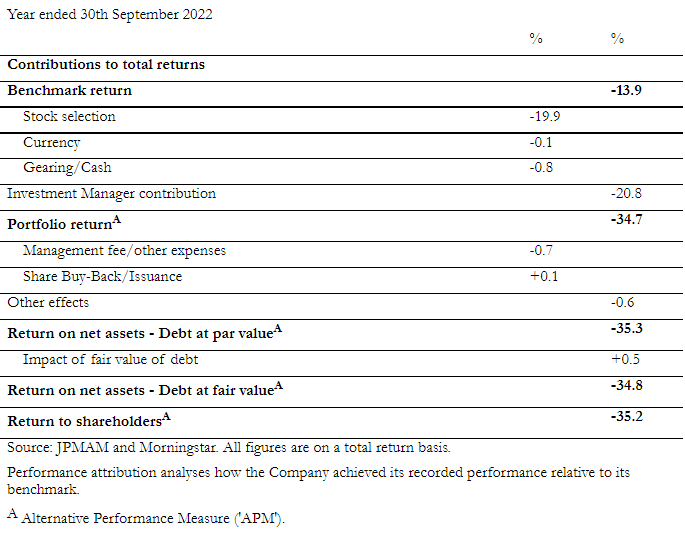

JPMorgan Japanese (JFJ) has published its annual results for the year ended 30 September 2022. JFJ underperformed during the first half of its financial year and this continued into the second half, although both relative and absolute performance recovered in the final months of the financial year. Overall, JFJ’s NAV total return for the period was -34.8%, compared with a total return of -13.9% on the Company’s benchmark index, the Tokyo Stock Exchange (TOPIX) Index (all in sterling terms), over the same period. Therefore, over the full financial year, JFJ underperformed its benchmark by -20.9% in NAV total return terms. Its share price total return over the period was -35.2%, reflecting a very modest widening of the discount over the period. JFJ says that a contributory factor to its negative absolute return was yen weakness versus sterling over the period – a decline of 7.4%.

The trust’s managers say that the main reason for JFJ’s recent underperformance was rapidly rising global inflation and the associated interest rates rises around the world coupled with the portfolio’s high exposure to growth stocks. Performance was particularly poor during the first four months of 2022 as all major equity markets reacted to news of Russia’s invasion of Ukraine, which compounded existing inflationary pressures and prompted an aggressive reaction from the US Federal Reserve and its counterparts in the UK and Europe. This was very detrimental to JFJ’s performance as higher interest rates outside Japan reduced the value of future cash flows, and thus company valuations globally, including those in Japan. This was especially the case for the valuations of technology and other growth-oriented stocks, which were hardest hit in the past year’s global stock market rout.

Performance attribution

JFJ’s portfolio has a strong bias towards growth companies. This can lead to poor performance at times, as it has done so in the past two years. JFJ’s managers say that the extent of the Company’s recent underperformance is certainly very disappointing to them, but stress that this underperformance is the result of the same focus, particularly on quality, that they believe achieves the best performance over a multi-year period.

Significant contributors and detractors to performance

The largest detractors from JFJ’s returns during the year were Recruit and Benefit One, providers of employment and business services, Keyence, a global leader in manufacturing sensors for factory automation and Hoya, a global business across the fields of healthcare and information technology. JFJ’s managers expect that share price weakness experienced by all of these names to prove transitory, as their results and investment cases remain robust, and all remain in the portfolio.

JFJ’s position in Nihon M&A Center, which provides mergers and acquisition-related services in Japan and globally, also remained under some pressure. The company’s share price fell sharply in late 2021 when it announced an investigation into some accounting irregularities over the last few years, which had the effect of artificially enhancing sales revenues in some periods. JFJ’s managers say that this issue has now been resolved and remedial measures are in place to prevent a recurrence of this problem. Although future revenue growth may be slower than previously expected as a result, JFJ continues to hold the stock, as its managers still have confidence in the long-term investment case.

The detrimental performance impact of these and other holdings was partially offset by the positive contribution of several other holdings, most notably Nintendo and another gaming company, Capcom, whose earnings have remained steady, displaying little economic cyclicality. The decision of Tokio Marine, a general insurer, to increase shareholder returns triggered a significant recovery in its share price. The managers’ decision not to own Nidec, which produces motors and electronic components, or Softbank Group, an owner of stakes in many energy, financial and technology companies, also helped relative performance, as both these names underperformed the benchmark over the period.

Portfolio activity

The managers say that the past year’s sharp sell-off in quality and growth companies has enabled them to further increase JFJ’s exposure to some great companies at compelling valuations. In addition to a number of acquisitions made in the first half of the financial year, the managers purchased several other “attractively priced companies” in the second half of the year. Highlights include:

- JGC, a leading builder of LNG production plants, that has performed very well since acquisition;

- A new position in Paltac, Japan’s number one wholesaler of household and personal goods;

- A new position in Itochu, which owns many stable cashflow generating businesses including the convenience store operator, Familymart. The managers say that they particularly appreciate Itochu’s focus on steady profit growth and ROE, and its determination to improve shareholder returns;

- Nippon Telegraph and Telephone, Japan’s leading telecoms company. The managers say that the company’s prioritisation of shareholder returns was the main reason for their decision to purchase this position;

- Murata, a leading global supplier of multi layered ceramic capacitors (MLCCs), which are used in many electronic devices, with demand from vehicle manufacturers increasing especially rapidly; and

- Ain Holdings – this purchase was prompted by the deregulation of retail pharmacies, historically a very fragmented sector. The Japanese government’s recent decision to permit pharmacies to operate inside large hospitals has allowed Ain to increase market share and scale up operations, by offering consumers a more conveniently located service.

These purchases have been funded in part by the outright sales of several holdings whose potential growth rates have been undermined by increased competition (JFJ’s interim report mentioned several disposals motivated by such concerns). In addition, in the second half of the year, the managers closed positions in:

- Uzabase and Minkabu, providers of financial and business information;

- Yappli, a software applications developer;

- Bengo4, an online legal consultation service;

- Lifenet, a life insurance company; and

- Rakuten, the internet retailer Rakuten (the managers say that, despite very heavy investment, there is still little evidence of progress in Rakuten’s mobile telecom operations, which remain heavily loss-making, creating a drain on an otherwise attractive online business).

In all, portfolio turnover over the past year was 19%, implying an average holding period of over five years. This is close to last year’s turnover, but lower than 2020’s 38%, which was due to the extraordinary opportunities provided by the onset of the pandemic.