Menhaden baled out by X-ELIO write up – Menhaden has released results for the year ended 31 December 2018. In an environment of falling markets, the NAV slipped again to 90.6p from 92.1p and the share price fell to 67p from 68.5p, with no sign of any narrowing of the discount. The NAV total return was -1.6% and the share price return -2.2%. This compares to a -3.0% return on the MSCI World Index. Subject to shareholder approval at the forthcoming AGM, a final dividend of 0.7p per share will be paid on 5 June 2019. Strong gains from Menhaden’s investment in Spanish solar company X-ELIO were offset by losses elsewhere. For example, the manager sold many of the fund’s Brazilian investments in June before the market soared in Bolsonaro’s election.

Extract from the manager’s report

“The quoted equity portfolio’s contribution to the decline was -1.5% for the year and as at 31 December 2018 accounted for 48.2% of the portfolio. We continued to rotate our quoted equities portfolio towards conviction holdings in established businesses with strong competitive positioning and highly predictable and stable cash flows. Our quoted equities portfolio outperformed the MSCI World Index (sterling) by 1.5% for the year. Our core holdings in Air Products, Airbus, Alphabet, Ocean Wilsons Holdings and Safran all ended the year in positive territory.

Safran was the stand-out performer in our public equities portfolio for the year, gaining 25.4% and adding 2.0% to our NAV. Safran manufactures aviation engines that are approximately 15% more fuel efficient than the industry standard. The company reported excellent results for the year to date delivering organic growth of 10.5% for the first nine months of this year over the same period last year. It is on track to deliver 1,100 LEAP engines for 2018 with transition costs from CFM 56 to LEAP running better than expectations. At its Capital Market Day in November, the company published solid medium-term targets with group revenues expected to grow at mid-single digits organically and margins to be in the range of 16-18% over 2018-22 estimates. Management expects to return c.75% of cumulative free cash flow to shareholders over the medium term, with c.50% through dividends and a further c.25% through buybacks.

During January we added Alphabet, parent company of Google, to the portfolio. Google is the world’s largest buyer of electricity generated from renewable sources: 2,600 megawatts, which represents 100% of the electricity used by the company. We like businesses with strong market positions, and Google has a very strong position globally in search, with that position being strengthened significantly over time as more and more people switch to mobile, which favours Google. The company is highly cash generative, with an expected free cash flow conversion of around half of EBITDA during the next five years. Google’s share price has lagged its technology peers in recent months, and offers good value at these levels, in our view.

We decided to sell our position in transport provider First Group in February, having decided that the group no longer presents an attractive risk to reward ratio due to its poor competitive positioning and highly levered balance sheet.

In April we added Ocean Wilsons Holding to the portfolio. The company controls Brazilian port terminal operator Wilson Sons, which has an asset base with high barriers to entry and substantial operating leverage to growth in Brazil’s international trade shipping sector. On a per unit basis, shipping has the lowest climate impact of any freight method, producing between 10-40 grams of CO2 per metric ton of freight per km of transportation, which is around half that even of rail freight. Currently Ocean Wilsons Holding is trading at a material discount to its peers, on a forward EV/EBITDA of less than 7x, in comparison to peers which trade on average at around 10x, and a recent large transaction which took place at more than 14x. Ocean Wilsons Holding enables us to obtain exposure to Wilson Sons at a discount of around 30%, which offers us a markedly asymmetric risk-reward profile whilst providing a dividend yield of circa 5%. Although the shares surged 25% in July following an announcement that the Board of Wilson Sons was initiating a strategic review to consider how best to unlock value from within the group, the share price sharply reverted following Q2 results. We expect to hear the conclusion of the strategic review in 2019.

