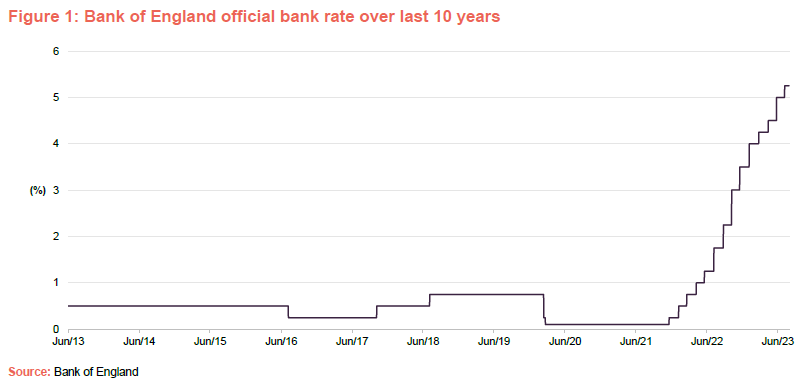

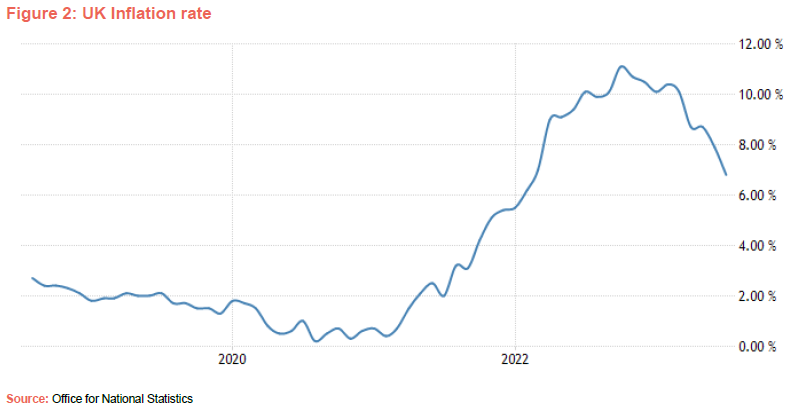

Reflecting the challenging macroeconomic backdrop, the last six months have been an uncertain period in markets. Key amongst investors’ concerns has, at least until recently, been stubbornly high inflation in most developed markets, particularly in Europe and the UK specifically. This had refused to roll over despite energy prices – a key factor a behind in the surge in prices – coming down significantly. With inflation remaining elevated, central banks have continued to push up interest rates to take heat out of their economies (the Bank of England’s 0.25% interest rate rise in August wasn’t much of a surprise given that inflation remained significantly above its 2% target), bringing with them an increased risk of recession.

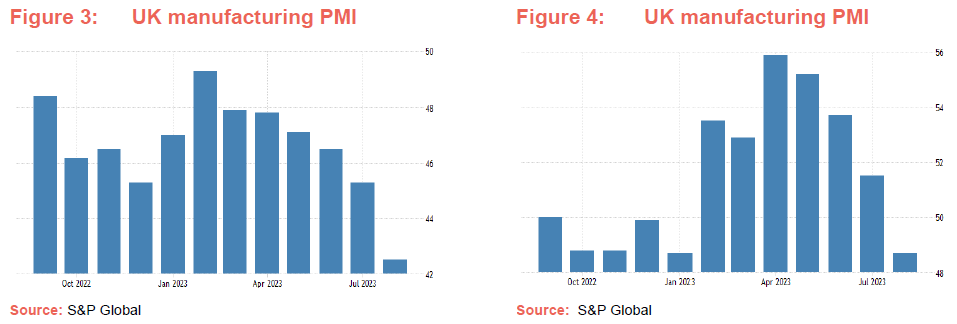

To underline this point, at the time of writing yield curves in most major markets are inverted (the UK, US, Euro area for example), which is a strong leading indicator of a recession. This has also been reflected in purchasing manager index (PMI) data (a survey-based index that provides insight into business conditions, specifically whether markets are expanding, staying the same, or contracting – indices are computed for both the manufacturing and services sectors, and a composite is also calculated), where many manufacturing indices have been below 50 for some time (this suggests contraction, whereas above 50 suggests expansion). However, the negative outlook for manufacturing has been buoyed by a more positive outlook for services, so that most composites have remained expansionary. However, as illustrated in Figures 3 and 4, both have been on a declining trend so far this year, adding to investors’ worries.

