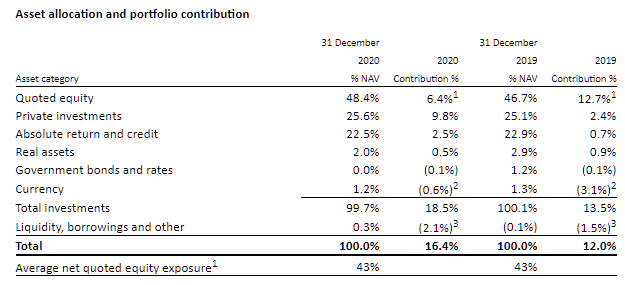

RIT Capital shrugs off effects of virus – RIT Capital Partners results for the year ended 31 December 2020 show an NAV total return of 16.4% for the year, which compares to 12.7% for the MSCI All Countries World Index and 4.2% for the company’s performance objective of inflation (as measured by the RPI) plus 3% per year. Unfortunately, a widening discount (from a 5.5% premium to a 9.9% discount) left shareholders with a return of -0.4%. The company has been buying back shares recently (116,000 shares over the last three months of 2020). The board intends to pay a dividend of 35.25p in 2021, in two equal instalments, in April and October. This represents an increase of 0.7% over the previous year.

Over the past five years, RIT’s net assets have grown by £1.4bn (before dividends) and since inception, RIT has now participated in 73% of market upside but only 38% of market declines. Over the same period, total shareholder return has compounded at 11.7% per year compared to the MSCI All Countries World Index compounding at 7.3% a year.

[It is a shame that the widening discount let down what otherwise would have been an impressive set of results. We think investors may have been unnerved by a lack of information on what was happening within the portfolio. The trust makes monthly NAV announcements and its factsheets don’t have much in the way of market commentary or any comment on progress within the portfolio.]

RCP : RIT Capital shrugs off effects of virus