We sold our position in Volkswagen during May, crystallising a total return of circa GBP2 million. Initially, we took the decision to redeploy the proceeds into Porsche Holdings, which offers exposure to Volkswagen (of which Porsche is the holding company) at a significant discount. However, Porsche declined sharply in the days after this redeployment and we took the decision quickly to cut our

losses (0.7% of the NAV) and sell the position entirely. Whilst we believe that Volkswagen is well placed to take a leading position in the global market for electric vehicles we have begun to question the attractiveness of the broader automotive industry at what is, in our view, an increasingly late stage of the global economic cycle.

In June we initiated positions in Union Pacific and Canadian Pacific Railways. Rail is substantially the most fuel efficient onshore form of freight transportation. Both of these rail freight leaders benefit from tangible barriers to entry and are positioned to benefit from both volume and pricing growth, helped by the current capacity constraints in the trucking sector. Canadian Pacific has emerged from a significant turnaround between 2012 and 2016 through the implementation of precision scheduled railroading (PSR). As such, the company continues to drive growth on the back of market share gains from rail peer Canadian National, as well as the trucking market, with significant opportunities identified for the next two years. Union Pacific on the other hand is at the beginning of this journey with the ongoing implementation of PSR under its Unified Plan 2020. The productivity gains were already apparent in its strong Q4 2018 results, and we believe the appointment of the new COO, Jim Vena from Canadian National, gives further credibility to the company’s strategy to unlock major efficiency gains.

In June we also sold our position in Adient, which makes lightweight seating and other automotive parts, following successive profit warnings and continuing operational challenges at the company. The last straw for us was the departure of the CEO/Chairman ahead of the company’s fiscal Q3 2018 results. In addition, our cautious outlook for the automotive industry given the escalating trade-war as well as the increasingly late stage of the economic cycle, significantly undermined our conviction of upside value in Adient over the medium term.

We sold our position in poorly performing European wind turbine manufacturer Senvion during the summer, following a period of poor financial performance which can be blamed in part on industry-related factors, and particularly ongoing cost deflation and consequent pressure on margins. However, the replacement of the CEO with the CFO brought additional uncertainty at an already challenging time.

Australian wind power developer and operator Infigen was the worst performer in the portfolio for the year, declining by 48.8%, which cost us 1.7% of NAV. The significant decline of the Australian dollar, combined with continued uncertainty around renewables policy in Australia, were factors underlying the poor share price performance of Infigen. We continue to closely monitor developments affecting the renewable energy market in Australia, and the progress of the development of Infigen’s substantial pipeline of new assets.

We added Waste Management to the portfolio in October, as a way to gain exposure to growth in the waste sector. The North American provider of waste management services is highly concentrated geographically, being the largest player in the US operating across 48 states, with a dominant market share of 20%. In addition, Waste Management benefits from stable volumes and pricing power owing to its ownership of landfill sites. In our view the group offers an appealing combination of predictable free cash flow generation, solid competitive position and a shareholder friendly management team.

Whilst Airbus shares performed well during the first nine months of the year, this positive performance was mostly reversed in the fourth quarter with the shares ending the year only marginally higher. Operationally, Airbus made notable progress and managed to fulfil its revised pledge to deliver 800 aircraft in 2018. The group will cease production on the loss-making A380 programme in 2021 and is now aiming to produce 63 aircraft per month as part of its A320 program in the same year. The new A320neo aircraft are expected to deliver up to 20% fuel efficiency savings, which will be key in helping the airline industry achieve its goal of carbon neutral growth after 2020. Finally, Airbus also announced the internal appointment of French engineer, Guillaume Faury, as its new CEO and Dominik Asam, formerly of Infineon Technologies, as its new CFO, both effective from April 2019.

Yield Investments

Our portfolio of yield investments represented 13.2% of our total NAV at the end of June, and declined by 7.8% during the period, costing us 1.1% of our NAV.

