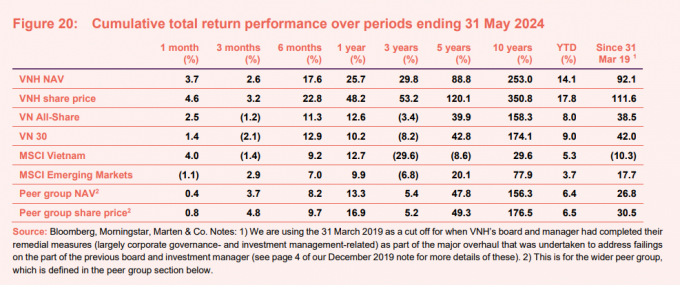

Figure 19 illustrates VNH’s NAV total return performance relative to both the VN-All Share and VN-30 during the last five years. A striking feature of this chart is the strong outperformance of the local indices by VNH’s NAV. This is echoed in Figure 20, which illustrates VNH’s share price and NAV total return performances in comparison with those of its wider peer group (as defined on page 17), the VN All-Share, VN30, MSCI Vietnam and MSCI Emerging markets indices. VNH’s NAV and share price total returns outperformed the various comparators by healthy margins for all periods six-months and above.

Over the very short-term, the Vietnamese market has underperformed wider markets with higher-than-expected inflation in the US delaying interest rate falls a likely factor. However, given the strength of the Vietnamese growth opportunity, we think that this is likely to be a short-term phenomenon, and expect Vietnam to continue to outperform with VNH capitalising on this outperformance.

Stock selection has been the primary driver of this performance and key stocks that have made strong contributions to VNH’s absolute and relative performances are FPT Corp, IDICO and PV Technical services, which are discussed on pages 11, 13 and 12 respectively. The manager highlights that the key allocation change was to move more underweight the banks and, while it still had a significant allocation which has been a headwind as the banks have struggled, VNH’s banking allocation has still been a source of outperformance as the banks it holds were the better performers.

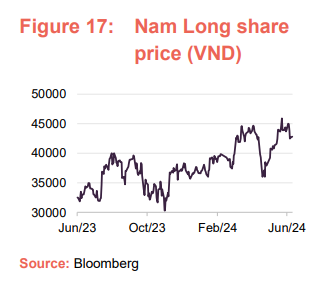

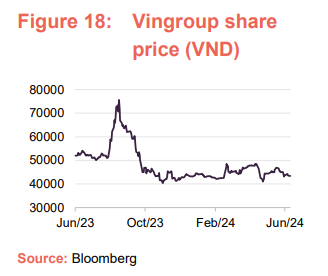

VNH’s exposure to real estate has been beneficial both because it is does not own Vingroup, which has struggled, and its holdings in both Nam Long and Khang Dien House have performed well. VNH’s industrial park holdings (for example, IDICO) have also outperformed. VNH’s manager highlights that Vingroup has a very complex shareholder structure with a number of subsidiaries (for example, Vinhomes is focused on residential development, Vincom is focused on shopping malls and Vinpearl is focused on the hospitality sector), which are generally doing well but it has had a strong push into the field of electric vehicles with its VinFast brand (this subsidiary is Nasdaq listed) which is an overhang on the stock and a concern for the manager.

VNH’s managers say they are not against EVs, but they are still at a very early stage, and this is a tough segment with a lot of competition. VinFast has already incurred considerable capex (it is believed to have US$3-5bn of debt) and a lot more capex is required. VNH’s managers continue to like the digitalisation theme but do not want to play this through VinFast.

VNH also has a small position in the construction materials company Viglacera Corp, which performed strongly and provided and a good contribution. VNH’s manager also increased the portfolio’s exposure to Phu Nhuan Jewelry (PNJ) recently and got an active return from doing this.

Peer group

Please click here for an up-to-date peer group comparison of VNH versus its Country Specialist peers.

VNH is a member of the AIC’s Country Specialist sector which comprises three funds focused on Vietnam as well as Weiss Korea Opportunity, a fund focused on Korean preference shares. Consistent with our previous notes, our peer group analysis takes a more comprehensive approach where we compare VNH against both a direct peer group that focuses on the three pure Vietnam funds, as well as a broader comparison that includes other single country funds from the wider Asia Pacific region. These were all previously peers of VNH when it was part of the Country Specialist: Asia Pacific-ex Japan sector that was discontinued at the end of March 2021. One notable change that has occurred since we last published is that abrdn China no longer appears in this peer group comparison, as this fund was merged into Fidelity China Special Situations in March this year.

