Pausing on equity reductions

Pausing on equity reductions

Over the last couple of years, Seneca Investment Managers (Seneca IM), the manager of Seneca Global Income & Growth Trust (SIGT), has been reducing the trust’s equity weighting, in advance of a global recession that it now expects in 2021.

Consistent with this view, the manager has increased SIGT’s weighting to gold and reduced net gearing (3.3% as at the end of September). Whilst it may make further equity reductions, we are now much closer to the point where these will cease, and it has decided to press pause for now (SIGT is now significantly underweight equities relative to its long-term allocation). Seneca IM expects its multi-asset strategy to strongly outperform equities in the downturn, although during such a period the trust would struggle against its absolute return-orientated benchmark.

Multi-asset, low volatility, with yield focus

Multi-asset, low volatility, with yield focus

Over a typical investment cycle, SIGT seeks to achieve a total return of at least inflation as measured by the Consumer Price Index (CPI) plus 6% per annum, after costs, with low volatility and with the aim of growing aggregate annual dividends at least in line with inflation. To achieve this, SIGT invests in a multi-asset portfolio that includes both direct investments (mainly UK equities) and commitments to open- and closed-end funds (overseas equities, fixed income and specialist assets). SIGT’s manager uses yield as the principal determinant of value when deciding on its tactical asset allocation and holding selection.

|

|

Fund profile

Fund profile

Multi-asset portfolio with low-volatility returns and an income focus

Multi-asset portfolio with low-volatility returns and an income focus

SIGT’s aim is to grow both income and capital through investment in a multi-asset portfolio and to have low volatility of returns. Its portfolio includes allocations to UK equities, global equities, fixed income and specialist assets.

SIGT is designed for investors who are looking for income, want that income to grow, want the capital of the investment to grow, and are seeking consistency, or lower volatility, in returns. A pure bond fund could meet the first of those needs; a pure equity fund could meet the first three. SIGT invests across a number of different asset classes with the aim of achieving all four.

Seneca Investment Managers – a multi-asset value investor

Seneca Investment Managers – a multi-asset value investor

SIGT’s portfolio has been managed by Seneca Investment Managers (Seneca IM), and its forerunners, since 2005. Seneca IM describes itself as a multi-asset value investor. We think the combination of multi-asset investing with an explicit value-oriented approach may be unique to Seneca IM. The idea is that Seneca IM can allocate between different asset classes and investments, emphasising those that offer the most attractive opportunities and yields. In this way it can make asset allocation, direct UK equity and fund selection (for access to other overseas equities and other asset classes) follow a value-based approach.

CPI + 6% per annum reflects the importance of achieving real returns

CPI + 6% per annum reflects the importance of achieving real returns

From 7 July 2017, a new benchmark of CPI + 6% per annum came into effect, replacing SIGT’s previous Libor + 3% benchmark, which had been in place since the strategy change in January 2012. The new benchmark is more relevant to SIGT’s investment strategy and the scale of returns that it has been achieving in recent years. Investors will welcome the emphasis on providing them with a real (inflation-adjusted) return.

The manager says that while it aims to beat CPI + 6% per annum over a typical cycle, there may be some cycles in which this is very difficult to achieve. This would typically be the case during cycles in which inflation rises sharply. Its analysis suggests that it can derive an average of 4.8% a year from strategic (long-term) asset allocation and an average of 2.3% from tactical (shorter-term) asset allocation and stock selection. Gearing (borrowing) will, the manager believes, add another 0.5% to returns, while costs will detract by around 1.5%, giving a real return of 6.0%. The manager says that, while some commentators would consider this ambitious, as an active manager these are the sort of returns it should be providing. These changes also brought SIGT into line with Seneca IM’s other funds, all of which are managed against a ‘CPI +’ benchmark, formally or otherwise.

Strategy has room to grow

Strategy has room to grow

SIGT has been expanding in recent years. However, with a market capitalisation of £85.5m and total net assets of £85.1m (as at 30 October 2019), SIGT is much smaller than its board would like it to be. SIGT’s investment approach could easily be applied to a much larger fund. Its low-volatility returns should prove attractive to investors and the certainty offered by its discount control mechanism (see page 19), should allow SIGT to continue to attract new shareholders and grow its asset base over time. Expanding the size of the trust should have the dual benefits of lowering the ongoing charges ratio and improving liquidity in SIGT’s shares.

Changes within the management team

Changes within the management team

As described on page 7, Seneca IM takes a team approach to managing its portfolios. On 11 October 2019, SIGT announced that Peter Elston, Seneca IM’s chief investment officer, had resigned for personal reasons and would be leaving at the end of 2019. Peter Elston is a significant and supportive shareholder in the management company and intends to remain so. The team is structured so that individual team members take primary responsibility for specific research areas, with support provided by another team member. Since joining Seneca IM at the beginning of 2018, Gary Moglione has supported Peter Elston on asset allocation and will take over the reins of this for the time being. Other research responsibilities will be managed by the team in the meantime.

Gary joined from Amundi Asset Management, where he managed €5 billion in European equity funds as well as multiple portfolios covering emerging markets, having previously held positions with Tilney Investment Management and Royal Liver Asset Managers. He has considerable experience of analysing funds and is the specialist responsible for research in developed market overseas equities and fixed income (where Seneca IM uses open- and closed-ended funds to gain exposure). Gary is part of Seneca IM’s ‘indirect investment team’, working alongside Tom Delic, who is focused on emerging market equity and fixed income research. A summary of the structure of the team is provided in Figure 1 on page 7.

Manager’s view

Manager’s view

Reducing equity exposure in anticipation of a global recession in 2020/2021

Reducing equity exposure in anticipation of a global recession in 2020/2021

Seneca Investment Managers (Seneca IM) has set out a clear ‘road map’ for SIGT’s equity weighting and how this will be reduced in advance of a global recession that it currently anticipates in late 2020/early 2021. The team expects to see a global equity bear market commencing in advance of this and aims for SIGT to be meaningfully underweight in equities at this time, as it is during the peak phase of the cycle that equities provide the worst performance.

Reflecting this, SIGT’s equity exposure has been on a decreasing trend since mid-2017 (initially this fell by 1% every couple of months, give or take, depending on market conditions, and more recently it has been cut by 1% every three months). Since setting out its intentions, Seneca IM has stuck to its plan. However, SIGT is now significantly underweight equities and the manager is pausing on further reductions for now.

The manager did not recommend an equity reduction at the end of September 2019. The manager says that, given the extent of the equity reduction made since the middle of 2019, it is happy to pause on these for now. SIGT is significantly underweight equities and, whilst Seneca IM may make further reductions, the team believes that a hiatus is appropriate. Either way, the manager considers that we are now much closer to the point where it will stop reducing equities.

