Hammerson has published results for the first half of 2014. Its EPRA NAV rose by 6.8% over the period. The interim dividend has been increased by 6% to 8.8p. The property portfolio returned 6.9% – in line with the return on the IPD Retail Property Universe. The UK portfolio did better than the French one (7.8% vs. 2.9%).

They say tenants sales growth in their shopping centres was 2.5% over the period and say strong demand for high quality retail property is driving rents higher. However occupancy at the end of the period was 97.2, down from 97.7%.

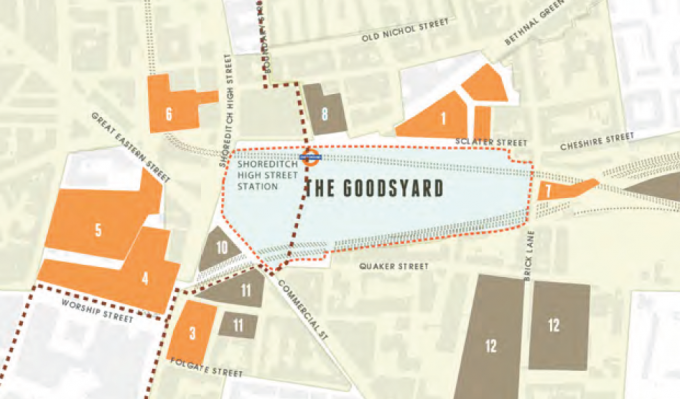

There were a number of milestones within the portfolio during the period including the opening of Les Terrasses du Port in Marseille and the submission of a planning application for a 260,000 sqm mixed use scheme at The Goodsyard in London.