More recently, there has been some good news with clear signs that inflation has started to retrench (see Figure 3). This has given investors hope that the end of interest rate rises may finally be in sight and that, while there will inevitably be some form of landing for stuttering developed economies, these might actually prove to be softer than had been previously feared. However, flash PMI data for the UK and Europe released on Wednesday was particularly bad. It showed UK and European services finally following manufacturing into contraction and, as services is a major part of these developed economies output, it has had a marked impact on the composite, suggesting that rather than the outlook improving, there could be more pain to come. Data from the US was also poor, although the overall growth outlook still remains marginally positive. It is clear that some investors have not been prepared for this shift, so we thought it would be worth looking at some of the trusts in the flexible investment sector that investors might look to help keep them afloat if the tide goes out further.

The flexible investment funds generate their returns from a variety of sources and so tend to be less market sensitive as a result, although some have a greater focus on capital preservation than others. Ruffer, Personal Assets, Capital Gearing and RIT Capital Partners all have a good record of capital preservation in down markets and are liquid with market caps in excess of £1bn.

Starting with Ruffer, which announced its first ever share buyback this week (click here to see our coverage of that), this trust had a good 2022 (its index-linked stocks are a significant percentage of its portfolio and these halved but this was offset by the manager’s derivative strategies) but has struggled this year (over the last six months it is the worst performing of these four, having lost 7.0% of its NAV). Reflecting this, its discount has widened out (while Ruffer was trading at a premium and still issuing stock as recent as early May, it is trading at a 4.8% discount at the time of writing) and is now close to its five-year high. The yield is not particularly high, so perhaps not one for those seeking a yield, but the board has recently provided liquidity around a 6% discount level, which may offer investors some comfort that they can get in and out of the trust around current valuations. There is also the prospect of a discount narrowing if the discount reverts back towards its longer-term averages.

Personal Assets places capital preservation at the centre of its ethos. Its manager, Troy Asset Management, says that it pays attention first and foremost to the downside risk of any investment. Its yield is comparable to Ruffer’s at 1.2% and its recent performance has outpaced Ruffer’s by some margin – it has lost 0.7% of its NAV over the last six months. It is trading close to par, so doesn’t offer the same discount opportunity as Ruffer, but it operates a zero-discount policy whereby the trust issues or buys back shares to keep the discount close to zero (it is trading at a discount of 0.5% at the time of writing).

Capital Gearing is managed by veteran fund manager, Peter Spiller. It has a strong focus on providing absolute returns and invests in a portfolio of quoted closed ended funds, other collective investment vehicles, equities, property equities as well cash, bonds, index linked securities and commodities to achieve its aims. It has, for example, held a meaningful allocation to US TIPS as an inflation hedge as the manager has long held the view that inflation was previously dormant and not dead. It saw a significant risk from inflation entering the system given current debt-to-GDP-ratios in the developed world, which it thought would limit central banks ability to raise interest rates without crippling their economies. However, the trust’s recent annual results (for the year ended 31 March 2023) are not as good as might have been expected – with an NAV total return of -3.6% this is the second time in the trust’s 41-year history where it has made a loss.

Like Personal Assets, Capital Gearing is active in the market for its own shares to keep them trading around par although these are allowed to trade within a wider band and have recently been trading around a 2% discount to NAV (2.4% at the time of writing). The yield is low at 1.3% and its performance over the last six months sits between that of Personal Assets and Ruffer – a loss of 3.5% of the NAV.

RIT Capital Partners is the investment vehicle for the family interests of Jacob Rothschild and, despite providing the best performance of the four over the last six months, as well as the best performance over three-, five- and 10-years, it is trading on the widest discount by a significant margin (20.2% at the time of writing), which is way wider than its longer-term averages. The discount widened towards the end of last year when a broker published a note bringing into question its capital protection credentials, the increased exposure to private assets and the risk of NAV declines and questions over its cost base (we wrote a note April addressing these questions – click here to read). At the time, we said that we thought its discount was unjustified and, given its performance since, we think this statement has been vindicated. Despite this, the discount has only narrowed modestly, and so there is additional upside potential should it revert to its previous trading range.