Manager’s view unchanged since we last published

Manager’s view unchanged since we last published

A detailed discussion of the manager’s views was also provided in our April 2019 note (see pages 2–4 of that note) and our July 2019 note (see pages 2–4 of that note). We recommend that readers who would like additional information should review these. However, to summarise:

- In developed markets, unemployment is very low and showing signs of bottoming (in the UK, the US and Japan, but less so in Europe). SIGT’s manager expects that the next move will be up, which will be a sign of an economic contraction.

- The US central bank (the Federal Reserve or Fed)’s behaviour suggests that it is concerned about the progression of the economic cycle. The Fed has said that there will be no interest rate rises in 2019 and quantitative tightening (a reversion of the policy of quantitative easing) has stopped.

- The yield curve inverted for some months (in other words short-term borrowing costs ended up being higher than long-term borrowing costs) and is now flat. SIGT’s manager says that on the six occasions over the past 50 years when the three-month yield has exceeded that of the 10-year yield, an economic recession has commenced, on average, 311 days later.

- There’s no safe haven to be found in government bonds. Inflation risk aside, the manager’s major concern is that with bond yields so low, they are extremely overvalued.

- SIGT’s Asian and emerging market equity exposure is now high relative to total equity exposure, reflecting the long-term structural growth available in the region and the less-efficient nature of its equity markets, which creates opportunities for skilled managers.

- There continue to be opportunities in the fixed income space. Specifically, there can be a big mismatch between spreads (the gap between the yield on a bond and the yield on a low risk bond of equivalent duration) and defaults (failure to pay interest or repay capital on debt when it is due), particularly in non-investment grade bonds.

- Despite the prospect of weaker global growth ahead, UK equities are cheap due to the effects of Brexit. The manager thinks that the UK equity market has effectively become dislocated, with international global growth companies being expensive, whilst domestically focused cyclical companies are very cheap, and thus still attractive. This is particularly acute in the mid-cap space, where SIGT’s UK direct equities exposure is focused.

- Seneca IM had expected the real yields on US Treasuries to rise to around 2%, with positive real yields in other markets but now thinks that in the current cycle, peak real interest rates may be lower than in previous cycles, reflecting structural deflationary pressures. The manager thinks this might be an indication that the end of the economic cycle is closer than was previously thought.

- The manager believes that gold offers the portfolio some protection against the risk that, in a recessionary environment, central bankers try to undermine the strength of their currencies (usually as a way of stimulating exports).

- The manager also expects specialist assets and cash to offer some protection in a recessionary environment.

Recent developments reinforce the manager’s view

Recent developments reinforce the manager’s view

Seneca IM tells us that, since we last published in July, its outlook has not changed and recent developments have served to reinforce its view. For example, the manager considers that the unemployment rate has reached a low point and should start to increase; manufacturing activity is being impacted almost everywhere in the world; and while developed markets are more focused on the provision of services, services generally support manufacturing, and these will be impacted in turn as manufacturing declines.

The manager believes that the US market, with its very high level of consumer confidence, is particularly vulnerable. They expect this to fall dramatically as job losses start to come through, leading to a marked reduction in aggregate demand and fuelling a vicious cycle. The manager says that, in addition to manufacturing data looking weak, global purchasing managers indices (PMIs) have been on a declining trend during the last 18 months. It is notable, too, that UK domestic stocks have been rising in recent months as hopes of a Brexit resolution increase.

Investment process

Investment process

Seneca IM takes a team approach to managing its portfolios. The team is structured so that individual team members take primary responsibility for specific research areas, with support provided by another team member. A summary of the structure is provided in Figure 1.

Tactical asset allocation – yield is the principal determinant of value

Tactical asset allocation – yield is the principal determinant of value

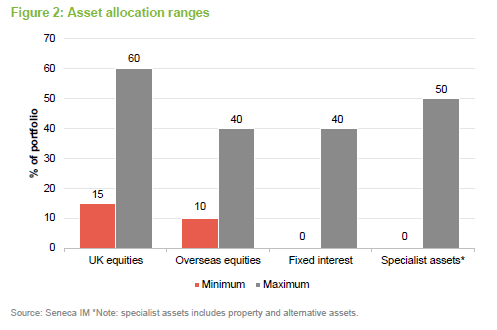

As illustrated in Figure 2, the board has set ranges for the individual asset classes in which SIGT invests. The research specialist for asset allocation then recommends a tactical asset allocation based on their assessment of the relative value attractions of different asset classes, where yield is the principal determinant of value. This reflects the fact that yield is relevant to all of the asset classes in which SIGT invests and it is also relevant to SIGT’s income requirements. Tactical asset allocation decisions are discussed by the investment team; any changes require majority approval.

The manager has some discretion to deviate from the target weights

The manager has some discretion to deviate from the target weights

Target weights for individual holdings are set by the research specialists. This occurs once an investment has been approved by the investment team. The manager has some discretion to deviate from the target weights (a maximum of 10% in aggregate), which allows sufficient flexibility to manage the portfolio efficiently with regard to cash flows etc. This discretion can be applied on an ongoing basis, but the manager aims to stick closely to the target asset allocation with deviations from this being short term in nature. The individual managers’ decisions and indeed all investment decisions are discussed, challenged and reviewed in weekly investment meetings. These are minuted and all investment decisions and the reasons for them are logged centrally so that they can be revisited at a later date.

Increasing the portfolio concentration

Increasing the portfolio concentration

Seneca IM is keen that investment decisions have a real impact on performance and has been slowly increasing portfolio concentration since the introduction of the new investment process three years ago. The aim is to focus on higher-conviction longer-term ideas, which is expected to generate superior returns. The longer-term investment approach has also seen portfolio turnover fall, which has reduced transactions costs.

Exposure to overseas equities and fixed income is gained via funds

Exposure to overseas equities and fixed income is gained via funds

Within SIGT’s portfolio, exposure to both overseas equities and fixed income is gained via funds, which allows SIGT to gain access to third-party managers’ expertise. The research for these areas focuses primarily on assessing the fund manager and its investment process rather than the asset class itself.

For overseas equities, SIGT’s manager is looking for funds that are actively managed and have a high active share; in particular, emphasis is placed on the underlying manager’s investment philosophy and process. The funds may be closed or open-ended although, for closed-end funds, discounts may be an additional indication of value. Either way, the research specialist also takes a view on the value present within a fund’s underlying holdings.

