Global markets have been decidedly choppy during the last few weeks, as central bankers have signalled their view that further interest rate rises are needed this year, if they are to knock the wind out of rising inflation.

In the US, inflation hit 7% in December (a level that has not been seen for decades) and there appears to be more to come. In the UK, we are seeing comparable levels of inflation here. So, it is perhaps not surprising that the intertwined topics of inflation and interest rates have been taking up a lot of column inches in the financial press (apologies for adding to this – I will try not to dwell too long).

After over a decade of low inflation and interest rates, the sudden uplift is a significant change (many of those who are early on in their careers in financial markets will be yet to see a period of heightened inflation, let alone the rampant inflation last witnessed during the 1970s).

The main triggers for this that are cited are the sheer level of stimulus pumped into the financial system, as governments around the world tried to shore up their economies in the face of COVID (the argument is that a wartime-type fiscal response has to bubble up somewhere), as well as demand appearing to have recovered strongly, while supply has been constrained. The effects of this are obvious for many commodities, and soaring gas and power prices are another good example.

Rising interest rates in response to rising inflation can be negative for many equites, particularly growth equities whose cashflows tend to be weighted to the future. The obvious exception to this, as James highlighted in his article a couple of weeks ago (click here to read), is financials, as many of these (for example banks and insurance companies) benefit from margin improvements as interest rates rise.

However, the impact on fixed income securities can be even more severe – rising interests rates drive down bond yields and, in recent years, even mild signs of rising inflation has raised the spectre of a bond market rout. This also had the effect of widening the discounts of investment companies focused on loans and bonds, particularly those focused at the higher yield end of the spectrum. I was therefore surprised when I spoke to Ian “Franco” Francis, the manager of CQS New City High Yield (NCYF), earlier this week and discovered that his trust is trading at a sensible premium and is issuing plenty of stock.

NCYF – a sleep at night portfolio, with quarterly dividends

For those that are not familiar with the fund, NCYF’s aim is to provide a high level of quarterly income, with the prospect of capital growth, by investment in a portfolio of predominantly higher-yielding fixed income securities. Essentially, it aims to be a sleep at night portfolio – Ian himself repeatedly describes it as “conservative and boring” – and the managers think that it is well suited for investors looking for a high level of income that don’t wish to take too much risk with their capital. Ian sifts through the fixed income market looking for securities that he thinks are undervalued and generate above average income returns, relative to their risk, which gives some scope for modest capital appreciation too.

8% dividend yield, despite the premium rating, with a healthy revenue reserve

Despite trading at a premium of 5.7% (as at 9 February 2022) NCYF offers a yield of just over 8% and, over the last three years (to the end of January 2022) has provided NAV and share price total returns of 20.8% and 26.5% respectively. Its five- and 10-year numbers are similarly respectable (30.6% and 97.8% for NAV and 34.6% and 101.4% for share price).

On the dividend, it is worth noting that this was modestly uncovered for the 2020/21 financial year (a total dividend of 4.47p was paid against net revenue income of 4.18p), but this year bore the brunt of COVID. Prior to this, NCYF’s dividend had been covered for many consecutive years, which has allowed it to build up a healthy revenue reserve (3.78p as at 30 June 2021 – equivalent to 85% of one year’s worth or dividends).