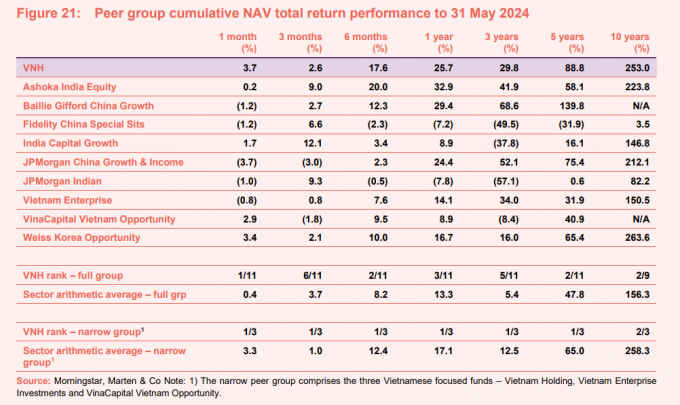

As illustrated in Figure 21, VNH is the top performing fund in the direct peer group of pure Vietnamese funds from periods between six-months and five-years, in NAV total return terms. Interestingly, VNH has outperformed VEIL, which is also focused on listed equities, over all of the time frames bar the shortest of time frames, and has also tended to outperform VOF in recent years. VNH also ranks as one of the top-performing funds in the wider peer group in recent years.

As we have previously discussed, VNH’s 10-year returns are fractionally below the average but changes made to VNH’s structure from September 2017 have benefited shareholders (see our December 2019 initiation note for more details – and page 23 of this note).

A comparison of the narrower and wider peer group averages illustrates why investors may wish to consider having a direct exposure to Vietnam. The average returns from the narrower group of Vietnamese funds exceed that of the broader peer group for all of time frames of six-months and above.

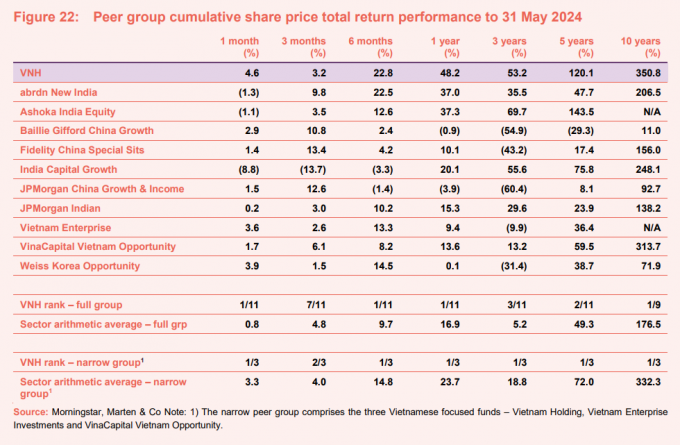

Looking at Figure 22, a similar pattern is seen in VNH’s share price total return performance against both its wider and direct peer group, although VNH’s absolute returns are higher in share price total returns terms, reflecting the benefits of the recent discount narrowing that has occurred largely in response to the introduction of the redemption opportunity (see page 21).

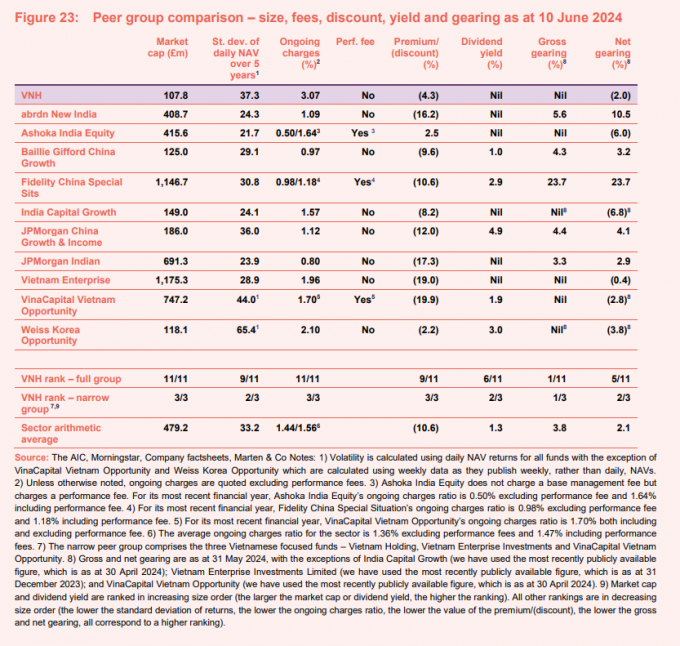

Looking at Figure 23, the volatility of VNH’s NAV returns is middle of the range for its Vietnam focused peers although, of the wider peer group, it remains one of the widest. At 3.07%, VNH has the highest ongoing charges ratio, both for the wider peer group and for the three Vietnamese-focused funds. The higher-than-average ongoing charges ratio largely reflects its relatively small size. It is notable that while VNH’s ongoing charges ratio is 111bp higher than VEIL’s, VEIL is a significantly larger fund (VEIL’s market cap is 10.9x that of VNH) and VNH’s higher running costs seem to be more than compensated for by its superior performance (which is after fees and expenses). Like the majority of the funds in the wider peer group, VNH does not charge a performance fee. Of its direct peers, VOF charges a performance fee, while VEIL does not.