Fixed income funds are selected that offer the prospect of attractive yields and where there is a strong focus on capital preservation. The latter consideration generally leads them to favour actively managed funds that work within a structured ‘relative value’ framework.

Specialist assets and specialist financials

Specialist assets and specialist financials

SIGT’s allocation to specialist assets includes exposure to various areas, such as private equity, property, infrastructure and specialist financial. (Specialist financial includes exposure to such areas as debt funds). Exposure is mostly gained via funds and the manager looks for assets that are less correlated to SIGT’s other asset classes and that offer attractive yields. In evaluating these opportunities, the manager considers the likely return over the life of the investment relative to the current price; security of income with the potential for this to grow in real terms; and strong asset backing.

Unquoted securities, gearing and cash

Unquoted securities, gearing and cash

SIGT is permitted to invest in unquoted securities (up to 7.5% of its gross assets). However, whilst it has had success in this area (for example, its long-held direct investment in AJ Bell, which has now listed on the London Stock Exchange), this is not an allocation that the manager is looking to add to at the present time.

SIGT is also permitted to hold cash. However, this cannot exceed 25% of its gross assets. SIGT is permitted to borrow, although this is limited to a maximum of 25% of its net assets. More information on SIGT’s borrowings is provided on page 21.

Asset allocation

Asset allocation

One per cent reduction in equity exposure every three months

One per cent reduction in equity exposure every three months

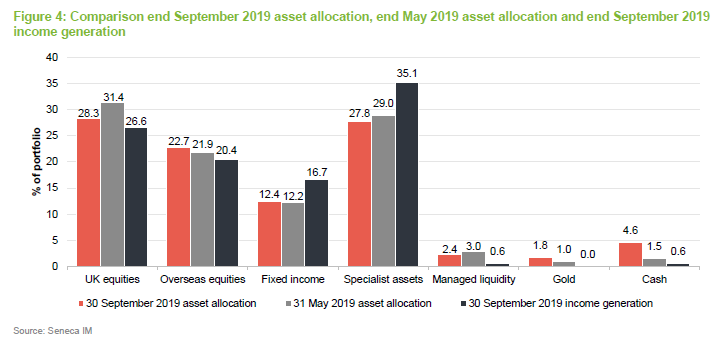

The team at Seneca IM set out its intention in mid-2017 to reduce SIGT’s allocation to equities during the next few years, with the aim of being significantly underweight by the time markets peak. Since we published our update note in July 2019, SIGT has published details of the changes that it made at the end of June 2019. This covered a 1% reduction in equities that was matched by a 1% increase in the allocation to physical gold. The equities reduction was comprised of:

- A 50bp reduction to European equities (overseas exposures are achieved via funds); and

- A 50bp reduction to Asian ex Japan equities.

As noted on page 6, the manager considers that the UK is structurally cheap due to the effects of Brexit, which has hit the mid-cap space, SIGT’s preferred area of investment, particularly hard. Consequently, Seneca IM did not want to reduce SIGT’s allocation to the UK. With a nil allocation to the US, Europe and Asia ex Japan became the obvious candidates for reductions. The manager is not particularly negative on these regions, but comments that there is not much news coming out of Europe, while Asia ex Japan is being impacted by China’s trade dispute with the US.

UK direct equities – key developments

UK direct equities – key developments

Since we last published, Seneca IM has reduced the allocation to AJ Bell (see below for more details) and, in the short term, has allocated some of the proceeds to the iShares Core FTSE 100 ETF (to maintain SIGT’s exposure to UK equities rather than holding cash) as well as initiating a new position in Purplebricks (see below).

The manager has also trimmed SIGT’s holdings in Marston’s and Ultra Electronics, as these have performed very strongly. The proceeds have been allocated to a spread of existing holdings that the manager considers offer better value (for example, Clinigen, OneSavings Bank, Legal and General and Halfords).

Overseas equities – Japanese exposure tilted further towards deep value

Overseas equities – Japanese exposure tilted further towards deep value

Regular followers of SIGT will be familiar with CC Japan Growth and Income Trust (CCJI – www.ccjapanincomeandgrowthtrust.com) as a fund that has regularly appeared in SIGT’s top five overseas equities holdings since its launch in December 2015 (SIGT participated in the IPO, along with other Seneca funds, which collectively owned around 7% of the fund at its launch). However, Seneca IM has sold the position in CCJI to fund a new position in the Morant Wright Fuji Yield Fund. Seneca IM says that the Japanese market experienced a marked decline during July and August and, with signs of a weakening global economic outlook, it took the view that it would be a good time to switch into a deeper value position.

Specialist assets – SIGT added to Hipgnosis Songs Fund during the capital raise

Specialist assets – SIGT added to Hipgnosis Songs Fund during the capital raise

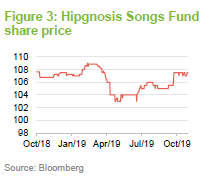

As discussed in our September 2018 update note, SIGT invested in Hipgnosis Songs Fund (SONG – www.hipgnosissongs.com) during its IPO in July 2018 (see pages 7 and 8 of the September 2018 note). SONG is a Guernsey-domiciled investment company established to offer a pure-play exposure to songs and associated musical intellectual property rights. It is targeting a dividend of 5% a year, which it also intends to grow, and it is targeting a total NAV return of 10% a year over the medium term (Hipgnosis’s manager earns a performance fee if this hurdle is reached).

Seneca IM says that, whilst there have been some concerns raised in the market around the visibility of SONG’s earnings, its internal analysis has allowed it to get comfortable with SONG, its ability to generate cash and the prices being paid to acquire catalogues. As such, it was happy to participate in the fundraise that closed on 27 August 2019 as well as Hipgnosis’s recent C-share offering (adding a further 50 basis points (0.5%) to the position).

Within the specialist assets bucket, the manager has switched some of SIGT’s allocation of Doric Nimrod Air Two to Doric Nimrod Air Three. The managers like both funds. At the time of the switch, the yields were broadly equitable, but, of the two, Doric Nimrod Air Three is the younger vehicle, with newer planes, and the manager considers it to be lower risk than the older vehicle.

Purplebricks – value and growth opportunity

Purplebricks – value and growth opportunity

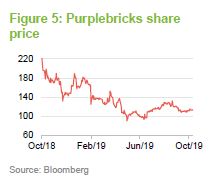

Purplebricks (www.purplebricks.co.uk) is an online estate agency, that has used technology to disrupt the traditional industry model. Initially its activities focused on the UK, but the company has expanded internationally and now has operations in Canada, the US and Australia.

