Syncona funds new immuno-oncology company – Syncona is contributing CHF 28 million (GBP21.4 million) to a CHF 35 million (GBP26.8 million) fundraising being carried out by Anaveon, a new immuno-oncology company. Syncona will have a 47.0 per cent stake in the business.

Anaveon was founded in December 2017 by leading experts in the field of immunotherapy, Onur Boyman, professor and chair in the Department of Immunology at the University of Zurich and a recognised IL-2 biology expert, and Andreas Katopodis, previously director at the Autoimmunity, Transplantation & Inflammation Group at the Novartis Institutes for BioMedical Research. Anaveon was founded with initial seed capital from the UZH Life Sciences Fund and additional funding from BaseLaunch, a healthcare accelerator operated by BaselArea.swiss.

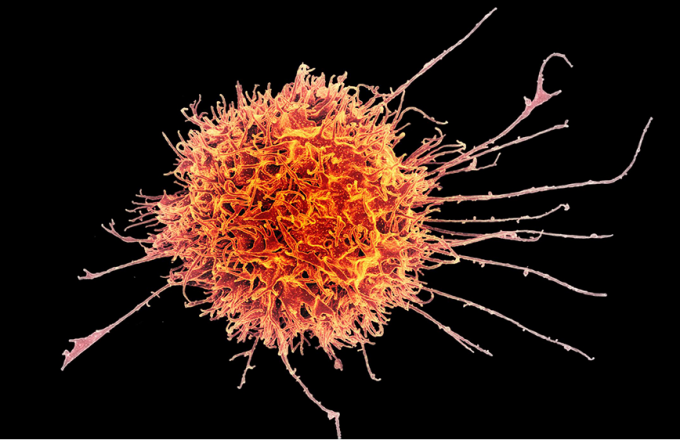

Anaveon is developing a selective IL-2 Receptor Agonist, a type of protein that could therapeutically enhance a patient’s immune system to respond to tumours. In the body, human IL-2 stimulates a type of immune cell, called a T-cell, to multiply and become activated. Under certain situations, T-cells are able to attack tumours and, consistent with this, human IL-2 is already approved as a medicine for the treatment of metastatic melanoma and renal cancer.

Human IL-2 has certain drawbacks, it can be toxic and has a short half-life requiring repeat dosing. Anaveon’s product is designed to address these challenges. This type of drug, if approved, could potentially have a wide utility in oncology, including in: cell therapies, vaccines, checkpoint inhibitors and in combination with radiotherapy.

Anaveon is Syncona’s tenth life science company following the company’s investment in OMass Therapeutics in August 2018.

Andreas Katopodis, co-founder and chief executive of Anaveon, said: “Based on the pioneering work of Onur Boyman, who was the first to demonstrate re-direction of IL-2 activity in vivo, Anaveon has developed biologic approaches for the highly selective expansion of anti-tumour immune cells. Our compounds act as adjuvants to increase anti-tumour immune responses. Pre-clinical evidence shows they have marked efficacy in a variety of tumour models either as mono- or as combination therapy. We are very excited to partner with two leading life science supporters to bring our compounds into the clinic and demonstrate benefit to patients.”

Martin Murphy, chief executive of Syncona Investment Management Limited, said: “Our commitment to Anaveon is a great example of our strategy to build truly innovative companies anchored by exceptional science and experienced teams. Anaveon has a strong strategic fit across Syncona’s cell therapy portfolio and we are excited by the potential to develop a best-in-class product in the IL-2 space. The Syncona team will work in close partnership with the company’s world-leading founders to develop its business plan and clinical pathway.”

Anja Koenig, global head of the Novartis Venture Fund and a board member at the UZH Life Science Fund, commented: “Such a strong Series A financing, by an international syndicate, of a company spun out of the University of Zurich was for me personally a great validation of the principles behind the UZH spinout fund to support Swiss innovation.”

Syncona chief executive, Martin Murphy, Syncona partner, Dominic Schmidt and Florian Muellershausen from Novartis Venture Fund have joined Anaveon’s board with Alice Renard, a Syncona partner, to be an observer.

[the picture shows shows an electron-microscopic view of one of the immune system’s CD8 killer cells and is courtesy of the National Institute of Allergy and Infectious Disease]

SYNC : Syncona funds new immuno-oncology company