Like many funds in the sector, VNH does not pay a yield reflecting both its capital growth focus and the underlying market in which it invests. In terms of gearing (borrowing), whilst VNH is permitted to borrow, the managers have chosen not to and, instead, maintain a modest cash balance that is sufficient to meet its ongoing cash needs. As we have previously observed, all of the Vietnam-focused funds tend to run with a net cash position to some degree. VNH’s level of net cash is low relative to its own history. Its net cash level places it in the middle of its direct peers and, versus the wider peer group, its net cash position of 2.0% compares against an average net gearing level of 2.1% for its wider peer group.

Fund intro

VNH is a closed-end fund, domiciled in Guernsey, that aims to provide investors with long-term capital appreciation by investing in a concentrated portfolio of high-growth companies in Vietnam that demonstrate strong environmental, social and corporate governance awareness.

Further information on VNH can be found at the manager’s website:

VNH invests predominantly in publicly-traded companies in Vietnam, but it may also, subject to certain restrictions, invest in foreign companies if a majority of their assets and/or operations are based in Vietnam (up to a maximum of 25% of its net assets). It can invest in equity-like securities, such as convertible bonds, and may also hold private companies (up to a maximum of 20% of its net assets). Further information on the manager’s ESG-orientated investment process, including investment restrictions, is provided on pages 9 to 12 of our December 2023 annual overview note (see previous publications section below). VNH has been a signatory of the UNPRI for over a decade.

Previous publications

Readers interested in further information about VNH, such as investment process, fees, capital structure, life and the board, may wish to read our annual overview Bringing you redemption, published on 15 December 2023, as well as our previous notes (details are provided in Figure 25 below). You can read the notes by clicking on them in Figure 25 or by visiting our website.

| IMPORTANT INFORMATION | ||

|---|---|---|

| Marten & Co (which is authorised and regulated by the Financial Conduct Authority) was paid to produce this note on Vietnam Holding Limited.This note is for information purposes only and is not intended to encourage the reader to deal in the security or securities mentioned within it.Marten & Co is not authorised to give advice to retail clients. The research does not have | regard to the specific investment objectives financial situation and needs of any specific person who may receive it.The analysts who prepared this note are not constrained from dealing ahead of it, but in practice, and in accordance with our internal code of good conduct, will refrain from doing so for the period from which they first obtained the information necessary to prepare the note | until one month after the note’s publication. Nevertheless, they may have an interest in any of the securities mentioned within this note.This note has been compiled from publicly available information. This note is not directed at any person in any jurisdiction where (by reason of that person’s nationality, residence or otherwise) the publication or availability of this note is prohibited. |

Accuracy of Content: Whilst Marten & Co uses reasonable efforts to obtain information from sources which we believe to be reliable and to ensure that the information in this note is up to date and accurate, we make no representation or warranty that the information contained in this note is accurate, reliable or complete. The information contained in this note is provided by Marten & Co for personal use and information purposes generally. You are solely liable for any use you may make of this information. The information is inherently subject to change without notice and may become outdated. You, therefore, should verify any information obtained from this note before you use it.

No Advice: Nothing contained in this note constitutes or should be construed to constitute investment, legal, tax or other advice.

No Representation or Warranty: No representation, warranty or guarantee of any kind, express or implied is given by Marten & Co in respect of any information contained on this note.

Exclusion of Liability: To the fullest extent allowed by law, Marten & Co shall not be liable for any direct or indirect losses, damages, costs or expenses incurred or suffered by you arising out or in connection with the access to, use of or reliance on any information contained on this note. In no circumstance shall Marten & Co and its employees have any liability for consequential or special damages.

Governing Law and Jurisdiction: These terms and conditions and all matters connected with them, are governed by the laws of England and Wales and shall be subject to the exclusive jurisdiction of the English courts. If you access this note from outside the UK, you are responsible for ensuring compliance with any local laws relating to access.

No information contained in this note shall form the basis of, or be relied upon in connection with, any offer or commitment whatsoever in any jurisdiction.

Investment Performance Information: Please remember that past performance is not necessarily a guide to the future and that the value of shares and the income from them can go down as well as up. Exchange rates may also cause the value of underlying overseas investments to go down as well as up. Marten & Co may write on companies that use gearing in a number of forms that can increase volatility and, in some cases, to a complete loss of an investment.