Seneca IM says that, while Purplebricks approach was initially well-received (its fixed fee structure, as opposed to charging a percentage of the sales price, appealed to UK vendors), the company expanded too quickly when going into overseas markets. US vendors, in particular, didn’t like the model and the company’s share price suffered heavily in February 2019 when it cut its revenue forecasts for its operations in the US and Australia. Elsewhere, Purplebricks has found itself amidst controversy on a number of occasions. For example, it has faced criticism regarding the quality of its online reviews. It was also a holding of Woodford Investment Management; both these factors weighed on the company’s share price.

However, Seneca IM says that, following a change of management, Purplebricks has a much more tech-savvy team at the helm and, in terms of market penetration versus brand awareness, the company has excellent growth prospects (for example, Purplebricks has a 5% market share in the UK but 96% brand awareness). The company has also retreated from the US and Australia, its most problematic markets, and is focusing on the most profitable: the UK and Canada (it was in Canada that Purplebricks bought an established business in 2018 in the form of DuProprio).

Overall, Seneca IM considers that the market is yet to appreciate the scale of change at Purplebricks and that the February set-back created the unusual opportunity to commence building a position in a growth company at value prices.

Update on Woodford Patient Capital Trust

Update on Woodford Patient Capital Trust

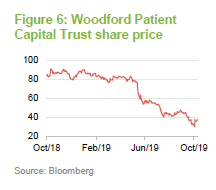

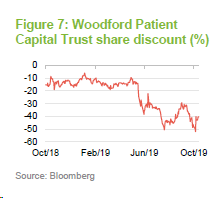

Since publishing our update in July 2019, Woodford Patient Capital Trust (WPCT – www.woodfordfunds.com/funds/wpct) has experienced a further decline in its share price and there have been a number of significant developments with the manager, Woodford Funds. We won’t dwell on these here as they are well documented in the media, other than to say that, having lost the mandate for its flagship equity income fund (the management fees for which underpinned the managers ongoing expenses), Woodford Funds gave notice on Woodford Patient Capital Trust and the LF Woodford Income Focus Fund.

On 24 October 2019, the trust announced that terms have been agreed to appoint Schroder Investment Management Limited as the trust’s portfolio manager. This is expected to occur by the end of the year. The trust is to be renamed as Schroder UK Public Private Trust and Schroders intends to manage the portfolio in line with WPCT’s existing investment objective and policy. The market responded positively to the announcement with WPCT’s shares up 25% on the day. We welcome this latest development; we do not think a fire sale of the assets is in anybody’s interests.

There are still question marks over what happens next with WPCT. However, the board says that further details will be announced following Schroders’ formal appointment.

Irrespective of whether it survives, Seneca IM says that there are tough decisions for the board to make. In this regard, it welcomes the recent refresh of the board (there are three new members although the chairman remains for now).

Largest investments

Largest investments

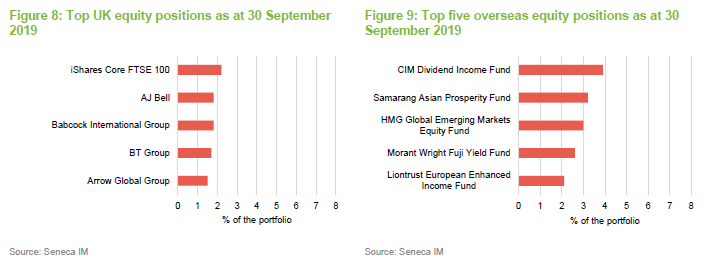

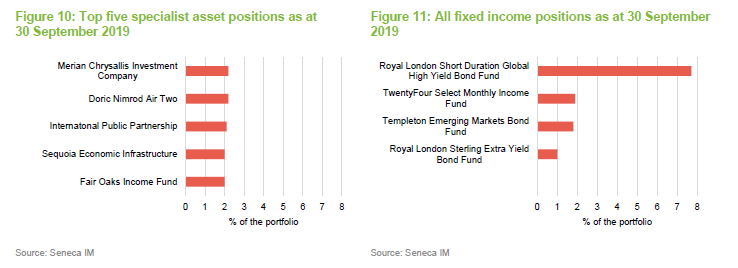

Figures 8-to-11 show the largest positions in each part of the portfolio as at 30 September 2019. Details of the rationale underlying some of these and other positions can be found in our previous notes (see page 23 of this note). For example, readers who would like more detail on the CIM Dividend Income Fund, Samarang Asian Prosperity Fund, Hipgnosis Songs Fund, Diploma, Victrex or Custodian REIT should see pages 6–9 of our September 2018 update note. Some of the more recent changes are also discussed in detail above.

Many of the names in Figures 8-to-11 will be familiar to readers of our previous notes on SIGT, particularly for the overseas equities, specialist asset and fixed income positions. Within SIGT’s top five UK direct equities, the partial sale of AJ Bell position has moved this into second place (see below) and the top spot is taken by the iShares Core FTSE 100 ETF (a temporary store for the proceeds of the partial AJ Bell sale). The net effect of one position becoming two is to push OneSavings Bank out of the top five. Looking at overseas equities, CC Japan Growth and Income has been replaced by the Morant Wright Fuji Yield Fund. Otherwise, the same stocks continue to feature in the top positions in their respective baskets, as you would expect from a lower-turnover portfolio such as SIGT’s.

AJ Bell (1.8%) – position size reduced to level consistent with other UK direct equity holdings

AJ Bell (1.8%) – position size reduced to level consistent with other UK direct equity holdings

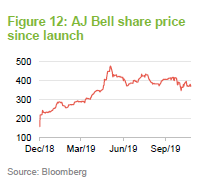

As discussed in previous notes, SIGT has held a position in AJ Bell (www.ajbell.co.uk) for a number of years. Initially, this was an unquoted holding, and treated as a specialist asset within SIGT’s portfolio, but AJ Bell listed on the London Stock Exchange on 7 December 2018 (Ticker: AJB), moving the position to SIGT’s direct UK equities portfolio. SIGT sold 50% of its holding as part of the IPO. It was subject to a six-month lock in on the remainder.

As illustrated in Figure 12, the share price doubled on the first day of trading and, while the company is now trading below its May 2019 peak of 445p per share, it is still more than double its IPO price. The effect was that AJ Bell continued to be a significant position in SIGT’s portfolio (7.6% as at 31 May 2019). As we discussed in our July 2019 note, SIGT is now out of the lock-up period (this expired on 18 June 2019) and the managers have been gradually trimming the position to bring it into line with SIGT’s other direct UK equity positions. Seneca IM continues to like the company, but was keen to normalise the position size and reduce the concentration risk.