During March we decided to commit US $15 million to the TCI Real Estate Partners Fund III (“TCI”). TCI is an investment firm headquartered in London with US$26 billion under management. The founder, Chris Hohn, has passed the majority of his wealth to a children and climate change-focused foundation named the Children’s Investment Fund Foundation (CIFF), a UK charity. Whilst TCI has focused on global equities, the firm created a credit strategy in 2009 for CIFF. This strategy provides asset-backed loans to prime real estate development projects that are best in class in terms of energy efficiency and environmental standards. The strategy has generated returns of circa 11% annually since inception. Due to the success of the strategy, TCI invited a limited number of investors to participate alongside CIFF in the new fund.

There is no management fee on the fund and investors will pay a carried interest of 20% over a hurdle of 6%. The fund has an expected life of 5-7 years.

In June we decided to exit our positions in Brazilian water utilities Copasa, Sanepar and Sabesp, given the heightened political uncertainty in Brazil ahead of the elections in October, as well as weakening of the currency as the Brazilian real hit a 2-year low in June.

Brookfield Renewable Energy suffered a share price decline of 16.9% during the year, costing us 0.7% of our NAV. After a strong 2017, when the shares rose 14.2%, the share price was initially hurt by rising US Treasury yields, along with other yield plays. However, the continued weakness through the year perplexed us. We continue to view Brookfield as both a best in class operator and allocator of capital, which possesses a portfolio of advantaged renewable power assets. With the current organic development pipeline and contract escalators underpinning both cash flow and distribution growth, we continue to see a bright future ahead for the group.

Private investments

We successfully sold our interest in the Alpina Fund during July. This sale brought us cash proceeds of around GBP2.3 million, in addition to the circa GBP1.6 million received during June from the sale of portfolio company Dolan. Moreover, the sale of this position releases us from the remaining drawdown commitment to the Alpina Fund of circa GBP2.3 million.

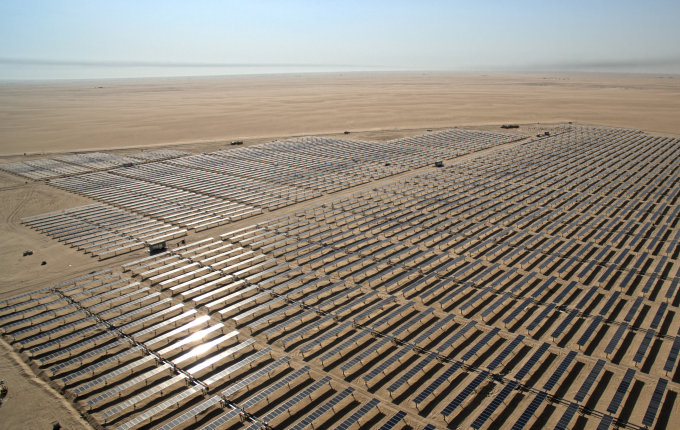

Our holding in private solar developer and operator X-ELIO was marked up by 25.2% during the year, adding 4.3% to our NAV. X-ELIO successfully completed the sale of a 186MW portfolio of operating and under-construction solar assets in Japan to the Development Bank of Japan and Tokyu Land. The enterprise value of the deal was $720 million, and the equity proceeds to X-ELIO (net of all

transaction expenses) was US$241 million. X-ELIO plans on retaining the sale proceeds in the company to fund the construction of its secured tariff pipeline of projects in Mexico, Spain and Japan. X-ELIO’s remaining operating solar assets have continued to perform strongly, and the company has made significant progress in its development pipeline during the year.

Our other private co-investment with KKR’s infrastructure team, Calvin Capital, the UK’s market-leading domestic energy metering company, was also written up during the year, by 3.8%, adding 0.2% to our NAV. Calvin’s portfolio of meters has increased substantially during the year, and the proportion of Calvin’s total portfolio represented by new ‘smart’ meters is now more than half for the first time. The financial out-performance against the original plan has been driven largely by increased compensation for old-fashioned ‘dumb’ meters (such as termination payments), good cost management by Calvin’s management team, and some efficiency programs. Moreover, Calvin has secured its first overseas contract in Australia. At the end of the year, we received our first dividend from Calvin of GBP142,000.”

MHN : Menhaden baled out by X-ELIO write up