NCYF – a long term premium to its peers

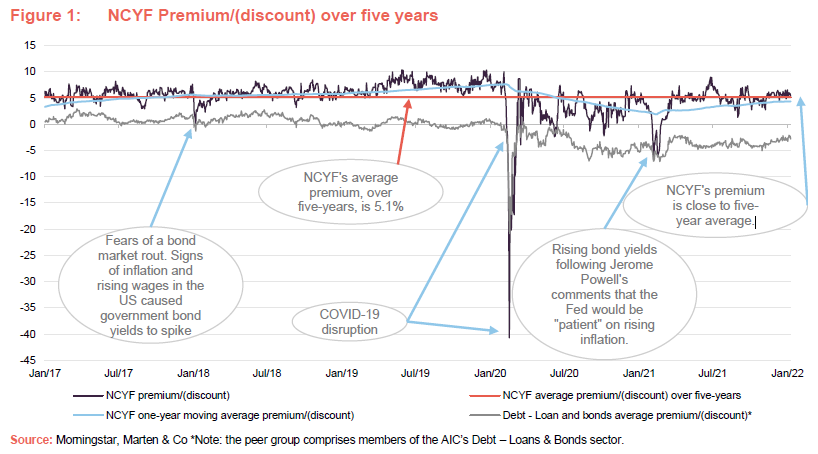

Figure 1 illustrates NCYF’s premium/(discount) over the last five years, as well as its five-year average, its one-year moving average and the average discount for its peer group – the AIC’s Debt – Bonds and loans sector.

NCYF has, for many years, traded at a marked premium to its peer group – which we attribute primarily to its yield and relative performance (NCYF has tended to outperform the average of its peer group over the long-term and consistently appears in the top half of the peer group’s rankings), a tendency towards lower volatility of returns versus its peers (over the last five years, the annualised standard deviation of NCYF’s NAV returns is 6.0 versus the peer group average of 8.5) and its relatively low ongoing charges ratio (NCYF is one of the largest funds in the peer group – its ongoing charges ratio is 1.26% versus a peer group average of 1.36%).

A closer inspection of Figure 1 illustrates two situations, aside from the COVID-related market rout of March 2020, where NCYF’s premium over the sector has narrowed significantly. One instance was at the beginning of February 2018 when early signs of inflation in the US (as economic growth accelerated), coupled with signs of rising wages (which had stagnated for a number of years) led to fears of an increase in interest rates and concerns that this would lead to a bond market rout. The second was in early March 2021, when markets were initially concerned by the prospect of a steepening yield curve, which was exacerbated by comments from Jerome Powell (the chairman of the Federal Reserve) that the Fed would be “patient” on rising inflation.

With inflation once again on the march, one might have reasonably expected that NCYF’s premium over the sector would narrow and that it might have moved back to trade closer to par or possibly a modest discount. However, this has not come to pass and any impact on NCYF’s discount appears muted at best, so what is different this time? I think that despite the initially savage impact on NCYF’s rating, it has actually benefitted from the pandemic as this has illustrated the benefit of both the manager’s experience and good underwriting standards.

Shortly after the collapse in March 2020, Ian said that with limited exceptions, he expected most of the credits should pull to par over time (in simple terms, the par value is the amount borrowed – if an issue is significantly discounted, this suggests that the market thinks that it might not be repaid in full), and that there should be strong upside potential provided there was no new shock to the economy. This appears to have come to pass

Investors were particularly concerned about NCYF’s retail and leisure holdings (NCYF’s holding in Matalan being an obvious example) as well as some of its financial holdings. However, Ian now says that there is nothing of any size in the portfolio that remains a concern and that where there are arrears these are being repaid. In the case of Matalan, the company is family owned and accounts for a large proportion of the family’s wealth. This gave Ian comfort that the credit would ultimately come good as the equity holders a strong incentive to meet their debt obligations – they would not want to lose control of the company. In the case of its financials holdings, which account for just over half of the portfolio, these not only proved resilient, but now stand ready to benefit from improving margins as interest rates rise.

I think that the market now has a better understanding of NCYF’s strategy, which is why its premium has not narrowed this time. Anecdotally, NCYF, while trading at premiums very close to its five-year average, is actually trading at the lower end of its pre-pandemic range (typically a premium of between five and 10%.), which could allow for some additional upside from here.

However, perhaps a more important reason to be excited about its prospects is the manager’s view on the opportunities coming across his desk. For a while, these were getting harder to find but Ian now says that he is now seeing plenty of good opportunities that offer the sort of risk and return profile that he is looking for. If so, there could be plenty of support for the premium going forward.