Morant Wright Fuji Yield Fund (2.6%) – deep value proposition

Morant Wright Fuji Yield Fund (2.6%) – deep value proposition

The Morant Wright Fuji Yield Fund (www.morantwright.co.uk/mw-fuji-yield-fund) is an Ireland-domiciled UCITS fund, managed from London, ‘that seeks to generate absolute returns by investing in undervalued Japanese companies that have strong balance sheets, sound business franchises and attractive dividend yields’. Seneca IM says that the fund has a ‘deep value with income focus’ that aligns closely with its own investment philosophy. The fund has a focus on mid-cap space, a high active share (circa 98%), a bottom up investment led asset allocation, is benchmark agnostic and, in Seneca IM’s view, the team has a very strong long-term track record. Furthermore, Seneca IM remains attracted to Japan – dividends are increasing, the regulatory environment is improving and corporate governance standards are rising.

Performance

Performance

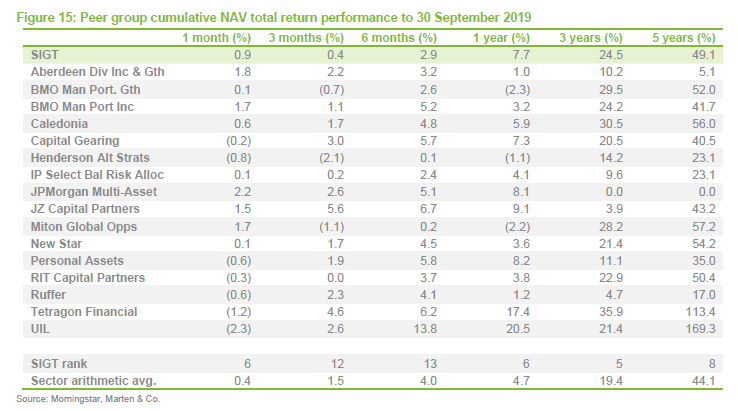

Figure 13 shows how SIGT’s share price and NAV total return performances compare with those of its peer group (selected from the Association of Investment Companies (AIC)’s Flexible Investment sector – see page 15), its blended benchmark, and UK and world markets as represented by the MSCI UK and MSCI World indices. During the last six months, there has been some mild underperformance of the broader peer group sector and its benchmark. However, SIGT’s long-term record remains very strong (ahead of the peer group and various indices over three and five years and since the strategy change in 2012. For the longer-term three- and five-year periods, is only beaten by the MSCI World). In our view, it is over longer-term horizons that SIGT’s performance is best assessed.

Looking at recent performance, the manager says that value stocks underperformed growth stocks significantly between June and mid-September this year, while the US market (where SIGT has zero exposure) performed strongly. However, the managers see the potential for this to reverse going forward, potentially giving a tail wind to SIGT’s performance.

Looking at Figure 14, SIGT has achieved these returns, with lower volatility than the average of its peer group, over all of the time periods provided. Its return volatility has also been markedly lower than that of both the MSCI UK and MSCI World indices.

In addition, SIGT’s share-price standard deviation is lower than that of the flexible investment sector over every time period and is lower over every period than those of the indices.

Peer group

Peer group

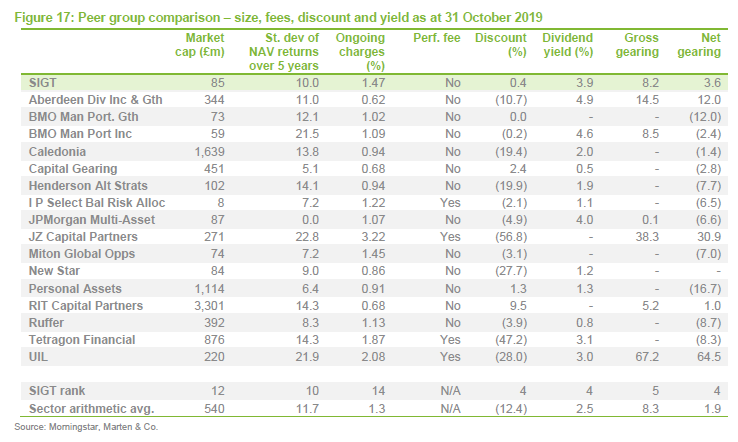

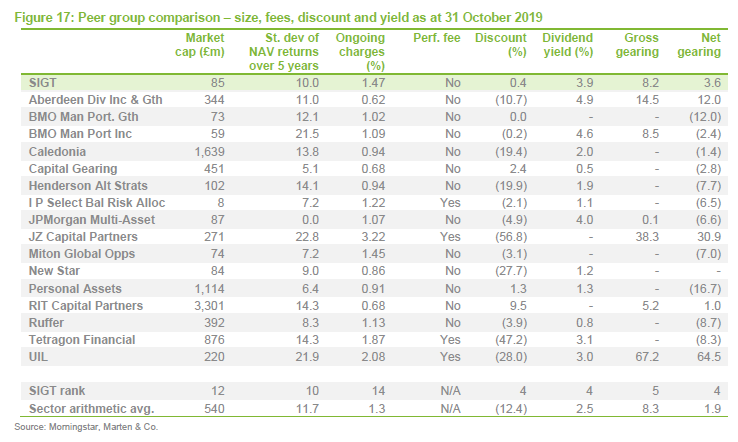

Since we last included a peer group comparison for SIGT, the AIC has recast its sectors. SIGT, and most of its previous peers, remain in the Flexible Investment sector. The overall peer group now comprises some 20 funds. However, for the purposes of this analysis, we have excluded a number of funds that we consider to be less relevant comparators. These are Bailiwick Investments (only listed on the International Stock Exchange); CIP Merchant Capital (relatively small with a portfolio that is highly concentrated – two fixed income positions account for circa 42% of the portfolio); Hansa Trust (circa 30% of the portfolio is Ocean Wilsons, whose success is heavily dependent on its Brazilian port and maritime logistics business); and Livermore Investments (little or no exposure to listed equities).

Figure 16 illustrates a similar story for share price total return although SIGT’s share- price performance is superior to that of the Flexible Investment sector over all of the periods, except that of three months.

Whilst not the smallest fund in the peer group, SIGT’s market cap is markedly below the sector average. However, there is still reasonable liquidity in its shares; at current prices, the value of its one-year average daily volume of shares traded is £172k. Investors also benefit from the confidence provided by SIGT’s discount control mechanism (see page 19).

