A host of rent collection figures for the first quarter of 2021 have been announced by property companies and, once again, it is the logistics-focused companies leading the way.

It is not that surprising given the well-documented rise in online retailing and the positive impact on demand for logistics space, but it does underline the strength of the sector.

Urban Logistics REIT, LondonMetric and SEGRO have all announced near 100% rent collection rates for the first quarter – building on similar figures in previous quarters during the pandemic.

Urban Logistics REIT today announced that 99% of rent had been collected for the first quarter, with the remaining 1% due imminently. LondonMetric said it had received 98% of rent due for the quarter, with a further 1% expected in the coming weeks, while SEGRO’s was slightly below those two – at 88% – but ahead of previous quarters the same period after the due date. SEGRO also said it had now collected 98% of the £417m of rent for 2020.

These figures, at a time of a global pandemic, are impressive.

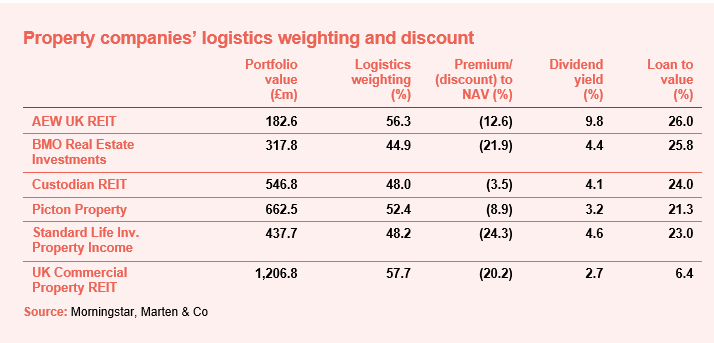

With that in mind, I thought it would be interesting to look at some of the property generalists that have a significant weighting to the industrial and logistics sector (around 50%).

These companies, that own diverse portfolios that could also include some retail, leisure and office assets, haven’t recovered their share price falls from March last year and it feels some have been a victim of investor caution on property, despite their exposure to the buoyant industrial and logistics sector.

These companies are all trading on discounts to net asset value (NAV) some of which are quite chunky and, given the make-up of the portfolios, perhaps unjustified.

Although none have announced rent collection figures for the first quarter yet, when one looks at the collection rate announcements in 2020, they have been relatively good.

BMO Real Estate Investments, which is trading at the widest discount among the group, said it had collected 92.8% of rent for the second and third quarters of 2020 and, at 22 October, had collected, or was expected to collect through monthly payments, 90.3% in the fourth quarter.

Custodian REIT, Picton Property and Standard Life Inv. Property Income also have collection rates that are or are expected to be 90% plus.

AEW UK REIT, which has a relatively small portfolio worth around £170m, said it had collected 87% of rents billed in the fourth quarter, while UK Commercial Property REIT’s collection rate was in the low 80% when announced at the start of November.

All these figures were announced towards the end of 2020 and would most likely have increased since then and do not include deferred rent agreements, which will increasingly be received throughout 2021.

Updates on rent collection rates are expected over the coming weeks, but with high weightings to industrial and logistics and strong rent collection, positive sentiment towards generalist property companies should return.

QD view – Don’t discount the property generalists