Henderson Smaller Companies has announced results for the 12 months ended 31 May 2023. This was a year of underperformance, as the NAV total return came in at -13.8% versus -6.5% for the company’s benchmark – the Numis Smaller Companies Index (excluding investment companies). The discount actually narrowed a little – from 14.6% to 13.2% – and that left shareholders with a total return of -12.0%. That compares to an average share price return of -5.5% for other constituents of the AIC UK Smaller Companies sector.

The annual dividend increased to 26p from 24p and that was amply covered by revenue earnings of 29.38p. With that marking the 20th year of consecutive dividend increases, Henderson Smaller Companies becomes an AIC dividend hero. The trust is trying to trace investors that haven’t been claiming their dividends, which we applaud.

Penny Freer’s chair’s statement says that the underperformance was largely caused by growth stocks remaining out of favour. However, she notes that the company’s long-term returns remain well ahead (+34%) of its benchmark over 10 years.

The discount narrowing was achieved without any shares being bought back. The chair’s statement says “We do not currently believe that share buy-backs represent the most effective way of generating long-term shareholder value.”

Extracts from the manager’s report

The underperformance came from a combination of the negative contributions from stock selection, gearing and expenses. Negative contributions from stock selection were principally a function of the underperformance of growth companies as they de-rated in valuation terms due to market concerns about the impact of rising interest rates and higher bond yields. In most cases, this was independent of the operational and financial performance of these businesses, which remained, on the whole, strong. Additionally, some of our cyclically exposed positions suffered as the global economy weakened, leading to selective earnings downgrades and consequent de-ratings.

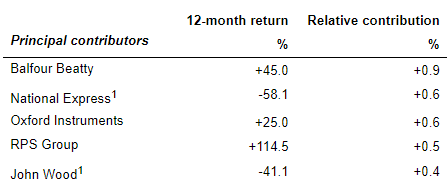

Attribution – positives

Balfour Beatty is an international contractor and infrastructure investor. New management has transformed the business over the last few years, driving margins higher across all operational activities in the UK, US and Hong Kong whilst maintaining the significant value of the infrastructure investment portfolio. Significantly improved cashflow has allowed the business to accelerate returns to shareholders through ongoing share buybacks and increased dividends. Given likely increased infrastructure investment in its key markets, the company looks well placed to continue to deliver growth in earnings, cashflow and returns to investors.

National Express (now Mobico) is an international operator of bus and rail services. The business has struggled to rebuild profitability post-Covid as weaker demand and higher wage costs have impacted the business. Additionally, the business suffers from high levels of debt. The Company did not own a position in this stock.

Oxford Instruments is a manufacturer of advanced instrumentation equipment. The company benefits from servicing a number of high-growth industries such as semiconductors, quantum computing, life sciences and advanced materials. In addition, its ‘Horizon’ programme of business improvement is driving sales, profit and margin growth. The company has a very strong balance sheet and, given a positive outlook for its end markets, the company is well placed for the future.

RPS Group is an independent environmental, health, safety and risk consulting group, which provides scientific, planning and design advice to customers in the commercial and government sectors. Formed by a series of acquisitions, the group has gone through significant change, with self-help improvement, a refreshed management team and tighter strategic focus. The group is benefiting from buoyant infrastructure, renewables and energy markets. The business was acquired by a US competitor, Tetra Tech, during the year at a significant premium to the undisturbed share price.

John Wood is an international engineering, procurement and construction (“EPC”) contractor for the oil and gas industry. Despite selling its ‘Built Environment’ business, the company still suffers from the perception of a weak balance sheet caused by provisions relating to historic loss-making contracts. The company was the subject of an abandoned takeover approach from Apollo. The Company did not own a position in this stock.

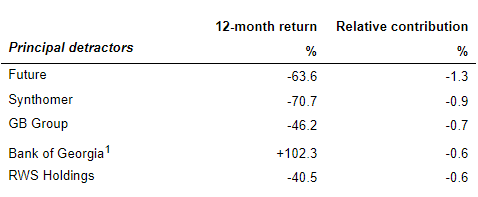

Negatives

Future is a tech-enabled global platform for specialised media which targets consumers and business-to-business (“B2B”) brands across Europe, America and Asia Pacific. The company creates specialised content to attract and grow high-value audiences. These audiences are then monetised through memberships and subscriptions, print and digital advertising, e-commerce sales and events. Future has both an organic and inorganic growth strategy. Management is focused on purchasing new brands and titles to leverage its scalable technology and drive digital growth using its revenue optimisation model. The shares have suffered from both earnings downgrades and a material de-rating during the year. Downgrades have been driven by greater-than-expected normalisation of spending in consumer technology post-pandemic, while the de-rating has been driven by concerns around advertising volumes and yields in an uncertain macroeconomic environment. There have also been more existential concerns around potential disruption to its business model from artificial intelligence (“AI”). Poorly handled communications around the retirement of the long-standing CEO in the period only added to investor nervousness. Whilst we cannot be certain the downgrade cycle has ended, we believe the rating has discounted much of this. A new CEO is now in place and the company has retained and, in some cases, improved on its leading market positions which gives us confidence that earnings can recover in improved macroeconomic conditions.

Synthomer is a diversified chemicals group. The group has expanded through acquisition which has diversified the company’s end markets. The group enjoyed extremely buoyant market conditions in its nitrile latex market as demand for gloves rapidly expanded during the pandemic. A marked cooling in demand in this market in the last year combined with a cyclical downturn in the coatings, adhesives and general chemicals markets has led to a significant fall in profitability. Additionally, previous acquisition activity has left the company with elevated financial leverage. A new management team is in the process of reducing debt by disposals and other balance sheet measures. We believe the business is well placed to benefit from a recovery in the nitrile latex market as demand recovers.

GB Group is a data identity, fraud prevention and address verification business. The company provides a combination of software and data to clients to help onboard their customers in an efficient and accurate manner whilst also reducing the risk of fraud. The company’s end markets are growing rapidly as services move from offline to online channels, a trend which is expected to continue as new business models are formed. GB Group has grown both organically and through acquisition. The shares have fallen in the year due to weaker trading conditions for some of the group’s financial service and internet economy customers as well as being impacted by the general market de-rating of growth companies.

Bank of Georgia is a leading retail and commercial bank in Georgia. Robust economic growth in the region has led to strong growth in profitability and an improving capital position for the business. The Company did not own a position in this stock.

RWS Holdings is a leading provider of translation software and services. Although the company is extracting the expected synergies from its acquisition of SDL plc, regulation change in its patent translation services business, weakness in demand from its large technology customers and a shift to SaaS from licence sales in its software division has led to modest falls in profitability. This has led to a de-rating in the valuation of the company. The business retains a strong net cash balance sheet and has significant potential for recovery once the negative drivers on profitability abate.

HSL : Henderson Smallers becomes latest dividend hero but adverse growth sentiment weighs on returns