SIGT’s smaller size also explains why its ongoing charges are at the top end of the range. However, if SIGT continues to be successful in growing its asset base, the ongoing charges ratio should continue to fall, all else being equal, as its fixed costs are spread over a larger asset base.

SIGT’s discount is tighter than that of the sector average, reflecting both demand for SIGT’s strategy and its discount control mechanism. In terms of gearing, SIGT’s exposure, at the gross level, is very close to the peer group average, while its net exposure is modestly above the sector average (3.6% versus 1.9%). It would appear that, whilst the split cap trusts (UIL and JZCP) pull the average up, a considerable proportion of the peer group are running net cash, arguably reflecting these managers’ views on the advanced stage of the economic cycle.

SIGT’s yield is markedly above the sector average (3.9% versus 2.3%) reflecting SIGT’s income focus (four of the trusts are not currently paying a dividend).

Quarterly dividend payments

Quarterly dividend payments

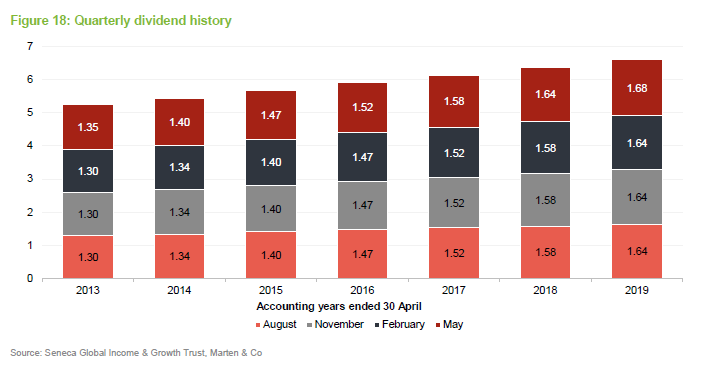

SIGT pays quarterly dividends. For a given financial year, the first interim dividend is paid in September with the second, third and fourth interims paid in December, March and June. In recent years, the quarterly dividend rate paid for the first quarter has been maintained for the second and third interims in December and March. This has then been followed by an increased dividend for the fourth interim (the June payment) which has established the base level for the first three interims of the following financial year (ex-dividend dates and record dates being the month prior to payment).

On 16 May 2019, SIGT declared its fourth interim dividend at 1.68p per share. This means that, for the year ending 30 April 2019, SIGT paid a total dividend for the year of 6.60p per share, which is an increase of 3.4% over the 6.38p per share paid for the 2018 year, as illustrated in Figure 18. This also suggests a minimum payment of 6.72p per share for the year ended 30 April 2020, assuming that SIGT at least maintains the quarterly dividend at 1.68p per share. This is a yield of 3.9% on SIGT’s share price of 173.5p as at 31 October 2019.

Average annual dividend growth of 3.9% since strategy change in 2012

Average annual dividend growth of 3.9% since strategy change in 2012

The average increase in the total annual dividend, since the change of strategy in 2012, has been 3.9%. This is significantly above the rate of inflation during the period. As illustrated in Figure 18, SIGT’s dividends have been on a rising trend over the past few years. However, this has been achieved at a time when the trust has also been rebuilding its revenue reserves (see our March 2017 note for further discussion).

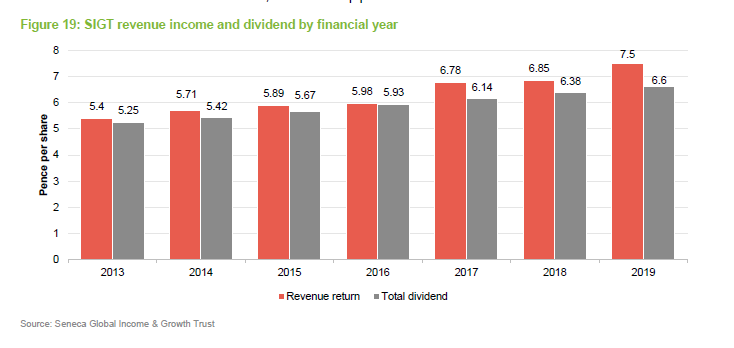

Figure 19 provides a comparison of SIGT’s revenue income versus the total dividend paid, since the 2012 strategy change. The dividend for the year ended 30 April 2019 was covered 1.14x by revenue earnings (2017: 1.07x). As at 30 April 2019, SIGT’s revenue reserve stood at £1.983m or 4.18p per share. Prior to the strategy change in 2012, it stood at 0.3p per share.

SIGT’s discount control mechanism keeps it trading close to asset value

SIGT’s discount control mechanism keeps it trading close to asset value

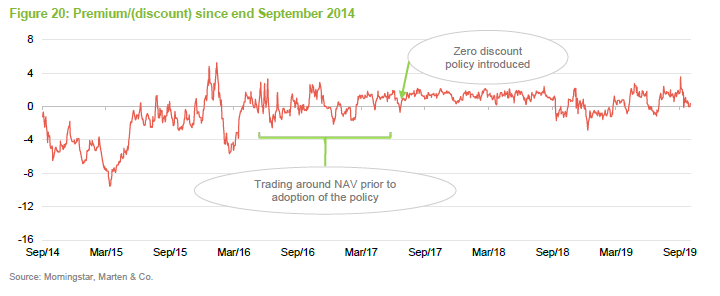

Under SIGT’s discount control mechanism, which went live on 1 August 2016, the trust actively provides support to the secondary market: buying and selling shares as necessary so that it effectively trades at, or close to, a zero discount. The introduction of the discount control mechanism has been a very positive development for SIGT, as it gives existing and potential shareholders confidence that they should be able to enter and exit the trust at close to NAV. As illustrated in Figure 20, SIGT has exhibited lower discount volatility since the introduction of the discount control mechanism; SIGT has traded at an average premium of 0.72% (median premium 1.02%) and in a range of a premium of 3.56% and a discount of 2.82%. In addition, the board and manager have allocated more resources to increasing awareness of the trust among investors in recent years.

Further potential to grow asset base

Further potential to grow asset base

The comfort provided by the discount control mechanism has helped to support liquidity in the secondary market. Provided that the trust continues to provide low-volatility returns that are attractive to investors, this, combined with the certainty offered by the discount control mechanism, could allow SIGT to continue to attract new shareholders and grow its asset base over time. All things being equal, this should serve to lower SIGT’s ongoing charges ratio and further support liquidity in its shares, for the benefit of all shareholders.

