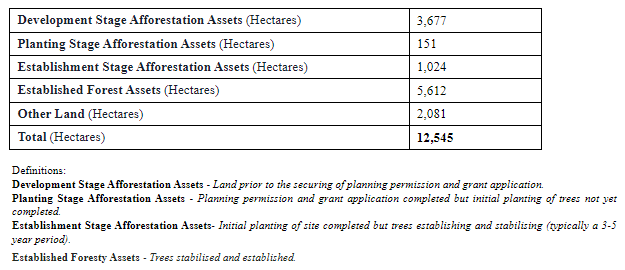

Foresight Sustainable Forestry (FSF) has acquired three assets in Scotland – Toun Hill, Threepwood Hill and Carlinden Burn – for a total cost of £8.3m (inclusive of tax and transaction costs). The purchase, which has been funded from FSF’s revolving credit facility (RCF), increases the size of FSF’s portfolio by 819 hectares to 12,545 hectares (spread across 68 properties). The new assets represent 4.4% of the last communicated Net Asset Value (NAV) as at 31 March 2023. FRSF’s RCF is now drawn by £10.4m and the company says that repayment will occur through a combination of timber harvesting and the planned disposal of non-core or other assets. FSF says that all three investments represent good value in the current market and are forecast to deliver strong returns, given the higher interest rate environment. These properties substantially complete FSF’s acquisition of land in preparation for its 2024/25 planting programme and there are no further material additions to the portfolio currently expected within the calendar year. An overview of the acquisitions can be found below with more detail listed in the appendix.

Toun Hill

This asset covers 230 hectares and is expected to create a c.166-hectare commercial afforestation scheme. The acquisition also includes a non-core residential property which is planned for subsequent disposal in due course.

Threepwood Hill

The investment, spanning 59 hectares, will see the creation of a 43-hectare commercial afforestation scheme and is located close (1.5 miles) to Chatto Craig, another afforestation property in FSF’s portfolio. Together, these properties have good potential for upside marriage value realisation.

Carlinden Burn

The 530-hectare property extends FSF’s cluster of properties in Aberdeenshire and is a mixed afforestation and forestry opportunity, with 216 hectares of afforestation potential and a further 102 hectares of existing forestry. Like Toun Hill, this purchase also includes some non-core residential property and land which is planned for disposal in due course.

Planting drives valuation uplift

As was seen in FSF’s most recent NAV update, planting of afforestation assets represents a key driver of valuation uplift for the company. FSF says that it remains on track to deliver a substantial planting programme during the upcoming winter with a view to completing planting and recognising voluntary carbon on many of its Development Stage and Planting Stage afforestation projects by the spring of 2024.

The current breakdown of the portfolio, post the acquisitions above, is shown in the table below.