Schroder Real Estate updates on portfolio – Schroder Real Estate Investment Trust has revealed some progress on properties in its portfolio.

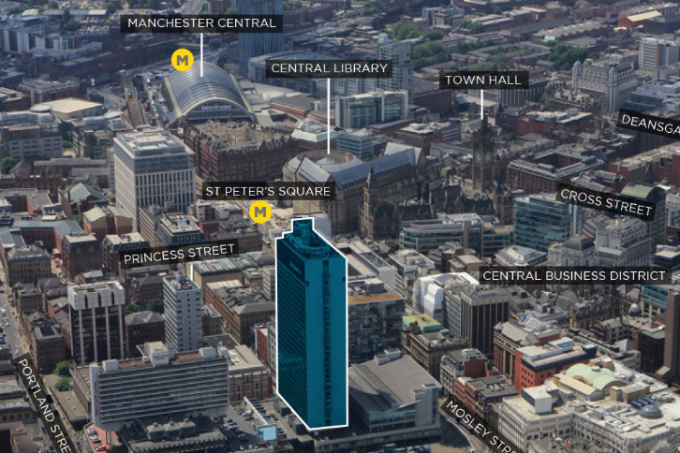

In the Manchester, City Tower (which Schroder Real Estate owns a quarter of) – An agreement has been exchanged for St Pirans School (GB) Ltd, trading as the London School of Commerce, to lease 8,215 sq ft on the sixth floor on a seven-year term at an initial rent of GBP59,556 a year (SREI’s share). The tenant will receive six months rent free and SREI will contribute GBP62,500 to the cost of the tenant fit out. In addition, Plexus Legal LLP, who currently occupy 9,120 sq ft on the 21st floor paying a rent of GBP45,600 per annum to SREI, has completed a ten year lease extension with effect from its current contracted expiry in March 2020. The new rent is GBP53,850 a year to SREI and the tenant will receive an incentive of 7.5 months rent free from completion. That still leaves a further 70,000 sq ft of empty office space at City Tower with a potential annual rental value to SREI of about GBP400,000. SREI says that it is seeing a healthy level of occupier demand for the space and further lettings are under negotiation.

Headingley Central, Leeds (a mixed use retail, leisure, office and hotel asset located in a densely populated area of Leeds) was bought in 2014 and Schroder’s strategy on acquisition was to convert the offices to alternative uses

which were complementary to the ground floor retail and leisure. The first phase of this strategy involved converting an eight story office into a Premier Inn. This was finished in 2017. In August this year, the remaining offices totalling 33,500 sq ft were vacated by their tenant which had been paying GBP327,360 per annum. An agreement for lease has now been exchanged with The Gym Limited, one of the UK’s largest gym operators, to lease 21,000 sq ft of the vacated office on a fifteen year lease without breaks at a rent of GBP240,000 per annum, representing a 16% increase on the previous apportioned rent. The lease has fixed uplifts of 10% at years five and ten and the tenant will receive nine months rent free. SREI needs to carry out refurbishment works to accommodate the gym use at a cost of approximately GBP1.8 million. This cost will be partly off-set by a dilapidations payment received from the outgoing office tenant of GBP750,000 (i.e. a net cost to SREIT of GBP1.05 million). The gym letting is subject to planning consent and an application has been made which should be determined during 2019. The works are scheduled to take seven months resulting in lease completion in the second half of 2020. Schroders reckon that the letting will improve tenant mix and footfall which will benefit the retail and leisure tenants that include Sainsbury’s, Boots, Costa Coffee and Pizza Express. The remaining 12,500 sq ft of vacated office space is being marketed for office and alternative uses.

Peterborough, Unit B Finmere Park – In May 2019 an agreement was exchanged with EDP Insulation Group to lease Unit B Finmere Park, which was subject to SREI refurbishing the 81,591 sq ft distribution warehouse. These works have been completed at a cost of GBP500,000. The lease to EDP has therefore completed for a ten year term without

break options at GBP450,000 per annum. The tenant receives a nine month rent free incentive.

SREI : Schroder Real Estate updates on portfolio

Click here to subscribe for free equity research on investment trusts, funds and listed companies.