SIGT continues to be successful in issuing stock. There was some repurchase activity in the last quarter of 2018 and January 2019, which led to the number of shares in issue falling mildly for the year ended 30 April 2019, but the overall trend since has been one of net issuance. During the last 12 months, SIGT has made net issuance of 1.9m shares (equivalent to 3.9% of the shares in issue at the beginning of the period). Since the launch of the discount control mechanism, SIGT has made net issuance of 9.4m shares, equivalent to 23.4% of its issued share capital at the time the discount control mechanism was launched.

Fees and expenses

Fees and expenses

Management fee

Management fee

Under the terms of its investment management agreement with Seneca IM, SIGT pays an annual base management fee of 0.9% of its market capitalisation on the first £50m, falling to 0.65% on amounts above that. As the management fee is charged as a proportion of market capitalisation, rather than net assets, this structure incentivises the manager to minimise the discount. The investment management agreement does not include a performance-fee element and is terminable on 12 months’ notice by either side.

Secretarial, administrative, AIFM and discount management services

Secretarial, administrative, AIFM and discount management services

PATAC Limited (PATAC) provides administrative, company secretarial and discount management services to SIGT. PATAC is entitled to fixed fees of £110,000 for secretarial and administration services and £33,000 for discount management services. Both of these fees are indexed against the retail price index annually. The agreement with PATAC can be terminated by either party on three months’ notice.

With effect from 4 April 2018, PATAC also became SIGT’s Alternative Investment Fund Manager (AIFM). The investment management agreement with Seneca IM was terminated and a new AIFMD compliant agreement was entered into with PATAC. PATAC delegated the portfolio management services back to Seneca IM, which continues to provide the same services as previously. The commercial terms of the delegation agreement are the same as the previous agreement, with the exception that the AIFM fee is borne by Seneca IM out of its management fee.

Allocation of fees and costs

Allocation of fees and costs

SIGT’s management fee and finance costs are charged 50% to revenue and 50% to capital. All other fees are charged wholly to revenue, with the exception of any loan break costs, which would be charged wholly to capital.

SIGT’s ongoing charges ratio, for the year ended 30 April 2019, was 1.47% (2018: 1.45%). The modest increase is in part a reflection of the fact that SIGT shrank slightly during the course of the year (from 47.6m shares as at 30 April 2018 to 47.4m shares as at 30 April 2019), thereby spreading SIGT’s costs across a slightly smaller asset base.

As illustrated in Figure 17, SIGT’s ongoing charges are at the top end of the range for its peer group, reflecting that its size is markedly below the sector average. However, SIGT’s ongoing charges are not that much higher than some funds that are considerably bigger and should continue to fall if the trust continues to grow as its board and manager intend.

Capital structure and trust life

Capital structure and trust life

Simple capital structure

Simple capital structure

SIGT has a simple capital structure with one class of ordinary shares in issue. Its ordinary shares have a premium main market listing on the London Stock Exchange and, as at 31 October 2019, there were 49,251,088 in issue with 350,000 held in treasury.

The trust is permitted to borrow up to 25% of net assets and has a £14m three-year short-term rolling loan, provided by RBS, for this purpose. As at 30 September 2019, £7m of the facility was drawn. The facility, which expires in October 2020, could theoretically provide gearing up to 16.4% (based on SIGT’s NAV as at 30 October 2019) and incurs interest at a rate of 110 basis points (1.1%) over Libor. SIGT does not have any other borrowing facilities in place. At 30 September 2019, SIGT had gross gearing of 8.2% and net gearing of 3.6%. SIGT’s 25% limit is in place to provide flexibility and is only likely to be used in more extreme market conditions. SIGT typically operates with more modest levels of gearing. The manager also sees the fund’s fixed income exposure as a natural hedge against its borrowings.

Shareholders approve new issuance of up to 30% of issued share capital

Shareholders approve new issuance of up to 30% of issued share capital

Commencing with its July 2017 AGM, SIGT has sought and received approval to issue up to 30% of its issued share capital, on a non-pre-emptive basis (in other words, it does not have to offer the shares to existing shareholders first). This is achieved via two resolutions. The first seeks permission to issue up to 10%. The second (or extra resolution) seeks permission to issue a further 20% that is solely in relation to SIGT’s discount control mechanism.

The board acknowledges that this approach is unusual and that the aggregate of 30% is higher than corporate governance guidelines recommend. However, it believes the approach is shareholder friendly as new shares are issued at a price that ensures existing shareholders are not diluted and it facilitates the efficient and cost-effective operation of the discount control mechanism. Given the ongoing level of demand for SIGT’s shares, this approach makes a sensible attempt to avoid the cost of having to convene a meeting of shareholders solely for the purpose of getting approval for additional share issuance.

Unlimited life

Unlimited life

SIGT has an unlimited life and, for a number of years, its shareholders were offered an annual continuation vote at each AGM (the last was at the trust’s July 2018 AGM). At that time, the board said that, with SIGT’s discount control mechanism now well established, the annual continuation vote was unnecessary, given the liquidity the discount control mechanism provides. Furthermore, given the rise in shareholders investing via platforms, the board had become concerned that few such shareholders vote, or have the chance to vote, their shares at SIGT’s AGMs.

The board therefore sought and received permission to remove the annual continuation vote. However, it says that should the discount control mechanism be suspended or withdrawn for any reason in the future, it would seek engagement with shareholders and explore the possible reinstatement of a continuation vote.

Financial calendar

Financial calendar

The trust’s year-end is 30 April. The annual results are usually released in June (interims in December) and its AGMs are usually held in July of each year. As discussed on page 17, SIGT pays quarterly dividends in September, December, March and June.

The board

The board

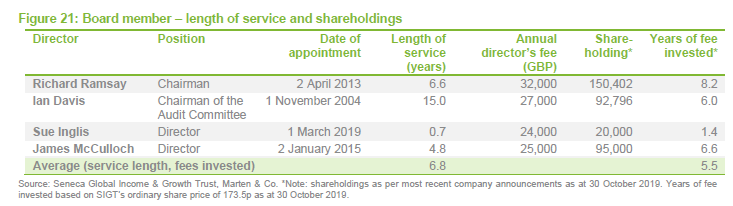

With the addition of Sue Inglis, who joined the board with effect of 1 March 2019, SIGT’s board now comprises four directors (details of their individual experience are provided below and overleaf); all members are non-executive and considered to be independent of the investment manager. The longest serving director is Ian Davis, chairman of the audit committee, who was appointed to the board in November 2004 and has now served for close to 15 years.

For a number of years, SIGT has operated with a relatively compact board. We have considered this appropriate to SIGT’s scale as it helps keep a rein on costs. However, the trust’s popularity has seen it grow significantly in recent years. We believe that it can now comfortably support the cost of expanding the board and welcome this additional appointment. All of SIGT’s board members retire and offer themselves for re-election annually.

Other than SIGT’s board, its directors do not sit together on any other boards. Each of the directors has a significant personal investment in the trust. This is favourable in our view, as it shows significant commitment and helps to align directors’ interests with those of shareholders.

Richard Ramsay (chairman)

Richard Ramsay (chairman)

Richard was previously an investment banker. He has considerable experience of the investment trust sector, gained as a managing director at Barclays de Zoete Wedd and a director at Intelli Corporate Finance. His experience also covers the fund management sector as a director with Ivory & Sime, the leisure sector as finance director at Aberdeen Football Club, the energy sector as a managing director at Ofgem and the public sector as a director at the Shareholder Executive. He is currently chairman of Northcourt and Castle Trust, a director of URICA and chairman of Wolsey Group. Richard is also a director of JLEN Environmental Assets Group.

Ian Davis (chairman of the audit committee)

Ian Davis (chairman of the audit committee)

Ian was a director of corporate finance with Hoare Govett Limited until 2002, having previously worked in Equity Capital Markets at De Zoete Bevan Limited and corporate finance at Baring Brothers & Co. Limited. Prior to this, he qualified as a chartered accountant with Price Waterhouse. Ian is also a non-executive director of Wintech Group Limited.

James (Jimmy) McCulloch

James (Jimmy) McCulloch

James was the executive chairman of Speirs & Jeffrey Ltd until his retirement in May 2016. He is a FCSI, having previously qualified as a chartered accountant with Coopers & Lybrand. James is a non-executive director of the Wealth Management Association and a trustee of Foundation Scotland.

Susan (Sue) Inglis

Susan (Sue) Inglis

Sue has over 30 years’ experience advising investment companies and financial institutions. A qualified lawyer, she was managing director – corporate finance in the investment companies teams at Cantor Fitzgerald Europe between 2012 and 2018. Prior to this, she held the same position at Canaccord Genuity from 2009 to 2012 and was a founding partner of Intelli Corporate Finance (an advisory boutique firm focusing on the asset management and investment company sectors) in 1999. Intelli was acquired by Canaccord Genuity in 2009. Sue was head of the funds and financial services group at the Scottish law firm, Shepherd & Wedderburn.

Sue is the chairman of The Bankers Investment Trust Plc. She is a nonexecutive director of Baillie Gifford US Growth Trust Plc, BMO Managed Portfolio Trust Plc, The European Investment Trust Plc and NextEnergy Solar Fund Limited.

Previous publications

Previous publications

Readers interested in further information about SIGT may wish to read our previous notes (details are provided below).

- “Going for gold”, published in July 2019, looks at SIGT’s managers decision to reduce the trust’s equity weighting for new gold allocations

- “Holding steady as cycle turns”, published in April 2019, notes how SIGT’s portfolio is expected to outperform in an anticipated downturn

- “Mind the (inflation) gap!“, published in September 2018, talks about the warning signs of a recession nearing and how SIGT’s management looks to stay ahead of the turn

- “Cutting back on equities“, publsihed in June 2018, highlights the recent changes SIGT is making to reduce exposure and an overview of the trust

- “Walk the walk“, Published in January 2018, looks at the road map set by management to to reduce it’s weighting in equities as developing markets are reaching their peak

- “Steady reduction in equity exposure“, published in September 2017, states how SIGT’s management is sticking with their strategy of selling off equities, reflecting high levels of confidence

- “Changing tack“, published in June 2017, notes how SIGT is outperforming peers as well as growing its asset base with new discount control mechanism

- “Celebrating five years since strategy change“, published in March 2017, looks at SIGT five years after allowing its managers to have more flexibility with the portfolio

- “In demand and no discount“, published in September 2016, talks about the new discount policy to give investors more confidence which is already showing demand

- “On track for zero discount policy“, published in May 2016, notes how SIGT is on track to adopt a zero discount policy to increase comfort with investors

- “Low volatility and growing income“, published in November 2015, the first look at SIGT highlights their returns and increasing dividend

The legal bit

The legal bit

Marten & Co (which is authorised and regulated by the Financial Conduct Authority) was paid to produce this note on Seneca Global Income & Growth Trust Plc.

This note is for information purposes only and is not intended to encourage the reader to deal in the security or securities mentioned within it.

Marten & Co is not authorised to give advice to retail clients. The research does not have regard to the specific investment objectives financial situation and needs of any specific person who may receive it.

The analysts who prepared this note are not constrained from dealing ahead of it but, in practice, and in accordance with our internal code of good conduct, will refrain from doing so for the period from which they first obtained the information necessary to prepare the note until one month after the note’s publication. Nevertheless, they may have an interest in any of the securities mentioned within this note.

This note has been compiled from publicly available information. This note is not directed at any person in any jurisdiction where (by reason of that person’s nationality, residence or otherwise) the publication or availability of this note is prohibited.

Accuracy of Content: Whilst Marten & Co uses reasonable efforts to obtain information from sources which we believe to be reliable and to ensure that the information in this note is up to date and accurate, we make no representation or warranty that the information contained in this note is accurate, reliable or complete. The information contained in this note is provided by Marten & Co for personal use and information purposes generally. You are solely liable for any use you may make of this information. The information is inherently subject to change without notice and may become outdated. You, therefore, should verify any information obtained from this note before you use it.

No Advice: Nothing contained in this note constitutes or should be construed to constitute investment, legal, tax or other advice.

No Representation or Warranty: No representation, warranty or guarantee of any kind, express or implied is given by Marten & Co in respect of any information contained on this note.

Exclusion of Liability: To the fullest extent allowed by law, Marten & Co shall not be liable for any direct or indirect losses, damages, costs or expenses incurred or suffered by you arising out or in connection with the access to, use of or reliance on any information contained on this note. In no circumstance shall Marten & Co and its employees have any liability for consequential or special damages.

Governing Law and Jurisdiction: These terms and conditions and all matters connected with them, are governed by the laws of England and Wales and shall be subject to the exclusive jurisdiction of the English courts. If you access this note from outside the UK, you are responsible for ensuring compliance with any local laws relating to access.

No information contained in this note shall form the basis of, or be relied upon in connection with, any offer or commitment whatsoever in any jurisdiction.

Investment Performance Information: Please remember that past performance is not necessarily a guide to the future and that the value of shares and the income from them can go down as well as up. Exchange rates may also cause the value of underlying overseas investments to go down as well as up. Marten & Co may write on companies that use gearing in a number of forms that can increase volatility and, in some cases, to a complete loss of an investment.